Duhani Capital 2025 Review: Everything You Need to Know

Executive Summary

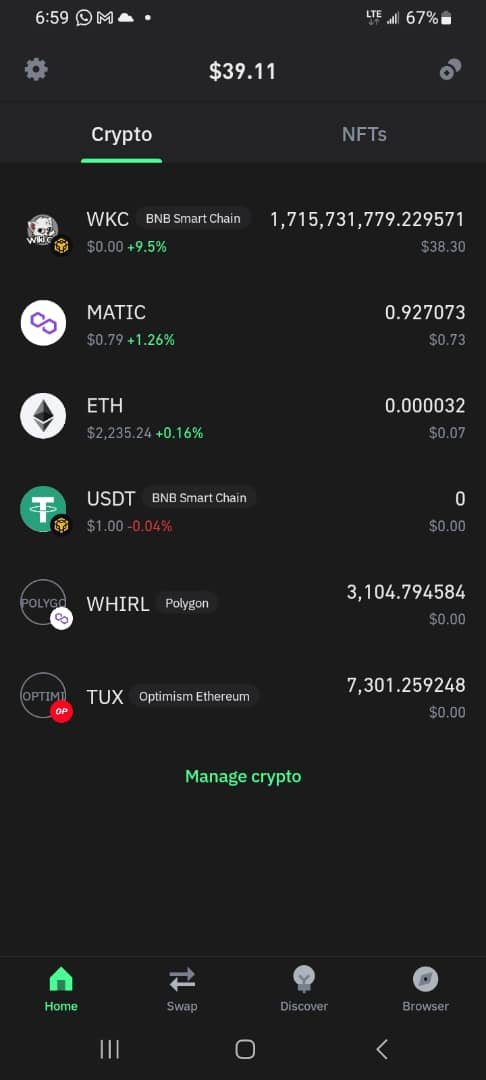

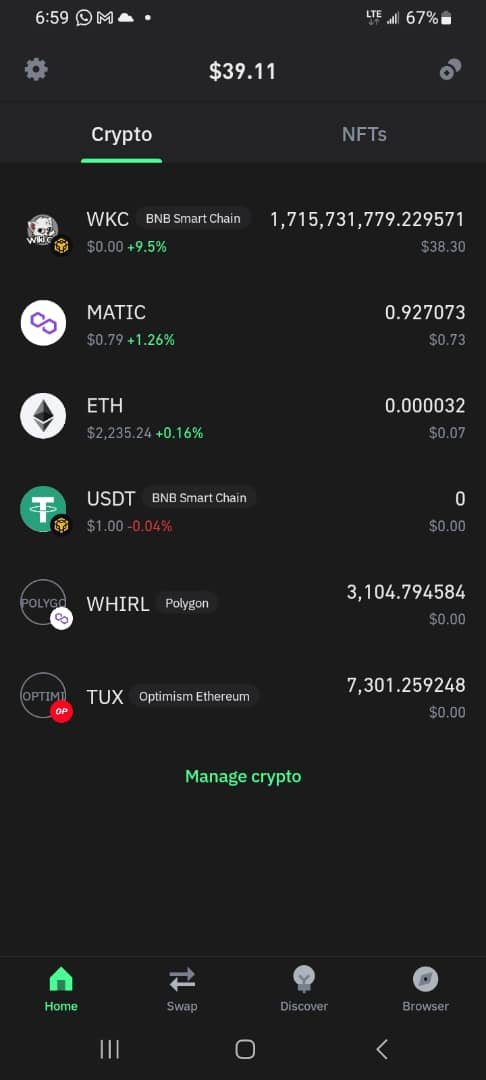

Duhani Capital is a new online forex broker. It was founded in 2023 and is registered in Dominica. This duhani capital review shows that the broker offers high leverage trading options up to 1:1000. This makes it attractive to traders who want bigger market exposure. The company works as an offshore financial services provider and specializes in leveraged transactions across various financial markets including forex, commodities, indices, and cryptocurrencies.

