European Trade 2025 Review: Everything You Need to Know

Executive Summary

This European Trade review gives you a complete analysis of a trading company that works in the European market. We keep a neutral view because there is limited public information available, and we look at how the broker might compete in the forex market. The broker seems to focus on traders who want to join European Union market trading, but we cannot find clear details about how it operates from the information we have.

Our review of European Trade shows big gaps in important areas like regulation status, trading conditions, and customer service. The European trade policy review framework helps us understand market changes, but we cannot find specific details about this broker's services, rule-following, and operating standards in current public sources. This lack of clear information makes us question whether the broker follows industry standards and protects traders properly.

Since we have limited information, potential traders should be careful and research thoroughly before using this platform. The missing regulatory information, detailed trading conditions, and proven customer feedback creates doubt about whether the broker is reliable and offers good service in the competitive forex market.

Important Notice

Regional Entity Differences: European Trade may work under different rules in various countries because we cannot find specific regulatory information in available sources. Traders should check the specific regulatory status for their region before opening accounts, as protections and trading conditions may be very different between operational entities.

Review Methodology: This review uses limited publicly available information. The lack of complete background materials, detailed operational data, and verified customer feedback limits how deep our analysis can be, so readers should consider this limitation when reading the assessment and get additional information directly from the broker before making trading decisions.

Rating Framework

Broker Overview

European Trade works in the competitive forex brokerage sector. We cannot find specific details about when it started, who founded it, and how the company is structured in current public documentation, which creates challenges for traders who want complete information about the platform's background and operating history.

The missing information about the company's regulatory status, licensing locations, and rule-following frameworks is a big concern for potential traders. In today's forex industry, clear regulatory disclosure is essential for trader protection and platform trust, and without verified regulatory information, traders cannot properly judge the level of protection and oversight for their potential trading activities.

This European Trade review shows why complete research is important when evaluating forex brokers. The platform's trading setup, supported asset types, and execution model are not detailed in available sources, making it hard to assess how the broker compares to established industry players, and traders typically need detailed information about spreads, execution speeds, platform stability, and asset availability to make informed decisions about broker selection.

Regulatory Regions: We cannot identify specific regulatory locations and licensing authorities in available source materials. This creates uncertainty about the broker's compliance status and trader protection measures.

Deposit and Withdrawal Methods: Payment processing options, supported currencies, and transaction processing times are not specified in current documentation. This limits traders' ability to assess fund management convenience.

Minimum Deposit Requirements: Entry-level investment amounts and account funding minimums are not detailed in available information sources.

Bonus and Promotions: Promotional offerings, welcome bonuses, and incentive programs are not described in accessible documentation.

Tradeable Assets: The range of available financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, is not specified in source materials.

Cost Structure: Spread ranges, commission rates, overnight financing charges, and additional fees are not detailed in available information. This prevents accurate cost assessment.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in current documentation.

Platform Options: Trading software choices, mobile applications, and web-based platform features are not described in available sources.

Geographic Restrictions: Regional availability and restricted territories are not clearly outlined in accessible materials.

Customer Support Languages: Multilingual support options and communication channels are not specified in current documentation.

This European Trade review emphasizes the significant information gaps that potential traders must consider when evaluating this platform against industry alternatives.

Account Conditions Analysis

The evaluation of European Trade's account conditions faces big limitations because we cannot find specific information in available source materials. Industry-standard account types typically include basic, premium, and VIP levels with different features, minimum deposits, and trading benefits, but European Trade's specific account structure, level benefits, and qualification requirements are not documented in accessible sources.

Minimum deposit requirements are crucial for trader accessibility, especially for newcomers to forex trading. Competitive brokers typically offer entry-level accounts with deposits ranging from $10 to $500, while premium accounts may require $1,000 to $10,000 or more, and without specific information about European Trade's deposit amounts, potential traders cannot assess the platform's accessibility or compare it effectively with industry alternatives.

Account opening procedures and verification requirements are essential considerations for trader onboarding. Modern brokers typically use Know Your Customer and Anti-Money Laundering procedures requiring identity verification, address confirmation, and financial background assessment, and the absence of detailed information about European Trade's onboarding process creates uncertainty about verification timeframes and documentation requirements.

Special account features, such as Islamic accounts for Muslim traders, demo accounts for practice trading, and managed account options, are increasingly important in the competitive brokerage landscape. This European Trade review cannot assess the availability of such specialized account types due to insufficient information in source materials, which limits the evaluation's completeness for traders with specific religious or experience-based requirements.

Trading tools and analytical resources form the backbone of successful forex trading platforms. European Trade's specific offerings in this area remain undocumented in available source materials, and modern brokers typically provide complete charting packages, technical indicators, economic calendars, and market analysis tools to support trader decision-making processes.

Educational resources are a critical difference-maker in the competitive brokerage market, particularly for novice traders seeking to develop their skills and market understanding. Industry leaders typically offer webinar series, video tutorials, e-books, and interactive courses covering fundamental and technical analysis, risk management, and platform operation, and the absence of information about European Trade's educational commitment limits assessment of its value for developing traders.

