ASX Markets 2025 Review: Everything You Need to Know

Executive Summary

ASX Markets operates as a trading platform providing access to various financial instruments. Comprehensive information about this specific broker remains limited in available public sources. Based on the accessible data, ASX Markets appears to position itself within the competitive landscape of online trading platforms, offering services related to market access and trading tools. However, unlike established brokers with extensive track records, detailed regulatory information and comprehensive service offerings for ASX Markets are not readily available through standard industry channels.

This asx markets review aims to provide an objective assessment based on available information while highlighting areas where transparency could be improved. The platform appears to target traders interested in market access. Specific details about asset classes, regulatory oversight, and trading conditions require further clarification from official sources. Potential users should exercise due diligence when considering any trading platform, particularly when comprehensive regulatory and operational information is not immediately accessible through standard industry verification channels.

Important Disclaimer

This asx markets review is based on publicly available information at the time of writing. Trading platforms may operate under different regulatory frameworks across various jurisdictions, and service offerings can vary significantly by region. The limited availability of comprehensive information about ASX Markets through standard industry channels means that potential users should conduct thorough independent research before making any trading decisions.

Our evaluation methodology combines analysis of available platform information, industry standards comparison, and general market practices. However, the absence of detailed operational data from official sources limits the depth of this assessment compared to reviews of more established brokers with extensive public documentation.

Rating Framework

Broker Overview

ASX Markets presents itself as a trading platform. Detailed background information about the company's establishment, founding year, and corporate structure is not readily available through standard industry verification channels. The limited public information makes it challenging to provide a comprehensive overview of the company's history, leadership, or specific business model compared to more established brokers in the forex and CFD trading space.

The platform's positioning within the competitive trading industry appears to focus on market access. Specific details about target demographics, unique selling propositions, and competitive advantages are not clearly documented in available sources. This lack of comprehensive public information is notable in an industry where transparency and regulatory compliance are increasingly important factors for trader confidence and regulatory approval.

Regarding trading platforms and asset offerings, specific information about the technology infrastructure, supported trading platforms, and available asset classes is not comprehensively documented in accessible sources. The absence of detailed regulatory information also makes it difficult to verify the broker's compliance status with major financial regulatory authorities, which is a crucial consideration in any thorough asx markets review.

Regulatory Status: Available sources do not provide clear information about specific regulatory licenses or oversight from major financial authorities such as FCA, ASIC, CySEC, or other recognized regulatory bodies.

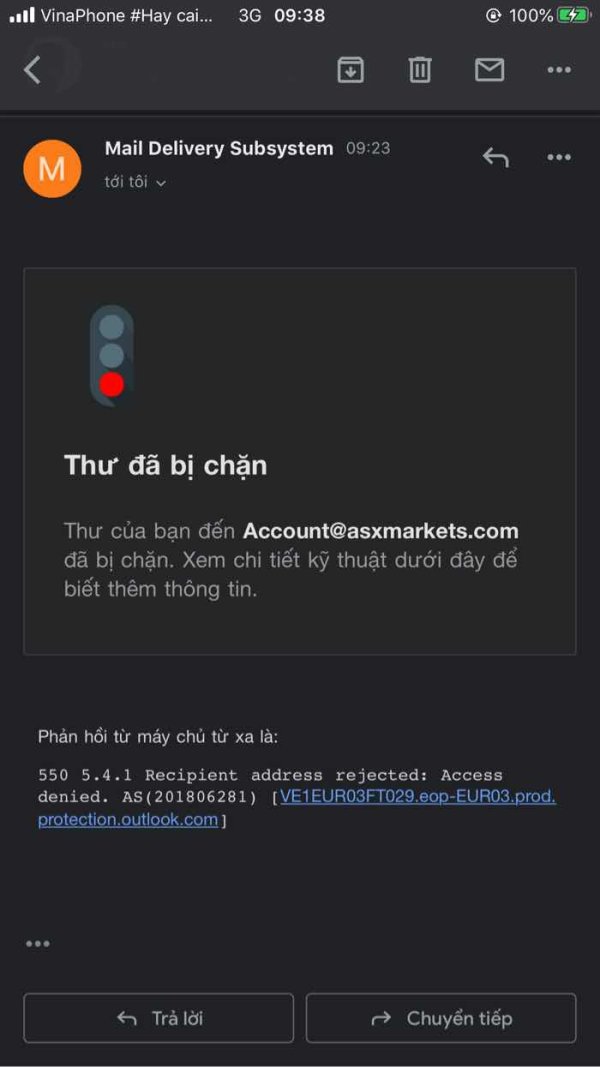

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in accessible documentation.

