Cmarket Review 1

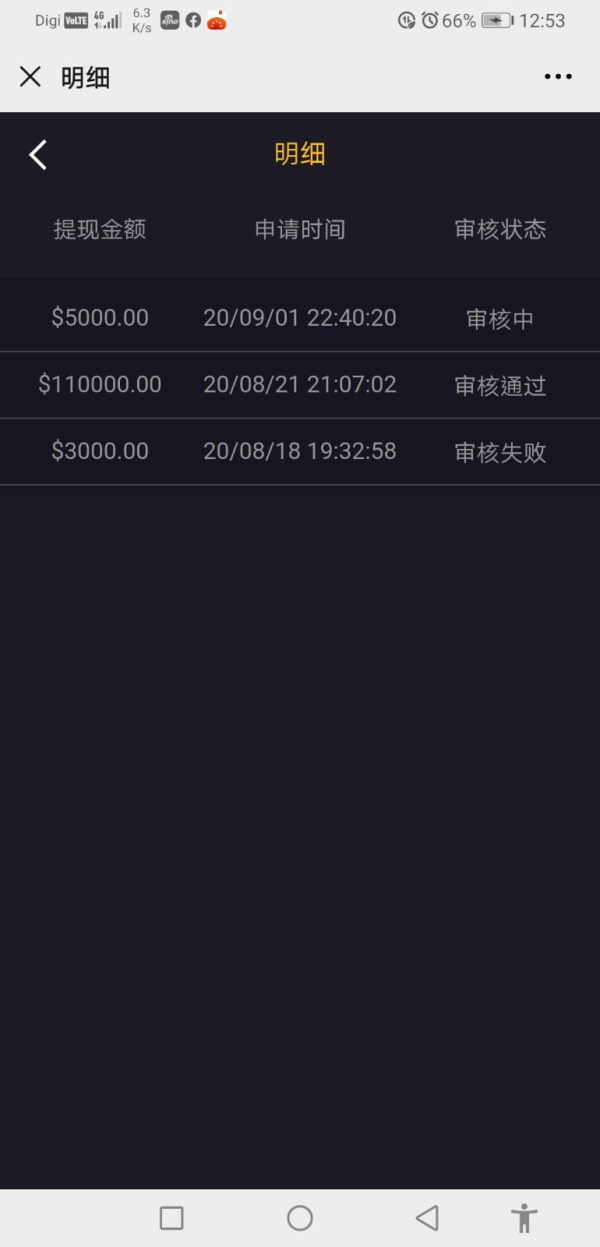

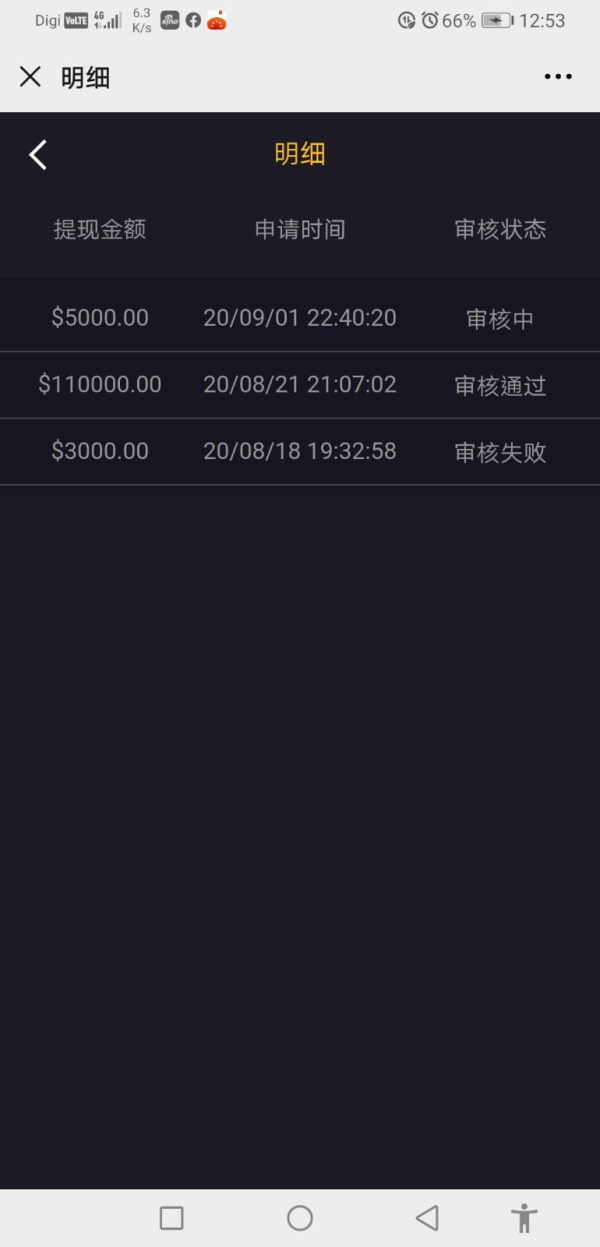

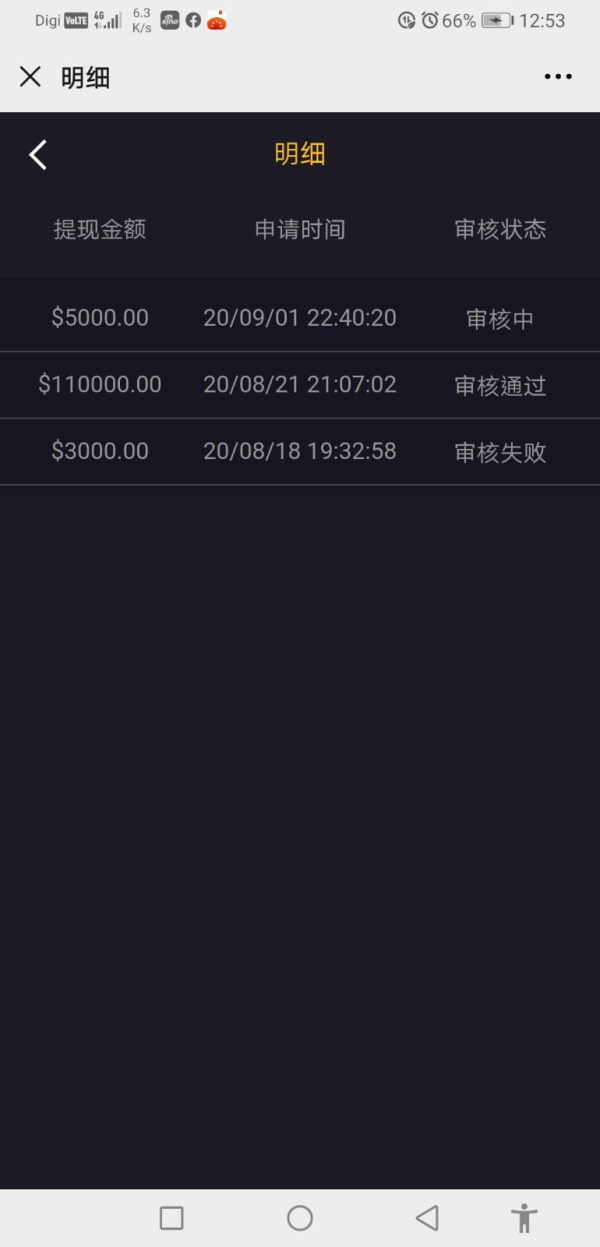

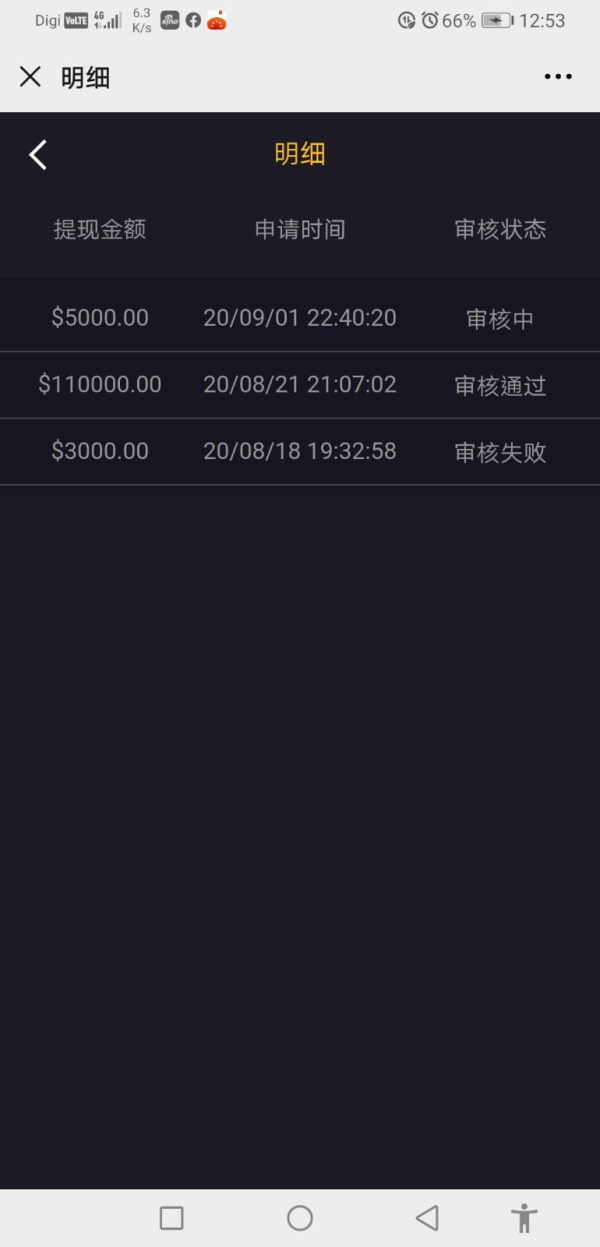

Beware of this fraud platform. I applied for withdrawals last August. But I haven’t received it yet. The customer service and the trader who guided me all blacklisted me and can’t be reached

Cmarket Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Beware of this fraud platform. I applied for withdrawals last August. But I haven’t received it yet. The customer service and the trader who guided me all blacklisted me and can’t be reached

This comprehensive Cmarket review examines a forex broker that presents a complex picture of legitimacy mixed with user concerns. Scamadviser has evaluated Cmarket as a legal and safe website, which suggests basic operational legitimacy. However, the broker faces significant credibility challenges with a notably low TrustScore of 2 from user evaluations on cmarketcap.com.

