EVA Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eva markets review examines a broker that has garnered mixed reactions from the trading community. EVA Markets operates as an unregulated forex broker registered in Comoros. The broker presents both opportunities and significant concerns for potential clients. While some users describe it as a trustworthy broker with innovative trading solutions, others have raised serious questions about its legitimacy and safety protocols.

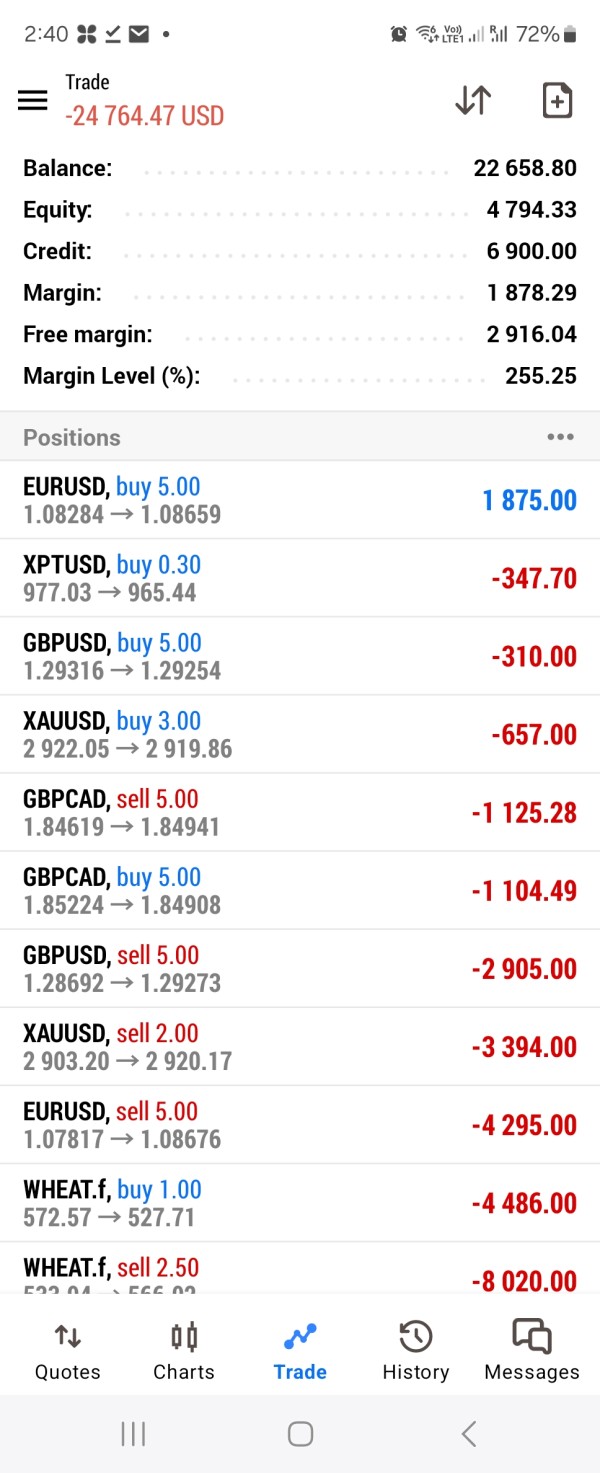

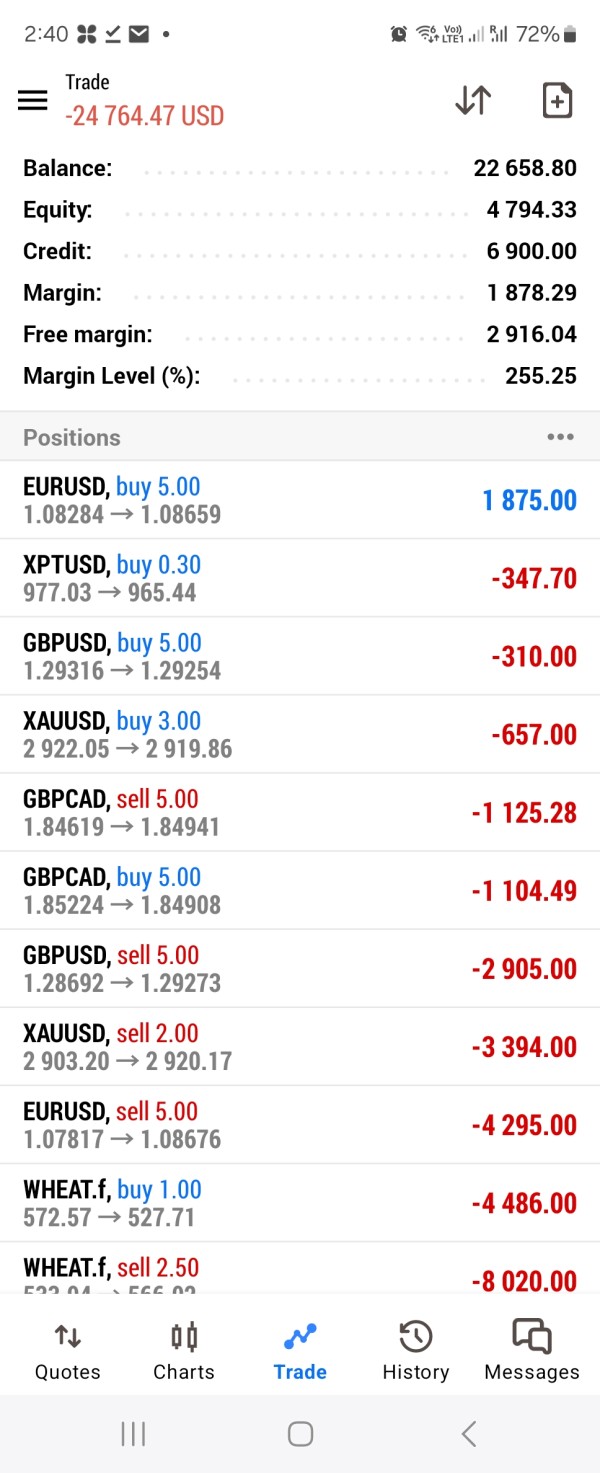

The broker's key features include leverage up to 1:500 and access to the comprehensive MetaTrader 5 trading platform. EVA Markets primarily targets individual investors. The company offers trading services across multiple asset classes including forex currency pairs, commodities, precious metals, futures, indices, stocks, and cryptocurrencies including Bitcoin. However, the lack of regulatory oversight and mixed user feedback create a complex picture that requires careful consideration by prospective traders.

According to available information, EVA Markets requires a minimum deposit of $1,000. This amount is relatively high compared to industry standards. The broker offers spreads starting from 1.5 pips, though specific commission structures remain unclear in publicly available materials.

Important Notice

EVA Markets operates as an unregulated broker, which raises significant concerns regarding investor protection and fund security. Potential clients should be aware that trading with unregulated brokers involves substantial risks. These risks include limited recourse options in case of disputes and potential challenges with fund withdrawals. The broker's registration in Comoros, while legal, does not provide the same level of investor protection as regulation by major financial authorities such as the FCA, CySEC, or ASIC.

This review is based on publicly available information and user feedback as of 2025. The analysis may contain subjective elements. Prospective clients should conduct their own due diligence before making any investment decisions. The trading environment and broker conditions may change without notice.

Overall Rating Framework

Broker Overview

EVA Markets entered the online trading market in 2023. The company established itself as a relatively new player in the competitive forex and CFD trading space. The company is registered in Comoros, though specific headquarters information is not readily available in public documentation. The broker positions itself as a destination for "effortless success." It targets individual investors seeking access to diverse trading opportunities across global financial markets.