Minimum Deposit Requirements: Minimum funding requirements for account opening are not specified in available sources.

Promotions and Bonuses: Details about welcome bonuses, trading incentives, or promotional offers are not documented in accessible materials.

Available Assets: The range of tradeable instruments, including forex pairs, commodities, indices, and other financial products, is not comprehensively outlined in available information.

Cost Structure: Specific details about spreads, commissions, overnight fees, and other trading costs are not clearly documented in accessible sources.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Options: Information about supported trading platforms and technological infrastructure is limited in accessible sources.

Geographic Restrictions: Specific information about service availability by region is not detailed in available materials.

Customer Support Languages: Details about multilingual support options are not documented in accessible sources.

This asx markets review highlights the need for greater transparency in publicly available information about the broker's services and regulatory status.

Account Conditions Analysis

The evaluation of account conditions for ASX Markets faces significant limitations due to the lack of comprehensive information in publicly available sources. Standard account features such as account types, minimum deposit requirements, and specific terms and conditions are not clearly documented through accessible channels. This absence of detailed account information makes it challenging for potential traders to make informed decisions about whether the platform meets their specific trading needs.

Account opening procedures, verification requirements, and onboarding processes are not detailed in available documentation. Most established brokers provide clear information about KYC requirements, document verification procedures, and account approval timelines, but such details are not readily accessible for ASX Markets through standard industry information channels.

Special account features, such as Islamic accounts, professional trader classifications, or institutional account options, are not documented in available sources. The lack of transparency regarding account conditions represents a significant gap when compared to industry standards where comprehensive account information is typically readily available to potential clients.

Without access to detailed account condition information, this asx markets review cannot provide a meaningful assessment of this crucial aspect of the broker's service offering. Potential users would need to contact the broker directly for specific account-related information.

The assessment of trading tools and resources available through ASX Markets is constrained by limited publicly available information about the platform's technological capabilities and analytical offerings. Most established brokers provide detailed information about their trading tools, research capabilities, and educational resources, but such comprehensive documentation is not readily accessible for ASX Markets through standard industry channels.

Research and analysis resources, which typically include market commentary, technical analysis tools, economic calendars, and trading signals, are not detailed in available sources. These resources are crucial for informed trading decisions, and their absence from publicly accessible documentation represents a significant information gap compared to industry standards.

Educational materials, such as trading guides, webinars, video tutorials, and market analysis content, are not documented in available sources. Educational support is increasingly important in the competitive broker landscape, as traders value platforms that provide comprehensive learning resources alongside trading access.

Automated trading support, including Expert Advisor compatibility, copy trading features, and algorithmic trading capabilities, is not detailed in accessible documentation. These advanced features are becoming standard offerings among competitive brokers, and their availability often influences platform selection decisions.

The limited availability of information about tools and resources makes it difficult to provide a comprehensive assessment in this area of the review.

Customer Service and Support Analysis

Customer service evaluation for ASX Markets faces significant limitations due to the absence of detailed support information in publicly available sources. Standard customer service metrics such as available contact channels, response times, and support quality indicators are not documented through accessible industry information channels.

Support channel availability, including live chat, email support, phone assistance, and help desk systems, is not clearly outlined in available documentation. Most established brokers provide comprehensive information about their customer support infrastructure, but such details are not readily accessible for ASX Markets through standard verification methods.

Response time commitments and service level agreements are not documented in available sources. Industry-standard practices typically include clear communication about expected response times for different types of inquiries, but this information is not publicly available for ASX Markets.

Multilingual support capabilities and global customer service coverage are not detailed in accessible documentation. For international trading platforms, language support and regional customer service availability are important factors that influence user experience and platform accessibility.

The absence of comprehensive customer service information in publicly available sources limits the ability to provide a thorough assessment of this crucial aspect of the broker's operations. This represents a significant transparency gap compared to industry standards where customer support information is typically readily accessible.

