Capstone 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Capstone Brokerage has carved a niche in the trading landscape by positioning itself as a low-cost, user-friendly platform offering a wide array of investment options, including cryptocurrencies, stocks, options, and futures. With a user-friendly interface, it appeals primarily to beginner and intermediate traders seeking affordable trading solutions. However, potential users must weigh these benefits against noteworthy risks, particularly the absence of regulation by recognized financial authorities. This lack of oversight raises concerns regarding the safety of funds and the reliability of withdrawal processes. Though touted for its low commissions and vast trading options, issues reported by users—ranging from difficulties in fund withdrawals to dubious customer support—serve as significant red flags for investors. As Capstone Brokerage continues to attract attention in 2025, potential customers are urged to conduct thorough due diligence to protect their investments.

⚠️ Important Risk Advisory & Verification Steps

- Risk Signals:

- Lack of Regulatory Oversight: Capstone is not regulated by top-tier financial authorities, which is crucial to ensuring the safety of client funds.

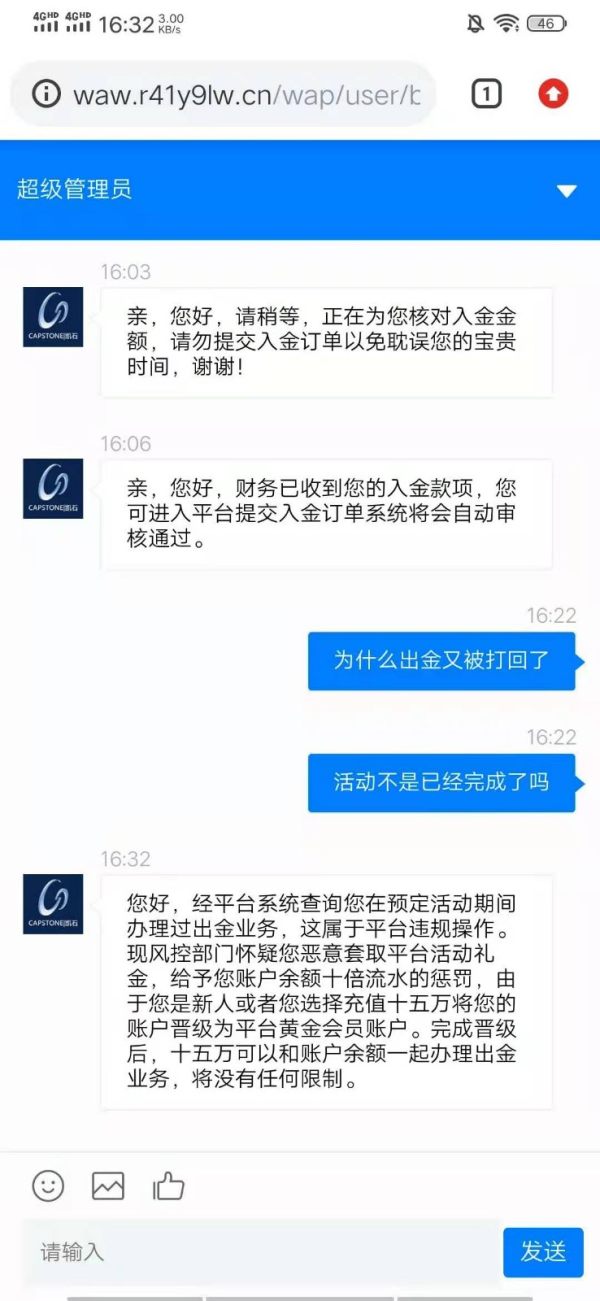

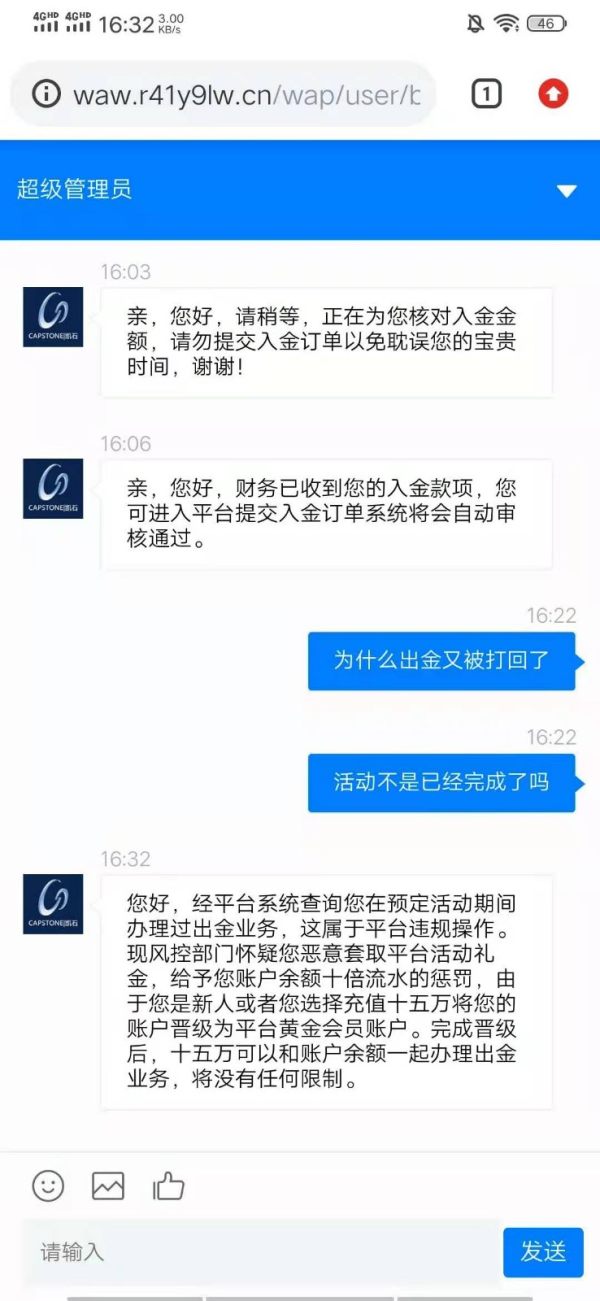

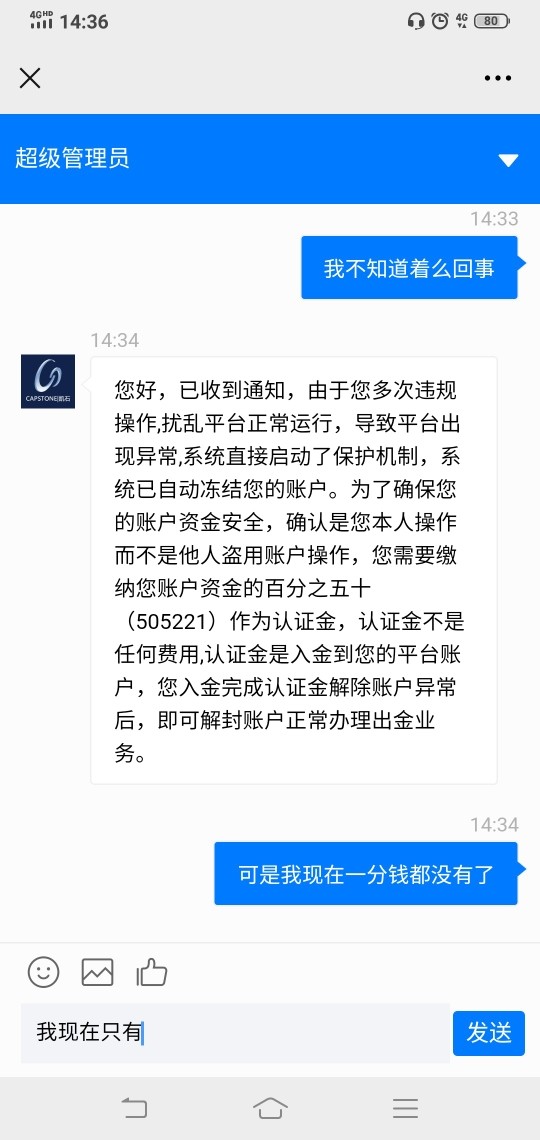

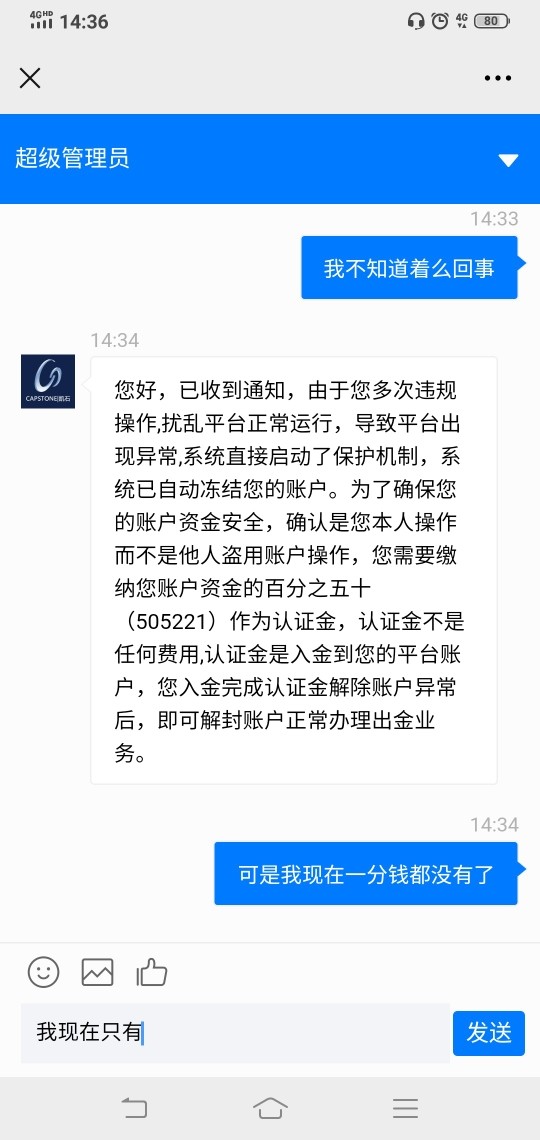

- Withdrawal Difficulties: Numerous customer complaints indicate problems with accessing funds, raising concerns about the platform's reliability.

- Conflicting Information: There are discrepancies surrounding the brokerage's operational practices and legitimacy, indicating possible deceptive practices.

Risk Statement: Engaging with Capstone Brokerage carries significant risks, including potential loss of funds and difficulties with financial transactions.

Potential Harms:

- Challenges in withdrawing funds can result in inaccessible capital.

- Unregulated platforms may expose users to fraudulent practices.

Verification Steps:

- Investigate the brokerage on regulatory databases (e.g., NFA BASIC database or similar).

- Search for user testimonials and complaints on trusted financial review websites.

- Confirm the companys claimed physical address through reputable sources.

