Cross Options Review 1

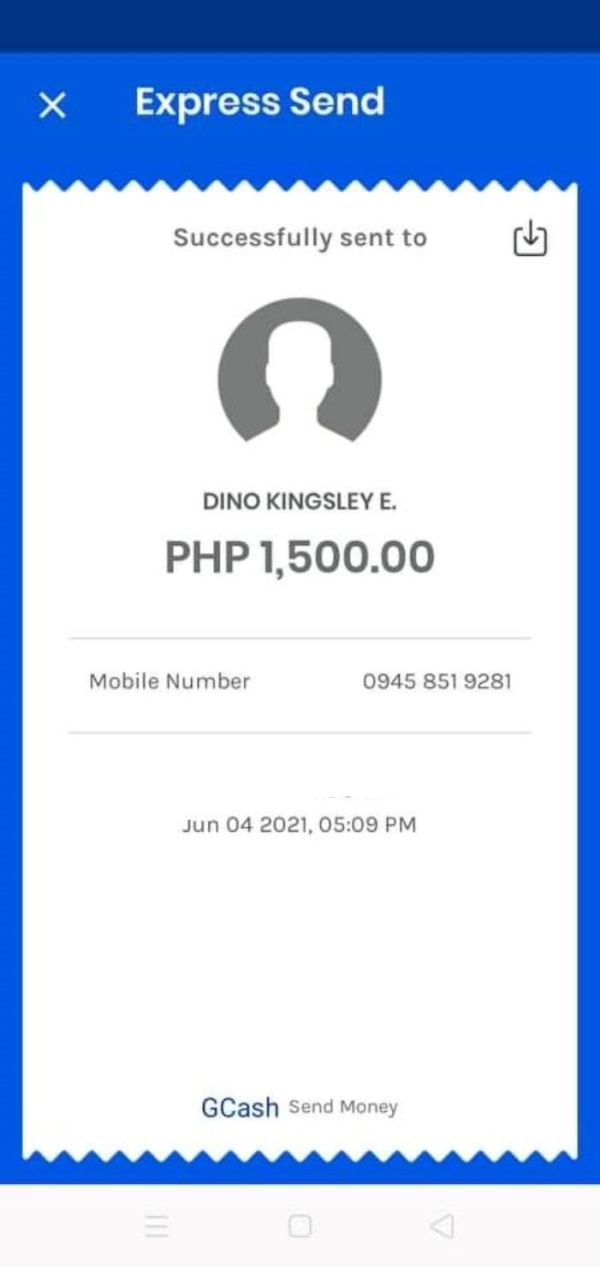

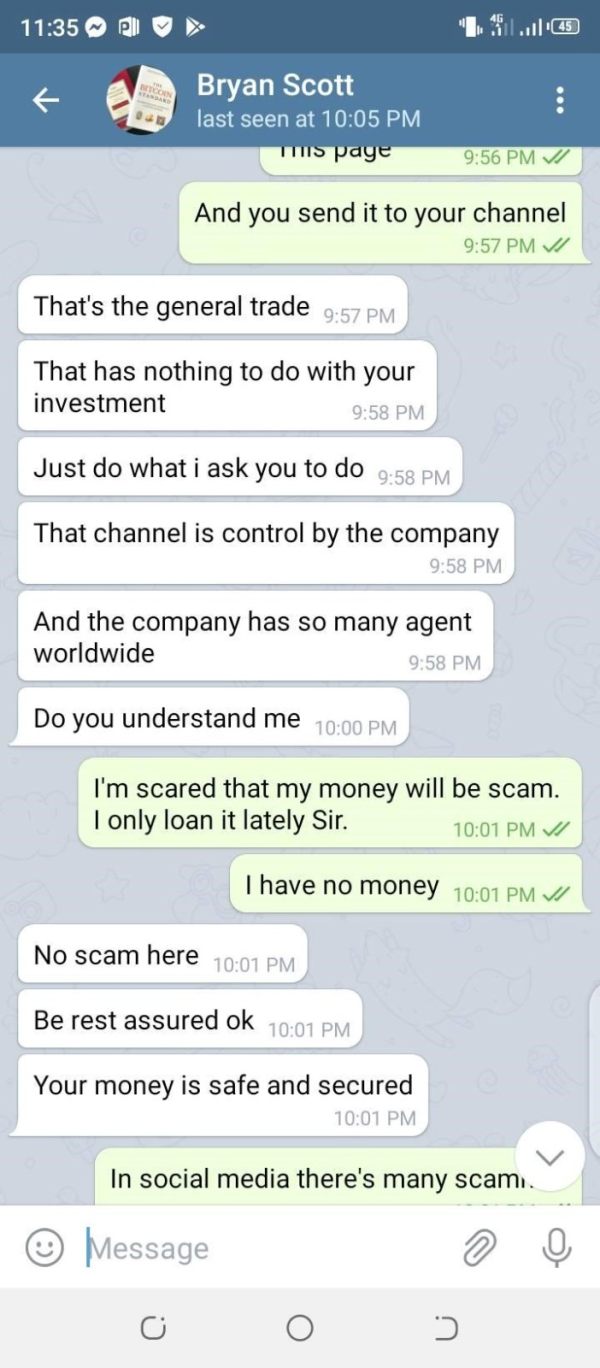