The company's business model focuses on providing premier trading services across forex, stocks, commodities, indices, and cryptocurrency markets. According to promotional materials, EVA Markets emphasizes "unparalleled trading conditions." However, the lack of detailed public information about company leadership, operational history, and corporate structure raises questions about transparency.

EVA Markets operates primarily through the MetaTrader 5 platform. The platform offers clients access to advanced charting tools, technical indicators, and automated trading capabilities. The broker supports trading across multiple asset classes including major and minor forex currency pairs, precious metals like gold and silver, energy commodities including oil, stock indices, individual equities, and various cryptocurrencies with Bitcoin being prominently featured. Despite its comprehensive asset offering, the broker's unregulated status and limited operational track record require careful consideration by potential clients.

Regulatory Status: EVA Markets is registered in Comoros but operates without regulation from major financial authorities. This unregulated status means the broker is not subject to stringent capital requirements, segregated client fund rules, or regular compliance audits. These features characterize regulated brokers.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public materials. The broker advertises "safely and cost-free money transfers" as part of its service offering.

Minimum Deposit Requirements: EVA Markets requires a minimum deposit of $1,000. This amount is significantly higher than many competitors in the retail forex market. This threshold may exclude smaller retail traders and beginning investors from accessing the platform.

Bonuses and Promotions: Current promotional offerings and bonus structures are not clearly outlined in available documentation. This suggests either limited promotional activities or lack of transparency in marketing materials.

Trading Assets: The broker offers a comprehensive range of tradeable instruments. These include forex currency pairs across major, minor, and exotic categories, commodities such as oil and agricultural products, precious metals including gold and silver, futures contracts, major stock indices, individual stocks, and cryptocurrency trading with Bitcoin and other digital assets.

