Nash 2025 Review: Everything You Need to Know

Summary

Nash Markets offers an interesting choice for forex traders. The broker has a very low minimum deposit and high leverage options. This nash review shows that nash attracts traders mainly through its $10 minimum deposit and leverage up to 1:500. This makes it very appealing to new forex traders. However, the lack of clear regulatory information may worry more careful investors who want transparency and oversight.

The broker calls itself a platform that lets traders "Trade Analytically, Prosper Indefinitely." It offers access to 138 forex pairs, 47 stocks/indices, 23 commodities, and 8 cryptocurrencies. With a minimum lot size of just 0.01, Nash Markets seems designed for both new traders testing small investments and experienced investors seeking high-leverage trading opportunities. The mix of low entry barriers and high leverage creates an environment that could attract retail traders who want to maximize their market exposure with limited capital.

Despite these appealing features, potential users should carefully consider trading with a broker where regulatory oversight information is not clearly displayed or easily available.

Important Notice

Users should be extra careful and do thorough research before using Nash Markets because comprehensive regulatory information is not available. Different regions may have varying levels of risk and regulatory protection. Traders should know that the lack of clear regulatory oversight could affect dispute resolution and fund protection.

This review uses publicly available information and may not fully show the complete trading experience or all aspects of the broker's operations. Prospective traders should verify all information independently and consider their risk tolerance before making any investment decisions.

Rating Framework

Broker Overview

Nash Markets works as a forex trading platform, though specific details about when it started and its corporate history are not clearly shown in available documentation. The company presents itself as a broker committed to analytical trading approaches. It emphasizes the philosophy of prospering through informed decision-making. However, comprehensive background information about the company's founders, headquarters location, and operational history remains limited in publicly accessible sources.

The broker's main business model focuses on forex trading services, though it has expanded its offerings to include various asset classes. Nash Markets appears to target a wide range of traders, from beginners attracted by low entry requirements to more experienced traders seeking high-leverage opportunities. The platform's tagline suggests a focus on analytical trading approaches. However, specific details about the company's trading philosophy and methodology are not extensively documented.

This nash review finds that while Nash Markets offers access to multiple asset classes including 138 forex pairs, 47 stocks/indices, 23 commodities, and 8 cryptocurrencies, detailed information about the underlying trading technology and platform specifications remains limited. The broker's approach appears to prioritize accessibility through low minimum deposits while offering substantial leverage options to accommodate various trading strategies and capital levels.

Regulatory Jurisdiction: Available documentation does not specify the regulatory jurisdiction under which Nash Markets operates. This represents a significant information gap for potential traders seeking regulatory oversight assurance.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in accessible sources, though the platform does specify a minimum deposit requirement.

Minimum Deposit Requirements: Nash Markets sets an exceptionally low minimum deposit threshold at $10. This makes it one of the most accessible brokers in terms of initial capital requirements.

Bonus and Promotions: Current promotional offerings and bonus structures are not specified in available documentation. This suggests either no active promotions or limited marketing of such incentives.

Tradeable Assets: The broker provides access to a diverse range of trading instruments, including 138 forex pairs, 47 stocks and indices, 23 commodities, and 8 cryptocurrency options. This offers reasonable diversification opportunities across major asset classes.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not prominently featured in available sources. This could impact traders' ability to accurately assess total trading expenses.

Leverage Ratios: Nash Markets offers leverage up to 1:500. This represents a significant multiplier that can amplify both profits and losses, requiring careful risk management from traders.

Platform Options: Specific trading platform details are not comprehensively covered in accessible documentation. This leaves questions about software capabilities and features.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in available sources.

Customer Service Languages: Available customer support languages are not detailed in accessible documentation.

This nash review highlights that while Nash Markets offers attractive entry-level conditions, the limited availability of detailed operational information may require prospective traders to conduct additional research through direct contact with the broker.