Trading Experience Analysis

The evaluation of trading experience with ASX Markets is significantly limited by the lack of comprehensive platform information in publicly available sources. Key performance indicators such as execution speed, platform stability, and order processing quality are not documented through accessible industry channels, making it challenging to assess the actual trading environment provided by the platform.

Platform functionality and user interface design details are not available in standard industry documentation sources. Most established brokers provide comprehensive information about their trading platforms, including features, capabilities, and user experience elements, but such documentation is not readily accessible for ASX Markets.

Mobile trading capabilities and cross-device synchronization features are not detailed in available sources. Mobile trading has become a crucial component of modern trading platforms, and the absence of information about mobile app features and capabilities represents a significant information gap in this asx markets review.

Order execution quality, including slippage rates, requote frequency, and execution speed metrics, is not documented in accessible sources. These technical performance indicators are crucial for evaluating trading conditions, particularly for active traders who require reliable and fast order processing.

The limited availability of trading experience information makes it difficult to provide a comprehensive assessment of the platform's performance and user experience compared to established industry benchmarks.

Trust and Reliability Analysis

Trust and reliability assessment for ASX Markets faces considerable challenges due to limited regulatory transparency in publicly available sources. Regulatory compliance is a fundamental aspect of broker evaluation, as it provides assurance about fund safety, operational standards, and dispute resolution mechanisms. However, specific regulatory licenses and oversight details are not clearly documented through standard industry verification channels.

Fund security measures, including client fund segregation, deposit insurance, and banking arrangements, are not detailed in accessible documentation. Most reputable brokers provide clear information about how client funds are protected and secured, but such crucial information is not readily available for ASX Markets through standard industry sources.

Corporate transparency, including company ownership, financial reporting, and operational history, is not comprehensively documented in available sources. Transparency about corporate structure and business operations is increasingly important in the financial services industry, particularly for trading platforms handling client funds.

Industry reputation and third-party recognition, such as awards, certifications, or industry association memberships, are not documented in accessible sources. While the absence of negative publicity is noted, the lack of positive industry recognition or regulatory acknowledgment represents a transparency concern.

The limited availability of trust and reliability information significantly impacts the ability to provide a comprehensive assessment of ASX Markets' credibility and regulatory standing.

User Experience Analysis

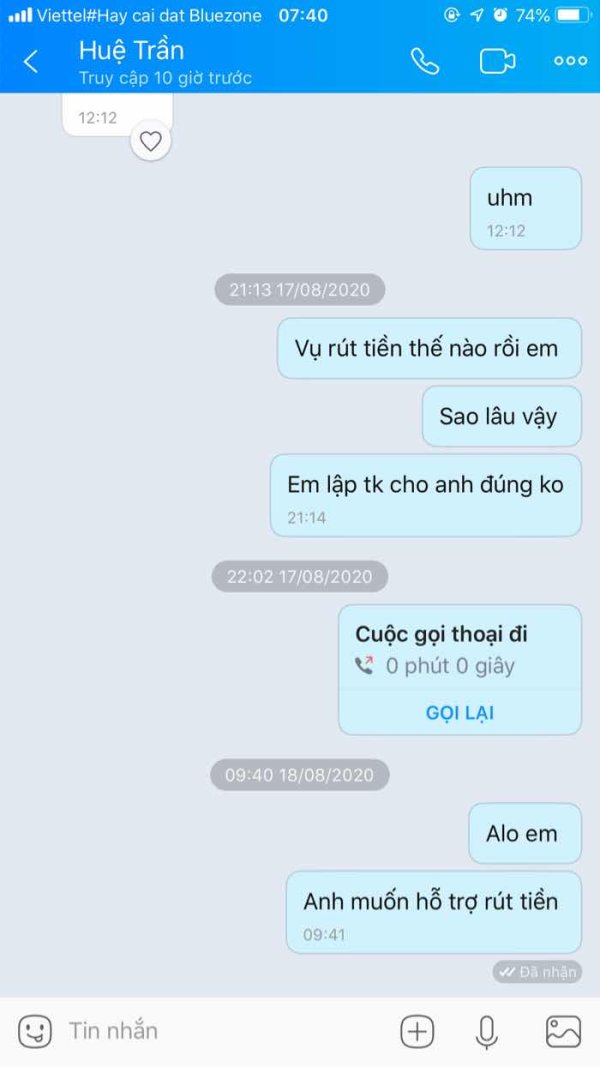

User experience evaluation for ASX Markets is constrained by the absence of comprehensive user feedback and satisfaction data in publicly available sources. User testimonials, satisfaction surveys, and community feedback are not readily accessible through standard industry review platforms, making it difficult to assess actual user experiences with the platform.

