ERG Review 1

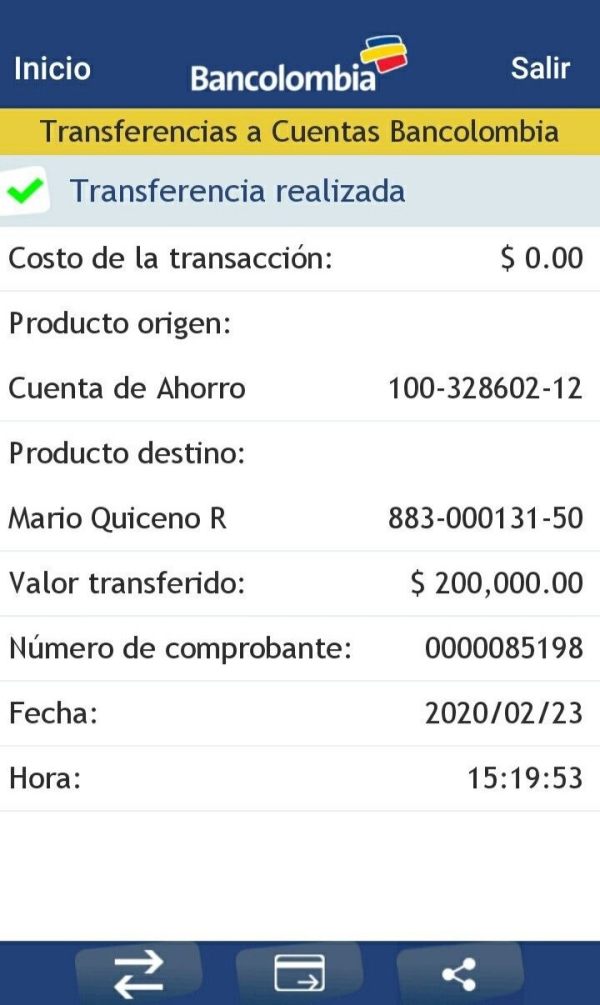

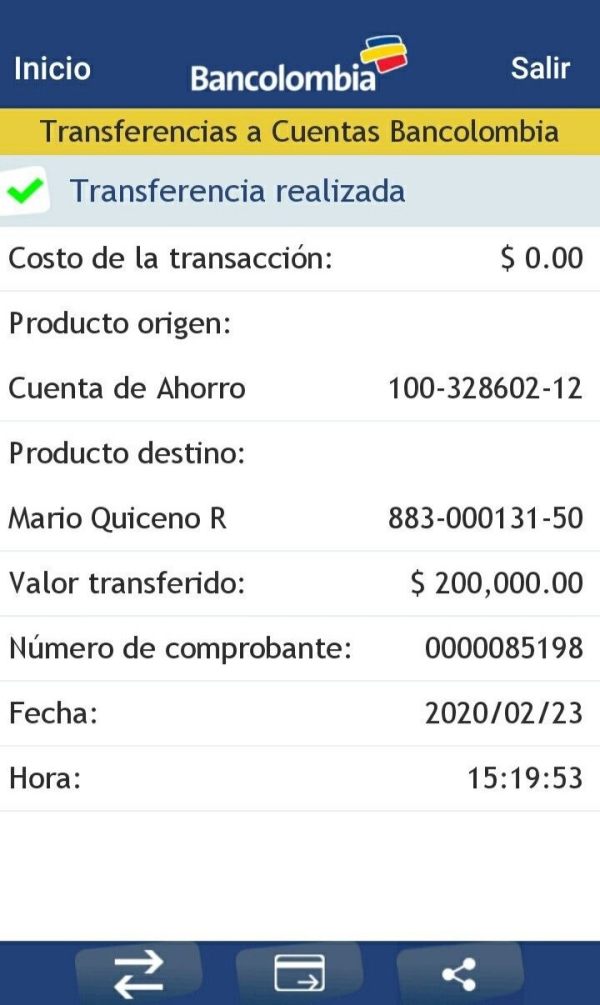

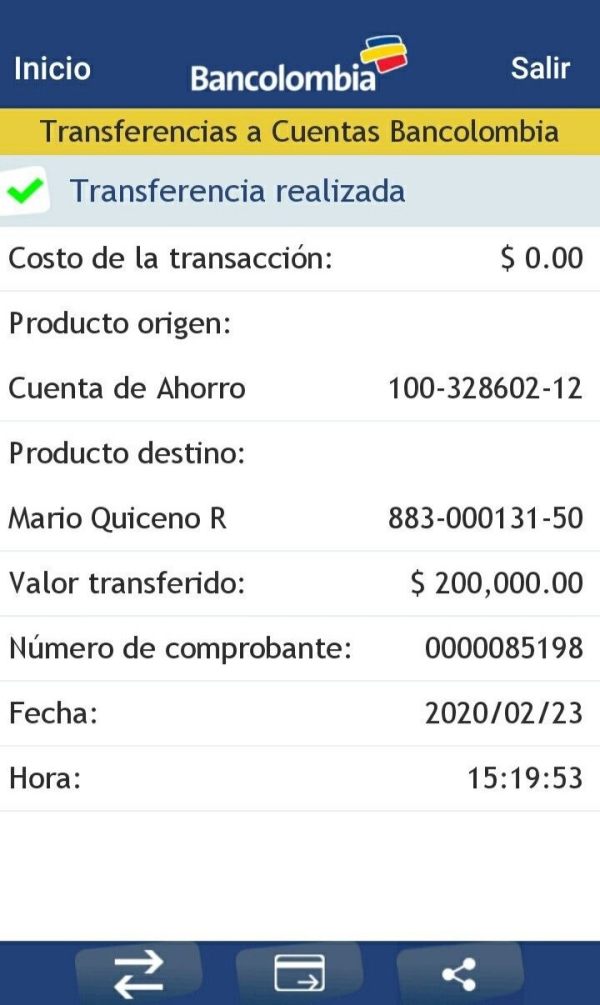

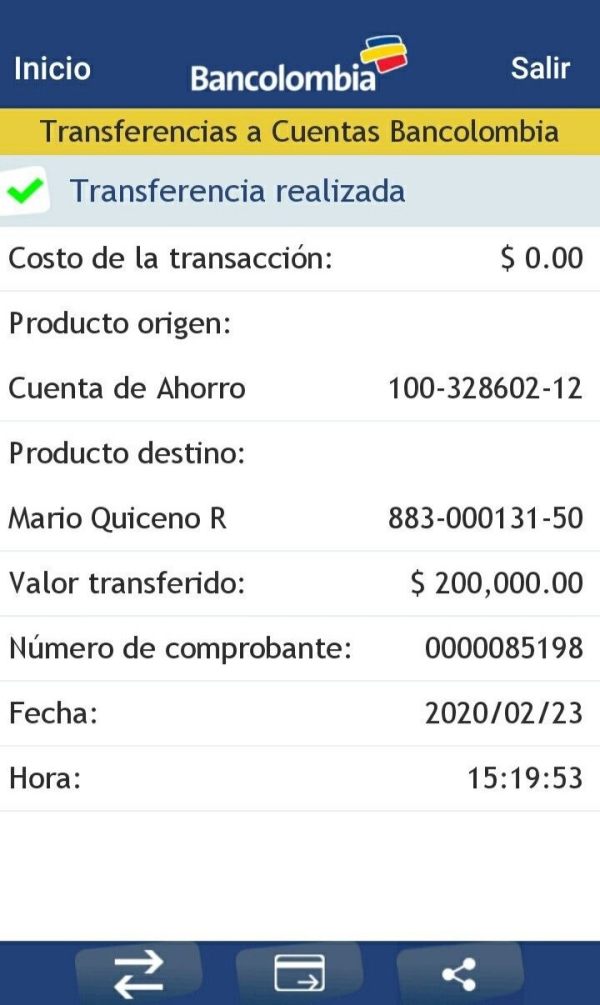

I put 200,000 pesos in my account, and they never put it in my account, I wrote a message to the report but they did not pay attention to me.

ERG Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I put 200,000 pesos in my account, and they never put it in my account, I wrote a message to the report but they did not pay attention to me.

This ERG review gives traders a complete analysis of ERG's services and offerings. ERG appears to be mainly recognized as a commercial real estate brokerage firm operating in New York and Long Island rather than a traditional forex broker, based on available information. The company has established itself in the real estate sector. However, detailed information about forex trading services remains limited in available resources.

ERG Commercial Real Estate has positioned itself as a brokerage firm serving clients in the New York metropolitan area. When evaluating ERG from a forex trading perspective, traders should note that comprehensive trading-specific information is not readily available through standard industry channels. This review examines the available data while highlighting areas where additional information would be beneficial for potential traders considering ERG's services.

