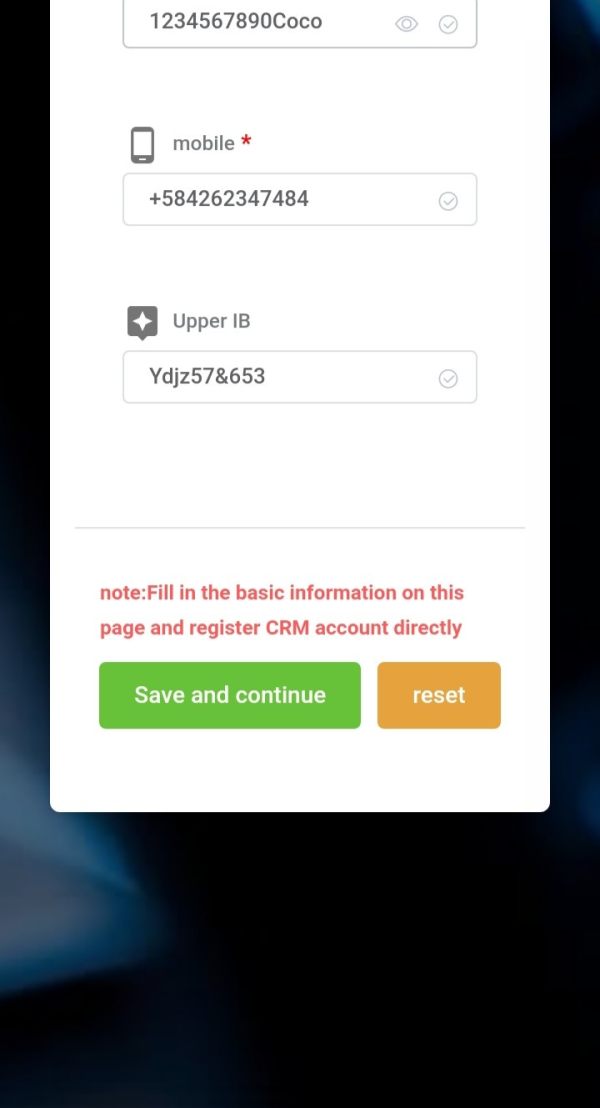

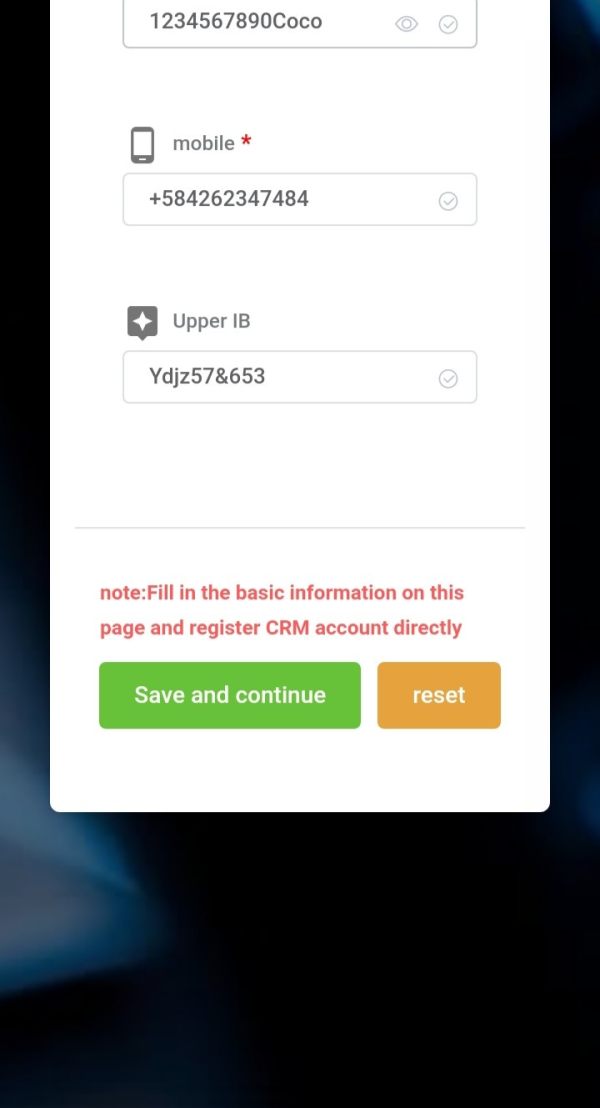

Founded under the trading name Vero Ford Markets Limited, the broker claims to be positioned within the UK forex market. Despite its claims of legitimacy and operational capability, the company fails to establish itself under proper regulatory compliance, consequently weakening its credibility in the eyes of potential clients. This broker primarily targets the Chinese market and promises an array of trading instruments while failing to provide transparency in its operational practices.

