AlgoFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive algofx review reveals major concerns about this forex and cryptocurrency broker. Traders should think carefully before opening an account with them. AlgoFX started in 2023 and has its headquarters in the United States, positioning itself as a provider of algorithmic trading solutions for forex and cryptocurrency markets. However, user feedback shows a troubling picture of the broker's services and reliability.

The platform offers high leverage up to 1:500. It uses the MT5 trading platform for executing trades across various asset classes including forex pairs, gold, silver, oil, and natural gas. Despite these potentially attractive features, AlgoFX has received mostly negative reviews from actual users, with multiple complaints about service quality and withdrawal issues.

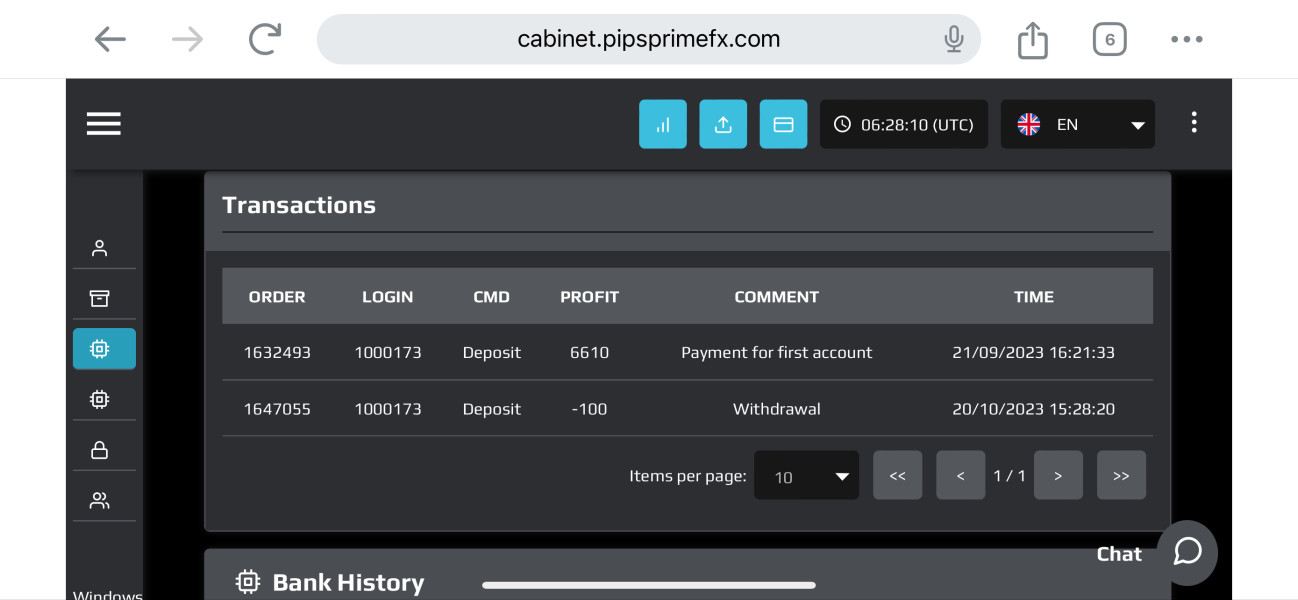

According to WikiFX monitoring data, AlgoFX has received very few positive reviews while building up concerning exposure reports from unhappy clients. One particularly notable complaint involves a user who deposited $6,610 in September 2023 and later described AlgoFX as "the worst broker." These red flags suggest that while the broker may offer competitive trading conditions on paper, the actual user experience falls far short of industry standards, making it unsuitable for most traders, especially beginners seeking a reliable trading environment.

Important Notice

This review is based on available public information and user feedback as of 2025. Potential traders should know that specific regulatory information was not clearly disclosed in available materials, which raises additional concerns about the broker's transparency and compliance status. Our evaluation method includes user testimonials, platform analysis, and market research to provide an objective assessment.