The platform shows contrasting ratings across different review platforms. While Cmarket.uk receives a 4-star rating on Trustpilot, other industry sources including Traders Union and BrokerChooser have raised potential scam risk concerns. This disparity in evaluations makes Cmarket a broker requiring careful consideration by potential traders.

The target user base appears to be traders seeking a legally compliant trading environment. The mixed reviews suggest users should exercise enhanced due diligence. The broker's positioning in the market reflects the ongoing challenges faced by newer or less established forex brokers in building comprehensive trust and reputation in a highly competitive industry.

Cmarket's regulatory status may vary significantly across different jurisdictions. Potential users must thoroughly research the specific regulatory framework applicable to their region before engaging with the platform. The evaluation methodology for this review encompasses multiple dimensions including user feedback analysis, safety assessments, and available regulatory information.

Traders should note that the conflicting information from various review platforms highlights the importance of conducting independent research. The significant variance in user ratings and safety assessments suggests that individual experiences with Cmarket may differ substantially. Personal due diligence is essential for any trading decision.

| Dimension | Score | Basis |

|---|---|---|

| Account Conditions | N/A | Information not available in source materials |

| Tools and Resources | N/A | Information not available in source materials |

| Customer Service | N/A | Information not available in source materials |

| Trading Experience | N/A | Information not available in source materials |

| Trust Score | 5/10 | Mixed signals: Legal/safe per Scamadviser, but scam risks noted by Traders Union and BrokerChooser |

| User Experience | N/A | Information not available in source materials |

Cmarket operates as a forex broker in an increasingly competitive market. Specific details about its establishment date and founding background are not detailed in available source materials. The company's business model and operational structure remain largely undisclosed in public documentation.