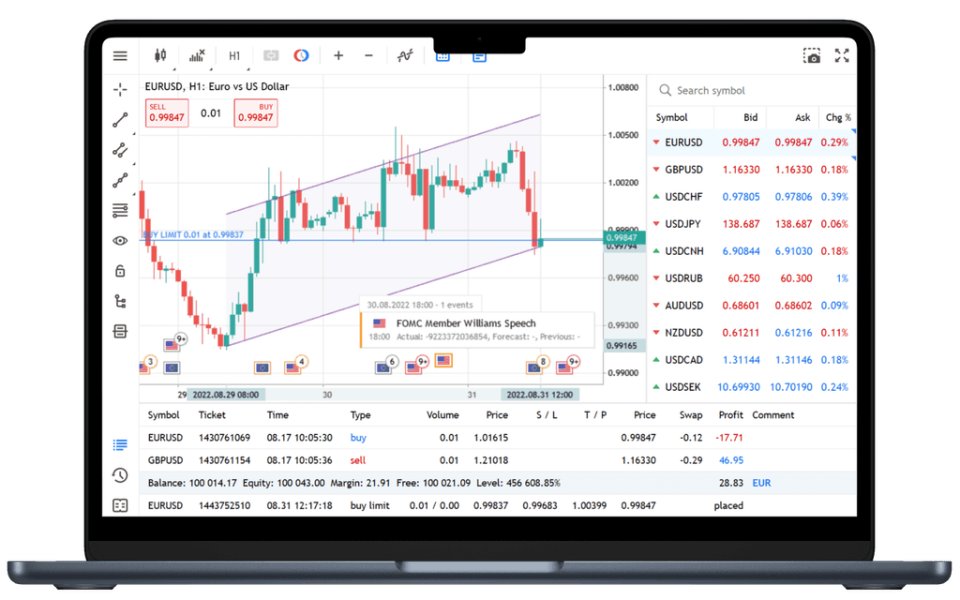

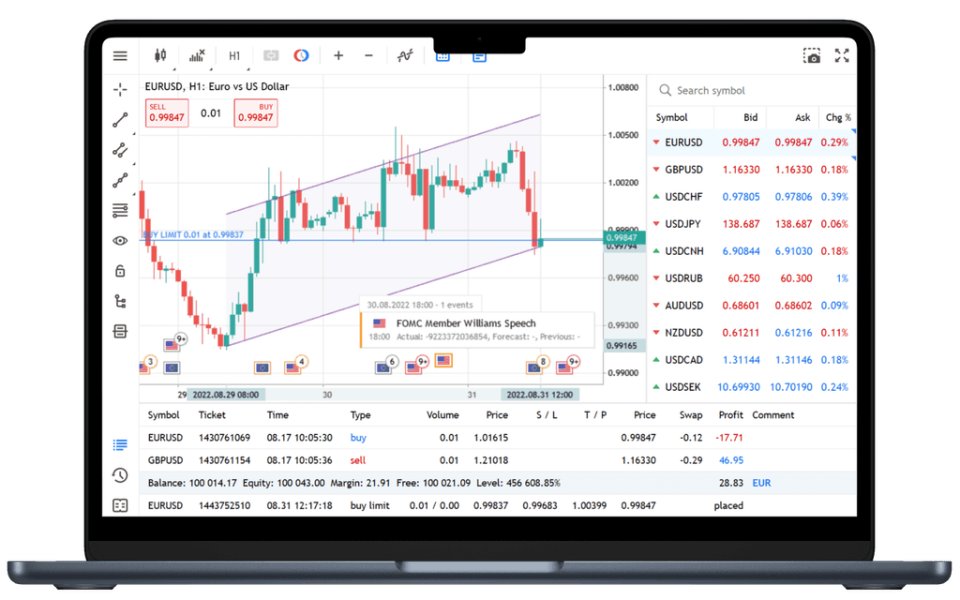

The broker uses the MetaTrader 5 platform. It provides five different live account types plus a demo account to fit various trading preferences. With its 24/5 trading availability and focus on technology, Duhani Capital positions itself as an investor-oriented organization. However, as an offshore broker regulated in Dominica, questions about its regulatory oversight and client protection measures have emerged among potential users. The broker mainly targets traders who seek high leverage opportunities and diversified trading assets. Its legitimacy and safety remain subjects of ongoing discussion in trading communities.

Important Notice

Regional Entity Differences: Duhani Capital operates as an offshore broker registered in Dominica. It falls under the jurisdiction of the Dominica Financial Services Commission. As an offshore entity, the regulatory oversight and client protection measures may be much weaker compared to brokers regulated by major financial authorities such as the FCA, ASIC, or CySEC. Potential clients should know that offshore regulation typically provides limited investor protection and recourse options.

Review Methodology: This comprehensive assessment is based on publicly available information, regulatory data, and user feedback collected from various sources. The evaluation aims to provide prospective users with an objective analysis of Duhani Capital's services, features, and overall reliability in the competitive forex brokerage landscape.

Overall Rating Framework

Broker Overview

Company Background and Establishment

Duhani Capital was established in 2023. It operates from St. George, Roseau, Dominica. As a relatively new entrant in the online financial markets, the company positions itself as an investor-oriented organization focused on providing reliable and solution-oriented services. The broker specializes in leveraged transactions across money markets and emphasizes its technology infrastructure, security measures, and order transmission speed as key competitive advantages.

With a team of expert staff, Duhani Capital offers comprehensive access to forex market advantages 24 hours a day, 5 days a week. The company's business model centers on providing high-leverage trading opportunities while maintaining what it claims to be robust technological support systems for its client base.