Given the limited regulatory disclosure and negative user experiences documented, traders are strongly advised to conduct thorough research and consider alternative brokers with stronger track records and clearer regulatory standing before making any investment decisions.

Rating Framework

Broker Overview

AlgoFX entered the competitive forex and cryptocurrency brokerage market in 2023. The company positions itself as a technology-focused trading solutions provider based in the United States. The company's business model centers around algorithmic trading services, targeting traders interested in automated and systematic trading approaches across multiple financial markets. Despite its relatively recent establishment, AlgoFX has attempted to stand out through high leverage offerings and comprehensive asset coverage.

The broker's operational framework includes the widely-recognized MT5 trading platform. This platform provides access to forex pairs, precious metals including gold and silver, and energy commodities such as oil and natural gas. This algofx review indicates that while the company has structured itself to serve both retail and institutional clients, the execution of these services has fallen short of industry standards. The lack of detailed regulatory information in publicly available materials raises questions about the broker's compliance status and operational transparency, factors that are crucial for trader confidence and fund security.

Regulatory Status: Available materials do not provide clear information about specific regulatory licenses or oversight bodies. This represents a significant transparency concern for potential clients.

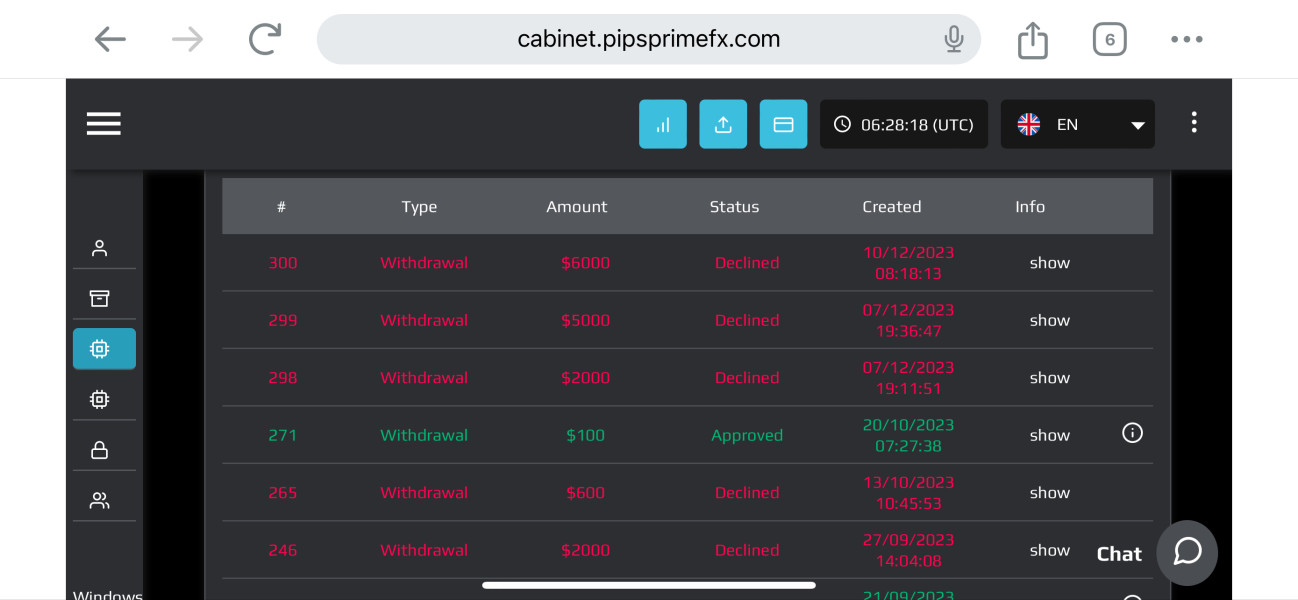

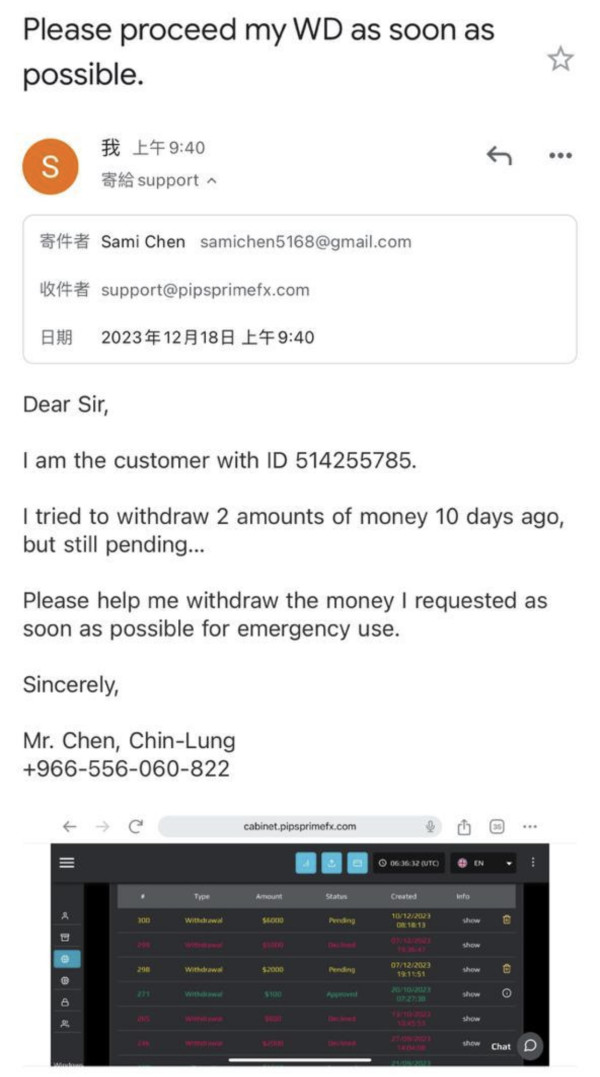

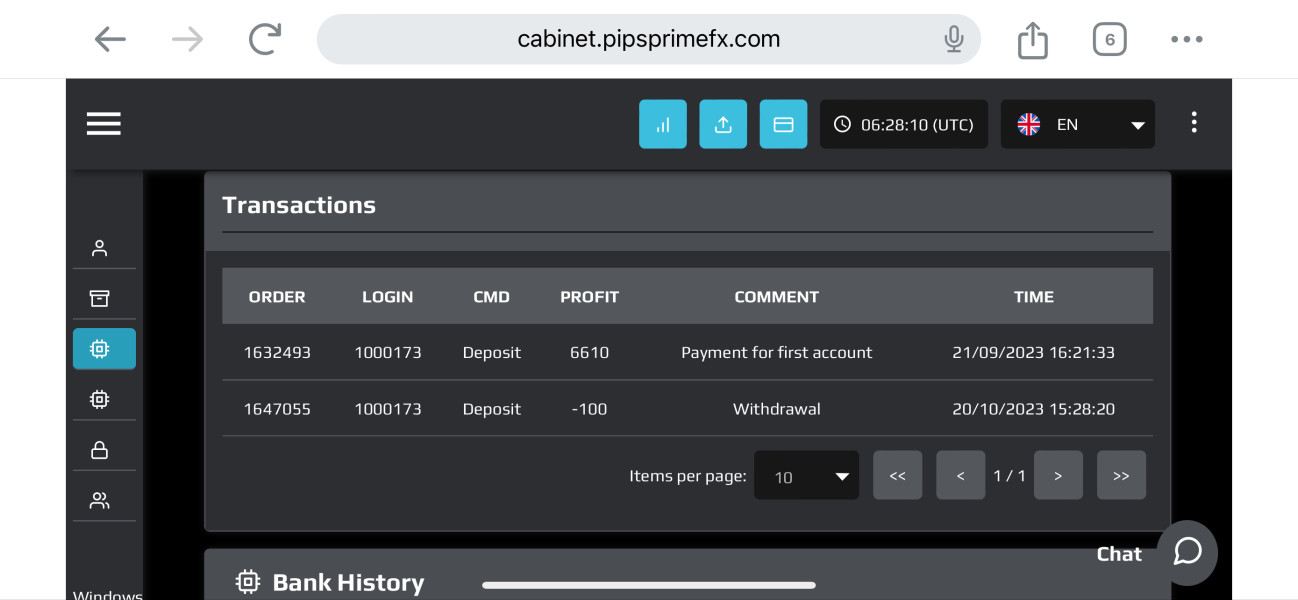

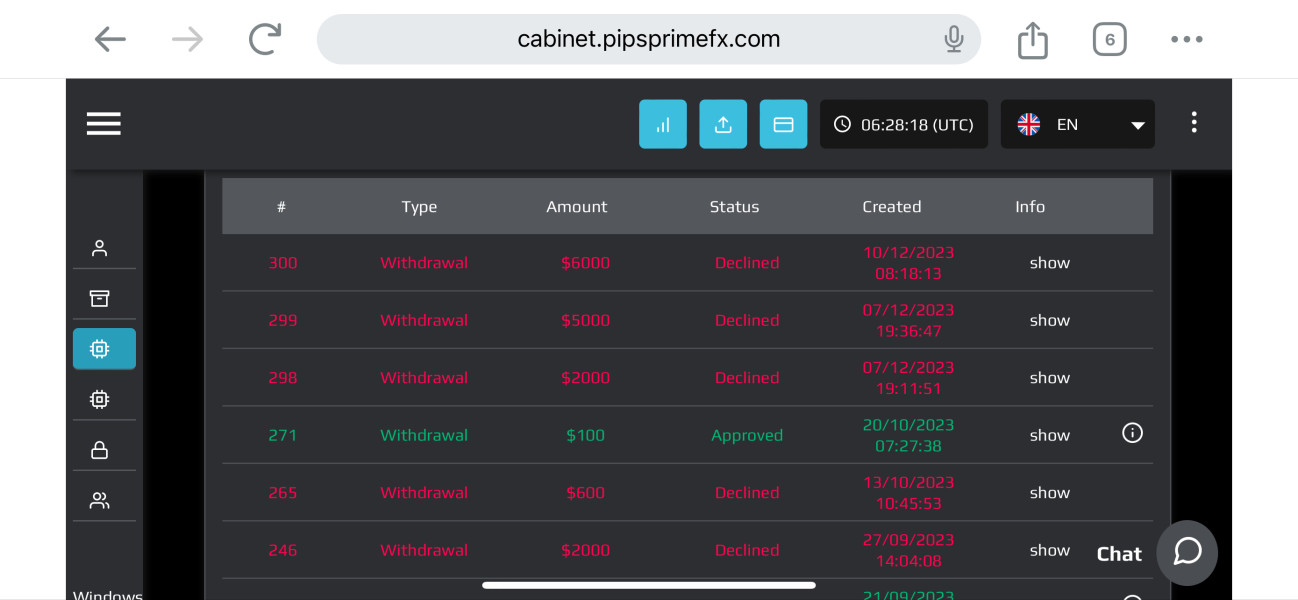

Deposit and Withdrawal Methods: Specific information about available payment methods and processing procedures was not detailed in accessible documentation. However, user complaints suggest potential issues with withdrawal processing.

Minimum Deposit Requirements: While exact minimum deposit amounts are not specified in available materials, user reports indicate deposits of substantial amounts mentioned in one case without satisfactory service delivery.

Bonuses and Promotions: No specific promotional offers or bonus structures were identified in the available information. This suggests either limited marketing initiatives or poor disclosure practices.

