ALKHAIR CAPITAL Review 1

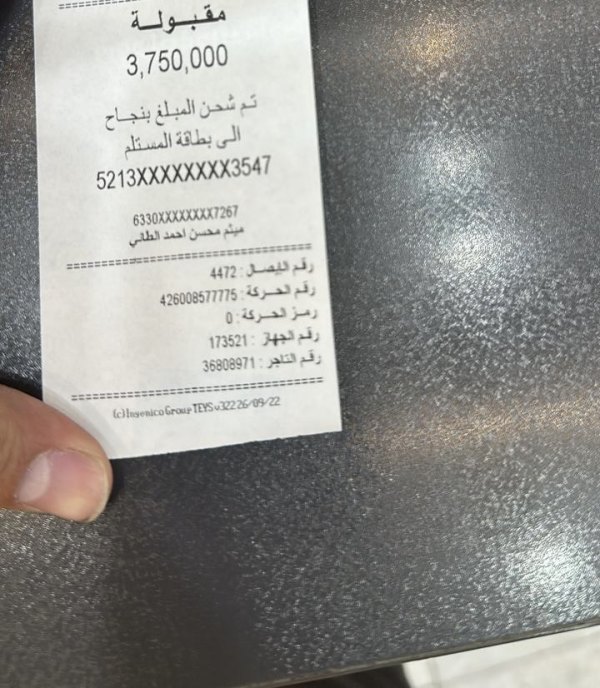

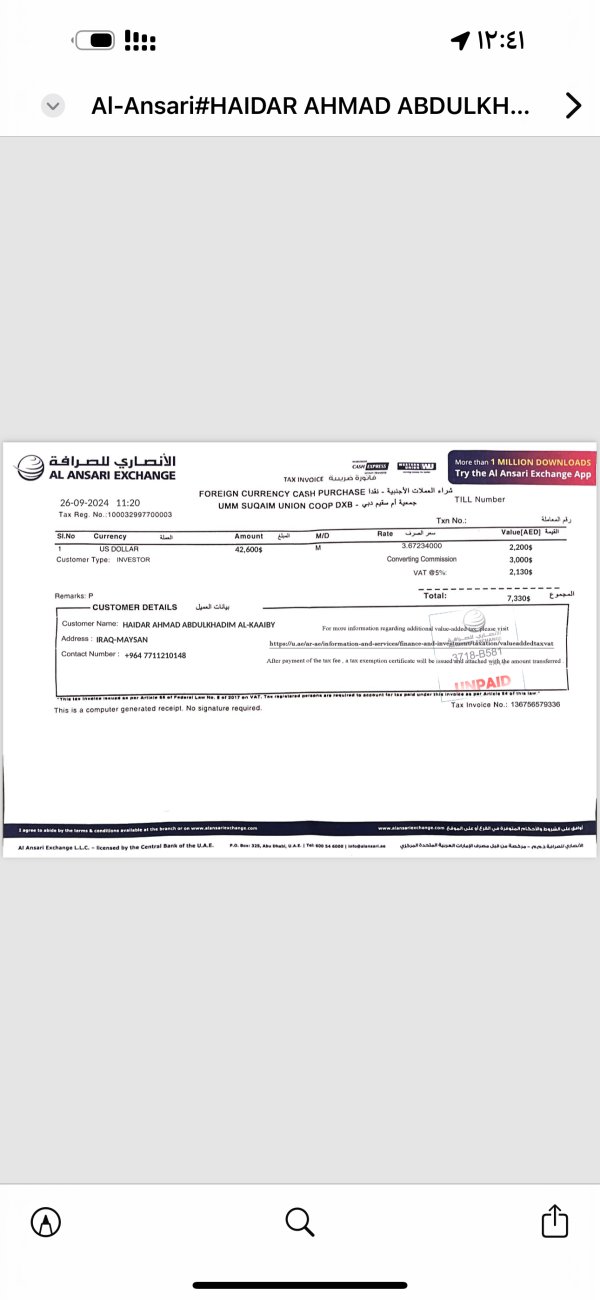

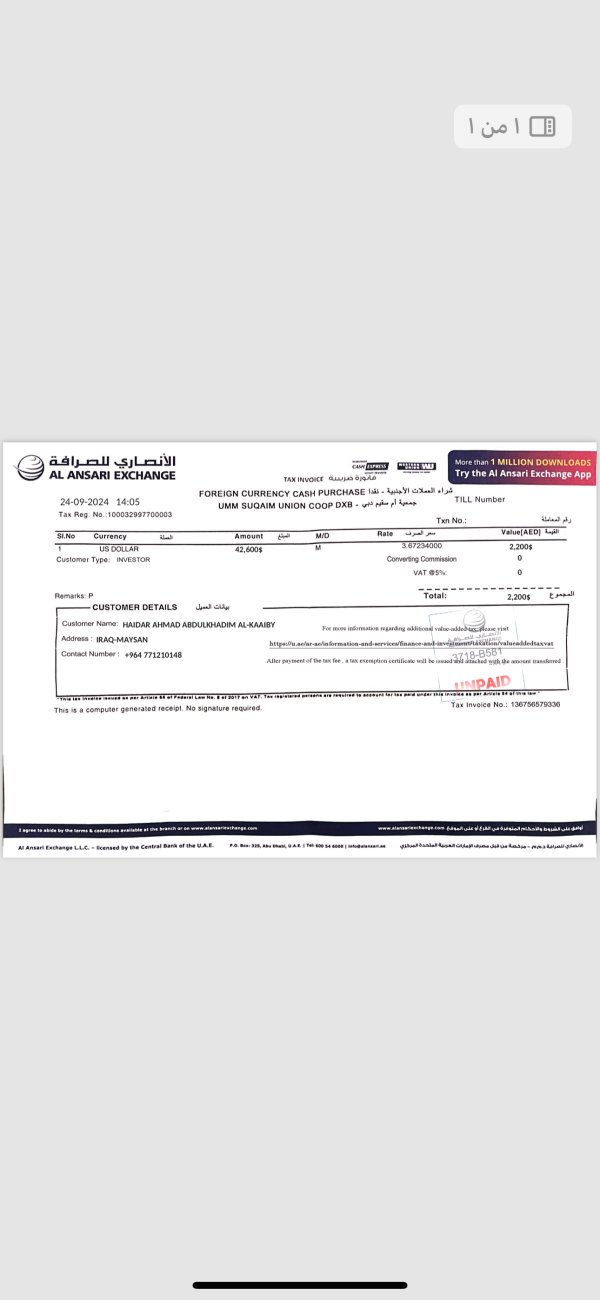

