Yomani Review 1

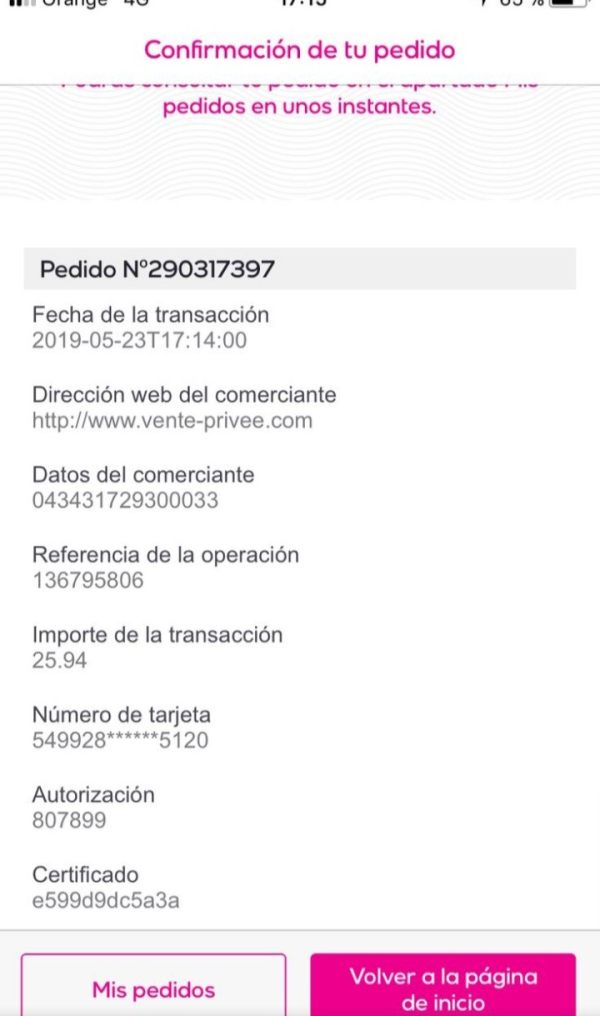

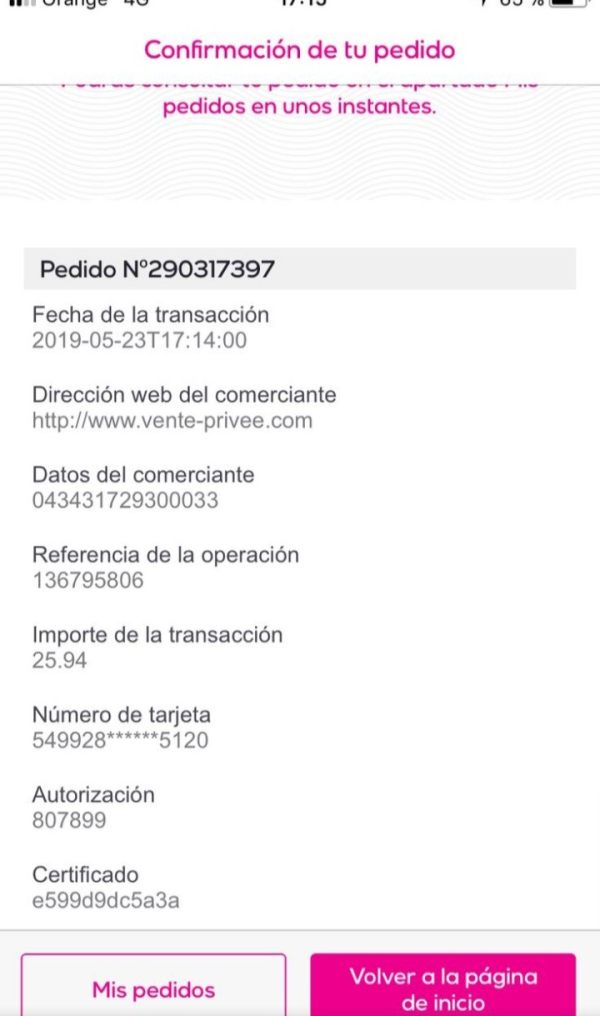

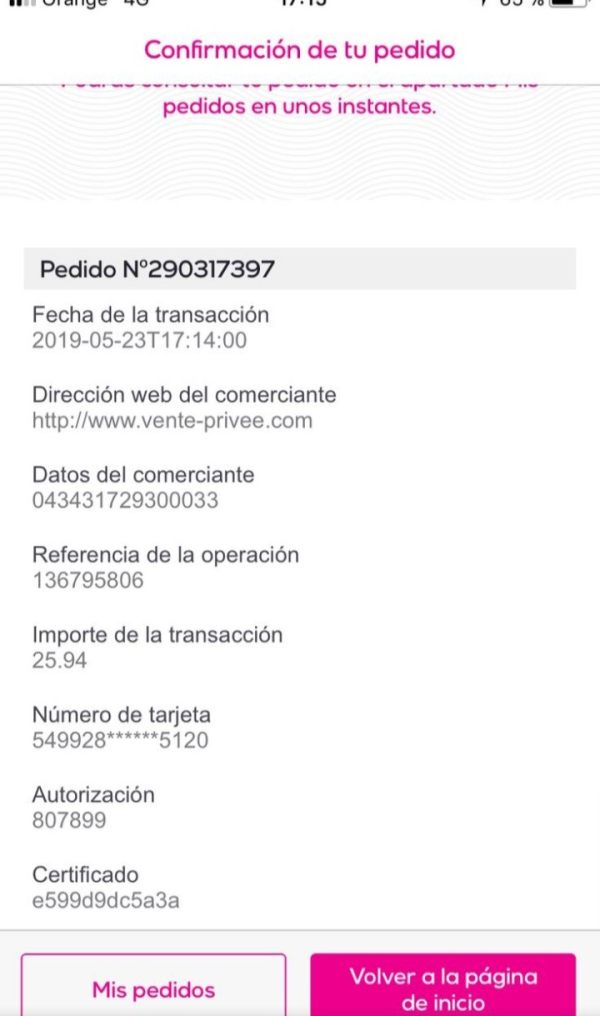

This company is a fraud, they have taken my deposit of $ 25.94, and the platform fell out of service, the IP address of your page does not work correctly, I have been scammed

Yomani Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

This company is a fraud, they have taken my deposit of $ 25.94, and the platform fell out of service, the IP address of your page does not work correctly, I have been scammed

This Yomani review gives you a complete analysis of a broker that works with very little public information and almost no user feedback. Yomani seems to be a new company in the financial services world, but we don't have enough information about whether it follows regulations, what its trading conditions are, or how it operates. The broker's profile stays mostly unknown. We found very few user reviews and limited transparency about how the business works.

Yomani has some key features that stand out, including no regulatory information and extremely few user testimonials, which hurts how credible it appears. The platform seems to target traders who want to try newer or less-established market players. However, this comes with risks because there's no comprehensive oversight and no proven track record.

The main users for Yomani would likely be traders willing to explore emerging markets or those looking for brokers that haven't gained widespread attention yet. Potential clients should be very careful since we have limited information about the company's operations, regulatory compliance, and customer protection measures.

This evaluation uses publicly available information and limited user feedback, which may not show the complete picture of Yomani's services and capabilities. We don't have detailed information about differences between regional entities, so trading conditions, regulatory oversight, and available services may vary a lot depending on where the client lives and which specific Yomani entity they work with.

