TradeFXM 2025 Review: Everything You Need to Know

Executive Summary

This tradefxm review shows a complete analysis of a broker that has raised major concerns in the forex trading community. TradeFXM has been flagged by many regulatory bodies and review platforms as an unregulated and possibly fraudulent broker, earning an overall rating of 1 out of 5 stars across various evaluation sources. The broker lacks essential licensing requirements. It has received warnings from the Financial Conduct Authority in the United Kingdom.

According to ForexBrokerz and TheForexReview, TradeFXM presents many red flags that pose major risks to trader funds. The platform claims to offer forex and CFD trading services along with investment plans, but it operates without proper regulatory oversight. User feedback has been very negative. Traders report concerning experiences regarding fund safety and withdrawal processes.

The broker mainly targets investors interested in forex and CFD trading, but given the many warnings and lack of regulatory compliance, extreme caution is advised for anyone considering this platform. Many independent sources have categorized TradeFXM as a potential scam operation. This makes it unsuitable for serious traders seeking a reliable and secure trading environment.

Important Notice

It is crucial to understand that TradeFXM's regulatory status varies greatly across different regions, with particular emphasis on the FCA warning issued in the United Kingdom regarding the broker's lack of proper licensing. The regulatory landscape for this broker is concerning. No legitimate regulatory oversight has been confirmed across major financial jurisdictions.

This review is based on publicly available information from multiple sources including ForexBrokerz, TheForexReview, and WikiBit, along with user feedback collected as of September 2023. The assessment may not reflect all user experiences, but the consistency of negative reports across multiple platforms provides a clear picture of the broker's standing in the industry.

Rating Framework

Broker Overview

TradeFXM operates as a forex and CFD broker that has attracted major negative attention from regulatory bodies and industry watchdogs. The company's establishment date and corporate background remain unclear, which itself raises concerns about transparency and legitimacy. According to multiple sources, TradeFXM has been accused of fraudulent activities. Essential background information about the company's founders, headquarters location, and corporate structure is notably absent from public records.

The broker claims to offer investment plans and real-time trading services, but operates without the necessary regulatory framework that legitimate brokers maintain. The lack of proper licensing and regulatory compliance suggests that TradeFXM does not follow industry standards for client fund protection, segregation of accounts, or operational transparency that traders should expect from a reputable broker.

TradeFXM allegedly provides forex and CFD trading services, though specific details about available trading instruments, asset classes, and market access remain vague in available documentation. The Financial Conduct Authority in the United Kingdom serves as the primary regulatory body that has issued warnings about this broker. It specifically notes the absence of required licenses for financial services provision. This regulatory warning represents a critical red flag for potential clients considering this platform.

Regulatory Status: TradeFXM claims to operate across multiple regions but has received specific warnings from the FCA regarding unauthorized financial activities. No legitimate regulatory licenses have been verified for this broker.

Deposit and Withdrawal Methods: Available documentation does not provide clear information about supported deposit and withdrawal methods. This itself is concerning for transparency.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly disclosed in available materials. This represents another transparency issue.

Bonus and Promotions: No verified information about bonus offerings or promotional campaigns has been identified in the available sources.

Tradeable Assets: While TradeFXM claims to offer forex and CFD trading, specific details about available currency pairs, commodities, indices, or other financial instruments are not clearly documented.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in available materials. This makes it impossible for traders to assess the true cost of trading.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available documentation.

Platform Options: Information about available trading platforms, including whether MT4, MT5, or proprietary platforms are offered, is not clearly specified in reviewed materials.

Geographic Restrictions: Specific information about restricted countries or regions is not available in current documentation.

Customer Service Languages: Details about supported languages for customer service are not provided in available materials.

This comprehensive tradefxm review reveals major information gaps that legitimate brokers typically address transparently. This further supports concerns about the platform's credibility.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by TradeFXM present many concerns for potential traders. Available documentation fails to provide clear information about account types, their specific features, or the benefits associated with different account tiers. This lack of transparency regarding account structures represents a major red flag. Legitimate brokers typically provide detailed information about their account offerings.

Minimum deposit requirements remain unspecified in available materials. This makes it impossible for traders to understand the financial commitment required to begin trading. The account opening process is not clearly documented, and there is no information available about verification procedures, required documentation, or the time frame for account activation.

Special account features such as Islamic accounts for Muslim traders, VIP accounts for high-volume traders, or demo accounts for practice trading are not mentioned in available sources. The absence of such standard industry offerings suggests either poor service provision or inadequate disclosure of available services.

User feedback regarding account conditions has been notably absent from available sources. This itself is concerning given that legitimate brokers typically have extensive user reviews about their account experiences. The lack of comparative information with other brokers makes it difficult to assess whether TradeFXM offers competitive account conditions, though the overall negative ratings suggest major deficiencies in this area.

This tradefxm review finds that the broker's account conditions lack the transparency and detail that traders should expect from a legitimate financial services provider.

