Executive Summary

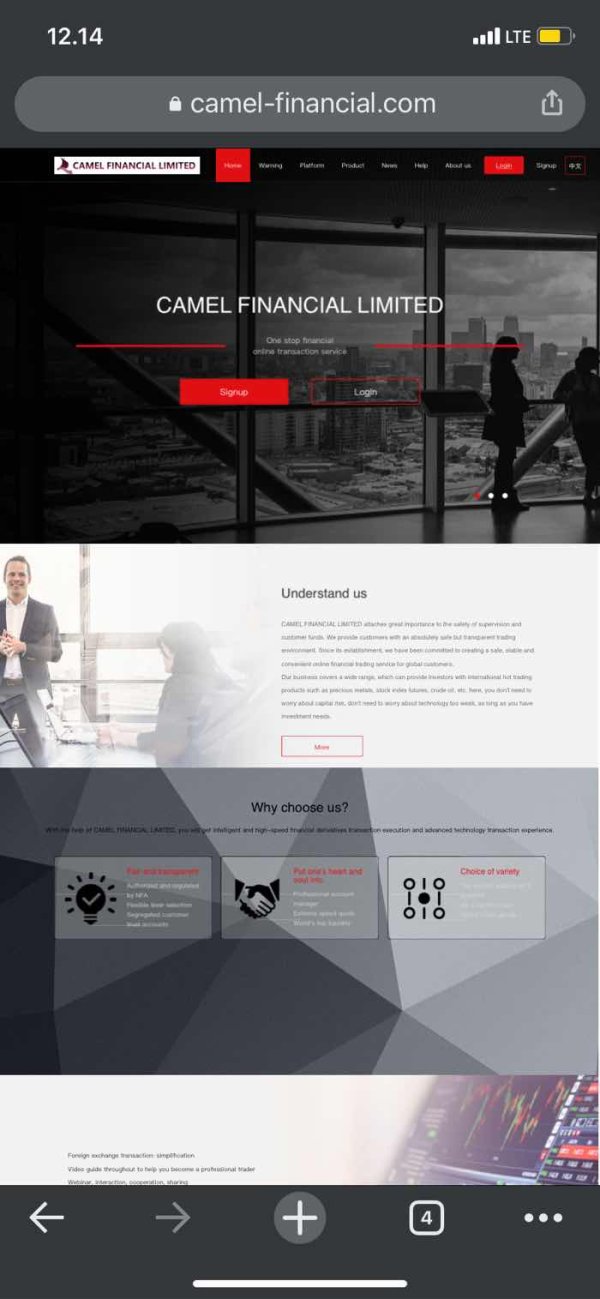

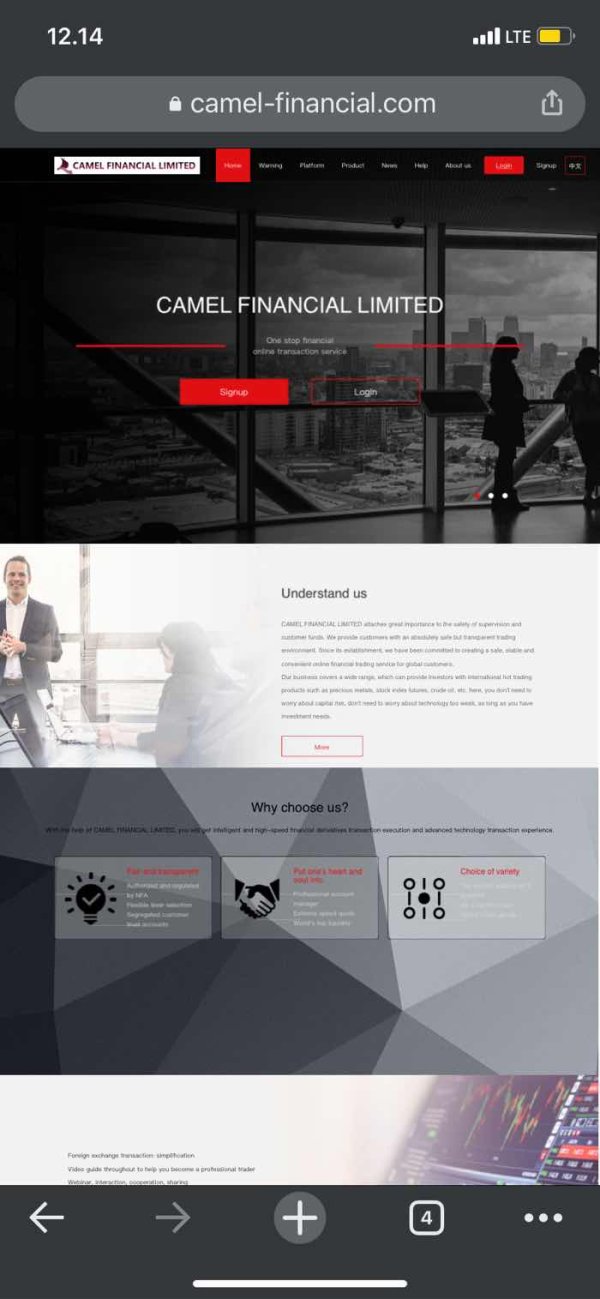

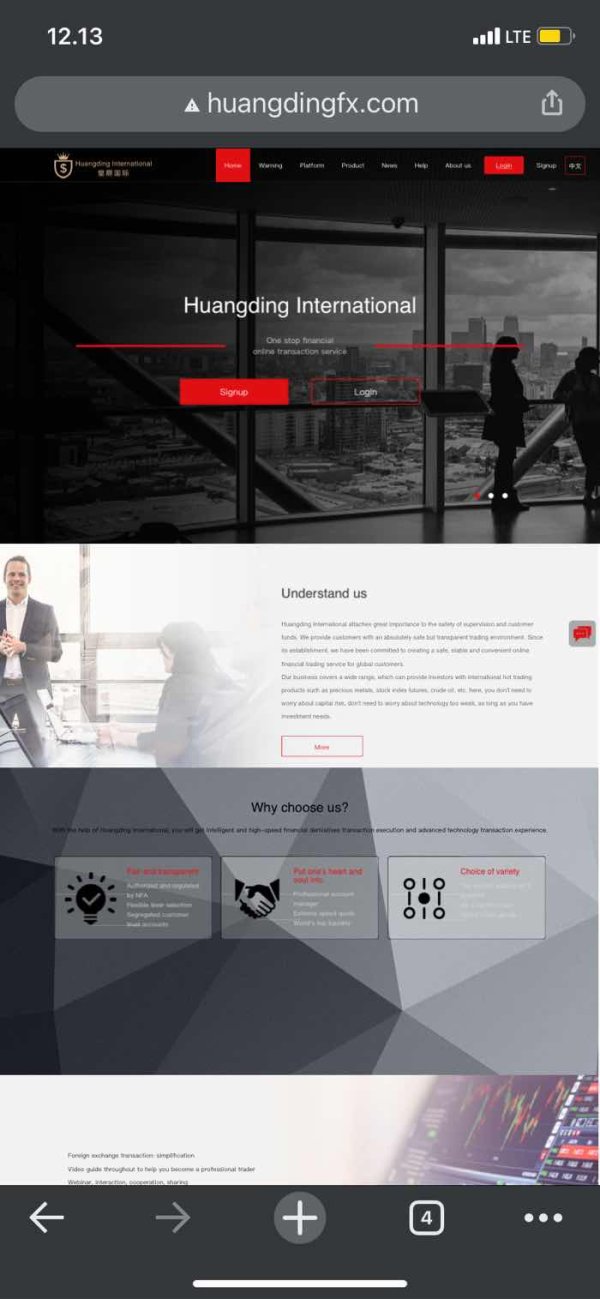

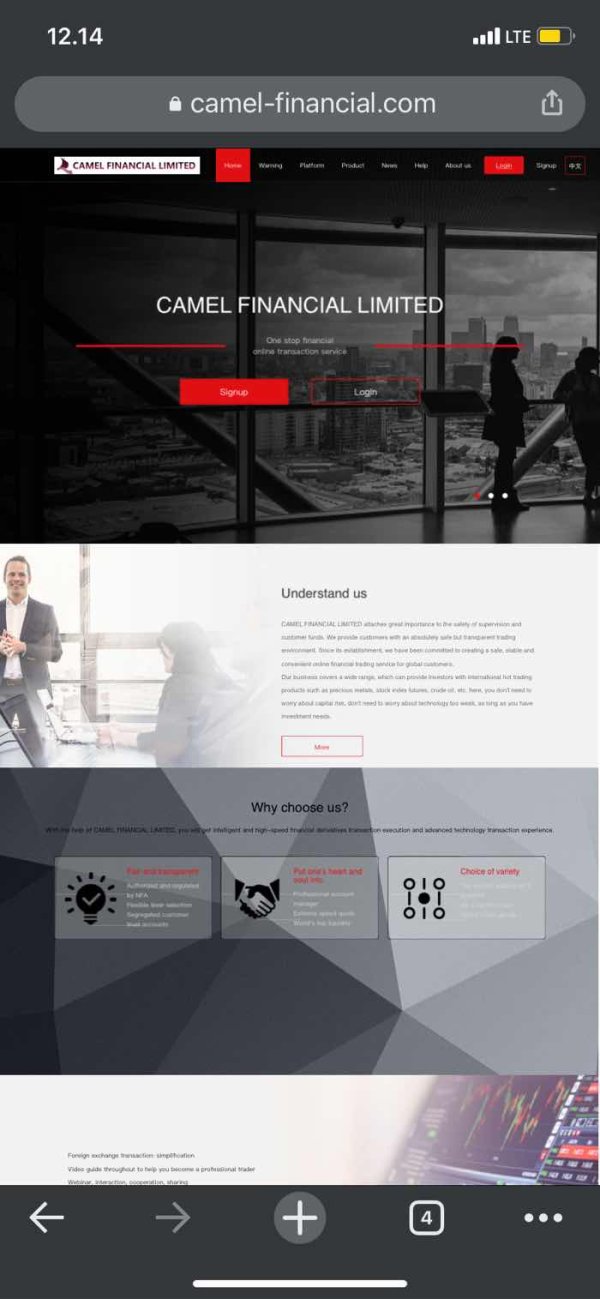

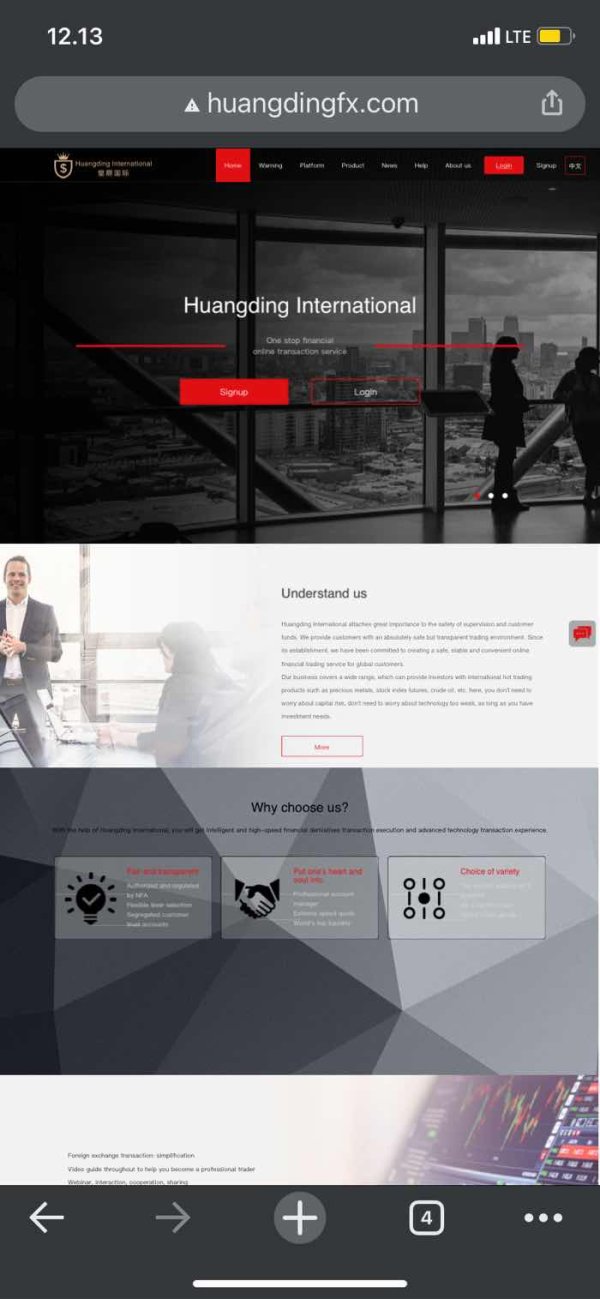

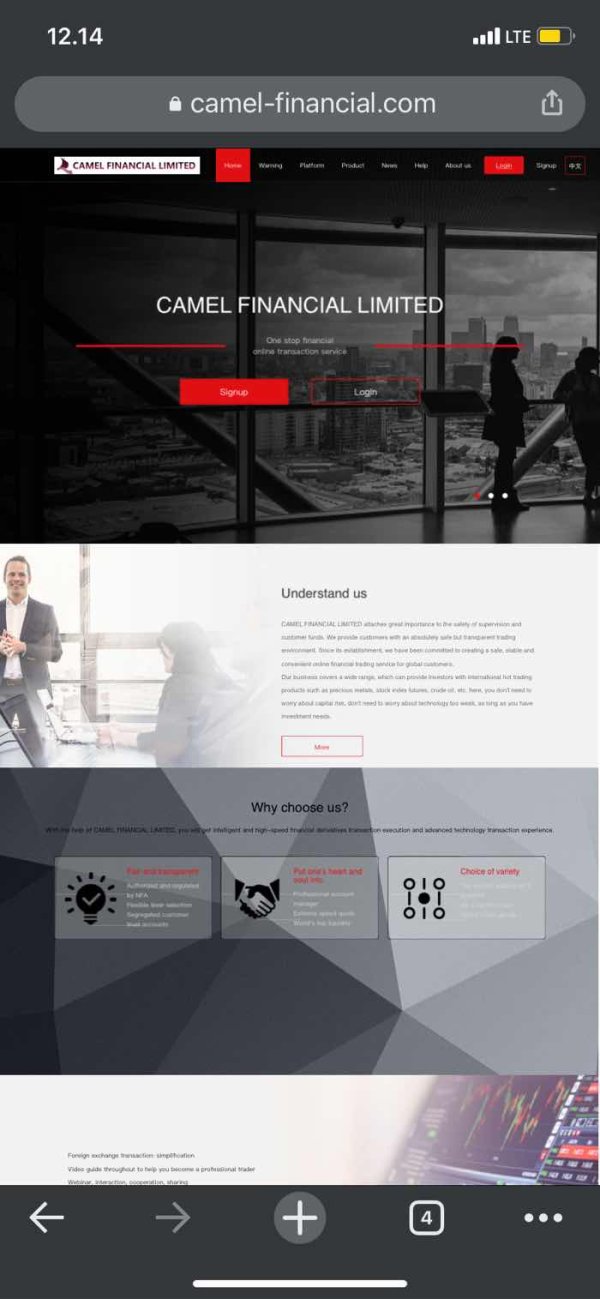

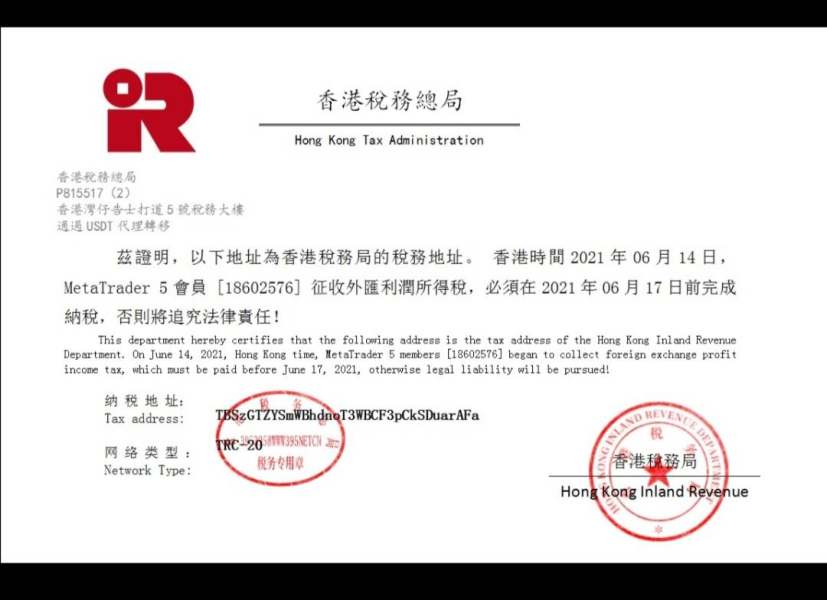

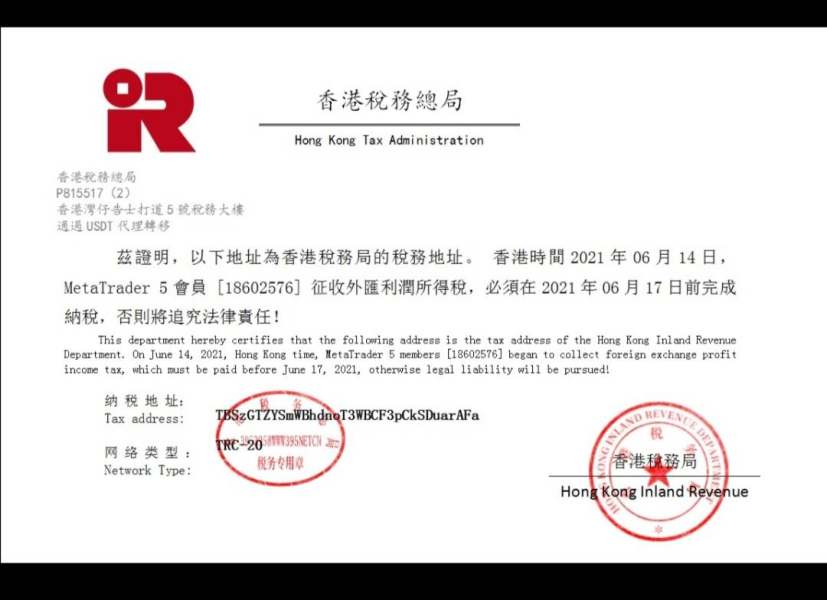

Our comprehensive camel financial limited review reveals significant concerns about this forex broker's operations and reliability. Based on user feedback and available information, Camel Financial Limited presents a predominantly negative profile with serious red flags regarding withdrawal processes and regulatory compliance. The broker operates using the MetaTrader 5 platform. It focuses primarily on forex trading services. However, multiple user reports indicate substantial difficulties with fund withdrawals, raising questions about the company's legitimacy and operational integrity.

The broker appears to target forex traders seeking MT5 platform access. However, the overwhelming negative user feedback suggests potential risks for investors. With 11 exposure reviews highlighting fraudulent practices and withdrawal issues, alongside minimal positive feedback, this broker presents considerable concerns for potential clients. The absence of clear regulatory information further compounds these trust issues. This makes it difficult to recommend Camel Financial Limited to any trader category, particularly newcomers to forex trading.

Important Notice

This camel financial limited review is based on publicly available information and user feedback collected from various sources. Camel Financial Limited has not provided specific regulatory information in available materials, which may indicate different legal risks across various jurisdictions. Potential clients should exercise extreme caution when considering this broker. The lack of transparent regulatory oversight presents significant risks.

Our evaluation methodology relies on user testimonials, publicly accessible broker information, and industry standard assessment criteria. We have not conducted on-site investigations or direct testing of the broker's services. This review should be considered alongside other independent sources before making any trading decisions.