- Contact customer support to assess responsiveness and clarity in communication.

Rating Framework

Broker Overview

Company Background and Positioning

Capstone Brokerage, founded in 1997 and based in Las Vegas, NV, has developed an integrated trading platform in the highly competitive online brokerage industry. Although it claims to provide clients with a low-cost trading experience, serious concerns arise when considering its lack of regulatory oversight. The company operates within a legal gray area, which could pose significant risks to its clients financial security.

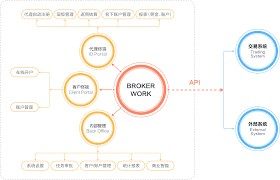

Core Business Overview

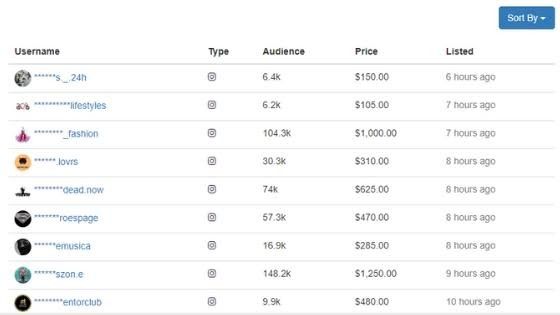

Capstone Brokerages primary offerings include access to various trading options like cryptocurrencies, stocks, options, and futures. Its platform prides itself on low trading fees, starting as low as $0.02, which appeals to cost-conscious traders. However, it is vital to scrutinize claims of competitive trading conditions and ensure that users are aware of potential hidden fees that may undermine its low-cost appeal.

