Executive Summary

This comprehensive HT Global review examines the broker's legitimacy, services, and overall performance in the competitive forex trading landscape. HT Global presents itself as a provider of diversified investment opportunities across forex, commodities, and cryptocurrency markets. However, our analysis reveals a mixed picture regarding the company's credibility and operational transparency. The findings raise several important concerns.

Based on available employee feedback from Glassdoor, HT Global Circuits maintains a concerning employee recommendation rate of only 48%, with ratings showing a 3% decline. Multiple sources, including WikiFX and industry reports, have raised red flags about potential fraudulent activities associated with the company. These concerns significantly impact the broker's overall trustworthiness rating. The evidence suggests serious operational issues.

The broker operates through different entities, including HT Global Consultancy established in 2012 and HT Global Trading, Inc., both registered in California. While the company offers access to popular trading markets including forex, commodities, and cryptocurrencies, the lack of clear regulatory information and transparency issues present substantial risks for potential clients. This creates a complex regulatory landscape.

This HT Global review concludes with a neutral-to-negative assessment, primarily targeting traders seeking exposure to forex, commodity, and cryptocurrency markets who are willing to accept higher risk levels. However, prospective clients should exercise extreme caution due to documented concerns about the company's business practices and regulatory status. The risks outweigh the potential benefits.

Important Disclaimers

Regional Entity Differences: HT Global operates through multiple entities across different jurisdictions. HT Global Consultancy is based in Los Angeles, California, while HT Global Trading, Inc. is registered in Monrovia, California. These different registrations may affect service quality, regulatory oversight, and client protection measures. Potential clients should verify which entity they would be dealing with and understand the implications for their trading relationship. This verification process is crucial.

Review Methodology: This evaluation is based on employee reviews from Glassdoor, third-party financial websites including WikiFX, and publicly available company information. The assessment may contain subjective elements and time-sensitive information that could change. Due to limited publicly available data about specific trading conditions and regulatory status, some sections rely on industry standards and comparative analysis rather than company-specific details. These limitations affect our conclusions.

Overall Rating Framework

Broker Overview

HT Global Consultancy was established in 2012, positioning itself as a financial services provider in the competitive trading industry. The company operates from Los Angeles, California, with an additional entity, HT Global Trading, Inc., registered in Monrovia, California. According to Bizapedia records, the company has maintained its registration status, though specific details about its operational history and growth trajectory remain limited in publicly available sources. This lack of transparency raises questions.

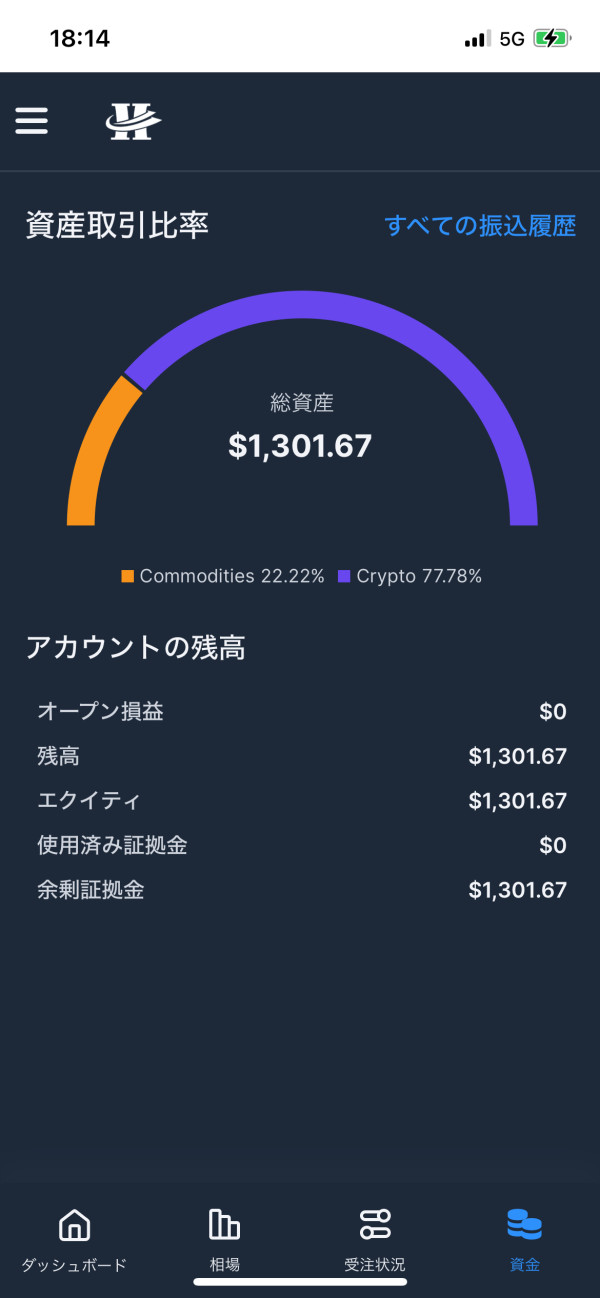

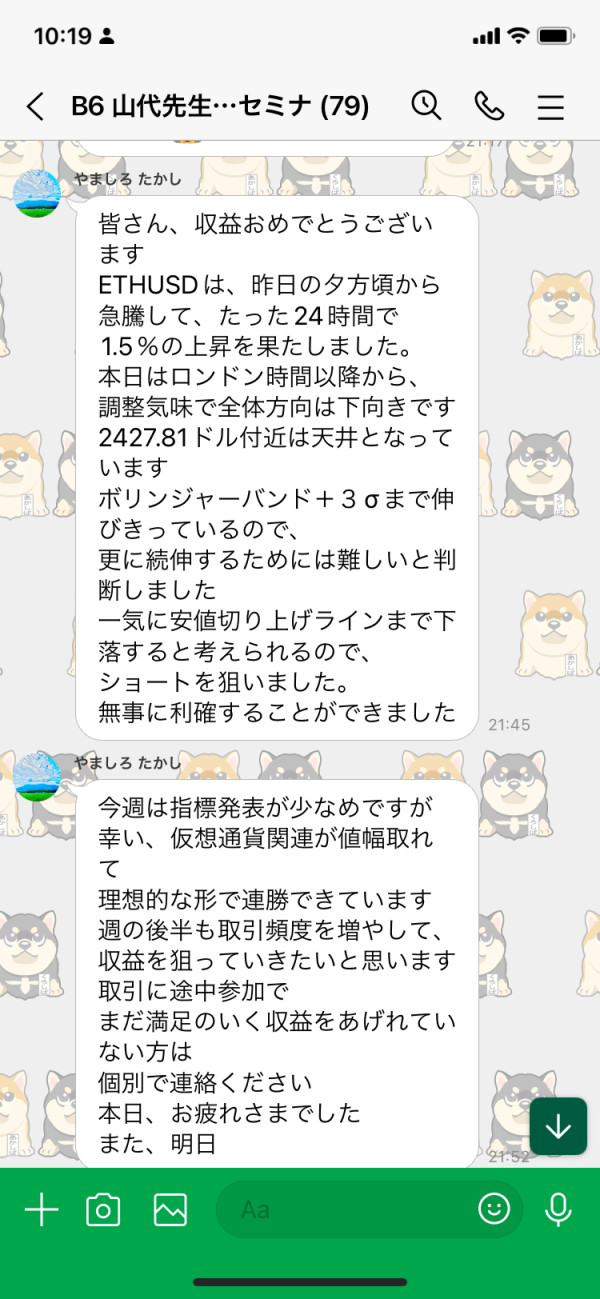

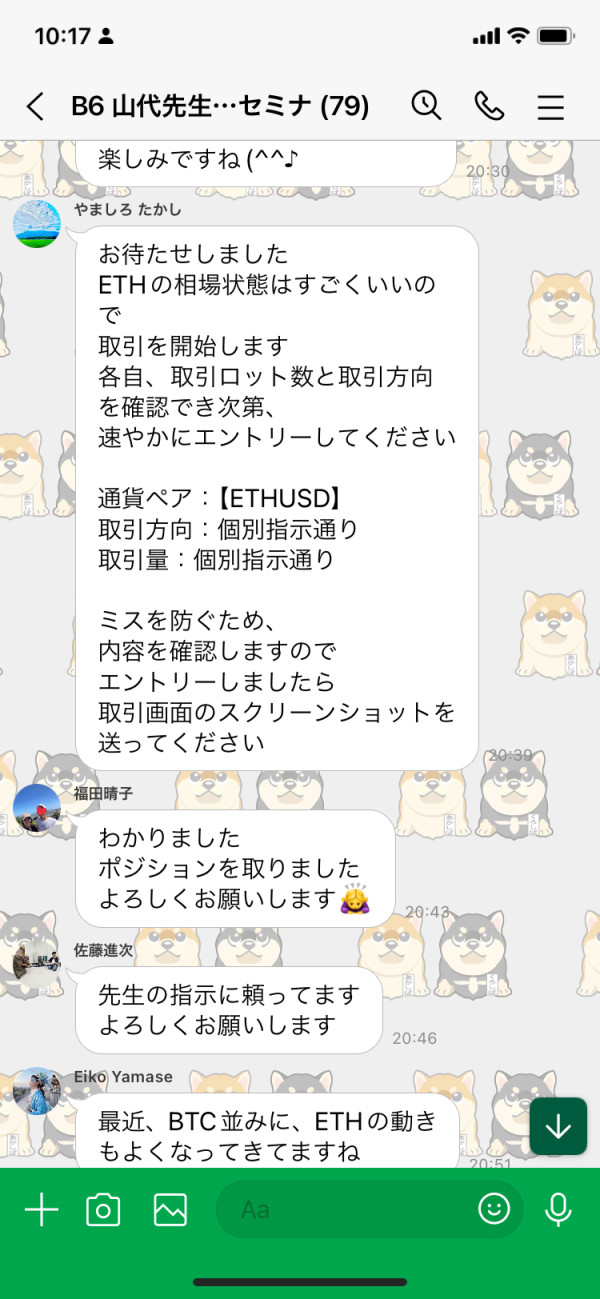

The broker's business model focuses on providing investment opportunities across multiple asset classes, including foreign exchange markets, commodity trading, and cryptocurrency investments. This diversified approach aims to attract traders seeking exposure to various financial markets through a single platform. However, the company's specific operational procedures, trading infrastructure, and client onboarding processes lack detailed public documentation. The missing information creates uncertainty.

