Boci 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Boci review examines one of Hong Kong's established financial service providers operating for more than 20 years. BOCI Securities Limited stands as a major securities broker in Hong Kong. The company offers a full range of financial products, investment advisory, and wealth management services. BOCI operates under the regulation of the Securities and Futures Commission in Hong Kong. The firm provides dealing, clearing, and settlement services for listed securities and derivatives products.

According to available market data, BOCI has received mixed user feedback with limited positive reviews alongside numerous exposure complaints. The firm has achieved significant recognition from Fitch Ratings. Fitch Ratings published BOC International's first-time 'A' rating with a stable outlook in 2025. The broker demonstrates commitment to service continuity by maintaining operations during severe weather conditions. This includes typhoon signals and extreme weather events. This Boci review targets traders seeking stable career development opportunities within a well-established financial institution. Potential users should carefully consider the mixed user feedback and evaluate whether the platform meets their specific trading requirements.

Important Notice

This evaluation focuses on BOCI Securities Limited. The company operates under the regulatory oversight of Hong Kong's Securities and Futures Commission. While the company maintains regulatory compliance in Hong Kong, specific license numbers and detailed regulatory information were not clearly specified in available materials. This may impact investor confidence. Different regional entities may operate under varying regulatory frameworks and service offerings.

This review methodology incorporates comprehensive analysis of user feedback, market information, and available public data to provide an objective assessment. All information presented reflects publicly available data and user experiences. Individual trading results may vary significantly based on market conditions and trading strategies.

Rating Framework

Broker Overview

BOCI Securities Limited represents a well-established financial institution with over two decades of operational history in Hong Kong's competitive financial services sector. The company serves as a major securities broker. BOCI positions itself as a comprehensive provider of financial products and investment solutions. The firm operates as part of BOC International Holdings Limited. This company functions as the primary holding company platform for Bank of China's investment banking business operations.

The firm's business model encompasses investment banking and securities brokerage services. BOCI delivers comprehensive investment banking services to both domestic and international clients. The company provides capital market-related products designed to complement traditional commercial banking operations. This creates an integrated financial services ecosystem. The company's service portfolio includes securities trading, derivatives products, investment advisory services, and wealth management solutions tailored to help clients achieve wealth appreciation goals.

According to Fitch Ratings analysis, BOCI maintains a strong market position within Hong Kong's financial services landscape. The company operates under Hong Kong's Securities and Futures Commission regulatory framework. This ensures compliance with local financial regulations and investor protection standards. The regulatory oversight provides a foundation for the company's operations. Specific licensing details require further verification for complete transparency in this Boci review assessment.

Regulatory Jurisdiction: BOCI operates under the regulatory supervision of Hong Kong's Securities and Futures Commission. The firm maintains compliance with local financial services regulations and investor protection requirements.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available materials. Potential clients need direct contact with the broker for comprehensive payment processing information.

Minimum Deposit Requirements: Available materials did not specify minimum deposit requirements for account opening. Potential clients should inquire directly about entry-level investment thresholds.

Bonus and Promotions: No specific information regarding promotional offers or bonus programs was mentioned in available sources. This indicates either absence of such programs or limited marketing of promotional activities.

Tradeable Assets: BOCI provides access to securities, derivatives products, and offers investment advisory services alongside wealth management solutions. The firm covers major asset classes within Hong Kong markets and international offerings.

Cost Structure: Detailed fee structures, commission rates, and trading costs were not specified in available materials. Direct inquiry is required for comprehensive cost analysis and comparison with competitor offerings.

Leverage Ratios: Specific leverage ratios and margin requirements were not detailed in accessible information. Direct communication with the broker is necessary for trading condition details.

Platform Options: Available materials did not specify particular trading platforms or technological solutions offered to clients. This represents a significant information gap in this Boci review evaluation.

Geographic Restrictions: Regional limitations and availability restrictions were not clearly outlined in available sources. Operations appear focused on Hong Kong and regional markets.

Customer Service Languages: Specific language support options for customer service were not detailed in available materials. Hong Kong operations suggest multilingual capabilities.