Cost Structure: EVA Markets advertises spreads starting from 1.5 pips. However, specific commission rates, overnight financing charges, and other trading costs are not clearly detailed in publicly available information. This lack of transparency in pricing makes it difficult for traders to accurately assess total trading costs.

Leverage Options: The broker offers maximum leverage of 1:500. This provides significant trading power but also substantially increases risk exposure for client accounts.

Platform Options: Trading is conducted primarily through MetaTrader 5 (MT5). The platform provides access to advanced technical analysis tools, algorithmic trading capabilities, and comprehensive market analysis features.

Geographic Restrictions: Specific information about geographic restrictions and prohibited jurisdictions is not clearly outlined in available materials.

Customer Support Languages: Available customer support languages are not specified in current public documentation.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

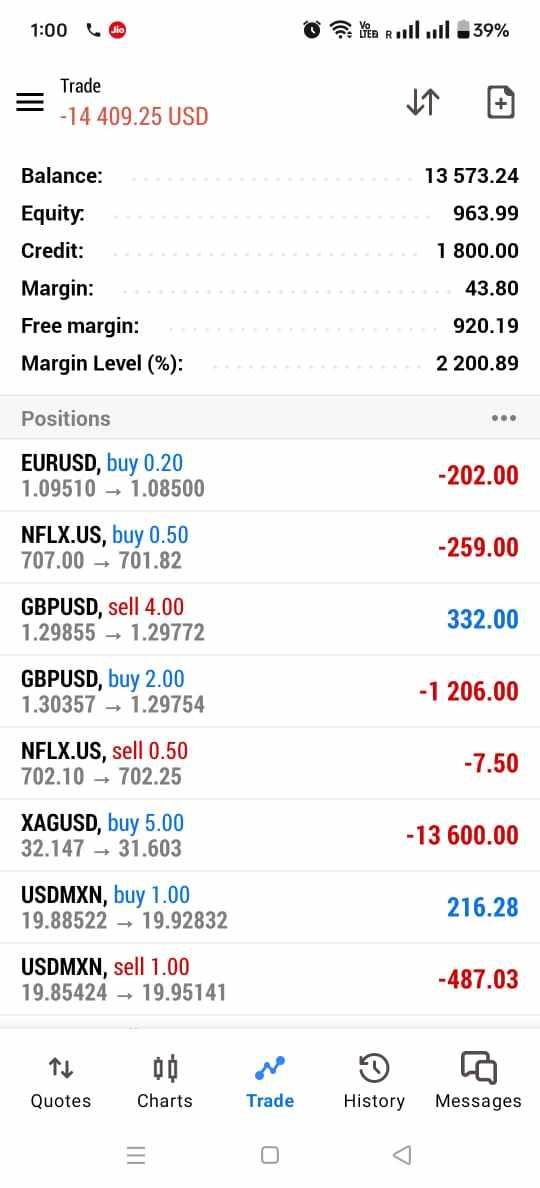

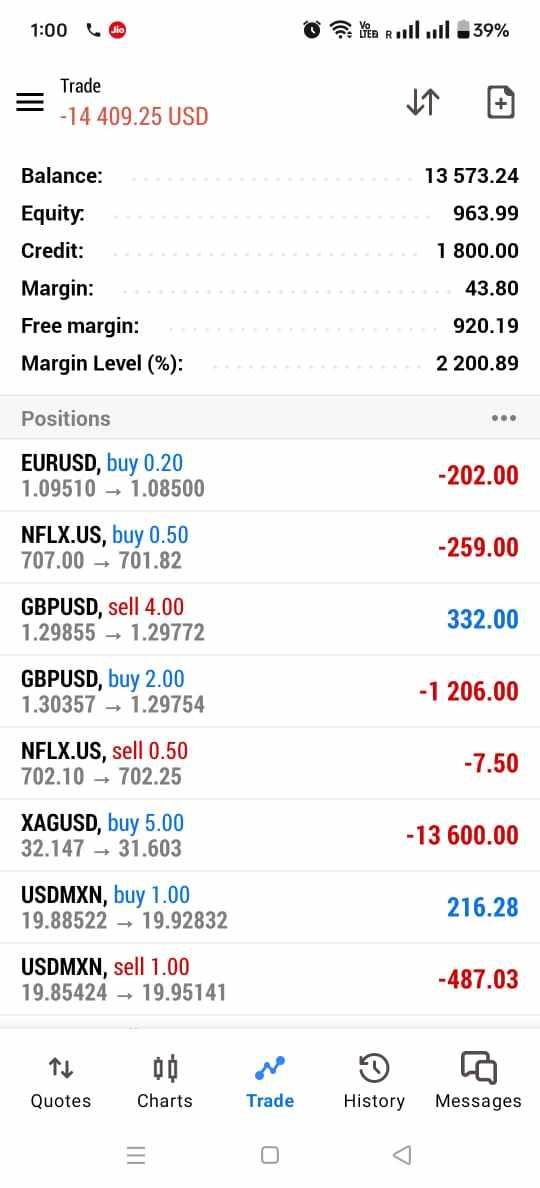

EVA Markets' account conditions present several challenges that significantly impact its overall appeal to retail traders. The eva markets review reveals that the broker's $1,000 minimum deposit requirement places it well above industry averages. Many reputable brokers offer account opening with deposits as low as $10-$100. This high barrier to entry effectively excludes many beginning traders and those seeking to test the platform with smaller amounts.

The lack of detailed information about different account types represents another significant weakness. Most established brokers offer tiered account structures with varying features, benefits, and requirements. EVA Markets' failure to clearly outline account categories, their respective benefits, or progression criteria suggests either a limited product offering or inadequate transparency in client communications.

User feedback indicates concerns about the high minimum deposit requirement. Some traders express frustration about the financial commitment required before being able to properly evaluate the broker's services. The absence of micro or cent account options further limits accessibility for risk-averse traders or those in regions with lower average incomes.

Commission structures and fee schedules remain unclear in public documentation. This makes it impossible for potential clients to accurately calculate total trading costs. This lack of transparency in pricing represents a significant disadvantage compared to regulated brokers who are required to provide clear, comprehensive fee disclosures. The combination of high minimum deposits and unclear fee structures creates an environment where traders cannot make fully informed decisions about account opening.