HT Global's market positioning appears to target retail traders interested in multi-asset trading capabilities. The company's website and available materials suggest a focus on providing access to global financial markets, though specific details about trading platforms, execution models, and technological infrastructure are not comprehensively disclosed. This HT Global review notes that the limited transparency regarding operational details raises questions about the company's commitment to client education and informed trading decisions. Such gaps are concerning.

The broker's corporate structure involves multiple entities, which is common in the financial services industry but can sometimes complicate regulatory oversight and client protection measures. Understanding these structural elements is crucial for potential clients evaluating the company's services and assessing associated risks. The complexity adds another layer of concern.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing HT Global's operations. This absence of clear regulatory information represents a significant concern for potential clients seeking regulated trading environments and associated protections. The lack of oversight is problematic.

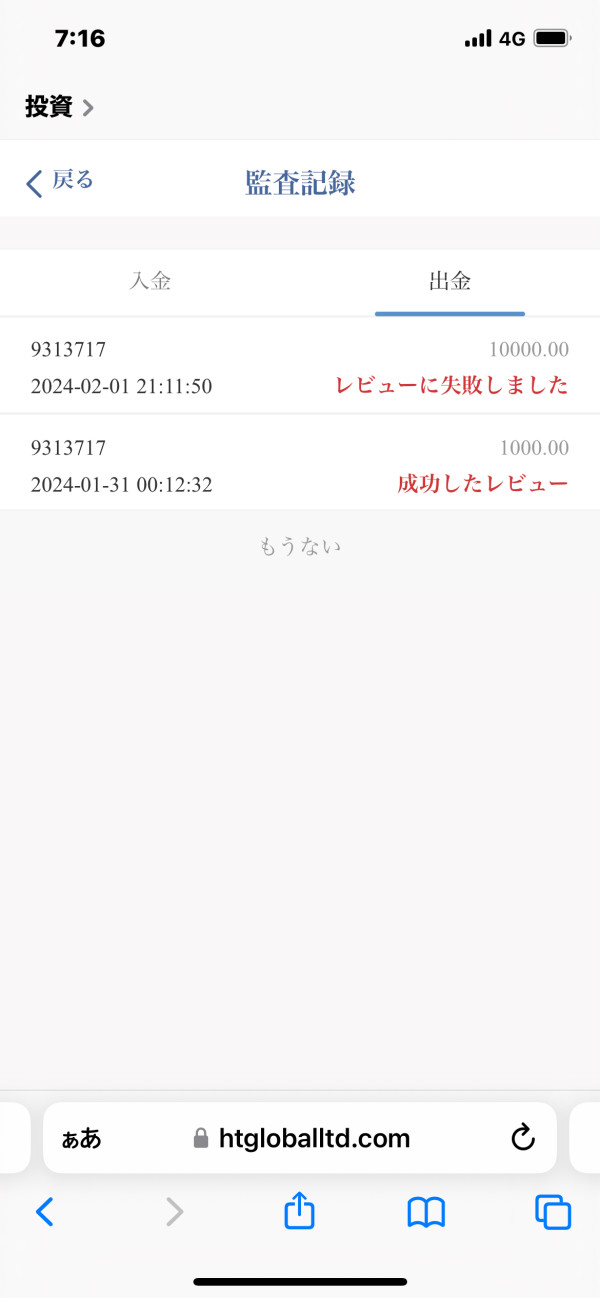

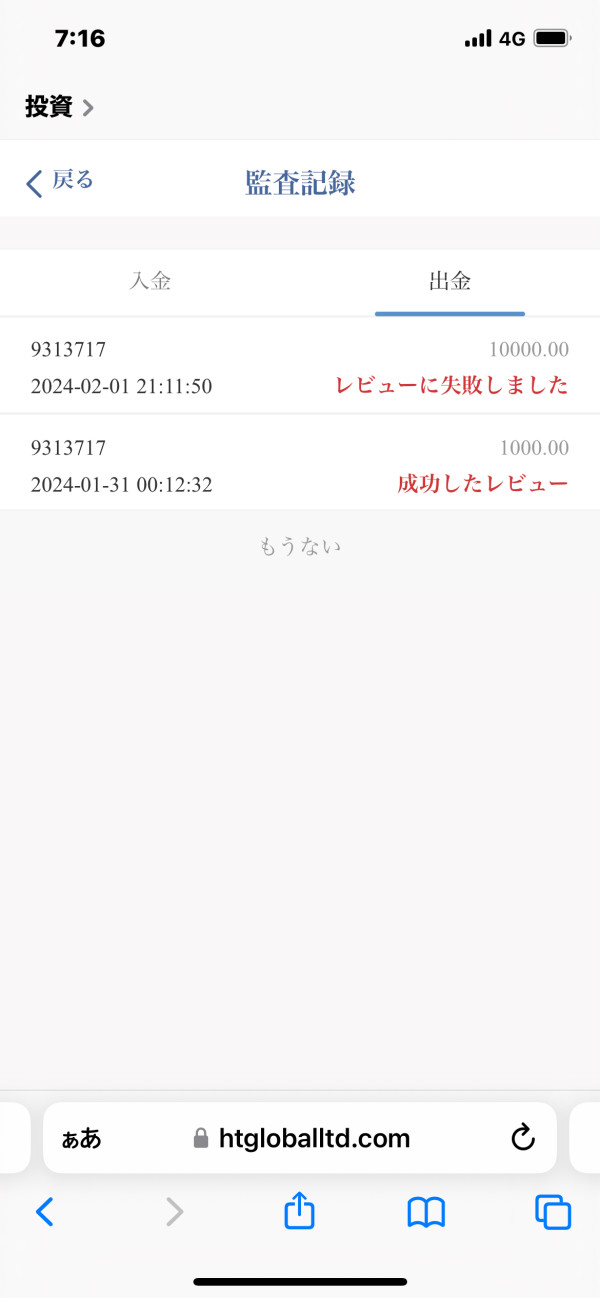

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. This lack of transparency regarding financial transactions is problematic for traders evaluating the broker's services. Clear payment information is essential.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available materials, making it difficult for potential clients to assess accessibility and entry-level requirements. This information gap hinders proper evaluation.

Bonuses and Promotions: No specific information about promotional offers, welcome bonuses, or ongoing incentive programs is available in the reviewed sources. The absence of promotional details is notable.