Research and analysis capabilities are essential for informed trading decisions. Competitive brokers provide daily market commentary, economic event analysis, and expert insights, and professional traders often rely on fundamental analysis reports, technical analysis updates, and real-time news feeds to guide their trading strategies. Without specific information about European Trade's research offerings, potential users cannot evaluate the platform's analytical support quality.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, and copy trading features, has become increasingly important in modern forex markets. The availability of such advanced features can significantly impact trader productivity and strategy implementation capabilities, yet European Trade's automation support remains unspecified in current documentation.

Customer Service and Support Analysis

Customer service quality is a fundamental aspect of broker evaluation. European Trade's support infrastructure remains undocumented in available source materials, and effective customer support typically includes multiple communication channels, including live chat, email, telephone support, and complete FAQ sections to address trader inquiries promptly and effectively.

Response time metrics are crucial indicators of customer service quality. Industry-leading brokers typically provide live chat responses within minutes and email responses within 24 hours, and professional support teams should demonstrate technical skills, trading knowledge, and problem-solving capabilities to address complex trader concerns effectively. The absence of information about European Trade's response performance creates uncertainty about service quality expectations.

Multilingual support capabilities are essential for brokers serving international markets. Competitive platforms typically offer customer service in major languages including English, Spanish, French, German, and regional languages relevant to their target markets, and professional translation and cultural sensitivity help ensure effective communication across diverse trader populations.

Support availability schedules significantly impact trader satisfaction, particularly for active traders operating across different time zones. Leading brokers typically provide 24/5 support during market hours, with some offering extended coverage for cryptocurrency and global market trading, and without specific information about European Trade's support hours and availability, traders cannot assess service accessibility for their trading schedules.