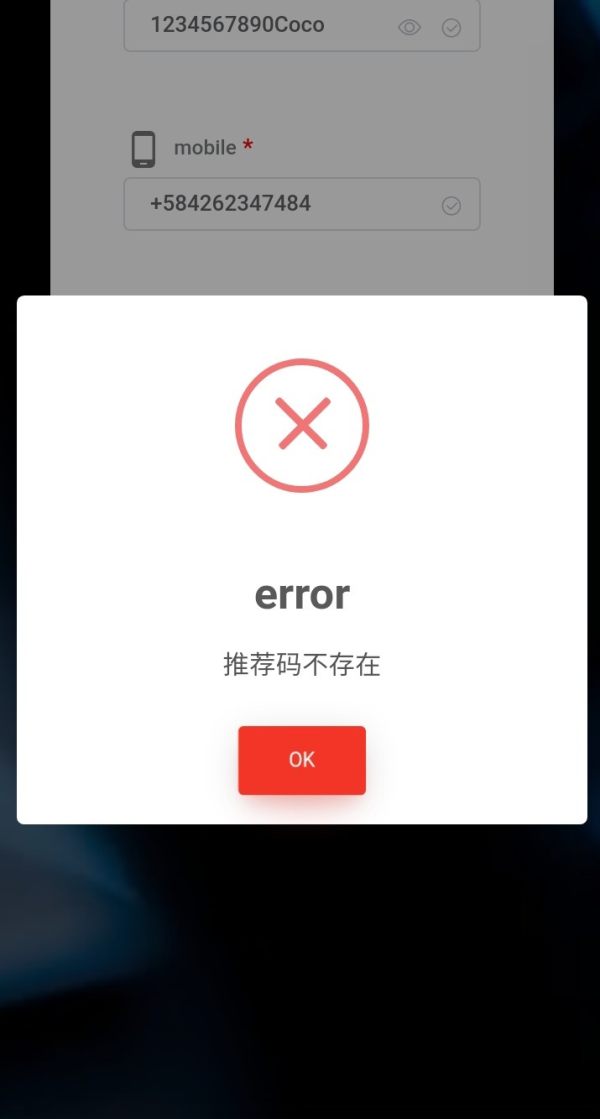

Vero Ford specializes in forex trading and claims to offer clients access to vital financial instruments including currencies, commodities, stocks, and indexes. Their trading modes include the popular MetaTrader 4 (MT4) platform. Despite these offerings, it is essential to note that Vero Ford operates without valid regulatory oversight, raising significant concerns for its clients assets and investments.