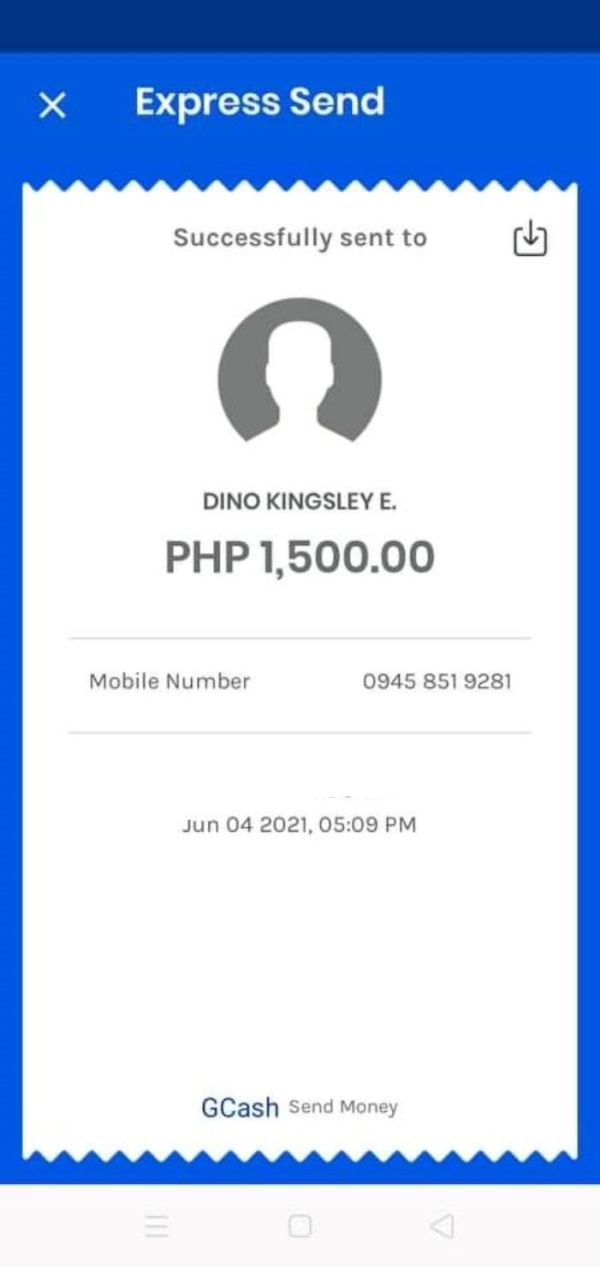

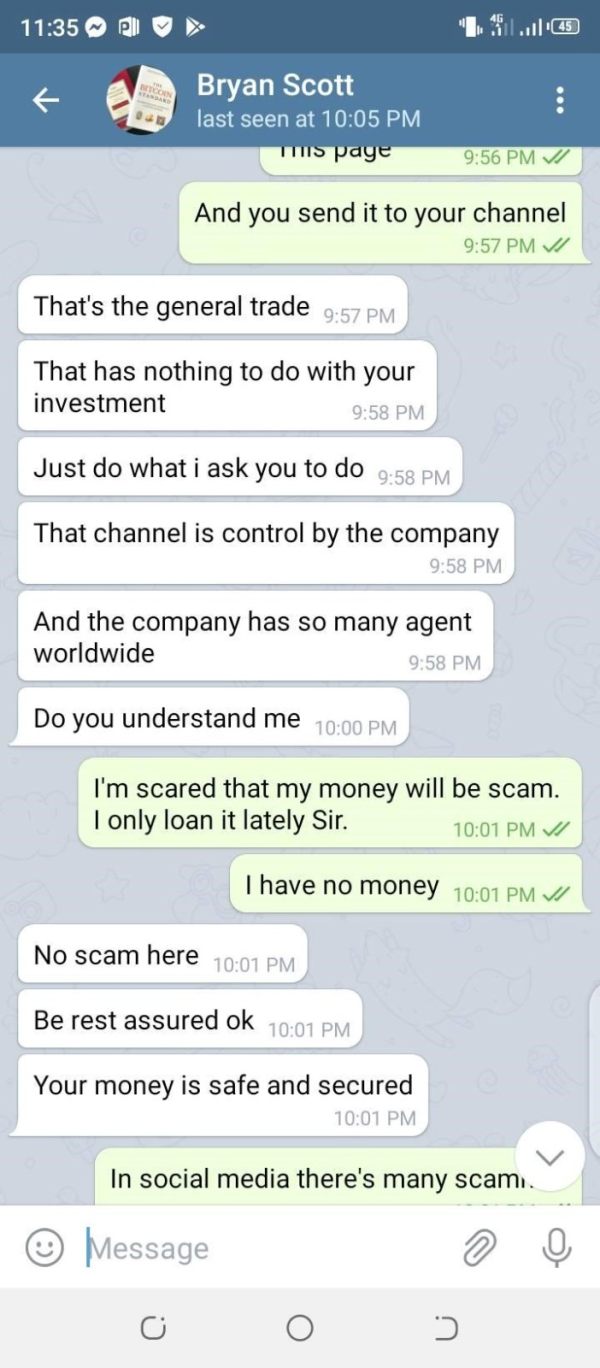

