NGL 2025 Review: Everything You Need to Know

Executive Summary

This ngl review examines National Guardian Life Insurance Company. NGL is a financial services provider that has been operating since 1909. Based on available information, NGL primarily functions as an insurance company rather than a traditional forex broker. The company offers long-term care insurance, life insurance, and annuity products across 49 states and Washington D.C. The company's unique selling points include unlimited benefit options and third-pool funding choices for long-term care insurance products.

According to multiple sources, NGL maintains a reputation as a trusted supplier in the insurance market. However, user feedback regarding the NGL application reveals concerns about anonymous expression features. These features may lead to aggressive communication, potentially impacting overall user experience. The company's headquarters in Madison, Wisconsin, serves as the operational center for their nationwide insurance services.

For potential clients seeking forex trading services specifically, this review finds limited information regarding traditional trading platforms. We also found limited regulatory oversight for forex operations or standard brokerage features. The evaluation therefore maintains a neutral stance on NGL's capabilities as a forex broker while acknowledging their established presence in the broader financial services sector.

Important Disclaimers

This ngl review is compiled based on publicly available information and user feedback. Due to the limited availability of specific regulatory information and detailed trading conditions in the source materials, readers should conduct independent verification before making any financial decisions. The information presented reflects NGL's primary focus on insurance products rather than forex brokerage services.

Cross-regional entity differences are not detailed in available sources. Specific trading-related regulatory frameworks remain unclear. This evaluation should be considered alongside additional research from official regulatory databases and the company's direct communications.

Rating Framework

Broker Overview

National Guardian Life Insurance Company was established in 1909. The company has built a substantial presence in the American insurance market over more than a century of operation. The company operates as an independent mutual life insurance company, headquartered in Madison, Wisconsin. NGL has obtained licensing across 49 states and Washington D.C., positioning itself as one of America's highly rated insurance providers.

The company's business model centers on providing comprehensive insurance solutions. These solutions include long-term care insurance, life insurance, annuities, and specialized insurance products. According to LTC News and Leverage Planning, NGL has maintained consistent reliability in the insurance sector. However, specific details about forex trading operations remain limited in available documentation.

Regarding trading platforms and asset classes typically associated with forex brokers, the available information does not specify particular trading software or currency trading capabilities. The regulatory framework governing any potential forex operations is not clearly outlined in the source materials. This suggests that NGL's primary regulatory oversight relates to insurance operations rather than securities or forex trading.

Regulatory Regions: Specific regulatory information for forex trading operations is not detailed in available sources. The company maintains insurance licensing across multiple U.S. states.

Deposit and Withdrawal Methods: Information regarding deposit and withdrawal mechanisms for trading accounts is not specified in the available documentation.

Minimum Deposit Requirements: Specific minimum deposit requirements for trading accounts are not mentioned in the source materials.

Bonuses and Promotions: No information about trading bonuses or promotional offers is available in the current documentation.

Tradeable Assets: The range of tradeable assets, including forex pairs, commodities, or CFDs, is not specified in available sources.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not provided in the available information.

Leverage Ratios: Specific leverage offerings for different asset classes are not mentioned in the documentation.

Platform Options: Information about trading platform choices, including MetaTrader or proprietary platforms, is not available in current sources.

Regional Restrictions: Specific geographical limitations for trading services are not detailed in available materials.

Customer Service Languages: Multi-language support options for customer service are not specified in the current ngl review materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of NGL's account conditions faces significant limitations due to insufficient information in available sources. Traditional forex broker account types, such as standard, premium, or Islamic accounts, are not detailed in the documentation. This absence of specific account structure information makes it challenging to assess the variety and appropriateness of account options for different trader profiles.

Minimum deposit requirements, which typically serve as a key differentiator among forex brokers, remain unspecified in the available materials. Similarly, the account opening process, including verification procedures, documentation requirements, and approval timeframes, lacks detailed description in current sources.

Special account features that modern traders often seek are not mentioned in the available information. These features include Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo accounts for strategy testing. This ngl review therefore assigns a neutral score reflecting the uncertainty around account conditions rather than any identified deficiencies or strengths.

The lack of comprehensive account information suggests potential clients would need to contact NGL directly for specific details about trading account structures and requirements.

The assessment of trading tools and resources available through NGL reveals significant information gaps in the available documentation. Standard forex trading tools such as economic calendars, technical indicators, charting packages, or market analysis software are not specifically mentioned in the source materials.

Research and analysis resources, which are crucial for informed trading decisions, lack detailed description. Elements such as daily market commentary, weekly outlook reports, technical analysis, or fundamental analysis resources are not outlined in the available information.

Educational resources are not specifically addressed in the current documentation. These resources include webinars, trading guides, video tutorials, or market education materials. For new traders, the availability and quality of educational content often determines the suitability of a broker, making this information gap particularly significant.

