Aurum Markets 2025 Review: Everything You Need to Know

Executive Summary

This Aurum Markets review gives a fair look at a broker that offers True ECN trading services. However, the company faces big trust problems with its users. Aurum Markets says it is a forex and CFD broker that provides low spreads, no swap fees, and commission-free trading. User feedback shows major concerns about how reliable the company is and how good their service quality really is.

The broker works under registrations in both Mauritius and Saint Lucia. Aurum Markets Limited is set up as an International Broker Company in Saint Lucia under registration number 2024-00298. The company has legal registration status, but user reviews on sites like Trustpilot show trust problems. Some users question if the broker is real. The main customers are forex and CFD traders who want low-cost trading solutions. Potential clients should be careful because of the mixed reputation and limited clear information about how they operate.

Important Notice

Regulatory Variations: Aurum Markets works through companies registered in different places, including Mauritius and Saint Lucia. Traders should know that regulatory protections and services may be different depending on which company and location controls their account.

Review Methodology: This review uses publicly available company information, user feedback from review sites, and official registration details. Some assessments reflect general user feelings rather than detailed operational analysis because comprehensive data is limited.

Rating Framework

Broker Overview

Aurum Markets Limited works as an International Broker Company set up in Saint Lucia with registration number 2024-00298. The company's registered address is at Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. The broker also has registration in Mauritius, though specific regulatory details for this location remain unclear in public documents.

The company's business model focuses on providing True ECN forex trading and CFD services to international clients. Aurum Markets markets itself as offering competitive trading conditions including low spreads, no swap fees, and commission-free trading. The broker's website was registered in July 2024, which shows a recent market entry. This matches with the Saint Lucia registration date of 2024. This recent start may partly explain the limited user base and mixed early feedback from traders.

The broker's main focus appears to be on forex and CFD trading services. They target traders who want cost-effective trading conditions. However, the lack of detailed information about trading platforms, account types, and complete service offerings raises questions about how transparent their operations are. Potential clients should think about this carefully.

Regulatory Status: Aurum Markets works under registrations in Saint Lucia and Mauritius. The Saint Lucia company holds registration number 2024-00298 as an International Broker Company. Specific regulatory oversight details and investor protection measures are not clearly outlined in available public information.

Deposit and Withdrawal Methods: Information about available deposit and withdrawal methods is not detailed in accessible company documentation. This may concern potential clients seeking transparency about funding options.

Minimum Deposit Requirements: Specific minimum deposit requirements are not clearly stated in available public materials. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: No specific information about welcome bonuses, deposit bonuses, or ongoing promotional campaigns is available in current public documentation.

Trading Assets: The broker offers forex and CFD trading opportunities. However, the complete range of available instruments, including specific currency pairs, commodities, indices, or other CFD products, is not fully detailed.

Cost Structure: Aurum Markets advertises low spreads, no swap fees, and commission-free trading as key selling points. However, detailed spread information, overnight financing costs, and other potential fees are not transparently disclosed in available materials.

Leverage Options: Specific leverage ratios offered to different account types and jurisdictions are not clearly specified in accessible documentation.

Trading Platform Options: While the broker mentions online forex trading capabilities, specific information about MetaTrader 4, MetaTrader 5, or proprietary platform offerings is not detailed in available resources.

Geographic Restrictions: Information about restricted countries or regional limitations is not clearly outlined in accessible company materials.

Customer Support Languages: Available customer service languages are not specifically mentioned in current public documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions at Aurum Markets get a moderate rating because of limited transparency and unclear account specifications. The broker promotes True ECN trading, which typically means direct market access and competitive pricing. However, the lack of detailed information about account types significantly impacts the evaluation.

Account Variety and Features: Available documentation does not clearly outline different account tiers, minimum balance requirements, or special features that might distinguish various account types. This lack of transparency makes it difficult for potential traders to understand what options are available. It also makes it hard to know which might suit their trading needs.

Minimum Deposit Accessibility: The absence of clear minimum deposit information creates uncertainty for potential clients. This is especially true for those with limited initial capital who need to understand accessibility requirements before considering the broker.

Account Opening Process: User feedback suggests that the account opening process exists. However, detailed information about required documentation, verification procedures, and timeframes is not readily available in public materials.

Special Account Features: Information about Islamic accounts, professional trader accounts, or other specialized offerings that might serve specific trader populations is not detailed in accessible company documentation. This limits the ability to assess comprehensive service offerings.

The tools and resources category gets a below-average rating primarily because of insufficient information about available trading tools and educational resources. This Aurum Markets review finds that the broker's public materials lack comprehensive details about analytical tools, research resources, and trader education programs.

Trading Tools Quality: While the broker mentions online trading capabilities, specific information about charting tools, technical indicators, automated trading support, or advanced order types is not detailed in available documentation.

Research and Analysis Resources: No clear information is available about market analysis, daily reports, economic calendars, or other research resources. Traders typically expect these from professional brokers.

