Forex3D 2025 Review: Everything You Need to Know

Summary

This comprehensive forex3d review reveals serious concerns about Forex3D as a trading platform. Forex3D has been operating for about 7 years but holds a troubling global ranking of 5935 according to FxGecko data. The broker shows a mixed picture with mostly negative user experiences that raise red flags about its reliability.

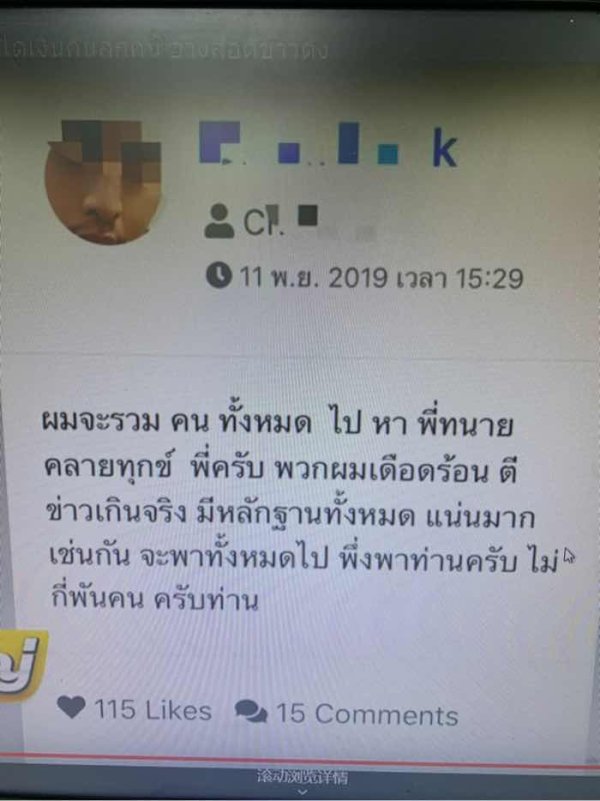

Multiple users have reported fraud and questionable business practices according to File A Scam complaint reports. The platform targets forex and CFD traders who want international market access, but evidence suggests potential investors should be very careful. User reviews consistently highlight problems ranging from poor customer service to platform crashes and withdrawal troubles.

The broker lacks clear regulatory information and faces many scam allegations, making Forex3D a high-risk choice for traders. This forex3d review aims to provide potential users with complete insights based on real user experiences and available market data to help make smart trading decisions.

Important Notice

This review uses publicly available information, user feedback, and third-party assessments from various online sources. Some regulatory and operational details may not be fully verifiable due to limited official documentation from Forex3D. Traders should do their own research and verify all information independently before making any investment decisions.

The information presented reflects current understanding based on available data and may not include recent changes in the broker's operations or regulatory status. Different regions may have different experiences with this broker's services.

Rating Framework

Overall Rating: 2.8/10

Broker Overview

Forex3D entered the forex trading market around 2016. The broker has struggled to build a positive reputation within the trading community despite operating for about seven years. According to FxGecko rankings, Forex3D holds a concerning global position of 5935, which shows its limited market presence and questionable standing among industry peers.

The company's background information remains mostly hidden. Limited transparency exists regarding its corporate structure, ownership, or operational headquarters. This lack of openness has contributed to growing doubt among traders and industry observers. User reports suggest the platform mainly focuses on forex and CFD trading, though specific details about their business model and operational framework are not available through official channels.

Forex3D appears to target retail traders seeking access to international forex markets based on available user feedback and complaint reports. However, the broker's reputation has been seriously damaged by numerous allegations of fraud and poor business practices. This forex3d review indicates that potential users should be particularly careful when considering this platform for their trading activities.

The broker's seven-year operational history has been marked by consistent negative feedback from users. This suggests systemic problems rather than isolated incidents. The buildup of complaints and scam allegations over this extended period raises serious concerns about the platform's legitimacy and operational integrity.

Regulatory Status: Available information does not provide clear details about specific regulatory oversight or licensing authorities governing Forex3D's operations. This regulatory uncertainty represents a significant concern for potential traders.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available sources. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not clearly specified in available documentation. This makes it difficult for potential users to plan their initial investment.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not readily available through public sources.

Trading Assets: The platform appears to offer forex currency pairs and CFD instruments based on user feedback. However, the complete range of available assets remains unclear.

Cost Structure: Specific information about spreads, commission rates, overnight fees, and other trading costs is not comprehensively detailed in available sources. This lack of transparency regarding pricing makes it challenging for traders to assess the true cost of trading.