Detailed Rating Analysis

Account Conditions Analysis

Nash Markets shows strong performance in account accessibility with its remarkably low $10 minimum deposit requirement. This positions it among the most accessible brokers for entry-level traders. The leverage offering of up to 1:500 provides substantial trading power, though this comes with correspondingly increased risk exposure that requires careful consideration. The minimum lot size of 0.01 offers flexibility for position sizing. This allows traders to implement precise risk management strategies even with smaller account balances.

However, this nash review notes that specific information about different account types and their respective features is not readily available in accessible documentation. The absence of detailed account tier information makes it difficult to assess whether the broker offers graduated services based on deposit levels or trading volumes. Additionally, information about special account features such as Islamic accounts, professional trader accounts, or other specialized offerings is not prominently featured.

The account opening process details are not extensively documented. This could present uncertainty for potential clients regarding verification requirements, documentation needs, and approval timeframes. While the low minimum deposit is attractive, the lack of comprehensive account condition information may require direct broker contact for complete details.

Despite these information gaps, the fundamental account conditions of low entry barriers and high leverage make Nash Markets particularly appealing to traders with limited initial capital who seek substantial market exposure capabilities.

The availability of trading tools and analytical resources at Nash Markets remains largely undocumented in accessible sources. This presents a significant information gap for this evaluation. Without specific details about charting capabilities, technical analysis tools, or fundamental analysis resources, it becomes challenging to assess the broker's commitment to providing comprehensive trading support infrastructure.

Educational resources, which are crucial for novice traders attracted by the low minimum deposit, are not specifically mentioned in available documentation. The absence of information about webinars, trading guides, market analysis, or educational materials suggests either limited offerings in this area or inadequate marketing of existing resources. For a broker targeting entry-level traders, robust educational support would be particularly valuable.

Automated trading capabilities, expert advisor support, and API access details are not specified. This could impact traders seeking to implement systematic trading strategies. Additionally, information about mobile trading applications, real-time market data feeds, and research partnerships is not readily available.

The lack of detailed information about tools and resources represents a notable weakness in Nash Markets' public presentation. Modern traders typically expect comprehensive analytical and educational support as standard offerings. This information gap may require prospective clients to engage directly with the broker to understand the full scope of available trading support tools.

Customer Service and Support Analysis

Customer service information for Nash Markets is notably limited in accessible documentation. This makes it difficult to assess the quality and accessibility of support services. Essential details such as available contact channels, support hours, and response time expectations are not prominently featured. This could indicate either limited service infrastructure or inadequate communication of existing capabilities.

The absence of information about multilingual support capabilities may concern international traders, particularly given the global nature of forex markets. Without details about supported languages, time zone coverage, or regional support teams, potential clients cannot adequately assess whether their service needs would be met effectively.

Live chat availability, phone support, email response protocols, and support ticket systems are not specifically documented. This leaves uncertainty about how traders would resolve issues or seek assistance. The lack of visible customer service information could be particularly problematic for novice traders who may require more frequent support during their initial trading experiences.

Additionally, there is no available information about account management services, educational support, or technical assistance capabilities. For a broker targeting entry-level traders with low minimum deposits, robust customer support would be essential for user retention and satisfaction. The limited visibility of customer service information represents a significant concern that may require direct verification through broker contact before account opening.

Trading Experience Analysis

The trading experience at Nash Markets cannot be comprehensively evaluated due to limited information about platform performance, execution quality, and technological infrastructure. Without specific details about order execution speeds, slippage rates, or platform stability metrics, it becomes challenging to assess the actual trading environment quality.

Platform functionality, user interface design, and navigation efficiency are not documented in accessible sources. This makes it difficult to evaluate the user experience quality. The absence of information about advanced order types, risk management tools, and trading automation capabilities may concern more sophisticated traders seeking comprehensive trading functionality.

Mobile trading capabilities, which are increasingly important for modern traders, are not specifically addressed in available documentation. Without details about mobile app features, cross-platform synchronization, or mobile-specific tools, traders cannot assess the broker's commitment to providing flexible trading access.