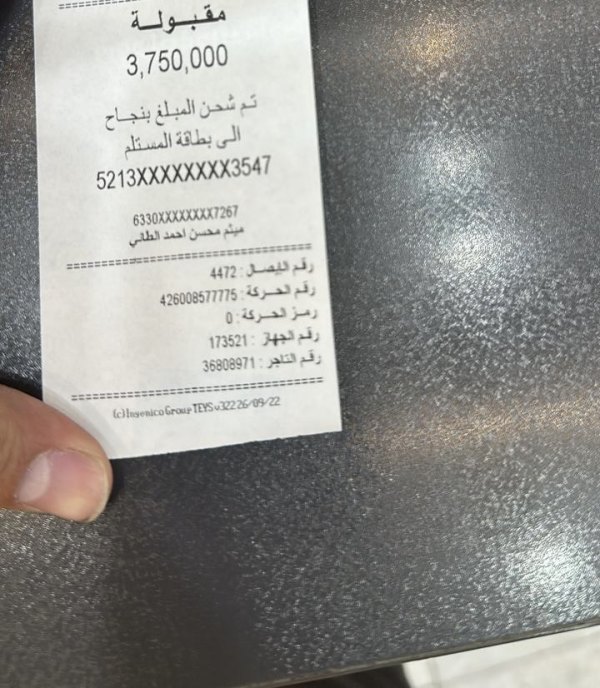

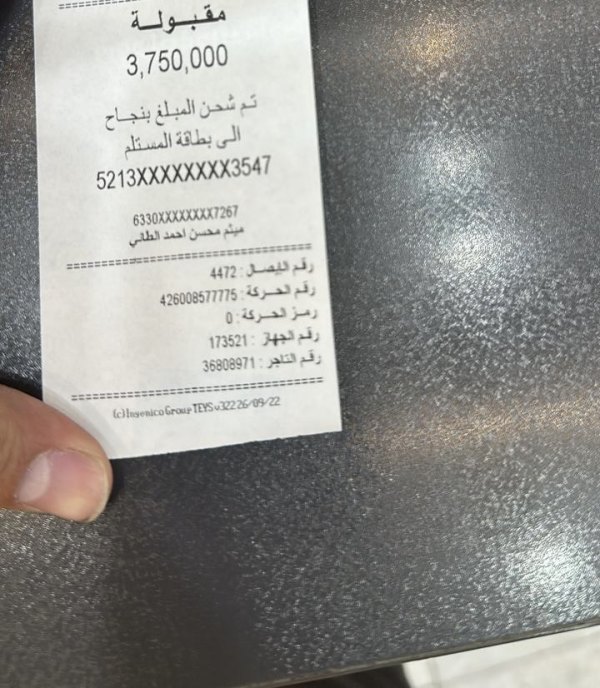

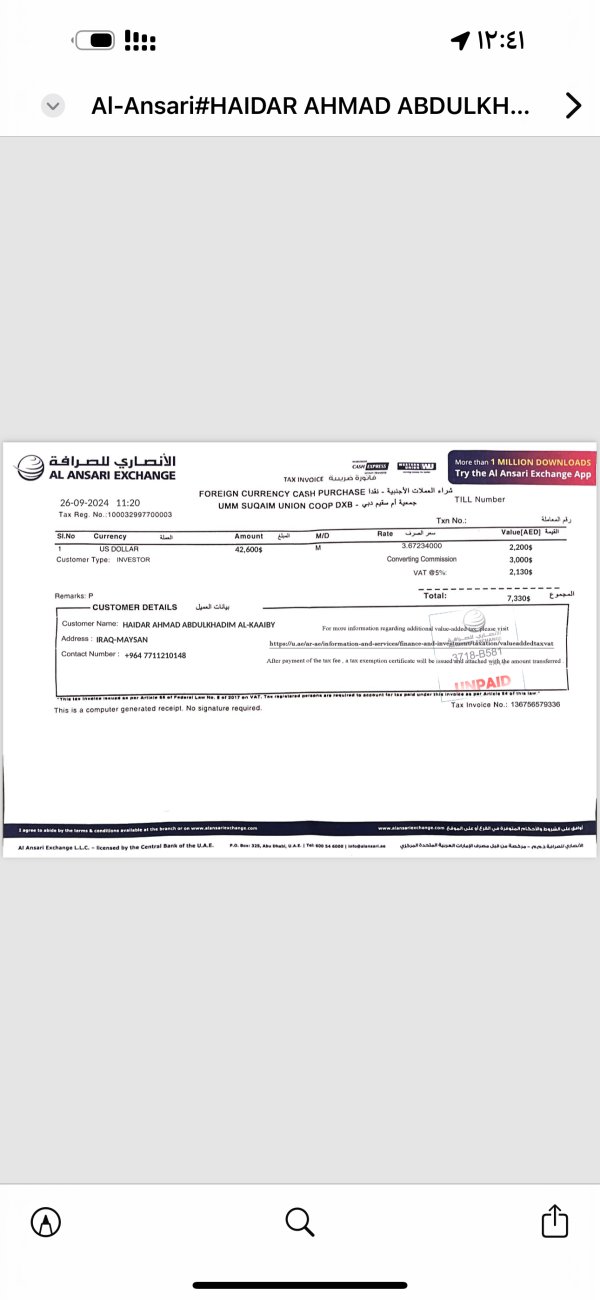