This lack of transparency raises questions that potential clients should consider. The broker's positioning suggests focus on providing forex trading services. The exact scope of its trading offerings, platform technologies, and asset coverage requires further investigation beyond what current assessments provide.

Cmarket has received legal and safety validation from Scamadviser according to available assessments. This indicates basic compliance with fundamental operational requirements. However, the absence of detailed regulatory information and specific licensing details in public materials suggests that this Cmarket review must acknowledge significant information gaps.

Potential users should address these gaps through direct inquiry with the broker.

Regulatory Coverage: Specific regulatory information is not detailed in available source materials. This represents a significant information gap for potential traders seeking comprehensive regulatory assurance.

Deposit and Withdrawal Methods: Available payment processing options are not specified in current source materials.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not available in source materials.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in available assessments.

Tradable Assets: The range of available trading instruments and asset classes is not specified in source materials.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in current assessments. This represents a crucial information gap for cost-conscious traders.

Leverage Ratios: Specific leverage offerings are not detailed in available materials.

Platform Options: Trading platform availability and technological infrastructure details are not specified in source materials.

Geographic Restrictions: Specific regional limitations are not detailed in current assessments.

Customer Support Languages: Available language support options are not specified in source materials.

This comprehensive Cmarket review must acknowledge that the lack of detailed operational information represents a significant concern for traders seeking thorough broker evaluation.

The evaluation of Cmarket's account conditions faces significant limitations due to insufficient information in available source materials. Account type varieties, their specific features, and differentiation strategies are not detailed in current assessments. This lack of transparency regarding account structures represents a substantial concern for potential traders.

Traders require clear understanding of available options before making platform commitments. Minimum deposit requirements, which serve as crucial decision factors for many traders, are not specified in available materials. The absence of clear deposit thresholds makes it difficult for potential users to assess accessibility and affordability.

The account opening process, verification requirements, and onboarding procedures remain undisclosed. This creates uncertainty about user experience expectations. Special account features such as Islamic accounts, professional trading accounts, or other specialized offerings are not mentioned in current source materials.

This information gap extends to account management tools, portfolio tracking capabilities, and account customization options. Modern traders typically expect these features from established brokers. The lack of comprehensive account condition information in this Cmarket review highlights the need for potential users to conduct direct inquiries with the broker.

Traders should obtain essential details about account structures, requirements, and available features before making trading decisions.

Assessment of Cmarket's trading tools and educational resources encounters substantial limitations due to insufficient information in available source materials. The range and quality of analytical tools, charting capabilities, and technical analysis resources remain unspecified. This makes it challenging to evaluate the platform's suitability for different trading strategies and experience levels.

Research and market analysis provisions, including economic calendars, market news feeds, and expert analysis, are not detailed in current assessments. Educational resources such as trading guides, webinars, tutorials, and learning materials are similarly absent from available information. This represents a significant gap for traders seeking comprehensive learning support.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, and API access, is not mentioned in source materials. These features have become increasingly important for modern forex trading. Their absence from available documentation raises questions about platform technological sophistication.

The information gaps regarding tools and resources in available materials suggest that potential users should directly contact Cmarket. Traders should obtain detailed information about available trading tools, educational support, and technological capabilities before making platform selection decisions.

Evaluation of Cmarket's customer service capabilities faces significant constraints due to limited information in available source materials. Customer support channels, including live chat availability, email support, phone assistance, and help desk operations, are not specified in current assessments. This makes it impossible to assess accessibility and convenience of support services.

Response time expectations, service quality standards, and problem resolution procedures remain undocumented in available materials. These factors are crucial for trader confidence, particularly during urgent trading situations or technical difficulties that require immediate assistance. Multilingual support capabilities, which are essential for international forex brokers, are not detailed in source materials.

The availability of support in various languages directly impacts user experience for non-English speaking traders. This represents an important service consideration. Customer service hours, timezone coverage, and 24/7 availability are not specified in current assessments.