Overall Rating Framework

Broker Overview

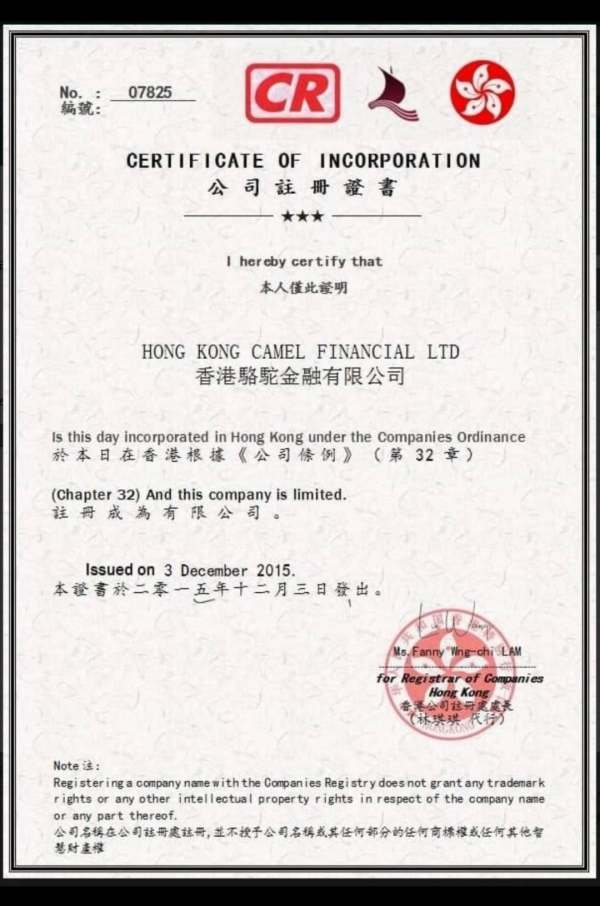

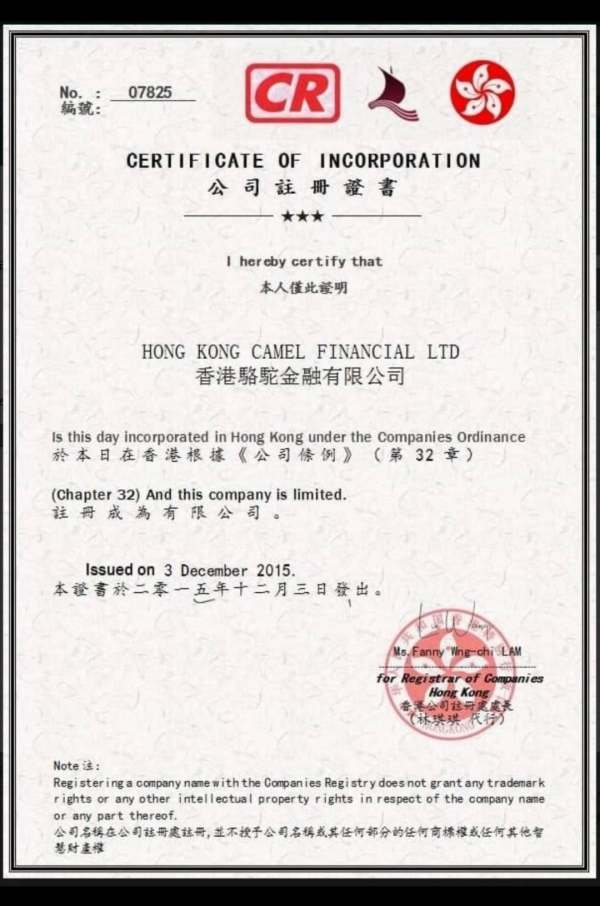

Camel Financial Limited operates as a forex broker in the online trading space. However, specific information about its establishment date and company background remains unclear in available materials. The broker's business model and operational structure are not detailed in accessible documentation. This creates transparency concerns for potential clients seeking comprehensive broker information.

The company's primary focus appears to be forex trading services, utilizing the popular MetaTrader 5 platform as its main trading interface. However, the absence of detailed company background information, including founding details and corporate structure, raises questions about the broker's transparency and commitment to client disclosure. This lack of fundamental business information represents a significant concern for traders seeking reliable broker partnerships.

Regarding regulatory oversight, available materials do not specify any regulatory authorities supervising Camel Financial Limited's operations. This absence of regulatory information is particularly concerning in the forex industry, where proper licensing and oversight are crucial for trader protection and fund security. The platform's focus on forex trading through MT5 suggests targeting of retail forex traders. However, without proper regulatory backing, this positioning becomes problematic for risk-conscious investors.

Regulatory Jurisdiction: Available materials do not specify any regulatory authorities overseeing Camel Financial Limited. This represents a significant red flag for potential clients seeking regulated broker services.