This nash review finds that while Nash Markets offers attractive leverage and low entry requirements, the limited information about actual trading experience quality represents a significant evaluation challenge. Real-time execution quality, platform reliability during volatile market conditions, and overall technological robustness remain unclear without more comprehensive documentation or user feedback data.

Trust and Regulation Analysis

The trust and regulation assessment for Nash Markets reveals significant concerns due to the absence of clear regulatory information in accessible documentation. Without prominent disclosure of regulatory authorities, license numbers, or compliance frameworks, potential traders face uncertainty about the level of oversight and protection available for their funds and trading activities.

Regulatory compliance is fundamental to broker trustworthiness, as it provides frameworks for dispute resolution, fund segregation requirements, and operational standards. The lack of visible regulatory information makes it impossible to verify compliance with established financial services standards or assess the level of investor protection available.

Fund safety measures, including client money segregation, deposit insurance, and bankruptcy protection protocols, are not specifically documented. For traders considering depositing funds, the absence of clear information about financial safeguards represents a substantial concern that could impact their decision-making process.

Company transparency regarding ownership, financial statements, and operational history is also limited in available sources. Without access to comprehensive corporate information, traders cannot adequately assess the stability and reliability of the organization behind the trading platform.

The regulatory information gap represents the most significant weakness identified in this evaluation, as it directly impacts the fundamental trust relationship between broker and client that is essential for successful trading partnerships.

User Experience Analysis

User experience evaluation for Nash Markets is constrained by limited specific feedback and detailed interface information in available sources. While some positive user sentiment has been noted, the absence of comprehensive user reviews and detailed experience reports makes it challenging to assess overall satisfaction levels and common user concerns.

The account registration and verification process efficiency is not specifically documented, though the low minimum deposit suggests an intention to provide accessible entry procedures. Without details about documentation requirements, verification timeframes, and onboarding support, potential users cannot adequately prepare for the account opening experience.

Interface design, navigation efficiency, and overall platform usability are not comprehensively covered in accessible documentation. For traders attracted by the low entry barriers, a user-friendly interface would be particularly important for successful platform adoption and continued engagement.