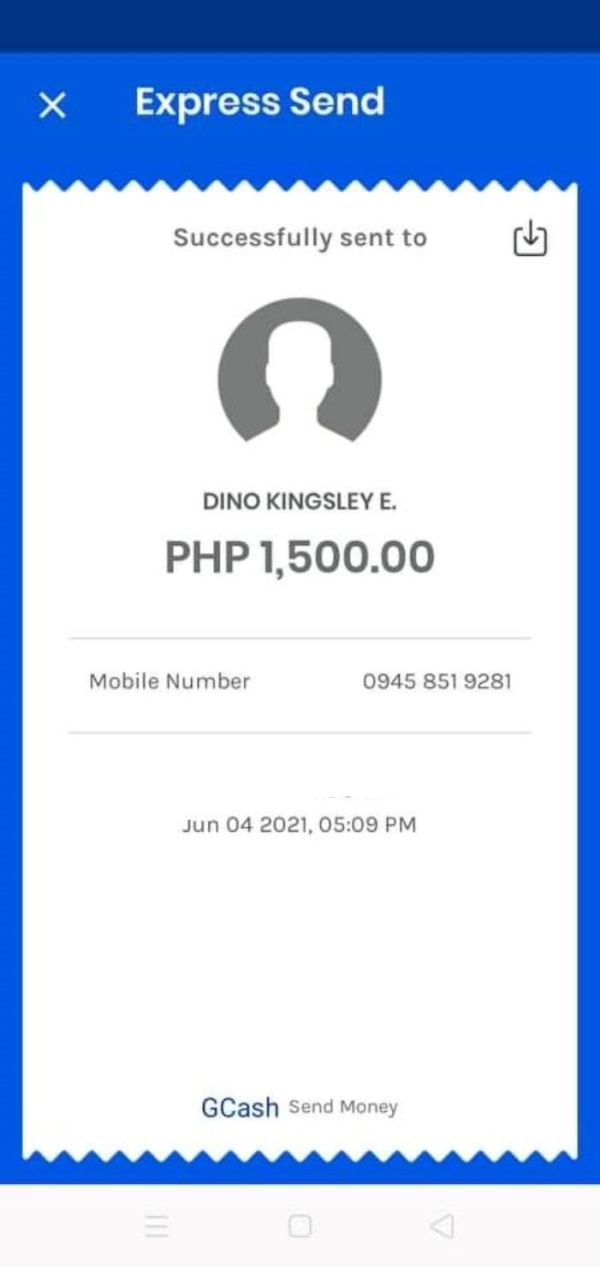

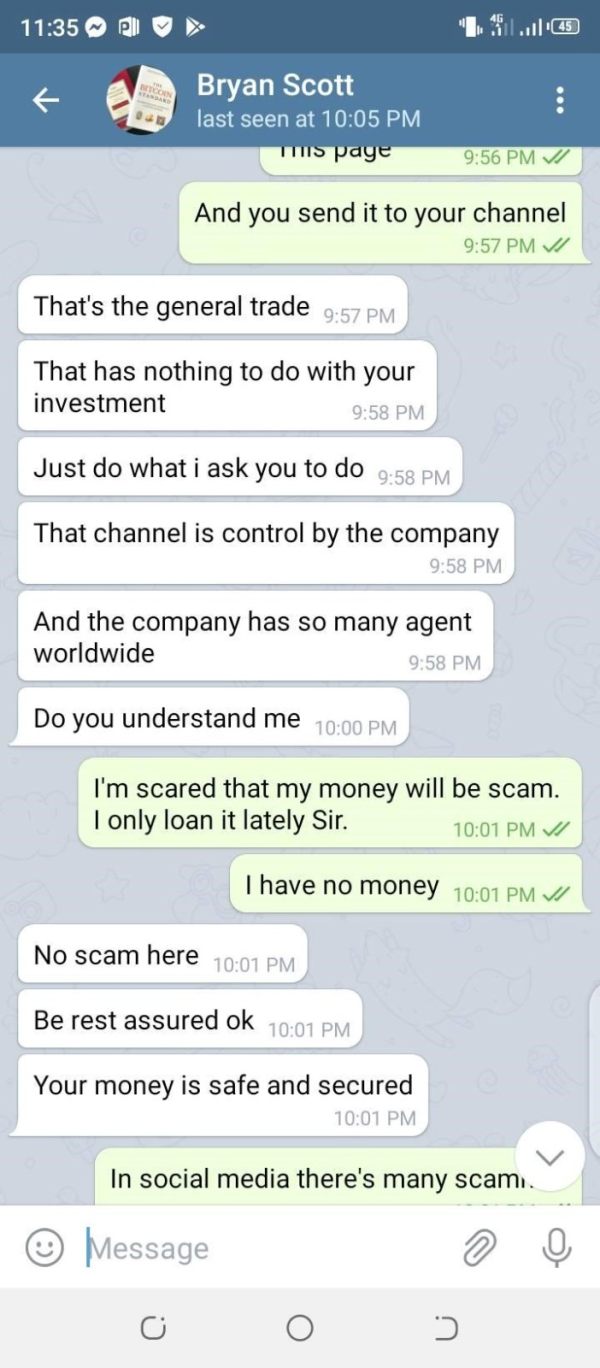

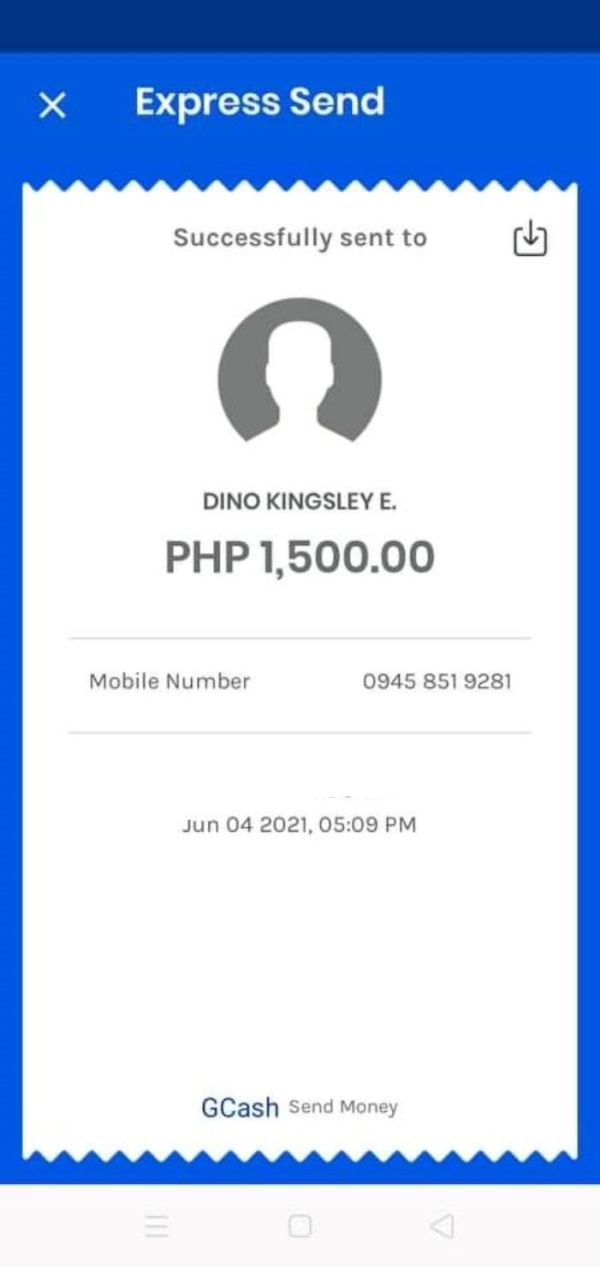

