DRCFX 2025 Review: Everything You Need to Know

Executive Summary

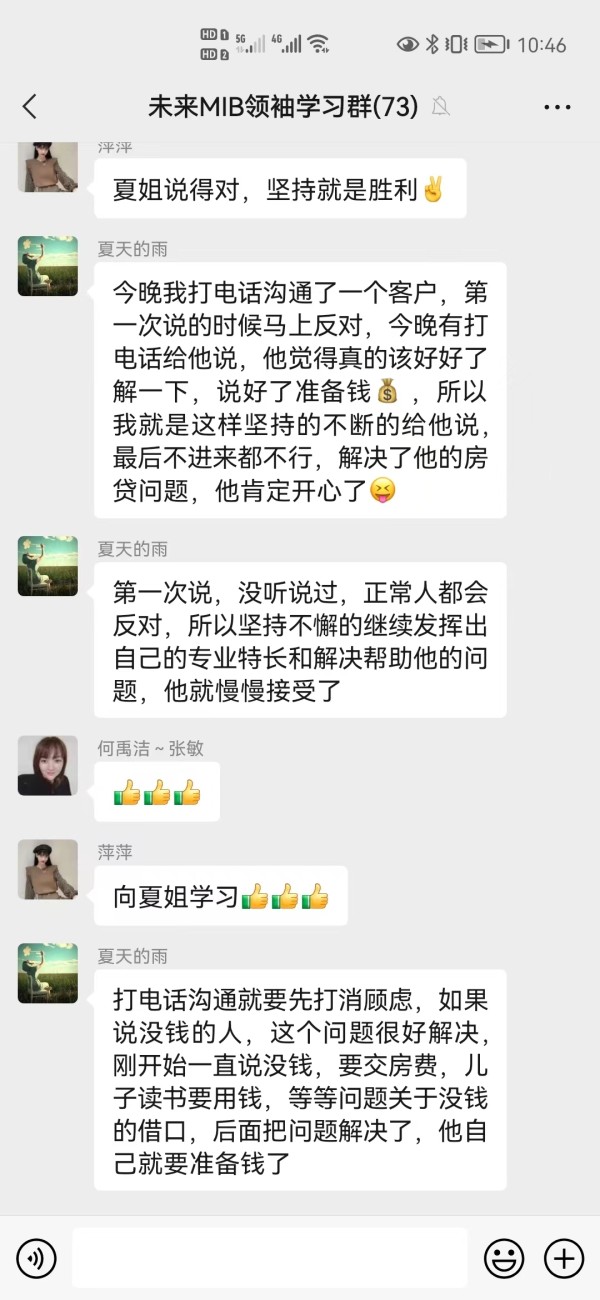

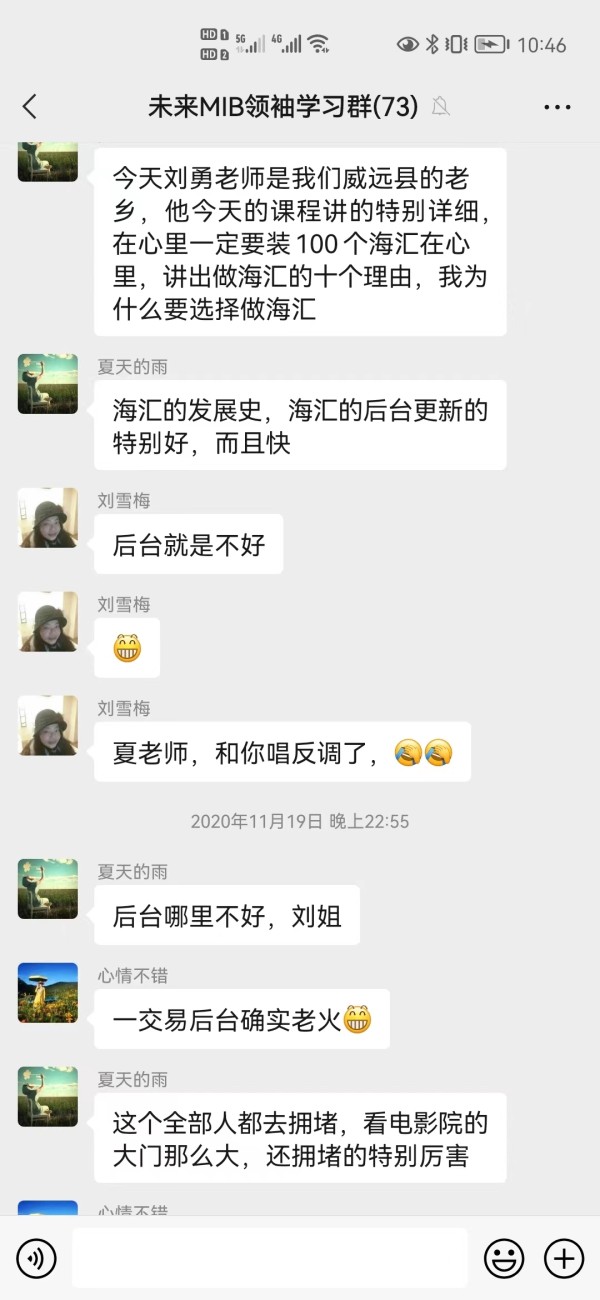

This drcfx review looks at an unregulated offshore forex broker. DRCFX has caused major controversy in the trading community since it started in April 2021. The broker works without any oversight from recognized regulatory authorities, which creates immediate red flags for potential traders.

