Amxer Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive amxer markets review reveals serious concerns about this new broker. Amxer Markets emerged in 2023 and operates from Saint Lucia, presenting itself as a multi-asset trading platform that offers over 130 trading instruments across forex, commodities, cryptocurrencies, stocks, and indices. Our investigation uncovers major red flags that potential traders must consider.

The broker operates without approval from any well-known financial regulatory authorities. This immediately raises questions about fund security and operational legitimacy, creating significant risks for traders who might choose this platform. Multiple industry watchdog websites have flagged Amxer Markets as a potential scam, citing various user complaints and suspicious business practices that suggest fraudulent operations. While the platform claims to offer diverse trading opportunities through CFD trading, the lack of regulatory oversight and negative user feedback significantly undermines its credibility.

This review targets traders seeking diversified trading instruments. However, we strongly advise extreme caution when considering this broker for any trading activities. The combination of no regulatory protection, limited transparency about company operations, and mounting evidence of fraudulent activities makes Amxer Markets a high-risk choice for serious traders.

Important Notice

Regional Entity Differences: Amxer Markets operates without approval from major financial regulatory bodies. These include the UK's Financial Conduct Authority, Cyprus Securities and Exchange Commission, or other internationally recognized regulators that provide essential investor protections. This lack of oversight means traders have limited recourse in case of disputes or fund recovery issues.

Review Methodology: This evaluation is based on publicly available information, user feedback from various trading forums, and reports from financial watchdog organizations. Our assessment aims to provide an objective analysis while highlighting potential risks associated with this broker and its questionable business practices.

Rating Framework

Broker Overview

Amxer Markets entered the online trading scene in 2023. The company positions itself as a comprehensive trading platform based in Saint Lucia, operating as a CFD provider that claims to offer access to global financial markets through a single platform. Despite its recent establishment, the broker has quickly attracted attention from regulatory watchdogs and experienced traders, though unfortunately for negative reasons that raise serious concerns about its legitimacy.

The platform markets itself to retail traders seeking exposure to multiple asset classes. These include major and minor currency pairs, precious metals, energy commodities, popular cryptocurrencies, international stock indices, and individual equity CFDs that appeal to diverse trading strategies. However, the company's business model lacks transparency, with limited information available about its operational structure, management team, or financial backing that would typically be disclosed by legitimate brokers. This opacity, combined with its unregulated status, raises immediate concerns about the broker's legitimacy and long-term viability in the competitive forex market.

Regulatory Status: Amxer Markets operates without authorization from established financial regulators. This leaves traders without essential investor protections that are standard in the industry.

