AMCC 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive amcc review evaluates AMCC Markets Limited. It's a trading platform that has gained attention in the forex and cryptocurrency trading community. Based on available information and user feedback, AMCC Markets Limited presents a high-risk profile with concerning user reports about trading losses and potential fraud. The platform offers leverage up to 1000:1. It operates with a unique business model that combines medical bill review services with forex trading operations.

AMCC Markets Limited targets forex and cryptocurrency investors seeking high-leverage trading opportunities. However, the lack of clear regulatory information and negative user experiences raise major concerns about the platform's reliability and trustworthiness. The company was established in 2022 and is headquartered in the United States. It primarily focuses on customized medical bill review solutions while also offering trading services across various asset classes including forex, cryptocurrencies, CFDs, indices, and precious metals.

Important Notice

This amcc review is based on publicly available information and user feedback collected from various sources. AMCC Markets Limited has not provided comprehensive regulatory information. There may be differences in regulatory requirements across different jurisdictions where the company operates. Readers should be aware that this evaluation does not cover undisclosed trading conditions or internal operational procedures that may affect the trading experience.

The assessment methodology relies on user testimonials, public company information, and industry standard evaluation criteria. Potential investors should conduct their own research and consider consulting with financial advisors before engaging with this platform.

Rating Framework

Broker Overview

AMCC Markets Limited was established in 2022 and is headquartered in the United States. The company operates with a distinctive dual business model that combines traditional medical bill review services with forex and cryptocurrency trading operations. According to available information, AMCC provides customized medical bill review solutions primarily serving the insurance industry. This includes insurance carriers, third-party administrators, and self-insured employers within the workers' compensation community.

The company's trading division offers services across multiple asset classes, including foreign exchange, cryptocurrencies, contracts for difference (CFDs), indices, and precious metals. Based in the Chicagoland area, AMCC claims to deliver nationwide services tailored to fit client needs regardless of size, scope, or geographical boundaries. However, the integration between their medical bill review services and trading operations remains unclear from available documentation.

This amcc review reveals that while the company positions itself as a comprehensive service provider, the lack of detailed information about their trading operations and regulatory compliance raises questions about their primary focus and expertise in financial markets. The company's dual business model appears unique in the industry. It may indicate a lack of specialization in either sector.

Regulatory Jurisdiction: Available information does not specify concrete regulatory oversight from recognized financial authorities. This absence of clear regulatory information represents a significant concern for potential traders seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees has not been disclosed in available materials.

Minimum Deposit Requirements: No specific minimum deposit amounts have been mentioned in the available documentation. This makes it difficult for potential clients to assess entry requirements.

Bonuses and Promotions: Current available information does not indicate any bonus structures or promotional offerings for new or existing clients.

Tradeable Assets: The platform offers trading opportunities across forex pairs, cryptocurrencies, contracts for difference, stock indices, and precious metals. This provides a diverse range of investment options.

Cost Structure: Critical information regarding spreads, commission rates, overnight fees, and other trading costs remains undisclosed in available materials.

Leverage Ratios: The platform offers maximum leverage up to 1000:1. This represents extremely high leverage that significantly amplifies both potential profits and losses.

Platform Options: Specific trading platform software and technology infrastructure details have not been provided in available documentation.

Geographic Restrictions: Information about regional limitations or restricted countries is not available in current materials.

Customer Support Languages: Available customer service languages and support channels are not specified in accessible documentation.

This amcc review highlights the concerning lack of transparency regarding essential trading conditions that informed investors typically require before making platform decisions.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions evaluation for AMCC Markets Limited reveals significant information gaps that substantially impact the overall assessment. Available materials do not specify different account types, their respective features, or the benefits associated with various membership levels. This lack of transparency makes it extremely difficult for potential clients to understand what they can expect when opening an account.

Minimum deposit requirements, which represent a fundamental consideration for most traders, remain unspecified in available documentation. Without this crucial information, potential clients cannot adequately plan their initial investment or compare AMCC's accessibility with other market participants. The absence of clear account opening procedures further complicates the evaluation process.

