Gee Bee Review 1

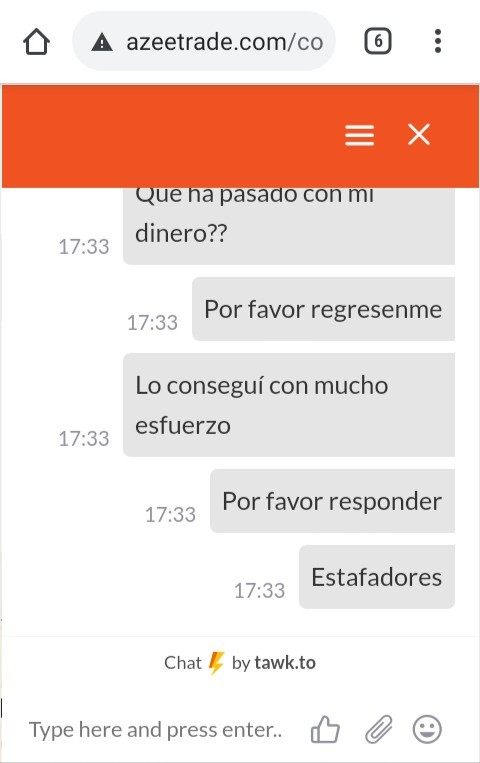

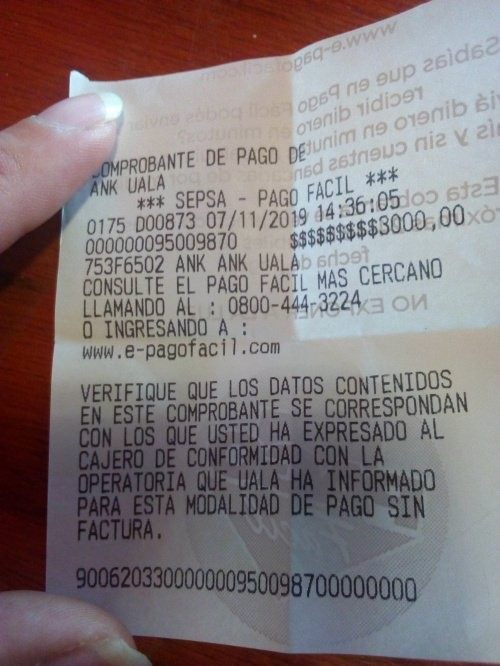

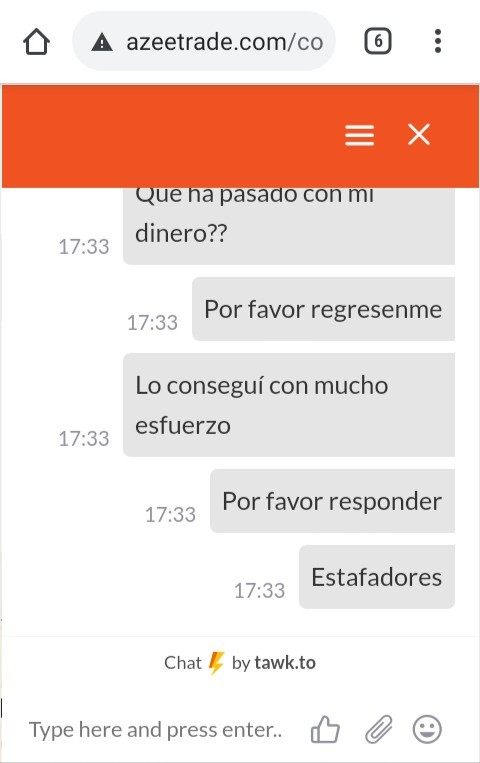

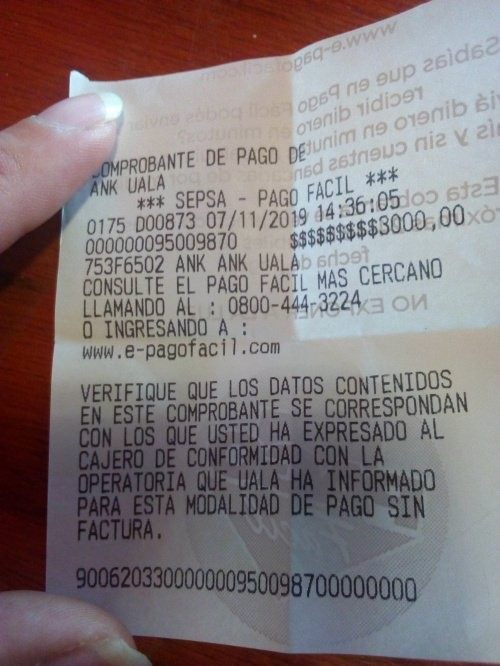

I deposited $3,000 and did not continue when they told me to. Then the balance started to disappear and decreased to 0. I wrote to the technical support but no one replied.

Gee Bee Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited $3,000 and did not continue when they told me to. Then the balance started to disappear and decreased to 0. I wrote to the technical support but no one replied.

This comprehensive Gee Bee review reveals concerning patterns in user satisfaction and service quality that potential traders should carefully consider. User feedback shows that Gee Bee Securities has received consistently low ratings, with users expressing significant dissatisfaction with various aspects of the service across multiple areas of operation. The company operates as Gee Bee Securities Pvt Ltd and holds SEBI registration. It appears to target entry-level traders and those seeking basic trading services in the Indian market.

User ratings average 1.9/5 for Gee Bee Nirman Company and 2.6/5 for GEEBEE Education. These scores indicate widespread user concerns about service delivery and overall experience that extend beyond isolated incidents. The feedback suggests particular issues with work environment quality and limited advancement opportunities for those associated with the company. Additionally, the educational component of their services has received minimal attention from users, suggesting either limited offerings or poor quality in this crucial area for beginner traders.

The company's focus appears to be on serving newcomers to forex trading and budget-conscious traders looking for basic market access. However, the consistently negative feedback raises questions about whether the service meets even basic expectations for this target demographic.

Potential users should exercise caution when considering Gee Bee Securities. Comprehensive regulatory information was not readily available in public sources during our research, which raises transparency concerns about their operations. The company operates under SEBI registration in India, but specific details about additional international regulatory oversight remain unclear. This Gee Bee review is based on available user feedback, company information from official sources, and publicly accessible data.