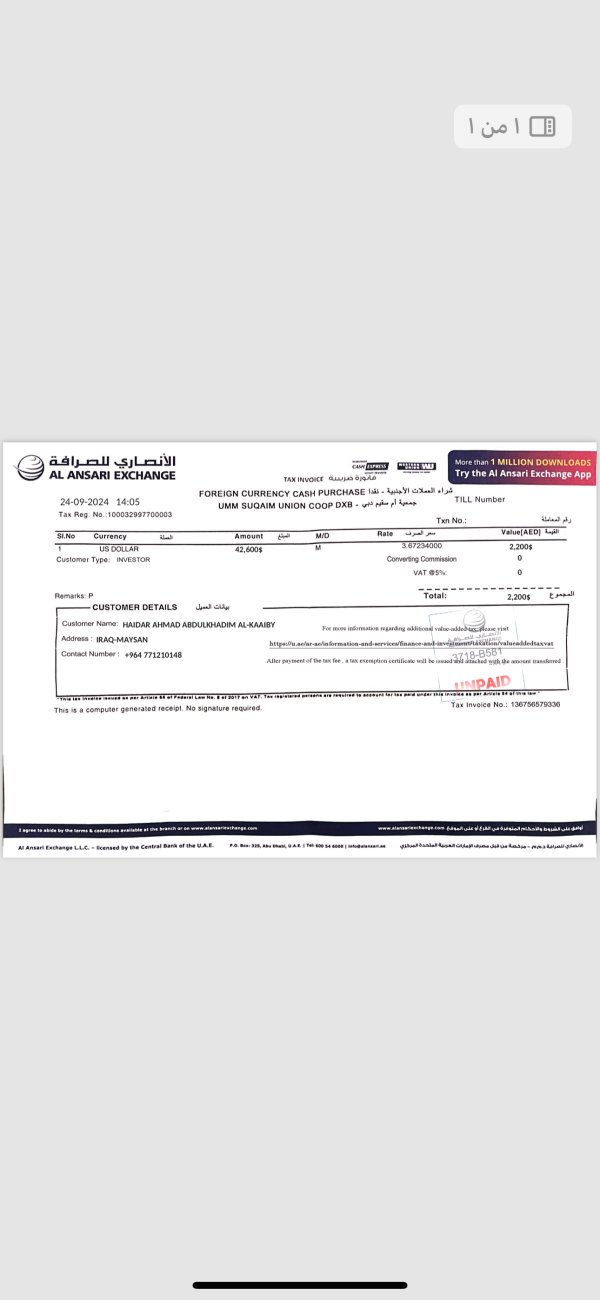

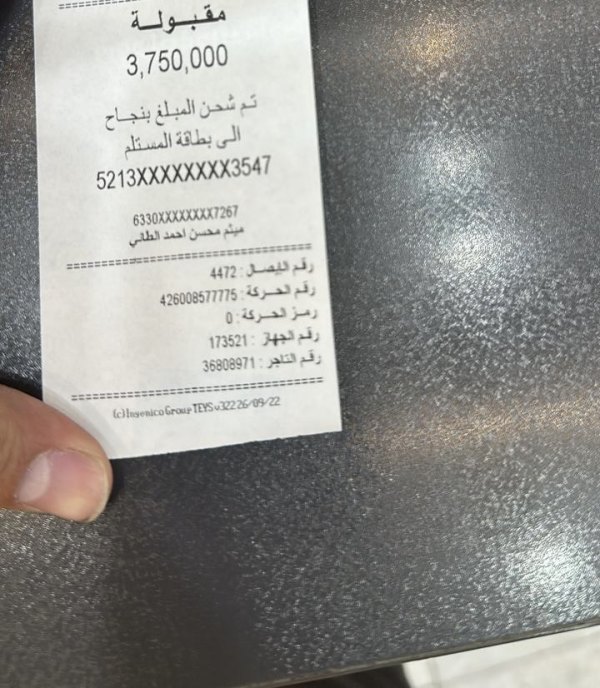

Please stay away from these companies as they have asked me for money in order to reach the amount and they are very skilled in fraud and deception, and they have partners in fraud in every country in the world.

