Is Expand Assets Global safe?

Business

License

Is Expand Assets Global a Scam?

Introduction

Expand Assets Global is positioned as a forex and CFD trading platform that claims to offer a range of trading services to both novice and experienced traders. With the rise of online trading, the forex market has become increasingly accessible, attracting many investors. However, this accessibility also opens the door to potential scams and fraudulent activities. Traders must exercise caution and conduct thorough evaluations of any broker before committing their funds. This article aims to provide an objective assessment of Expand Assets Global, exploring its regulatory status, company background, trading conditions, customer feedback, and overall safety. Our investigation is based on a detailed review of online sources, customer testimonials, and regulatory information to determine whether Expand Assets Global is safe or a scam.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in assessing its safety and legitimacy. A regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and protects client funds. In the case of Expand Assets Global, the broker has faced significant scrutiny from various regulatory bodies. Reports indicate that the Financial Markets Authority (FMA) in New Zealand has issued warnings against the broker, labeling it as a high-risk investment platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FMA | N/A | New Zealand | Warning Issued |

The lack of a valid license from a recognized regulatory authority raises red flags. Legitimate brokers are usually registered with top-tier regulators such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). The absence of such regulation suggests that Expand Assets Global operates in a potentially unregulated environment, increasing the risk for investors. Furthermore, the FMA's warning indicates a history of complaints and issues related to fund withdrawals and customer service, reinforcing concerns about the broker's reliability.

Company Background Investigation

Expand Assets Global's company history is another area of concern. The broker's website lacks transparency regarding its ownership structure and management team. Typically, reputable brokers provide detailed information about their founders and key personnel, including their qualifications and experience in the financial industry. In this case, however, the absence of such information raises questions about the credibility of the broker.

The company's operational history is relatively short, which can be a disadvantage in the financial services industry. Established brokers often have a track record that demonstrates their ability to manage client funds responsibly over time. The lack of transparency and the short history of Expand Assets Global contribute to the perception that it may not be a trustworthy option for traders looking to invest their money.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its overall value. Expand Assets Global claims to provide competitive trading conditions, including various account types and trading instruments. However, many reviews highlight potential issues with the broker's fee structure.

| Fee Type | Expand Assets Global | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable (up to 3 pips) | 1-2 pips |

| Commission Model | N/A | N/A |

| Overnight Interest Range | High (up to 5%) | 0.5-1% |

The spreads offered by Expand Assets Global are notably higher than the industry average, which could significantly impact traders' profitability. Additionally, the lack of a clear commission structure may lead to confusion regarding the total cost of trading. High overnight interest rates further exacerbate the cost of holding positions, making it less favorable for traders who prefer longer-term strategies. Such unfavorable trading conditions warrant caution and further investigation into whether Expand Assets Global is truly safe for trading.

Client Funds Security

The safety of client funds is paramount when choosing a broker. Expand Assets Global's approach to fund security has been questioned due to its lack of regulatory oversight. Legitimate brokers typically implement measures such as segregated accounts to protect clients' funds from being used for operational expenses. However, there is little information available regarding Expand Assets Global's policies on fund segregation and investor protection.

Furthermore, the broker's website does not mention any negative balance protection, which is a crucial feature that ensures clients cannot lose more than their deposited amounts. The absence of such protections raises concerns about the potential risks associated with trading with Expand Assets Global. Historical complaints about difficulties in withdrawing funds further highlight the importance of ensuring that a broker has robust security measures in place.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. A review of online platforms reveals a pattern of negative experiences reported by users of Expand Assets Global. Many clients have expressed frustration over withdrawal issues, with complaints about excessive fees and delays in processing requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Misleading Information | High | Poor |

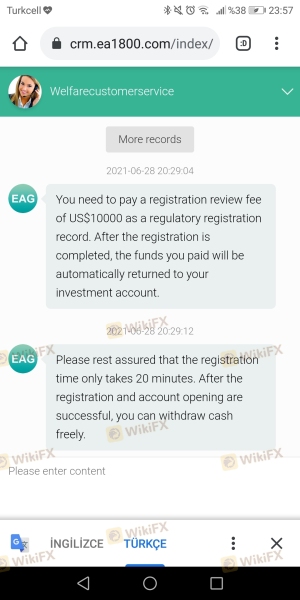

Several users have reported that after depositing funds, they faced challenges when attempting to withdraw their money. In some instances, customers have claimed that their accounts were frozen or that they were pressured to deposit additional funds before being allowed to withdraw. These complaints indicate a concerning trend that suggests Expand Assets Global may not prioritize customer satisfaction or transparency, raising further doubts about whether it is safe for trading.

Platform and Trade Execution

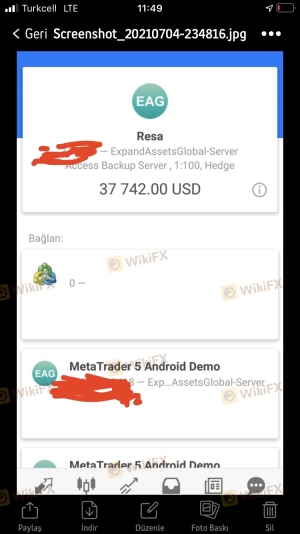

The trading platform offered by a broker is critical for providing a seamless trading experience. Expand Assets Global claims to offer a user-friendly platform; however, user experiences suggest otherwise. Many clients have reported issues with platform stability and execution quality. Instances of slippage and order rejections have been noted, which can severely affect trading outcomes.

Moreover, the absence of industry-standard platforms such as MetaTrader 4 or 5 raises concerns about the broker's technological capabilities. A lack of advanced trading tools and features can hinder traders' ability to analyze markets effectively and execute trades efficiently. If Expand Assets Global does not provide a reliable platform, it could further exacerbate the risks associated with trading with this broker.

Risk Assessment

Using Expand Assets Global involves several inherent risks that potential traders should be aware of. A comprehensive risk assessment reveals the following:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, FMA warnings issued. |

| Financial Risk | High | High spreads and overnight fees could lead to losses. |

| Operational Risk | Medium | Reports of platform issues and poor customer service. |

| Withdrawal Risk | High | Numerous complaints about withdrawal difficulties. |

Given these risks, traders should proceed with extreme caution. It is advisable to consider alternative brokers with a proven track record and better regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Expand Assets Global raises several red flags that warrant serious consideration. The lack of regulatory oversight, high trading costs, and numerous customer complaints indicate that it may not be a safe option for traders. Potential investors should be wary of the risks associated with this broker.

For traders seeking reliable alternatives, it is recommended to consider brokers that are regulated by reputable authorities and have a history of positive customer feedback. Some trustworthy options include brokers like IG, OANDA, and Forex.com, which offer competitive trading conditions and robust regulatory protections. Ultimately, conducting thorough research and due diligence is essential for ensuring a safe and profitable trading experience.

Is Expand Assets Global a scam, or is it legit?

The latest exposure and evaluation content of Expand Assets Global brokers.

Expand Assets Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Expand Assets Global latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.