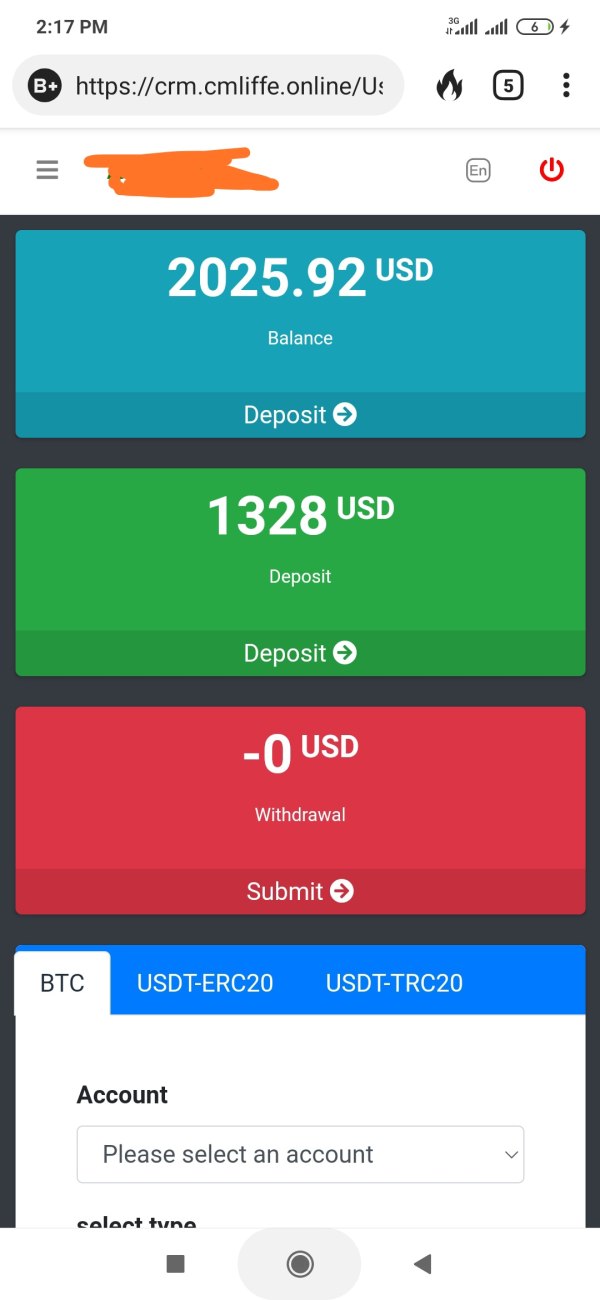

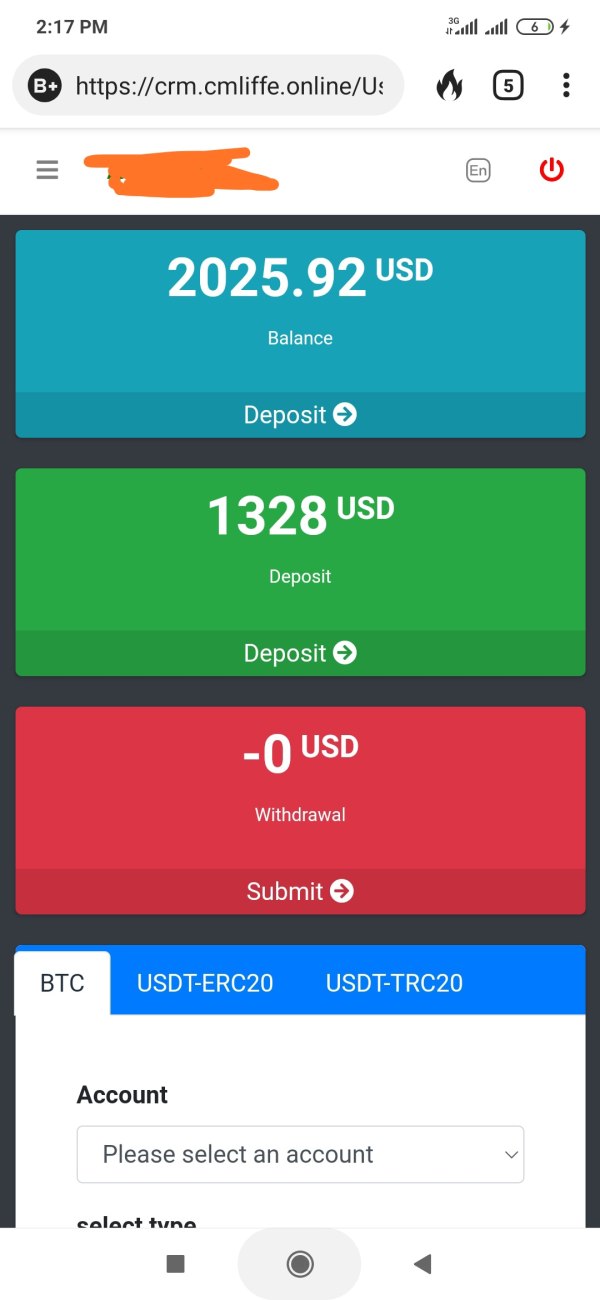

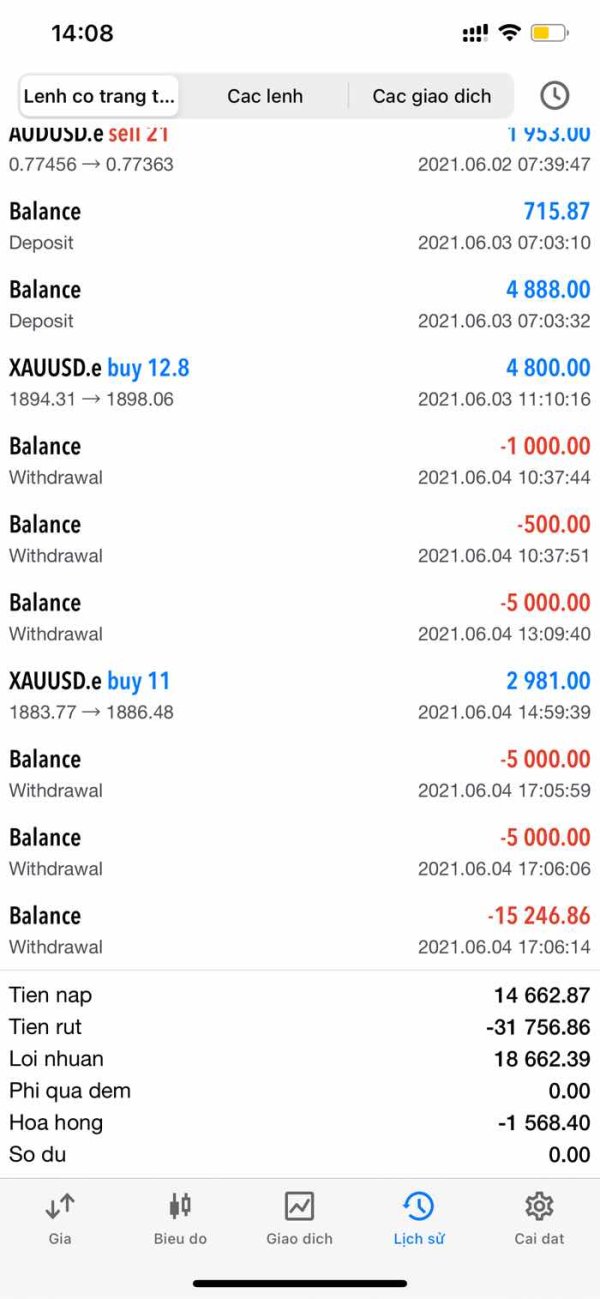

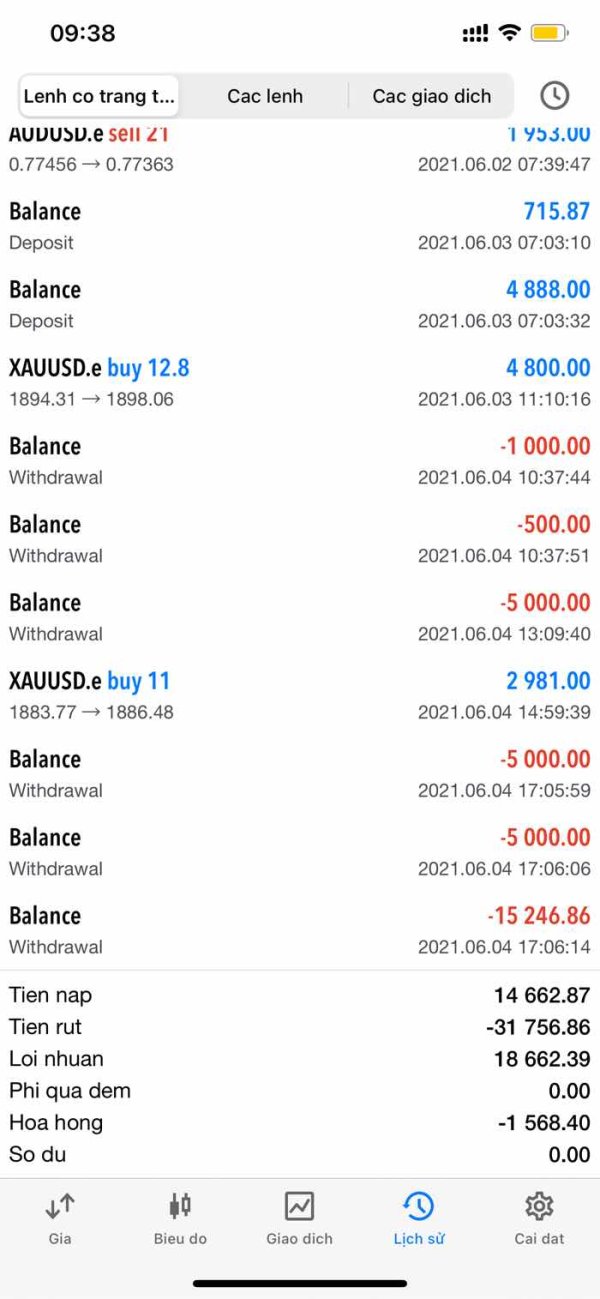

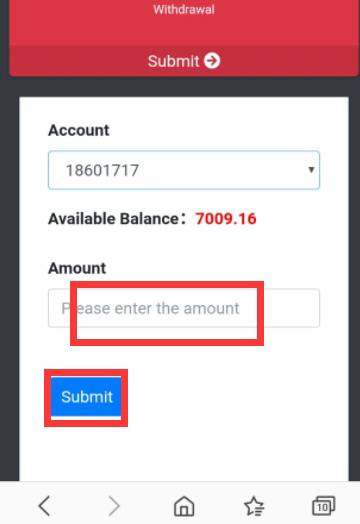

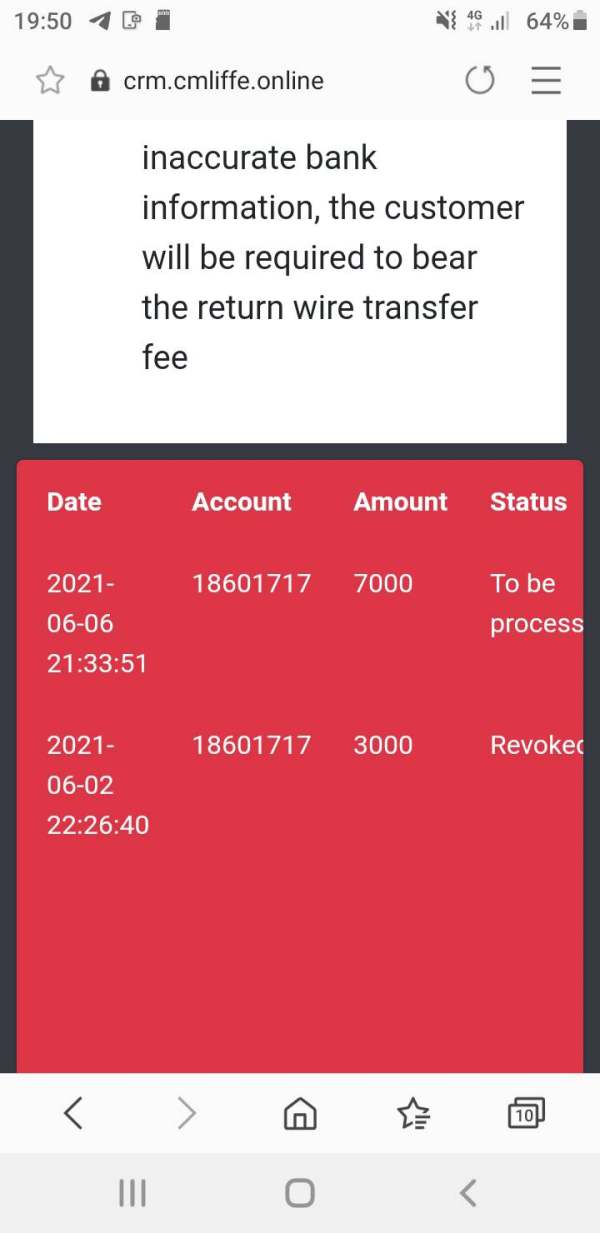

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in source materials. User feedback suggests significant problems with withdrawal processing.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not specified in available documentation. This makes it difficult for potential clients to understand entry-level investment needs.

Bonus and Promotional Offers: No information about bonus programs or promotional offers is available in the source materials. This suggests either absence of such programs or lack of transparency in marketing.

Available Trading Assets: The broker focuses on forex trading as its primary asset class. However, specific currency pairs and market coverage details are not comprehensively outlined.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in source materials. This creates uncertainty about the broker's pricing competitiveness.

Leverage Ratios: Specific leverage offerings are not mentioned in available documentation. This is concerning given the importance of leverage information for forex traders.

Platform Options: Camel Financial Limited provides MetaTrader 5 as its primary trading platform. This is a widely recognized and respected trading interface in the forex industry.

Geographic Restrictions: Specific regional limitations or service availability restrictions are not detailed in available materials.

Customer Support Languages: Information about supported languages for customer service is not specified in source documentation.

This camel financial limited review highlights significant information gaps that potential clients should consider carefully before engaging with this broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Camel Financial Limited remain largely unclear due to insufficient information in available materials. This lack of transparency regarding account types, their specific features, and associated benefits represents a major concern for potential clients. Without clear details about different account tiers, traders cannot make informed decisions about which account type might suit their trading needs and experience levels.

The absence of minimum deposit information further complicates the account evaluation process. Reputable brokers typically provide clear, accessible information about their account structures, including entry-level requirements, account benefits, and any restrictions or limitations. The lack of such fundamental information suggests either poor communication practices or intentional opacity in the broker's operations.

Account opening procedures and verification requirements are also not detailed in available sources. This information gap extends to special account features that many modern brokers offer, such as Islamic accounts for traders requiring Sharia-compliant trading conditions. The overall lack of account-related information significantly undermines confidence in the broker's professionalism and commitment to client transparency.

User feedback does not provide substantial insights into account conditions, as most complaints focus on withdrawal issues rather than account features. This camel financial limited review must therefore rate account conditions poorly due to insufficient available information and lack of transparency.

Camel Financial Limited's primary strength lies in its provision of the MetaTrader 5 platform. MT5 is widely regarded as one of the industry's leading trading interfaces. MT5 offers comprehensive charting capabilities, technical analysis tools, and automated trading support, providing traders with professional-grade functionality for forex market analysis and execution.

However, beyond the MT5 platform provision, information about additional trading tools and resources remains limited. Research and market analysis resources, which are crucial for informed trading decisions, are not detailed in available materials. Educational resources, including tutorials, webinars, and trading guides, are similarly absent from the available information. This represents a significant gap in trader support services.

The lack of information about automated trading support, expert advisors, and algorithmic trading capabilities through the MT5 platform suggests either limited offering or poor communication about available features. While MT5 inherently supports automated trading, the broker's specific policies and support for such activities remain unclear.

User feedback regarding the platform's performance and available tools is limited, with most user concerns focusing on financial rather than technical issues. The platform's stability and additional tool availability cannot be thoroughly assessed based on available user experiences.

Customer Service and Support Analysis (Score: 2/10)

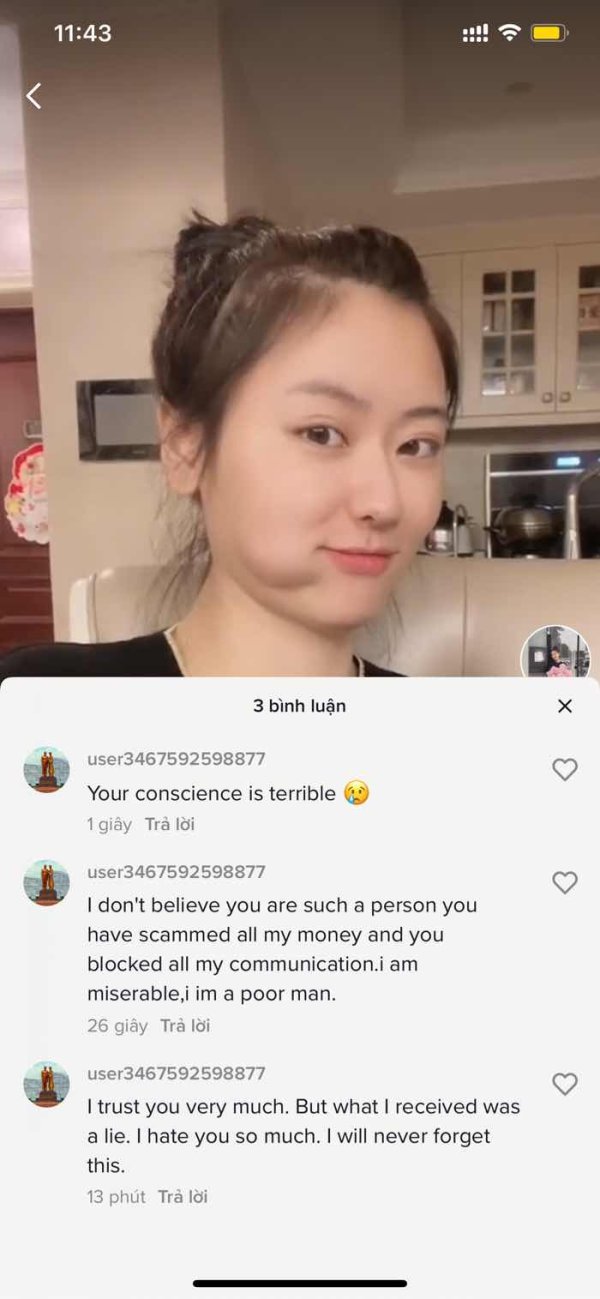

Customer service represents one of Camel Financial Limited's most significant weaknesses, based on available user feedback and operational transparency issues. User reports consistently highlight poor service quality, with particular emphasis on unresponsive communication and inadequate problem resolution capabilities.