ALKHAIR CAPITAL Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Please stay away from these companies as they have asked me for money in order to reach the amount and they are very skilled in fraud and deception, and they have partners in fraud in every country in the world.

This Alkhair Capital review gives you a complete look at a Saudi Arabia-based financial services company that has been working since 2009. The company started as a Closed Joint Stock Company with paid-up capital of SAR 1 billion, and Alkhair Capital SA focuses on asset management, investment banking, and brokerage services that follow Islamic finance rules.

The company has made itself a major player in the Middle Eastern financial sector. Reports show it earned recognition as the fastest-growing brokerage company in the Middle East region in 2020, which is impressive. However, our research shows mixed user feedback and limited transparency about specific trading conditions and regulatory oversight, which raises some concerns.

The broker mainly attracts investors who want Sharia-compliant financial services. Potential clients should carefully look at the available information before making investment decisions, though.

Our review gives a neutral assessment based on available data and user feedback because there isn't enough detailed information about trading conditions, regulatory status, and complete client services. The company's focus on Islamic finance represents its main distinguishing feature in the competitive brokerage landscape.

This Alkhair Capital review uses publicly available information and user feedback from various sources. The experience may vary a lot for users in different regions because there's limited detailed information about specific regulatory oversight and trading conditions in different places.

The company operates mainly from Saudi Arabia, and regulatory conditions may differ based on where the client lives and what local laws apply. Our assessment method uses available corporate information, user testimonials, and industry reports, but potential clients should do their own research and check current terms and conditions directly with the company before making any investment decisions.

Financial services regulations and company policies may change over time. This means you should always verify the most current information before proceeding.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account types, minimum deposits, and terms not detailed in available sources |

| Tools and Resources | N/A | Trading tools, research resources, and educational materials not specified |

| Customer Service | N/A | Customer support channels, response times, and service quality information unavailable |

| Trading Experience | N/A | Platform performance, execution quality, and user interface details not provided |

| Trust and Reliability | N/A | Limited regulatory information available, though company has established corporate structure |

| User Experience | N/A | Comprehensive user satisfaction data not available in current sources |

Note: Ratings marked as N/A indicate insufficient detailed information in available sources to provide accurate scoring.

Alkhair Capital SA represents a major financial institution in the Saudi Arabian market. The company was established in 2009 as a Closed Joint Stock Company, which shows its formal business structure.

With headquarters in Riyadh, Saudi Arabia, the company operates with significant paid-up capital of SAR 1 billion, showing considerable financial backing. The institution has built its reputation around providing complete financial services including asset management, investment banking, and brokerage services, and it specializes in Islamic finance principles that follow Sharia law requirements.

The company's business model centers on serving clients who need Sharia-compliant financial products and services. This specialization has apparently helped its growth, with reports showing recognition as the fastest-growing brokerage company in the Middle East region in 2020, which is quite an achievement.

However, specific details about trading platforms, asset classes offered, and regulatory oversight remain limited in publicly available information. The company operates under Saudi Arabian commercial registration, though complete regulatory details and international licensing information are not extensively documented in current sources.

Regulatory Status: Available information shows that Alkhair Capital SA operates as a registered entity in Saudi Arabia with commercial registration. Specific regulatory oversight details and international licensing information are not completely detailed in current sources, though.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This includes supported payment systems, processing times, and associated fees.

Minimum Deposit Requirements: Current sources do not specify minimum deposit amounts required to open trading accounts. Different service tiers with Alkhair Capital also lack specific requirements in available information.

Bonuses and Promotions: Information about promotional offers, welcome bonuses, or ongoing incentive programs is not available in current documentation. This makes it hard to know what special offers might be available.

Tradeable Assets: The company provides brokerage services, but specific details about available trading instruments are not completely outlined in available sources. Asset classes and market access options also lack comprehensive documentation.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not specified in current documentation. This makes cost comparison with other brokers challenging for potential clients.