Educational Resources: Details about educational materials, trading guides, webinars, or other learning resources for new and experienced traders are not evident in accessible company materials.

Automation Support: Information about Expert Advisor support, copy trading, or other automated trading solutions is not clearly outlined. This may concern traders interested in algorithmic trading strategies.

Customer Service and Support Analysis (4/10)

Customer service gets a below-average rating based on user feedback indicating dissatisfaction with support quality and responsiveness. Available user reviews suggest that customer service experiences have been disappointing for several clients.

Support Channel Availability: Specific information about available customer support channels, including live chat, email, phone support, or ticket systems, is not clearly detailed in accessible company materials.

Response Time Performance: User feedback indicates concerns about response times. Some traders report delays in receiving assistance for account-related inquiries and technical issues.

Service Quality Assessment: Based on available user reviews, customer service quality appears to be a significant weakness. Traders express frustration about the level of professional support received.

Multilingual Support: Information about available support languages is not specified. This may limit accessibility for international traders who require assistance in their native languages.

Support Availability Hours: Operating hours for customer support services are not clearly outlined in accessible documentation. This creates uncertainty about when assistance is available.

Trading Experience Analysis (6/10)

Trading experience gets a moderate-positive rating primarily because of the broker's advertised competitive trading conditions, including low spreads and commission-free trading. However, user feedback suggests that actual trading experiences may vary significantly from marketed promises.

Platform Stability and Performance: User feedback indicates mixed experiences with platform performance. However, specific technical details about execution speed, server stability, or platform reliability are not comprehensively documented.

Order Execution Quality: While True ECN trading typically implies quality execution, specific information about slippage rates, requote frequency, or execution statistics is not transparently provided in available materials.

Platform Functionality: Detailed information about platform features, advanced trading tools, customization options, or analytical capabilities is not clearly outlined in accessible company documentation.

Mobile Trading Experience: Information about mobile trading applications, mobile platform features, or on-the-go trading capabilities is not detailed in available public materials.

Trading Environment: The advertised low spreads and no-commission structure suggests competitive trading conditions. However, actual spread ranges, market hours, and trading restrictions are not comprehensively detailed.

This Aurum Markets review notes that while trading conditions appear competitive on paper, the lack of detailed performance data and mixed user feedback suggests potential gaps between marketing claims and actual trading experiences.

Trust and Reliability Analysis (3/10)

Trust and reliability get the lowest rating in this evaluation because of significant concerns raised by user feedback and limited operational transparency. Several factors contribute to this concerning assessment of the broker's trustworthiness.

Regulatory Oversight: While Aurum Markets maintains registrations in Saint Lucia and Mauritius, the level of regulatory oversight and investor protection provided by these jurisdictions may not match the standards of major financial centers. These include the UK, EU, or Australia.

Fund Security Measures: Information about client fund segregation, deposit insurance, compensation schemes, or other investor protection measures is not clearly detailed in accessible company documentation.

Company Transparency: The lack of comprehensive information about company management, financial reports, operational history, or business practices raises transparency concerns. This affects overall trustworthiness.

Industry Reputation: User reviews on platforms like Trustpilot indicate significant trust issues. Some users express concerns about the broker's legitimacy and reliability.

Negative Incident Management: Information about how the company handles disputes, complaints, or negative incidents is not clearly outlined. This impacts confidence in problem resolution capabilities.

User Experience Analysis (5/10)

User experience gets a neutral rating reflecting mixed feedback from actual clients and limitations in available information about user interface design and overall service quality.

Overall User Satisfaction: Available user feedback indicates mixed experiences. Negative reviews outweigh positive testimonials, suggesting significant room for improvement in overall client satisfaction.

Interface Design and Usability: Specific information about platform interface design, ease of navigation, customization options, or user-friendly features is not detailed in accessible company materials.

Registration and Verification Process: While account opening is presumably available, detailed information about the convenience, speed, and user-friendliness of registration and verification procedures is not comprehensively documented.