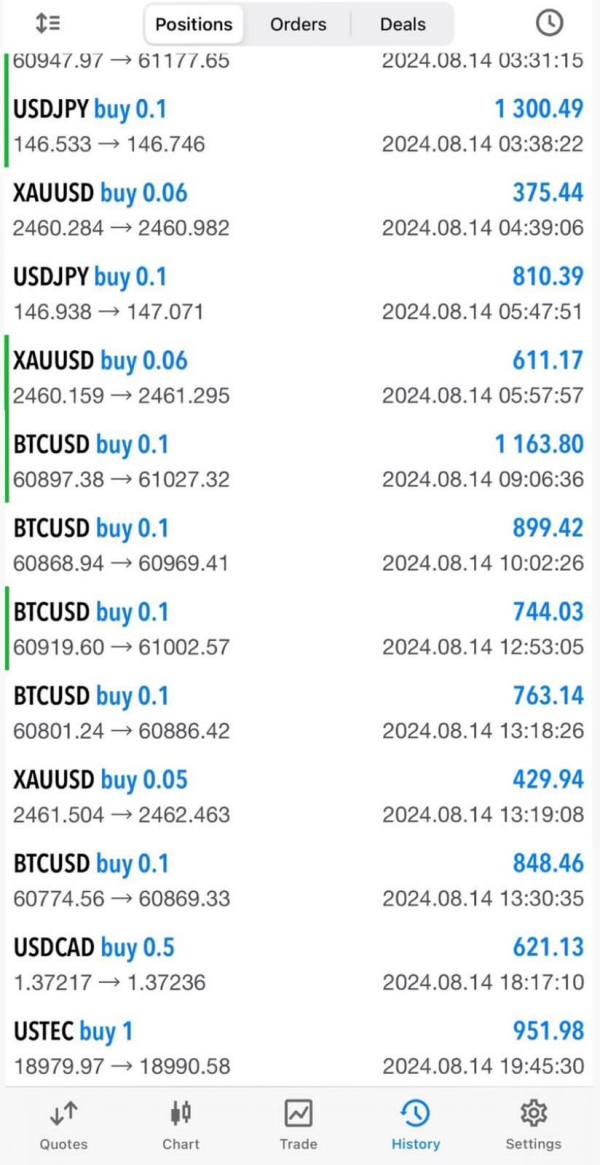

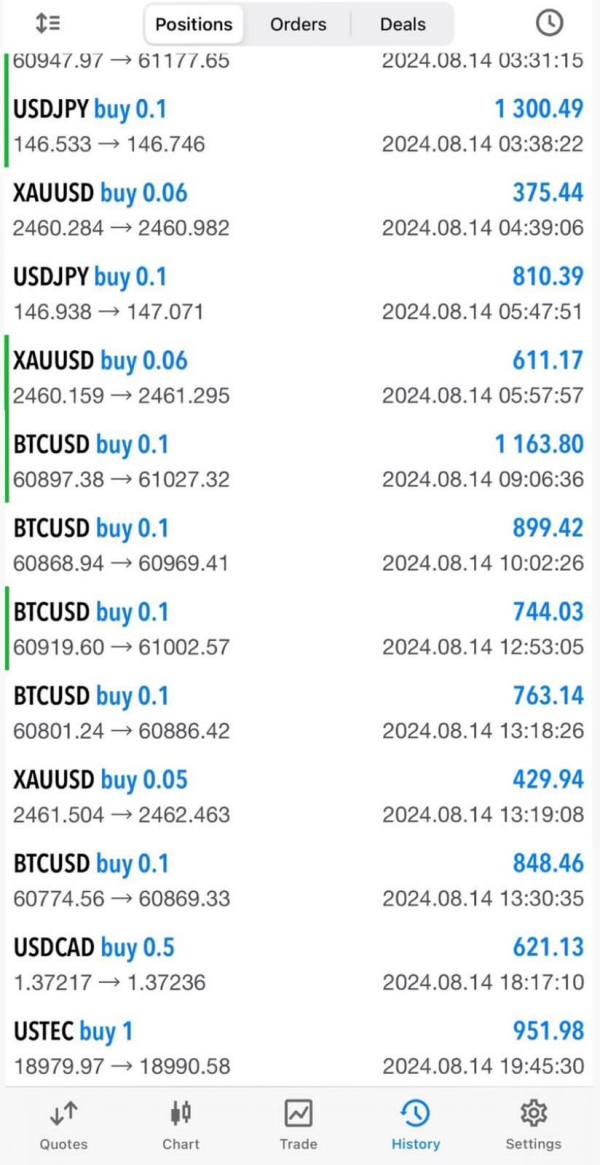

EVA Markets demonstrates strength in its technological infrastructure, primarily through its implementation of the MetaTrader 5 platform. MT5 represents one of the industry's most sophisticated trading platforms. The platform offers advanced charting capabilities, comprehensive technical analysis tools, and robust algorithmic trading support. The platform's multi-asset capabilities align well with EVA Markets' diverse instrument offering, allowing traders to manage forex, stocks, commodities, and cryptocurrency positions from a single interface.

The broker's asset diversity represents a significant advantage. The platform provides access to major forex pairs, commodities including oil and precious metals, stock indices, individual equities, and cryptocurrency markets. This comprehensive instrument selection allows traders to diversify their portfolios and implement sophisticated trading strategies across multiple market sectors.

However, the eva markets review reveals notable gaps in educational and research resources. Unlike many established brokers who provide market analysis, educational webinars, trading guides, and economic calendars, EVA Markets appears to offer limited educational support. This deficiency particularly impacts beginning traders who rely on broker-provided resources to develop their trading skills and market knowledge.

The absence of proprietary trading tools, market research, or analytical resources beyond the standard MT5 offering represents a missed opportunity to differentiate from competitors. Many successful brokers supplement platform capabilities with custom indicators, market sentiment tools, or exclusive research content that adds value for clients.

Customer Service and Support Analysis (4/10)

Customer service represents a significant weakness in EVA Markets' service offering, based on available user feedback and the lack of transparent support infrastructure. User reviews consistently highlight concerns about response times. Traders report delays in receiving assistance for account-related inquiries and technical issues.

The quality of customer service interactions appears inconsistent. Some users express frustration about the knowledge level and problem-solving capabilities of support staff. Effective customer service is crucial in the forex industry, where technical issues, account problems, or trading disputes require prompt, knowledgeable resolution to maintain client confidence and satisfaction.

Available documentation does not clearly outline customer support channels, operating hours, or language capabilities. This suggests potential limitations in support accessibility. Most reputable brokers provide multiple contact methods including live chat, telephone support, and email assistance with clearly defined response time commitments.

The absence of detailed support information raises concerns about the broker's commitment to client service and may indicate resource limitations that could impact support quality. User feedback suggests that problem resolution can be lengthy and sometimes unsatisfactory. This potentially leaves traders without adequate assistance during critical trading situations.

