Is CAPSTONE凯石 safe?

Business

License

Is Capstone Safe or a Scam?

Introduction

Capstone, a name that has emerged in the forex trading landscape, positions itself as a platform offering a range of trading opportunities. As the forex market continues to attract both novice and experienced traders, it becomes increasingly vital for participants to evaluate the legitimacy and safety of the brokers they choose to work with. With the prevalence of scams and unregulated entities in the financial sector, understanding the regulatory status, company background, trading conditions, and customer experiences is essential. This article aims to provide a comprehensive assessment of Capstone, exploring its safety profile and whether it can be deemed a reliable trading partner.

To conduct this investigation, we utilized a multi-faceted approach that includes an analysis of regulatory information, company history, trading conditions, client feedback, and risk assessments. By synthesizing data from multiple reputable sources, we aim to present a balanced view of Capstone's operations and its standing in the forex market.

Regulation and Legitimacy

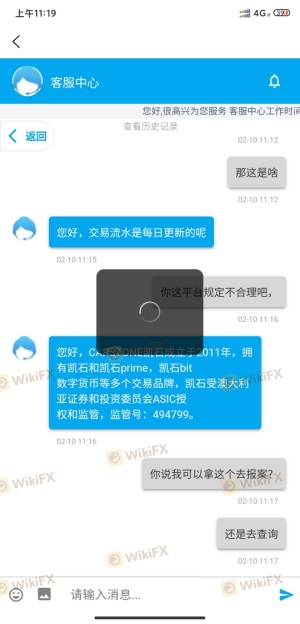

The regulatory status of a broker is a critical factor in determining its safety and credibility. Capstone's lack of oversight from a recognized financial authority raises significant concerns about its operational legitimacy. A broker that operates without regulation is often more susceptible to engaging in fraudulent activities, leaving clients vulnerable.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation from top-tier authorities like the SEC (United States), FCA (United Kingdom), or ASIC (Australia) indicates that Capstone does not adhere to the stringent standards necessary for protecting investors. Regulatory bodies play a crucial role in ensuring that brokers maintain transparency, segregate client funds, and adhere to fair trading practices. Without such oversight, the risks associated with trading through Capstone significantly increase.

Additionally, the lack of historical compliance records or any regulatory warnings against Capstone further complicates its credibility. Traders are advised to remain vigilant when dealing with unregulated brokers, as the potential for fraud and mismanagement of funds is heightened.

Company Background Investigation

A thorough examination of Capstone's history reveals a relatively new player in the forex market, established in 2020. The company's ownership structure and management team remain opaque, with limited information available about the individuals behind the operation. This lack of transparency raises red flags, as reputable brokers typically provide detailed profiles of their management teams, including their qualifications and industry experience.

Furthermore, the absence of a physical address or verifiable contact information on Capstone's website contributes to concerns regarding its legitimacy. A trustworthy broker should have a clear operational framework and be willing to disclose relevant information to potential clients. The lack of transparency in Capstone's operations makes it difficult for traders to assess the company's stability and reliability, leading to increased skepticism about its safety.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure and any potential hidden costs. Capstone's trading fees and spreads are not clearly outlined, which can lead to confusion and unexpected expenses for traders.

| Fee Type | Capstone | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - $10) |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and overnight interest rates can significantly impact a trader's profitability. Additionally, if Capstone employs unusual fees or commissions, it could indicate an attempt to exploit traders. Traders should be wary of brokers that do not provide clear and comprehensive information regarding their trading conditions, as this can lead to unexpected financial burdens.

Client Funds Security

The safety of client funds is paramount when selecting a forex broker. Capstone's measures for ensuring the security of client funds remain largely unverified. A reputable broker should implement strict fund segregation practices, ensuring that client funds are held separately from the company's operational capital. This practice protects traders in the event of financial difficulties faced by the broker.

Moreover, the absence of investor protection mechanisms, such as compensation funds or negative balance protection, raises further concerns about the safety of funds held with Capstone. In the event of a broker's insolvency, clients may find it challenging to recover their investments. Historical disputes or issues related to fund security can also serve as warning signs, and any such incidents involving Capstone should be thoroughly investigated by potential clients.

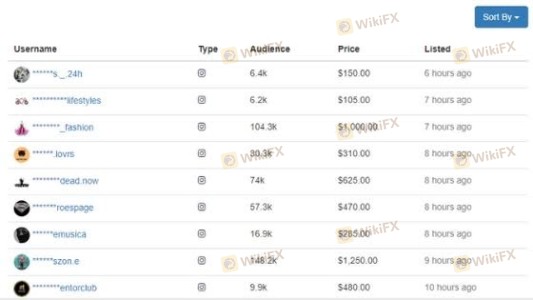

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing the reliability of a broker. Reviews and testimonials about Capstone reveal a mixed bag of experiences, with some users reporting difficulties in withdrawals and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Lack of Transparency | Medium | Limited Information |

Common complaints include delays in processing withdrawal requests and a lack of clear communication from the support team. The severity of these complaints cannot be underestimated, as they indicate potential operational inefficiencies and a disregard for customer concerns. In one case, a user reported that their withdrawal request was pending for several weeks without any explanation, raising doubts about the platform's reliability.

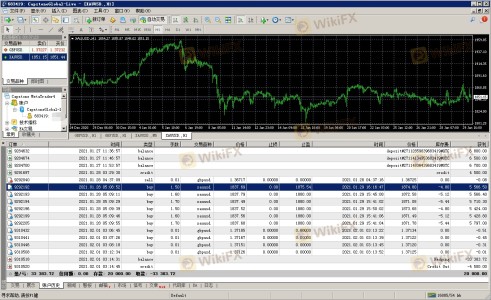

Platform and Trade Execution

The performance and stability of a trading platform are critical for a successful trading experience. Capstone's platform has received mixed reviews, with some users noting issues related to order execution quality, including slippage and rejected orders.

A reliable broker should offer a seamless trading experience, with minimal disruptions and prompt execution of trades. If Capstone's platform exhibits signs of manipulation or inefficiencies, it could severely impact traders' ability to capitalize on market opportunities.

Risk Assessment

Using Capstone as a trading platform carries inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | Lack of investor protections |

| Operational Risk | Medium | Complaints about service quality |

Given the high level of regulatory and fund security risks associated with Capstone, traders should approach this broker with caution. It is advisable to conduct thorough research and consider alternative options that offer more robust regulatory oversight and proven fund protection measures.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is clear that Capstone raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that traders should exercise extreme caution when considering this broker.

For traders seeking a reliable forex trading experience, it would be prudent to explore alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com are recommended as safer options for traders looking to engage in the forex market.

In conclusion, while Capstone may present itself as a viable trading platform, the associated risks and lack of transparency indicate that it is not a safe choice for traders. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading environment.

Is CAPSTONE凯石 a scam, or is it legit?

The latest exposure and evaluation content of CAPSTONE凯石 brokers.

CAPSTONE凯石 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAPSTONE凯石 latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.