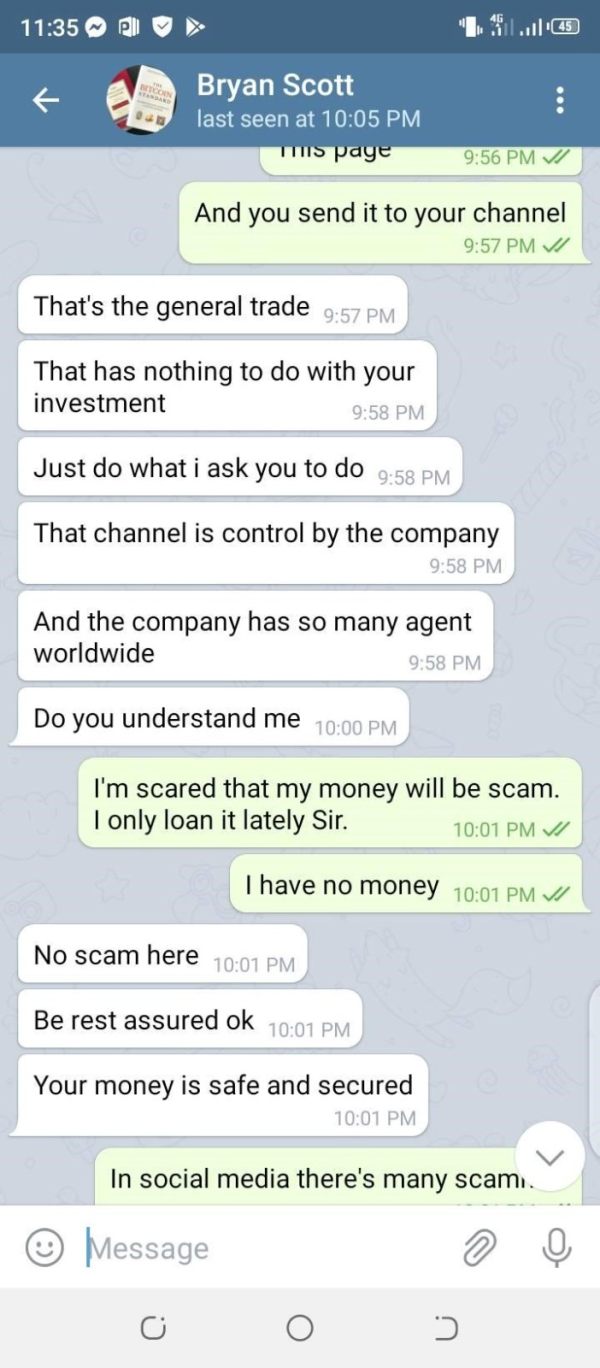

He cheated me I Invested 1500p, now he blocked me, John his no.+63 29-205-9687 , pls tell him to return my Invested money CROSS OPTIONS is scam.

