Is BOCI safe?

Business

License

Is Boci Safe or a Scam?

Introduction

Boci, officially known as BOCI Securities Limited, is a Hong Kong-based brokerage that has established itself in the foreign exchange (forex) market since its inception in 2004. As a subsidiary of the Bank of China, Boci aims to provide a wide range of financial services, including forex trading, to both individual and institutional clients. However, as with any financial service provider, it is crucial for traders to carefully evaluate the credibility and safety of the broker they choose to work with. The forex market is rife with potential risks, including scams and unregulated brokers, making it essential for traders to conduct thorough research before committing their funds. This article will investigate whether Boci is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, client feedback, and overall risk profile.

Regulation and Legitimacy

Boci operates under the regulatory framework of the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent oversight of financial institutions. The importance of regulation cannot be overstated, as it provides a layer of protection for traders by ensuring that brokers adhere to strict operational standards and ethical practices. Below is a summary of Boci's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AAC 298 | Hong Kong | Verified |

The SFC is recognized as a top-tier regulator, which implies that Boci must comply with rigorous reporting and operational requirements to maintain its license. This includes regular audits and the need to keep client funds in segregated accounts, ensuring that traders' money is protected in the event of the broker's insolvency. Historical compliance data indicates that Boci has not faced any significant regulatory actions, further enhancing its credibility. However, it is vital to note that while regulation adds a level of safety, not all regulated brokers provide the same level of service or protection. Therefore, traders should remain vigilant and conduct their due diligence.

Company Background Investigation

Boci has a rich history in the financial services sector, having been founded in 2004 as a subsidiary of the Bank of China, one of the largest banking institutions in China. This affiliation lends Boci a level of credibility, as it operates under the auspices of a well-established financial entity. The management team at Boci comprises experienced professionals with extensive backgrounds in finance and investment banking, which is crucial for the effective operation of a brokerage firm. Transparency is another critical factor in evaluating a broker's safety. Boci provides comprehensive information about its services, fees, and trading conditions on its website, which is a positive indicator of its commitment to client education and transparency. However, the level of detailed information available can vary, and potential clients should always seek clarity on any uncertainties before proceeding with their investments.

Trading Conditions Analysis

Boci offers a variety of trading options, including forex, commodities, and futures. However, the overall cost structure and trading conditions are vital for traders to understand before opening an account. Boci's fee structure includes spreads, commissions, and overnight financing costs, which can significantly impact profitability. Below is a comparison of Boci's core trading costs against industry averages:

| Fee Type | Boci | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (typically competitive) | Competitive |

| Commission Model | Commission-based | Varies by broker |

| Overnight Interest Range | Depends on position | 3% - 5% |

While Bocis spreads are reportedly competitive, some users have raised concerns about hidden fees and unclear commission structures. Traders should be cautious and ensure they fully understand the fee model before engaging in trading activities. Moreover, it is essential to inquire about any potential additional costs that may arise during trading, such as withdrawal fees or inactivity charges, which could affect overall trading profitability.

Client Fund Safety

The safety of client funds is a paramount concern when selecting a broker. Boci implements several measures to ensure the security of client funds, including the segregation of client accounts and adherence to regulatory requirements set forth by the SFC. Segregated accounts are crucial as they protect traders' funds from being used for the broker's operational expenses, thereby reducing the risk of loss in the event of financial difficulties. Additionally, Boci does not provide negative balance protection, which means clients could potentially lose more than their initial investment. Historical data does not indicate any significant incidents of fund mismanagement or security breaches at Boci; however, the absence of a robust investor protection scheme could be a point of concern for risk-averse traders.

Customer Experience and Complaints

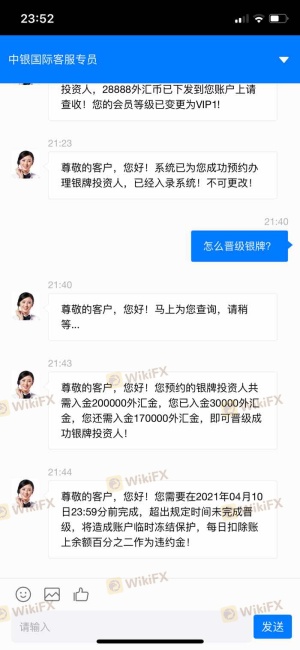

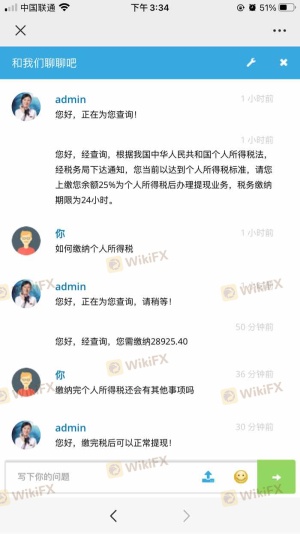

Customer feedback is an essential aspect of evaluating a broker's reliability. Boci has received a mixed bag of reviews from users, with some praising its services and others highlighting issues, particularly related to withdrawal processes and customer service responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delay | Medium | Acknowledged but slow |

Several users have reported difficulties in withdrawing their funds, citing long wait times and inadequate support from customer service. In one notable case, a trader was unable to withdraw funds for an extended period, leading to frustration and distrust. Such experiences raise concerns about the overall customer experience and indicate potential operational weaknesses within Boci's support framework.

Platform and Execution

The trading platform provided by Boci is designed to facilitate a seamless trading experience, but its performance can vary. Traders have reported issues with order execution speed and slippage, which can impact trading outcomes. The platform's stability is crucial for active traders, and any signs of manipulation or technical glitches should be closely monitored. While Boci does not appear to have significant issues in this area, traders should remain vigilant and consider testing the platform with a demo account before committing real funds.

Risk Assessment

Using Boci as a trading platform involves several risks that traders should be aware of. Below is a summary of the key risk areas associated with Boci:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Compliance with SFC standards, but concerns about operational practices. |

| Withdrawal Risk | High | Reports of delayed withdrawals and inadequate customer support. |

| Market Risk | High | Exposure to forex market volatility. |

To mitigate these risks, traders should consider starting with a small investment, utilize risk management tools, and maintain clear communication with customer support regarding any issues that arise.

Conclusion and Recommendations

In conclusion, while Boci is regulated by the Securities and Futures Commission of Hong Kong, which adds a level of legitimacy, there are several red flags that potential clients should consider. The presence of customer complaints regarding withdrawal issues and the lack of negative balance protection are significant concerns. Therefore, it is advisable for traders to exercise caution when dealing with Boci.

For those seeking a broker with a solid reputation and fewer complaints, it may be prudent to consider alternatives such as IG, OANDA, or Saxo Bank, which are known for their strong regulatory oversight and positive customer feedback. Ultimately, thorough research and careful consideration of personal risk tolerance are essential in making an informed decision about whether Boci is safe or a potential scam.

Is BOCI a scam, or is it legit?

The latest exposure and evaluation content of BOCI brokers.

BOCI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOCI latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.