Regarding the legitimacy of ONE ROYAL forex brokers, it provides ASIC, CYSEC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is ONE ROYAL safe?

Pros

Cons

Is ONE ROYAL markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Royal Financial Trading Pty Ltd

Effective Date: Change Record

2012-06-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 15 60 MARGARET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Royal Financial Trading (Cy) Ltd

Effective Date:

2016-08-10Email Address of Licensed Institution:

Compliance@oneroyal.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.oneroyal.euExpiration Time:

--Address of Licensed Institution:

152 Fragklinou Rousvelt, 3045 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 080 880Licensed Institution Certified Documents:

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Royal CM Limited

Effective Date:

2022-12-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is OneRoyal A Scam?

Introduction

OneRoyal is a multi-licensed forex and CFD broker that has been operating since 2006. It has positioned itself as a reliable option for traders looking for diverse trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. As the trading landscape becomes increasingly accessible, it is crucial for traders to carefully evaluate the credibility of their chosen brokers. The potential for scams in the forex market necessitates a thorough investigation of the regulatory compliance, financial practices, and overall reputation of brokers like OneRoyal. This article employs a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer experiences, and risk evaluations to determine whether OneRoyal is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a key factor in assessing the legitimacy of a forex broker. OneRoyal operates under the oversight of multiple regulatory bodies, which adds a layer of security for its clients. The broker is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Vanuatu Financial Services Commission (VFSC), and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines. The presence of these regulatory licenses indicates a commitment to maintaining industry standards and protecting client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 420268 | Australia | Verified |

| CySEC | 312/16 | Cyprus | Verified |

| VFSC | 700284 | Vanuatu | Verified |

| FSA | 149 LLC 2019 | Saint Vincent | Verified |

The quality of regulation is paramount, with ASIC and CySEC recognized as tier-1 regulatory bodies that enforce strict compliance measures. OneRoyal's adherence to these regulations suggests a commitment to transparency and client safety. However, it is important to note that the VFSC and FSA are often viewed as less stringent, which could raise concerns about the broker's overall regulatory framework. Historical compliance records for OneRoyal indicate no significant regulatory breaches, further enhancing its credibility as a legitimate broker.

Company Background Investigation

OneRoyal was established in 2006 and has since grown to become a prominent player in the forex and CFD trading space. The company is owned and operated by Royal Financial Trading Pty Ltd, which is registered in Australia and holds the necessary licenses to operate in various jurisdictions. The management team comprises experienced professionals with backgrounds in finance and trading, ensuring that the company is led by individuals who understand the complexities of the financial markets.

Transparency is a critical aspect of any broker's operations, and OneRoyal appears to maintain a clear outline of its business practices. The company's website provides detailed information about its services, regulatory status, and contact details, which is essential for building trust with potential clients. However, some traders have expressed concerns regarding the availability of comprehensive information about the company's ownership structure and management team. A higher level of transparency in these areas could further bolster OneRoyal's reputation as a trustworthy broker.

Trading Conditions Analysis

OneRoyal offers a range of trading conditions that cater to different types of traders. The broker's fee structure is competitive, with low spreads and various account types available. Traders can choose from classic, ECN, VIP, and ECN Elite accounts, each with its own advantages and minimum deposit requirements. The overall cost structure is designed to be transparent, with no hidden fees that could catch traders off guard.

| Cost Type | OneRoyal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.4 pips | 1.0 - 2.0 pips |

| Commission Model | $0 - $7 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

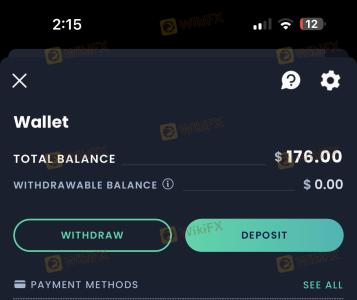

OneRoyal's spreads start as low as 0.0 pips for ECN accounts, which is competitive compared to industry averages. However, traders should be aware of the commission structure associated with different account types, as this can significantly impact overall trading costs. While the broker does not impose deposit or withdrawal fees, some clients have reported unexpected charges related to specific payment methods, which could be a point of concern.