Our assessment method relies on available data sources, user reviews, and industry standards. However, since we have limited information about Yomani, this review may not capture the full scope of the broker's offerings or how it operates. Potential clients should strongly consider doing independent research and getting additional information directly from the broker before making any investment decisions.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 3/10 | Poor |

| Customer Service and Support | 4/10 | Below Average |

| Trading Experience | 5/10 | Average |

| Trust and Regulation | 2/10 | Poor |

| User Experience | 4/10 | Below Average |

| Overall Score | 3.7/10 | Below Average |

Yomani operates as a financial services company with limited publicly available information about when it started, its corporate background, or its operational history. Research sources show that the broker lacks comprehensive documentation about its founding year, headquarters location, or corporate structure. This absence of fundamental business information raises significant concerns about transparency and regulatory compliance within the financial services industry.

The company's business model stays largely unclear based on current available data. Established brokers typically provide detailed information about their trading infrastructure, regulatory oversight, and operational framework, but Yomani shows minimal disclosure regarding these critical aspects. This lack of transparency may indicate either a very new market entrant or a broker operating with limited regulatory oversight.

Specific information about Yomani review criteria regarding trading platforms and asset offerings remains unavailable in current documentation. The broker has not clearly specified its trading platform technology, whether it operates on proprietary systems or third-party solutions, or the range of financial instruments available to clients. Additionally, regulatory oversight information is notably absent, with no clear indication of licensing jurisdictions or supervisory authorities governing its operations.