User feedback suggests negative experiences with account management, though specific details about account features, special functionalities, or Islamic account options are not available. The lack of comprehensive account information in this amcc review indicates either poor communication practices or potential issues with transparency that could affect client relationships.

The evaluation of trading tools and resources available through AMCC Markets Limited reveals concerning gaps in available information. No specific details about analytical tools, charting capabilities, or research resources have been provided in accessible materials. This absence of information about essential trading infrastructure raises questions about the platform's commitment to providing comprehensive trading support.

Educational resources, which are increasingly important for trader development and platform differentiation, are not mentioned in available documentation. The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the assessment of the platform's technological offerings.

User feedback regarding trading tools and resources is insufficient to provide meaningful insights into the actual quality and functionality of available features. Without concrete information about the platform's technological infrastructure, potential clients cannot make informed decisions about whether the available tools meet their trading requirements and expectations.

Customer Service and Support Analysis (3/10)

Customer service evaluation reveals significant concerns based on available user feedback and the absence of detailed support information. Available materials do not specify customer service channels, availability hours, or response time commitments, which are fundamental aspects of professional trading platform operations.

User reports indicate negative experiences with customer support, suggesting potential issues with service quality and problem resolution capabilities. The lack of information about multilingual support options may limit accessibility for international clients. The absence of detailed contact methods raises concerns about platform accessibility during critical trading situations.

Without specific information about support ticket systems, live chat availability, phone support, or dedicated account management services, potential clients cannot assess whether the platform provides adequate support infrastructure for their trading needs and potential issue resolution requirements.

Trading Experience Analysis (4/10)