Leverage Options: Maximum leverage ratios and margin requirements are not clearly specified in available documentation.

Platform Technology: The specific trading platforms offered by Forex3D are not detailed in available sources. User feedback suggests potential stability issues.

Geographic Restrictions: Information about regional availability and trading restrictions is not clearly outlined in accessible materials.

Customer Support Languages: The range of supported languages for customer service is not specified in available documentation.

This forex3d review highlights the concerning lack of transparency in many fundamental operational areas that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

Forex3D's account conditions receive a poor rating due to the lack of transparent information and numerous user complaints. Available sources do not provide clear details about different account types, their specific features, or the benefits offered to different trader categories. This opacity makes it extremely difficult for potential users to understand what they can expect from their trading accounts.

The minimum deposit requirements are not clearly specified. This creates uncertainty for traders planning their initial investment. User feedback suggests that the account opening process may be problematic, with some traders reporting difficulties during registration and verification procedures. The absence of detailed information about special account features, such as Islamic accounts or professional trading accounts, further reduces the platform's appeal.

User testimonials indicate that account management has been a source of frustration. Complaints include unexpected changes to account terms and conditions. The lack of clear documentation about account benefits, fee structures, and trading conditions contributes to the poor user experience. Compared to reputable brokers in the industry, Forex3D's account offerings appear significantly underdeveloped and poorly communicated.

This forex3d review emphasizes that the unclear account conditions represent a major weakness that potential traders should carefully consider before opening an account with this broker.

The trading tools and resources offered by Forex3D receive a below-average rating based on available information and user feedback. Specific details about the variety and quality of trading tools are not comprehensively outlined in accessible sources, suggesting either limited offerings or poor communication of available resources.

Market research and analysis resources appear to be minimal or non-existent based on user reports. Traders typically expect access to market commentary, technical analysis, economic calendars, and research reports from their brokers, but Forex3D seems to fall short in providing these essential resources. The absence of robust analytical tools significantly hampers traders' ability to make informed decisions.

Educational resources, which are crucial for trader development, do not appear to be a strong focus for this platform. User feedback suggests limited access to educational materials, webinars, tutorials, or training programs that could help both novice and experienced traders improve their skills. This lack of educational support is particularly concerning for new traders who rely on their brokers for learning opportunities.

Automated trading support and advanced trading tools also appear to be limited based on available information. The platform's technological infrastructure seems inadequate compared to industry standards, potentially limiting traders' ability to implement sophisticated trading strategies.

Customer Service and Support Analysis (4/10)

Customer service represents one of the more problematic aspects of Forex3D's operations. It scores slightly higher than other categories due to the existence of some support channels. User feedback consistently highlights significant issues with response times, service quality, and problem resolution effectiveness.

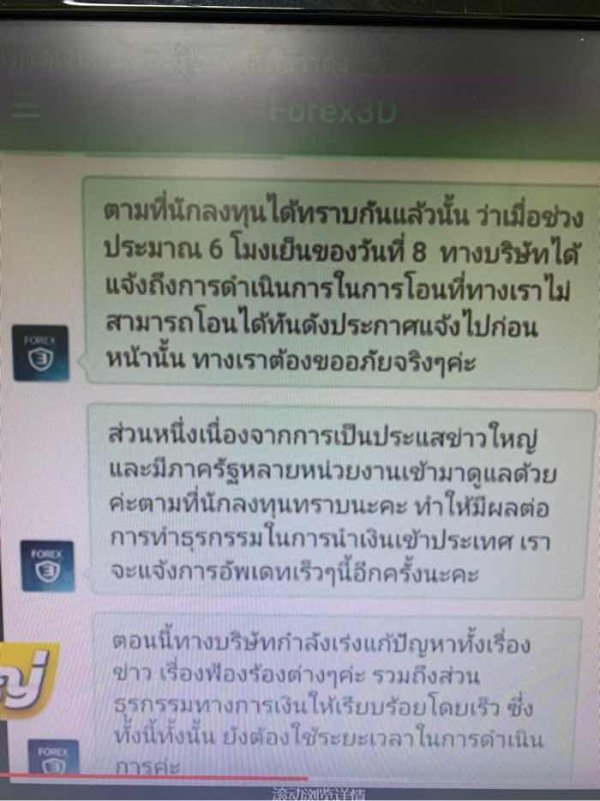

Available information suggests that customer support channels may be limited. Users report difficulties in reaching qualified representatives. Response times appear to be considerably longer than industry standards, with some users waiting days or weeks for responses to critical inquiries. This delayed response time is particularly problematic when traders face urgent issues related to their accounts or trading activities.

