Is LMAX Global Ltd safe?

Business

License

Is LMAX Global Ltd Safe or Scam?

Introduction

LMAX Global Ltd is a brokerage firm that operates within the foreign exchange (forex) market, providing access to various trading instruments including currencies, commodities, and cryptocurrencies. Established in 2008, LMAX has positioned itself as a reputable player in the forex industry, catering primarily to institutional and professional traders. However, the nature of forex trading requires traders to exercise caution when selecting a broker, as the industry is rife with both legitimate firms and potential scams. This article aims to provide a comprehensive analysis of LMAX Global Ltd, assessing its safety and legitimacy through a structured evaluation framework that includes regulatory compliance, company background, trading conditions, customer fund security, user experiences, platform performance, and risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its safety and legitimacy. LMAX Global Ltd claims to operate under several regulatory bodies, which is essential for ensuring that the broker adheres to strict financial standards and provides adequate protection for traders funds. The following table summarizes the core regulatory information for LMAX Global Ltd:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (UK) | 509778 | United Kingdom | Verified |

| CySEC (Cyprus) | 310/16 | Cyprus | Verified |

| FMA (New Zealand) | FSP612509 | New Zealand | Verified |

| FSC (Mauritius) | N/A | Mauritius | Verified |

The presence of multiple tier-1 regulators, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), indicates that LMAX Global Ltd is subject to rigorous oversight. This regulatory framework is designed to protect traders from fraud and mismanagement, ensuring that client funds are held in segregated accounts and that the broker operates transparently. However, it is crucial to note that while LMAX is regulated, some entities under its umbrella, such as LMAX Global Ltd, have faced scrutiny regarding their operational practices, leading to mixed reviews in the market. Overall, the regulatory quality surrounding LMAX Global Ltd supports the assertion that it is a safe broker, provided traders are aware of the specific entity they are dealing with.

Company Background Investigation

LMAX Global Ltd is part of the LMAX Group, which has established itself as a leading independent operator in the forex and digital assets markets. Founded in 2008, the company has grown significantly, providing a multilateral trading facility (MTF) that emphasizes transparency and efficiency. The ownership structure of LMAX Group includes various institutional investors, which adds a layer of credibility to its operations.

The management team at LMAX Global Ltd comprises experienced professionals with extensive backgrounds in finance and technology. This expertise is reflected in the brokers commitment to providing high-quality trading services and innovative technological solutions. Transparency and information disclosure are also prioritized by LMAX, as evidenced by the availability of regulatory documents and operational details on its official website. This level of openness is a positive indicator of the broker's legitimacy and reliability, reinforcing the notion that LMAX Global Ltd is a safe option for traders.

Trading Conditions Analysis

When considering whether LMAX Global Ltd is safe, it is essential to examine its trading conditions, which include fees, spreads, and commissions. The broker operates under a commission-based model, which is generally favorable for traders who engage in high-volume trading. Below is a comparison of core trading costs associated with LMAX Global Ltd and the industry average:

| Fee Type | LMAX Global Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.5 pips |

| Commission Model | From $2.50 per $100,000 | $4.00 per $100,000 |

| Overnight Interest Range | Variable | Variable |

LMAX Global Ltd offers competitive spreads, particularly for major currency pairs, which is a significant advantage for traders looking to minimize trading costs. The commission structure is also relatively low compared to industry averages, making it an attractive option for active traders. However, potential clients should be aware of the high minimum deposit requirement of $10,000, which may limit access for novice traders or those with smaller capital. Overall, the trading conditions at LMAX Global Ltd suggest that it is a safe choice for experienced traders who can meet the financial commitment.

Customer Fund Security

The safety of customer funds is paramount when evaluating the reliability of a forex broker. LMAX Global Ltd employs several measures to ensure the security of client funds, including the segregation of accounts and participation in investor compensation schemes. Client funds are held in segregated accounts at top-tier banks, which means that in the event of the broker's insolvency, client funds remain protected. Furthermore, LMAX participates in the Financial Services Compensation Scheme (FSCS) in the UK, which provides additional protection for eligible clients up to £85,000.

Moreover, LMAX Global Ltd implements negative balance protection policies, ensuring that traders cannot lose more than their deposited amount. This is a critical feature that enhances the safety of trading with LMAX, as it mitigates the risk of significant financial loss. While LMAX has not faced major controversies regarding fund security, potential clients should remain vigilant and conduct their due diligence to ensure that they are trading with the correct entity under the LMAX umbrella. Overall, the measures in place for customer fund security reinforce the conclusion that LMAX Global Ltd is a safe broker.

