Fexsi Review 2

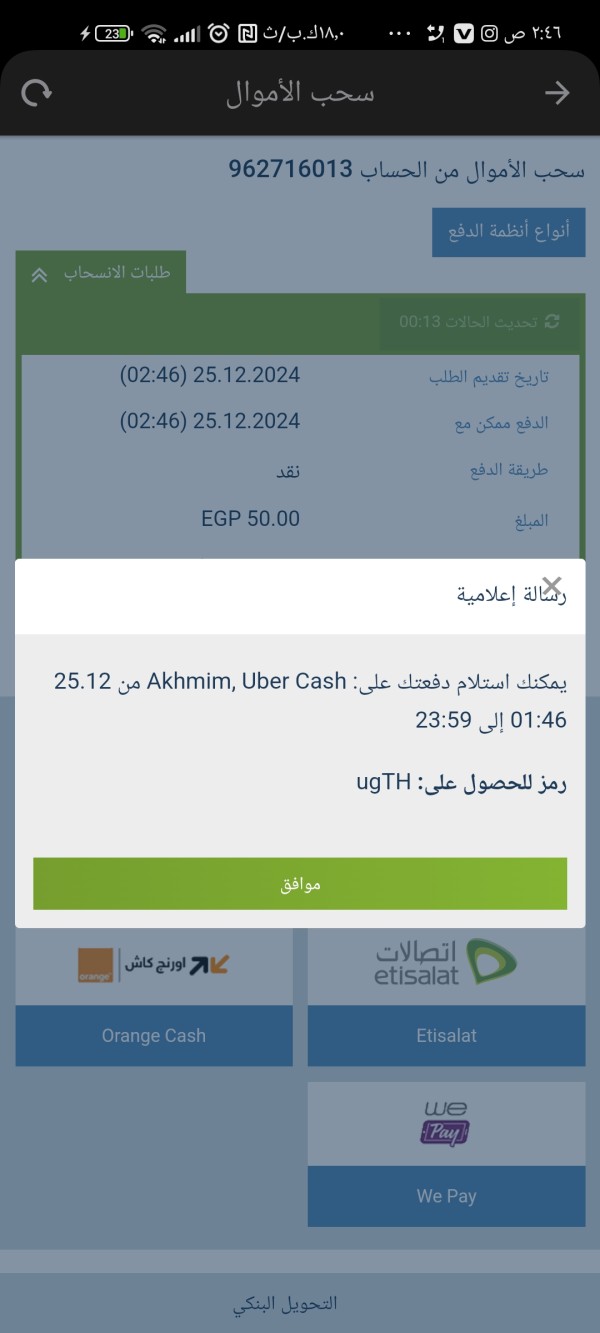

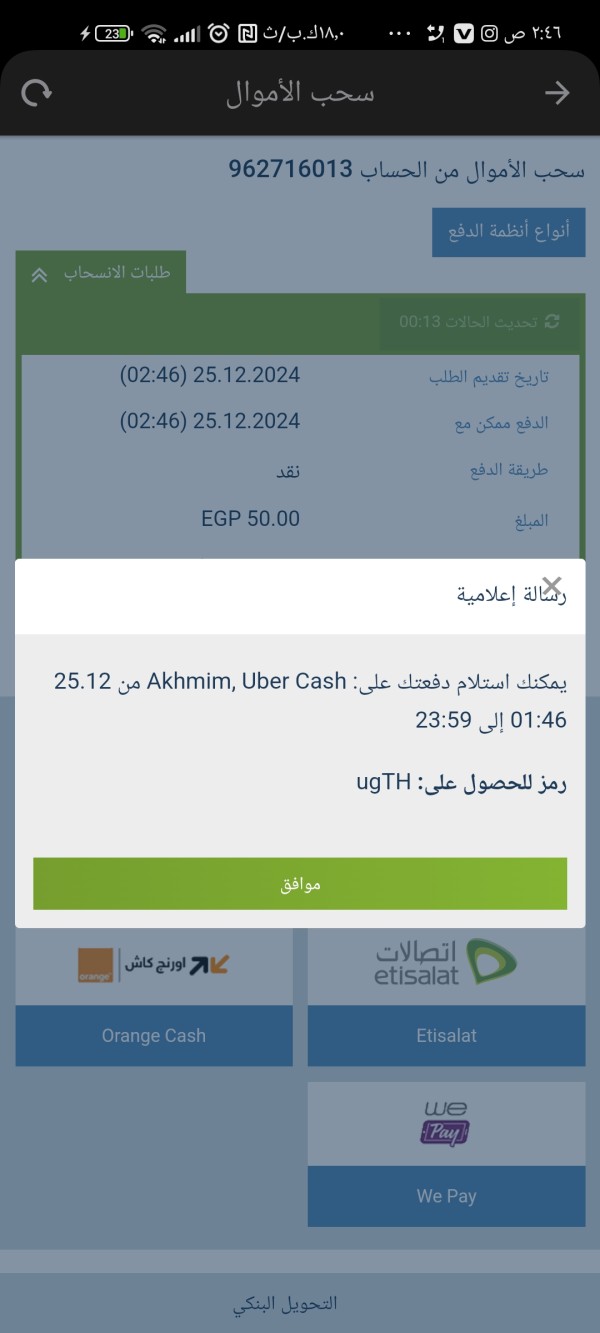

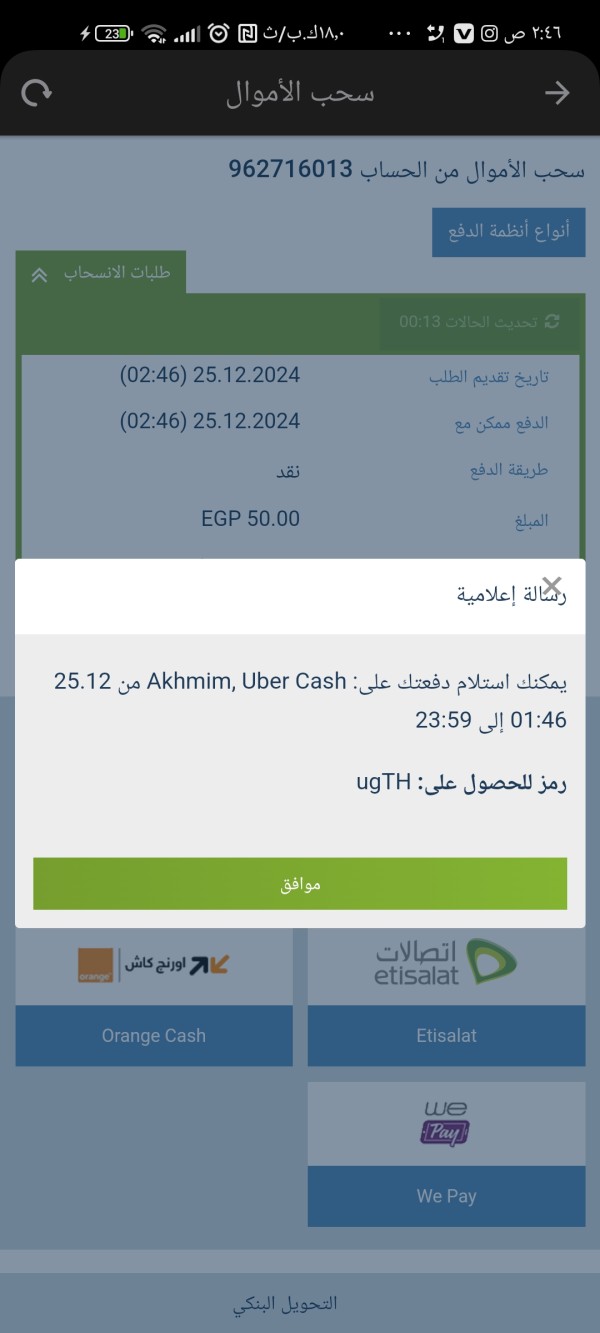

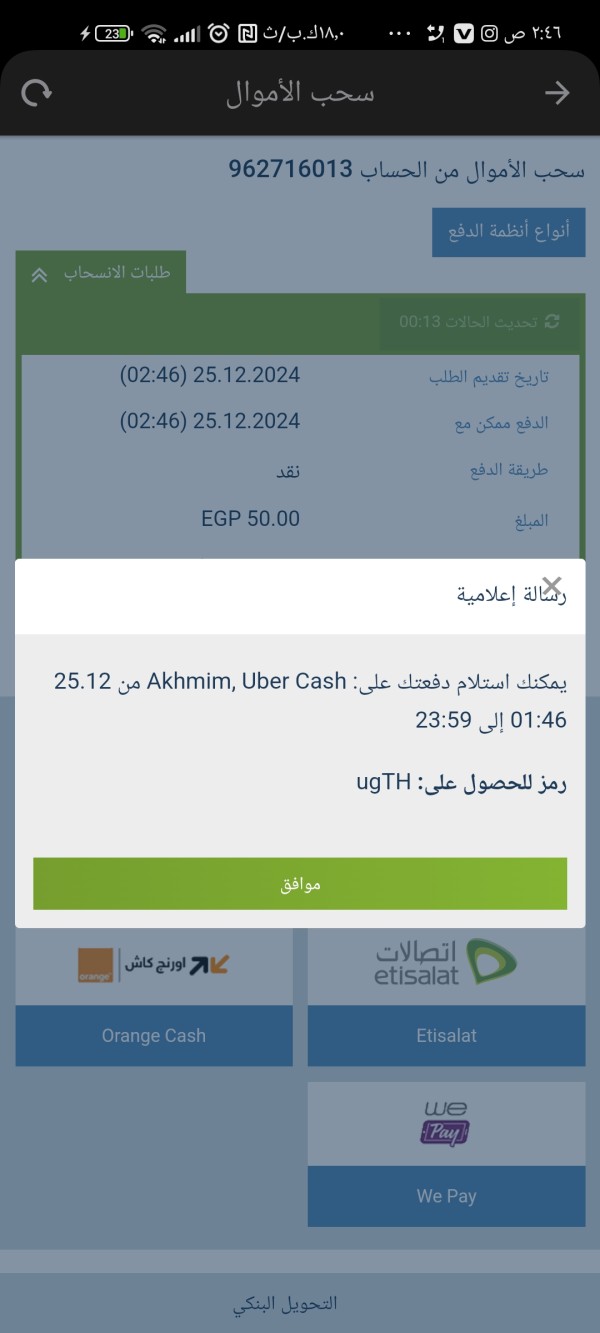

Need support to withdraw funds

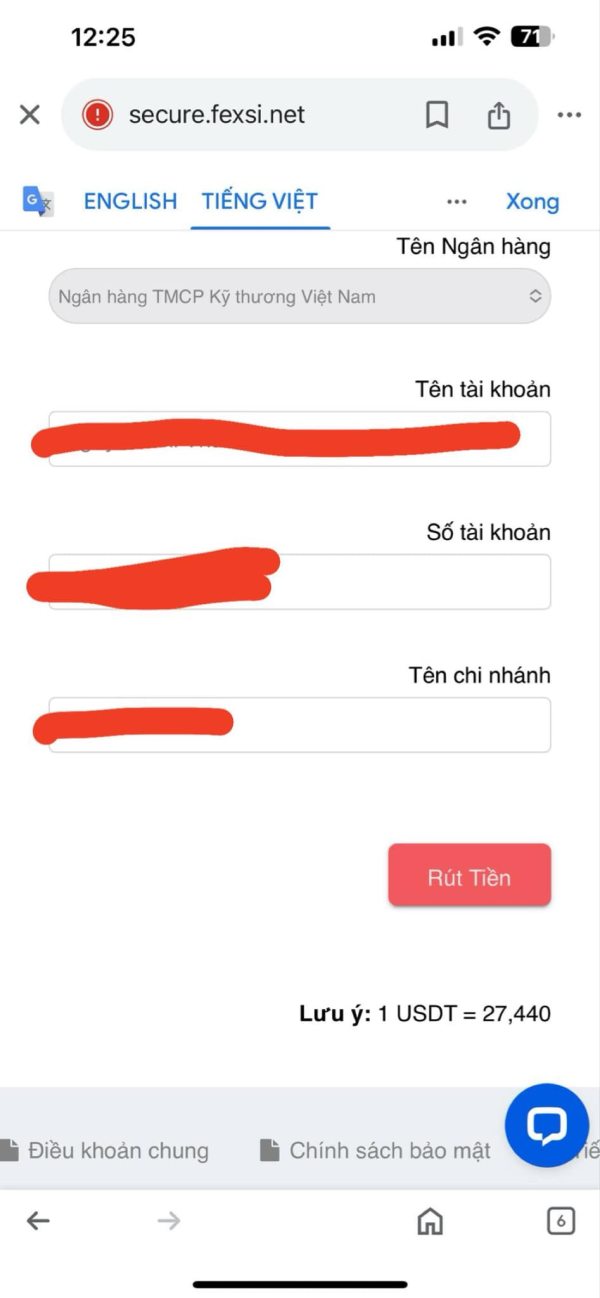

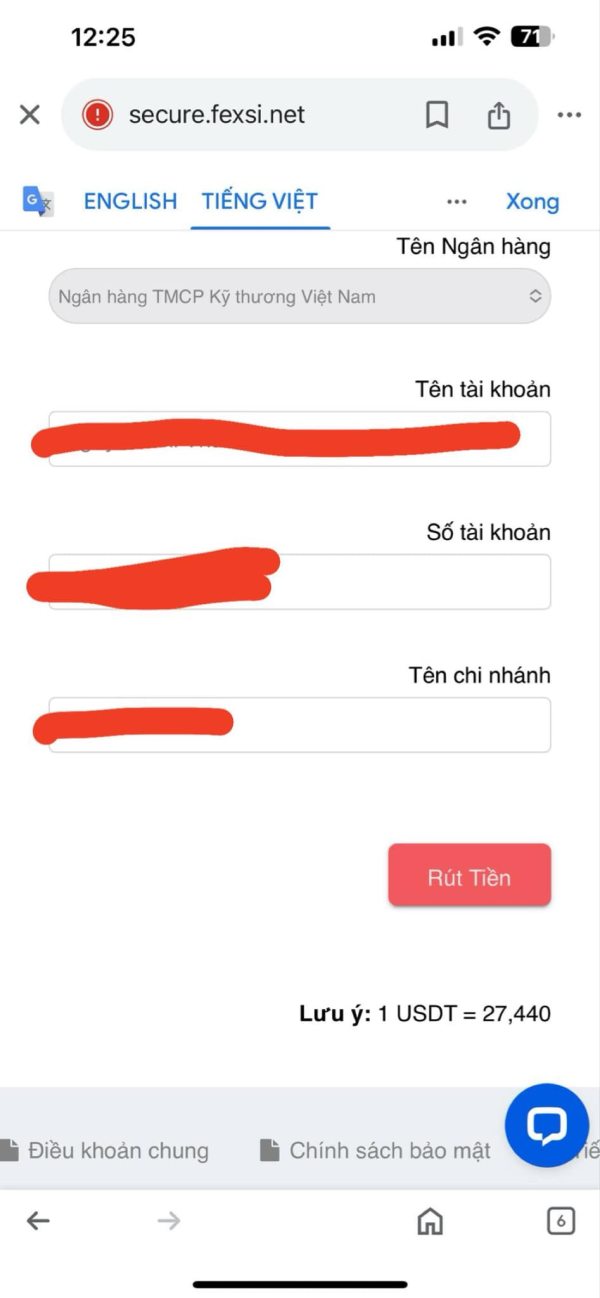

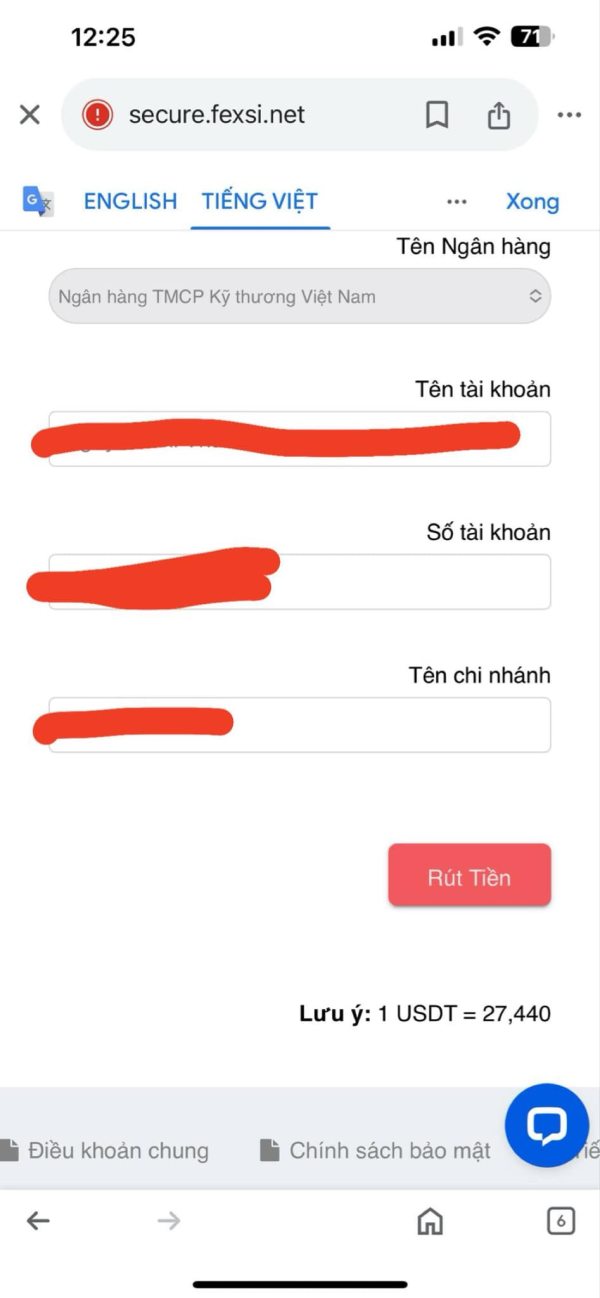

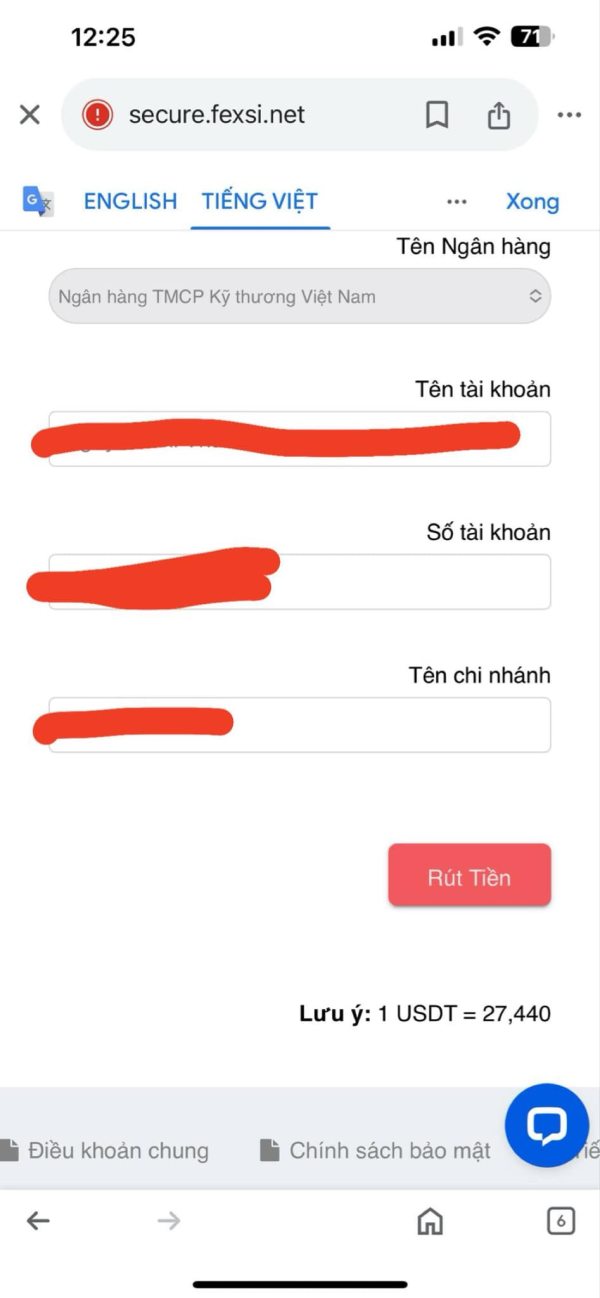

Unable to withdraw money

Fexsi Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

Need support to withdraw funds

Unable to withdraw money

This fexsi review shows concerning findings about a broker that works without proper rules. Fexsi is an unregulated forex and CFD