Detailed Rating Analysis

Account Conditions Analysis

BOCI's account conditions present a mixed picture for potential traders. Limited transparency exists regarding specific account types and requirements. Available information does not detail various account tiers, minimum deposit requirements, or specific features that differentiate account offerings. This lack of detailed account information creates uncertainty for potential clients seeking to understand entry requirements and available trading conditions.

The account opening process details were not specified in available materials. Interested traders must contact the broker directly for comprehensive information. User feedback indicates concerns about career opportunities and compensation structures. This may reflect broader dissatisfaction with account conditions and service offerings. The absence of clear information about Islamic accounts or specialized trading account features further limits the appeal for diverse trader demographics.

When compared to other established brokers in the Hong Kong market, BOCI appears to lack the transparency typically expected in account condition disclosure. This opacity may deter potential clients who prefer clear, upfront information about trading conditions and requirements. The limited available information suggests that this Boci review cannot provide comprehensive account condition assessment without additional direct inquiry to the broker.

The trading tools and resources offered by BOCI remain largely unspecified in available materials. This creates significant gaps in understanding the broker's technological capabilities. No specific mention was made of proprietary trading platforms, third-party platform integrations, or advanced trading tools that might enhance the trading experience for clients.

Research and analysis resources appear limited based on available information. No clear indication exists of market research departments, technical analysis tools, or fundamental analysis resources. Educational resources for traders were not mentioned in accessible materials. This suggests either limited educational offerings or insufficient marketing of available learning resources.

Automated trading support and algorithmic trading capabilities were not detailed in available sources. This potentially limits appeal for sophisticated traders seeking advanced execution methods. The absence of specific tool descriptions makes it difficult to assess whether BOCI provides competitive technological solutions compared to other major Hong Kong brokers. This information gap represents a significant limitation in evaluating the broker's overall service quality and technological capabilities.

Customer Service and Support Analysis

Customer service capabilities at BOCI show mixed results based on available feedback and information. User reviews suggest that working hours follow standard practices. This indicates predictable availability for client support services. However, the overall service quality appears to face challenges. User feedback suggests areas for improvement in client satisfaction and support responsiveness.

Available materials did not specify customer service channels, response time commitments, or service level agreements that clients might expect. The absence of detailed customer service information makes it difficult to assess the quality and accessibility of support services. Multi-language support capabilities were not clearly outlined. Hong Kong operations suggest potential for English and Chinese language services.

Service quality concerns appear in user feedback. Some reviews indicate dissatisfaction with overall service delivery and professional development opportunities. The lack of specific customer service metrics or performance indicators limits the ability to provide comprehensive assessment of support quality. Problem resolution processes and escalation procedures were not detailed in available materials. This suggests potential areas for service improvement and transparency enhancement.

Trading Experience Analysis

The trading experience offered by BOCI remains largely unclear due to limited information about platform stability, execution quality, and overall trading environment. Available materials did not provide specific details about trading platforms, execution speeds, or order processing capabilities that directly impact trader experience and satisfaction.

Platform stability and performance metrics were not specified in accessible information. This makes it impossible to assess system reliability during various market conditions. Order execution quality, including fill rates, slippage characteristics, and execution speed benchmarks, were not detailed in available sources. This represents significant information gaps for potential traders.

Mobile trading capabilities and platform functionality details were not provided in available materials. This limits understanding of trading accessibility and user interface quality. The trading environment characteristics, including spread information, liquidity provisions, and market access details, require direct inquiry for comprehensive evaluation. This lack of specific trading experience information significantly limits the completeness of this Boci review assessment and suggests the need for direct platform testing by interested traders.

Trust and Reliability Analysis

BOCI demonstrates strong regulatory credentials through its oversight by Hong Kong's Securities and Futures Commission. This provides a solid foundation for regulatory compliance and investor protection. The company's regulatory status offers reassurance regarding operational standards and adherence to financial services regulations within Hong Kong's established regulatory framework.

Fitch Ratings' assignment of an 'A' rating with stable outlook to BOC International represents significant third-party validation of the company's financial stability and creditworthiness. This rating suggests strong financial foundations and operational capabilities. However, it applies to the broader BOC International Holdings rather than specifically to the brokerage operations.