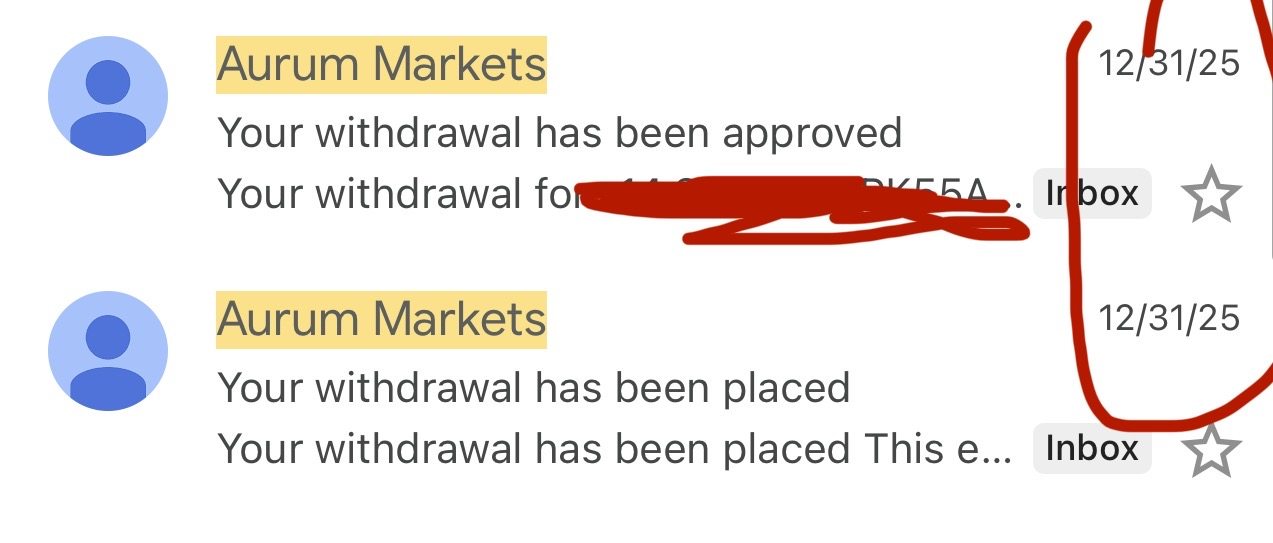

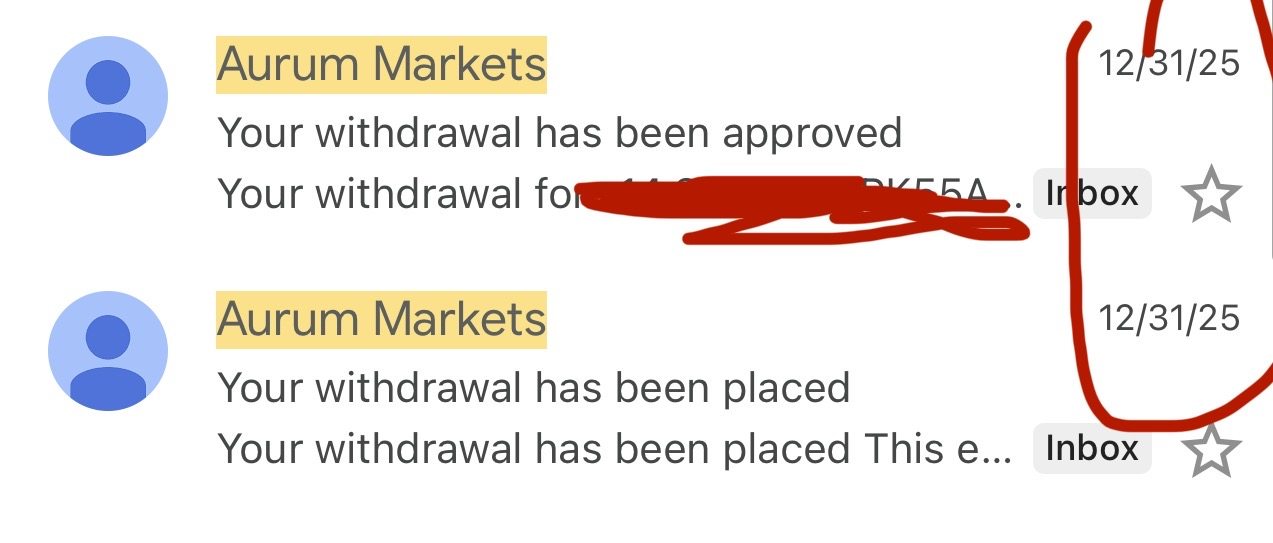

Fund Management Experience: User experiences with deposit and withdrawal processes are not well-documented in available materials. This creates uncertainty about the efficiency and reliability of financial transactions.

Common User Complaints: Based on available feedback, primary concerns center on trust issues, customer service quality, and transparency about trading conditions and company operations.

User Demographics: The broker appears to target cost-conscious traders seeking competitive trading conditions. However, the actual user base and satisfaction levels among different trader segments are not clearly documented.

Conclusion

This Aurum Markets review concludes that while the broker offers potentially attractive trading conditions including low spreads and commission-free trading, significant concerns about trust, transparency, and service quality limit its overall appeal. The broker may suit traders prioritizing low-cost trading conditions who are willing to accept higher risks associated with newer, less established brokers.

Primary Advantages: Competitive trading costs, True ECN trading model, and no-commission structure represent the broker's main selling points.

Significant Disadvantages: Limited operational transparency, concerning user feedback about reliability, unclear regulatory protection levels, and inadequate customer service quality represent major drawbacks. Potential clients should carefully consider these issues.

Traders considering Aurum Markets should exercise enhanced due diligence and carefully evaluate whether the potential cost savings justify the elevated risks. These risks are associated with the broker's current reputation and limited operational history.