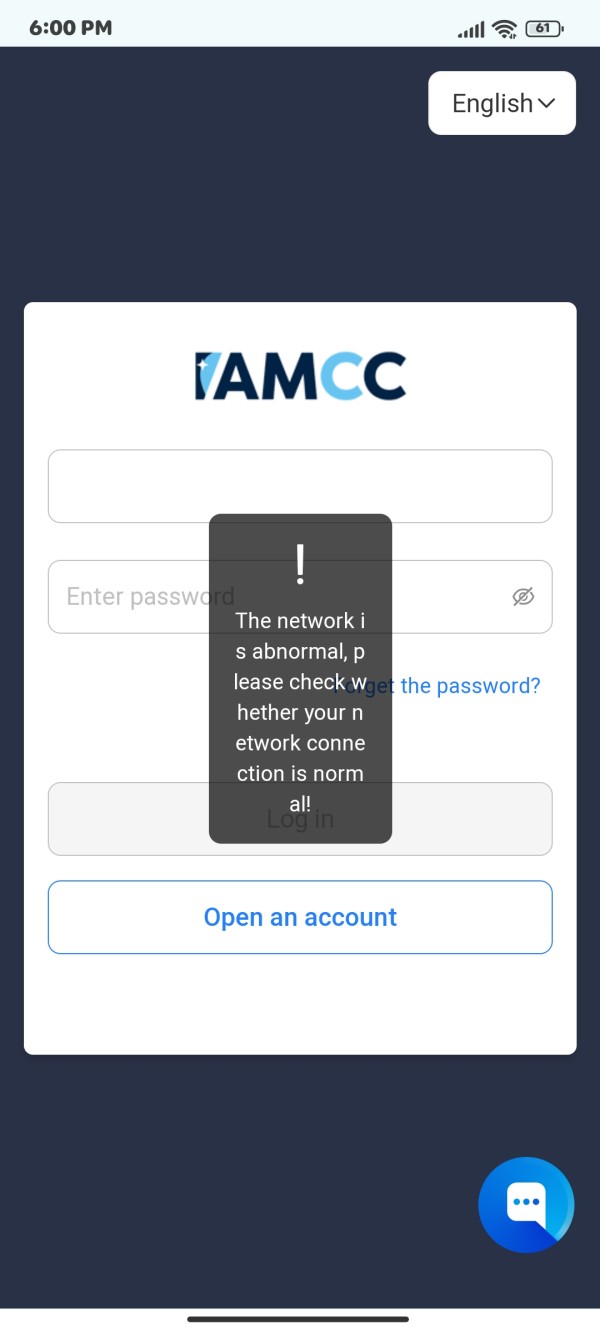

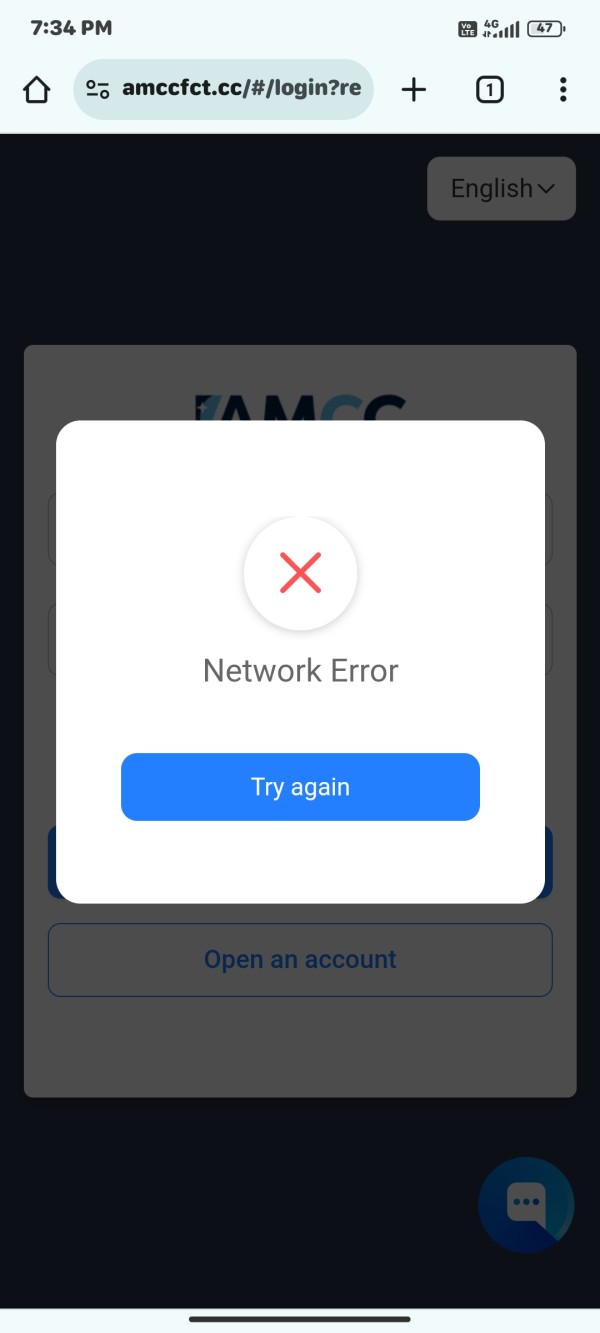

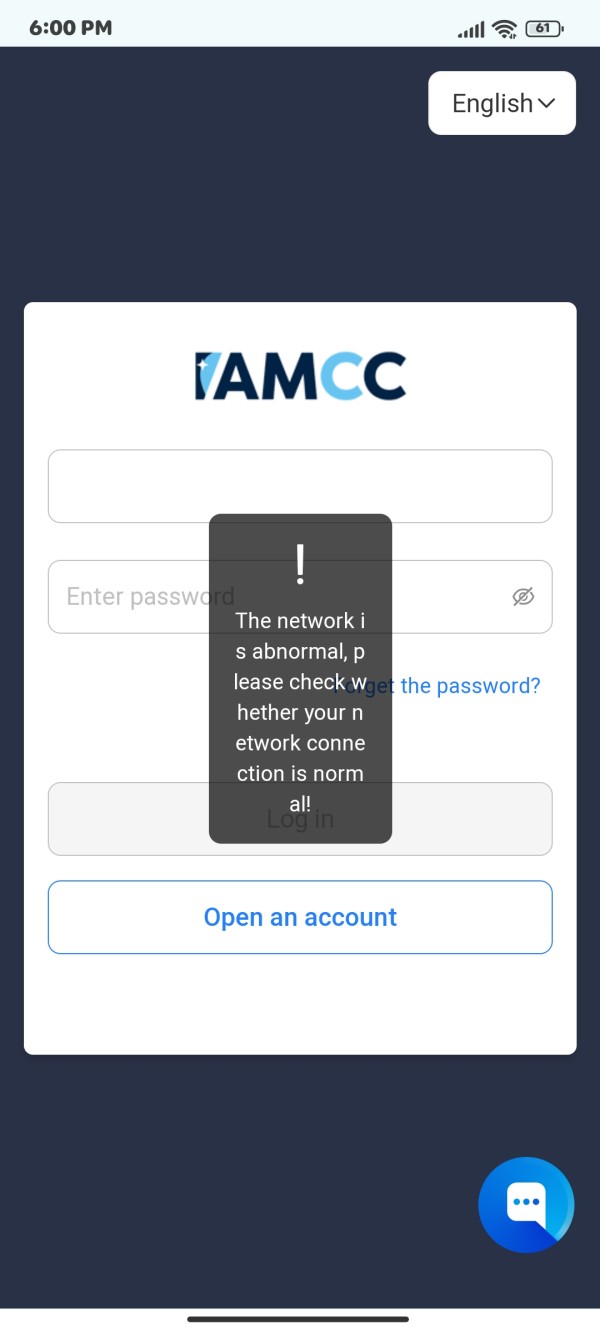

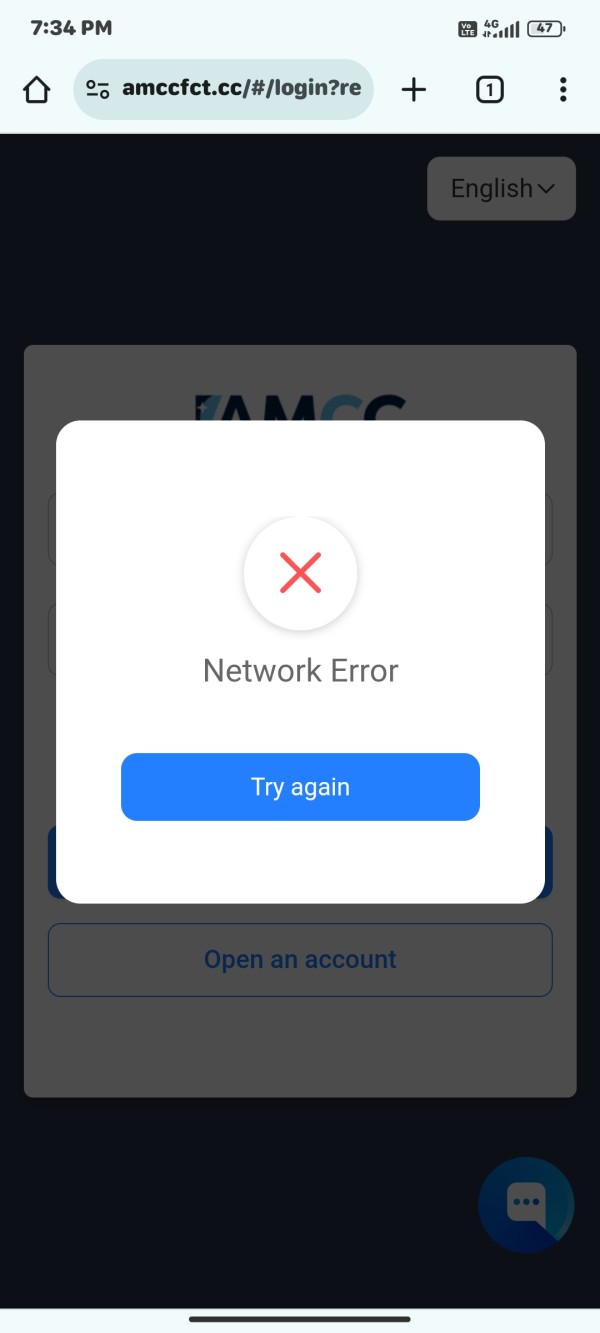

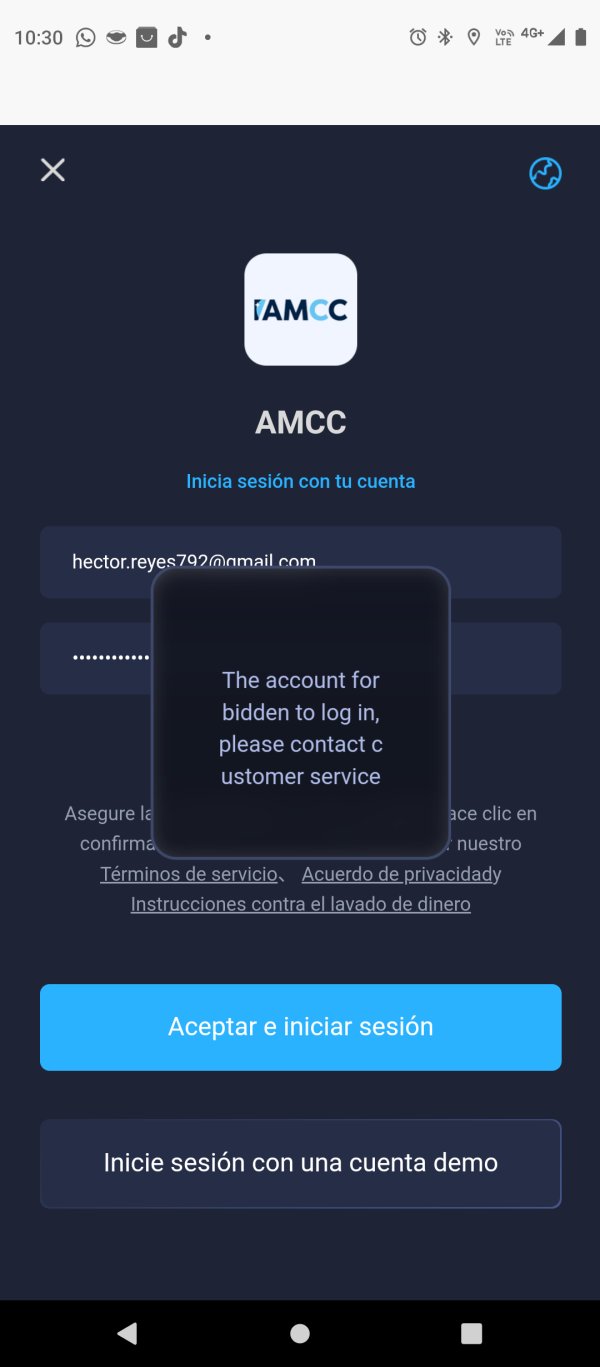

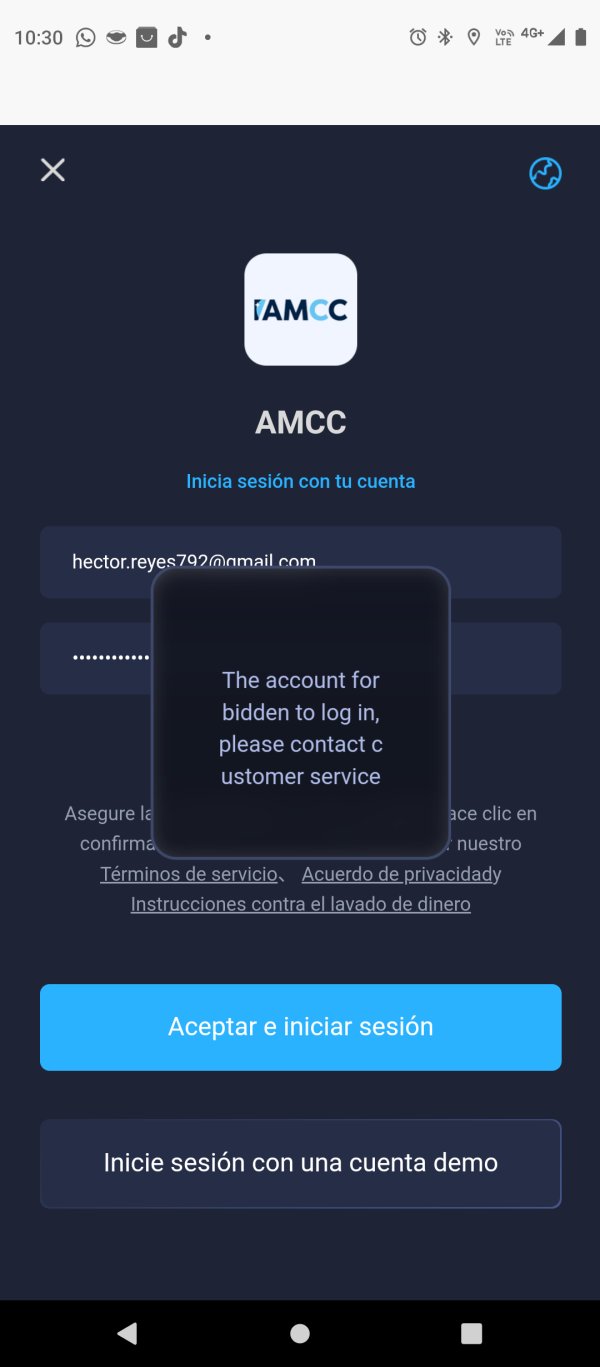

The trading experience evaluation reveals substantial concerns due to limited platform information and negative user feedback. Available materials do not provide specific details about trading platform stability, execution speed, or order processing capabilities. These are fundamental aspects of professional trading operations.

User reports indicate experiences with trading losses, though it remains unclear whether these losses result from normal market risks or potential platform-related issues. The absence of information about mobile trading capabilities, platform functionality, and trading environment quality makes it difficult to assess the overall trading experience quality.

Without concrete data about execution quality, slippage rates, or platform performance metrics, this amcc review cannot provide definitive insights into the actual trading conditions