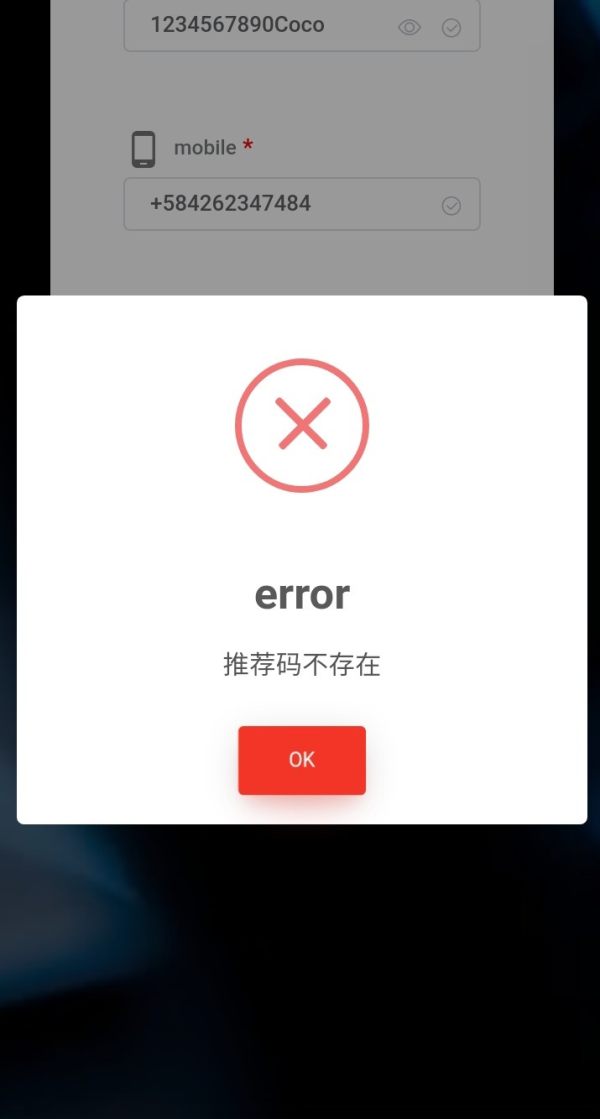

Vero Ford lacks valid regulatory licensing, resulting in a significantly low score of 1.78/10 on WikiFX and a growing number of complaints regarding fund safety. The absence of proper regulatory supervision exposes traders to potential fraud and significant risks.

- Visit the NFAs BASIC database: NFA BASIC.

- Search for the broker's name: Vero Ford.

- Verify whether they are listed or flagged for any misconduct.

- Check for links to other regulatory orders or warnings.

- Confirm any user experiences via trading community platforms.

“Vero Ford is a very bad broker, and I was unable to withdraw my funds.” - User review on WikiFX

Industry Reputation:

Feedback surrounding Vero Ford tends to be predominantly negative, particularly about the safety of users' capital. Many traders have expressed concerns about withdrawal challenges, reinforcing the broker's unreliable reputation.

Trading Costs Analysis

Advantages in Commissions:

Vero Ford boasts a low-cost commission structure favorable for experienced traders. The minimum spread starts from 1.6 pips, and higher tiers offer tighter spreads from 0.6 pips, which presents an attractive value proposition amid competitive markets.

The "Traps" of Non-Trading Fees:

Despite the allure of low commissions, users have reported hidden fees that diminish overall gains. Positive experiences reporting low trading fees often contrast with complaints about excessive withdrawal fees, with some users stating:

"I lost $30 on a withdrawal fee without prior notice." - User complaint on WikiFX.

Cost Structure Summary:

For experienced traders who are comfortable with risks, Vero Ford might offer appealing commission structures. However, the hidden costs associated with fund movement create a precarious balance, especially for less informed clients.

Platform Diversity:

Vero Ford provides access solely through the MT4 platform—one of the most recognized platforms in forex trading. It supports various functionalities such as algorithmic trading, comprehensive charting tools, and adaptability across devices (iOS and Android). However, the lack of newer platforms might limit functionality for some users.

Quality of Tools and Resources:

While MT4 offers professional stability, the supporting educational resources offered by Vero Ford are lackluster. Comparatively, other brokers provide more extensive training materials, which are vital for market newbies.

Platform Experience Summary:

User feedback on the platform suggests usability challenges, especially for first-time traders venturing into the financial markets. Overall impressions highlight that while MT4's reliability is acknowledged, operational support and educational materials are found deficient.

User Experience Analysis

User experiences with Vero Ford show a blend of highs and lows. The appeal of their commission structure clashes with significant withdrawal difficulties and customer service issues. A fair amount of dissatisfaction regarding responsiveness emphasizes the broker's inadequate user support framework.

Customer Support Analysis

Vero Ford's customer support has been described as inconsistent. Despite having multiple avenues for communication, including a phone line and email, several users have reported slow or ineffective responses. Concerns about fund withdrawal have further complicated the perception of their customer service quality.

Account Conditions Analysis

Vero Ford's account conditions appeal to active traders, specifically with their competitive leverage and low deposit thresholds. However, proceeding without adequate regulatory oversight calls for cautious consideration of the inherent risks that come with these account settings.

Conclusion

In conclusion, while Vero Ford offers a competitive trading environment with low entry costs and high leverage options, the glaring lack of regulatory oversight presents significant risks. Experienced traders may appreciate the potential for profit, but the myriad of withdrawal complaints and inadequate customer support highlights the need for regulatory scrutiny. Therefore, individuals should thoroughly weigh these trade-offs before engaging with this broker. New or inexperienced traders, in particular, should remain cautious and seek more stable, regulated alternatives for their forex trading needs.