Automated trading support, including Expert Advisor compatibility, algorithmic trading platforms, or copy trading services, remains unspecified in available sources. The below-average score reflects these substantial information gaps rather than confirmed deficiencies in tool quality or availability.

Customer Service and Support Analysis

Customer service evaluation for NGL encounters mixed signals from available information. While specific customer service channels, response times, and availability hours are not detailed in the documentation, user feedback provides some insights into service quality concerns.

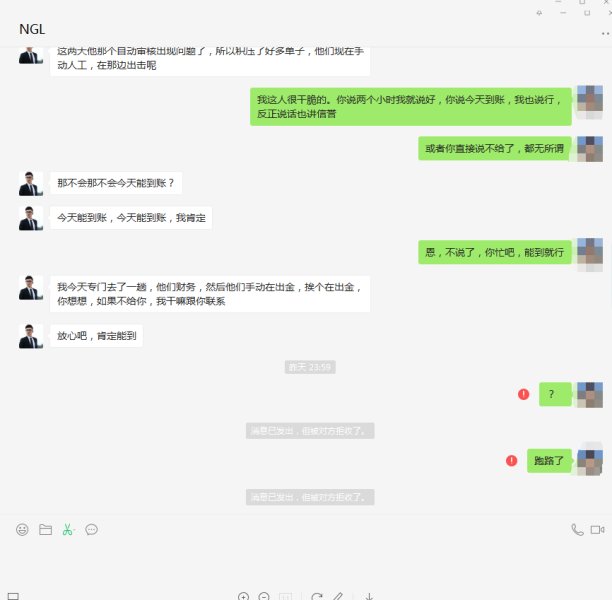

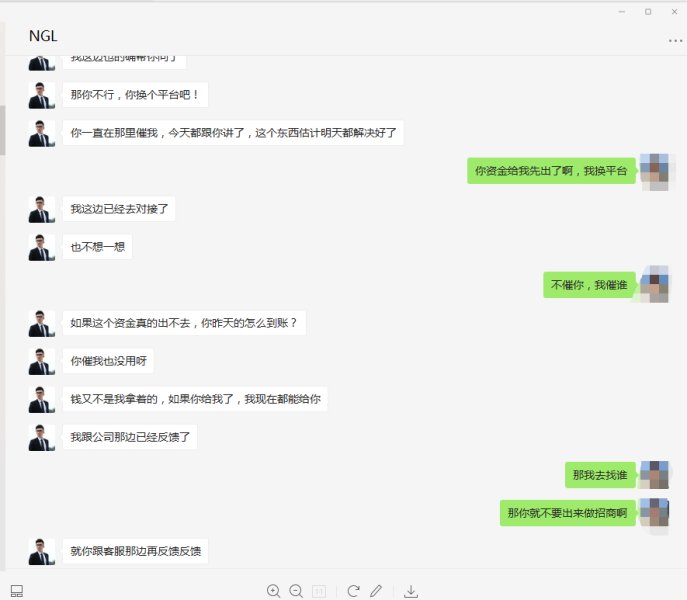

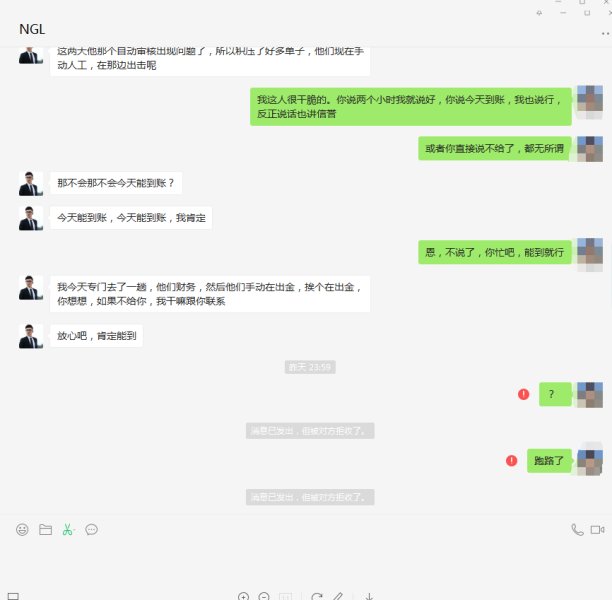

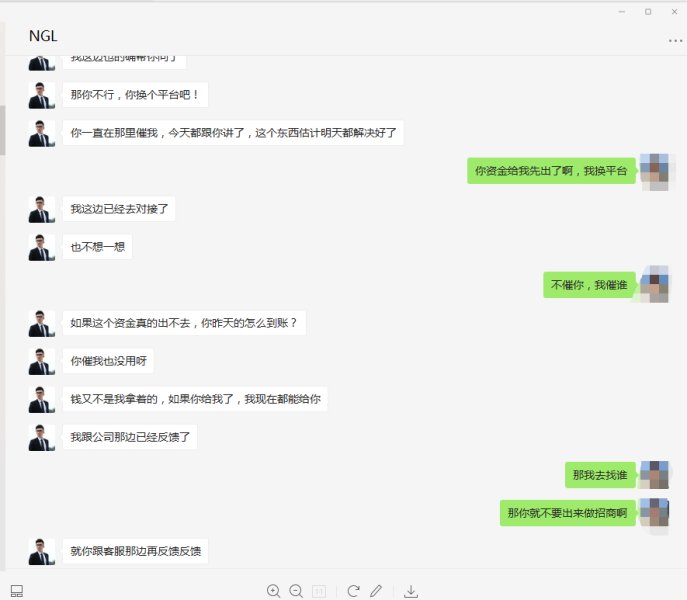

According to available user evaluations, the NGL application's anonymous expression features have created environments where aggressive communication occurs. This potentially impacts the overall service experience. This suggests that while anonymity may be intended as a user-friendly feature, it has unintended consequences for communication quality.

Multi-language support options, 24/7 availability, and specialized trading support services are not specifically mentioned in available sources. The absence of detailed customer service information, combined with user concerns about communication quality, contributes to the below-average rating.

Response time benchmarks, problem resolution procedures, and escalation processes remain unspecified in current documentation. The rating reflects both the information limitations and the identified user experience concerns rather than comprehensive service quality assessment.

Trading Experience Analysis

Platform stability and execution speed, critical factors for successful forex trading, are not specifically addressed in available documentation. The absence of performance metrics, uptime statistics, or execution quality data makes comprehensive trading experience evaluation challenging.

Order execution quality lacks specific mention in current sources. This includes slippage rates, rejection frequencies, and fill rates during high-volatility periods. These technical performance indicators are essential for assessing the suitability of any trading platform for active forex trading.

Platform functionality completeness remains undetailed in available materials. This encompasses advanced order types, risk management tools, and analytical capabilities. Mobile trading experience, increasingly important for modern traders, is not specifically addressed in the current ngl review documentation.

Trading environment factors are not clearly outlined. These factors include dealing desk operations, market maker versus ECN models, and liquidity provision mechanisms. The neutral score reflects the substantial information gaps rather than confirmed strengths or weaknesses in trading experience delivery.

Trust and Reliability Analysis

NGL's trust and reliability assessment benefits from the company's long-standing presence in the financial services sector. Established in 1909, the company has maintained operations for over a century. This suggests institutional stability and operational continuity.

