Is NASH safe?

Business

License

Is Nash Markets A Scam?

Introduction

Nash Markets is a relatively new player in the foreign exchange (forex) trading space, having been established in 2020 and operating out of Saint Vincent and the Grenadines. The broker positions itself as a provider of various trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. As the forex market continues to attract traders globally, it becomes increasingly crucial for individuals to evaluate the credibility and reliability of brokers like Nash Markets. With numerous reports of scams and fraudulent activities in the industry, traders must exercise caution when selecting a broker to ensure their investments are safe.

This article aims to provide a comprehensive analysis of Nash Markets, focusing on its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. The evaluation will utilize a structured framework that combines qualitative insights with quantitative data to determine whether Nash is safe or potentially a scam.

Regulation and Legitimacy

The regulatory environment for forex brokers plays a vital role in ensuring the safety and security of traders' funds. Unfortunately, Nash Markets operates as an unregulated broker, which raises significant concerns regarding its legitimacy. The absence of oversight from a recognized regulatory authority can expose traders to various risks, including the potential for fraud and mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that Nash Markets is not subject to the stringent compliance standards set by recognized entities like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. Additionally, the Financial Services Authority (FSA) of Saint Vincent and the Grenadines has publicly stated that it does not regulate forex trading activities. This raises a red flag for potential investors, as unregulated brokers often lack the necessary investor protection mechanisms.

While some traders may be attracted to the high leverage and low deposit requirements that unregulated brokers like Nash Markets offer, the risks associated with trading under such conditions cannot be overstated. The absence of regulatory oversight also means that traders have limited recourse in the event of disputes or issues with fund withdrawals, making it imperative for potential clients to thoroughly consider whether Nash is safe for their trading activities.

Company Background Investigation

Nash Markets was founded in 2020, and while it claims to provide a wide range of trading services, its operational history is relatively short. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework, which often attracts unlicensed or fraudulent brokers. The companys ownership structure remains opaque, with limited information available about its management team or their qualifications. This lack of transparency raises concerns about accountability and the overall integrity of the broker.

The management teams background is critical in assessing a broker's credibility. Unfortunately, there is little publicly available information regarding the qualifications or experience of those behind Nash Markets. This absence of information can hinder potential clients from making informed decisions about the broker's reliability.

Moreover, the level of transparency regarding company operations and financial practices is minimal. The lack of detailed disclosures about business practices, financial health, and operational procedures is a significant concern for traders looking to ensure their funds are managed responsibly. Given these factors, it is essential for traders to question whether Nash is safe and to consider the implications of trading with a broker that lacks a clear and accountable structure.

Trading Conditions Analysis

Nash Markets offers a variety of trading conditions, including different account types, leverage options, and trading fees. The broker claims to provide competitive spreads and low commission rates, which can be appealing to traders. However, understanding the complete fee structure and any potential hidden costs is crucial.

The overall fee structure for Nash Markets is as follows:

| Fee Type | Nash Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0.5 pips | 0.1 - 0.3 pips |

| Commission Model | $5 - $10 per lot | $3 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the advertised spreads may seem attractive, traders should be aware that spreads can widen significantly during periods of high volatility, which could impact trading costs. Additionally, the commission structure varies depending on the account type, with some accounts carrying higher fees than industry standards.

Moreover, traders should be cautious of any unusual fee policies, such as withdrawal fees or inactivity fees, which can eat into profits. The absence of a demo account also raises concerns, as it prevents traders from testing the platform before committing real funds. This lack of flexibility can be particularly detrimental to novice traders who may need more time to familiarize themselves with the trading environment. Therefore, potential clients should carefully evaluate whether Nash is safe for their trading needs based on these trading conditions.

Customer Fund Security

The safety of client funds is paramount when evaluating a forex broker. Nash Markets claims to implement certain security measures to protect traders' funds; however, the effectiveness of these measures is questionable given the broker's unregulated status.

The broker does not provide clear information regarding fund segregation, which is a critical practice that separates client funds from the brokers operating capital. Without this separation, there is a risk that client funds could be misappropriated or lost in the event of financial difficulties faced by the broker. Furthermore, Nash Markets does not participate in any investor protection schemes, which are often established by regulated brokers to safeguard clients' funds in case of insolvency.