Customer Experience and Complaints

Analyzing customer feedback is essential to gauge the overall experience of traders with LMAX Global Ltd. Reviews from users indicate a mixed experience, with some praising the broker's execution quality and customer service, while others express concerns about withdrawal issues and high minimum deposits. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

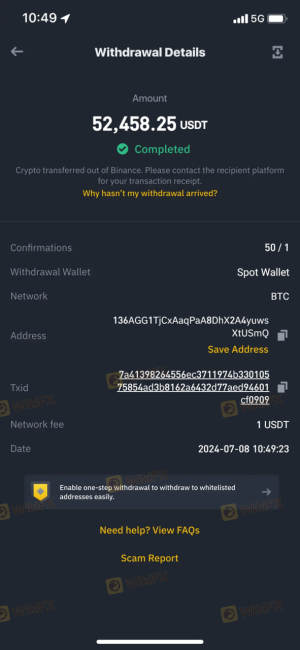

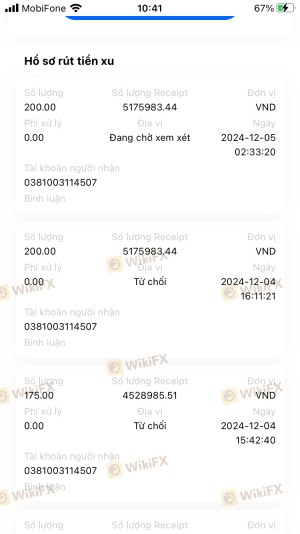

| Withdrawal Delays | High | Slow response times |

| High Minimum Deposit | Medium | Standard policy |

| Customer Service Availability | Low | Generally responsive |

One notable case involved a trader who reported difficulties in withdrawing funds after meeting the necessary trading conditions. The broker's response was deemed inadequate, leading to frustration for the affected trader. Another trader highlighted the high minimum deposit requirement as a barrier to entry, particularly for beginner traders. These complaints underscore the importance of transparency and effective communication in maintaining customer trust.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors for traders when assessing a broker's safety. LMAX Global Ltd offers a proprietary trading platform along with access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The platform is designed to provide low-latency execution and a user-friendly interface, catering to the needs of professional traders.

In terms of order execution quality, LMAX Global Ltd boasts a high-speed execution model, with orders typically processed in less than three milliseconds. This level of efficiency is crucial for traders who rely on timely execution to capitalize on market opportunities. However, some users have reported instances of slippage and rejected orders, which can be concerning for those trading in volatile market conditions. Overall, the platform's performance and execution capabilities suggest that LMAX Global Ltd is a safe broker, particularly for traders who prioritize speed and reliability.

Risk Assessment

While LMAX Global Ltd offers several advantages, it is essential to consider the potential risks associated with trading through the broker. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by reputable authorities |

| Financial Risk | Medium | High minimum deposit may limit access |

| Operational Risk | Medium | Potential withdrawal issues reported by users |

To mitigate these risks, traders are advised to thoroughly research the broker, understand its policies, and ensure they are comfortable with the financial commitment required. Additionally, maintaining a diversified trading portfolio can help manage exposure to market fluctuations.

Conclusion and Recommendations

In conclusion, LMAX Global Ltd presents itself as a reputable and regulated broker within the forex market, with robust safety measures in place to protect customer funds. The broker's regulatory compliance, competitive trading conditions, and commitment to transparency contribute to its overall reliability. However, potential clients should remain cautious regarding the high minimum deposit requirement and be aware of mixed customer experiences related to withdrawals.

For traders seeking a safe and reliable forex broker, LMAX Global Ltd is a viable option, particularly for those with substantial trading capital. However, novice traders or those with limited funds may want to explore alternative brokers that offer lower minimum deposit requirements and more accessible trading conditions. Overall, while LMAX Global Ltd is not a scam, it is essential for traders to conduct their due diligence and ensure that they are comfortable with the broker's terms before proceeding.

Is LMAX Global Ltd a scam, or is it legit?

The latest exposure and evaluation content of LMAX Global Ltd brokers.

LMAX Global Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LMAX Global Ltd latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.