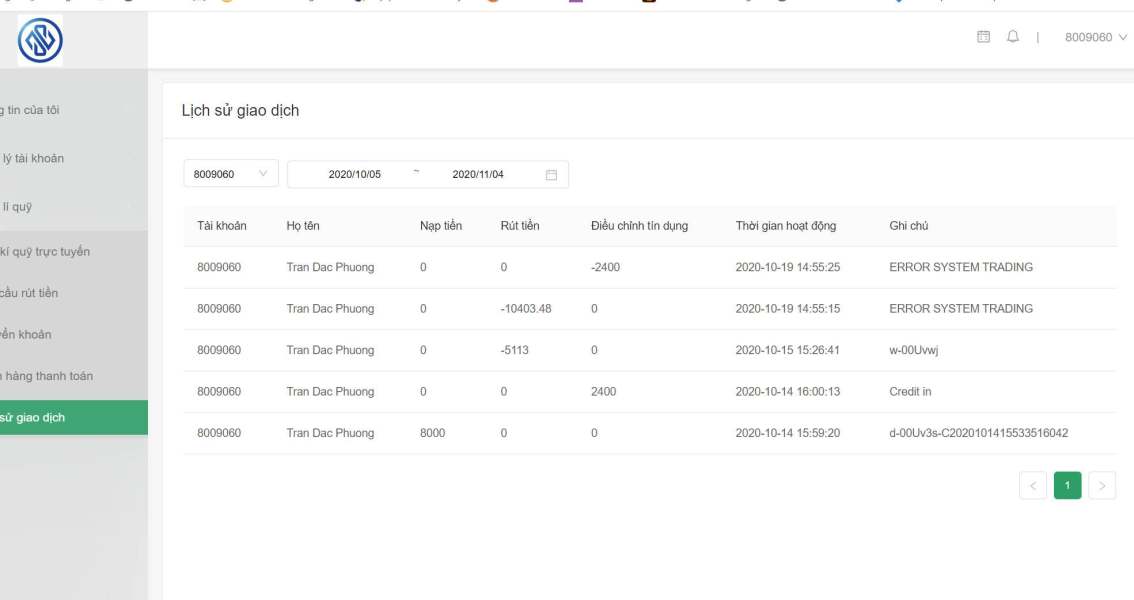

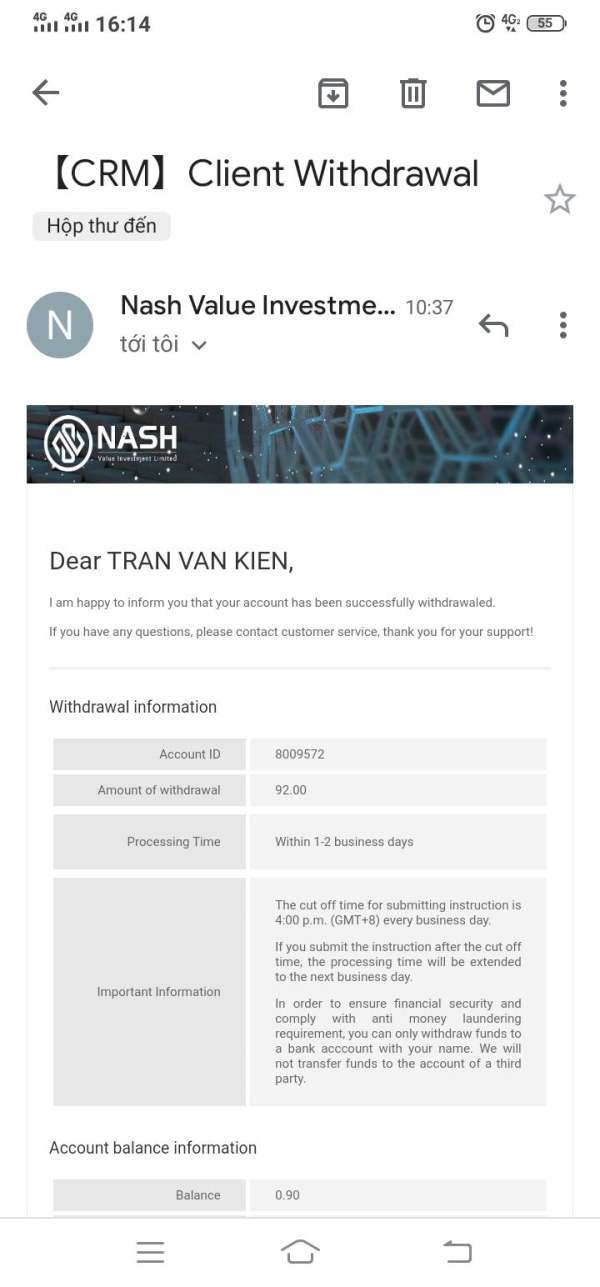

Deposit and withdrawal experience details, including processing times, available methods, and associated fees, are not prominently featured. This information gap could impact user satisfaction, particularly for active traders who frequently move funds.

The limited availability of detailed user experience information suggests that prospective traders may need to rely on trial experiences or direct broker contact to assess platform suitability for their specific needs and preferences.

Conclusion

Nash Markets presents a mixed proposition for forex traders. It offers exceptional accessibility through its $10 minimum deposit and substantial leverage up to 1:500, while simultaneously raising concerns due to limited regulatory transparency and operational information. This nash review concludes that the broker may be most suitable for novice traders seeking low-cost market entry and experienced traders comfortable with higher-risk, less-regulated trading environments.

The primary advantages include remarkably low entry barriers and significant leverage capabilities. This makes it accessible to traders with limited initial capital. However, the absence of clear regulatory oversight, limited customer service information, and gaps in platform details represent substantial drawbacks that could impact trader confidence and safety.

Prospective users should carefully weigh the attractive entry conditions against the regulatory uncertainty and information limitations before making trading decisions. The broker may be appropriate for traders willing to accept higher regulatory risk in exchange for accessible trading conditions. However, it may not suit those prioritizing comprehensive oversight and transparency.