Tradeable Assets: The platform provides access to forex currency pairs, precious metals, and energy commodities. This offers reasonable diversification for algorithmic trading strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not clearly disclosed in available materials. This hampers transparent cost comparison with competitors.

Leverage Options: Maximum leverage reaches 1:500. This is competitive within the industry and may appeal to traders seeking higher position sizing capabilities.

Platform Options: MT5 trading platform serves as the primary trading interface. It provides advanced charting, automated trading capabilities, and comprehensive market analysis tools.

Geographic Restrictions: Specific information about restricted jurisdictions was not detailed in available documentation.

Customer Support Languages: Available customer service languages and support hours were not clearly specified in accessible materials. However, contact information includes WhatsApp and email.

This algofx review reveals concerning gaps in basic operational transparency that potential clients should carefully consider.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

AlgoFX's account conditions present several areas of concern that contribute to its low rating in this category. The broker's lack of transparency regarding account types, minimum deposit requirements, and specific account features creates uncertainty for potential traders. Available information does not detail whether the broker offers multiple account tiers, Islamic accounts for Muslim traders, or specialized institutional accounts.

The most significant red flag comes from actual user experiences. One documented case shows a trader depositing $6,610 in September 2023 only to later describe AlgoFX as "the worst broker." This substantial deposit amount suggests that the broker may require significant minimum deposits, but the poor subsequent experience indicates that higher deposits do not translate to better service quality.

The account opening process details remain unclear from available materials. There is no information about account verification requirements, documentation needs, or processing timeframes. This lack of transparency extends to account management features, special conditions, and any potential account-related fees beyond trading costs.

Compared to established brokers that provide detailed account specifications, fee structures, and clear terms of service, AlgoFX falls significantly short in this algofx review analysis. The combination of poor user experiences and limited disclosure makes the account conditions unsuitable for most traders seeking reliable and transparent trading environments.

AlgoFX receives a moderate rating for tools and resources primarily due to its use of the MT5 trading platform. This platform provides a robust foundation for trading activities. MT5 offers advanced charting capabilities, automated trading through Expert Advisors, and comprehensive market analysis tools that can support both manual and algorithmic trading strategies.

The platform supports trading across multiple asset classes including forex pairs, precious metals, and energy commodities. This provides reasonable diversification opportunities for traders. The algorithmic trading focus aligns with MT5's capabilities for automated strategy implementation and backtesting, which could appeal to technically-oriented traders.

However, available materials do not indicate comprehensive educational resources, market research, or analytical tools beyond the standard MT5 offerings. Many competitive brokers provide proprietary research, daily market analysis, economic calendars, and educational webinars that enhance the trading experience. The absence of detailed information about such value-added services suggests either limited offerings or poor marketing communication.

Additionally, there is no clear information about mobile trading applications, web-based platforms, or additional trading tools that might complement the MT5 environment. The lack of detailed platform specifications, server locations, or execution technology details further limits the assessment of the broker's technical infrastructure quality.

Customer Service and Support Analysis (3/10)