Regulatory Jurisdiction: Current available information does not specify any regulatory oversight or licensing jurisdictions for Yomani, which represents a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and available payment systems has not been disclosed in available documentation. This limits clients' ability to assess operational convenience.

Minimum Deposit Requirements: No specific minimum deposit amounts have been identified in current available information. This makes it difficult to assess accessibility for different trader segments.

Promotional Offers: Details regarding welcome bonuses, trading incentives, or promotional campaigns are not available in current documentation. This suggests either absence of such programs or limited marketing disclosure.

Available Trading Instruments: The range of tradeable assets, including forex pairs, commodities, indices, or other financial instruments, remains unspecified in available information sources.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs has not been disclosed. This prevents accurate cost comparison with industry standards.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. These are crucial factors for risk management assessment.

Platform Options: Information regarding trading platform availability, mobile applications, or web-based trading solutions remains undisclosed in current Yomani review materials.

Geographic Restrictions: Specific information about regional availability or restricted jurisdictions has not been provided in available sources.

Customer Support Languages: Available customer service languages and communication channels are not specified in current documentation.

The assessment of Yomani's account conditions proves challenging due to the absence of detailed information regarding account types, structural offerings, and client onboarding processes. The broker has not published comprehensive details about different account tiers, their respective features, or the benefits associated with various account levels based on available data. This lack of transparency significantly hampers potential clients' ability to make informed decisions about account selection.

Minimum deposit requirements represent another area where information remains unavailable. Industry standards typically range from $10 to $500 for basic accounts, with premium accounts requiring higher initial investments. However, we cannot determine Yomani's specific requirements from current available sources, making it impossible to assess accessibility for different trader demographics or compare competitiveness with industry standards.

The account opening process lacks detailed documentation regarding required verification procedures, documentation requirements, or processing timeframes. Established brokers typically provide clear guidance about Know Your Customer procedures, document submission requirements, and account activation timelines. The absence of such information from Yomani review materials suggests either incomplete disclosure or potentially underdeveloped operational procedures.

Special account features, including Islamic trading accounts, professional trader classifications, or institutional services, remain unspecified in available documentation. These specialized offerings are increasingly important for brokers serving diverse global markets, and their absence or non-disclosure may limit the broker's appeal to specific trader segments requiring compliant trading solutions.

The evaluation of Yomani's trading tools and analytical resources faces significant limitations due to insufficient available information about the broker's technological infrastructure and client support systems. Current documentation does not specify the range of trading tools, analytical software, or supplementary resources provided to clients. This represents a critical gap in assessing the broker's value proposition.

Research and market analysis capabilities remain undisclosed in available sources. Established brokers typically offer economic calendars, market commentary, technical analysis tools, and fundamental research reports to support client decision-making. The absence of information regarding such resources in this Yomani review suggests either limited offerings or inadequate disclosure of available services.

Educational resources, including webinars, tutorials, trading guides, or market education programs, are not mentioned in current available documentation. These resources are increasingly important for broker differentiation and client retention, particularly for novice traders requiring guidance and skill development. The lack of educational program information may indicate limited investment in client development or insufficient marketing of available resources.

Automated trading capabilities, including Expert Advisor support, copy trading systems, or algorithmic trading infrastructure, remain unspecified. Modern trading environments increasingly demand sophisticated automation tools, and the absence of such information limits assessment of the broker's technological competitiveness and appeal to advanced trader segments requiring automated execution capabilities.

Customer service evaluation for Yomani encounters substantial challenges due to the limited availability of information regarding support infrastructure, response protocols, and service quality metrics. Available documentation does not specify the customer service channels offered, such as live chat, telephone support, email assistance, or help desk systems. This makes it impossible to assess accessibility and convenience for clients requiring assistance.

Response time commitments and service level agreements remain undisclosed in current sources. Industry standards typically include response time guarantees for different communication channels, with live chat responses expected within minutes and email inquiries addressed within 24 hours. The absence of such commitments in available Yomani review materials prevents assessment of service reliability and client support prioritization.

Service quality indicators, including customer satisfaction metrics, resolution rates, or service quality monitoring systems, are not available in current documentation. Established brokers often publish customer satisfaction scores or maintain third-party service quality certifications, which help potential clients assess expected support experiences. The lack of such information limits confidence in service delivery capabilities.

Multilingual support capabilities and global service coverage remain unspecified in available sources. International brokers typically offer support in multiple languages and provide regional service coverage to accommodate diverse client bases. The absence of language support information may indicate limited international capabilities or insufficient disclosure of available services, potentially affecting accessibility for non-English speaking clients.