Quick-Look Details Table

In-depth Analysis of Each Dimension

1. Trustworthiness Analysis

In the landscape of online trading, trust is paramount. Unfortunately, Capstone Brokerage shows signs that raise concerns about the reliability of its services. Noteworthy discrepancies exist regarding regulatory information. Capstone is not regulated by any recognized authority—such as the SEC, FCA, or ASIC—placing users at significant risk.

Analysis of Regulatory Information Conflicts: Information from various sources, including regulatory databases, suggests instability and misinformation about Capstone's operational legitimacy. Without the oversight of a top-tier regulator, clients face increased vulnerability.

User Self-Verification Guide:

Check Capstone‘s registration status through reputable regulatory sites (e.g., NFA’s BASIC).

Search for feedback and complaints on financial forums and review platforms.

Confirm operational legitimacy by checking business registration databases.

Investigate the background of the company and the details of management.

Contact support channels to assess their response speed and effectiveness.

Industry Reputation and Summary: User testimonials on platforms like Glassdoor and eToro indicate dissatisfaction, particularly regarding funds safety. As one user expressed,

“I wish I had done my homework before choosing Capstone—transfers are often delayed or rejected.”

2. Trading Costs Analysis

Trading costs can significantly influence trader profitability and experience.

Advantages in Commissions: Capstone boasts competitive commissions, starting as low as $0.02, which are enticing for larger volume traders.

The "Traps" of Non-Trading Fees: While commissions are low, complaints reveal potentially high withdrawal fees. For instance, one user indicated that they were charged $30 for withdrawals, which is notably steep.

Cost Structure Summary: For beginner traders, Capstone may present an attractive low-commission structure. However, hidden fees and withdrawal challenges may detract from the initial financial advantages, particularly for less experienced users.

A brokerage's platform can greatly impact trading efficiency and user satisfaction.