The broker's customer service channels and availability hours are not clearly specified in available materials. This creates uncertainty about how clients can access support when needed. This lack of transparency about support accessibility represents a fundamental operational concern, as reliable customer service is essential for addressing trading issues and account management needs.

Response time issues feature prominently in user complaints, with traders reporting delays in receiving assistance for critical account-related problems. The quality of service interactions, when they do occur, appears to be substandard based on user feedback. This suggests inadequate training or support infrastructure.

Multilingual support capabilities remain unclear, which could pose additional barriers for international clients seeking assistance in their preferred languages. The absence of comprehensive customer service information, combined with negative user experiences, significantly undermines confidence in the broker's commitment to client support and satisfaction.

Trading Experience Analysis (Score: 4/10)

The trading experience with Camel Financial Limited appears to be significantly impacted by operational issues, particularly regarding fund management and withdrawal processes. While the MetaTrader 5 platform provides a solid technical foundation for trading activities, user feedback suggests that broader operational problems negatively affect the overall trading environment.

Platform stability concerns emerge from user reports, though specific technical performance data is not available in source materials. Order execution quality appears to be compromised by the broker's operational issues, with users expressing dissatisfaction about various aspects of their trading experience beyond just platform functionality.

The trading environment's quality is further undermined by user concerns about liquidity and spread competitiveness, though detailed performance metrics are not available for objective assessment. Mobile trading experience details are not specified in available materials. This represents another information gap for traders seeking comprehensive platform access.

User feedback consistently points to problems that extend beyond normal trading activities, focusing particularly on fund security and withdrawal processing. These operational concerns create an environment where even technically sound trading platform features become secondary to fundamental trust and reliability issues affecting the overall camel financial limited review assessment.

Trust and Safety Analysis (Score: 1/10)