The quality of customer service interactions has been a frequent source of user complaints. Reports suggest that support representatives may lack the necessary expertise to address complex trading-related questions or technical issues effectively. Language support options are not clearly specified, which may create additional barriers for international traders seeking assistance.

Problem resolution capabilities appear to be inadequate based on user testimonials. Many traders report that their issues remain unresolved even after multiple contact attempts, leading to frustration and loss of confidence in the platform. The lack of effective problem-solving mechanisms significantly impacts the overall user experience and contributes to the negative reputation surrounding this broker.

Trading Experience Analysis (3/10)

The trading experience with Forex3D receives a poor rating based on consistent user feedback highlighting significant platform issues and execution problems. Users frequently report platform stability concerns, including unexpected downtime, connection issues, and system crashes that can severely impact trading activities.

Order execution quality appears to be a major weakness. Traders report instances of slippage, requotes, and delayed order processing. These execution issues can significantly impact trading profitability and create frustration for users attempting to implement their trading strategies effectively. The platform's inability to provide reliable order execution represents a fundamental flaw in its core functionality.

Platform functionality completeness seems limited based on user reports. Traders note missing features and tools that are standard in modern trading platforms. The user interface and overall platform design appear to be outdated and less intuitive compared to industry-leading alternatives. These limitations can significantly hinder traders' ability to analyze markets and execute trades efficiently.

Mobile trading experience, which is increasingly important for modern traders, appears to be inadequate based on available feedback. Users report difficulties accessing their accounts and executing trades through mobile devices, limiting their flexibility and ability to respond to market opportunities quickly.

This forex3d review emphasizes that the poor trading experience represents a significant barrier to successful trading and should be a primary concern for potential users.

Trust and Safety Analysis (2/10)

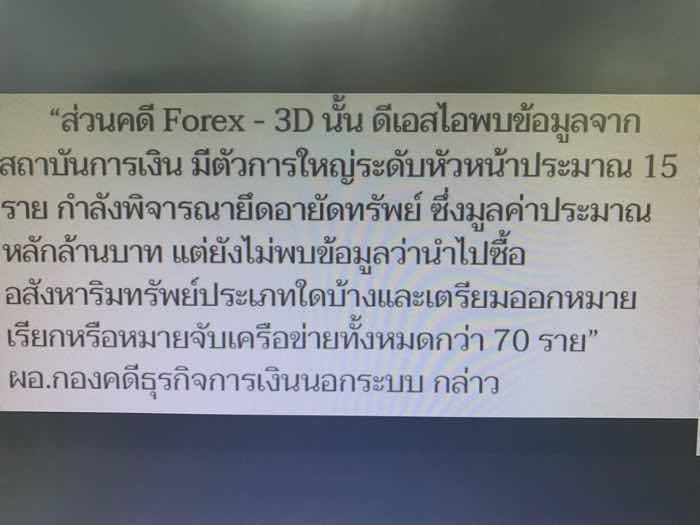

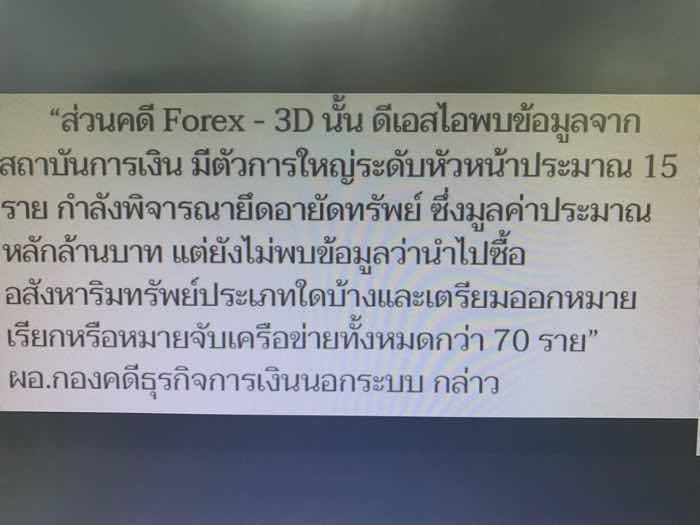

Trust and safety represent the most concerning aspects of Forex3D's operations, earning the lowest possible rating based on available evidence and user reports. The platform's regulatory status remains unclear, with no verifiable information about oversight from recognized financial authorities. This regulatory ambiguity creates significant concerns about investor protection and operational oversight.