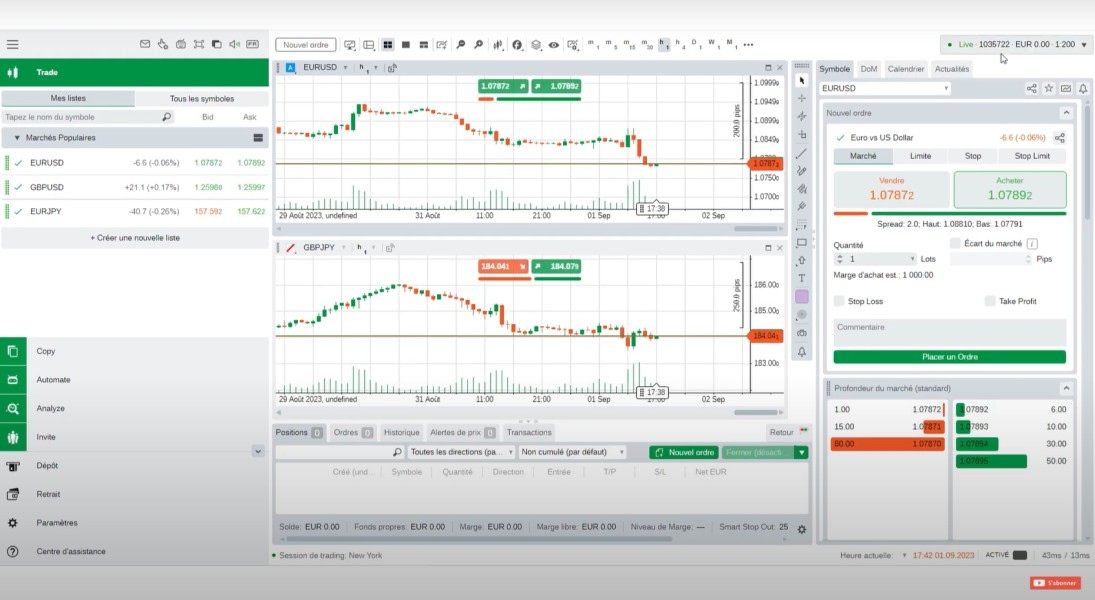

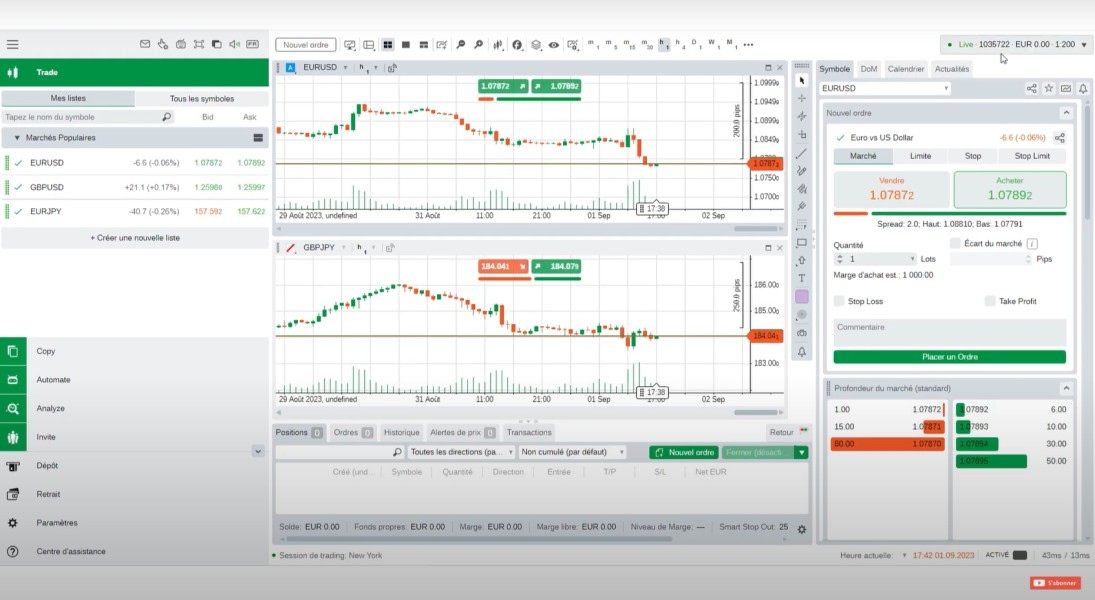

Trading Experience Analysis

Platform stability and execution quality form the foundation of positive trading experiences. European Trade's technical performance metrics are not available in source documentation, and modern trading platforms must deliver reliable connectivity, fast order execution, minimal slippage, and consistent uptime to meet professional trader requirements in fast-moving forex markets.

Order execution quality includes fill rates, execution speeds, and price accuracy. Competitive brokers typically achieve execution times under 100 milliseconds and minimal price deviation from quoted rates, and professional traders require consistent execution performance during both normal and volatile market conditions to implement their strategies effectively.

Platform functionality and user interface design significantly impact trader productivity and satisfaction. Modern trading platforms typically offer advanced charting capabilities, customizable layouts, one-click trading options, and complete order management tools, and mobile trading applications should mirror desktop functionality while optimizing for touch-screen navigation and on-the-go trading requirements.

Trading environment factors, including available order types, risk management tools, and position sizing options, influence strategy implementation capabilities. Professional traders often require advanced order types such as stop-loss, take-profit, trailing stops, and pending orders to execute sophisticated trading strategies effectively, and this European Trade review cannot assess these critical features due to insufficient technical information in available sources.

Trustworthiness Analysis

Regulatory oversight is the cornerstone of broker trustworthiness. European Trade's regulatory status remains unspecified in available documentation, and reputable brokers typically hold licenses from recognized authorities such as the FCA, CySEC, ASIC, or other tier-one regulators that enforce strict operational standards and client protection measures.

Fund security measures, including segregated client accounts, deposit insurance, and banking relationships with reputable financial institutions, are essential for trader protection. Leading brokers typically maintain client funds separate from operational capital and provide clear disclosure about fund protection mechanisms and insurance coverage limits.

Corporate transparency, including detailed company information, management team disclosure, and financial reporting, helps establish broker credibility and accountability. Professional brokers typically provide complete corporate information, regulatory filing access, and clear communication about business operations and risk factors.

Industry reputation and track record assessment requires evaluation of operational history, regulatory compliance records, and any significant incidents or sanctions. The absence of detailed background information about European Trade prevents complete assessment of its industry standing and historical performance record.

User Experience Analysis

Overall user satisfaction assessment faces limitations because we cannot find verified customer feedback and testimonials in available source materials. User experience evaluation typically includes platform usability, customer service interactions, trading condition satisfaction, and overall recommendation rates from existing traders.

Interface design and usability factors significantly impact trader adoption and long-term satisfaction. Modern trading platforms should offer intuitive navigation, customizable workspaces, efficient trade execution workflows, and responsive design across desktop and mobile devices, and professional traders require platforms that support their workflow efficiency and minimize operational friction.

Registration and account verification processes should balance security requirements with user convenience. They typically require identity verification, address confirmation, and financial background assessment while minimizing approval delays, and streamlined onboarding procedures help reduce trader frustration and accelerate account activation timelines.

Fund management operations, including deposit processing, withdrawal procedures, and transaction transparency, significantly impact user satisfaction. Competitive brokers typically offer multiple payment methods, reasonable processing times, and transparent fee structures for financial transactions, and the absence of specific information about European Trade's fund management procedures limits assessment of user convenience and satisfaction potential.

Conclusion

This European Trade review reveals significant information limitations that prevent complete assessment of the broker's offerings, regulatory status, and operational quality. The absence of detailed information about trading conditions, regulatory compliance, customer service capabilities, and user feedback creates substantial uncertainty for potential traders considering this platform.

The evaluation suggests that European Trade may be suitable for traders specifically interested in European Union market participation. The lack of concrete operational details makes it difficult to recommend the platform confidently, and the significant information gaps identified across all evaluation categories indicate potential concerns about transparency and operational maturity compared to established industry competitors.

Potential traders should exercise considerable caution and conduct extensive independent research before engaging with European Trade, given the limited publicly available information about its regulatory status, trading conditions, and customer protection measures. The competitive forex brokerage market offers numerous well-established alternatives with transparent operations and complete regulatory oversight that may better serve trader needs and protection requirements.