Traders should be aware that different entities under the Gee Bee name may operate with varying service levels and regulatory frameworks. We recommend conducting independent verification of regulatory status and service terms before engaging with any trading platform to ensure adequate protection. The analysis presented here reflects information available at the time of review and may not capture all aspects of current operations.

| Evaluation Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Insufficient information available in sources |

| Tools and Resources | N/A | No specific details found in available materials |

| Customer Service and Support | 4/10 | Based on negative user feedback regarding service quality |

| Trading Experience | N/A | Limited information available in research sources |

| Trustworthiness | 3/10 | Lack of comprehensive regulatory transparency and negative user sentiment |

| User Experience | 4/10 | Poor user satisfaction ratings and workplace culture feedback |

Gee Bee Securities Pvt Ltd operates from Kolkata, West Bengal, India. The company serves as a SEBI-registered entity in the Indian financial services sector, though specific founding dates were not detailed in available sources. The company's reported revenue of approximately $600,000 suggests a relatively modest operation compared to major international brokers. The organization appears to focus primarily on providing forex trading access and basic educational services to Indian retail traders.

The company structure indicates a lean operation with minimal reported staff. This may explain some of the service quality concerns raised by users in their feedback. Gee Bee's business model centers on offering entry-level trading services, particularly targeting individuals new to forex markets who require basic platform access rather than sophisticated trading tools or premium support services.

Available information suggests the broker operates primarily within the Indian regulatory framework. However, specific details about trading platforms, asset coverage, and international regulatory relationships were not comprehensively documented in accessible sources. This Gee Bee review found that the company's market positioning emphasizes accessibility for beginning traders rather than advanced features for experienced professionals.

Regulatory Coverage: The company operates under SEBI registration in India. However, specific details about additional international regulatory oversight were not available in reviewed sources.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures was not detailed in available materials.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in the sources reviewed for this analysis.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers were not found in available company information.