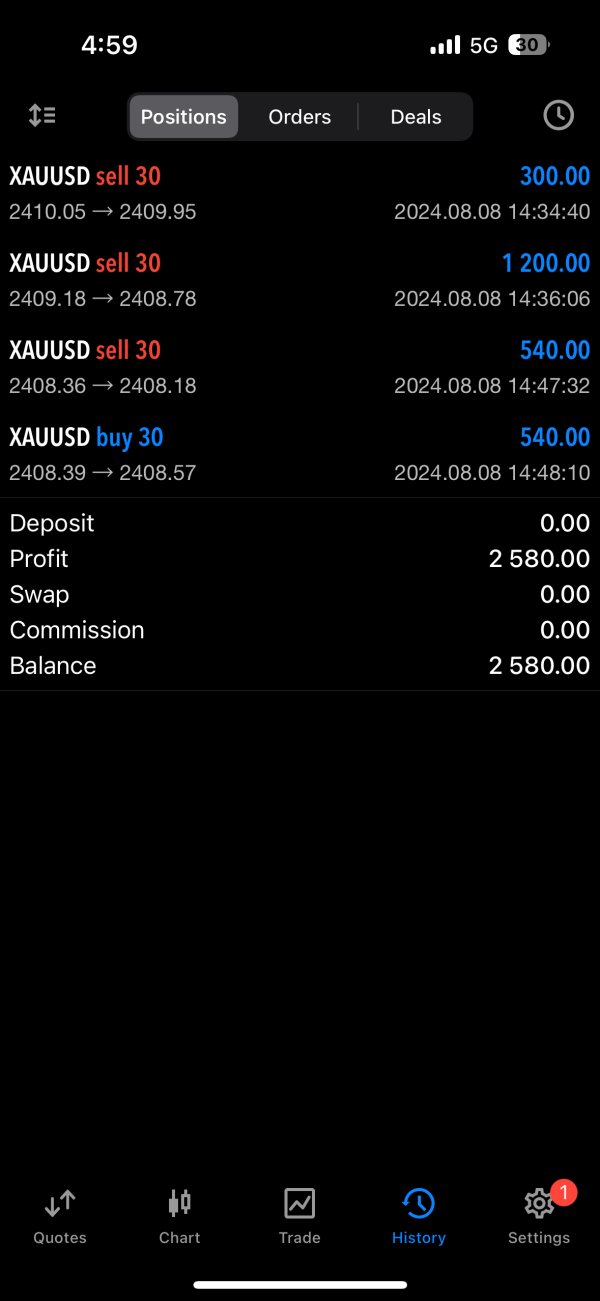

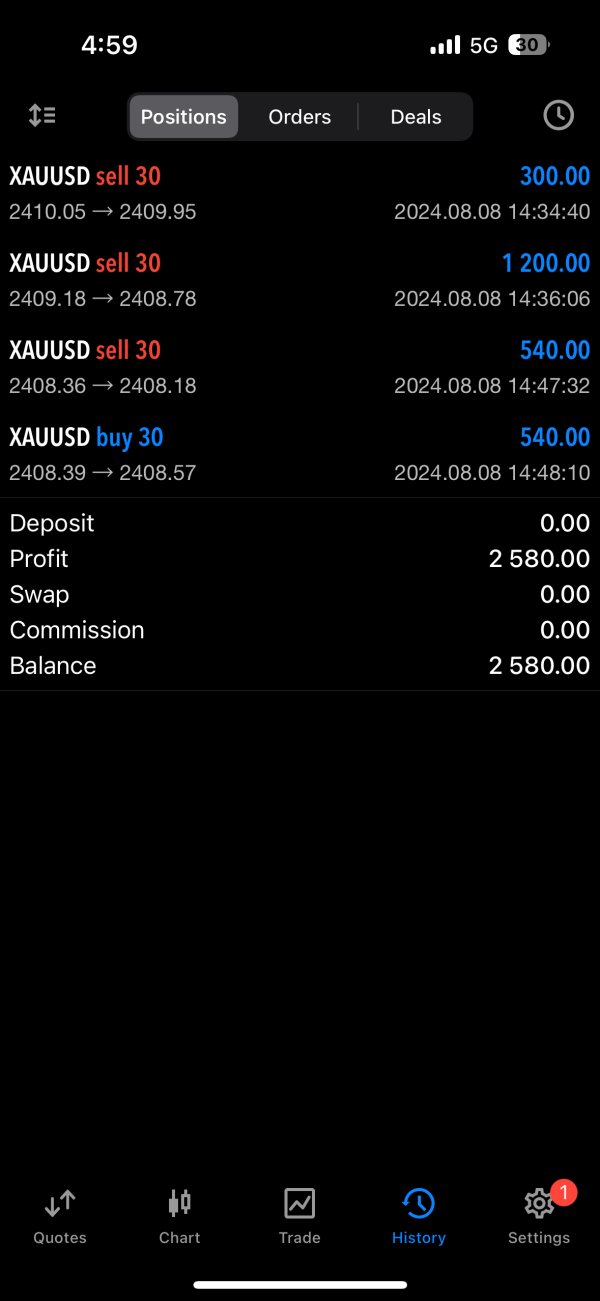

Trading Experience Analysis (5/10)

The trading experience with EVA Markets presents a mixed picture, with user feedback revealing both positive aspects and significant concerns. The MetaTrader 5 platform provides a solid foundation for trading activities. It offers advanced charting tools, technical indicators, and order management capabilities that experienced traders expect from professional trading software.