Trading Infrastructure and Asset Coverage

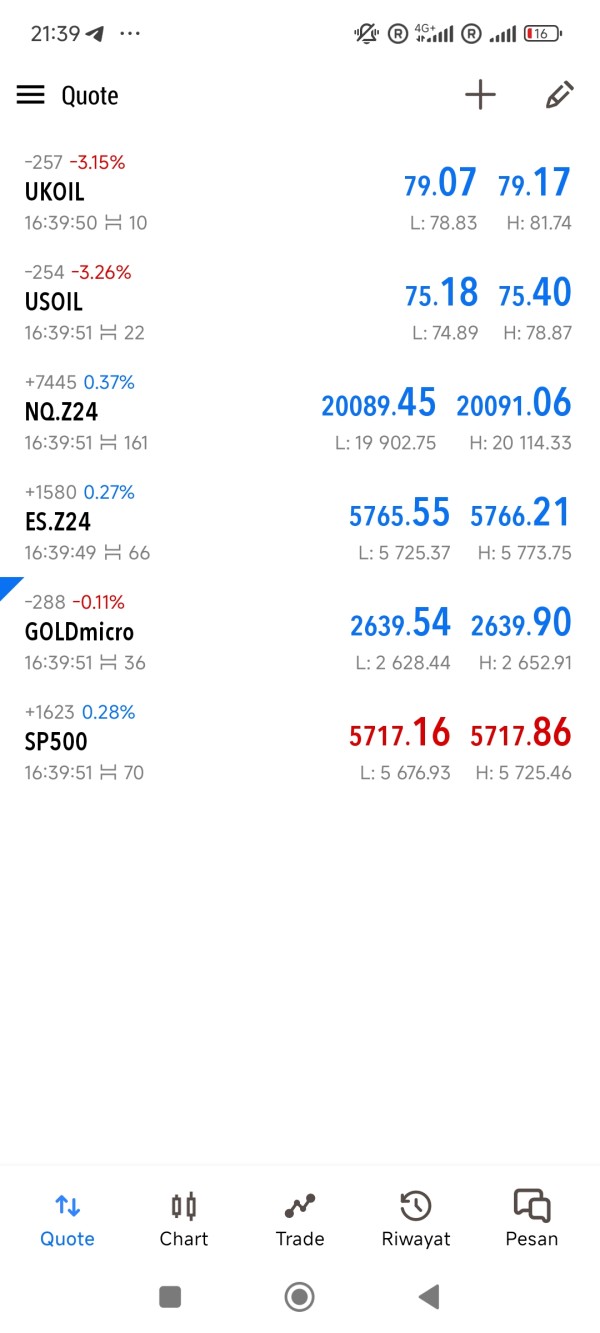

This duhani capital review shows that the broker uses the MetaTrader 5 platform as its primary trading interface. It provides clients with access to advanced charting tools, technical indicators, and automated trading capabilities. The platform supports trading across multiple asset classes including major and minor currency pairs, precious metals like gold, various commodities, individual stocks, global indices, and cryptocurrency instruments.

The broker operates under the regulatory framework of Dominica. This positions it as an offshore financial services provider. While this allows for higher leverage ratios and more flexible trading conditions, it also means that client protection measures may not meet the standards typically associated with major regulatory jurisdictions.

Regulatory Jurisdiction: Duhani Capital operates under the regulatory oversight of the Dominica Financial Services Commission. As an offshore jurisdiction, Dominica's regulatory framework provides limited investor protection compared to tier-one regulators. This may impact client fund security and dispute resolution processes.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available materials. This raises transparency concerns for potential clients seeking clear funding options.

Minimum Deposit Requirements: The minimum deposit requirements for different account types were not specified in available documentation. This makes it difficult for traders to assess entry-level investment needs.

Promotional Offers: No specific bonus programs or promotional activities were mentioned in available sources. This suggests the broker may not currently offer introductory incentives or loyalty rewards.

Tradeable Assets: The platform provides access to diverse trading instruments including major and exotic currency pairs, precious metals (particularly gold), various commodities, individual stocks, global market indices, and cryptocurrency pairs. This offers traders multiple diversification opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not provided in available materials. This significantly impacts cost transparency for potential clients.

Leverage Ratios: The broker offers maximum leverage up to 1:1000. This appeals to traders seeking high market exposure but also increases risk levels substantially.

Platform Options: MetaTrader 5 serves as the primary trading platform. It provides comprehensive technical analysis tools, automated trading support, and multi-asset trading capabilities.

Geographic Restrictions: Specific regional limitations or restricted countries were not detailed in available information.

Customer Support Languages: Available customer service languages were not specified in source materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Account Variety and Structure

Duhani Capital provides five distinct live trading accounts alongside a demo account option. This demonstrates an attempt to cater to various trader experience levels and capital requirements. The variety suggests the broker recognizes different client needs, from beginners requiring smaller position sizes to experienced traders seeking advanced features. However, this duhani capital review identifies significant transparency concerns regarding account specifications.

Deposit Requirements and Accessibility

The absence of clearly stated minimum deposit requirements creates uncertainty for potential clients. They cannot evaluate their entry options properly. This lack of transparency makes it difficult to assess whether the broker caters to retail traders with smaller capital or primarily targets high-net-worth individuals. Clear deposit requirements are fundamental for trader decision-making and the absence of this information suggests incomplete service documentation.

Account Opening Process

While specific details about the account opening process were not available in source materials, the provision of demo accounts indicates some level of accessibility for users wanting to test the platform before committing funds. However, without detailed onboarding information, it's challenging to evaluate the efficiency and user-friendliness of the registration process.

Special Account Features

No information was available regarding Islamic accounts, VIP services, or other specialized account features. Many brokers offer these to accommodate different religious, cultural, or investment preferences. This duhani capital review notes this as a potential limitation for traders requiring specific account accommodations.

Trading Platform Capabilities

The MetaTrader 5 platform represents a significant strength in Duhani Capital's offering. It provides traders with industry-standard tools including advanced charting capabilities, technical indicators, and algorithmic trading support. MT5's multi-asset trading functionality aligns well with the broker's diverse instrument offering, allowing seamless transitions between forex, commodities, and other asset classes within a single interface.

