CGL 2025 Review: Everything You Need to Know

CGL, a forex broker, has drawn mixed reviews from users and analysts alike. While some users praise its low fees and quick transactions, others express serious concerns about withdrawal issues and lack of regulatory oversight. This review will delve into the key features and findings regarding CGL, offering insights into user experiences, pros and cons, and expert opinions.

Note: It is essential to consider the regulatory landscape across different regions, as CGL operates under various entities that may not be uniformly regulated. This review aims for fairness and accuracy by synthesizing information from multiple sources.

Rating Overview

How We Score Brokers: Our scoring is based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's services.

Broker Overview

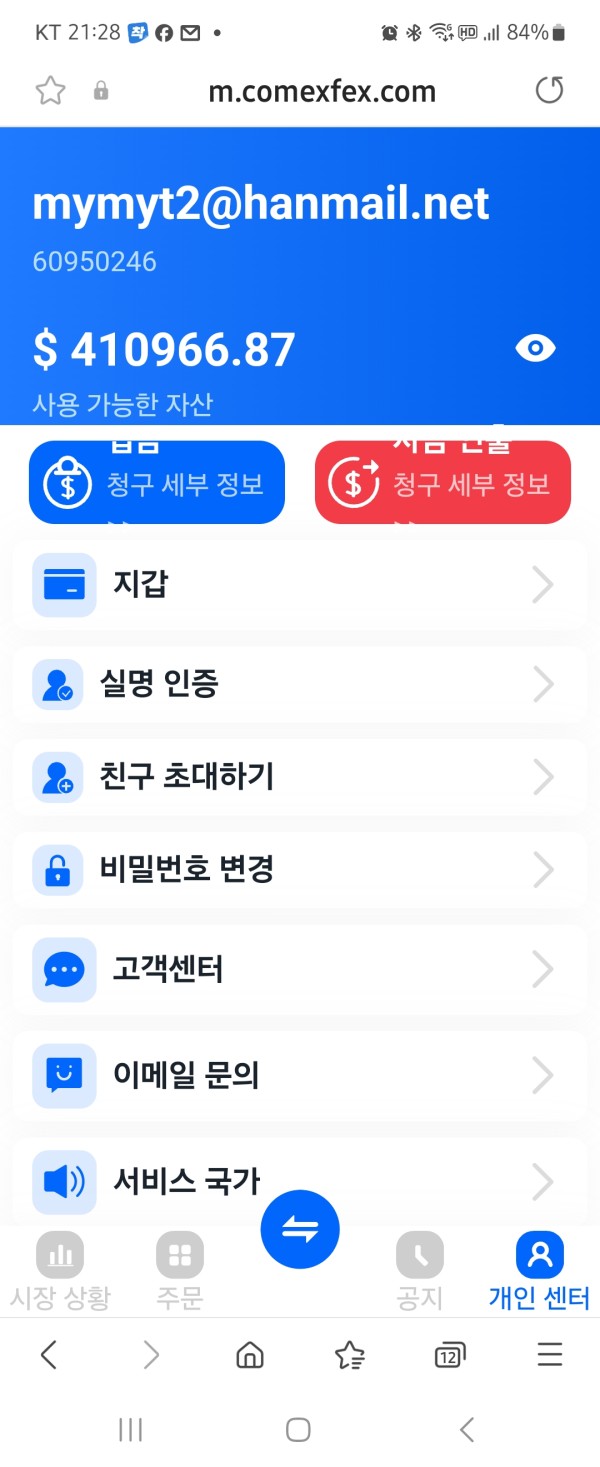

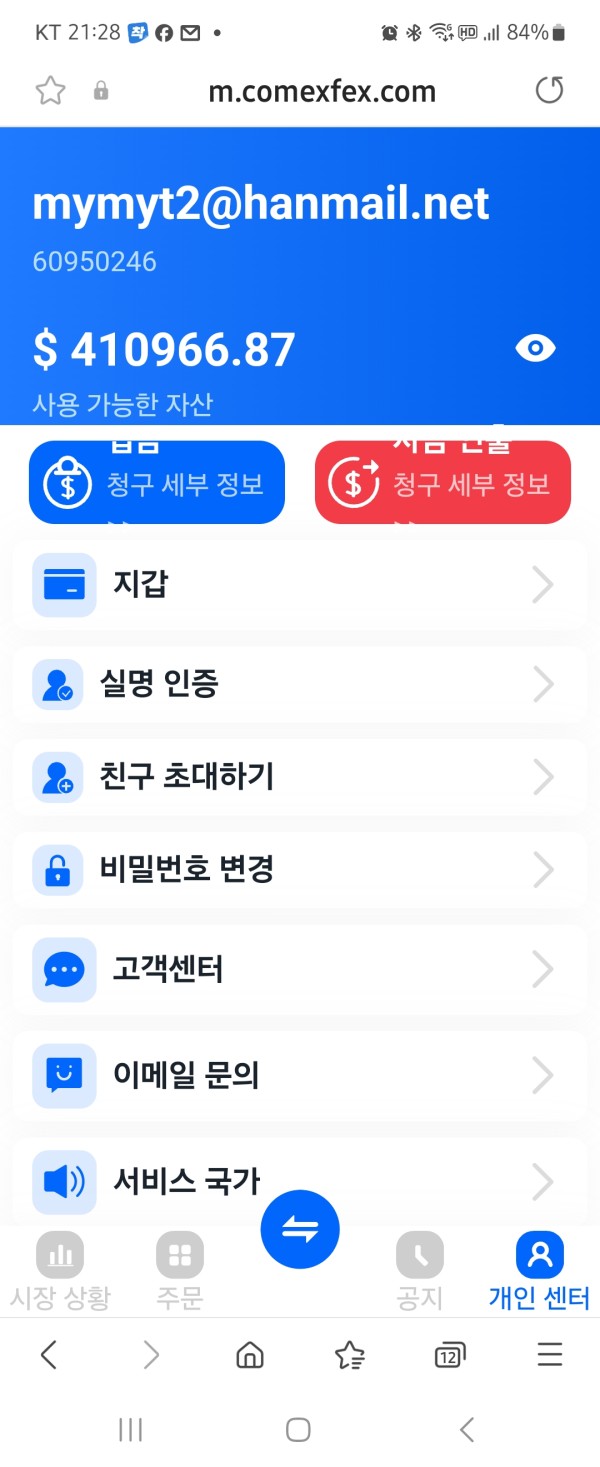

CGL is an online forex broker that has been associated with varying degrees of legitimacy. Specific founding details are sparse, but it is reported that the broker operates under the name Comex Group Ltd. CGL offers trading platforms like MT4 and MT5, allowing users to engage in forex, cryptocurrencies, and commodities trading. However, it lacks proper regulatory oversight, raising concerns about the safety of user funds.

Detailed Section

-

Regulated Geographical Areas/Regions: CGL claims to operate under a regulatory license from the Hong Kong SFC, but this has been flagged as potentially suspicious. There are indications that it may be a clone of a regulated entity, which is a significant red flag for potential investors.