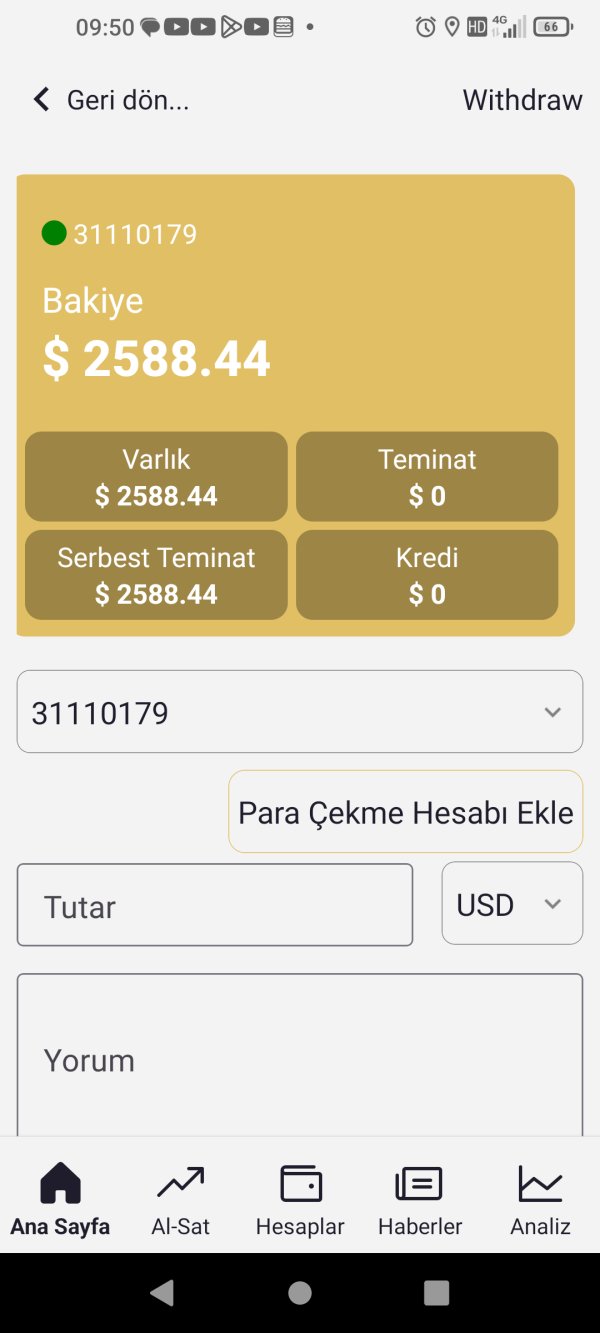

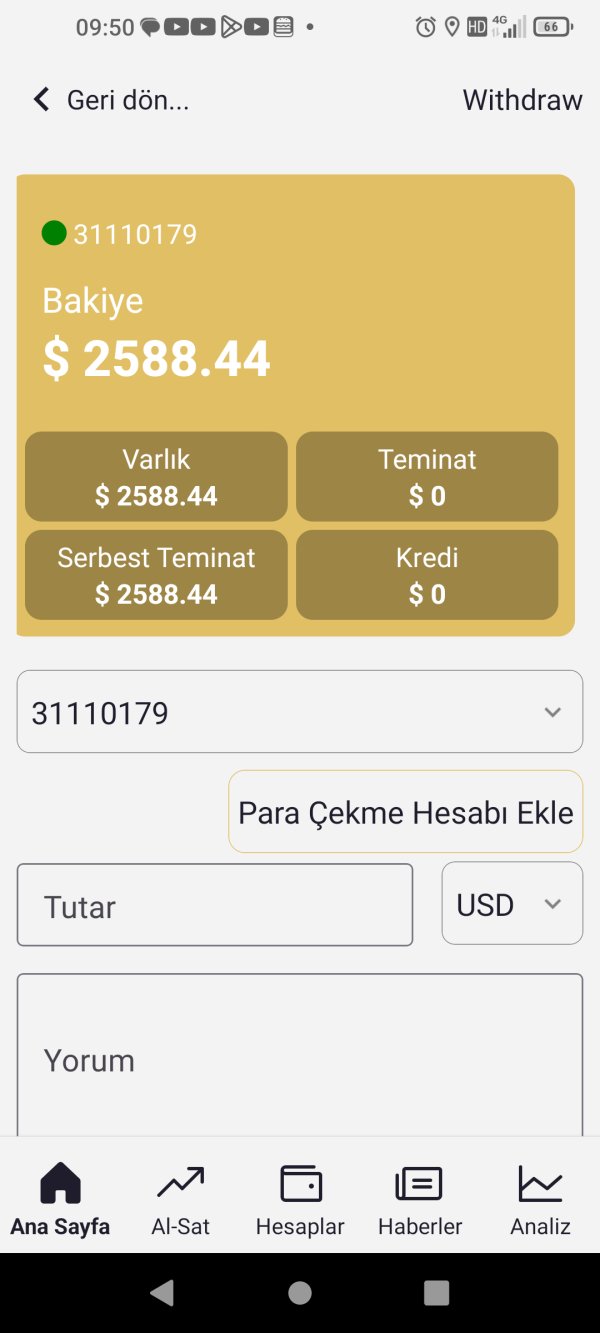

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods remains unclear in available documentation. This lack of transparency is concerning for potential clients who need to understand how they can fund their accounts.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts. This makes it difficult for traders to assess accessibility and plan their initial investment.