The evaluation reveals significant gaps in publicly available information regarding trading conditions, regulatory status, and platform offerings. These details are typically expected from established forex brokers.

Regional Entity Differences: Due to limited information available in our research, specific details about regional regulatory differences cannot be confirmed. Traders should independently verify regulatory status in their jurisdiction before engaging with any broker.

Review Methodology: This review is based on available public information and company background research. The analysis reflects current publicly accessible data, and traders are advised to conduct additional due diligence. Given the limited forex-specific information available, this evaluation focuses on general company background while highlighting information gaps that potential traders should address through direct inquiry.

| Criteria | Score | Status |

|---|---|---|

| Account Conditions | N/A | Information not available |

| Tools and Resources | N/A | Information not available |

| Customer Service and Support | N/A | Information not available |

| Trading Experience | N/A | Information not available |

| Trust and Reliability | N/A | Information not available |

| User Experience | N/A | Information not available |

ERG Commercial Real Estate operates as a brokerage firm based in New York and Long Island, focusing primarily on commercial real estate services. The company has established its presence in the competitive New York real estate market, though specific founding details and operational history are not extensively documented in available sources. The firm appears to maintain a traditional brokerage model within the real estate sector.

The company's primary business operations center around commercial real estate transactions and services in the New York metropolitan area. ERG Commercial Real Estate has developed its services to cater to the specific needs of the local market. However, comprehensive details about their full service portfolio remain limited in publicly available information.

From a forex trading perspective, this ERG review must note that standard trading platform information, asset classes, and regulatory details typically associated with forex brokers are not readily available through conventional research channels. This presents a significant consideration for traders seeking comprehensive broker evaluation data.

Regulatory Regions: Specific regulatory information for forex trading services is not available in current research materials. Traders should verify regulatory status directly with the company.

Deposit and Withdrawal Methods: Information regarding payment methods and processing procedures is not detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit information is not provided in accessible company materials.

Bonus and Promotions: Details about promotional offers or bonus structures are not available through current research.

Tradeable Assets: Comprehensive information about available trading instruments is not documented in available sources.

Cost Structure: Detailed fee schedules, spreads, and commission structures are not specified in current materials.

Leverage Ratios: Specific leverage offerings are not detailed in available information.

Platform Options: Information about trading platforms and technological infrastructure is not available through standard research channels.

Regional Restrictions: Specific geographical limitations are not detailed in current sources.

Customer Service Languages: Supported languages for customer service are not specified in available materials.

This ERG review highlights the need for direct communication with the company to obtain comprehensive trading-related information.

The evaluation of ERG's account conditions faces significant limitations due to the absence of detailed information in available sources. Traditional forex broker account structures typically include various account types such as standard, premium, and professional accounts, each with distinct features and requirements. However, specific details about ERG's account offerings, including account types, minimum balance requirements, and account-specific benefits, are not documented in accessible materials.

Account opening procedures and verification processes represent critical aspects of broker evaluation that remain unclear in current research. Most established forex brokers provide comprehensive documentation about their account structures. However, ERG's specific approach to account management and client onboarding is not detailed in available sources.

The absence of clear account condition information presents challenges for traders attempting to evaluate suitability. Standard industry practices include tiered account structures with varying benefits, but ERG's specific approach cannot be confirmed through current research. This ERG review emphasizes the importance of direct inquiry to obtain accurate account information.

Without detailed account condition data, traders cannot effectively compare ERG's offerings with industry standards or assess whether the broker's account structure aligns with their trading needs and experience level.

Trading tools and resources represent fundamental components of forex broker evaluation. However, comprehensive information about ERG's technological offerings remains unavailable through standard research channels. Modern forex brokers typically provide extensive analytical tools, charting capabilities, economic calendars, and research resources to support trader decision-making.

Educational resources constitute another critical evaluation area where information gaps exist. Established brokers commonly offer webinars, tutorials, market analysis, and educational materials for traders at various experience levels. However, ERG's specific educational offerings and trader support resources are not documented in available materials.

Research and analysis capabilities, including market commentary, technical analysis tools, and fundamental analysis resources, represent standard industry offerings that cannot be confirmed for ERG through current research. The availability and quality of such resources significantly impact trader experience and success potential.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, and API access, represents increasingly important broker features that remain unconfirmed for ERG. The absence of detailed tool and resource information limits comprehensive broker evaluation.