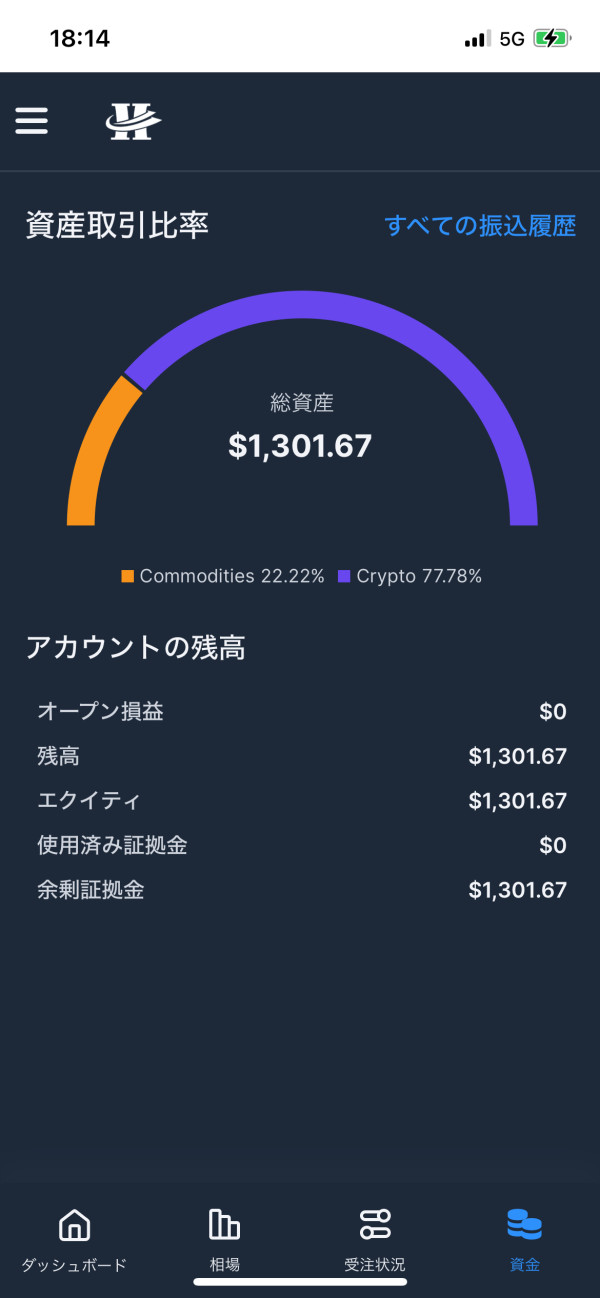

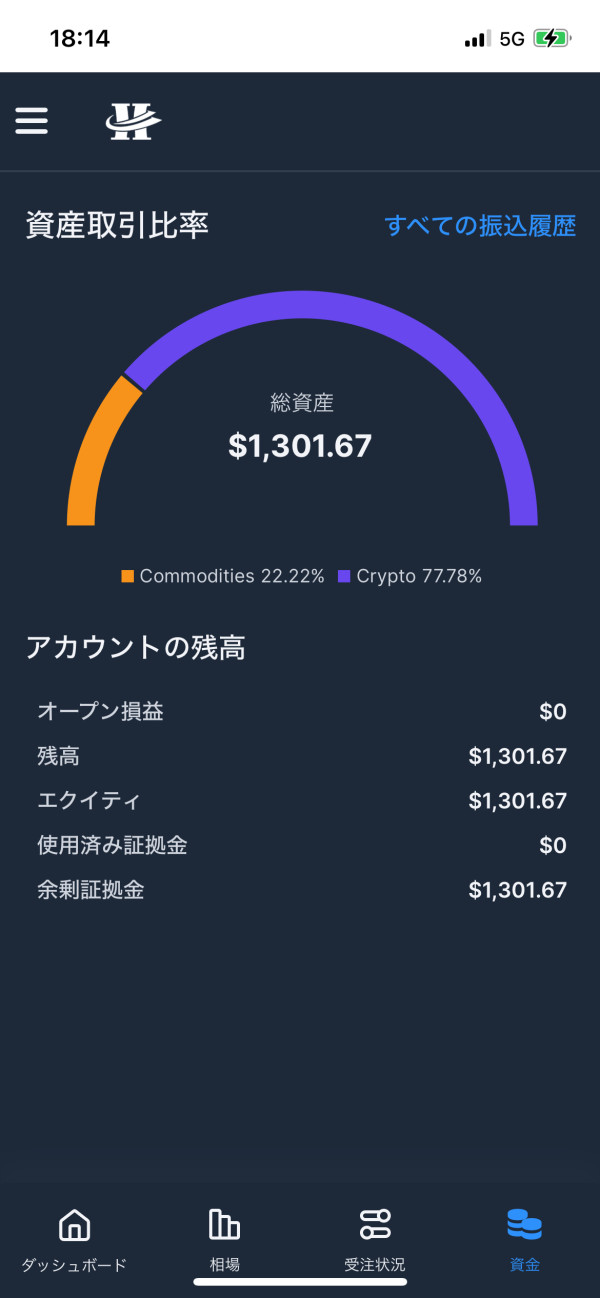

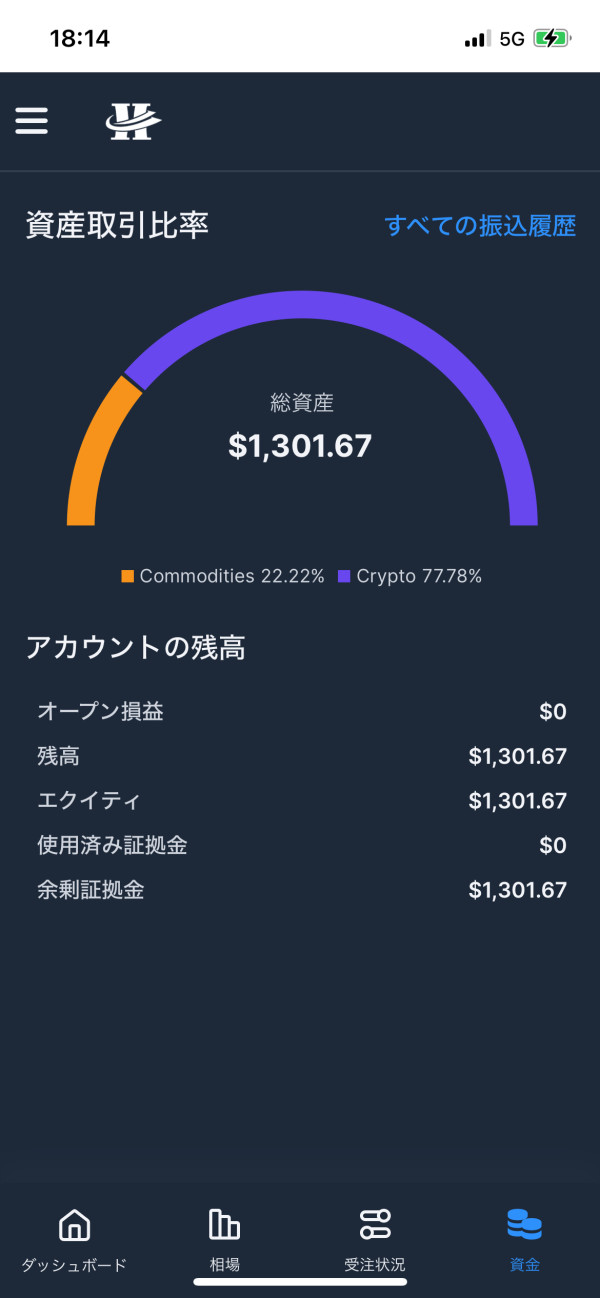

Tradable Assets: The company offers access to forex markets, commodity trading, and cryptocurrency investments, providing diversified trading opportunities across major asset classes. This represents one of the few clear advantages.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available, limiting traders' ability to assess the total cost of trading with HT Global. Cost transparency is crucial for informed decisions.

Leverage Options: Specific leverage ratios offered by the broker are not mentioned in available sources, which is crucial information for risk management and trading strategy development. This missing data is significant.

Platform Options: Trading platform specifications, including software providers, mobile applications, and advanced trading tools, are not detailed in the reviewed materials. Platform quality affects trading success.

Geographic Restrictions: Information about supported countries and restricted jurisdictions is not specified in available sources. This creates uncertainty for international traders.

Customer Support Languages: Available customer service languages are not mentioned in the reviewed materials, though the company's US base suggests English-language support. Language support affects accessibility.

This HT Global review emphasizes that the limited availability of specific operational details significantly hampers comprehensive evaluation of the broker's services and suitability for different trader profiles. The information gaps are extensive.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The evaluation of HT Global's account conditions faces significant challenges due to limited publicly available information. Standard account types, their specific features, and associated benefits are not clearly outlined in accessible materials. This lack of transparency makes it extremely difficult for potential clients to understand what they can expect from different account tiers or service levels. The information void is concerning.

Minimum deposit requirements, which are crucial for accessibility assessment, are not specified in available sources. Without this fundamental information, traders cannot properly evaluate whether the broker's services align with their financial capabilities and investment goals. The absence of clear account opening procedures and verification requirements further complicates the assessment process. These gaps create uncertainty.

Special account features such as Islamic accounts, professional trader accounts, or VIP services are not mentioned in available materials. This suggests either limited product diversity or poor communication about available options. According to industry standards, reputable brokers typically provide comprehensive account information to help clients make informed decisions. The missing details are problematic.

The lack of detailed account condition information raises concerns about the company's transparency and client-focused approach. Professional trading environments typically feature clear, accessible information about account structures, requirements, and benefits. This HT Global review notes that the information gap significantly impacts the broker's credibility and accessibility for informed decision-making. Transparency is essential for trust.

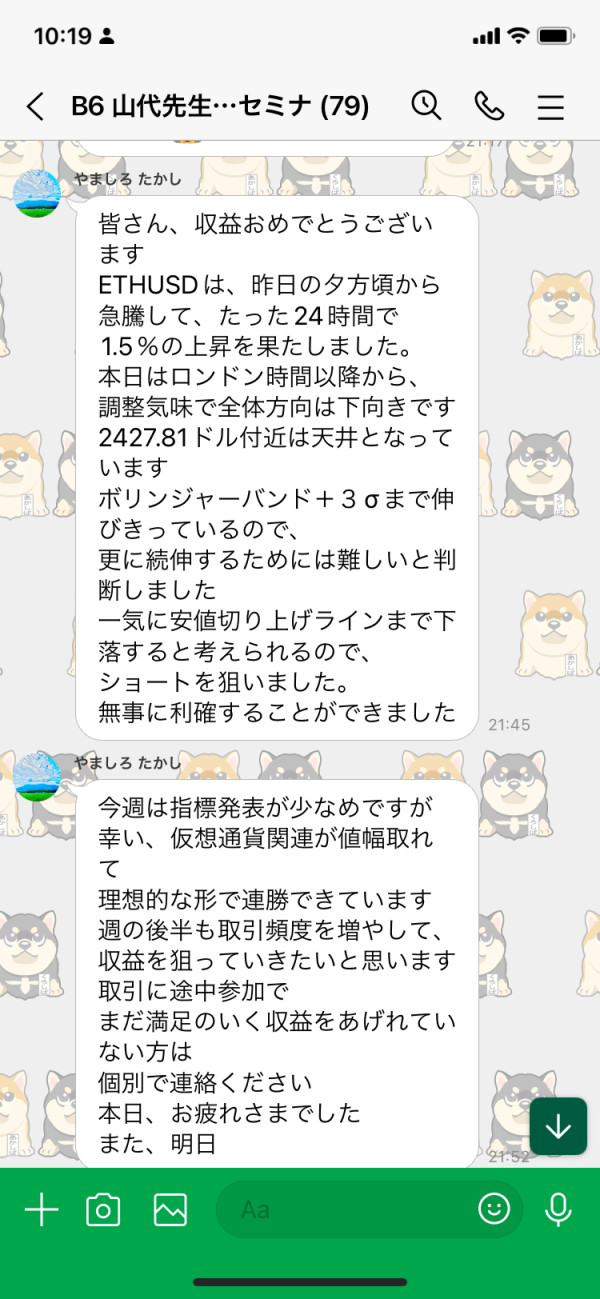

HT Global's tools and resources receive a moderate rating primarily based on the company's stated provision of diversified investment opportunities across forex, commodities, and cryptocurrency markets. However, specific details about trading tools, analytical resources, and educational materials are not comprehensively available in reviewed sources. The lack of detail limits assessment.

