Morning Sky 2025 Review: Everything You Need to Know

Executive Summary

Morning Sky presents itself as an online trading broker serving global clients. Our morning sky review reveals significant concerns that potential investors should carefully consider before investing their money. The broker operates from the UK with headquarters located at 64A Cumberland St, Edinburgh EH3 6RE, UK, offering trading services through the MetaTrader 4 platform. While the company provides access to over 50 tradeable assets including forex, spot metals, CFDs, and spot indices, the most critical issue identified is the apparent lack of proper regulatory oversight, which significantly impacts investor trust and safety.

The platform's primary strength lies in its diverse trading instruments and the utilization of the widely-recognized MetaTrader 4 platform. This platform offers comprehensive trading tools and functionality that many traders find useful. However, the absence of clear regulatory information raises substantial red flags for potential clients seeking secure trading environments. This regulatory gap represents a major weakness that overshadows the platform's technical offerings and could expose traders to unnecessary risks.

Important Notice

Due to the limited regulatory information available for Morning Sky, traders from different regions may face varying levels of risk when engaging with this broker. The lack of transparent regulatory oversight means that client protection measures, fund segregation policies, and dispute resolution mechanisms may not meet standard industry requirements. This review is based on publicly available information and does not include comprehensive user feedback or detailed market research data. Potential clients should exercise extreme caution and conduct additional due diligence before considering any investment with this broker.

Rating Framework

Broker Overview

Morning Sky operates as an online trading brokerage company headquartered in the United Kingdom at 64A Cumberland St, Edinburgh EH3 6RE, UK. The company positions itself as a global service provider, offering trading opportunities to international clients through digital platforms. However, critical information regarding the company's establishment date, founding team, and corporate history remains unclear from available sources. This adds to the overall uncertainty surrounding this broker's legitimacy and operational track record.

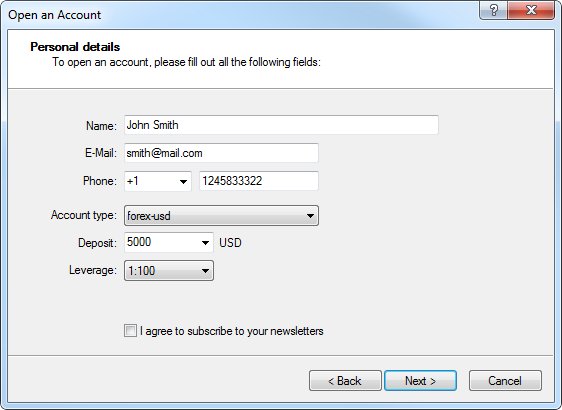

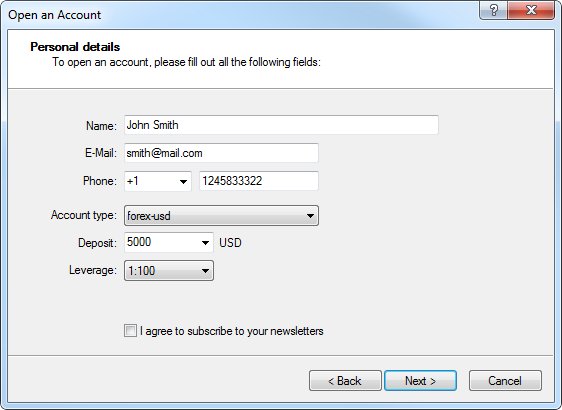

The broker's business model centers on providing access to financial markets through online trading services. It targets retail and potentially institutional clients worldwide. Morning Sky utilizes the MetaTrader 4 trading platform, one of the industry's most recognized trading software solutions, which suggests some level of technical competency. The platform offers access to multiple asset classes including foreign exchange markets, spot metals, contracts for difference, and spot indices. The company claims to provide over 50 different tradeable instruments. Despite these offerings, the absence of regulatory information significantly undermines confidence in the broker's operational legitimacy and client protection measures.

Regulatory Status: Available sources indicate that Morning Sky lacks proper regulatory oversight or effective regulatory authorization. This represents a critical concern for potential clients seeking secure trading environments.

Deposit and Withdrawal Methods: Specific information regarding payment processing methods, supported currencies, and transaction procedures is not detailed in available documentation.

Minimum Deposit Requirements: The broker's minimum deposit thresholds and account funding requirements are not specified in accessible materials.

Bonus and Promotional Offers: Information concerning welcome bonuses, trading incentives, or promotional campaigns is not available in current sources.

Tradeable Assets: Morning Sky provides access to forex markets, spot metals, CFDs, and spot indices. The company advertises over 50 different tradeable instruments across these categories.

Cost Structure: Detailed information regarding spreads, commissions, overnight fees, and other trading costs is not comprehensively outlined in available materials. This makes cost comparison difficult.

Leverage Options: Specific leverage ratios and margin requirements for different asset classes are not detailed in accessible documentation.

Platform Selection: The broker exclusively utilizes MetaTrader 4 as its primary trading platform. This offers clients access to this established trading software.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not specified in available sources.

Customer Support Languages: The range of supported languages for customer service is not detailed in accessible materials. This makes this morning sky review incomplete in this aspect.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Morning Sky's account conditions is severely hampered by the lack of comprehensive information in available sources. Standard account features such as account types, tier structures, minimum deposit requirements, and special account offerings like Islamic accounts are not detailed in accessible documentation. This information gap prevents potential clients from making informed decisions about account selection and suitability for their trading needs.