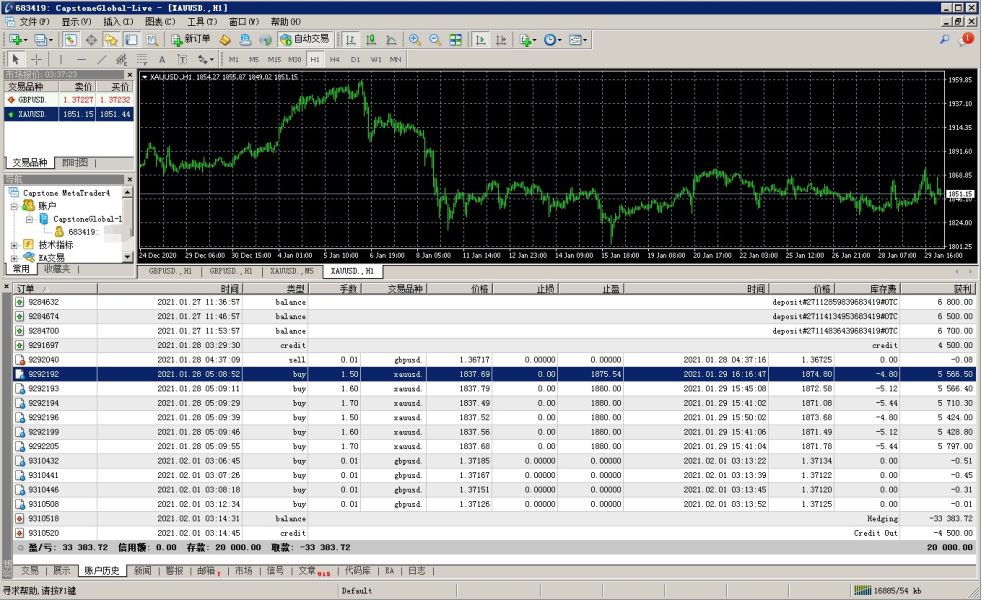

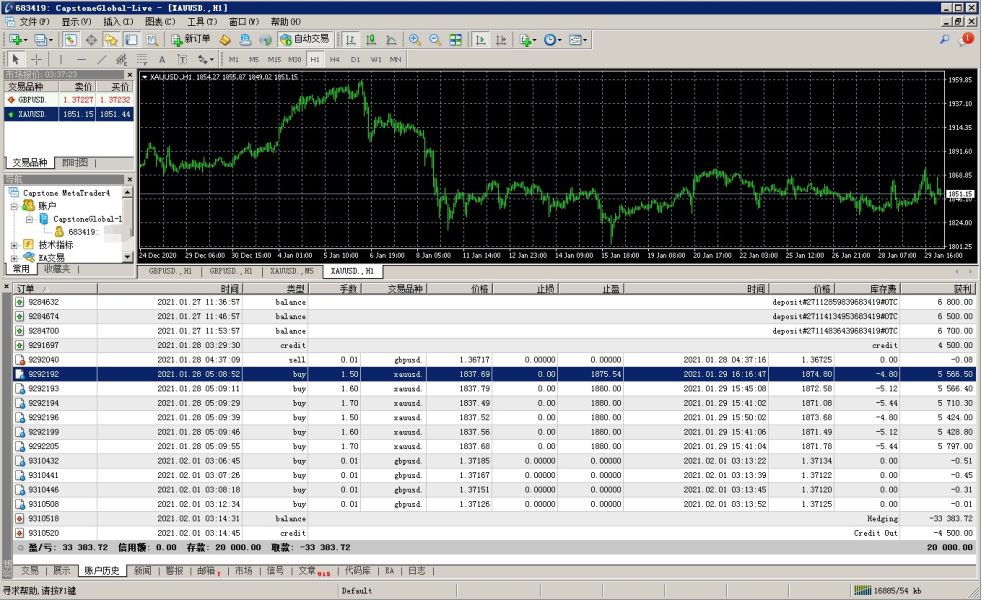

Platform Diversity: Capstone provides access to multiple trading platforms, including MT5. However, the feature set and execution speed may not meet the standards set by more advanced platforms.

Quality of Tools and Resources: Several reviews highlight limitations in educational tools and analytics, essential for informed trading decisions.

Platform Experience Summary: User feedback suggests a lack of intuitive design. One user noted,

"I found the platform hard to navigate at times, which made my trading stressful."

4. User Experience Analysis

User experience plays a crucial role in client retention.

Interface Usability: The overall user interface is frequently described as confusing, particularly for beginners unfamiliar with trading platforms.

Feedback on Trading Satisfaction: Complaints about execution delays have been documented, potentially leading to unfavorable trading outcomes.

User Experience Summary: High entry barriers exist for new users due to the complicated functionality of the platform, underscoring the need for improved user education and training resources.

5. Customer Support Analysis

Customer support is integral to a trader's overall experience.

Support Channels: Capstone advertises multiple support options, but many users report unreturned calls and delayed responses to emails.

User Testimonials: Several online reviews indicate a lack of responsiveness and accountability from the support team, complicating users' experience when resolving issues.

Customer Support Summary: The need for more reliable support alternatives is critical as reported challenges can deter new clients from enrolling in services altogether.

6. Account Conditions Analysis

Conditions surrounding account management can vary significantly among brokerages.

Account Types: Capstone offers a simplified account structure, which may appeal to novice traders but lacks the diversity found in more established firms.

Withdrawal Processes: Complications concerning withdrawal procedures have surfaced, where clients struggle to retrieve their funds within a reasonable timeframe.

Account Conditions Summary: Though the minimum deposit is relatively low, the ambiguous conditions surrounding withdrawals and account management can pose a barrier to investors with less capital.

Conclusion

Capstone Brokerage presents attractive features, such as competitive trading costs and user-friendly experiences, aimed primarily at new entrants in the trading arena. Yet, its lack of regulatory oversight and negative feedback from users should not be taken lightly. The trading environment carries inherent risks that could compromise the safety of one's investments. As such, potential users must exercise due diligence, thoroughly verify the legitimacy of Capstone Brokerage before embarking on their trading journey, and be vigilant for potential pitfalls. To navigate the financial landscape safely, consider regulated alternatives that provide higher levels of trust and security.