Customer service evaluation requires comprehensive information about support channels, availability, response times, and service quality that is not available through current research on ERG. Modern forex brokers typically offer multiple support channels including live chat, phone support, email assistance, and comprehensive FAQ sections.

Service availability represents a crucial consideration for active traders who may require assistance during various market hours. Standard industry practice includes 24/5 support during market hours, with some brokers offering extended or 24/7 support. However, ERG's specific support schedule and availability cannot be confirmed through available sources.

Response time and service quality metrics, often reflected in customer feedback and reviews, provide insight into broker reliability and customer satisfaction. However, comprehensive customer service reviews and feedback specifically related to ERG's trading services are not available through standard research channels.

Multilingual support capabilities, particularly important for international traders, represent another evaluation area where specific information is not available. The absence of detailed customer service information limits the ability to assess ERG's support infrastructure and commitment to client service.

Platform stability, execution speed, and overall trading environment represent critical factors in broker evaluation that cannot be assessed comprehensively due to limited available information about ERG's trading infrastructure. Modern forex trading requires reliable platform performance, fast order execution, and minimal slippage to ensure optimal trading conditions.

Order execution quality, including fill rates, execution speed, and price accuracy, significantly impacts trading outcomes and trader satisfaction. However, specific performance metrics and execution statistics for ERG are not available through current research channels. This ERG review cannot provide definitive assessment of execution quality without access to performance data.

Platform functionality, including charting capabilities, order management tools, and analytical features, represents fundamental aspects of trading experience that remain unconfirmed for ERG. Mobile trading capabilities, increasingly important for modern traders, also lack detailed documentation in available sources.

Trading environment factors such as server reliability, platform uptime, and technical support during platform issues constitute important considerations that cannot be evaluated without comprehensive broker information and user feedback data.

Regulatory oversight represents the cornerstone of broker trustworthiness. However, specific regulatory information for ERG's forex trading operations is not available through standard research channels. Established forex brokers typically maintain licenses with recognized regulatory bodies such as the FCA, CySEC, ASIC, or other national financial authorities.

Fund safety measures, including segregated client accounts, deposit protection schemes, and institutional banking relationships, provide crucial protection for trader capital. However, specific information about ERG's fund safety protocols and client protection measures is not detailed in available sources.

Company transparency, reflected through comprehensive disclosure of business practices, regulatory status, and operational procedures, enables traders to make informed decisions. The limited availability of detailed operational information presents challenges for comprehensive trust assessment.

Industry reputation and track record, typically evidenced through regulatory history, industry awards, and third-party evaluations, cannot be thoroughly assessed for ERG's forex operations due to information limitations in current research materials.

Overall user satisfaction represents a crucial evaluation metric that requires comprehensive user feedback and review data not readily available for ERG's forex trading services. Modern broker evaluation relies heavily on trader testimonials, user reviews, and satisfaction surveys to assess user experience quality.

Interface design and platform usability significantly impact trader effectiveness and satisfaction. However, detailed information about ERG's trading platform interface, navigation structure, and user-friendly features is not available through current research channels.

Registration and verification processes, including account opening efficiency, document requirements, and approval timeframes, represent important user experience factors that cannot be thoroughly evaluated without access to detailed procedural information and user feedback.

Fund management experience, including deposit and withdrawal processes, processing times, and associated fees, constitutes critical user experience elements that lack detailed documentation in available sources. The absence of comprehensive user experience data limits the ability to provide definitive assessment of ERG's service quality from a trader perspective.

This ERG review reveals significant information gaps regarding forex trading services and standard broker evaluation criteria. While ERG operates as a commercial real estate brokerage firm in New York and Long Island, comprehensive details about forex trading offerings, regulatory status, and trading conditions are not available through standard research channels.

The evaluation suggests that traders seeking detailed broker information should engage in direct communication with ERG to obtain comprehensive trading-related details. The absence of readily available forex-specific information presents challenges for thorough broker assessment and comparison with industry standards.

Potential users should conduct extensive due diligence, including verification of regulatory status, trading conditions, and service offerings before making any trading decisions. The limited publicly available information emphasizes the importance of direct inquiry and careful evaluation of any broker's credentials and services.

FX Broker Capital Trading Markets Review