However, user reports indicate issues with trade execution quality, including concerns about slippage during volatile market conditions and occasional requoting of prices. These execution issues can significantly impact trading profitability. They particularly affect scalping strategies or high-frequency trading approaches that rely on precise entry and exit timing.

Platform stability appears to be a concern based on user feedback. Some traders report connectivity issues and trading delays during peak market hours. Such technical problems can be particularly problematic in fast-moving markets where delayed order execution can result in substantial losses or missed opportunities.

The spreads starting from 1.5 pips may be competitive for some instruments. However, without clear information about average spreads across different asset classes and market conditions, traders cannot accurately assess the overall cost competitiveness. User feedback suggests some concerns about spread widening during news events and market volatility, which is common but should be clearly communicated to clients.

This eva markets review indicates that while the basic trading infrastructure exists, execution quality and platform reliability issues may impact the overall trading experience for active traders.

Trust and Safety Analysis (3/10)

EVA Markets' trust and safety profile presents the most significant concerns in this comprehensive review. The broker's unregulated status represents the primary risk factor. It operates without oversight from established financial regulatory authorities such as the FCA, CySEC, ASIC, or other major regulators that provide investor protection frameworks.

Operating from Comoros, while legal, does not provide the same level of investor protection, dispute resolution mechanisms, or compensation schemes that traders receive when working with regulated brokers. The absence of regulatory oversight means that client fund segregation, capital adequacy requirements, and operational standards are not subject to external verification or enforcement.

User feedback includes specific concerns about the broker's legitimacy. Some traders question the safety of their deposits and the broker's long-term viability. These concerns are compounded by limited information about company ownership, management team, and corporate structure, which reduces transparency and makes it difficult for clients to assess the organization behind their trading accounts.

The lack of regulatory protection means that in case of broker insolvency or disputes, traders have limited recourse options compared to clients of regulated brokers. Regulated brokers provide compensation schemes and regulatory intervention capabilities. This fundamental safety concern significantly impacts the broker's overall trustworthiness rating.

User Experience Analysis (4/10)

User experience with EVA Markets reflects the mixed nature of feedback received from the trading community. Overall satisfaction levels vary significantly. Some users report positive experiences with the trading platform and asset selection, while others express frustration with various aspects of the service.

Interface design and platform usability receive mixed reviews, though much of the user interface experience is determined by the MetaTrader 5 platform rather than broker-specific customizations. Users familiar with MT5 generally find the platform navigation intuitive. Those new to the platform may face a learning curve.

The account opening and verification process details are not clearly documented. User feedback suggests that the process may be more complex or time-consuming than with some competitors. Clear, efficient onboarding processes are important for user satisfaction and regulatory compliance, even for unregulated brokers.

