7BForex 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

7BForex is a Nigeria-based forex broker, founded in 2010 and operating under the auspices of Instant Web-Net Technologies Ltd. The broker aims to provide local traders in Nigeria with competitive trading conditions, featuring a low minimum deposit requirement of ₦5,000 (approximately $10), high leverage options of up to 1:1000, and various account types suited to different trading styles. While these attributes present enticing opportunities for local traders, potential clients must exercise caution due to the broker's unregulated status, which raises significant concerns regarding the safety of funds and overall service reliability.

The ideal customers for 7BForex are local Nigerian traders comfortable with higher risk trading strategies, seeking low-cost entry into the forex market and interested in trading in Nigerian Naira. Conversely, those who prioritize regulatory oversight and fund security, as well as comprehensive educational resources or advanced trading tools, should consider alternate options.

⚠️ Important Risk Advisory & Verification Steps

Attention: Trading with 7BForex involves significant risks due to the absence of regulation. Please note the following:

Lack of Regulatory Oversight: 7BForex operates without authorization from the Central Bank of Nigeria or any other reputable financial regulatory body, exposing traders to potential fraud or mishandling of funds.

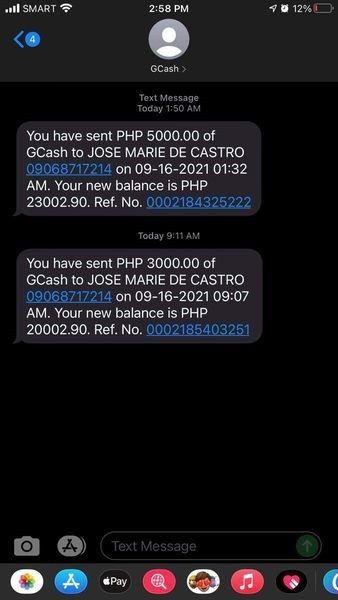

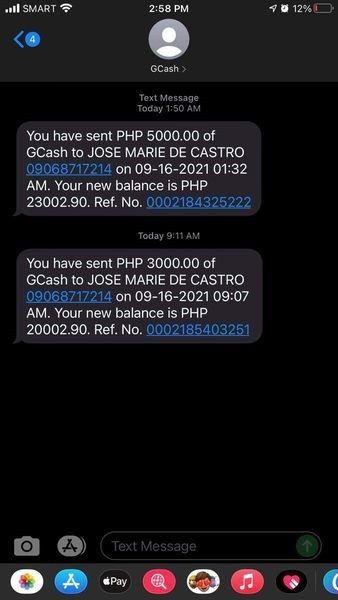

Risks of Unregulated Trading: Trading with unregulated brokers can lead to significant financial losses. Users have reported difficulties with withdrawals and concerns over fund security.

Verification Steps:

- Check the broker's claims on regulatory status using authoritative resources such as the NFA's BASIC database.

- Review user feedback and complaints online, particularly regarding fund safety and withdrawal issues.

- Consult financial forums and communities for insights and shared experiences from other traders.

Rating Framework

Broker Overview

Company Background and Positioning

7BForex, based in Lagos, Nigeria, has been operational since 2010. Initially founded to provide tailored trading solutions for Nigerian traders, the broker claims to focus on local needs by allowing trading in Naira, thus mitigating currency exchange risks. However, despite their local focus, 7BForex operates under an offshore registration in Saint Vincent and the Grenadines, specifically under the name 7BForex Ltd, which has caused legitimate concerns regarding its regulatory status.

Core Business Overview

7BForex offers forex and CFD trading services through three account types: Standard, Classic, and Elite. All accounts provide access to the popular MetaTrader 4 (MT4) platform, which facilitates trading in forex pairs, commodities, and indices, along with high leverage up to 1:1000. However, the broker does not support the trading of cryptocurrencies directly, although it offers limited exposure on specific accounts.