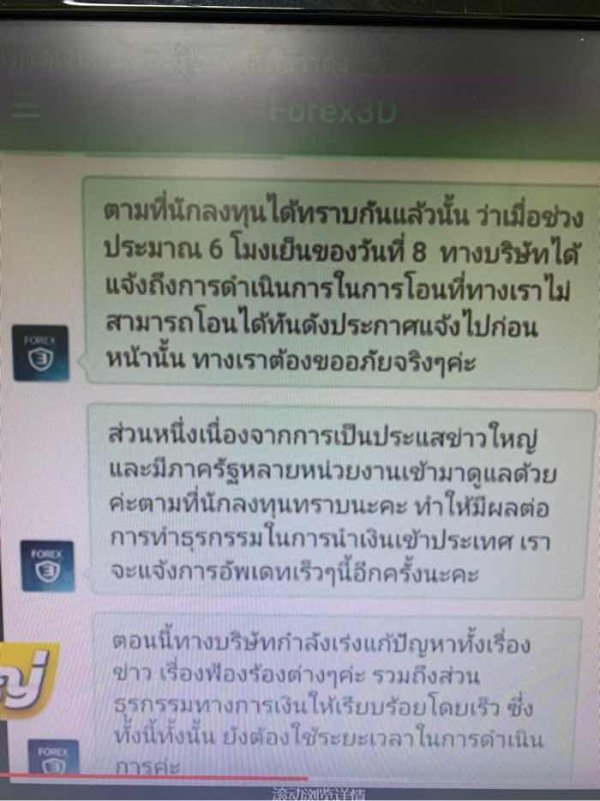

Fund safety measures are not clearly documented or communicated. This leaves traders uncertain about how their deposits are protected. The absence of information about segregated client accounts, deposit insurance, or other standard safety measures raises serious red flags about fund security. User reports include allegations of withdrawal difficulties and funds being withheld, further undermining confidence in the platform's financial integrity.

Company transparency is severely lacking. Limited information is available about corporate structure, ownership, management team, or operational locations. This opacity makes it impossible for traders to verify the legitimacy of the organization or assess its financial stability. Reputable brokers typically provide comprehensive information about their corporate background and regulatory compliance.

Industry reputation has been significantly damaged by numerous scam allegations and negative user experiences documented across multiple complaint platforms. The consistent pattern of negative feedback and fraud allegations suggests systemic issues rather than isolated incidents. These reputation concerns are compounded by the platform's poor ranking and limited positive user testimonials.

User Experience Analysis (3/10)

Overall user satisfaction with Forex3D appears to be significantly below industry standards based on available feedback and complaint reports. The majority of user testimonials express frustration with various aspects of the trading experience, from account management to platform functionality and customer service interactions.

Interface design and usability receive criticism from users who report that the platform is not user-friendly and lacks the intuitive design elements found in modern trading platforms. Navigation difficulties and confusing layout elements contribute to a poor user experience that can hinder effective trading activities. The platform's design appears outdated compared to contemporary industry standards.

Registration and verification processes have been sources of user complaints. Reports include lengthy verification procedures, unclear requirements, and difficulties completing account setup. These initial hurdles create negative first impressions and may discourage potential traders from completing their account opening process.

Fund management operations, including deposits and withdrawals, generate significant user complaints. Traders report difficulties accessing their funds, unexpected delays in processing, and unclear fee structures that impact their overall experience. These fund management issues represent critical concerns that directly affect traders' financial interests.

Common user complaints consistently focus on platform reliability, customer service quality, fund access issues, and overall transparency concerns. The accumulation of these negative experiences has created a predominantly unfavorable user sentiment that potential traders should carefully consider before engaging with this platform.

Conclusion

This comprehensive forex3d review reveals significant concerns about the broker's operations, safety, and overall reliability. Forex3D presents numerous red flags that make it unsuitable for most traders seeking a secure and professional trading environment based on available evidence and user feedback.

The platform is not recommended for traders who prioritize safety, transparency, and reliable service quality. The combination of regulatory ambiguity, poor user experiences, platform instability, and numerous scam allegations creates an unacceptable risk profile for serious traders.

Key disadvantages include potential fraudulent activities, poor customer service, inadequate trading infrastructure, lack of regulatory oversight, and consistent negative user feedback. These fundamental issues overshadow any potential benefits and suggest that traders would be better served by choosing more reputable and transparent brokers in the competitive forex market.