Leverage Options: Leverage ratios and margin requirements offered by Alkhair Capital are not detailed in available sources. This information would be important for traders who use leverage in their strategies.

Platform Selection: Specific trading platforms offered are not detailed in current information. This includes proprietary or third-party solutions, mobile applications, and platform features.

Regional Restrictions: Geographic limitations or restrictions on services are not specified in available documentation. Potential clients from different regions should verify their eligibility directly.

Customer Service Languages: Available customer support languages and communication channels are not detailed in current sources. This Alkhair Capital review highlights the limited availability of specific operational details, which potential clients should clarify directly with the company.

The evaluation of Alkhair Capital's account conditions faces significant limitations because there isn't enough publicly available information about specific account types, terms, and requirements. The company operates as a substantial financial institution with SAR 1 billion in paid-up capital, but detailed information about retail trading accounts, institutional offerings, and account tiers remains unclear in current documentation.

Minimum deposit requirements usually serve as a key factor in broker selection, but they are not specified in available sources. This lack of transparency makes it difficult for potential clients to understand the financial commitment required to begin trading or access different service levels, which is a significant concern.

Information about account opening procedures, required documentation, and verification processes is also not detailed in current sources. Given the company's focus on Islamic finance, it makes sense that Sharia-compliant account options may be available, though specific features and conditions of such accounts are not clearly outlined.

The absence of detailed account information represents a significant gap in transparency. Potential clients should address this through direct communication with the company before making any decisions.

This Alkhair Capital review cannot provide a definitive assessment of account conditions without more complete information about terms, requirements, and available options. Clients need this information to make informed choices about their trading accounts.

The assessment of trading tools and resources offered by Alkhair Capital is severely limited by the lack of detailed information in available sources. As a company providing brokerage services since 2009, you would expect a range of trading tools, analytical resources, and educational materials, yet specific details about these offerings are not documented in current sources.

Market research and analysis resources are crucial for informed trading decisions, but they are not described in available documentation. Educational resources that might help clients understand market dynamics or improve their trading skills are also not detailed, which is concerning for potential clients.

The absence of information about charting tools, technical analysis capabilities, and fundamental analysis resources makes it difficult to evaluate the company's support for client trading activities. Automated trading support is also not mentioned in current sources, including Expert Advisors, algorithmic trading capabilities, or copy trading services.

For a brokerage operating for over a decade, the lack of detailed information about technological tools and resources represents a significant transparency gap. Potential clients should investigate these capabilities directly with the company before opening accounts.

Without specific information about tools and resources, this evaluation cannot provide meaningful insights into the company's technological capabilities or client support infrastructure. This is a major limitation for traders who rely on advanced tools and resources.

Customer service evaluation for Alkhair Capital faces substantial limitations because there isn't enough information about support channels, availability, and service quality in current documentation. The company has been operating since 2009 and serves clients requiring specialized Islamic finance services, but specific details about customer support infrastructure are not available in current sources.

Response times, service quality metrics, and customer satisfaction indicators are not documented in available information. The absence of details about support channels makes it impossible to assess the accessibility and convenience of customer service options, whether they offer phone, email, live chat, or in-person consultations.

Multi-language support capabilities would be particularly relevant for a Middle Eastern broker serving diverse regional clients, but they are not specified in current sources. Customer service hours, holiday schedules, and emergency support availability also remain unclear, which could be problematic for clients who need immediate assistance.

User feedback about customer service experiences is not completely available in current sources, though some user reviews and complaints have been referenced on various platforms. The limited availability of detailed customer service information represents a significant gap in transparency that potential clients should address through direct inquiry with the company.

Good customer service is essential for any financial services company. Without clear information about support options, potential clients cannot be sure they will receive adequate help when needed.

Evaluating the trading experience offered by Alkhair Capital proves challenging because there's limited information about platform performance, execution quality, and user interface characteristics in available sources. The company has established itself as a significant player in the Saudi Arabian financial sector, but specific details about trading platform stability, execution speeds, and overall trading environment are not documented.