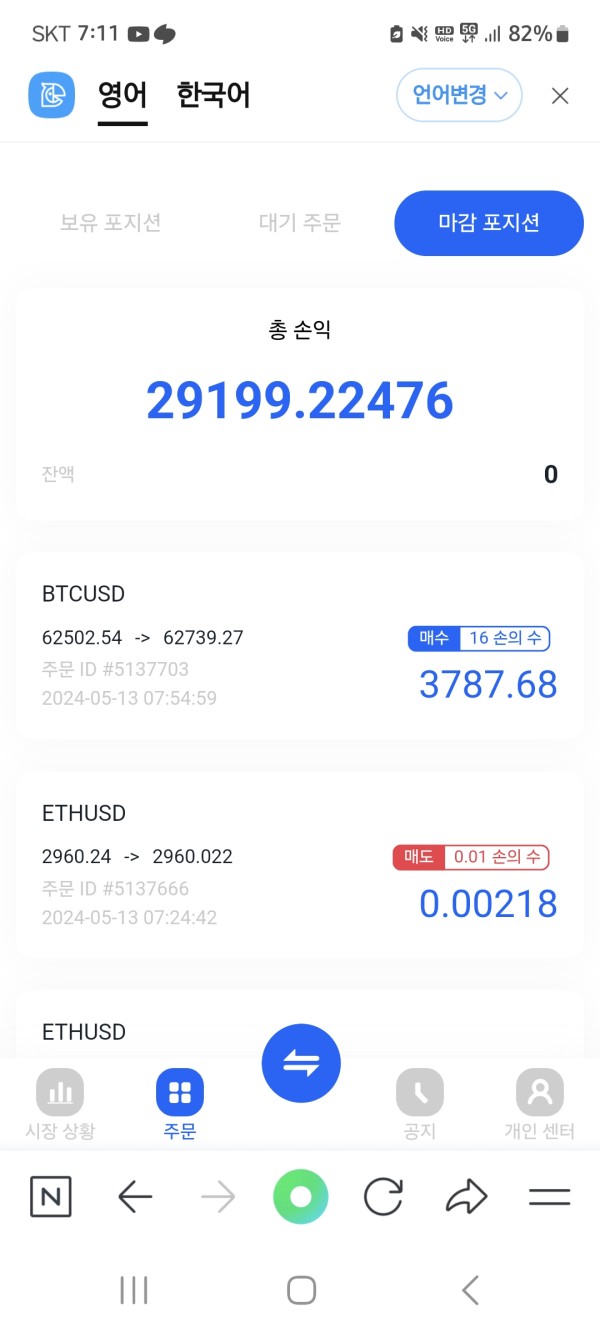

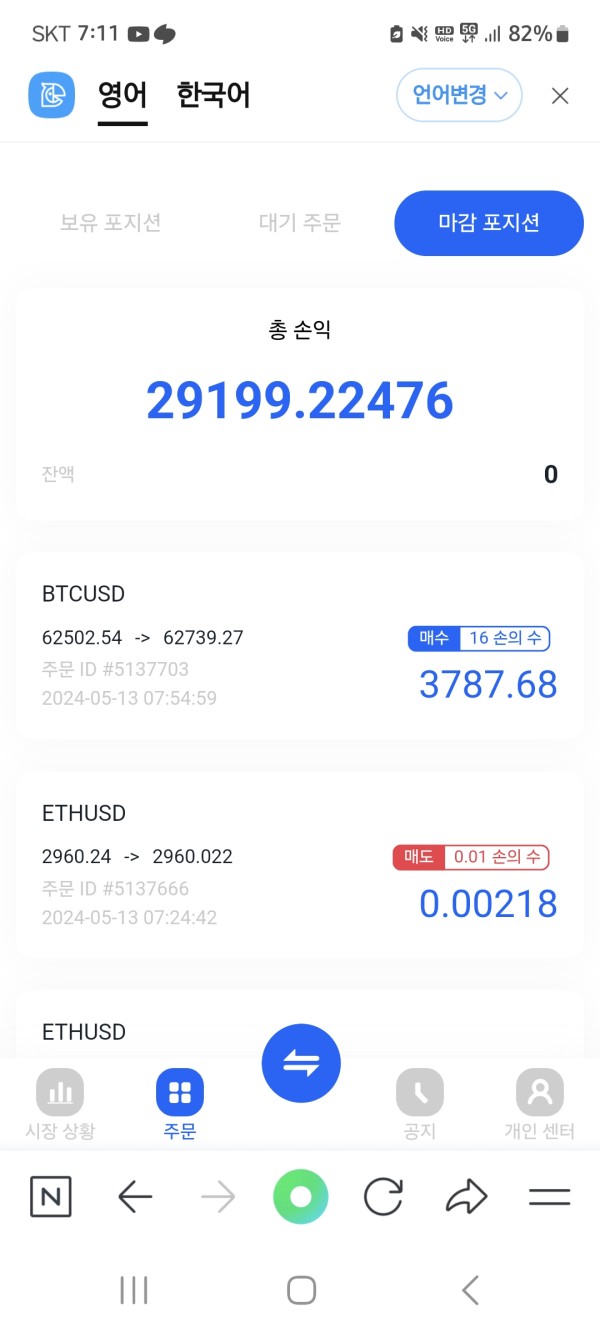

Deposit/Withdrawal Currencies/Cryptocurrencies: The specifics regarding deposit and withdrawal methods are unclear, with reports of users facing difficulties when trying to access their funds. There have been claims of excessive fees and delayed withdrawals, which are common indicators of fraudulent platforms.

Minimum Deposit: Exact figures for the minimum deposit required to open an account with CGL are not consistently reported across sources, but users have mentioned varying amounts, leading to confusion.

Bonuses/Promotions: There is little information about current promotions or bonuses offered by CGL, which is unusual for most brokers. This lack of transparency can be a cause for concern.