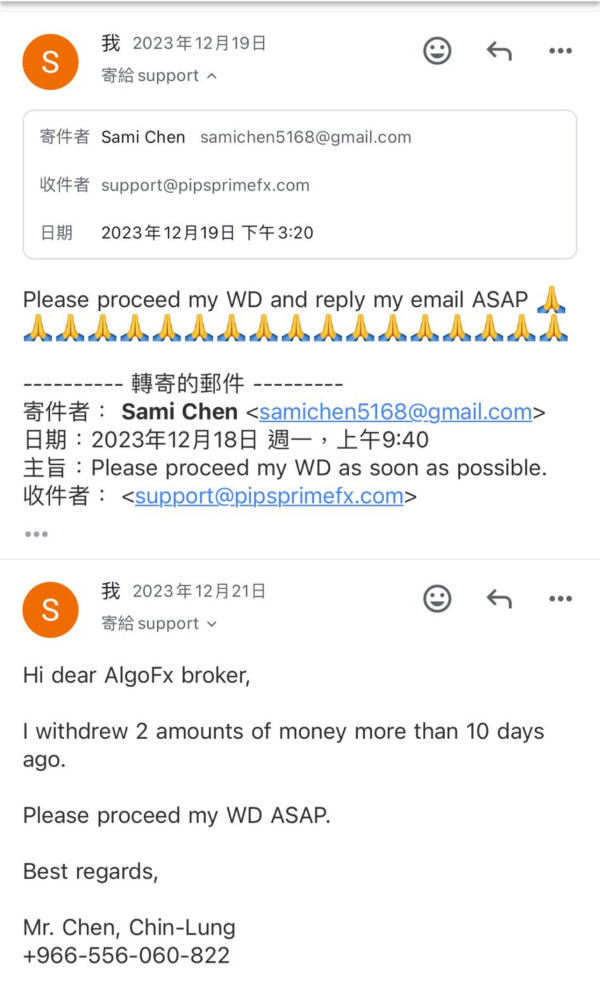

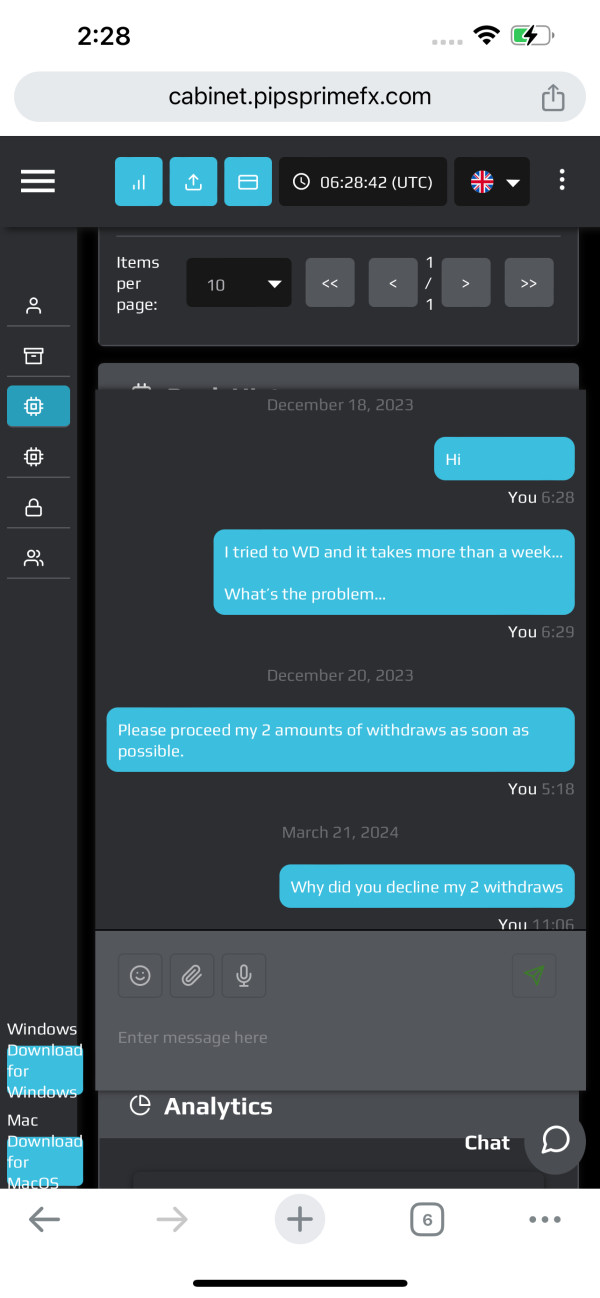

Customer service represents one of AlgoFX's weakest areas based on available user feedback and documented complaints. The broker's customer support has received mostly negative reviews, with users expressing frustration about response times, service quality, and problem resolution effectiveness.