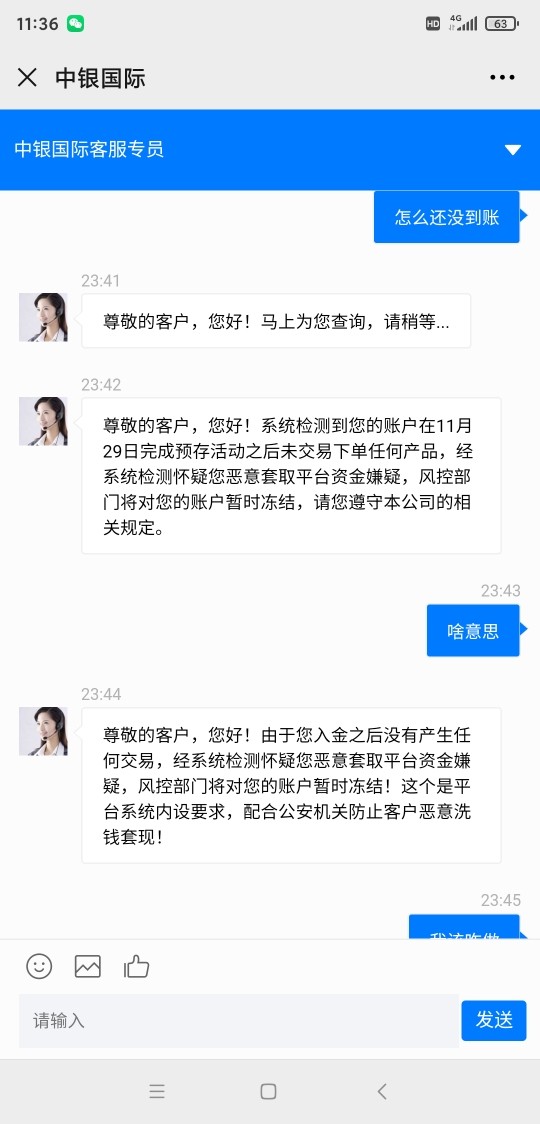

User feedback presents mixed signals regarding trust and reliability. Numerous exposure complaints exist alongside limited positive reviews. The contrast between professional credit ratings and user feedback suggests potential gaps between institutional assessment and client experience. Fund safety measures and client fund protection details were not specifically outlined in available materials. This represents areas where additional transparency could enhance client confidence. The company's long operational history of over 20 years provides some reassurance regarding business continuity and market presence.

User Experience Analysis

Overall user satisfaction with BOCI appears moderate based on available feedback. Users express mixed opinions about service quality and career development opportunities. The general user sentiment suggests adequate but not exceptional service delivery. Particular concerns about professional advancement opportunities and compensation structures affect overall satisfaction ratings.

Interface design and platform usability information was not detailed in available materials. This makes it difficult to assess the user-friendliness of trading platforms and service interfaces. Registration and verification processes were not specifically described. Standard Hong Kong regulatory requirements likely apply to account opening procedures.

Fund operation experiences, including deposit and withdrawal processes, were not detailed in accessible information. This represents significant gaps in understanding the practical aspects of account management. Common user complaints center around limited career opportunities and compensation concerns. This may reflect broader organizational challenges affecting client service quality. The target user profile appears to focus on traders seeking stable, long-term relationships with established financial institutions. Current user feedback suggests room for improvement in meeting client expectations and service delivery standards.

Conclusion

This comprehensive Boci review reveals a well-established financial institution with over 20 years of operational experience and strong regulatory credentials in Hong Kong. BOCI benefits from SFC regulation and Fitch Ratings' 'A' rating validation. The broker faces challenges in transparency and user satisfaction that potential clients should carefully consider.

The broker appears most suitable for traders prioritizing regulatory security and institutional stability over cutting-edge technology or comprehensive service transparency. The significant information gaps regarding trading conditions, fee structures, and platform capabilities limit the ability to provide definitive recommendations. Potential clients should conduct thorough due diligence and direct inquiry before committing to BOCI's services. This is particularly important given the mixed user feedback and limited publicly available detailed information about trading conditions and service offerings.