Asset Diversity and Market Access

The broker's comprehensive asset coverage spans currencies, precious metals, commodities, stocks, indices, and cryptocurrencies. This provides substantial diversification opportunities. The range allows traders to implement various strategies across different market conditions and economic cycles, representing good value for traders seeking multi-market exposure.

Research and Analysis Resources

Available information did not detail specific research offerings, market analysis, or educational resources provided by the broker. This represents a significant gap in service transparency. Quality research and educational support are crucial differentiators in the competitive brokerage landscape.

Automation and Advanced Features

While MetaTrader 5 supports automated trading through Expert Advisors (EAs), specific information about Duhani Capital's policies regarding algorithmic trading, latency optimization, or advanced order types was not available in source materials.

Customer Service and Support Analysis (Score: 5/10)

Service Quality and Responsiveness

According to available user feedback, customer service quality appears inconsistent. Some traders express dissatisfaction with response times and problem resolution capabilities. This suggests potential inadequacies in support infrastructure or staff training, which could significantly impact user experience during critical trading situations or account issues.

Support Channel Availability

Specific information about available customer service channels (phone, email, live chat, etc.) was not detailed in source materials. This lack of transparency regarding support accessibility raises concerns about the broker's commitment to client communication and assistance availability.

Professional Competency

User feedback indicates concerns about the professional competency and problem-solving abilities of customer service representatives. Effective support requires both technical knowledge and communication skills. Deficiencies in either area can severely impact client satisfaction and trust.

Service Hours and Coverage

While the broker claims 24/5 trading availability, specific customer service hours and timezone coverage were not detailed. Given the global nature of forex markets, comprehensive support coverage is essential for addressing urgent trading-related issues.

Trading Experience Analysis (Score: 6/10)

