Is Forex3D safe?

Business

License

Is Forex3D Safe or Scam?

Introduction

Forex3D is a forex broker that has positioned itself within the online trading market, primarily targeting traders interested in forex trading. Established in 2018 and based in the United Kingdom, Forex3D offers various trading accounts and utilizes the widely recognized MetaTrader 4 platform. However, the rise of online trading has also seen an increase in fraudulent activities, making it crucial for traders to carefully evaluate the credibility of their chosen brokers. In this article, we will explore whether Forex3D is a legitimate trading platform or a potential scam. Our investigation is based on a thorough review of available information, including regulatory status, company background, trading conditions, customer feedback, and overall reputation within the trading community.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and reliability. Forex3D operates without any valid regulatory oversight, which raises significant concerns about its legitimacy and client protection. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that Forex3D is not subject to the strict standards and oversight that regulated brokers must adhere to. This lack of oversight can lead to increased risks for traders, such as potential fraud, loss of funds, and limited recourse in case of disputes. Moreover, unregulated brokers often lack transparency in their operations, making it difficult for traders to assess their credibility. In the case of Forex3D, the lack of regulatory information on its website suggests a concerning level of opacity, which should raise red flags for potential investors.

Company Background Investigation

Forex3D has a relatively brief history, having been established in 2018. However, the details surrounding its ownership structure and management team remain unclear. The company's website does not provide comprehensive information about its founders or key personnel, which limits transparency and raises questions about its operational integrity. A broker's management team plays a crucial role in its credibility, and the lack of disclosed backgrounds can lead to skepticism among potential clients.

Furthermore, the operational history of Forex3D has been marred by complaints and allegations of fraudulent activities. Reports indicate that several users have faced difficulties in withdrawing funds, leading to suspicions about the company's practices. Given the importance of transparency and accountability in the financial sector, Forex3D's lack of information about its management and ownership structure is a significant concern for traders evaluating whether Forex3D is safe.

Trading Conditions Analysis

An essential aspect of assessing a broker's legitimacy is understanding its trading conditions. Forex3D offers two primary account types: the standard account, requiring a minimum deposit of $1,000, and the premium account, which requires a minimum deposit of $10,000. While these deposit amounts are not unusual for the forex market, they are on the higher side compared to many other brokers that allow entry with lower minimum deposits.

In terms of trading costs, Forex3D claims to offer competitive spreads. Below is a comparison of the core trading costs associated with Forex3D:

| Cost Type | Forex3D | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 0.1 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Forex3D may appear attractive, there are concerns about the transparency of its pricing policy. Users have reported discrepancies between the spreads advertised and those experienced in practice. Furthermore, the absence of a clear commission structure raises questions about hidden fees that could impact overall trading costs. These factors contribute to the uncertainty surrounding Forex3D's trading conditions and whether they align with industry standards.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Forex3D does not provide adequate information regarding its fund safety measures. For instance, it is unclear whether client funds are held in segregated accounts, which is a standard practice among regulated brokers to ensure that client deposits are protected in the event of insolvency. Additionally, the lack of investor protection schemes raises concerns about the safety of funds deposited with Forex3D.

Historically, unregulated brokers like Forex3D have faced scrutiny for their handling of client funds. Reports of withdrawal issues and allegations of fraudulent practices further exacerbate the fears surrounding fund safety. Without a robust regulatory framework to hold Forex3D accountable, traders must exercise extreme caution when considering whether Forex3D is safe for their investments.

Customer Experience and Complaints

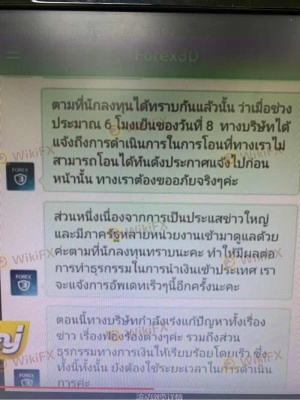

Customer feedback is a vital component in assessing a broker's reputation and reliability. In the case of Forex3D, numerous complaints have surfaced, particularly regarding withdrawal difficulties and poor customer service. Traders have reported long delays in processing withdrawal requests, leading to frustration and distrust in the broker's operations.

The following table summarizes the primary complaint types associated with Forex3D:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Lack of Transparency | Medium | Limited information |

| Poor Customer Service | High | Unresponsive |

Two notable cases exemplify the challenges faced by Forex3D clients. In one instance, a trader reported being unable to withdraw funds for over three months, despite multiple requests for assistance. In another case, a user expressed frustration over the lack of communication from customer support when seeking clarification on account issues. These complaints highlight a concerning trend regarding Forex3D's responsiveness and commitment to customer satisfaction, further questioning whether Forex3D is safe for potential traders.

Platform and Execution

The trading platform offered by Forex3D is the widely used MetaTrader 4, known for its user-friendly interface and extensive features. However, user experiences with the platform have been mixed. Some traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. These execution problems are particularly concerning for traders who rely on precise timing and execution for their strategies.

Moreover, there have been allegations of platform manipulation, where users claim that the broker may have influenced trade outcomes to its advantage. Such practices, if true, would further diminish the credibility of Forex3D and raise serious concerns about its operational integrity.

Risk Assessment

Engaging with Forex3D carries inherent risks that potential investors should carefully consider. The following risk assessment provides a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Fund Safety Risk | High | Lack of transparency on fund handling |

| Execution Risk | Medium | Reports of slippage and rejections |

| Customer Service Risk | High | Poor response to client inquiries |

To mitigate these risks, potential traders should conduct thorough research, seek out regulated alternatives, and consider starting with a small investment to assess the broker's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Forex3D exhibits several red flags that indicate it may not be a safe trading option. The absence of regulation, coupled with numerous complaints regarding fund withdrawals and customer service, raises significant concerns about its legitimacy. While Forex3D may offer attractive trading conditions on the surface, the underlying issues related to transparency, fund safety, and customer experience cannot be overlooked.

For traders seeking to engage in forex trading, it is advisable to consider regulated brokers with a proven track record of reliability and customer satisfaction. Alternatives such as brokers regulated by reputable authorities like the FCA or ASIC provide a safer trading environment and greater protection for client funds. Ultimately, thorough research and due diligence are essential to ensure a secure trading experience in the forex market.

Is Forex3D a scam, or is it legit?

The latest exposure and evaluation content of Forex3D brokers.

Forex3D Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex3D latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.