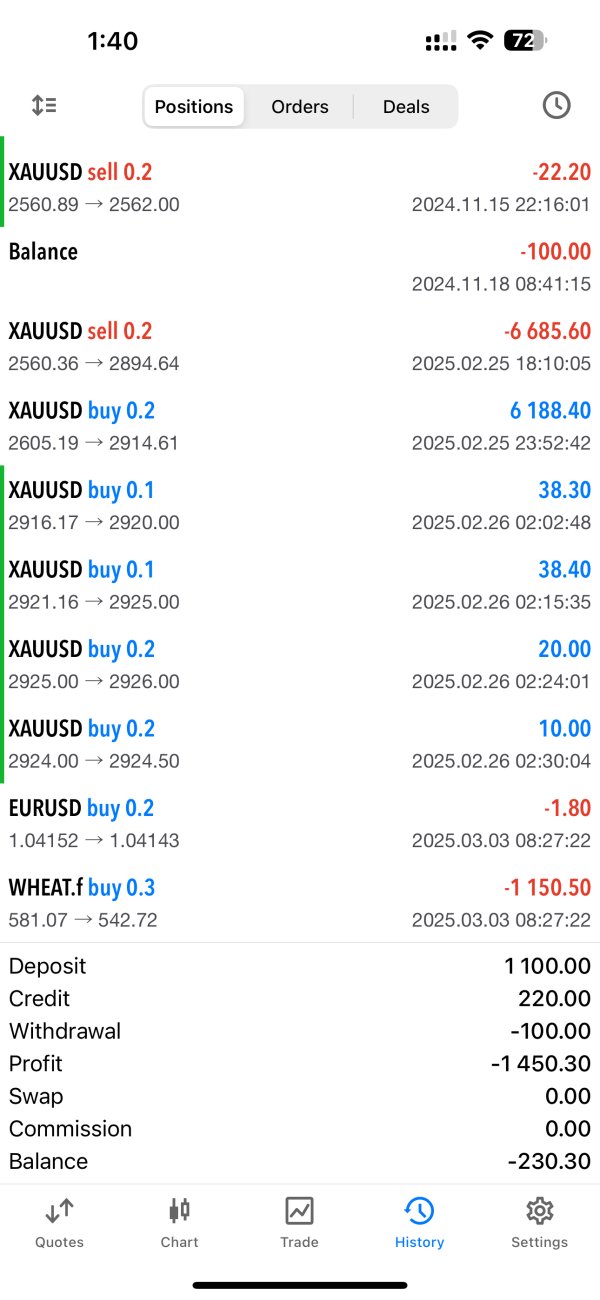

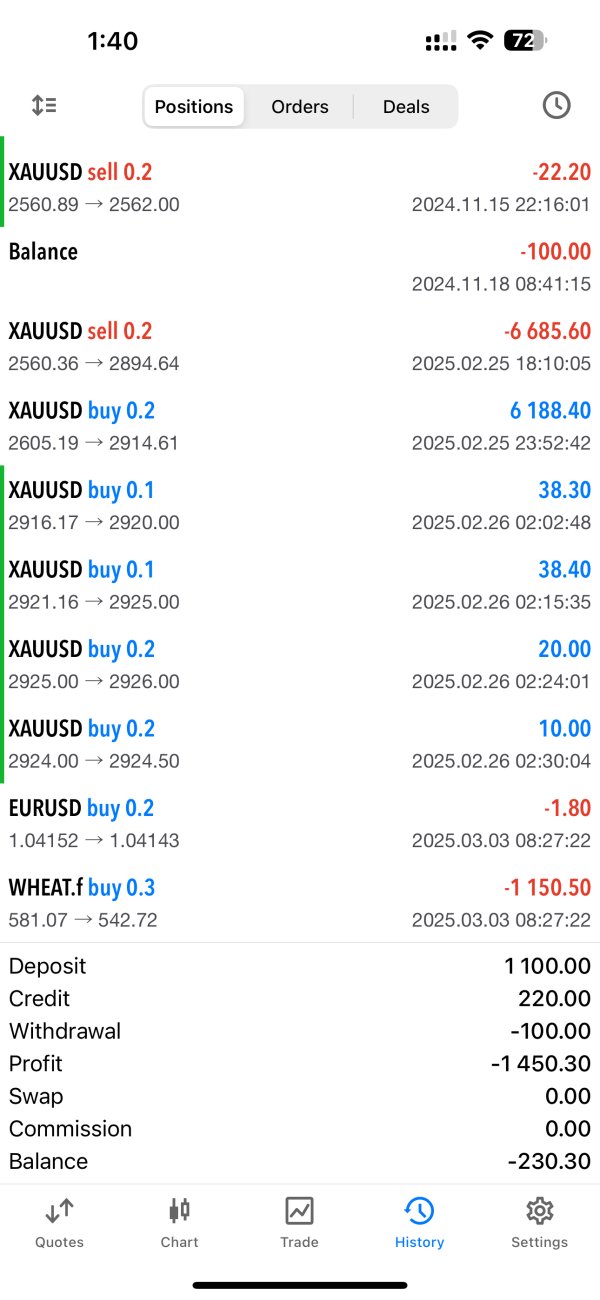

Fund operation experiences vary among users. Some report satisfactory deposit and withdrawal processes while others express concerns about transaction times and requirements. The lack of detailed information about payment methods and processing times contributes to uncertainty about fund management efficiency.

Common user complaints center around customer service responsiveness, platform stability issues, and concerns about the broker's regulatory status. Positive feedback typically focuses on the asset variety available and the functionality of the MT5 platform. The polarized nature of user feedback suggests that experience quality may depend significantly on individual trading requirements and expectations.

Conclusion

This eva markets review reveals a broker that presents both opportunities and significant risks for potential clients. EVA Markets offers access to diverse trading instruments through the professional MetaTrader 5 platform. The broker provides competitive leverage options that may appeal to experienced traders seeking variety in their trading activities.

However, the broker's unregulated status, mixed user feedback, and concerns about customer service quality create substantial risk factors that cannot be overlooked. The high minimum deposit requirement of $1,000 combined with limited transparency about fees and account conditions further complicate the value proposition for retail traders.

EVA Markets may be suitable for experienced traders who understand and accept the risks associated with unregulated brokers. These traders prioritize asset diversity and platform functionality over regulatory protection. However, beginning traders, those seeking comprehensive educational resources, or investors prioritizing fund safety should consider regulated alternatives that provide greater transparency, investor protection, and established track records in the industry.