Trading Assets: Specific information about available currency pairs, commodities, indices, or other tradeable instruments was not comprehensively detailed in accessible sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs was not available in the materials reviewed.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in available sources.

Platform Selection: Information about trading platforms, whether proprietary or third-party solutions like MetaTrader, was not specified in reviewed materials.

Geographic Restrictions: Details about service availability in different countries were not found in accessible sources.

Customer Service Languages: Specific information about supported languages for customer support was not available in reviewed materials.

This Gee Bee review highlights significant information gaps that potential users should address directly with the company before making trading decisions.

The lack of detailed information about account types and conditions represents a significant concern for potential traders evaluating Gee Bee Securities. Standard industry practice involves clearly outlining different account tiers, minimum deposit requirements, and specific features available to different user categories. The absence of this information in publicly accessible sources suggests either limited transparency or minimal account differentiation.

Most established brokers offer multiple account types ranging from basic retail accounts to premium services for high-volume traders. Without clear information about Gee Bee's account structure, potential users cannot adequately assess whether the service meets their specific trading requirements or budget constraints.

The account opening process, verification requirements, and time frames for account activation were not detailed in available sources. This lack of transparency extends to special account features that many modern brokers offer, such as Islamic accounts for traders requiring Sharia-compliant services or demo accounts for practice trading.

For a comprehensive evaluation, traders would need to contact Gee Bee directly to obtain specific details about account conditions, minimum deposits, and available features. This Gee Bee review cannot provide definitive guidance on account suitability without access to detailed terms and conditions that should typically be readily available to potential clients.

The evaluation of trading tools and resources at Gee Bee Securities is significantly hampered by the lack of detailed information in publicly available sources. Modern forex brokers typically provide comprehensive suites of analytical tools, charting capabilities, and educational resources to support trader decision-making and skill development.

Standard industry offerings usually include real-time market analysis, economic calendars, technical analysis tools, and various charting options with multiple timeframes and indicators. The absence of specific information about such tools at Gee Bee raises questions about the comprehensiveness of their trading environment.

Educational resources represent a crucial component for brokers targeting beginning traders, as indicated by Gee Bee's apparent market positioning. However, user feedback suggests limited satisfaction with educational offerings, with GEEBEE Education receiving only 2.6/5 in user ratings. This suggests that either the educational content quality is poor or the availability of learning materials is insufficient.

Automated trading support, research publications, market commentary, and third-party analysis integration are standard features that sophisticated traders expect. Without clear information about these capabilities, it becomes difficult for potential users to assess whether Gee Bee can support their trading strategies and ongoing market analysis needs.

Customer service quality emerges as a significant concern in this Gee Bee review. User feedback indicates substantial dissatisfaction with support services across multiple areas of interaction. The consistently low ratings across different Gee Bee entities suggest systemic issues with service delivery that extend beyond isolated incidents or individual experiences.

Effective customer support in forex trading requires multiple communication channels, including phone, email, live chat, and potentially social media support. Response times should be minimal, particularly for urgent trading-related issues, and support staff should demonstrate comprehensive knowledge of platform functionality and market conditions.

The negative user feedback regarding service quality suggests that Gee Bee may not meet industry standards for customer support responsiveness or effectiveness. This is particularly concerning for beginning traders who typically require more guidance and support as they navigate their initial trading experiences.

Multilingual support capabilities, extended service hours to accommodate different time zones, and specialized technical support for platform issues are standard expectations in the modern forex brokerage industry. The poor user satisfaction ratings suggest that Gee Bee may not adequately address these basic service requirements.

Without access to specific information about support channels, response time commitments, or service level agreements, potential users should carefully evaluate their support needs against the documented user experiences before committing to the platform.

The trading experience evaluation for Gee Bee Securities is significantly limited by the absence of detailed information about platform capabilities, execution quality, and overall trading environment. User feedback provides minimal insight into actual trading conditions, making it difficult to assess whether the platform meets basic functionality requirements for forex trading.