that clients might experience. The lack of detailed platform information suggests either poor marketing communication or potential transparency issues that could affect client confidence.

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of this evaluation, with AMCC Markets Limited receiving the lowest scores in this critical category. The absence of specific regulatory authority oversight from recognized financial regulators raises fundamental questions about platform legitimacy and client protection measures.

User feedback indicates high-risk assessments and allegations of fraudulent behavior, which represent serious concerns for potential investors. The lack of transparency regarding fund security measures, segregated account policies, and client money protection protocols further undermines confidence in the platform's reliability.

Third-party evaluations and user trust feedback consistently indicate negative experiences and safety concerns. Without clear regulatory compliance information and given the serious allegations mentioned in user reports, potential clients should exercise extreme caution when considering this platform for their trading activities.

User Experience Analysis (3/10)

Overall user satisfaction based on available feedback indicates significant concerns about the platform's ability to meet client expectations. Negative user reports regarding trading outcomes and platform experiences suggest systematic issues that may affect client satisfaction and retention.

The absence of detailed information about user interface design, platform navigation, registration processes, and account verification procedures makes it difficult to assess the practical aspects of client onboarding and daily platform interaction. User complaints about trading losses, while potentially related to normal market risks, appear to be more frequent than typical market feedback.

Common user concerns mentioned in available feedback focus on trading outcomes and platform reliability. The lack of positive user testimonials or success stories in available materials suggests potential issues with client satisfaction and platform performance that prospective users should carefully consider.

Conclusion

This comprehensive amcc review reveals that AMCC Markets Limited faces significant challenges in terms of user trust, transparency, and regulatory clarity. The platform's overall assessment leans heavily negative due to concerning user feedback, lack of regulatory information, and insufficient disclosure of essential trading conditions.

The platform may be suitable for highly experienced investors with substantial risk tolerance who are specifically seeking high-leverage trading opportunities and are comfortable operating in less regulated environments. However, the combination of high-risk assessments, missing regulatory information, and negative user experiences makes AMCC Markets Limited unsuitable for most retail investors.

The main advantages include the availability of high leverage up to 1000:1 and access to multiple asset classes. However, these potential benefits are significantly outweighed by major disadvantages including high-risk evaluations, absence of clear regulatory oversight, lack of transparency regarding trading conditions, and concerning user feedback regarding platform reliability and trustworthiness.