According to multiple sources, NGL maintains recognition as a trusted supplier in the insurance market. This contributes positively to overall reliability assessment. However, specific regulatory oversight for forex operations remains unclear in available documentation, including registration numbers, compliance frameworks, and supervisory authorities.

Fund safety measures are not specifically detailed for trading operations. These measures include segregated client accounts, deposit insurance, or regulatory capital requirements. The company's transparency regarding financial reporting and management structure in the context of forex services lacks comprehensive documentation.

Industry reputation in the forex sector specifically, as opposed to insurance services, cannot be thoroughly assessed based on available information. The above-average score reflects the company's established business presence while acknowledging the limitations in forex-specific regulatory and safety information.

User Experience Analysis

Overall user satisfaction assessment faces limitations due to the scarcity of forex trading-specific user feedback in available sources. The general user evaluations available focus primarily on the company's application features rather than trading platform experiences.

Interface design and usability for trading platforms are not specifically described in current documentation. Registration and verification processes for trading accounts lack detailed coverage in available materials, including required documentation, approval timeframes, and user interface quality.

Fund operation experiences are not specifically addressed in the available information. These experiences include deposit processing times, withdrawal procedures, and payment method reliability. User complaints identified in the documentation relate primarily to anonymous expression features rather than core trading functionalities.

The neutral score reflects the substantial information gaps regarding user experience in forex trading contexts. It also acknowledges the limited feedback available about application-based user interactions.

Conclusion

This comprehensive ngl review reveals that while National Guardian Life Insurance Company maintains a strong reputation in the insurance sector with over a century of operations, specific information about forex trading services remains limited. The company's established presence and trusted status in insurance markets provide some confidence. However, the absence of detailed trading conditions, regulatory frameworks, and user feedback specific to forex operations necessitates a cautious approach.

The evaluation suggests NGL may be more suitable for individuals seeking insurance and investment products rather than active forex traders. Active forex traders typically look for comprehensive trading platforms and tools. The lack of specific information about account conditions, trading tools, and regulatory oversight for forex operations indicates potential clients should seek additional clarification directly from the company before proceeding with trading-related decisions.