Platform Stability and Performance

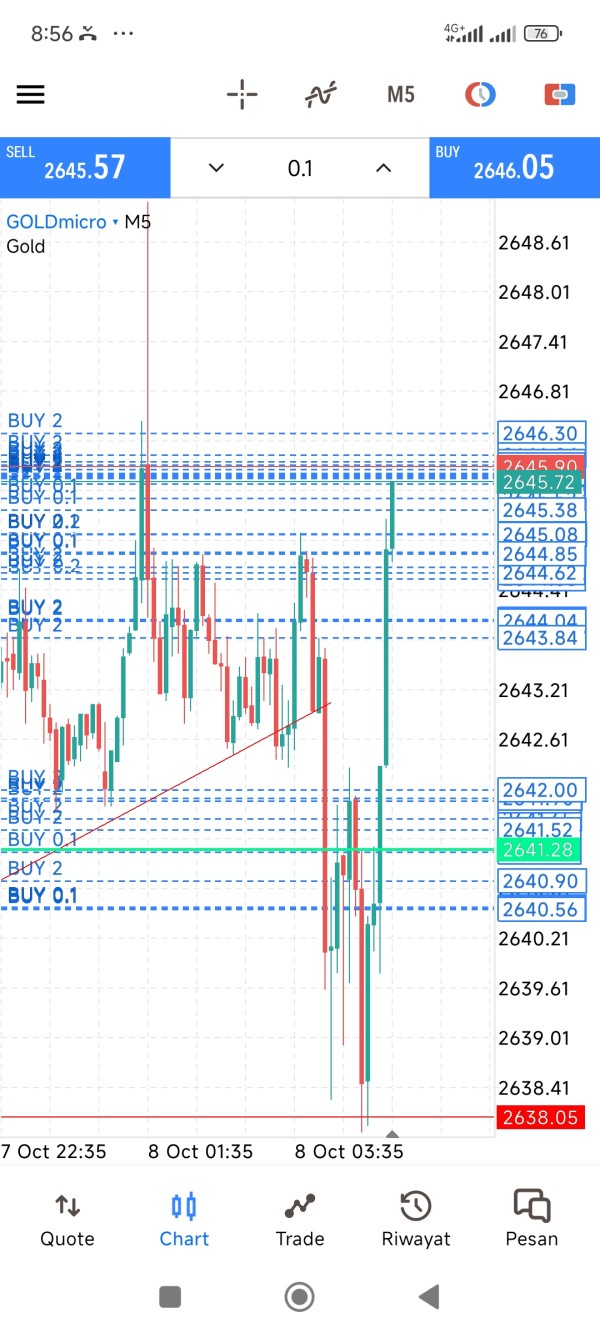

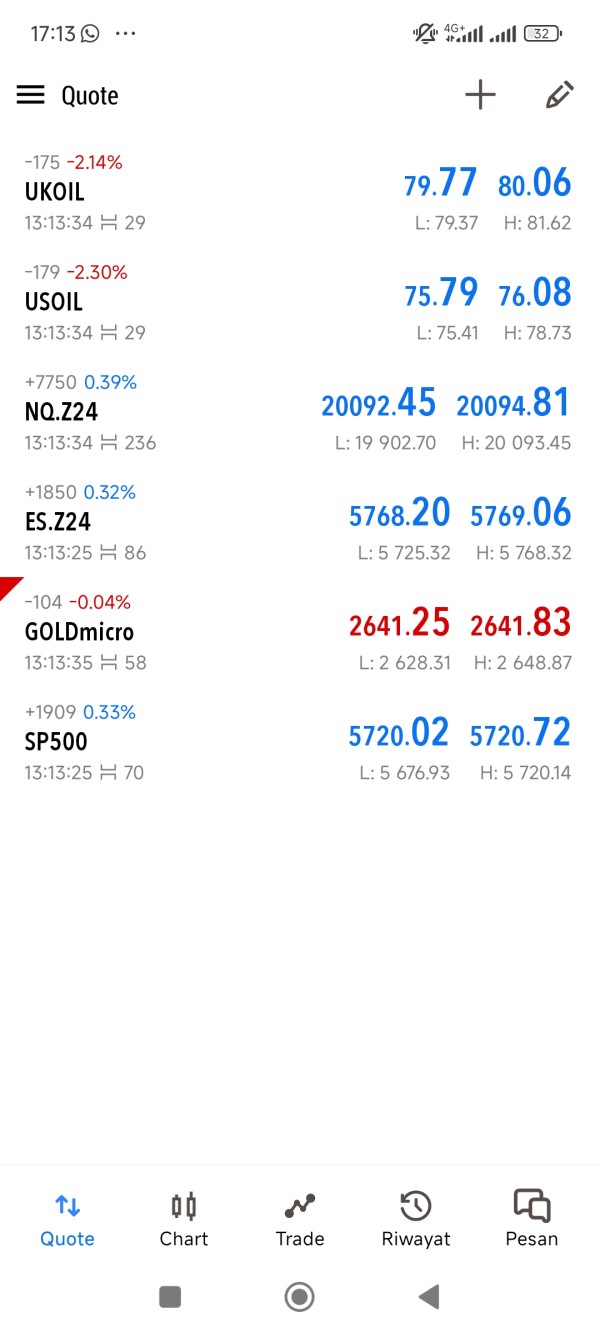

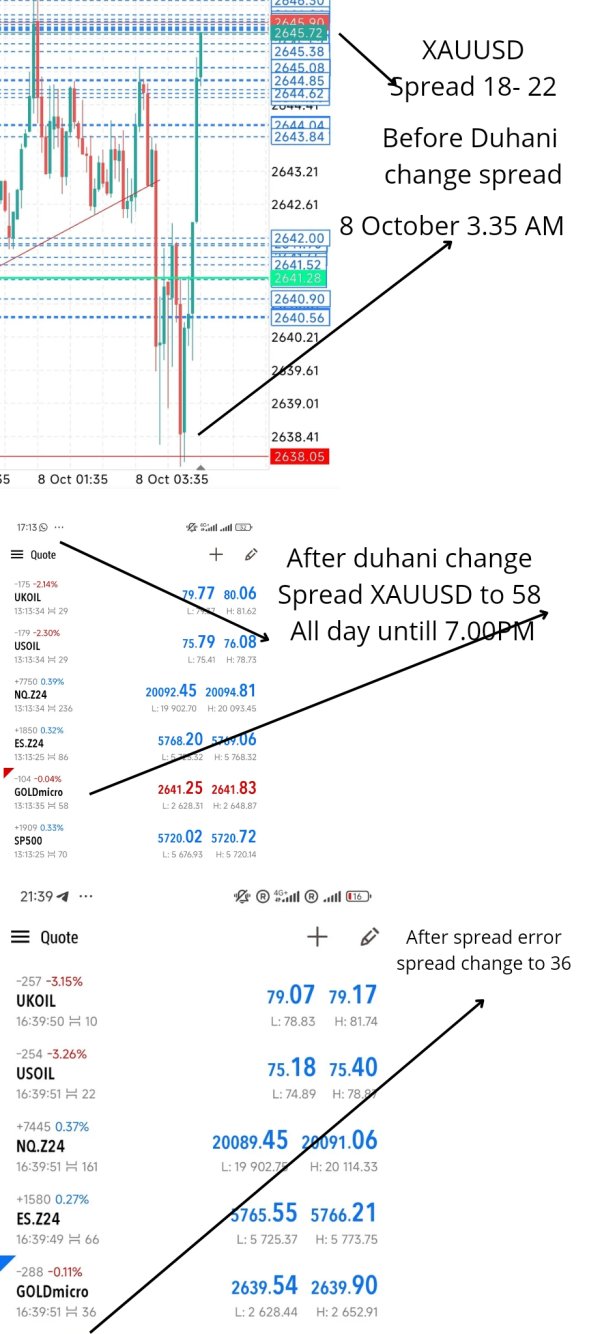

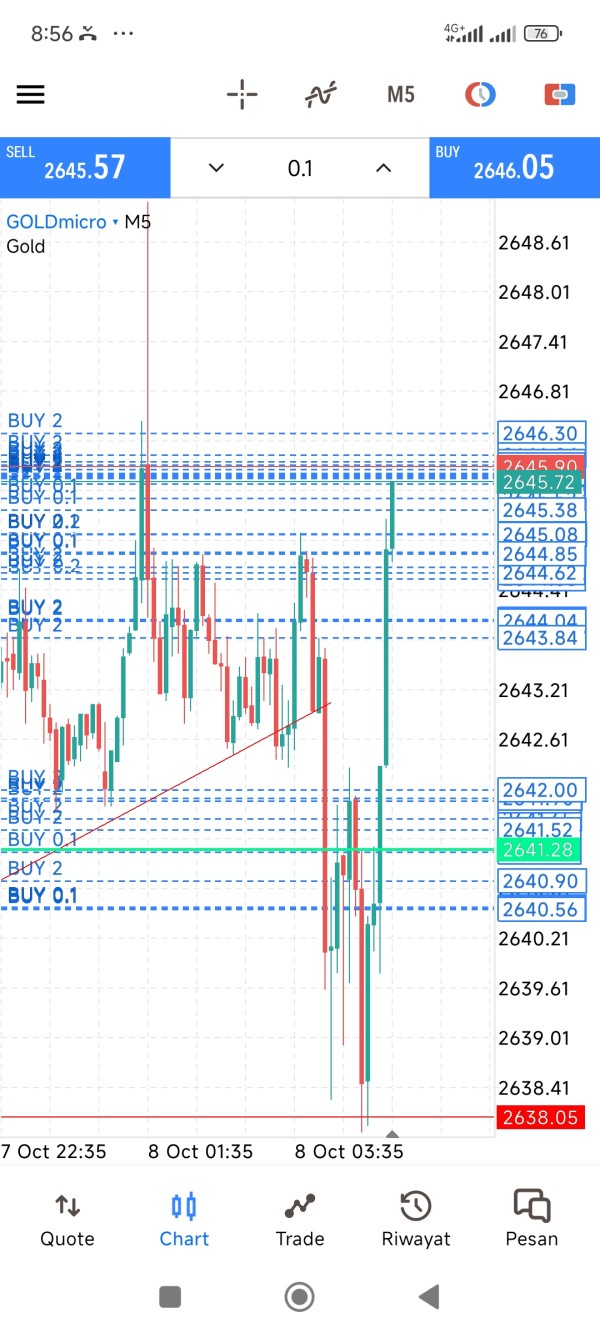

User feedback regarding platform stability and execution speed presents mixed results. Some traders report concerns about slippage and requotes during volatile market conditions. These execution issues can significantly impact trading profitability and user satisfaction, particularly for scalpers and high-frequency traders.

Order Execution Quality

Reports of slippage and requoting suggest potential challenges in the broker's order execution infrastructure or liquidity provision. Quality execution is fundamental to trader success. Consistent execution problems can erode confidence in the broker's reliability and technological capabilities.

Platform Functionality

MetaTrader 5's comprehensive functionality provides robust trading capabilities. However, user-specific experiences with Duhani Capital's implementation were not extensively documented. The platform's native features include advanced charting, multiple timeframes, and extensive technical analysis tools.

Mobile Trading Experience

Specific information about mobile application performance, features, or availability was not provided in source materials. Mobile trading capability is increasingly important for active traders requiring market access across different locations and time zones.

This duhani capital review notes that while the underlying MT5 platform is sophisticated, the broker's specific implementation and infrastructure quality remain areas requiring further evaluation based on user feedback.

Trust and Safety Analysis (Score: 4/10)

Regulatory Framework and Oversight

Duhani Capital's regulation under the Dominica Financial Services Commission represents a significant concern for trader safety and fund security. Dominica operates as an offshore jurisdiction with limited regulatory enforcement capabilities and minimal investor protection measures compared to established financial centers. This regulatory environment provides fewer safeguards against broker misconduct or financial difficulties.

Fund Security Measures

