Is CAMEL FINANCIAL LIMITED safe?

Business

License

Is Camel Financial Limited Safe or Scam?

Introduction

Camel Financial Limited positions itself as a player in the forex and CFD trading market, offering a platform for traders looking to engage in various financial instruments. However, the landscape of forex trading is fraught with risks, and the presence of unregulated brokers can make it even more perilous. For traders, it is crucial to carefully assess the credibility and safety of any broker before committing funds. This article aims to provide an objective evaluation of Camel Financial Limited, analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our investigation is based on a review of available online resources, including expert analyses and user experiences.

Regulation and Legitimacy

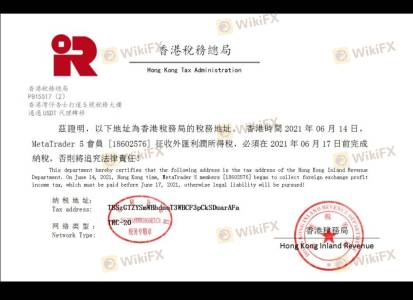

The regulatory status of a forex broker is a critical factor in determining its safety. Regulated brokers are required to adhere to strict guidelines that protect traders' funds and ensure fair trading practices. In the case of Camel Financial Limited, multiple sources indicate that the broker operates without any regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Camel Financial Limited does not have to comply with the strict requirements imposed by recognized financial authorities. This lack of oversight is particularly alarming, as it exposes traders to potential risks, including fraud and mismanagement of funds. Furthermore, the broker's website does not provide any verifiable information about its registration or compliance with regulatory standards, further complicating its credibility. In summary, Camel Financial Limited is not safe, as it operates as an unregulated broker, which poses a higher risk for traders.

Company Background Investigation

Camel Financial Limited's company history is another area of concern. The broker claims to operate within the forex market, but detailed information about its establishment, ownership structure, and operational history is scarce. Sources suggest that the company may not have a transparent background, which raises red flags regarding its trustworthiness.

The management team behind Camel Financial Limited is also not well-documented. A lack of information about the executives and their qualifications can lead to uncertainty about the broker's operational integrity. Transparency in a company's leadership is vital for assessing its reliability, and the absence of such information in Camel Financial Limited's case further diminishes its credibility.

Overall, Camel Financial Limited does not present itself as a safe option for traders, given its opaque company background and lack of verifiable information about its management.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Camel Financial Limited claims to offer competitive trading conditions; however, the specifics remain vague. Many user reviews and expert analyses indicate that the broker may impose hidden fees and unfavorable trading practices.

| Fee Type | Camel Financial Limited | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Moderate |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

The fee structure at Camel Financial Limited appears to be less favorable than that of regulated brokers. Traders have reported unexpected charges, which can significantly impact profitability. Moreover, the lack of clarity regarding commissions and overnight interest rates leaves traders vulnerable to surprise costs. Therefore, Camel Financial Limited's trading conditions are not safe, as they may not provide the transparency and fairness that traders expect.

Customer Funds Safety

Ensuring the safety of customer funds is paramount for any forex broker. Camel Financial Limited's lack of regulatory oversight raises concerns about its ability to safeguard client deposits. Many regulated brokers implement measures such as segregated accounts and investor protection schemes to ensure that clients' funds are secure.

In the case of Camel Financial Limited, there is no clear information about its fund protection policies. The absence of details regarding fund segregation and negative balance protection is particularly troubling. Traders should be wary of brokers that do not openly disclose these critical safety measures, as it can lead to significant financial risks.

In conclusion, Camel Financial Limited does not appear to be a safe option for traders concerned about the security of their funds, given its lack of transparency and regulatory oversight.

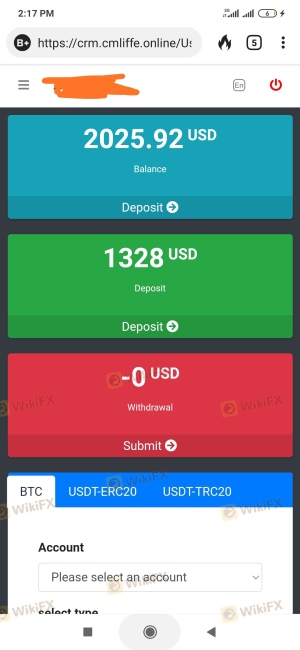

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of Camel Financial Limited, user experiences are mixed, with several complaints highlighting issues related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

Many users have reported challenges when attempting to withdraw their funds, which is a significant red flag for any broker. Additionally, the company's slow response times to customer inquiries further exacerbate these concerns. For instance, one user recounted a frustrating experience trying to withdraw funds, only to be met with delays and a lack of communication from the support team. Such complaints indicate that Camel Financial Limited may not be a safe choice, as these issues can lead to substantial financial and emotional stress for traders.

Platform and Trade Execution

A broker's trading platform plays a crucial role in the overall trading experience. Camel Financial Limited reportedly offers the MT5 platform, known for its advanced features. However, user reviews suggest that the platform may suffer from performance issues, including frequent downtimes and execution delays.

Traders have expressed concerns about order execution quality, with reports of slippage and rejections during high volatility periods. Such issues can severely impact trading outcomes and raise suspicions about potential platform manipulation. Therefore, while Camel Financial Limited offers a recognizable trading platform, the execution quality may not be safe, as it does not meet the standards expected by traders.

Risk Assessment

Using Camel Financial Limited presents various risks that traders should be aware of. The absence of regulation, unclear trading conditions, and negative customer feedback contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for hidden fees |

| Operational Risk | Medium | Platform performance issues |

To mitigate these risks, traders should consider the following recommendations:

- Conduct thorough research before trading with any broker.

- Avoid unregulated brokers and seek those with transparent practices.

- Use demo accounts to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, Camel Financial Limited exhibits several characteristics that suggest it may not be a safe broker for traders. The lack of regulation, unclear trading conditions, and negative customer feedback collectively raise significant concerns about its legitimacy. Traders are advised to exercise extreme caution when dealing with Camel Financial Limited and to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences.

If you are seeking reliable trading options, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, which ensure higher levels of safety and transparency. Ultimately, ensuring the safety of your trading experience should be your top priority.

Is CAMEL FINANCIAL LIMITED a scam, or is it legit?

The latest exposure and evaluation content of CAMEL FINANCIAL LIMITED brokers.

CAMEL FINANCIAL LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAMEL FINANCIAL LIMITED latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.