Given the global nature of forex markets, round-the-clock support availability often serves as a differentiating factor among brokers. This information gap is particularly significant for international traders seeking reliable support coverage.

Assessment of Cmarket's trading experience quality encounters substantial limitations due to insufficient technical information in available source materials. Platform stability, execution speed, and system reliability metrics are not provided in current assessments. This makes it difficult to evaluate the fundamental technical performance that directly impacts trading success.

Order execution quality, including slippage rates, requote frequency, and fill rates, remains unspecified in available documentation. These technical performance indicators are crucial for traders, particularly those employing scalping strategies or trading during high volatility periods. Execution quality directly affects profitability in these scenarios.

Platform functionality completeness, including advanced order types, risk management tools, and trading interface customization options, is not detailed in source materials. Mobile trading experience, application availability, and cross-device synchronization capabilities are similarly absent from current assessments. The trading environment characteristics, including market depth information, price feed quality, and trading condition transparency, are not specified in available materials.

This comprehensive Cmarket review must acknowledge that the absence of detailed trading experience information represents a significant evaluation limitation. Potential users seeking thorough platform assessment face substantial information gaps.

Cmarket's trust evaluation reveals a complex landscape of mixed signals that potential traders must carefully consider. Scamadviser has evaluated the platform as legal and safe according to assessments, providing basic legitimacy validation. However, this positive assessment contrasts sharply with concerns raised by other industry sources.

This creates a nuanced trust picture requiring careful analysis. Traders Union and BrokerChooser have noted potential scam risks associated with Cmarket, introducing significant credibility concerns. These concerns contradict the safety validation from other sources.

This disparity in professional assessments highlights the importance of comprehensive due diligence. Trust evaluation cannot rely on single source validation. The TrustScore of 2 from user evaluations on cmarketcap.com indicates substantial user dissatisfaction or concerns.

This suggests that actual user experiences may not align with formal safety assessments. This low user trust rating represents a significant red flag that potential traders should carefully consider alongside professional evaluations. Regulatory transparency and licensing information gaps further complicate trust assessment.

Comprehensive regulatory validation typically serves as a cornerstone of broker credibility. The absence of detailed regulatory disclosure in available materials adds uncertainty to overall trust evaluation and emphasizes the need for enhanced due diligence by potential users.

User experience evaluation for Cmarket faces significant limitations due to insufficient feedback data in available source materials. Overall user satisfaction metrics, beyond the notably low TrustScore of 2, are not comprehensively detailed in current assessments. This makes it challenging to develop a complete picture of user sentiment and experience quality.

Interface design quality, platform usability, and navigation efficiency are not specified in available materials. These factors directly impact daily trading experience and user satisfaction. Their absence from documentation represents a significant evaluation limitation for potential users seeking user-friendly trading environments.

Registration and verification process efficiency, including KYC procedures, document submission requirements, and account activation timelines, remain undocumented in source materials. Funding operation experiences, including deposit processing times, withdrawal efficiency, and payment method reliability, are similarly absent from available assessments. The low TrustScore suggests potential user experience challenges.

Specific complaint categories and common user concerns are not detailed in available materials. This information gap prevents comprehensive understanding of user experience pain points. It also limits the ability to provide targeted guidance for potential users considering the platform.

This Cmarket review reveals a forex broker operating in a complex credibility landscape that requires careful consideration by potential users. The platform has received legal and safety validation from Scamadviser, indicating basic operational legitimacy. However, significant concerns arise from mixed professional assessments and notably low user trust ratings.

The broker may be suitable for traders specifically seeking platforms with basic legal compliance validation. The substantial information gaps regarding operational details, regulatory transparency, and service offerings represent significant evaluation challenges. The contrast between safety validation and user trust concerns suggests that individual experiences may vary considerably.

Key advantages include legal and safety recognition from established assessment sources. Primary disadvantages encompass low user trust scores, mixed professional evaluations, and insufficient operational transparency. Potential users should conduct enhanced due diligence, directly verify regulatory status, and carefully assess their risk tolerance before engaging with the platform.

FX Broker Capital Trading Markets Review