The assessment of Yomani's trading experience faces significant constraints due to limited available information regarding platform performance, execution quality, and overall trading environment characteristics. Current documentation does not provide specific details about platform stability, system uptime, or technical performance metrics that are crucial for evaluating trading experience quality.

Order execution capabilities, including execution speeds, slippage management, and order fulfillment quality, remain undisclosed in available sources. These factors are critical for trader satisfaction and profitability, particularly for strategies requiring precise timing or high-frequency trading approaches. The absence of execution quality data in this Yomani review prevents accurate assessment of trading environment competitiveness.

Platform functionality and feature completeness cannot be adequately evaluated based on current available information. Modern trading platforms typically offer advanced charting tools, technical indicators, risk management features, and customizable interfaces. The lack of platform specification details limits understanding of available functionality and user experience quality.

Mobile trading capabilities and cross-device synchronization features are not specified in available documentation. Mobile trading has become essential for modern traders requiring flexibility and constant market access. The absence of mobile platform information may indicate limited technological development or inadequate disclosure of available mobile solutions, potentially affecting trader convenience and market participation capabilities.

The evaluation of Yomani's trustworthiness and regulatory compliance reveals significant concerns due to the complete absence of regulatory information in available documentation. Regulatory oversight represents the cornerstone of broker credibility and client protection, making this information gap particularly problematic for potential clients seeking secure trading environments.

No regulatory licenses, supervisory authorities, or compliance certifications have been identified in current available sources. Established brokers typically maintain licenses from recognized financial regulators such as the FCA, CySEC, ASIC, or other respected supervisory bodies. The absence of regulatory information in this Yomani review raises serious questions about legal compliance, client fund protection, and operational legitimacy within regulated financial markets.

Client fund security measures, including segregated account policies, deposit insurance coverage, or investor compensation schemes, remain completely unspecified. These protections are fundamental requirements in regulated jurisdictions and serve as critical safeguards for client investments. The lack of fund security information represents a major red flag for potential clients considering account opening with Yomani.

Corporate transparency and public disclosure practices appear limited based on available information. Reputable brokers typically provide comprehensive company information, including corporate registration details, management team profiles, financial statements, and operational transparency reports. The absence of such disclosures suggests either limited transparency practices or potential concerns regarding corporate legitimacy and operational accountability within the financial services sector.

User experience assessment for Yomani proves extremely challenging due to the scarcity of user feedback and testimonial information in available sources. The limited user review data significantly constrains the ability to evaluate real-world client satisfaction, platform usability, and overall service delivery quality from actual user perspectives.

Interface design and platform usability cannot be adequately assessed without access to user feedback or platform demonstrations. Modern trading platforms require intuitive design, efficient navigation, and user-friendly interfaces to support effective trading activities. The absence of user experience data in available Yomani review materials prevents evaluation of these critical usability factors.

Registration and account verification processes lack detailed user feedback regarding convenience, efficiency, and user-friendliness. Client onboarding experiences significantly impact initial impressions and long-term satisfaction, making user testimonials valuable for assessing operational quality. The limited availability of such feedback constrains understanding of actual client experiences with Yomani's operational procedures.

Common user complaints and satisfaction patterns remain unknown due to insufficient review data. Established brokers typically accumulate substantial user feedback that reveals both strengths and areas for improvement. The absence of comprehensive user feedback for Yomani may indicate either very limited client base, recent market entry, or insufficient engagement with review platforms and feedback collection systems.

This Yomani review reveals a broker operating with significant information gaps and limited transparency regarding fundamental business operations, regulatory compliance, and service offerings. The overall assessment remains notably constrained by the absence of comprehensive data about trading conditions, regulatory oversight, and user experiences, resulting in a below-average evaluation across multiple criteria.

Yomani may potentially suit traders specifically seeking opportunities with emerging or less-established market participants, though such engagement carries substantial risks due to the lack of regulatory clarity and proven operational track record. The broker's current information profile suggests either very recent market entry or limited commitment to transparency and public disclosure.

The primary concerns identified include the complete absence of regulatory information, limited user feedback availability, and insufficient disclosure regarding trading conditions and operational procedures. These factors significantly impact the broker's credibility and make it difficult to recommend for mainstream trading activities, particularly for clients prioritizing security, transparency, and regulatory protection in their trading relationships.

FX Broker Capital Trading Markets Review