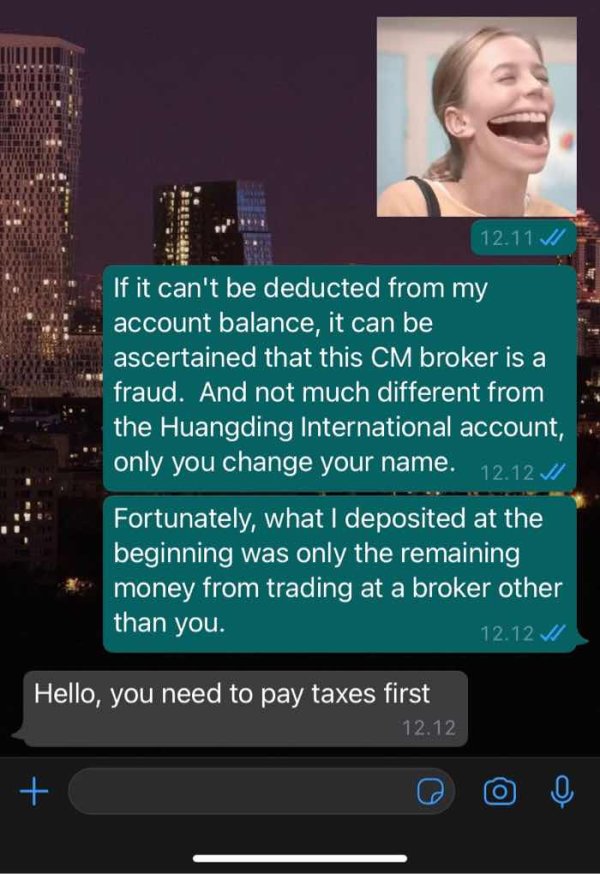

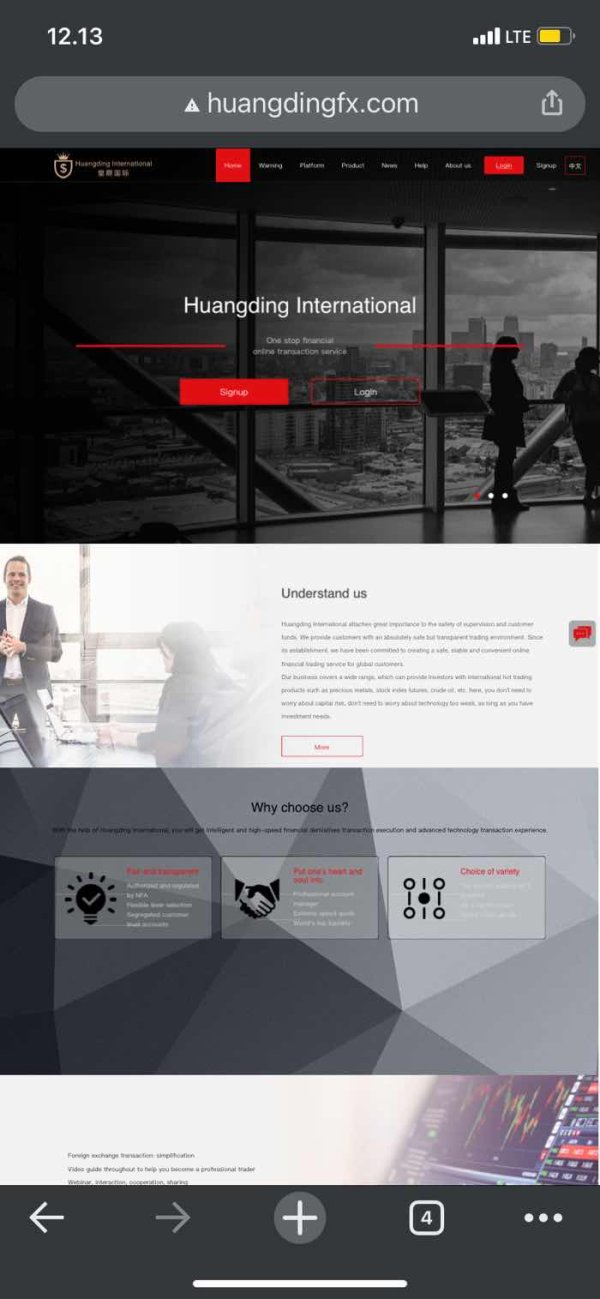

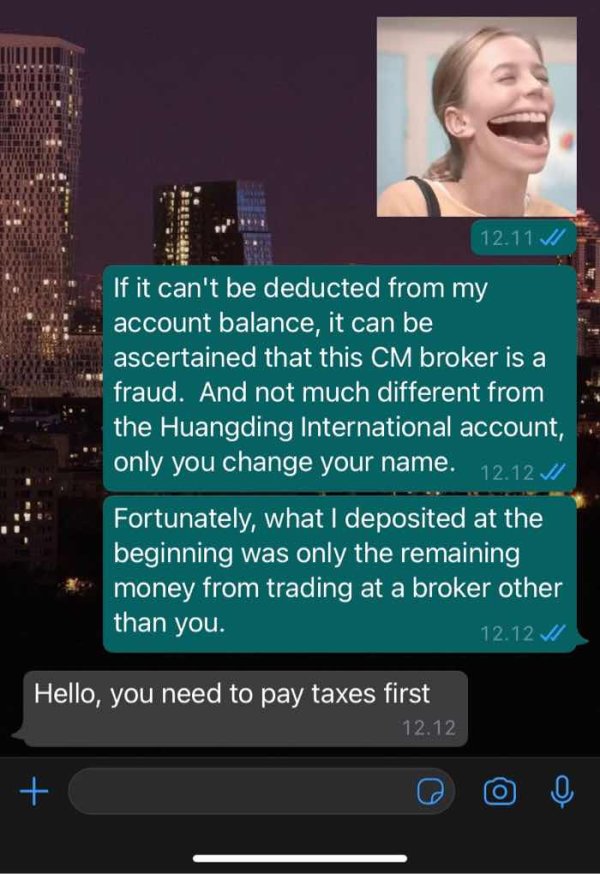

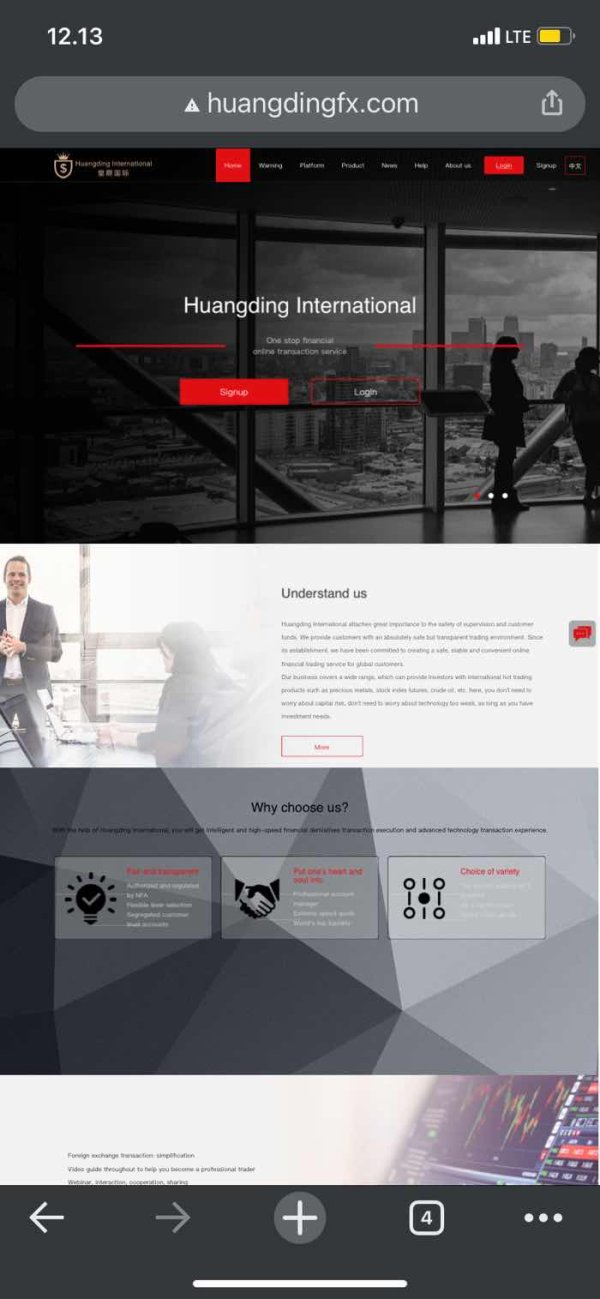

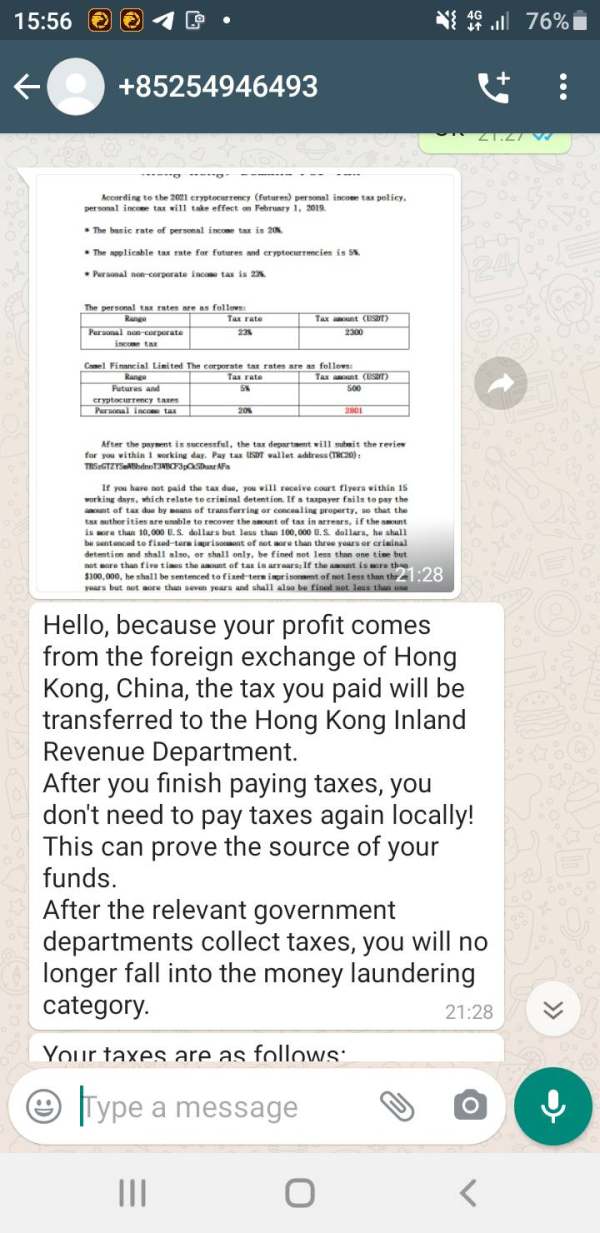

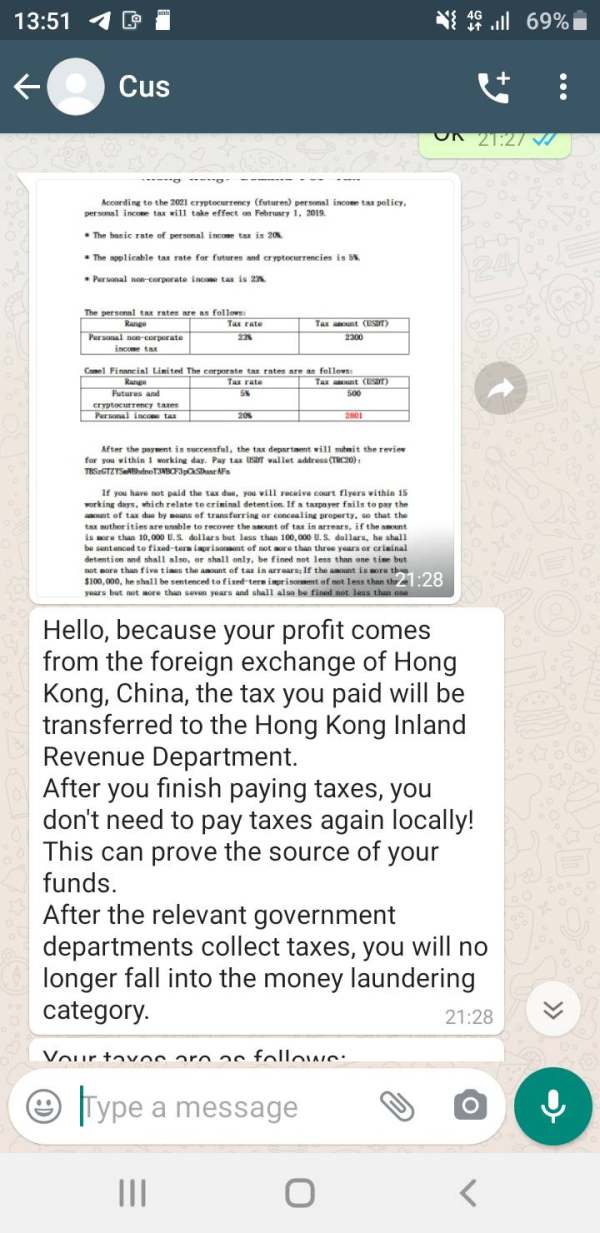

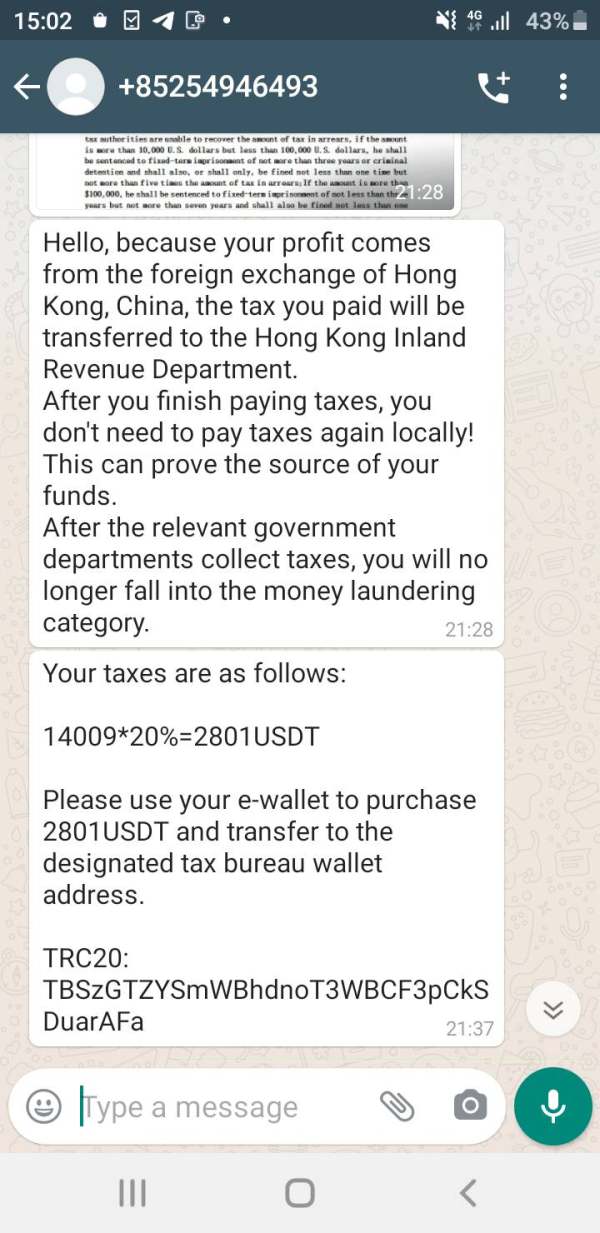

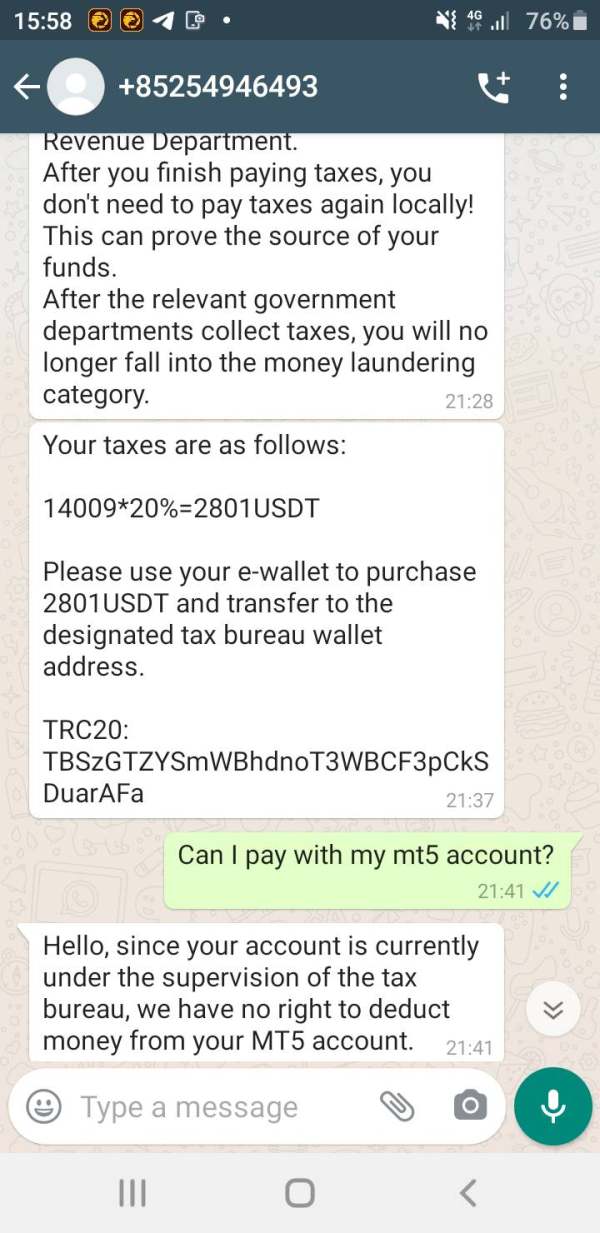

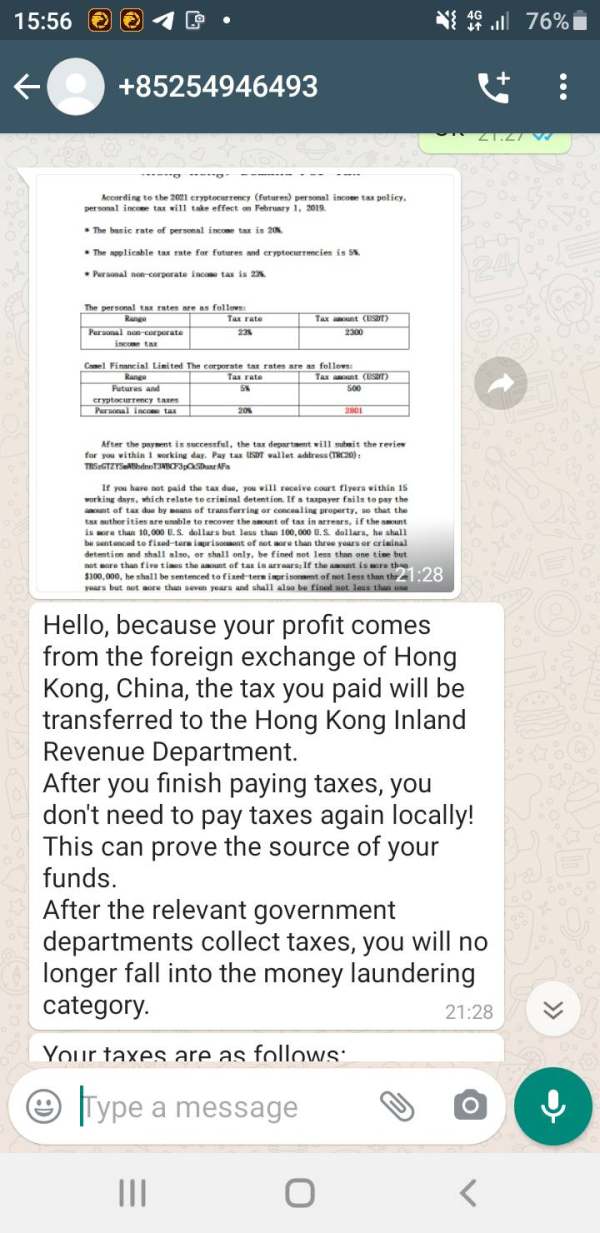

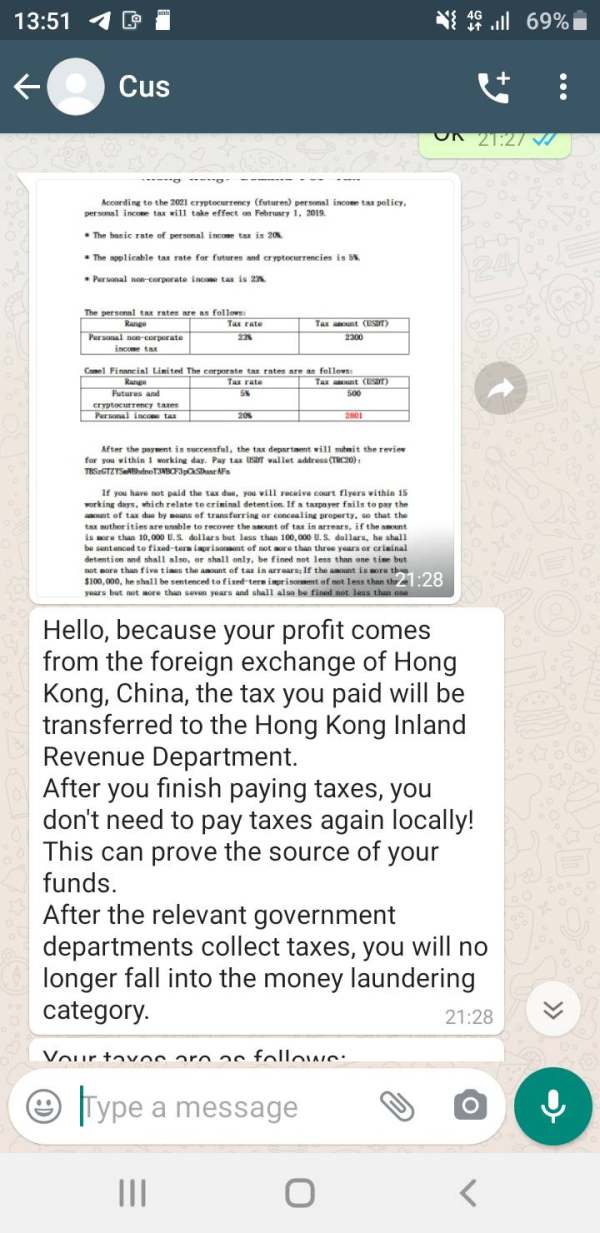

Trust and safety represent the most critical concerns in this evaluation of Camel Financial Limited. The absence of regulatory information in available materials immediately raises red flags about the broker's legitimacy and commitment to industry standards. Regulated oversight is fundamental to forex broker operations, providing essential protections for client funds and operational transparency.

