TJM Investments Review 1

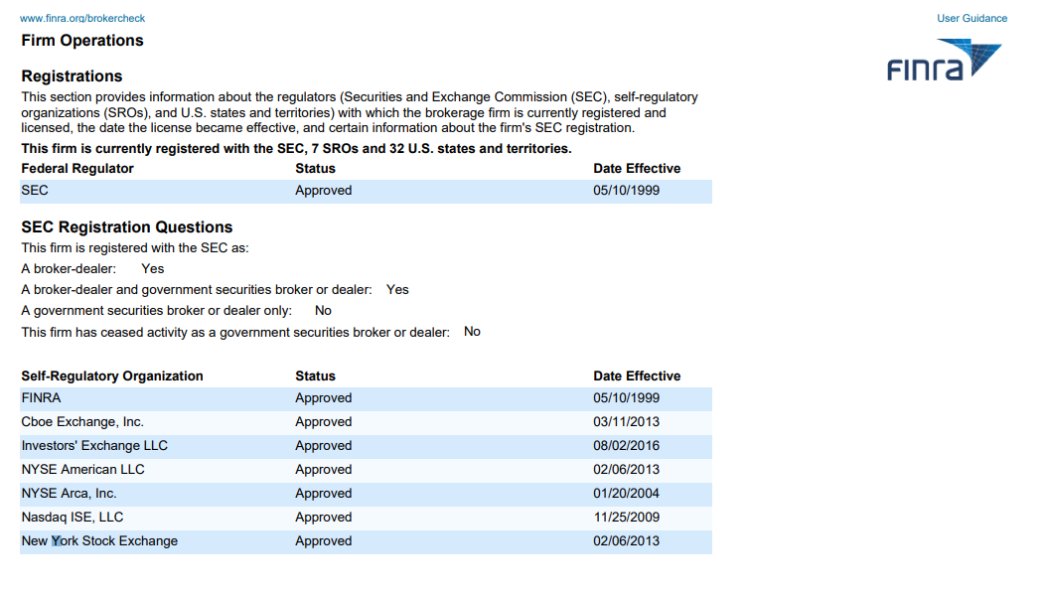

TJM Investments is a fully registered company with the SEC and 7 other self-regulatory organizations: FINRA, CBOE, ICE, NYSE, NASDAQ, NYSE

TJM Investments Forex Broker provides real users with 1 positive reviews, * neutral reviews and * exposure review!

TJM Investments is a fully registered company with the SEC and 7 other self-regulatory organizations: FINRA, CBOE, ICE, NYSE, NASDAQ, NYSE

Tjm Investments has garnered mixed reviews in the forex brokerage community, with significant concerns raised regarding its regulatory status and customer service. While the firm offers a wide range of trading instruments and specialized services for institutional clients, it is also flagged for having a suspicious regulatory license, which may deter potential clients.

Note: It is crucial to consider that Tjm Investments operates under different entities across regions, which can affect its regulatory standing and user experience. This review aims to provide a fair and accurate assessment based on the latest available information.

| Category | Rating |

|---|---|

| Account Conditions | 4/10 |

| Tools and Resources | 5/10 |

| Customer Service and Support | 3/10 |

| Trading Experience | 6/10 |

| Trustworthiness | 2/10 |

| User Experience | 4/10 |

We rate brokers based on a combination of user feedback, expert analysis, and available data.

Founded in 1996, Tjm Investments is an independent broker-dealer based in Chicago, Illinois. The firm specializes in a variety of trading instruments, including equities, index options, futures, and forex, catering primarily to institutional clients. Tjm Investments is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). However, its regulatory license from the U.S. National Futures Association (NFA) is under suspicion of being a clone, raising significant concerns about its legitimacy and trustworthiness.

The broker does not specify the trading platforms it offers, leading to speculation about the tools available for clients. Additionally, Tjm Investments provides services like clearing and capital introduction, which are tailored for institutional traders.

Tjm Investments operates primarily in the United States, but its regulatory status is a substantial concern. As mentioned in various reviews, the NFA has flagged Tjm Investments as a "suspicious clone," which raises questions about the broker's legitimacy. This classification suggests that potential clients should exercise caution before engaging with the firm. According to WikiFX, the broker has a regulatory index of 0.00, indicating a high risk of fraud.

Tjm Investments does not provide clear information regarding the currencies accepted for deposits and withdrawals, nor does it specify which cryptocurrencies, if any, are supported. This lack of transparency can be a red flag for potential clients.

The minimum deposit requirement for opening an account with Tjm Investments is not explicitly stated in the available reviews. This ambiguity can be concerning for traders looking to start with a specific budget.

There is no information available regarding any bonuses or promotions offered by Tjm Investments. The absence of such incentives may make it less appealing compared to other brokers that provide attractive offers to new clients.

Tjm Investments offers a diverse range of tradable assets, including equities, index options, futures, forex, cash treasuries, and energy products. This variety allows institutional clients to adopt different trading strategies tailored to their investment goals.

Details regarding spreads, fees, and commissions are notably sparse in the reviews. The lack of transparency about trading costs can lead to uncertainty for potential clients, as they may not fully understand the financial implications of trading with Tjm Investments.

The leverage options available through Tjm Investments are not clearly defined in the available information. This absence of detail can be frustrating for traders who rely on leverage to maximize their trading potential.

There is no specific mention of the trading platforms supported by Tjm Investments. This lack of clarity can make it difficult for traders to assess whether the broker meets their technological needs.

Tjm Investments does not provide information about restricted regions, which can be a significant factor for international traders. Understanding where the broker operates legally is crucial for compliance and security.

Customer support at Tjm Investments is primarily offered in English, with limited options for other languages. Users have reported that customer support channels are limited, primarily consisting of phone and email, with no live chat or 24/7 assistance available. This limitation can lead to frustration, especially for clients requiring immediate assistance.

| Category | Rating |

|---|---|

| Account Conditions | 4/10 |

| Tools and Resources | 5/10 |

| Customer Service and Support | 3/10 |

| Trading Experience | 6/10 |

| Trustworthiness | 2/10 |

| User Experience | 4/10 |

Account Conditions: Tjm Investments lacks clear information on minimum deposits and account types, earning it a low score in this category.

Tools and Resources: While the broker offers various trading instruments, the absence of specified trading platforms and tools limits its appeal.

Customer Service and Support: The limited customer support options and lack of immediate assistance contribute to a poor user experience.

Trading Experience: Despite offering a range of tradable assets, the lack of transparency regarding costs and leverage options negatively impacts the trading experience.

Trustworthiness: The "suspicious clone" status from the NFA significantly undermines Tjm Investments' reliability.

User Experience: Overall, user experience is hindered by insufficient information and limited support options.

In conclusion, Tjm Investments presents a mixed bag for potential clients. While it offers a diverse range of trading instruments and specialized services for institutional clients, the significant concerns regarding its regulatory status and customer service cannot be overlooked. Prospective clients are encouraged to conduct thorough research and consider these factors carefully before choosing Tjm Investments as their broker.

FX Broker Capital Trading Markets Review