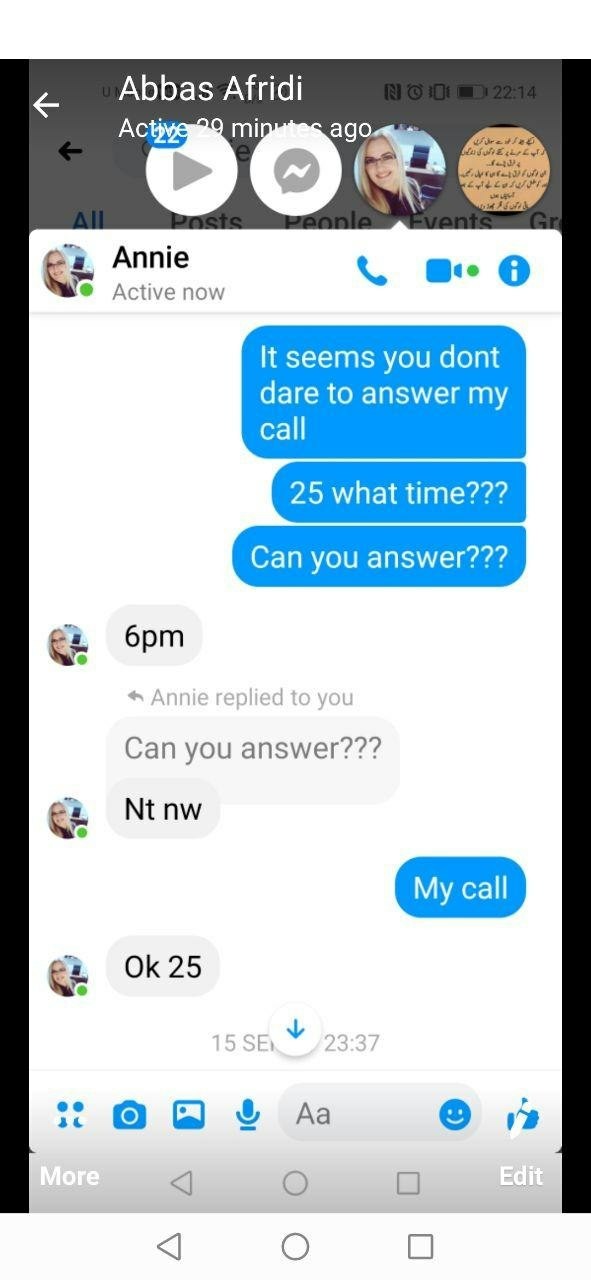

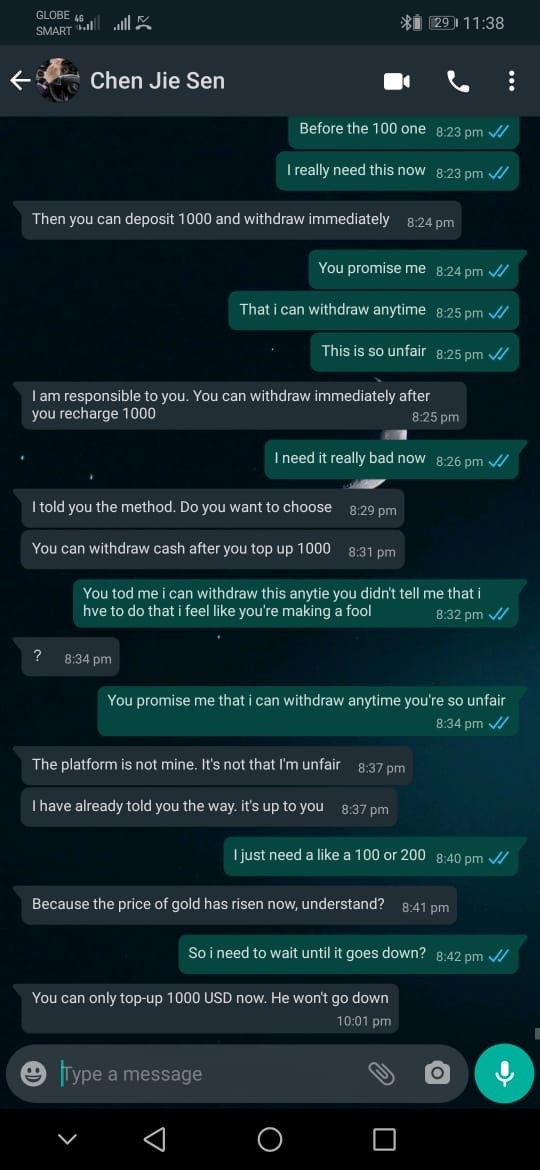

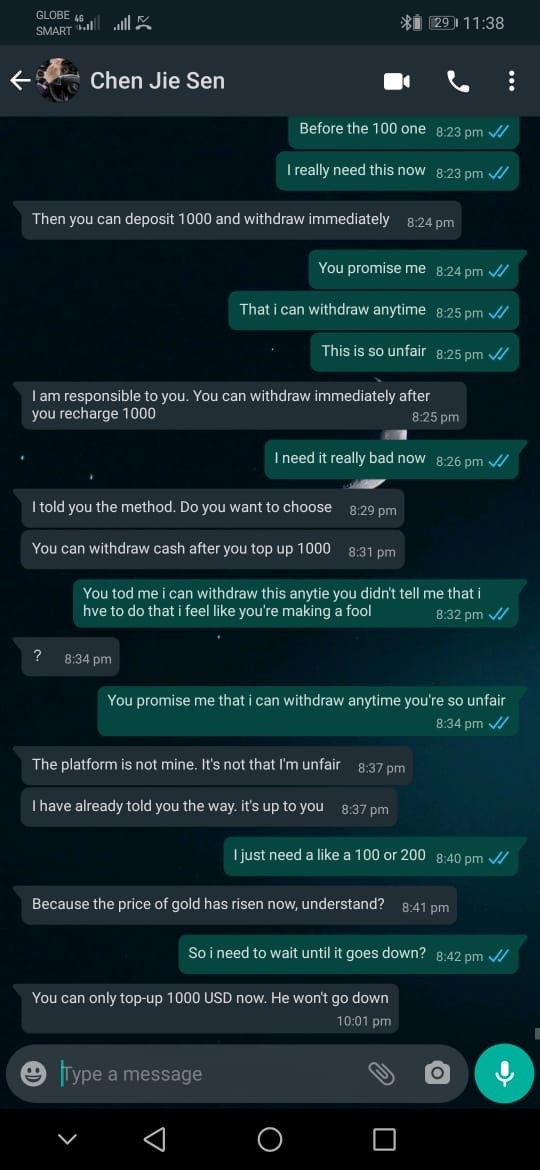

The broker's reputation shows mixed user feedback. Some clients report successful trading and smooth withdrawals, while others raise serious concerns about the platform's legitimacy and business practices. According to market intelligence, DRCFX received a concerning trust score of just 25% from Scamdoc.

This indicates major risk factors. The broker has been linked to allegations of Ponzi scheme operations, though these claims remain unverified. User reviews across platforms show stark divisions, with Trustpilot and WikiFX displaying very different user experiences and ratings.

The platform targets traders seeking high-risk, high-reward opportunities. However, the lack of regulatory protection means users operate entirely at their own risk. Without proper licensing or oversight, clients have no recourse through regulatory channels if disputes arise, making DRCFX suitable only for experienced traders who fully understand the risks.

Important Disclaimers

DRCFX operates as an offshore broker without regulatory supervision. This creates significant differences from licensed entities that traders should understand. The absence of regulatory oversight means standard investor protections, including deposit insurance and dispute resolution mechanisms, are not available.

The broker's operations may vary significantly from regulated competitors. This affects fund security, business practices, and client treatment in ways that could harm traders. This review uses publicly available information, user feedback, and market intelligence from various sources.

No direct testing or verification of the platform's services has been conducted. Information accuracy may vary, and potential discrepancies exist between different sources. Readers should conduct independent research and exercise extreme caution before engaging with any unregulated financial service provider.