Bonuses and Promotions: No specific promotional offers or bonus structures have been identified in our research. The absence of clear promotional information suggests poor marketing transparency.

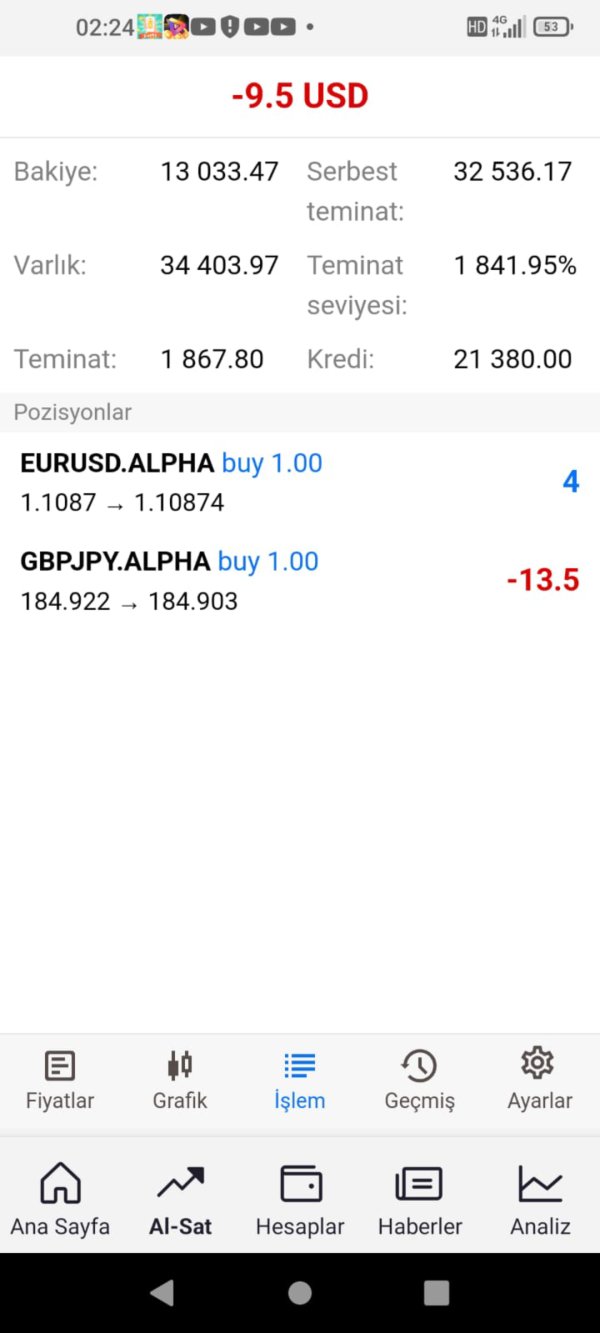

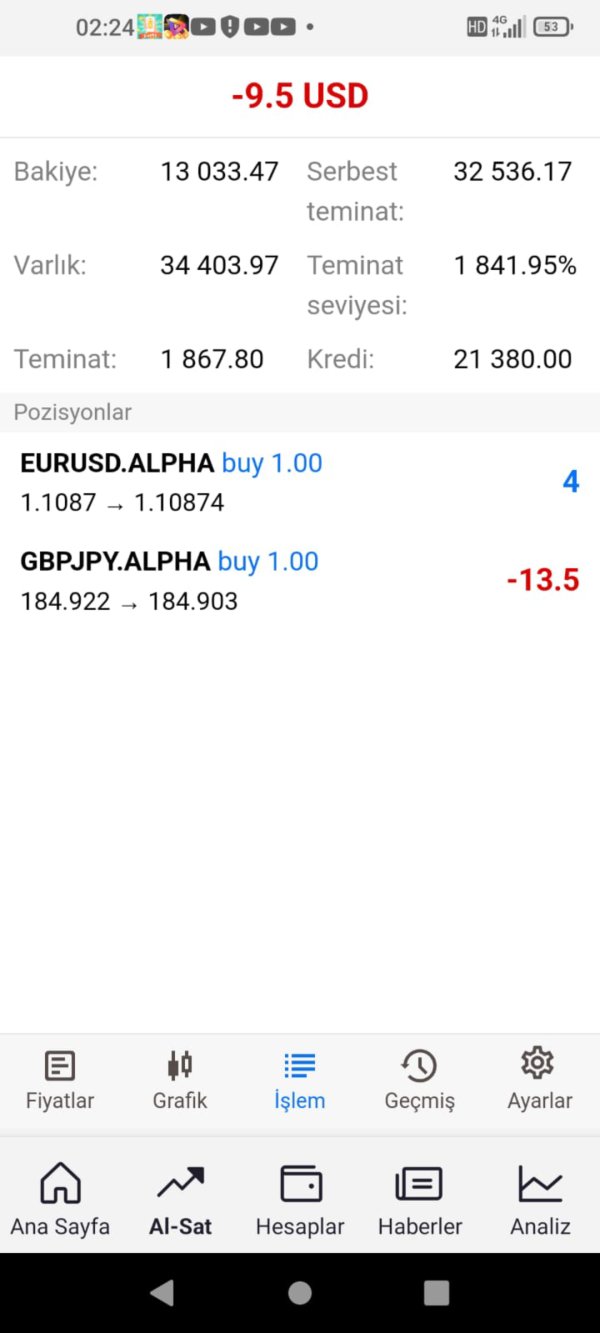

Tradeable Assets: The platform offers access to over 130 instruments across multiple categories. These include forex pairs, commodities like gold and oil, major cryptocurrencies, stock indices, and individual stock CFDs.

Cost Structure: Detailed information about spreads, commissions, and overnight financing charges is not readily available. This lacks the transparency expected from legitimate brokers in the financial industry.

Leverage Ratios: Specific leverage offerings have not been disclosed in available materials. This information gap makes it impossible for traders to assess risk management options.

Platform Options: The trading platform technology and software providers remain unspecified in this amxer markets review. Without this information, traders cannot evaluate the quality of the trading environment.

Geographic Restrictions: Information about restricted countries or regions is not clearly stated. This creates uncertainty for international traders about service availability.

Customer Support Languages: Available language support options are not specified in accessible documentation. This lack of information suggests limited international support capabilities.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Amxer Markets receives a poor rating for account conditions due to the complete lack of transparency. The broker provides virtually no information about account types, minimum deposits, and opening procedures that traders need to make informed decisions. Unlike established brokers that clearly outline their account tiers, features, and requirements, Amxer Markets leaves potential clients in the dark about what to expect.

The absence of detailed account specifications raises immediate red flags about the broker's professionalism. Legitimate brokers typically offer multiple account types catering to different trader experience levels and capital requirements, complete with clear fee structures and benefit comparisons that help clients choose appropriate services. The lack of information about Islamic accounts, which are standard offerings in the industry, further demonstrates the broker's inadequate service framework.

Without clear account opening procedures or verification requirements, potential clients cannot assess whether the broker meets their trading needs. This opacity also raises questions about compliance with anti-money laundering regulations that legitimate brokers must follow. The combination of missing information and unregulated status makes account conditions a significant weakness in this amxer markets review.

The broker's strongest aspect appears to be its claimed offering of over 130 trading instruments. This diversity potentially appeals to traders seeking exposure to various markets through a single platform, which can simplify portfolio management for some trading strategies. The range reportedly includes major forex pairs, commodities, cryptocurrencies, and equity indices, which could satisfy diverse trading approaches.

However, the quality and execution of these instruments remain questionable without proper regulatory oversight. While the quantity of available assets is noteworthy, the absence of detailed information about research tools, market analysis, or educational resources significantly limits the overall value proposition for serious traders. Established brokers typically provide comprehensive market research, economic calendars, technical analysis tools, and educational content to support trader decision-making.