The broker's multi-asset approach suggests some level of market access diversity, which can be valuable for traders seeking portfolio diversification. However, without specific information about charting tools, technical indicators, automated trading capabilities, or market analysis resources, it's challenging to assess the quality and comprehensiveness of the trading environment. Missing technical details create uncertainty.

Educational resources, which are crucial for trader development and informed decision-making, are not detailed in available materials. Professional brokers typically offer market analysis, trading guides, webinars, and educational content to support client success. The absence of information about such resources suggests potential limitations in client support and development. Education is vital for trading success.

Research and analysis capabilities, including market commentary, economic calendars, and fundamental analysis tools, are not specifically mentioned in available sources. These resources are essential for informed trading decisions and risk management. The lack of detailed information about analytical support raises questions about the broker's commitment to providing comprehensive trading environments. Analysis tools are crucial.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not addressed in available materials, limiting assessment of the platform's technical sophistication and suitability for advanced trading strategies. Advanced features matter for experienced traders.

Customer Service and Support Analysis (4/10)

Customer service evaluation for HT Global is significantly hampered by the lack of specific information about support channels, availability, and service quality. Standard customer service metrics such as response times, available communication methods, and support hours are not detailed in accessible sources. This information gap is concerning.

The absence of clear customer service information raises concerns about the broker's commitment to client support and problem resolution. Professional trading environments typically feature multiple support channels including live chat, email, phone support, and comprehensive FAQ sections. Without information about these basic service elements, potential clients cannot assess the level of support they might expect. Support quality affects trading success.

Multi-language support capabilities, which are important for international brokers, are not specified in available materials. Given the global nature of forex and cryptocurrency markets, language support diversity is often crucial for effective client communication and problem resolution. International accessibility matters.

Service quality indicators, such as customer satisfaction ratings, response time benchmarks, or client testimonials specifically related to customer service experiences, are not available in reviewed sources. This absence of performance metrics makes it impossible to evaluate the effectiveness of the company's client support operations. Quality metrics provide important insights.

The lack of detailed customer service information, combined with concerns about the company's overall legitimacy raised in various sources, suggests potential challenges in obtaining adequate support when needed. Professional brokers typically prioritize transparent communication about their support capabilities and service standards. Support transparency builds confidence.

Trading Experience Analysis (5/10)

The trading experience assessment for HT Global faces significant limitations due to insufficient information about platform stability, execution quality, and user interface design. Available sources do not provide specific feedback about platform performance, order execution speeds, or overall trading environment quality. Performance data is essential.

Platform stability and reliability, which are fundamental for successful trading operations, cannot be properly evaluated based on available information. Professional trading requires consistent platform uptime, fast execution speeds, and reliable order processing. Without specific performance data or user feedback about these critical elements, assessment remains incomplete. Stability affects profitability.

Order execution quality, including factors such as slippage rates, requote frequency, and execution speeds, is not addressed in available materials. These technical performance metrics are crucial for evaluating the actual trading conditions and potential impact on trading profitability. Execution quality determines trading costs.

Mobile trading capabilities and cross-platform compatibility are not detailed in reviewed sources. In today's trading environment, mobile access and seamless platform integration across devices are essential features that significantly impact user experience and trading flexibility. Mobile trading is increasingly important.

The trading environment's sophistication, including advanced order types, risk management tools, and customization options, cannot be assessed due to limited available information. This HT Global review notes that the lack of specific trading experience data makes it difficult for potential clients to evaluate whether the platform meets their trading requirements and expectations. Sophisticated tools enhance trading effectiveness.

Trust and Safety Analysis (3/10)