Interface design and usability information is not detailed in available documentation. Modern trading platforms typically provide extensive information about user interface features, customization options, and usability enhancements, but such details are not accessible for ASX Markets through standard industry channels.

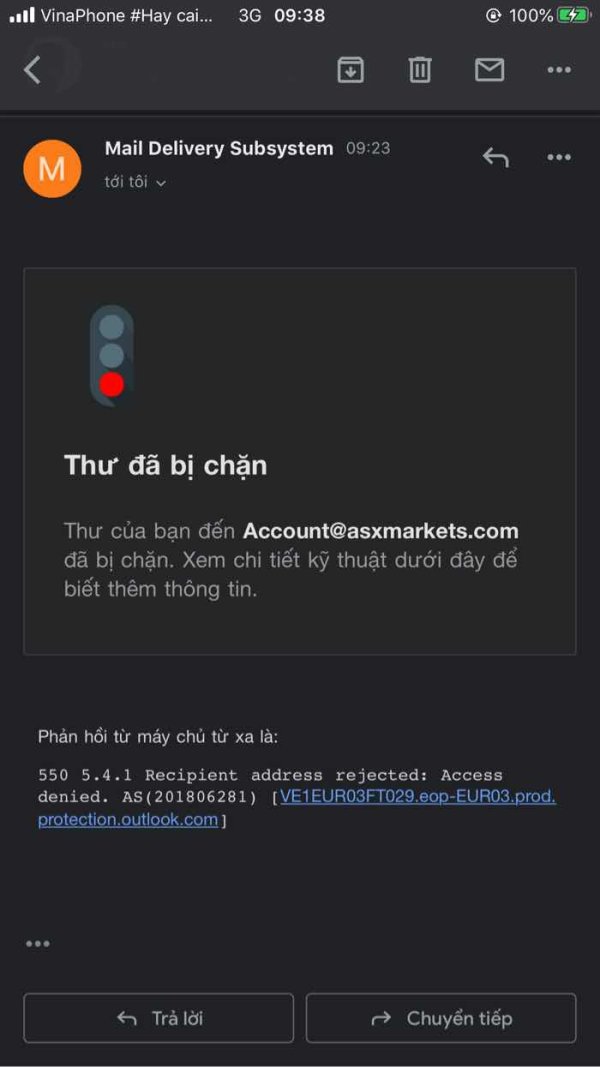

Registration and verification process details are not documented in available sources. The account opening experience, including required documentation, verification timelines, and onboarding procedures, represents crucial aspects of user experience that are not clearly outlined in accessible information.

Funding and withdrawal experience details, including processing times, fee structures, and payment method options, are not comprehensively documented in available sources. These operational aspects significantly impact overall user satisfaction and platform usability.

The lack of detailed user experience information limits the ability to provide meaningful insights about the practical aspects of using ASX Markets as a trading platform compared to industry standards where user feedback is typically more readily available.

Conclusion

This asx markets review reveals significant limitations in publicly available information about the broker's services, regulatory status, and operational details. While ASX Markets appears to operate as a trading platform, the absence of comprehensive documentation about key aspects such as regulatory compliance, trading conditions, and user experience represents a notable transparency gap compared to established industry standards.

The platform may be suitable for traders who can obtain detailed information directly from the broker and are comfortable with limited public documentation. However, the lack of readily accessible information about regulatory oversight, trading costs, and service features suggests that potential users should exercise enhanced due diligence before committing to the platform.

The main limitations identified include insufficient regulatory transparency, limited publicly available information about trading conditions, and absence of comprehensive user feedback data. These factors make it challenging to provide a definitive recommendation without additional verification from official sources.