Platform stability and execution speed are critical factors that directly impact trading profitability. This is particularly true for strategies that depend on precise timing or rapid market movements. Without specific user reports about platform performance, connection reliability, or order execution quality, potential traders cannot adequately assess these crucial operational aspects.

Modern trading platforms typically offer sophisticated charting capabilities, multiple order types, risk management tools, and seamless mobile integration. The lack of detailed information about these features at Gee Bee suggests either limited platform capabilities or poor communication of available functionality to potential users.

Mobile trading has become essential for active traders who need market access while away from desktop computers. The absence of specific information about mobile applications, their functionality, and user experience represents a significant information gap in evaluating Gee Bee's overall trading environment.

Order execution transparency, including information about slippage, requotes, and execution statistics, should be readily available from reputable brokers. The lack of such information in available sources raises questions about operational transparency and commitment to providing traders with the data needed to evaluate platform performance.

Trust and reliability concerns represent perhaps the most significant issues identified in this Gee Bee review. The combination of limited regulatory transparency, poor user feedback, and insufficient publicly available information creates substantial uncertainty about the broker's overall reliability and commitment to client protection.

While Gee Bee operates under SEBI registration in India, the lack of detailed information about additional regulatory oversight, client fund segregation practices, and investor protection measures raises important questions about fund security. Reputable brokers typically provide comprehensive information about regulatory compliance, audit procedures, and client protection mechanisms.

Company transparency extends beyond regulatory compliance to include clear communication about business operations, fee structures, and service capabilities. The significant information gaps identified throughout this review suggest that Gee Bee may not meet modern standards for operational transparency that traders should expect from their chosen broker.

Industry reputation and track record are typically established through consistent service delivery, positive user experiences, and transparent business practices. The predominantly negative user feedback and limited positive testimonials suggest that Gee Bee has not established a strong reputation within the trading community.

The absence of information about how the company handles disputes, client complaints, or negative situations further undermines confidence in their commitment to fair dealing and client protection. Established brokers typically provide clear procedures for issue resolution and demonstrate commitment to addressing client concerns promptly and fairly.

User experience analysis reveals concerning patterns that potential traders should carefully consider before choosing Gee Bee Securities. The consistently low user satisfaction ratings across different company entities indicate widespread dissatisfaction that extends beyond isolated service issues to suggest systemic problems with overall user experience.

The 1.9/5 rating for Gee Bee Nirman Company and 2.6/5 for GEEBEE Education represent significantly below-average user satisfaction levels compared to industry standards. These ratings suggest that users encounter substantial difficulties with various aspects of their interaction with the company, from initial onboarding through ongoing service delivery.

User feedback specifically mentions concerns about work environment and advancement opportunities. This may indicate broader organizational issues that could impact client service quality. Companies with poor internal cultures often struggle to deliver consistent, high-quality external services to their clients.

The registration and verification process, fund management procedures, and overall platform usability were not specifically detailed in available user feedback. However, the poor overall ratings suggest that these fundamental aspects of the user experience may not meet reasonable expectations.

Common user complaints appear to center on service quality and organizational culture issues, which can directly impact the quality of support and service that trading clients receive. The negative feedback patterns suggest that users should expect potential difficulties with various aspects of their trading relationship with Gee Bee Securities.

This comprehensive Gee Bee review reveals significant concerns about service quality, transparency, and overall user satisfaction that potential traders should carefully evaluate. The consistently poor user ratings, limited publicly available information about key service features, and lack of comprehensive regulatory transparency combine to create a concerning picture for potential clients.

The broker appears to target beginning and budget-conscious traders. However, the negative user feedback suggests that even this demographic may not receive adequate service quality or support. The absence of detailed information about trading conditions, platform capabilities, and client protection measures represents a significant barrier to informed decision-making.

Based on available evidence, this review cannot recommend Gee Bee Securities to traders seeking reliable, transparent, and well-supported forex trading services. The combination of poor user satisfaction, limited transparency, and insufficient publicly available information suggests that traders would be better served by exploring alternative brokers with stronger track records and more comprehensive service offerings.

FX Broker Capital Trading Markets Review