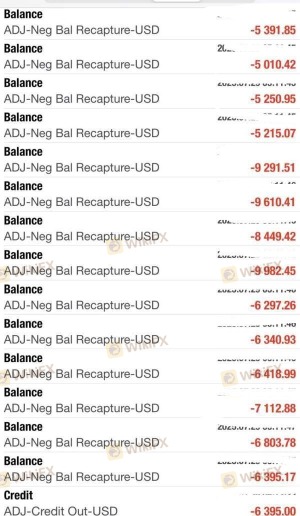

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. OneRoyal implements several measures to ensure the security of its clients' assets. Client funds are held in segregated accounts, meaning that they are kept separate from the company's operational funds. This practice is essential for protecting traders' capital in the event of financial difficulties faced by the broker.

Additionally, OneRoyal offers negative balance protection, which prevents clients from losing more than their account balance. This feature is particularly important for traders who utilize high leverage, as it mitigates the risk of incurring significant losses. While there have been no major incidents reported regarding fund security at OneRoyal, traders should remain vigilant and conduct their own due diligence to ensure their investments are safe.

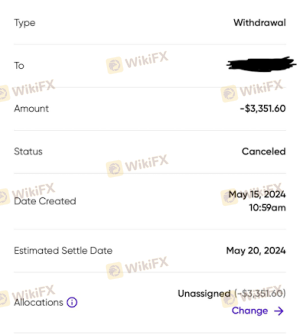

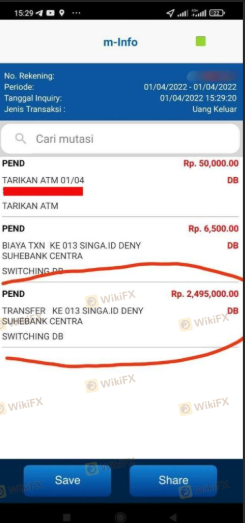

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. OneRoyal has received mixed reviews from users, with some praising the broker's trading conditions and customer support, while others have raised concerns about withdrawal delays and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Slow response |

| Poor Customer Support | High | Inconsistent |

| Account Verification Issues | Moderate | Generally resolved |

Common complaints among users include delays in processing withdrawal requests and difficulties in reaching customer support during peak times. For instance, one trader reported waiting several days for a withdrawal to be processed, leading to frustration and concerns about the broker's reliability. While OneRoyal has made efforts to address these issues, the inconsistency in customer service response times remains a point of contention.

Platform and Trade Execution

OneRoyal utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading features. The platform supports a variety of trading tools, including expert advisors (EAs) for automated trading. Overall, users have reported a satisfactory experience with the platform's performance, although some have noted occasional instances of slippage during high volatility periods.

The execution quality on OneRoyal's platform is generally regarded as reliable, with most trades being executed promptly. However, traders should be cautious of potential slippage, particularly during major economic events when market conditions can be unpredictable. There have been no significant reports of order manipulation or refusal to execute trades, which is a positive indicator of the broker's integrity.

Risk Assessment

Using OneRoyal as a trading platform comes with inherent risks, as is the case with any broker. Traders should be aware of the following risks associated with OneRoyal:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple regulators, but some are less stringent. |

| Withdrawal Delays | High | Reports of slow processing of withdrawal requests. |

| Customer Service Issues | Medium | Inconsistent response times from support team. |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. It is also recommended to start with a demo account to familiarize themselves with the platform and trading conditions before committing real funds.

Conclusion and Recommendations

In summary, OneRoyal presents itself as a legitimate broker with a solid regulatory framework and competitive trading conditions. However, potential traders should be cautious of reported withdrawal delays and customer service inconsistencies. While there are no clear indications of fraudulent activity, the mixed reviews and some complaints warrant careful consideration.

For traders seeking a reliable forex broker, it may be beneficial to explore alternatives such as brokers with a stronger reputation for customer service and more robust regulatory oversight. Overall, OneRoyal could be a suitable choice for traders who prioritize low spreads and a diverse range of trading instruments, but they should remain vigilant and informed about the potential risks involved.

Is ONE ROYAL a scam, or is it legit?

The latest exposure and evaluation content of ONE ROYAL brokers.

ONE ROYAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ONE ROYAL latest industry rating score is 6.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.