Available information did not detail specific client fund protection measures such as segregated accounts, deposit insurance, or compensation schemes. The absence of clearly stated fund protection policies raises serious concerns about capital safety. This is particularly concerning given the offshore regulatory environment.

Company Transparency and Background

As a newly established broker founded in 2023, Duhani Capital lacks the operational history and track record that would typically support trust assessments. Limited publicly available information about company ownership, financial backing, or operational transparency further compounds trust concerns.

Industry Recognition and Reputation

No information was available regarding industry awards, third-party certifications, or recognition from reputable financial industry organizations. The absence of external validation makes it difficult to assess the broker's standing within the professional trading community.

Negative Feedback and Legitimacy Concerns

User discussions regarding the broker's legitimacy and potential scam concerns significantly impact trust assessments. While such discussions are common with new brokers, the combination of offshore regulation and limited transparency amplifies these concerns.

User Experience Analysis (Score: 5/10)

Overall Satisfaction Indicators

Available user feedback presents mixed satisfaction levels. Some traders express concerns about service quality and platform performance. The limited feedback available makes it challenging to establish clear satisfaction trends or identify consistent user experience patterns.

Interface Design and Usability

While MetaTrader 5 provides a professionally designed interface, specific customizations or modifications implemented by Duhani Capital were not detailed in available materials. The standard MT5 interface is generally well-regarded for its functionality. However, it may require some learning curve for new users.

Registration and Verification Process

Detailed information about account opening procedures, verification requirements, and onboarding efficiency was not available in source materials. Streamlined registration processes are important for user experience. This is particularly true in competitive brokerage markets.