Rating Framework

Broker Overview

DRCFX entered the forex market on April 22, 2021. The platform positions itself as an offshore trading broker based in the United States, though specific location details remain undisclosed. The company operates as an unregulated entity, deliberately avoiding oversight from established financial regulatory bodies such as the FCA, CySEC, or ASIC.

This structure allows the broker to offer services with minimal compliance requirements. However, it simultaneously exposes clients to substantial risks that regulated brokers help prevent. The broker's business model appears designed to attract traders seeking opportunities that regulated brokers typically cannot provide.

These opportunities include extremely high leverage ratios or unrestricted trading strategies. However, this freedom comes at the cost of client protection and regulatory safeguards that are standard in the legitimate forex industry. Despite its recent establishment, DRCFX has already generated considerable attention within trading communities.

This attention primarily stems from conflicting reports about its legitimacy and operational practices. The platform's rapid emergence and subsequent controversy highlight the importance of thorough due diligence when selecting forex brokers. This drcfx review aims to provide clarity on the broker's actual offerings and associated risks.

Regulatory Status: DRCFX operates without supervision from any recognized financial regulatory authority. This unregulated status means the broker is not bound by standard industry practices regarding fund segregation, capital adequacy, or client protection measures.

Payment Methods: Specific information regarding deposit and withdrawal methods is not detailed in available documentation. This lack of transparency regarding financial transactions is concerning and typical of unregulated operators who may change payment policies without notice.

Minimum Deposit Requirements: No specific minimum deposit amounts have been disclosed in available sources. This makes it difficult for potential traders to assess the accessibility of the platform or plan their initial investment strategy.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not available in current documentation. Unregulated brokers often use aggressive bonus schemes to attract clients, but the absence of such information may indicate either conservative marketing or limited promotional activities.

Available Assets: The range of tradeable instruments offered by DRCFX has not been specified in available sources. This information gap makes it challenging to evaluate whether the broker meets specific trading requirements or offers diversification opportunities.

Cost Structure: Crucial information about spreads, commissions, and other trading costs remains undisclosed. Without this data, traders cannot accurately assess the competitiveness of DRCFX compared to regulated alternatives or calculate potential trading expenses.

Leverage Options: Maximum leverage ratios have not been specified. Unregulated brokers typically offer higher leverage than their regulated counterparts, potentially exceeding ratios that regulatory bodies consider safe for retail traders.

Platform Technology: The specific trading platforms available through DRCFX have not been identified in current documentation. This makes it impossible to evaluate technological capabilities or user interface quality. This drcfx review reveals significant information gaps that potential clients should consider carefully before proceeding.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by DRCFX remain largely opaque. This contributes to its poor rating in this category and creates serious concerns for potential traders. Without detailed information about account types, minimum deposit requirements, or specific terms and conditions, potential traders cannot make informed decisions about the suitability of available options.

The absence of transparent account structures is particularly concerning for an industry where clear terms are essential. Traditional forex brokers typically offer multiple account tiers designed to accommodate different trader profiles, from beginners to institutional clients. Each tier usually features distinct characteristics such as varying minimum deposits, spread structures, and available leverage.

However, DRCFX has not provided comparable clarity about its account offerings. This makes it impossible to assess whether the broker caters to diverse trader needs or maintains competitive conditions. The account opening process, verification requirements, and ongoing account maintenance procedures also remain undisclosed.

This lack of transparency extends to important aspects such as margin requirements, position sizing limits, and account closure procedures. Without this fundamental information, traders cannot properly evaluate the practical implications of choosing DRCFX as their broker. User feedback regarding account conditions has been mixed, with some traders reporting satisfactory experiences while others express concerns about unclear terms and unexpected changes to account parameters.

The absence of regulatory oversight means that account conditions can be modified without the protections typically afforded to clients of licensed brokers. This drcfx review emphasizes the importance of understanding these limitations before committing funds.

DRCFX receives a very poor rating for tools and resources. This stems from the complete absence of information about available trading tools, analytical resources, or educational materials. Professional forex trading requires access to comprehensive market analysis tools, real-time data feeds, and sophisticated charting capabilities.

The lack of disclosed information about these essential components raises serious questions about the broker's commitment to providing adequate trading infrastructure. Modern forex brokers typically offer integrated economic calendars, technical analysis tools, automated trading capabilities, and market research from reputable sources. These resources are fundamental for making informed trading decisions and managing risk effectively.

Without clear information about available tools, potential DRCFX clients cannot assess whether the platform meets their analytical and strategic requirements. Educational resources represent another critical gap in DRCFX's disclosed offerings. Reputable brokers invest significantly in educational content, including webinars, tutorials, market analysis, and trading guides.