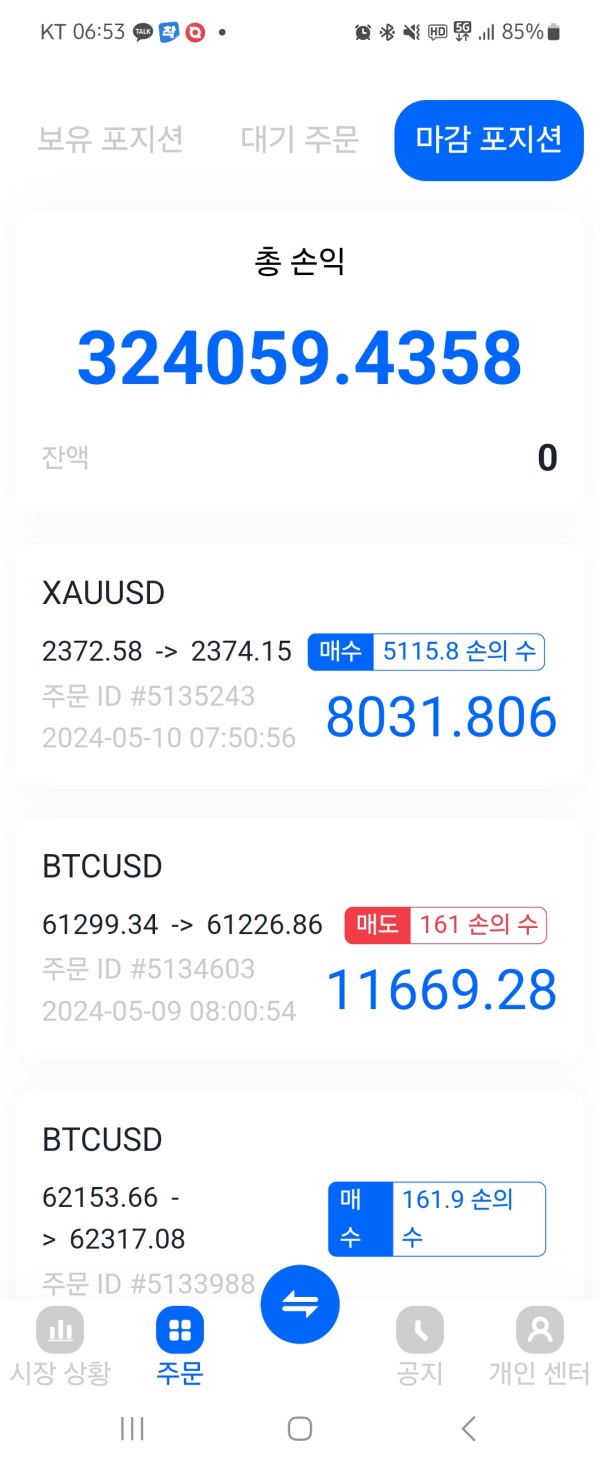

Tradable Asset Classes: CGL offers a variety of trading options, including forex pairs, cryptocurrencies, and commodities. However, the depth of these offerings and the quality of execution remain questionable.

Costs (Spreads, Fees, Commissions): Users have reported low fees, but there are significant concerns about hidden charges that can emerge during the withdrawal process. This inconsistency in user experience highlights the lack of transparency.

Leverage: Information regarding leverage options is not clearly stated, which is an essential aspect for traders looking to maximize their positions.

Allowed Trading Platforms: CGL supports popular trading platforms such as MT4 and MT5, which are well-regarded in the trading community. However, user experiences with these platforms have been mixed, particularly concerning app stability.

Restricted Regions: There is no clear information on the regions where CGL is restricted, but given its lack of regulation, it may not be advisable for traders in heavily regulated jurisdictions.

Available Customer Service Languages: Customer support appears to be limited, with reports of unresponsive service. Users have expressed frustration over the difficulty of reaching support, which is a critical factor for traders.

Rating Breakdown

-

Account Conditions (3/10): The account conditions are not clearly defined, and the lack of transparency regarding minimum deposits and withdrawal processes raises concerns.

Tools and Resources (4/10): While CGL offers popular trading platforms, the user experience is marred by reports of app stability issues, making trading difficult during volatile market conditions.

Customer Service & Support (2/10): Users have consistently reported poor customer service, with many complaints about unresponsive support when withdrawal issues arise.

Trading Experience (3/10): The overall trading experience is hindered by technical issues and withdrawal problems, leading to a negative perception among users.

Trustworthiness (1/10): The lack of regulatory oversight and numerous reports of withdrawal issues categorize CGL as a potentially untrustworthy broker.

User Experience (2/10): User experiences vary widely, but the negative reports significantly outweigh the positive, indicating a troubling trend.

Detailed Breakdown

-

Account Conditions: Users have reported unclear account conditions, with some claiming they faced unexpected fees when attempting to withdraw funds. This lack of clarity can deter potential investors.

Tools and Resources: Although CGL provides access to popular trading platforms, the reported instability of the mobile app is a significant disadvantage. Users have shared experiences of the app freezing during trades, leading to losses.

Customer Service & Support: The customer service offered by CGL has been heavily criticized. Users have reported long wait times and unhelpful responses, particularly when trying to resolve withdrawal issues.

Trading Experience: The trading experience has been marred by technical issues, with many users complaining about the app's performance during critical trading moments.

Trustworthiness: CGL's trustworthiness is highly questionable due to its lack of regulation and numerous negative reviews regarding fund withdrawal.

User Experience: The user experience is largely negative, with many traders expressing frustration over the inability to withdraw funds and the overall lack of support from the broker.

In conclusion, while CGL may present itself as an attractive option for forex trading, the significant concerns regarding its regulatory status, withdrawal issues, and customer service cannot be overlooked. Potential investors should proceed with caution and consider more reputable alternatives before committing their funds.