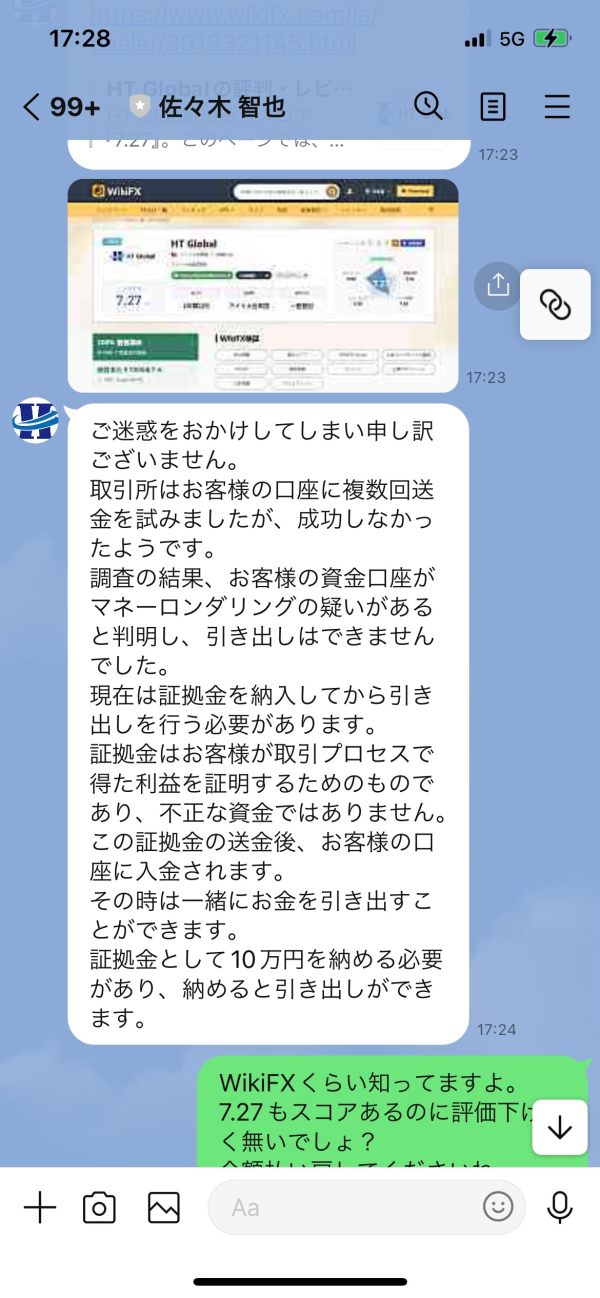

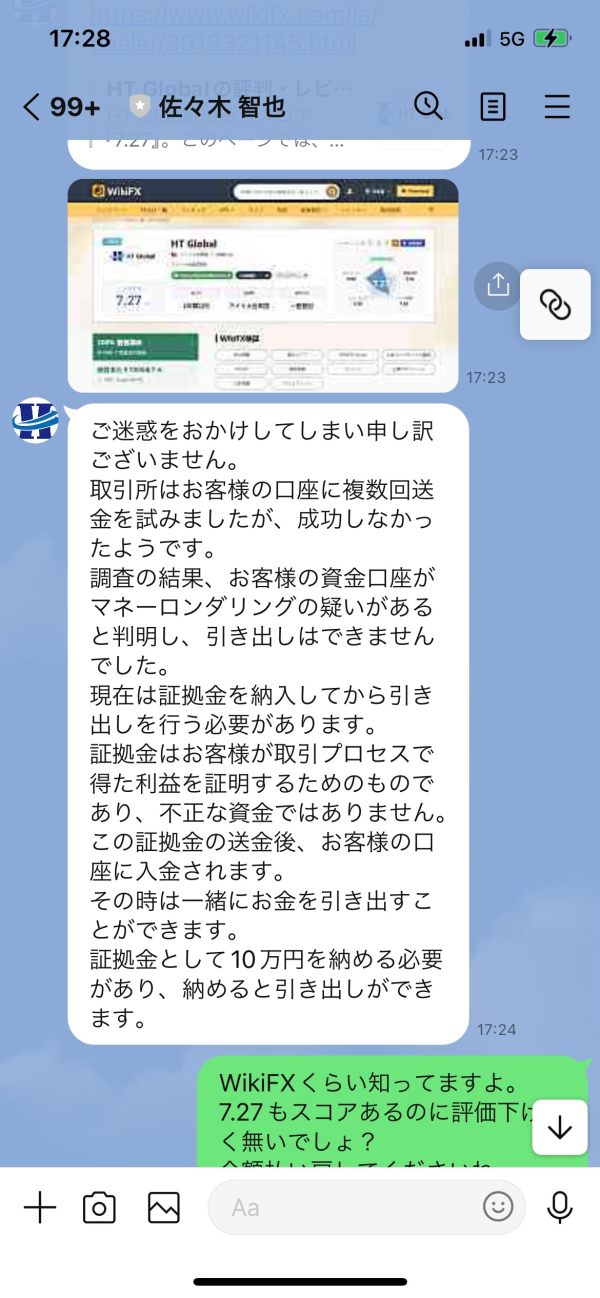

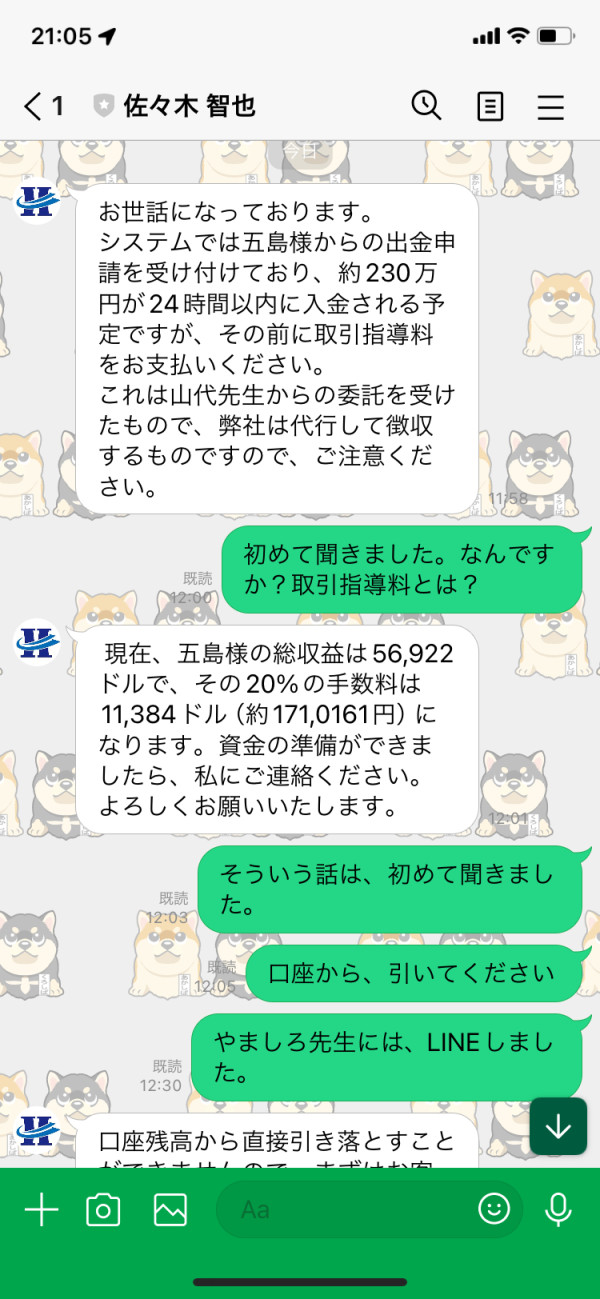

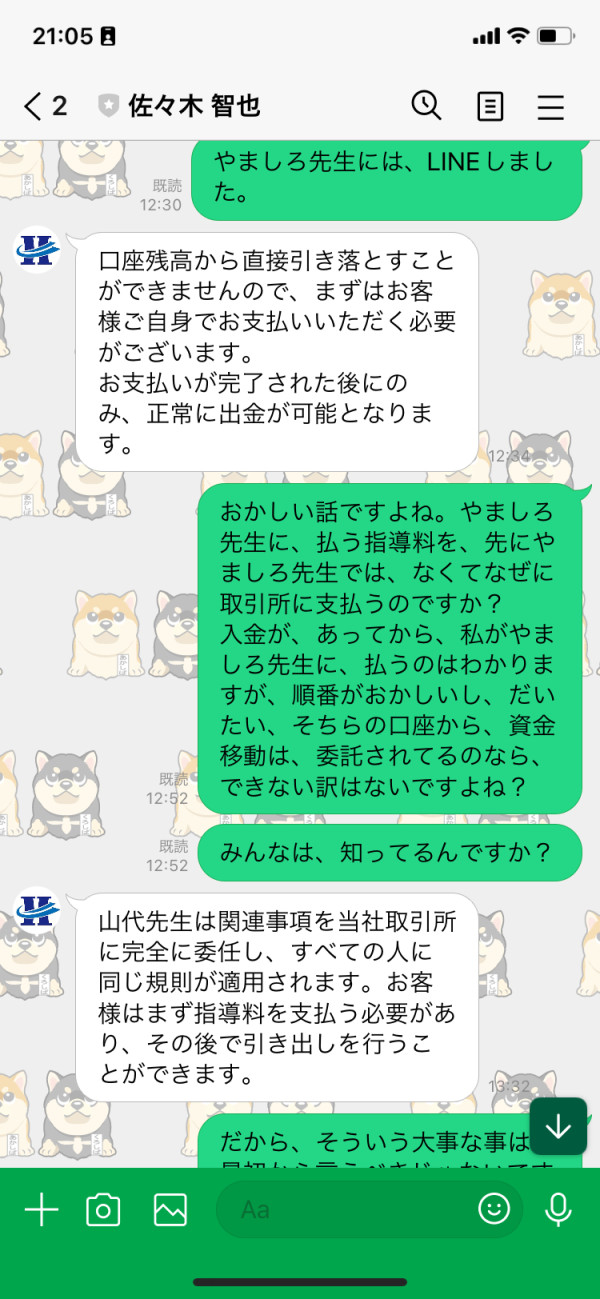

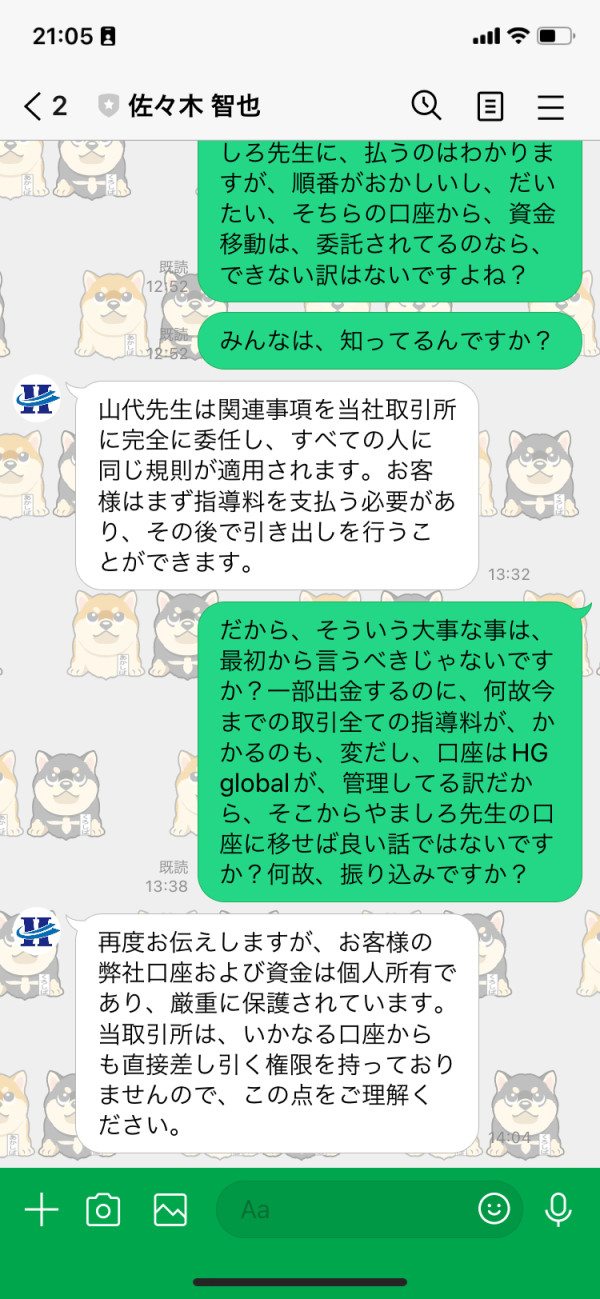

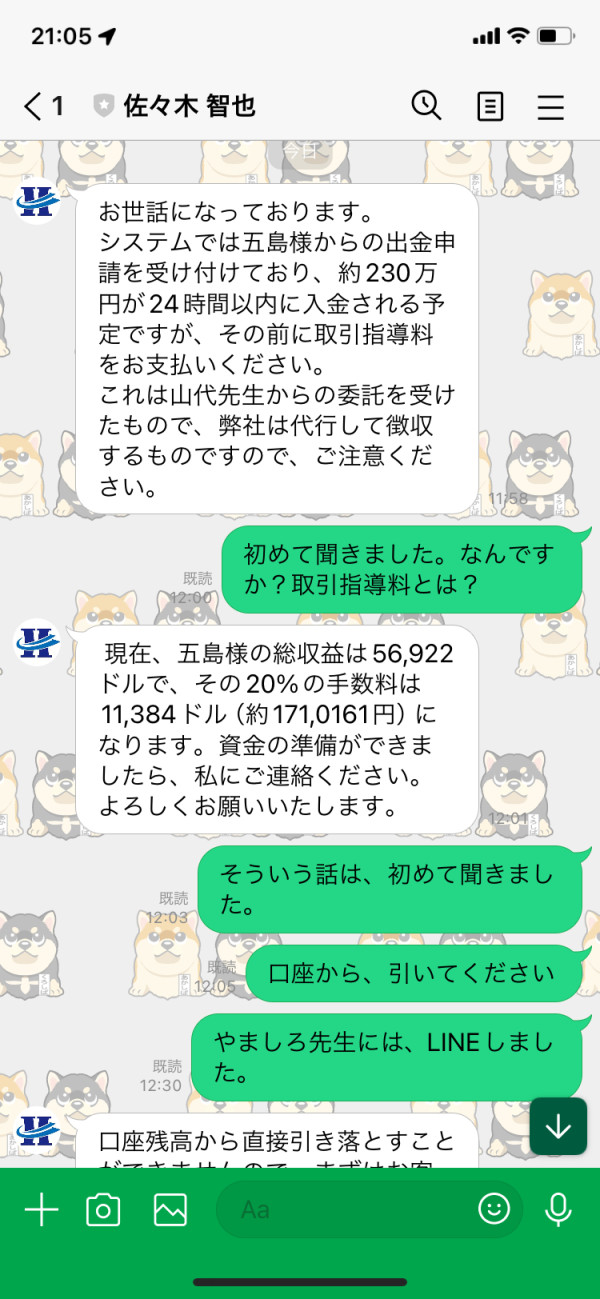

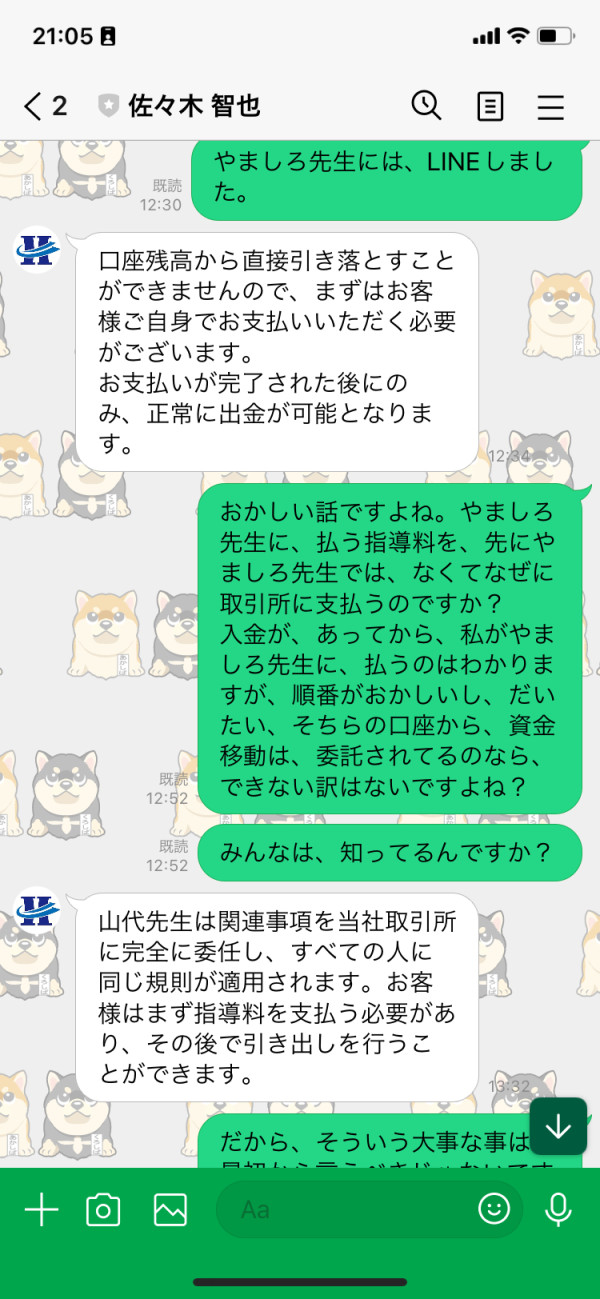

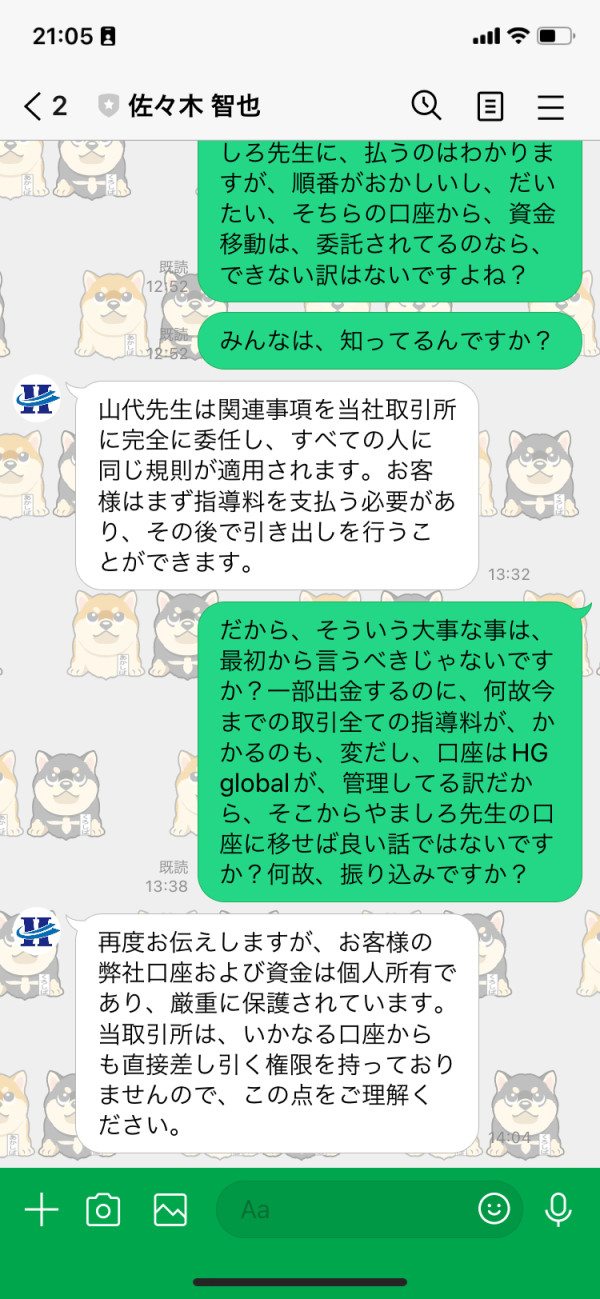

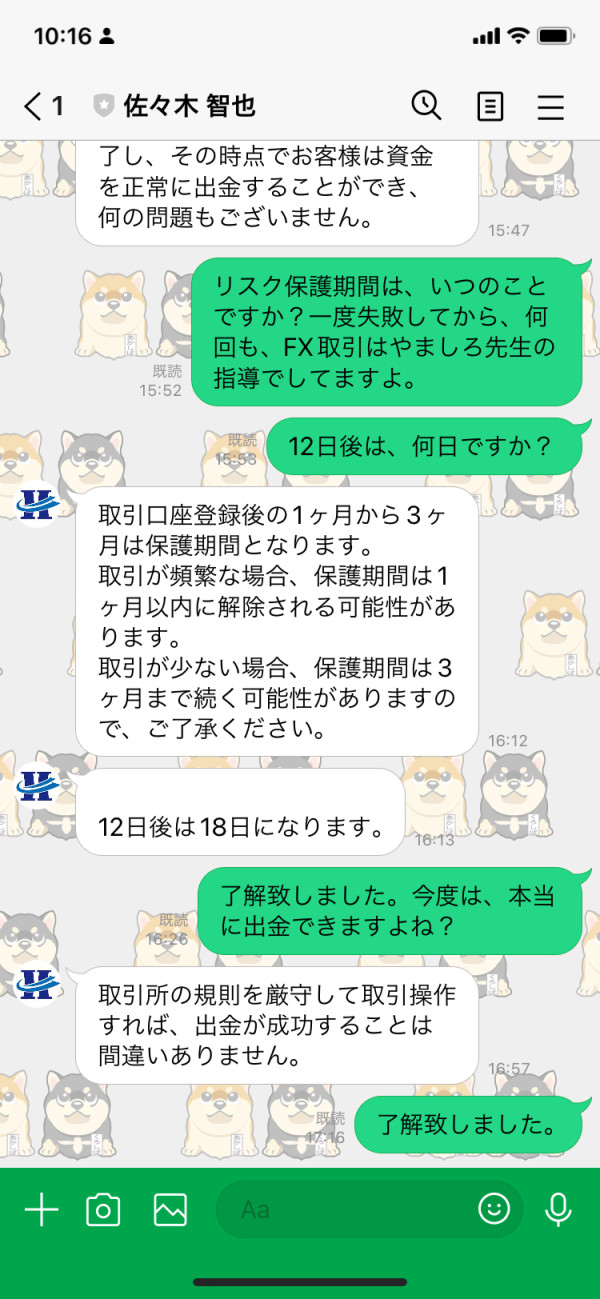

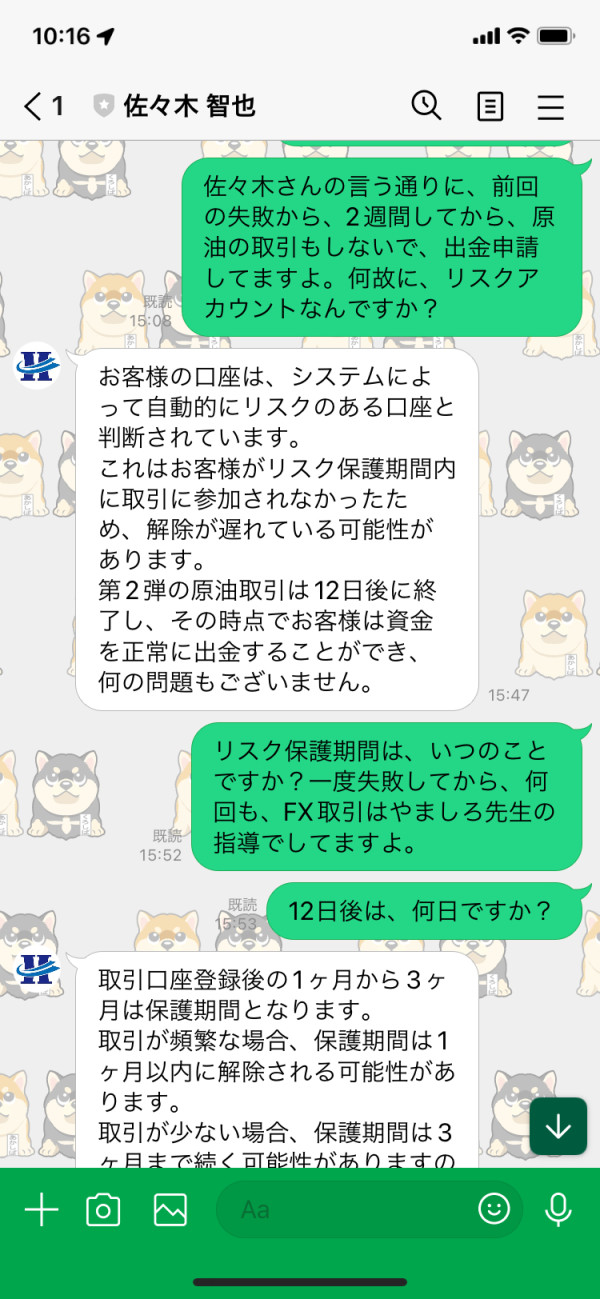

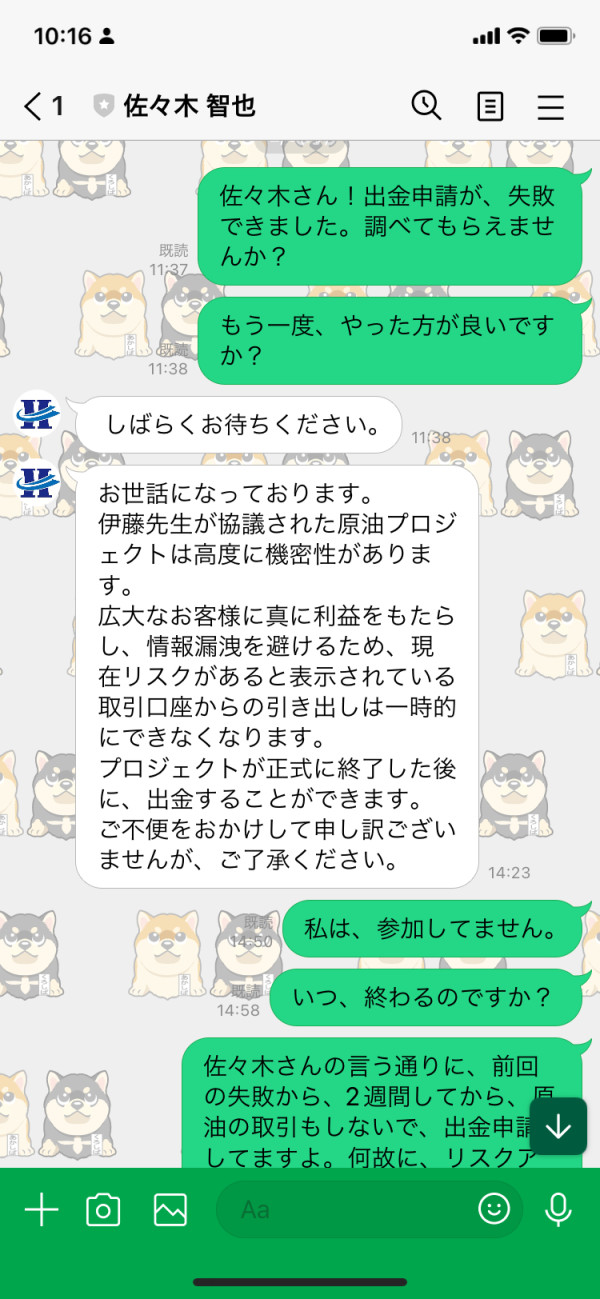

Trust and safety represent the most concerning aspects of this HT Global review. Multiple sources, including WikiFX and other industry monitoring platforms, have raised significant red flags about potential fraudulent activities associated with HT Global operations. These concerns fundamentally impact the broker's credibility and safety assessment. The fraud allegations are serious.

Regulatory oversight information is notably absent from available sources, which is particularly problematic for a financial services provider. Legitimate brokers typically maintain clear regulatory relationships and prominently display their licensing information. The lack of specific regulatory details raises serious questions about operational legitimacy and client protection measures. Regulation provides essential protection.

Fund safety measures, including segregated account policies, insurance coverage, and compensation schemes, are not detailed in available materials. These protections are essential for client fund security and are typically required by reputable regulatory authorities. The absence of clear fund protection information represents a significant risk factor. Fund safety is paramount.

Company transparency, including detailed operational information, management team details, and clear business practices, is limited in publicly available sources. Professional financial services providers typically maintain high transparency standards to build client trust and demonstrate operational legitimacy. Transparency builds trust.

The combination of fraud allegations, limited regulatory information, and transparency concerns creates a highly problematic trust profile. Industry reports and user feedback suggesting potential fraudulent activities represent serious warning signs that potential clients should carefully consider before engaging with the company's services. These warnings should not be ignored.

User Experience Analysis (4/10)