According to WikiFX monitoring data, AlgoFX has built up exposure reports indicating customer service failures and unresolved complaints. The documented case of a user depositing $6,610 and later calling AlgoFX "the worst broker" suggests systematic issues in customer relationship management and support quality.

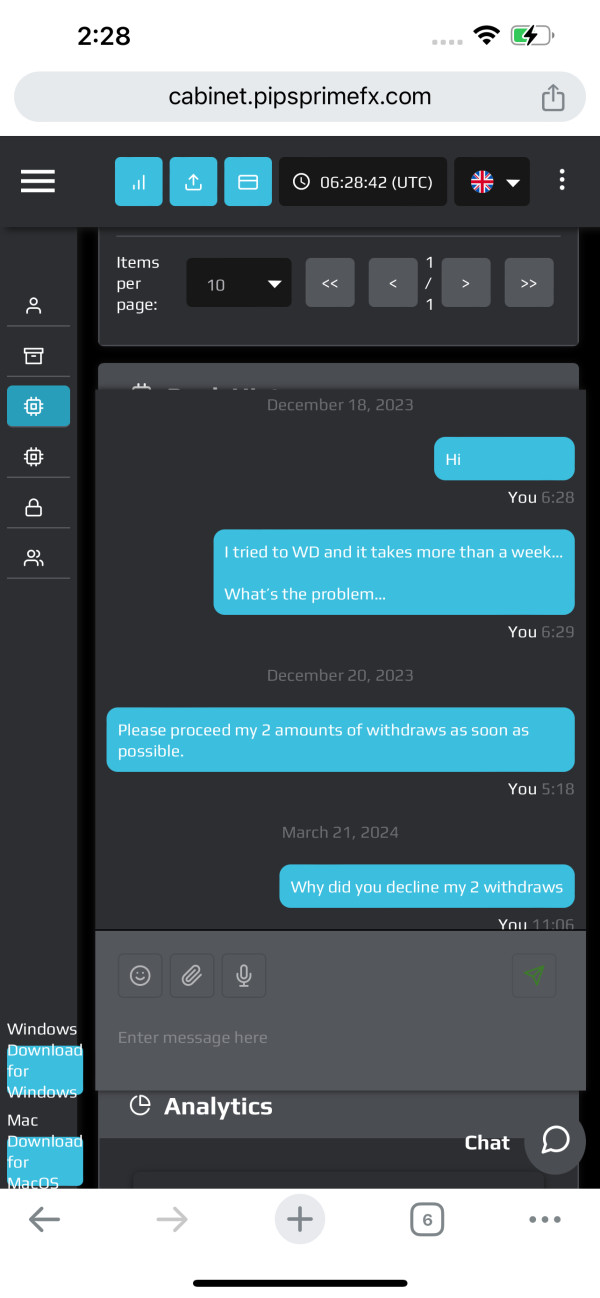

Available contact information includes WhatsApp and email, but there is no information about support hours, response time commitments, or escalation procedures. The lack of multiple communication channels like live chat, phone support, or comprehensive FAQ sections indicates limited support infrastructure.

Furthermore, there is no information about multilingual support capabilities. This is crucial for an international broker serving diverse markets. The absence of detailed support policies, complaint handling procedures, or customer service standards suggests either inadequate service frameworks or poor transparency in service delivery commitments.

The combination of negative user experiences, limited contact options, and poor complaint resolution creates significant concerns about the broker's ability to provide adequate customer support when issues arise.

Trading Experience Analysis (5/10)

The trading experience at AlgoFX receives a mixed rating due to contrasting factors between platform capabilities and user satisfaction. While the MT5 platform provides a solid technical foundation with advanced trading features, actual user experiences suggest significant implementation and service delivery issues.

MT5 offers comprehensive trading functionalities including advanced order types, algorithmic trading capabilities, and sophisticated charting tools. The platform's stability and feature set are generally well-regarded in the industry, providing the technical infrastructure necessary for effective trading across multiple asset classes.