The trading tools and resources provided by TradeFXM are poorly documented and appear to be very limited based on available information. No specific details about trading tools, technical analysis features, or advanced order types are mentioned in reviewed sources. This raises concerns about the platform's capability to support serious trading activities.

Research and analysis resources, which are essential for informed trading decisions, are not described in available materials. Legitimate brokers typically provide market analysis, economic calendars, news feeds, and research reports to support their clients' trading activities. The absence of such resources suggests either inadequate service provision or poor communication about available features.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in available documentation. This represents a major deficiency. Education is crucial for trader development and success, particularly for novice traders entering the forex market.

Automated trading support, including expert advisors, algorithmic trading capabilities, and API access for advanced traders, is not discussed in available sources. These features are increasingly important in modern trading environments. Their absence or poor documentation suggests limited platform sophistication.

User feedback about tool effectiveness and resource quality is notably absent from available sources. This prevents a comprehensive assessment of actual user experiences with the platform's capabilities.

Customer Service and Support Analysis (Score: 1/10)

Customer service and support represent critical areas where TradeFXM appears to fall very short of industry standards. Available documentation provides no clear information about customer service channels, including whether phone support, live chat, email support, or other contact methods are available to clients.

Response times for customer inquiries are not documented in available sources. This makes it impossible to assess the efficiency of support services. Quick response times are crucial in trading environments where market conditions change rapidly and traders may need immediate assistance with technical issues or account problems.

Service quality assessments are not available in reviewed materials, and there is a notable absence of user testimonials or feedback regarding customer service experiences. This lack of feedback is concerning. Customer service quality is typically one of the most discussed aspects of broker reviews.

Multilingual support capabilities are not specified in available documentation. This could pose major barriers for international traders who require assistance in their native languages. Most legitimate brokers provide support in multiple languages to serve their global client base effectively.

Customer service hours and availability are not clearly communicated in available materials. This makes it unclear whether support is available during all trading hours or if traders might face periods without assistance during critical market events.

Trading Experience Analysis (Score: 1/10)

The trading experience offered by TradeFXM appears to be severely compromised based on available information and user feedback. Platform stability and execution speed, which are fundamental to successful trading, are not addressed in available documentation. The lack of positive user feedback suggests potential issues in these critical areas.

Order execution quality, including factors such as slippage, requotes, and execution speed, is not documented in available sources. These factors are crucial for trader profitability, particularly for scalpers and high-frequency traders who depend on precise and rapid order execution.

Platform functionality and feature completeness are not clearly described in available materials. Essential trading features such as one-click trading, advanced charting capabilities, multiple timeframes, and technical indicators are not specifically mentioned. This raises questions about the platform's trading capabilities.

Mobile trading experience, which is increasingly important for traders who need to monitor and manage positions while away from their computers, is not addressed in available documentation. The absence of information about mobile apps or mobile-optimized platforms suggests potential limitations in trading accessibility.

The overall trading environment, including factors such as market depth, available liquidity, and trading conditions during volatile market periods, is not documented in available sources. User feedback about trading experiences has been overwhelmingly negative. Multiple sources rate the broker at 1 out of 5 stars.

This tradefxm review indicates that the trading experience is likely to be unsatisfactory for serious traders seeking reliable and professional trading conditions.

Trust and Security Analysis (Score: 1/10)

Trust and security represent the most concerning aspects of TradeFXM's operations. The broker has been explicitly warned against by the Financial Conduct Authority for operating without necessary licenses. This represents a fundamental breach of regulatory requirements for financial services provision.

Fund safety measures, including client fund segregation, deposit protection schemes, and secure banking relationships, are not documented in available materials. Legitimate brokers typically provide clear information about how client funds are protected and segregated from company operational funds.

Company transparency is severely lacking, with essential information about corporate structure, management team, physical address, and operational history either missing or inadequately disclosed. This lack of transparency is a major red flag for potential clients.

Industry reputation has been severely damaged by multiple warnings and negative reviews from independent sources. The consistent 1 out of 5 star ratings across multiple review platforms indicate widespread concerns about the broker's legitimacy and operational practices.

Negative event handling and crisis management capabilities cannot be assessed due to the broker's questionable operational status. Multiple sources have flagged TradeFXM as a potential scam. This represents the most serious level of concern in the industry.

User Experience Analysis (Score: 1/10)

Overall user satisfaction with TradeFXM has been extremely poor, with available ratings consistently showing 1 out of 5 stars across multiple review platforms. This level of negative feedback is highly unusual and indicates serious systemic issues with the broker's services.

Interface design and usability are not well-documented in available sources, but the lack of positive user feedback suggests major deficiencies in platform design and user experience. Modern traders expect intuitive, responsive, and feature-rich trading interfaces.