Despite the customized local offerings, the lack of regulation is stark; the broker operates without any safeguarding measures for clients' funds, which raises substantial concerns among potential users regarding the safety of their investments.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The most glaring risk factor associated with 7BForex is its complete lack of regulation. It operates without oversight from any recognized financial authority, exposing traders to significant risks. According to multiple reviews, clients have reported issues with account management and withdrawal challenges.

User Self-Verification Guide

- Visit official regulatory websites such as the NFA or FCA to verify claimed licenses.

- Look for user reviews and testimonials on independent platforms such as Trustpilot or Forex Peace Army.

- Engage with trading communities online to assess user experiences and common concerns related to 7BForex.

Industry Reputation Summary

User feedback reflects a mix of experiences, with some pointing to efficient trading execution while others have voiced concerns regarding slow withdrawals and fund mismanagement.

"I started with 7BForex thinking I found a great local broker, but withdrawal issues and lack of support raised significant red flags."

Trading Costs Analysis

Advantages in Commissions

One of the appealing facets of trading with 7BForex is its low commission structure. The Standard and Classic accounts feature competitive rates, particularly for introductory traders, encouraging engagement without the burden of high initial trading costs.

Non-Trading Fees Traps

However, despite low trading commissions, 7BForex has received complaints about sizable withdrawal fees. For instance:

"₦ 60" commission on forex majors and substantial withdrawal fees have been noted by users, leading to frustrations over unexpected charges.

Cost Structure Summary

The overall cost structure may appear favorable for some traders, but the hidden fees and wide spreads could render trading with this broker costly, especially for high-frequency traders.

The only trading platform available with 7BForex is the widely recognized MT4, providing essential functionalities for traders. While MT4 has a strong reputation in the industry, the absence of alternate platforms limits options for users seeking advanced trading tools.

Reviewing available tools for analysis and trade execution, MT4 excels with its chart options and indicators. However, the educational materials offered by 7BForex are limited, catering primarily to beginner traders without in-depth resources for advanced users.

According to user experiences, the platform is functional yet simplistic.

"MT4 is solid, but I wish there were more tutorials and support for navigating tricky trades."

User Experience Analysis

Overall Experience Insights

7BForex provides a beginner-friendly interface, ensuring easy navigation through essential features. However, many users have expressed the need for more comprehensive educational resources to help enhance their trading skills.

Strengths in Onboarding

Clients can quickly start trading with a user-friendly registration process and demo account availability, helping newcomers familiarize themselves with the trading environment.

User Feedback Summary

While customer service is often noted as responsive, negative experiences regarding account management stem from the lack of regulatory control.

Customer Support Analysis

Responsiveness and Assistance

Customer support operates 24/5, primarily assisting through telephone and online chat. Users often report prompt replies, showcasing the company's dedication to service.

Issue Resolution Challenges

Despite positive feedback regarding speed, unresolved complaints about account issues reflect larger concerns about the company's capacity to effectively manage customer queries under regulatory scrutiny.

Account Conditions Analysis

Account Types Overview

7BForex offers three account types, each catering to different trading needs. However, all accounts feature a singular currency base (Naira), limiting flexibility for traders accustomed to operating in USD or other currencies.

Limitations and Flexibility

Traders are restricted to a maximum of three accounts, which may not accommodate more diversified trading preferences, especially for those looking to experiment with various trading strategies.

Overall Impression

The limited account offerings and regulatory framework present concerns for long-term stability and growth as a trader within the 7BForex ecosystem.

Conclusion

In conclusion, while 7BForex presents itself as an intriguing option for Nigerian traders due to its low entry costs and localized service, the significant risks involved cannot be overlooked. The absence of regulatory oversight, combined with mixed user feedback regarding fund safety and service reliability, suggests that potential clients should exercise caution. For those determined to trade with local brokers, understanding the risks associated with unregulated environments is critical for making informed choices. Exploring alternatives with sound regulatory oversight may provide a safer path in the volatile world of forex trading.

By carefully examining each key aspect of 7BForex and referencing user experiences, this review aims to provide a detailed yet balanced perspective for traders considering their options in the market.