Without clear account condition details, traders cannot assess whether the broker offers competitive terms compared to industry standards. The absence of information regarding account opening procedures, verification requirements, and account management features raises additional concerns about the broker's transparency and operational professionalism. This morning sky review cannot provide a meaningful rating for account conditions due to insufficient data. This itself represents a significant red flag for potential clients seeking comprehensive broker information.

The lack of account condition transparency may indicate operational deficiencies or deliberate obfuscation of terms that might not be competitive in the current market environment.

Morning Sky demonstrates reasonable capability in trading tools and resources by offering the MetaTrader 4 platform. This provides traders with access to comprehensive charting tools, technical indicators, and automated trading capabilities. The platform's inclusion represents a positive aspect of the broker's service offering, as MT4 is widely recognized for its reliability and functionality in the trading community.

The broker's claim of providing over 50 tradeable assets across forex, spot metals, CFDs, and spot indices suggests a diverse instrument selection. This could meet various trading strategies and preferences. However, detailed information about research resources, market analysis tools, educational materials, and advanced trading features is not available in current sources. This limits the complete assessment of the broker's tool ecosystem.

The absence of information regarding proprietary trading tools, third-party integrations, copy trading features, or social trading capabilities suggests that the broker may offer only basic functionality through the MT4 platform. Additionally, details about mobile trading applications, web-based platforms, or alternative trading interfaces are not specified in available documentation.

Customer Service and Support Analysis

The assessment of Morning Sky's customer service capabilities is impossible to complete due to the complete absence of relevant information in available sources. Critical customer support elements such as contact methods, availability hours, response times, and service quality indicators are not documented in accessible materials.

Standard customer service features including live chat support, telephone assistance, email support, and multilingual capabilities cannot be evaluated based on current information. The lack of customer service transparency raises significant concerns about the broker's commitment to client support and problem resolution.

Without information about support ticket systems, FAQ resources, help documentation, or customer service team qualifications, potential clients cannot assess whether the broker provides adequate assistance for trading-related issues. They also cannot determine if help is available for technical problems or account management needs. This information gap represents a major deficiency in the broker's transparency and may indicate inadequate customer service infrastructure.

The absence of customer service details in this morning sky review reflects poorly on the broker's overall professionalism and client-focused approach.

Trading Experience Analysis

Evaluating Morning Sky's trading experience requires assessment of platform performance, execution quality, and overall trading environment. Available sources provide limited insight into these critical areas. While the broker utilizes MetaTrader 4, which generally offers stable performance and comprehensive functionality, specific performance metrics, execution speeds, and platform reliability data are not available.

The trading experience assessment is further complicated by the absence of information regarding order execution policies, slippage rates, requote frequency, and market access quality. These factors significantly impact trader satisfaction and profitability, yet remain undocumented in accessible materials.

Mobile trading capabilities, platform customization options, and advanced order types availability cannot be properly evaluated without detailed platform specifications. Additionally, information about server locations, connection stability, and technical support for platform-related issues is not provided in current sources.

The lack of trading experience data in this morning sky review prevents comprehensive evaluation of the broker's execution quality and platform performance. These are fundamental considerations for active traders.

Trust and Security Analysis

Trust and security represent the most concerning aspects of Morning Sky's operations. This is primarily due to the apparent lack of proper regulatory oversight. Available sources indicate that the broker does not possess adequate regulatory authorization, which fundamentally undermines client protection and operational legitimacy.

Regulatory compliance serves as the foundation of broker trustworthiness, providing essential safeguards including fund segregation, compensation schemes, and dispute resolution mechanisms. The absence of regulatory oversight means that clients may lack recourse in case of operational failures, fund misappropriation, or business closure.

Additional security concerns arise from the lack of transparency regarding fund protection measures, insurance coverage, and operational risk management procedures. Information about anti-money laundering policies, know-your-customer procedures, and data protection measures is not available in current sources.

The regulatory deficiency identified in this morning sky review represents the most significant risk factor for potential clients and should be carefully considered before engaging with this broker.

User Experience Analysis

The evaluation of Morning Sky's user experience is severely limited by the absence of user feedback, satisfaction surveys, and experience-related data in available sources. Without access to client testimonials, review aggregations, or user satisfaction metrics, it is impossible to assess the overall user experience quality.

Key user experience elements including registration processes, account verification procedures, platform usability, and general client satisfaction cannot be evaluated based on current information. The lack of user experience data prevents understanding of common user challenges, satisfaction levels, and areas of concern.

Interface design quality, navigation efficiency, and overall platform accessibility remain unknown without detailed user feedback or comprehensive platform reviews. Additionally, information about user onboarding processes, educational support, and client retention rates is not available in accessible sources.

The absence of user experience information in available materials represents a significant gap in this review. It may indicate limited client base or poor feedback collection practices by the broker.

Conclusion

This comprehensive morning sky review reveals significant concerns that potential investors should carefully consider before engaging with this broker. While Morning Sky offers some positive aspects including MetaTrader 4 platform access and a diverse range of over 50 tradeable assets, the critical lack of regulatory oversight represents a fundamental weakness that overshadows these benefits.

The broker appears most suitable for experienced traders who prioritize asset diversity and are comfortable with higher risk tolerance. However, the regulatory concerns make it difficult to recommend for any investor category. The primary advantages include comprehensive trading tools through MT4 and broad instrument selection, while the major disadvantages center on regulatory deficiencies and operational transparency issues.

Given the substantial regulatory and transparency concerns identified in this analysis, potential clients should exercise extreme caution. They should consider alternative brokers with proper regulatory authorization and comprehensive client protection measures.