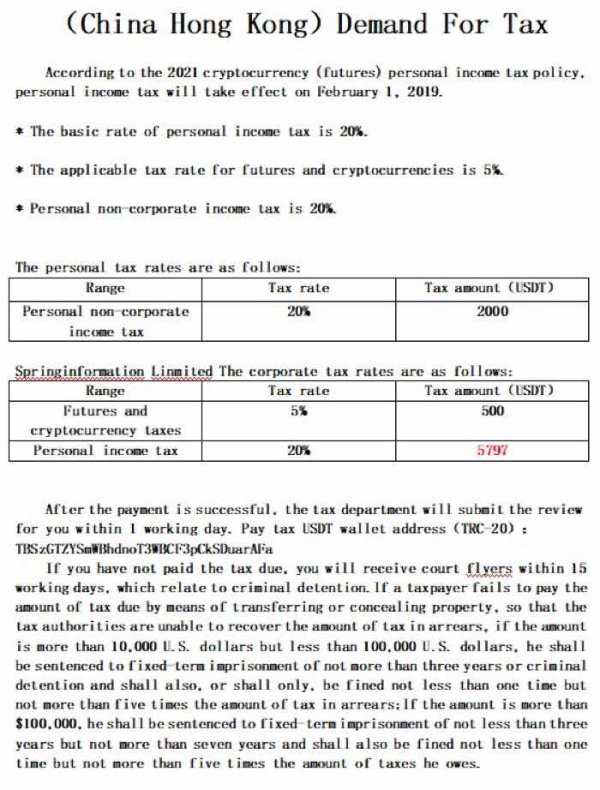

The lack of specified fund security measures further compounds trust concerns. Reputable brokers typically maintain segregated client accounts, provide deposit insurance, or operate under regulatory frameworks that ensure fund protection. The absence of such information suggests either inadequate protective measures or poor transparency about existing safeguards.

Company transparency issues extend beyond regulatory information to include basic operational details and corporate structure information. This opacity makes it impossible for potential clients to conduct proper due diligence about the broker's background, financial stability, and operational legitimacy.