Cross Options Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

He cheated me I Invested 1500p, now he blocked me, John his no.+63 29-205-9687 , pls tell him to return my Invested money CROSS OPTIONS is scam.

Cross Options has emerged as a notable player in the forex brokerage landscape, but its reputation remains controversial. This review synthesizes various sources to provide a comprehensive overview of Cross Options, highlighting its strengths and weaknesses, as well as expert opinions and user experiences.

Cross Options is a forex broker that has garnered mixed reviews, with several users expressing concerns about its legitimacy and regulatory status. While some praise its trading platform and algorithmic trading capabilities, others warn of potential risks associated with unregulated trading. Notably, the absence of valid regulatory oversight raises red flags for potential investors.

Attention: It is crucial to note that the regulatory environment can vary significantly across regions, and potential investors should be aware of the risks associated with trading with a broker that lacks proper oversight.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 3 |

| Tools and Resources | 5 |

| Customer Service and Support | 4 |

| Trading Experience | 5 |

| Trustworthiness | 2 |

| User Experience | 4 |

| (Optional) Additional Features | 3 |

How We Rated the Broker: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding Cross Options.

Founded approximately 2 to 5 years ago, Cross Options operates out of the Netherlands. The broker positions itself as a cutting-edge trading house that utilizes proprietary algorithms and research to facilitate trading across various markets. The trading platform supports popular trading software like MT4 and MT5, catering to a wide range of trading assets, including forex, commodities, and options. However, a significant concern is the lack of regulatory oversight, with no valid licenses reported, which can lead to heightened risks for users.

Cross Options operates without any regulatory oversight, which is a substantial concern for potential clients. The absence of a regulatory body means that users may not have access to the protections typically afforded by regulated brokers. According to WikiFX, there are multiple user complaints regarding the broker, with some claiming they were cheated out of their investments.

The platform primarily supports deposits and withdrawals in euros, which is standard for brokers operating in the European region. However, the lack of transparency regarding transaction fees for withdrawals can be a deterrent for potential clients.

The minimum deposit requirement for opening an account with Cross Options is not explicitly stated in the sources reviewed, which may indicate a lack of clarity in their account conditions. This ambiguity can lead to distrust among potential investors.

There is no substantial information regarding any promotional offers or bonuses available to new clients. This lack of incentives can make Cross Options less appealing compared to competitors that offer more attractive bonuses.

Cross Options allows trading in a variety of asset classes, including forex, commodities, and options. However, the specifics of available trading pairs or options are not clearly outlined, which could limit traders' choices.

The cost structure remains vague, with no specific details on spreads or commission rates provided in the sources. This lack of transparency can be a significant downside for traders who prefer brokers with clearly defined pricing strategies.

The leverage offered by Cross Options is not mentioned in the sources, which is a critical factor for many traders. Without this information, potential clients cannot assess the risk-reward ratio associated with trading on this platform.

Cross Options supports popular trading platforms, including MT4 and MT5, which are favored by many traders for their advanced features and user-friendly interfaces. However, the absence of proprietary trading tools or features may hinder the overall trading experience.

The sources do not specify any regions where Cross Options is restricted, but the lack of regulation may deter users from certain jurisdictions that require brokers to be licensed.

Cross Options appears to offer customer support primarily in English, which may limit accessibility for non-English speaking clients. The quality of customer service has been rated poorly, with users reporting long response times and insufficient support.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 3 |

| Tools and Resources | 5 |

| Customer Service and Support | 4 |

| Trading Experience | 5 |

| Trustworthiness | 2 |

| User Experience | 4 |

| (Optional) Additional Features | 3 |

In conclusion, the Cross Options review presents a mixed picture of the broker. While it offers a range of trading options and supports popular platforms, the lack of regulatory oversight and transparency raises significant concerns. Potential investors should proceed with caution and consider these factors before engaging with Cross Options.

FX Broker Capital Trading Markets Review