Regarding the legitimacy of MSC GROUP forex brokers, it provides ASIC and WikiBit, .

Is MSC GROUP safe?

Business

License

Is MSC GROUP markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MELBOURNE SECURITIES CORPORATION LIMITED

Effective Date:

2013-10-03Email Address of Licensed Institution:

sbrown@msc.groupSharing Status:

No SharingWebsite of Licensed Institution:

https://www.msc.groupExpiration Time:

--Address of Licensed Institution:

Level 2, 395 Collins Street, MELBOURNE VIC 3000Phone Number of Licensed Institution:

0061 0390502000Licensed Institution Certified Documents:

Is MSC Group A Scam?

Introduction

In the dynamic world of forex trading, the choice of a broker can significantly impact a trader's success. MSC Group, an online trading platform, has emerged as a potential player in this market. However, as with any financial institution, it is crucial for traders to evaluate its credibility and reliability. The forex market is rife with scams and unregulated brokers, making it imperative for traders to conduct thorough research before committing their funds. This article aims to provide an objective analysis of MSC Group, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on various online reviews, regulatory databases, and user feedback, ensuring a comprehensive evaluation of whether MSC Group is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Regulatory bodies ensure that brokers adhere to specific standards, protecting traders from fraud and malpractice. Unfortunately, MSC Group operates without any significant regulatory oversight, which raises red flags about its legitimacy. Below is a summary of the broker's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

MSC Group does not hold a license from any major financial authority, such as the FCA in the UK or ASIC in Australia. This lack of regulation means that traders have little to no legal recourse if they encounter issues with the broker. Furthermore, unregulated brokers often lack transparency and may engage in practices detrimental to traders, such as manipulating spreads or refusing withdrawals. The absence of oversight suggests that MSC Group does not meet the necessary standards to ensure trader safety, leading to the conclusion that MSC Group is not safe.

Company Background Investigation

MSC Group claims to have been established in 2020, but details about its ownership and management team are scarce. The lack of transparency regarding the company's history and the individuals running it raises concerns. A reputable broker typically provides comprehensive information about its founders and management, including their backgrounds and qualifications. In the case of MSC Group, this information is either missing or difficult to verify.

The company's website does not provide clear details about its operational structure or its physical location. This ambiguity is concerning, as it prevents potential clients from understanding who they are entrusting with their money. A broker's credibility is often bolstered by a transparent history and a well-qualified management team; without this, MSC Group appears less trustworthy. Given its unregulated status and the lack of clear ownership information, it is reasonable to conclude that MSC Group may not be a safe option for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. MSC Group offers various trading instruments, including forex, CFDs, and commodities. However, the specifics of its fee structure and trading conditions are not readily available, which is a common tactic employed by potentially fraudulent brokers. Below is a comparison of MSC Group's trading costs with industry averages:

| Fee Type | MSC Group | Industry Average |

|---|---|---|

| Spread on Major Pairs | 5 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread of 5 pips on major currency pairs is significantly higher than the industry average, indicating that trading with MSC Group could be less profitable for traders. Additionally, the absence of a clear commission structure raises questions about hidden fees that may not be disclosed upfront. Such practices are often indicative of a broker that is not fully transparent or may engage in unethical trading practices. Therefore, traders should exercise caution and consider the potential financial implications of trading with MSC Group, as it appears to be an unsafe choice.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. MSC Group's lack of regulation is a significant concern regarding the security of client funds. Regulated brokers are required to implement measures such as segregating client funds from their operational funds, providing a layer of protection in case of insolvency. Unfortunately, MSC Group does not offer such assurances.

The absence of negative balance protection is another significant risk factor. This policy protects traders from losing more money than they initially deposited, a crucial safeguard in the volatile forex market. Without these protections, traders could face substantial financial losses without any recourse. Additionally, there have been reports of clients struggling to withdraw their funds, a common complaint associated with unregulated brokers. This history further emphasizes that MSC Group is not safe for trading.

Customer Experience and Complaints

Customer feedback is a valuable tool for assessing a broker's reliability. Reviews of MSC Group reveal a pattern of complaints related to withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, which is a significant warning sign. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Unresponsive |

| Poor Customer Service | Medium | Limited Assistance |

| High Fees | Medium | Not Addressed |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests. The lack of communication from the broker exacerbated the situation, leading to frustration and distrust. Such experiences are indicative of a broker that may not prioritize customer satisfaction or ethical practices. Therefore, the overall customer experience with MSC Group suggests that it may not be a safe or reliable trading option.

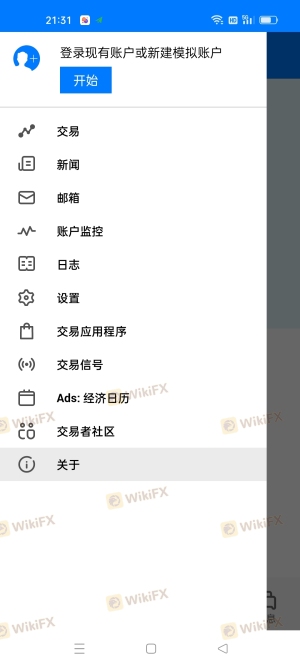

Platform and Execution

The trading platform's performance is crucial for a seamless trading experience. MSC Group utilizes the widely known MetaTrader 4 (MT4) platform, which is generally regarded as user-friendly and efficient. However, user reviews indicate that the platform may experience issues such as slow execution times and occasional downtime. These factors can significantly impact trading effectiveness, especially in the fast-paced forex market.

Additionally, there are concerns about potential manipulation of trading conditions, such as slippage and order rejections. Instances of slippage can lead to unexpected losses, particularly during volatile market conditions. Traders should be wary of platforms that do not provide clear information on execution policies, as this lack of transparency can be a sign of underlying issues. Given these factors, it is essential to approach MSC Group with caution, as the platform may not provide a safe trading environment.

Risk Assessment

Trading with MSC Group presents several risks that potential clients should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the potential for fraud. |

| Fund Safety Risk | High | Lack of fund segregation and negative balance protection. |

| Customer Service Risk | Medium | Reports of poor customer support and unresolved complaints. |

| Trading Conditions Risk | High | High spreads and unclear fee structures can lead to unexpected costs. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with any broker. It is advisable to seek out regulated brokers with transparent practices and robust customer support systems. Additionally, traders should only invest capital they can afford to lose, especially when dealing with unregulated entities like MSC Group.

Conclusion and Recommendations

In conclusion, the evidence suggests that MSC Group raises multiple red flags concerning its legitimacy and safety. The lack of regulatory oversight, combined with a history of customer complaints and unclear trading conditions, indicates that MSC Group is not safe for traders. Potential clients should be cautious and consider alternative options that offer regulatory protection and transparent practices.

For traders seeking reliable alternatives, we recommend considering brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically provide better security for client funds, clearer trading conditions, and a more robust customer support system. By prioritizing safety and transparency, traders can enhance their chances of success in the forex market while minimizing risks associated with unregulated brokers like MSC Group.

Is MSC GROUP a scam, or is it legit?

The latest exposure and evaluation content of MSC GROUP brokers.

MSC GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MSC GROUP latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.