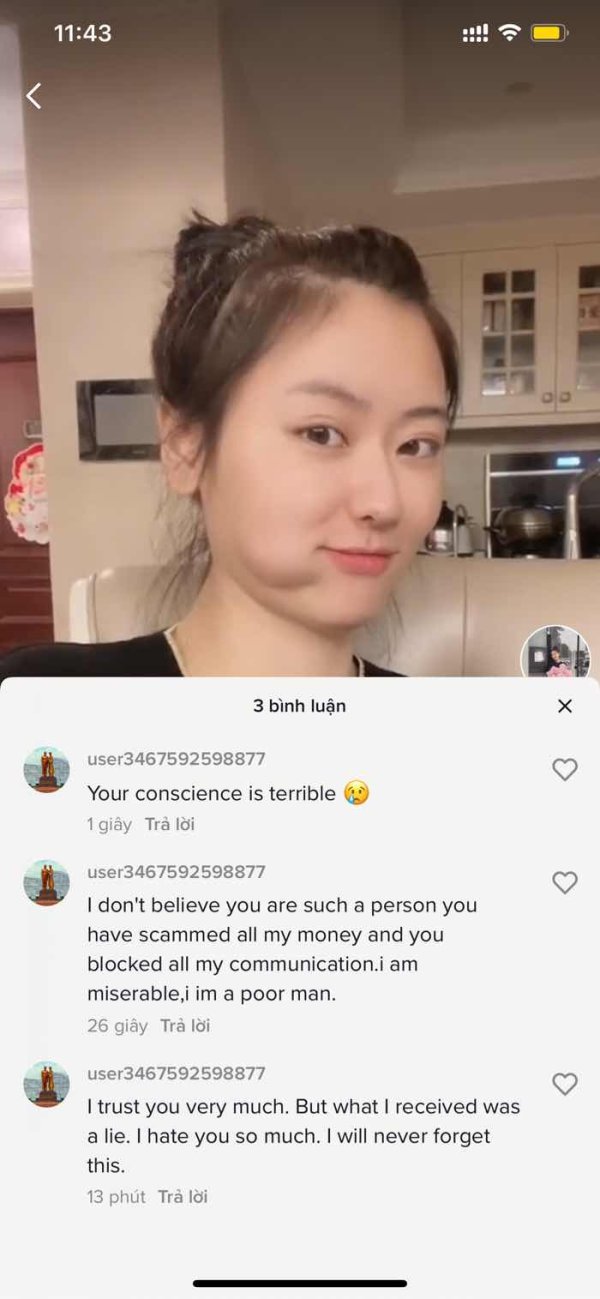

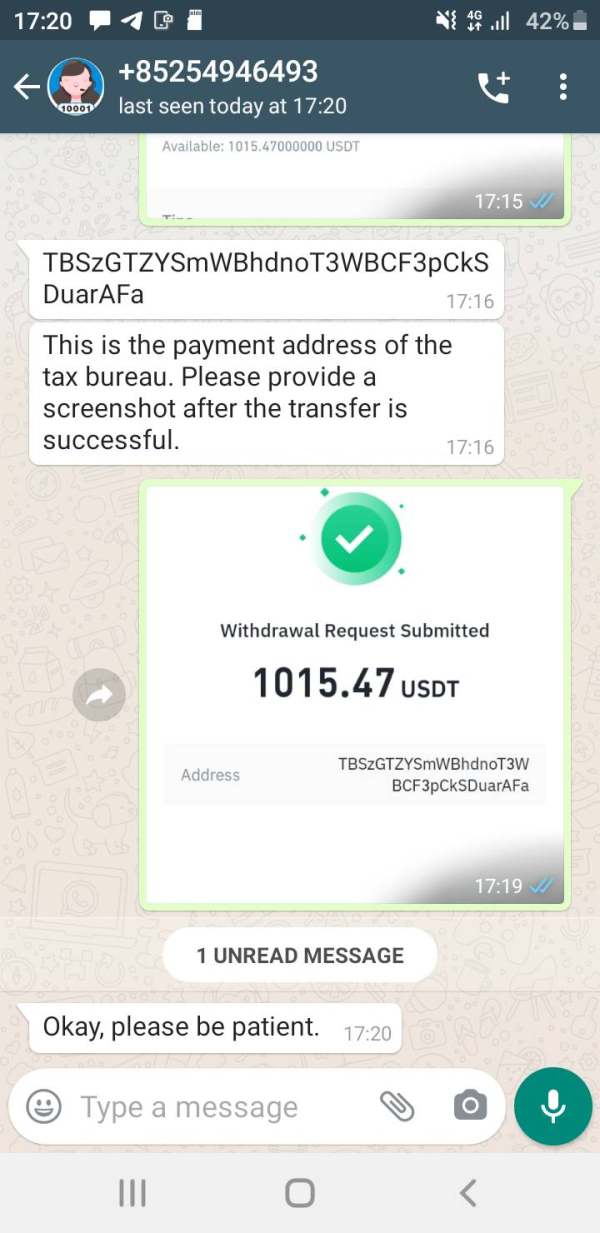

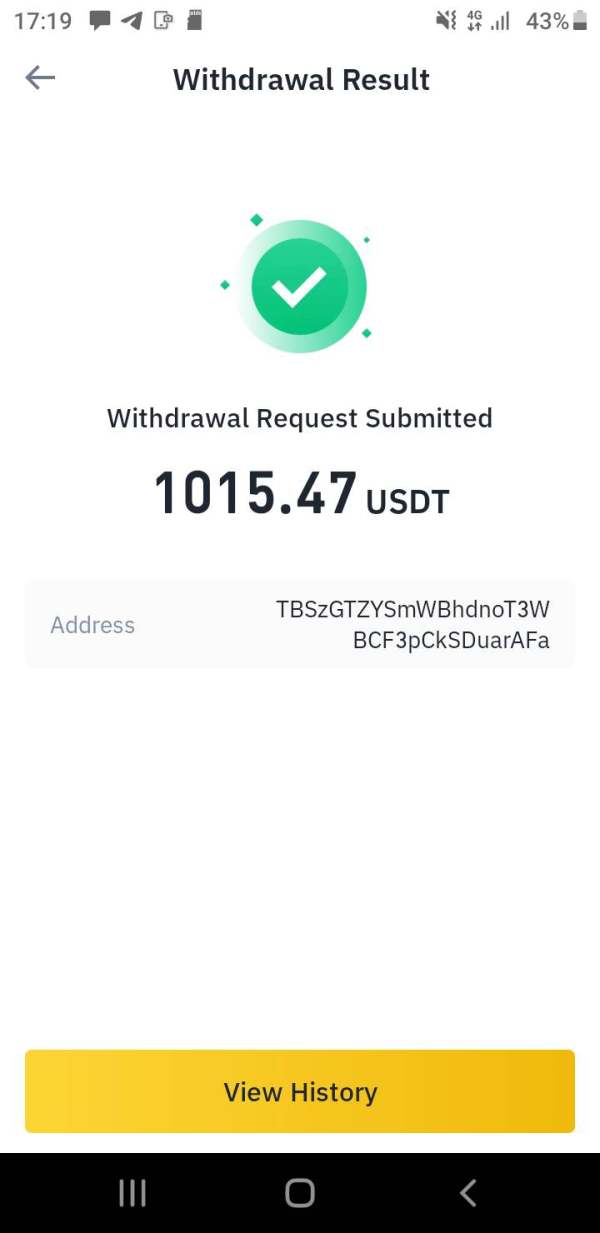

Industry reputation appears to be significantly damaged by user reports of fraudulent activities and withdrawal problems. The handling of negative events and client complaints seems inadequate based on available feedback. This suggests systemic issues with the broker's operational integrity and client relationship management.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Camel Financial Limited appears to be extremely low, based on the predominance of negative feedback and exposure reports. The broker's user experience is severely impacted by operational problems that extend far beyond normal trading platform functionality or service quality issues.

Interface design and platform usability details are not extensively covered in available user feedback, as most complaints focus on more fundamental operational concerns. The registration and account verification processes are not detailed in available materials. However, user experiences suggest potential problems in these areas as well.

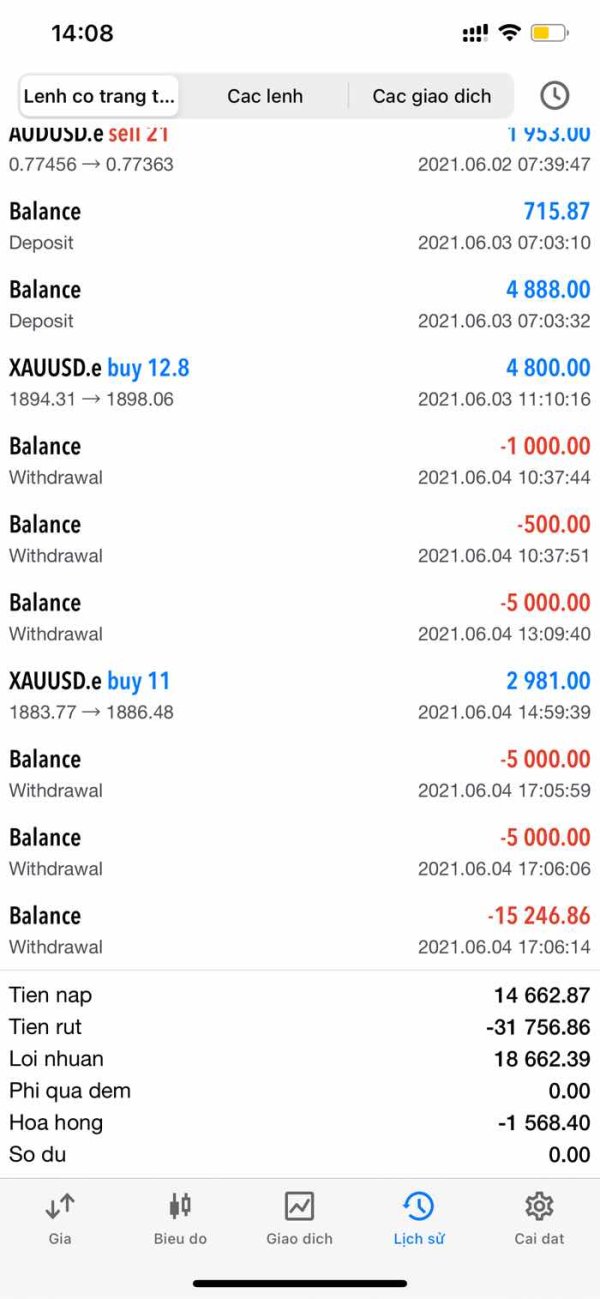

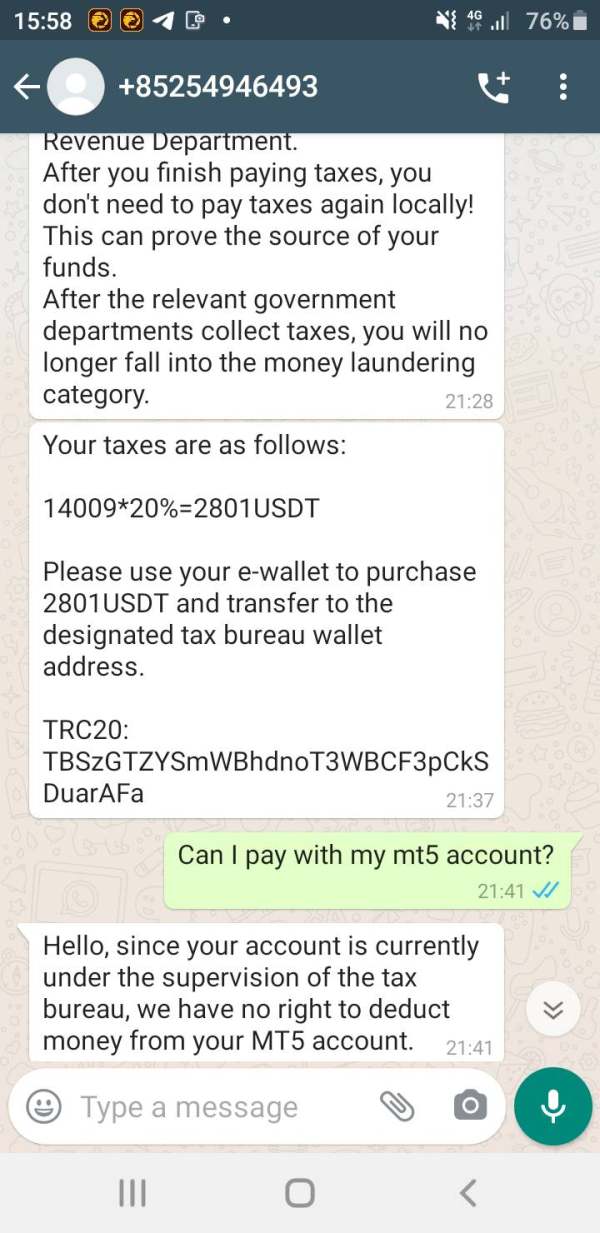

Fund operation experiences represent the most significant user concern, with withdrawal problems featuring prominently in negative feedback. Users consistently report difficulties accessing their funds. This represents the most serious possible issue for any financial services provider.

Common user complaints center on withdrawal processing problems and concerns about fund security. The pattern of negative feedback suggests systemic issues rather than isolated incidents, indicating fundamental problems with the broker's operational capabilities. The user profile appears to include forex traders seeking MT5 platform access. However, the negative experience pattern suggests this broker is unsuitable for any trader category, regardless of experience level.

Conclusion

This comprehensive camel financial limited review reveals significant concerns that make it difficult to recommend this broker to any category of trader. The overall evaluation is predominantly negative, with serious red flags regarding regulatory compliance, fund security, and operational transparency that should concern potential clients.

The broker is particularly unsuitable for novice traders who require reliable, regulated environments for learning and developing trading skills. Even experienced traders seeking MetaTrader 5 access would be better served by alternative brokers offering similar platform capabilities with proper regulatory oversight and transparent operations.

The main advantage of MetaTrader 5 platform availability is significantly outweighed by critical disadvantages including withdrawal processing problems, lack of regulatory information, poor customer service quality, and overall operational transparency concerns. These fundamental issues make Camel Financial Limited a high-risk choice for forex trading activities.