Additionally, the absence of negative balance protection is alarming, as it exposes traders to the risk of losing more than their initial investment. This lack of safety features raises significant concerns about whether Nash is safe for traders, particularly those who may not have extensive experience in the forex market.

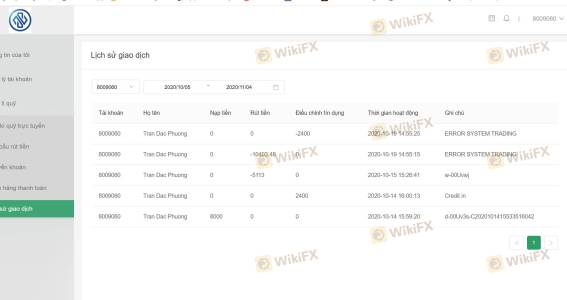

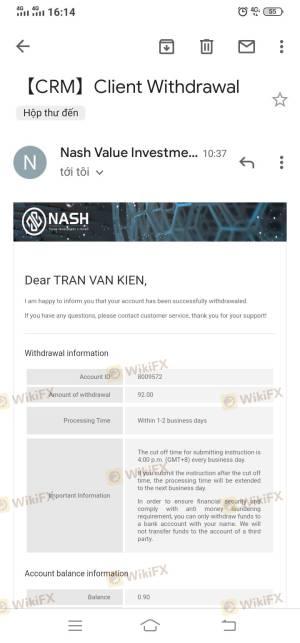

Customer Experience and Complaints

Customer feedback is an essential factor in assessing a broker's reliability and service quality. Reviews of Nash Markets indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and issues with customer support responsiveness.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Account Blocking | High | No resolution |

Many users have reported that their withdrawal requests were delayed or denied without clear explanations, leading to frustration and distrust. For instance, one trader mentioned that after depositing a significant amount, they faced multiple hurdles when attempting to withdraw their profits, ultimately leading them to question the integrity of the broker.

The company's response to complaints has been described as slow and unhelpful, further compounding customer dissatisfaction. This pattern of negative feedback raises serious concerns about the broker's commitment to customer service and its ability to address issues effectively. Therefore, it is crucial for potential clients to consider these experiences when evaluating whether Nash is safe for their trading activities.

Platform and Trade Execution

The trading platform is a critical component of the overall trading experience. Nash Markets provides access to both MetaTrader 4 and MetaTrader 5, which are widely regarded as reliable platforms for forex trading. However, the performance and stability of these platforms are essential indicators of a broker's quality.

Traders have reported mixed experiences regarding order execution quality, with some users experiencing slippage and delays during high volatility periods. While the platforms themselves offer a wealth of features for analysis and execution, the potential for manipulation or technical issues raises concerns about whether trades are executed fairly and transparently.

Additionally, there have been anecdotal reports of orders being rejected or executed at unfavorable prices, which can significantly impact trading outcomes. This raises the question of whether Nash is safe, as reliable execution is fundamental to successful trading.

Risk Assessment

Trading with Nash Markets carries inherent risks that potential clients should carefully evaluate. The lack of regulation, combined with the broker's opaque operational practices, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety Risk | High | No fund segregation |

| Withdrawal Risk | High | Complaints of delayed withdrawals |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, traders should consider starting with smaller investments and thoroughly researching the broker's practices before committing significant capital. Additionally, it is advisable to have a clear exit strategy and to remain vigilant regarding account activity. The overall assessment suggests that potential clients should approach Nash Markets with caution and consider whether Nash is safe for their trading needs.

Conclusion and Recommendations

In conclusion, the analysis of Nash Markets reveals several red flags that suggest potential risks for traders. The lack of regulation, combined with opaque operational practices and negative customer experiences, raises significant concerns about the broker's reliability. While the trading conditions may appear attractive at first glance, the associated risks and complaints indicate that traders should exercise caution.

For those considering forex trading, it may be prudent to explore alternative brokers that offer robust regulatory oversight and a proven track record of customer satisfaction. Some reputable options include brokers regulated by the FCA, ASIC, or other recognized authorities, which provide greater security and transparency.

Ultimately, the question of whether Nash is safe remains unresolved for many potential clients. Traders are encouraged to conduct thorough research and weigh the risks before proceeding with any investments.

Is NASH a scam, or is it legit?

The latest exposure and evaluation content of NASH brokers.

NASH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NASH latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.