broker registered in the Comoros, which has raised big red flags among industry analysts and trading communities. Many independent sources, including BrokersView and AsiaForexMentor, have issued warnings about potential fraudulent activities and advised traders to avoid this platform entirely.

The broker lacks transparency about its operations. This combines with its registration in a place known for minimal financial oversight, which creates big risks for potential clients. While Fexsi claims to offer forex and CFD trading services, the absence of legitimate regulatory approval from recognized financial authorities makes it unsuitable for serious traders seeking secure trading environments.

According to Scamadviser, the platform received a trust score of 77. This may seem moderate but fails to address the fundamental regulatory concerns. The primary user group appears to be high-risk investors, though mainstream traders are strongly advised to seek alternatives with proper regulatory credentials and transparent operational frameworks.

Fexsi operates as a financial entity registered in the Comoros, specifically in Hamchako, Mutsamudu, according to TraderKnows data. However, this registration does not mean approval or supervision by any internationally recognized financial regulatory authority. The broker lacks authorization from major regulatory bodies such as the FCA, CySEC, ASIC, or other reputable financial supervisors.

Our evaluation method focuses mainly on regulatory compliance, operational transparency, and user safety based on available industry reports and user feedback. This assessment puts security concerns and regulatory status over promotional features, given the significant risks associated with unregulated trading platforms.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 2/10 | Lack of transparent account information and numerous negative user reports |

| Tools and Resources | 2/10 | No detailed information available about trading tools or educational resources |

| Customer Service | 3/10 | Limited user feedback available, with no specific service quality metrics |

| Trading Experience | 3/10 | No verifiable data on platform stability or execution quality |

| Trust and Safety | 1/10 | Unregulated status with multiple fraud warnings from industry sources |

| User Experience | 2/10 | Predominantly negative user feedback and poor transparency ratings |

Fexsi presents itself as an online brokerage company offering forex and CFD trading services to international clients. According to TraderKnows, the company is registered in Hamchako, Mutsamudu in the Comoros, though the exact establishment date remains undisclosed in available public records. This lack of basic transparency about the company's founding and operational history immediately raises concerns about its legitimacy and commitment to regulatory compliance.

The broker's business model appears to focus on providing access to foreign exchange markets and contracts for difference. This targets traders seeking alternative investment opportunities. However, the absence of detailed information about the company's leadership, operational structure, and financial backing creates significant uncertainty about its stability and reliability as a trading partner.