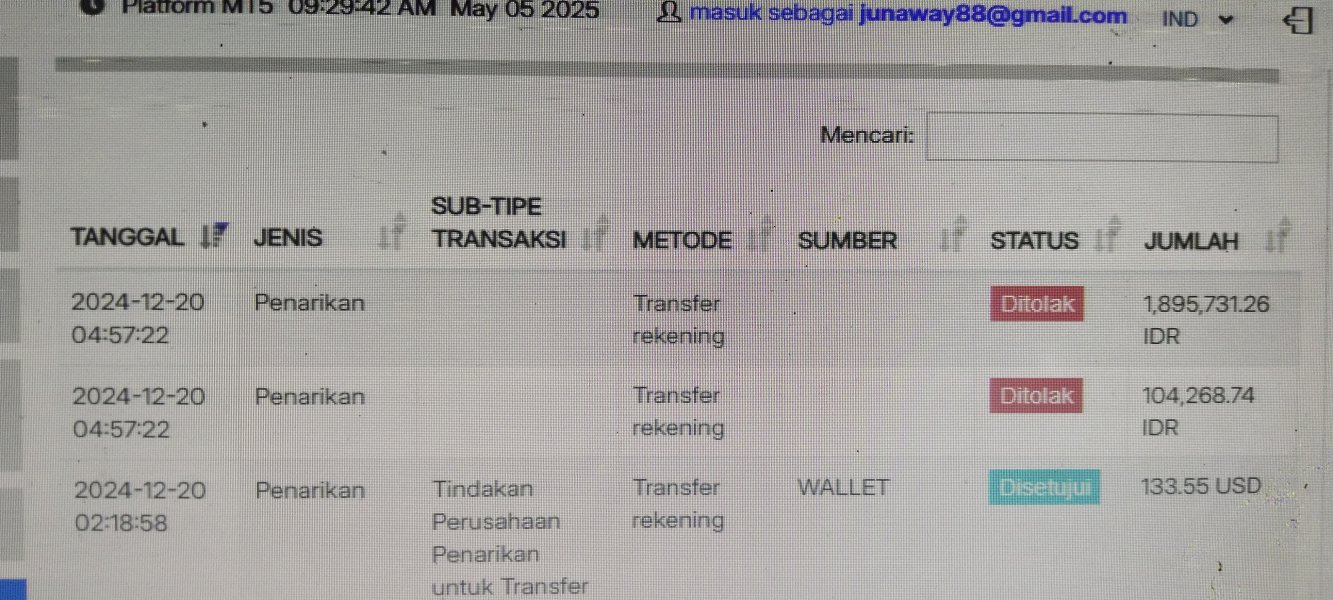

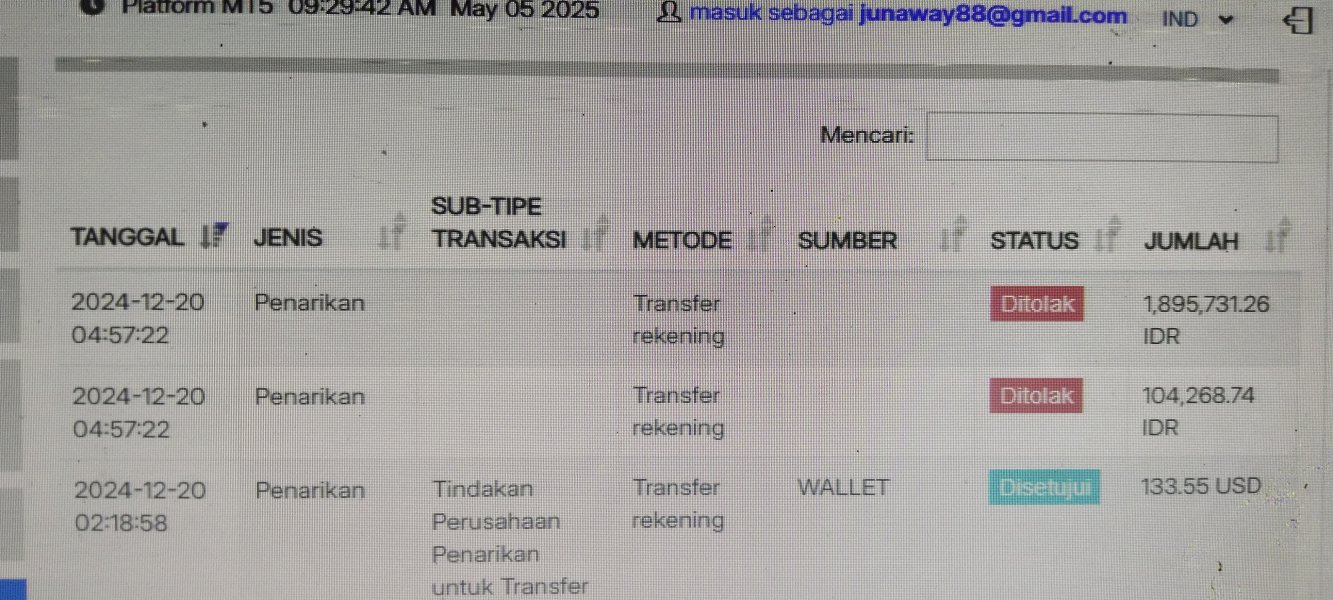

