Is FALCOM safe?

Pros

Cons

Is Falcom Safe or a Scam?

Introduction

Falcom is a relatively new player in the forex market, seeking to establish itself as a reliable broker for traders interested in various financial instruments. With the increasing popularity of online trading, the number of brokers has surged, making it imperative for traders to carefully assess the legitimacy and safety of these platforms. A thorough evaluation of a broker's regulatory status, operational history, and customer feedback is crucial in determining whether it is a safe environment for trading or a potential scam. This article investigates Falcom's credibility by examining its regulatory framework, company background, trading conditions, and customer experiences, providing a comprehensive analysis to help traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a brokerage firm is one of the most critical factors in assessing its safety. A well-regulated broker is typically subject to stringent oversight, ensuring compliance with financial standards and protecting investors' interests. Unfortunately, Falcom does not appear to be regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation means that Falcom operates without the oversight that helps ensure transparency and accountability. Regulatory bodies enforce rules that protect traders from potential fraud and malpractice, making their presence essential for a trustworthy trading environment. Given that Falcom lacks this regulatory framework, traders should exercise extreme caution when considering engaging with this broker.

Company Background Investigation

Falcom's history and ownership structure are vital components of its credibility. Established in Saudi Arabia, the company claims to offer a range of financial services, including forex trading and asset management. However, detailed information about its founding, management team, and operational history is scarce, which raises red flags about its transparency.

The management team's background is crucial in assessing the broker's reliability. A team with extensive experience in finance and trading can indicate a higher likelihood of ethical practices. Unfortunately, the lack of publicly available information makes it difficult to evaluate the qualifications and expertise of Falcom's leadership. This opacity can lead to concerns about the company's operational integrity and overall trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by Falcom is essential for evaluating its appeal to potential clients. A broker's fee structure can significantly impact a trader's profitability. Falcom's overall fees and commissions are not clearly outlined, which can be a source of frustration and confusion for traders.

| Fee Type | Falcom | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The lack of transparency regarding fees can lead to unexpected costs for traders, making it difficult to assess the true cost of trading with Falcom. Traders should be wary of any hidden fees or unusual charges that may not be disclosed upfront. This lack of clarity is a significant concern when determining whether Falcom is safe or a potential scam.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Falcom's approach to fund security is unclear, which raises concerns about the safety of traders' investments. A reputable broker typically implements measures such as segregated accounts to ensure that client funds are kept separate from the company's operational funds, thereby protecting investors in the event of financial difficulties.

Additionally, the lack of information regarding investor protection policies, such as negative balance protection, is alarming. Traders should be aware of the risks associated with brokers that do not provide adequate safeguards for their funds. The absence of past incidents or controversies related to fund security could indicate a lack of transparency or accountability, further questioning whether Falcom is safe.

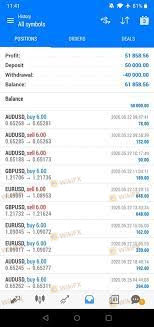

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reputation. By analyzing reviews and complaints, potential clients can gain insights into the experiences of other traders. Unfortunately, there is limited information available regarding customer experiences with Falcom, which makes it difficult to gauge the overall satisfaction level among its users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Fee Transparency | Medium | Limited Explanation |

Common complaints often revolve around withdrawal issues and a lack of transparency regarding fees. The company's responsiveness to these complaints is also a critical factor in determining its reliability. A broker that fails to address customer concerns promptly may indicate a lack of commitment to client satisfaction, raising the question of whether Falcom is safe for traders.

Platform and Execution

The performance and reliability of a trading platform are vital for a successful trading experience. Falcom's platform quality, including its stability, execution speed, and overall user experience, is essential to evaluate. Unfortunately, detailed information regarding the platform's performance is scarce, leaving potential clients in the dark about what to expect.

Inadequate execution quality, such as high slippage rates or frequent order rejections, can lead to substantial losses for traders. If Falcom's platform exhibits signs of manipulation or inefficiency, it could further indicate that the broker is not trustworthy. Traders should seek platforms that offer reliable execution and a user-friendly interface to minimize their risks.

Risk Assessment

Engaging with an unregulated broker like Falcom presents various risks that traders should carefully consider. The lack of oversight, transparency, and clear trading conditions creates an environment where traders may face significant challenges.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight increases risk of fraud. |

| Fund Security | High | Lack of information on fund protection measures. |

| Customer Support | Medium | Limited responsiveness to complaints and issues. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. Seeking out regulated alternatives with proven track records can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Falcom raises several red flags that warrant caution. The absence of regulation, limited transparency, and unclear trading conditions all contribute to a perception of risk. Traders should be vigilant and consider whether they are comfortable engaging with a broker that does not provide adequate safeguards for their investments.

For those seeking safer trading options, it is advisable to consider brokers that are regulated by reputable authorities and offer clear information about their fees, fund security measures, and customer support. Some recommended alternatives include brokers with solid regulatory frameworks and positive customer feedback.

In summary, while Falcom may present attractive trading opportunities, the potential risks associated with its lack of regulation and transparency make it a broker that traders should approach with caution. The question "Is Falcom safe?" leans towards a negative response, urging traders to prioritize their safety and seek more reliable trading partners.

Is FALCOM a scam, or is it legit?

The latest exposure and evaluation content of FALCOM brokers.

FALCOM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FALCOM latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.