The platform's registration in the Comoros is particularly concerning, as this place is known for minimal financial oversight and has been associated with numerous questionable financial entities. According to ScamTracing and other industry watchdogs, Fexsi has not obtained approval from any recognized financial regulatory authority, which means client funds lack the protections typically associated with regulated brokers. This fexsi review emphasizes that traders should be extremely cautious when considering this platform for their trading activities.

Regulatory Status: Fexsi operates without approval from any internationally recognized financial regulatory authority. The company's registration in the Comoros does not provide the regulatory protections typically expected by serious traders.

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal procedures is not transparently disclosed in available public materials. This raises additional concerns about operational transparency.

Minimum Deposit Requirements: The broker has not clearly communicated minimum deposit thresholds. This makes it difficult for potential clients to assess accessibility and account structure.

Promotional Offers: No specific bonus or promotional structures are detailed in available sources. However, traders should be wary of unrealistic promotional offers from unregulated entities.

Available Assets: The platform reportedly offers forex currency pairs and CFD instruments. However, the exact range of available markets and trading instruments lacks detailed specification.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not transparently available. This makes it impossible to assess the true cost of trading with this broker.

Leverage Ratios: Maximum leverage offerings and margin requirements are not clearly specified in available documentation.

Platform Options: The specific trading platforms, software solutions, or technological infrastructure used by Fexsi are not detailed in accessible sources.

Geographic Restrictions: Information about jurisdictional limitations and restricted territories is not clearly communicated.

Customer Support Languages: Available support languages and communication channels are not specified in public materials.

The account conditions offered by Fexsi remain largely unclear. No clear information is available about different account types, their respective features, or specific requirements for account opening. This lack of transparency is particularly concerning for potential clients who need to understand the terms and conditions governing their trading relationship with the broker.

Available sources do not provide details about minimum deposit requirements for different account tiers. This makes it impossible for traders to assess whether the platform aligns with their capital allocation strategies. The absence of information about account verification procedures, documentation requirements, and approval timeframes further compounds concerns about the broker's operational transparency.

User feedback consistently indicates skepticism about the platform's legitimacy. Multiple sources advise against account opening due to fraud concerns. The lack of specialized account features, such as Islamic accounts for Sharia-compliant trading, suggests limited attention to diverse client needs and regulatory requirements.

Compared to regulated brokers that provide comprehensive account documentation and clear terms of service, Fexsi's opacity regarding account conditions represents a significant red flag for potential clients seeking professional trading relationships.

The trading tools and educational resources offered by Fexsi are not adequately documented in available public information. This raises serious questions about the platform's commitment to supporting trader development and success. Professional trading platforms typically provide comprehensive suites of analytical tools, market research, and educational materials to help clients make informed trading decisions.

No specific information is available about charting capabilities, technical analysis tools, economic calendars, or market research reports. These would typically be expected from a legitimate forex broker. This absence of detailed tool descriptions makes it impossible to assess whether the platform can support serious trading activities or advanced analytical requirements.

Educational resources, which are crucial for trader development, appear to be either non-existent or inadequately promoted. Legitimate brokers typically offer webinars, tutorials, market analysis, and educational content to help clients improve their trading skills and market understanding.

The lack of information about automated trading support, API access, or third-party tool integration suggests limited technological sophistication and reduced appeal for experienced traders who rely on advanced trading infrastructure.

Customer service quality and availability represent critical factors in broker selection. Yet specific information about Fexsi's support infrastructure is notably absent from available sources. Professional brokers typically provide multiple communication channels, including phone support, live chat, email assistance, and comprehensive FAQ sections.

Response times, service quality metrics, and customer satisfaction ratings are not documented in accessible materials. This makes it impossible to assess the broker's commitment to client support. The absence of clear communication about support availability hours, regional coverage, and escalation procedures raises concerns about potential difficulties in resolving account or trading issues.