However, user feedback indicates problems with the overall trading environment that extend beyond platform capabilities. The documented negative experiences suggest potential issues with order execution, platform stability, or broker-specific implementation problems that affect the practical trading experience.

The lack of detailed information about execution speeds, slippage rates, or platform uptime statistics makes it difficult to assess the technical quality of trade execution. Additionally, there is no information about trading conditions during high-volatility periods or the broker's ability to maintain service quality during market stress.

This algofx review indicates that while the underlying MT5 technology provides strong capabilities, the broker's implementation and service delivery significantly undermines the potential trading experience. This results in user dissatisfaction despite the technical foundation.

Trust and Safety Analysis (2/10)

Trust and safety represent critical concerns for AlgoFX, earning the lowest rating among all evaluation criteria. The broker's lack of clear regulatory disclosure creates immediate transparency issues that affect trader confidence and fund security assessments.

Available materials do not provide specific information about regulatory licenses, oversight bodies, or compliance frameworks that would typically assure traders of proper operational standards. This regulatory ambiguity is particularly concerning for international traders who rely on regulatory protection for fund security and dispute resolution.

The broker has been subject to allegations of fraudulent practices, with multiple sources describing it as a problematic platform. WikiFX monitoring data indicates exposure reports and negative user experiences that suggest systematic issues rather than isolated incidents. The documented case of significant user dissatisfaction after a substantial deposit raises serious questions about the broker's operational integrity.

Additionally, there is no information about fund segregation practices, insurance coverage, or other client protection measures that established brokers typically implement. The absence of clear terms of service, privacy policies, or regulatory compliance statements further undermines confidence in the broker's operational standards.

The combination of regulatory ambiguity, negative user reports, and lack of standard protection disclosures creates a high-risk environment. This makes AlgoFX unsuitable for traders prioritizing fund security and regulatory protection.

User Experience Analysis (4/10)

User experience at AlgoFX has been mostly negative based on available feedback and documented complaints. The overall user satisfaction appears significantly below industry standards, with multiple reports of dissatisfaction and service quality issues.

The most notable user feedback comes from a trader who deposited $6,610 in September 2023 and later described AlgoFX as "the worst broker." This indicates severe dissatisfaction with the overall service experience. This substantial negative feedback suggests systematic issues affecting multiple aspects of the user journey.

Available information does not provide details about the registration process, account verification procedures, or onboarding experience. This makes it difficult to assess the initial user experience. However, the documented post-deposit experiences suggest that even after successful account funding, users encounter significant service quality issues.

The lack of information about user interface design, platform usability, or customer satisfaction surveys indicates either poor user experience monitoring or inadequate disclosure of user feedback data. Additionally, there is no evidence of user experience improvements or customer satisfaction initiatives.

Common user complaints appear to center around customer service quality and withdrawal processing issues. This suggests that the problems extend beyond trading functionality to core business operations. The absence of positive user testimonials or satisfaction indicators further reinforces concerns about the overall user experience quality.

Conclusion

This comprehensive algofx review reveals significant concerns that make AlgoFX unsuitable for most traders, particularly beginners or risk-averse investors. While the broker offers potentially attractive features such as high leverage up to 1:500 and the robust MT5 trading platform, these advantages are overshadowed by serious deficiencies in service delivery, transparency, and user satisfaction.

The broker's lack of clear regulatory disclosure, combined with mostly negative user feedback and documented complaints, creates a high-risk environment. This contradicts the security and reliability that traders should expect from a financial services provider. The documented case of substantial user dissatisfaction following a significant deposit highlights systematic service quality issues that extend beyond isolated incidents.

For traders seeking reliable, transparent, and well-regulated trading environments, AlgoFX's current operational standards fall significantly short of industry expectations. The combination of regulatory ambiguity, poor customer service ratings, and negative user experiences makes this broker inappropriate for serious trading activities, regardless of the technical capabilities offered through the MT5 platform.