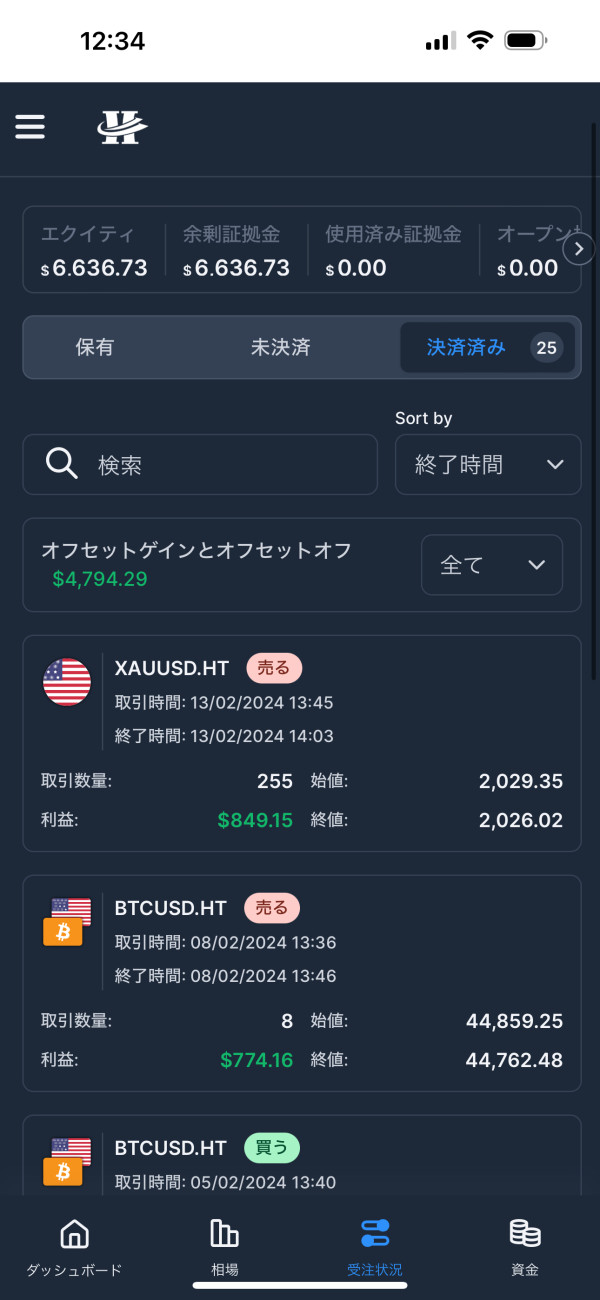

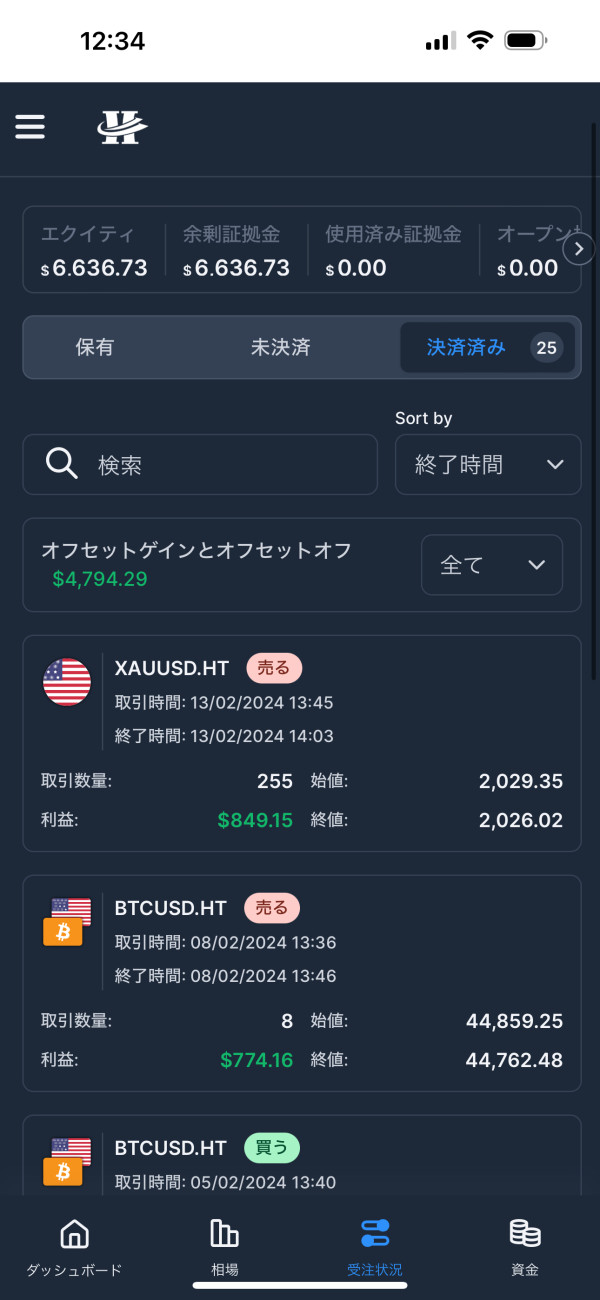

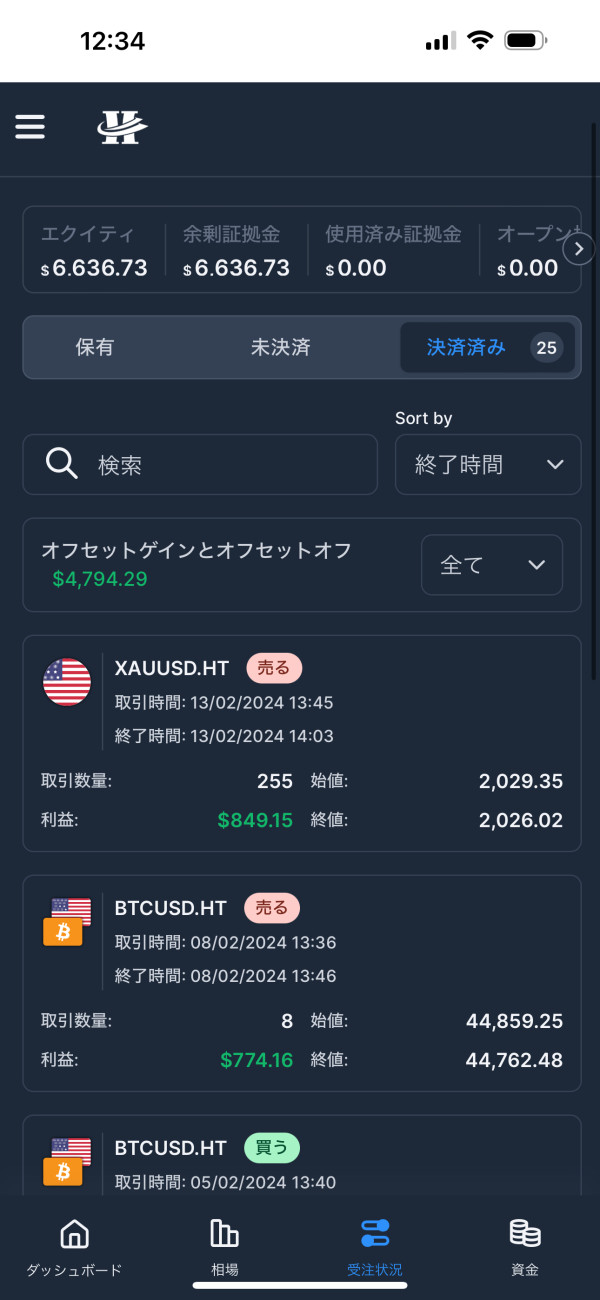

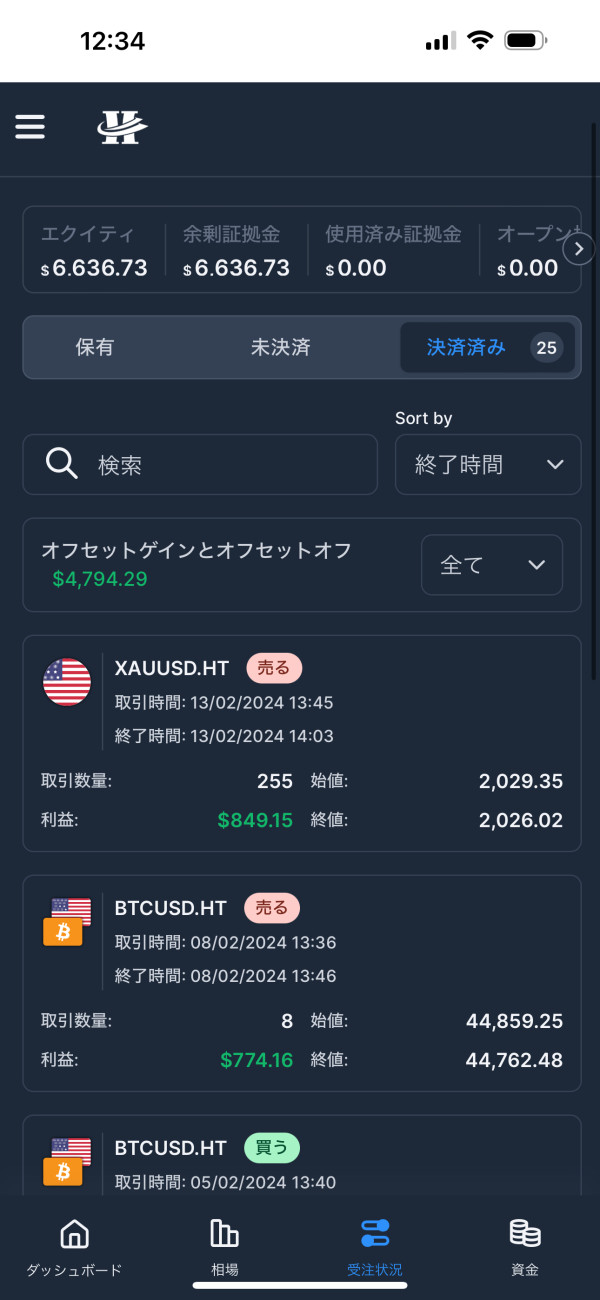

User experience evaluation reveals concerning trends based on available employee and industry feedback. Glassdoor data indicates that HT Global Circuits maintains only a 48% employee recommendation rate, with company ratings showing a 3% decline. These metrics suggest internal operational challenges that may impact client service quality. Internal problems often affect external service.

Overall user satisfaction appears problematic based on available indicators. Low employee satisfaction rates often correlate with poor client service quality, as internal company culture typically reflects in external client interactions. The declining rating trend suggests ongoing challenges rather than improving conditions. Declining trends are concerning.

User interface design and platform usability cannot be properly assessed due to limited available information about the trading platform and client portal features. Professional trading platforms typically emphasize user-friendly design, intuitive navigation, and comprehensive functionality. Without specific platform details, assessment remains incomplete. User interface affects trading efficiency.

Registration and account verification processes are not detailed in available sources, making it difficult to evaluate the onboarding experience and associated convenience or complexity factors. Streamlined account opening procedures are important for user satisfaction and accessibility. Smooth onboarding improves user experience.

Common user complaints and satisfaction indicators, beyond the general employee rating decline, are not specifically documented in available sources. Professional brokers typically maintain feedback systems and address common user concerns transparently. The lack of detailed user feedback information, combined with concerning trust indicators, suggests potential challenges in overall user experience quality. Feedback systems demonstrate commitment to improvement.

The combination of declining internal ratings, limited transparency about user experience features, and broader concerns about company legitimacy creates a problematic user experience profile that potential clients should carefully consider. Multiple negative indicators suggest systemic issues.

Conclusion

This comprehensive HT Global review reveals a broker with significant concerns that outweigh its potential benefits. While the company offers diversified investment opportunities across forex, commodities, and cryptocurrency markets, substantial red flags regarding legitimacy, transparency, and operational practices create considerable risks for potential clients. The risks are substantial.

The broker may be suitable for experienced traders who thoroughly understand the risks associated with unregulated or poorly regulated trading environments and are specifically seeking multi-asset market access. However, the combination of fraud allegations, limited regulatory oversight, and poor transparency makes HT Global unsuitable for most retail traders, particularly those prioritizing safety and regulatory protection. Safety should be the primary concern.

Primary advantages include diversified market access across popular asset classes, while significant disadvantages encompass questionable legitimacy, limited regulatory oversight, poor transparency, and concerning industry feedback. The risk-to-benefit ratio heavily favors avoiding this broker in favor of more established, properly regulated alternatives that offer similar market access with substantially better safety profiles. Better alternatives exist in the market.