Platform functionality remains unclear in current documentation, including order types, trading tools integration, and real-time data provision. The absence of information about slippage rates, execution quality statistics, and platform uptime makes it difficult to assess the technical performance that traders might experience, which is crucial for successful trading.

Mobile trading capabilities have become essential for modern traders, but they are not detailed in available sources. Information about platform customization options, advanced trading features, and integration with third-party tools is also not provided, limiting our ability to assess the complete trading experience.

User feedback specifically related to trading experience, platform performance, and execution quality is not completely available in current sources. This Alkhair Capital review cannot provide a meaningful assessment of trading experience without more detailed information about platform capabilities and performance metrics.

Trading experience directly affects profitability and satisfaction. Without clear information about these aspects, potential clients cannot make informed decisions about whether this broker meets their trading needs.

The trust and reliability assessment of Alkhair Capital presents a mixed picture based on available information. The company shows substantial financial backing with SAR 1 billion in paid-up capital and operates as a registered entity in Saudi Arabia, providing some foundation for institutional credibility.

The reported recognition as the fastest-growing brokerage company in the Middle East region in 2020 suggests industry acknowledgment of its growth trajectory. However, complete regulatory oversight details and international licensing information are not extensively documented in current sources, which raises some concerns about transparency.

While the company operates under Saudi Arabian commercial registration, specific regulatory protections, compliance measures, and oversight mechanisms remain unclear in available documentation. Client fund security measures, segregation policies, and deposit protection schemes are also not detailed in current sources, which is concerning for potential clients.

The absence of clear information about regulatory oversight and client protection mechanisms represents a significant concern for potential clients evaluating the safety of their investments. User complaints and reviews referenced in various sources indicate mixed experiences, though specific details about complaint resolution processes and company responses are not completely documented.

The limited transparency about regulatory status and client protection measures requires careful consideration by potential clients. Trust and reliability are fundamental for any financial services provider, and the lack of clear information in these areas is problematic.

User experience evaluation for Alkhair Capital faces significant limitations because there isn't enough detailed feedback and interface information in available sources. The company has been operating for over fifteen years and serves clients in the specialized Islamic finance sector, but complete user satisfaction data and detailed experience reports are not extensively available.

Interface design, navigation ease, and overall platform usability are not described in current documentation. The absence of information about user onboarding processes, account management interfaces, and general platform accessibility makes it difficult to assess the quality of user interaction with the company's services, which directly affects client satisfaction.

Registration and verification procedures significantly impact initial user experience, but they are not detailed in available sources. Fund management processes are also not completely documented, including deposit and withdrawal experiences, which are crucial aspects of the overall user experience.

User feedback compilation from available sources indicates mixed reviews and some complaints, though specific details about common user concerns and company responsiveness are not extensively documented. The limited availability of complete user experience data represents a significant gap in understanding the practical aspects of working with this broker.

Good user experience is essential for client retention and satisfaction. Without clear information about how users interact with the platform and services, potential clients cannot assess whether they will have a positive experience with this broker.

This Alkhair Capital review reveals a financial institution with substantial backing and established presence in the Saudi Arabian market. Significant transparency gaps limit complete evaluation, though.

The company's SAR 1 billion paid-up capital and reported industry recognition suggest institutional credibility, but the absence of detailed information about trading conditions, regulatory oversight, and client services creates uncertainty for potential clients. The broker appears most suitable for investors specifically seeking Islamic finance-compliant services, given its stated specialization in Sharia-compliant financial products.

However, the limited transparency about account conditions, trading platforms, and regulatory protections requires careful consideration and direct verification with the company. The main advantages include established market presence and specialization in Islamic finance, while the primary concerns center on insufficient transparency about operational details and mixed user feedback.

Potential clients should conduct thorough research and direct communication with the company to clarify essential terms and conditions before making investment decisions. This step is crucial given the limited publicly available information about many important aspects of the company's services.

FX Broker Capital Trading Markets Review