User feedback regarding customer service experiences is limited, though the overall negative sentiment surrounding the platform suggests that support quality may not meet professional standards. The lack of multilingual support information is particularly concerning for international clients who may require assistance in their native languages.

Problem resolution capabilities and dispute handling procedures are not transparently communicated. This could leave clients vulnerable in situations requiring urgent assistance or conflict resolution with the broker.

The trading experience offered by Fexsi cannot be adequately assessed due to insufficient information about platform stability, execution quality, and technological infrastructure. Critical performance metrics such as order execution speeds, slippage rates, and platform uptime are not documented in available sources.

Platform functionality and user interface quality remain unknown. This makes it impossible to evaluate whether the trading environment supports efficient order management and market analysis. The absence of information about mobile trading capabilities is particularly concerning in an era where mobile accessibility is considered essential for active traders.

Trading environment factors, including market depth, liquidity provision, and execution models, are not transparently communicated. This lack of information prevents potential clients from understanding how their orders will be processed and whether the platform can support their trading strategies effectively.

User feedback about trading experiences is predominantly negative, though specific performance complaints are not detailed in available sources. This fexsi review emphasizes that the lack of verifiable performance data makes it extremely difficult to recommend the platform for serious trading activities.

Trust and safety represent the most critical concerns regarding Fexsi. Multiple independent sources identify significant regulatory and operational red flags. The broker's unregulated status means that client funds lack the protections typically provided by legitimate financial authorities, creating substantial risk for potential traders.

The absence of regulatory oversight from recognized authorities such as the FCA, CySEC, or ASIC means that clients have limited recourse in case of disputes or fraudulent activities. Fund segregation practices, which are standard among regulated brokers, are not documented or guaranteed, potentially exposing client deposits to operational risks.

Company transparency regarding ownership, financial statements, and operational procedures is notably lacking. This contradicts industry best practices for legitimate financial service providers. Multiple sources, including BrokersView and AsiaForexMentor, have specifically warned about potential fraudulent activities and advised traders to avoid the platform entirely.

The broker's registration in the Comoros, a place known for minimal financial oversight, further undermines confidence in its regulatory compliance and operational integrity. This combination of factors results in an extremely low trust rating and strong recommendations for traders to seek regulated alternatives.

Overall user satisfaction with Fexsi appears to be significantly poor based on available feedback and industry assessments. The lack of positive user testimonials or detailed experience reports suggests that the platform fails to meet basic expectations for professional trading services.

Interface design and platform usability cannot be adequately assessed due to insufficient information. However, the overall negative sentiment suggests that user experience design may not meet contemporary standards for trading platforms. Registration and account verification processes are not clearly documented, potentially creating frustration for new users.

Fund management experiences, including deposit and withdrawal procedures, lack transparent documentation and user feedback. This raises concerns about the ease and reliability of financial transactions. Common user complaints appear to focus on transparency issues and concerns about platform legitimacy rather than specific functional problems.

The target user group appears to be limited to high-risk investors willing to accept significant regulatory and operational uncertainties. However, mainstream traders seeking reliable, transparent, and regulated trading environments should consider alternative brokers with established track records and proper regulatory credentials.

This comprehensive fexsi review reveals a broker that presents significant risks for potential clients due to its unregulated status and lack of operational transparency. The platform's registration in the Comoros, combined with warnings from multiple industry sources about potential fraudulent activities, makes it unsuitable for serious traders seeking secure and reliable trading environments.

While Fexsi may appeal to high-risk investors willing to accept substantial regulatory uncertainties, mainstream traders are strongly advised to seek alternatives with proper regulatory credentials and transparent operational frameworks. The broker's primary disadvantages include its unregulated status, lack of transparency, and negative industry assessments, while any potential advantages are overshadowed by these fundamental safety concerns.

Traders should prioritize regulated brokers with established track records, transparent fee structures, and comprehensive client protections when selecting trading platforms for their investment activities.

FX Broker Capital Trading Markets Review