Registration and verification processes are not clearly outlined in available materials. This creates uncertainty for potential users about account opening procedures and requirements. Legitimate brokers typically provide clear, step-by-step guidance for account setup.

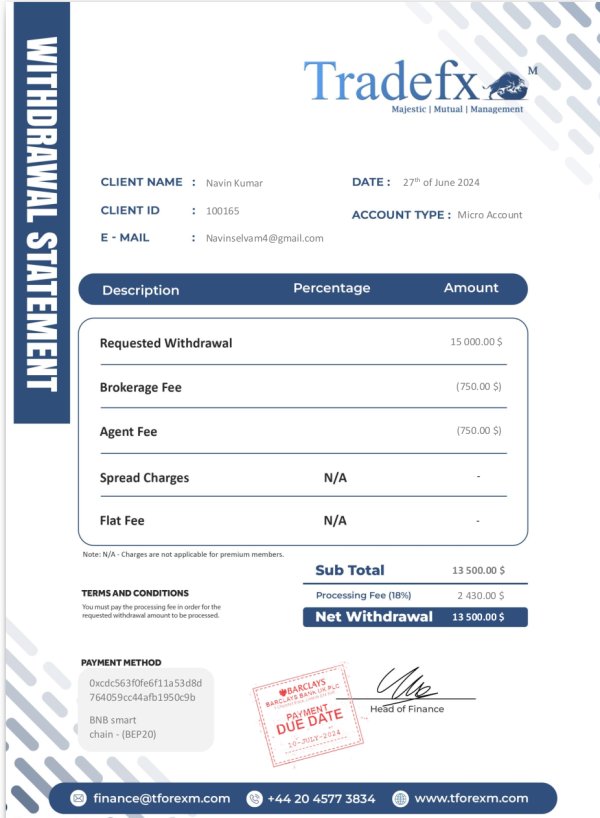

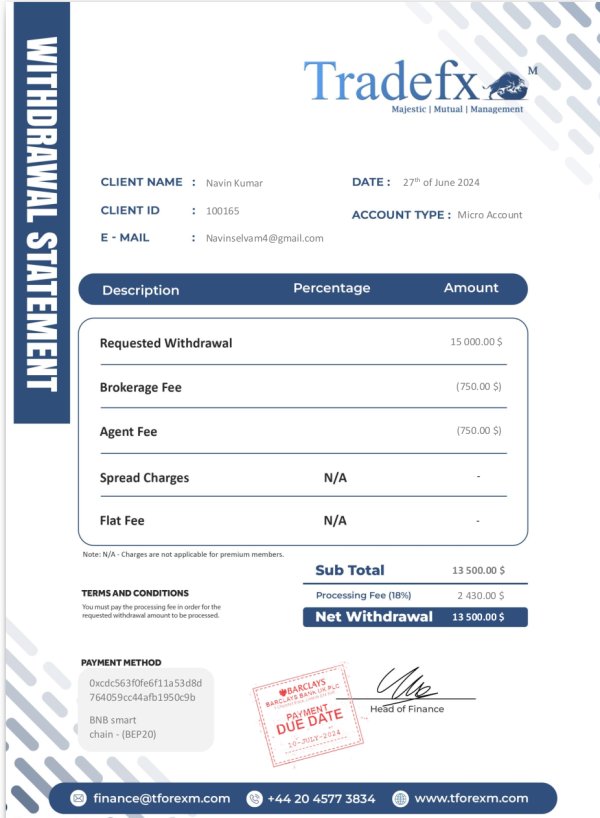

Fund operation experiences, including deposit and withdrawal processes, appear to be problematic based on the negative user feedback and warnings from regulatory bodies. Issues with fund access and withdrawal are among the most serious concerns traders can face.

Common user complaints, based on the consistent negative ratings and regulatory warnings, appear to center around fund safety, withdrawal difficulties, and overall platform reliability. The absence of positive user testimonials or success stories is notable and concerning.

User demographic analysis suggests that TradeFXM may target investors interested in forex and CFD trading, but the overwhelming negative feedback indicates that the platform is unsuitable for traders seeking secure and reliable trading conditions.

Conclusion

This comprehensive tradefxm review reveals that TradeFXM operates as an unregulated broker with major red flags that pose substantial risks to trader funds and overall trading success. The broker has received explicit warnings from the Financial Conduct Authority and consistently poor ratings from multiple independent review sources. It earns an overall rating of 1 out of 5 stars.

The platform is not recommended for any category of traders, particularly those who prioritize fund safety, regulatory compliance, and reliable trading conditions. The lack of proper licensing, absence of transparency, and overwhelmingly negative user feedback create an environment unsuitable for serious trading activities.

Major disadvantages include the complete absence of regulatory oversight, lack of transparency in operations and fees, poor or non-existent customer service documentation, and serious concerns about fund safety and withdrawal capabilities. No major advantages have been identified in available sources. The consistent warnings from multiple independent sources strongly suggest avoiding this platform entirely.