The lack of information about automated trading support, API access, or advanced charting capabilities suggests limited technological infrastructure. Without these essential trading tools, even a wide asset selection loses much of its appeal for professional traders who require sophisticated analysis capabilities.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents a critical weakness for Amxer Markets. Multiple concerning factors have been identified in our investigation that suggest inadequate support infrastructure for client needs. The broker fails to provide clear information about available support channels, operating hours, or response time commitments.

This lack of transparency about customer service accessibility is particularly troubling for international traders. User feedback available online includes complaints about unresponsive customer support and difficulty reaching representatives when issues arise, creating frustration for clients who need assistance. The absence of live chat, comprehensive FAQ sections, or detailed contact information suggests inadequate investment in customer support infrastructure.

The language support options remain unclear, which could create additional barriers for international clients. Without proper customer service standards or accountability measures, traders face significant risks when problems occur with their accounts or transactions, leaving them with limited recourse for resolution.

Trading Experience Analysis (Score: 5/10)

The trading experience with Amxer Markets receives a below-average rating. Limited information is available about platform stability, execution quality, and overall functionality that traders need to evaluate before committing funds. While the broker claims to offer diverse trading instruments, the actual trading environment quality remains largely unknown without detailed platform specifications or performance data.

The absence of information about order execution speeds, slippage rates, or platform uptime statistics makes assessment impossible. Professional traders require reliable platform performance, especially during high-volatility market conditions, but Amxer Markets provides no assurance of meeting these critical standards for successful trading operations.

Mobile trading capabilities, which are essential in today's trading environment, are not clearly documented. The lack of information about platform features, charting tools, or order types suggests a potentially limited trading environment that may not meet sophisticated trader requirements in this amxer markets review.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most significant concerns with Amxer Markets. The broker earns the lowest possible rating due to multiple serious red flags that make it unsuitable for any serious trading activity. The broker operates without any regulatory authorization from recognized financial authorities, leaving traders without essential investor protections or recourse mechanisms.

Multiple industry watchdog websites have identified Amxer Markets as a potential scam. These warnings cite various suspicious practices and user complaints that suggest fraudulent operations designed to deceive traders and steal funds. The lack of regulatory oversight means no independent authority monitors the broker's operations, fund handling, or compliance with financial standards.

The company's transparency regarding its management team, financial backing, or operational history is virtually non-existent. Legitimate brokers typically provide detailed company information, regulatory status, and financial reports to build trust with potential clients and demonstrate their commitment to ethical business practices. The combination of regulatory absence and industry warnings makes trust and reliability the primary concern for anyone considering this broker.

User Experience Analysis (Score: 4/10)

User experience with Amxer Markets appears problematic based on available feedback. The overall user satisfaction seems low, with negative reviews and warnings from various sources suggesting significant problems with the broker's service delivery that affect client satisfaction. The registration and account verification processes are not clearly documented, which creates uncertainty for potential users about what to expect.

Interface design and platform usability cannot be properly assessed due to limited available information. The general lack of transparency suggests a poor user experience framework that fails to meet modern trading standards and client expectations. Common user complaints identified in our research include difficulties with customer service, concerns about fund security, and questions about the broker's legitimacy.

The absence of positive user testimonials or detailed success stories further indicates problematic user experiences. For traders considering this platform, the negative feedback patterns suggest significant risks to satisfactory service delivery that could result in financial losses and frustration.

Conclusion

This comprehensive amxer markets review reveals a broker with significant risks. These risks far outweigh any potential benefits that might attract traders to this platform. While Amxer Markets offers a diverse range of trading instruments across multiple asset classes, the complete absence of regulatory oversight, combined with multiple fraud warnings from industry watchdogs, makes it unsuitable for serious traders.

The broker may appeal to traders seeking diverse trading opportunities. However, the lack of transparency, poor customer service indicators, and potential scam warnings create unacceptable risks that could result in significant financial losses. The main advantage of instrument diversity is completely overshadowed by fundamental trust and reliability issues.

We strongly recommend that traders seek regulated alternatives with proper oversight. These alternatives should offer transparent operations and positive user feedback rather than risking capital with Amxer Markets, which presents too many red flags for safe trading.