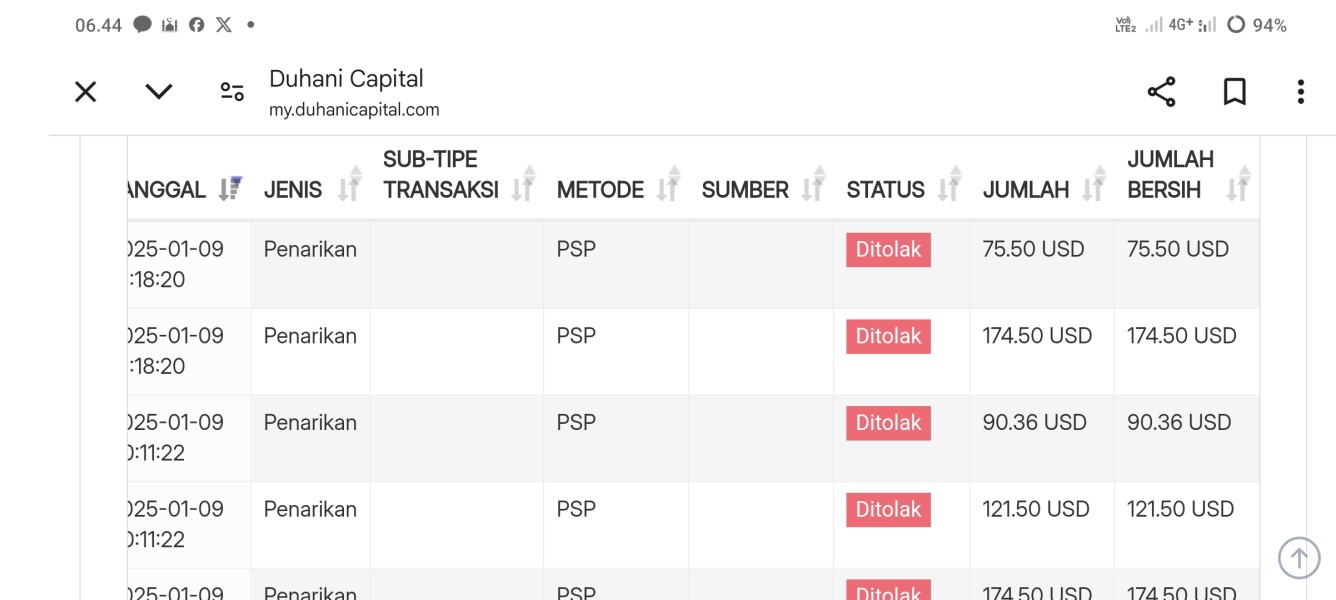

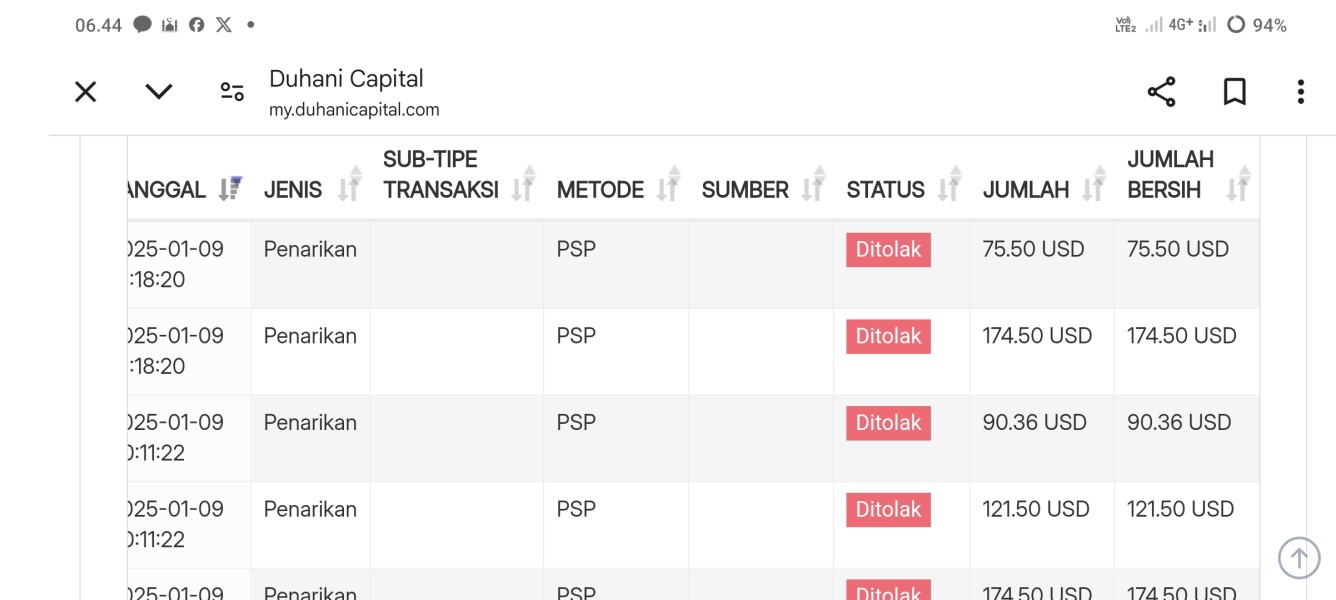

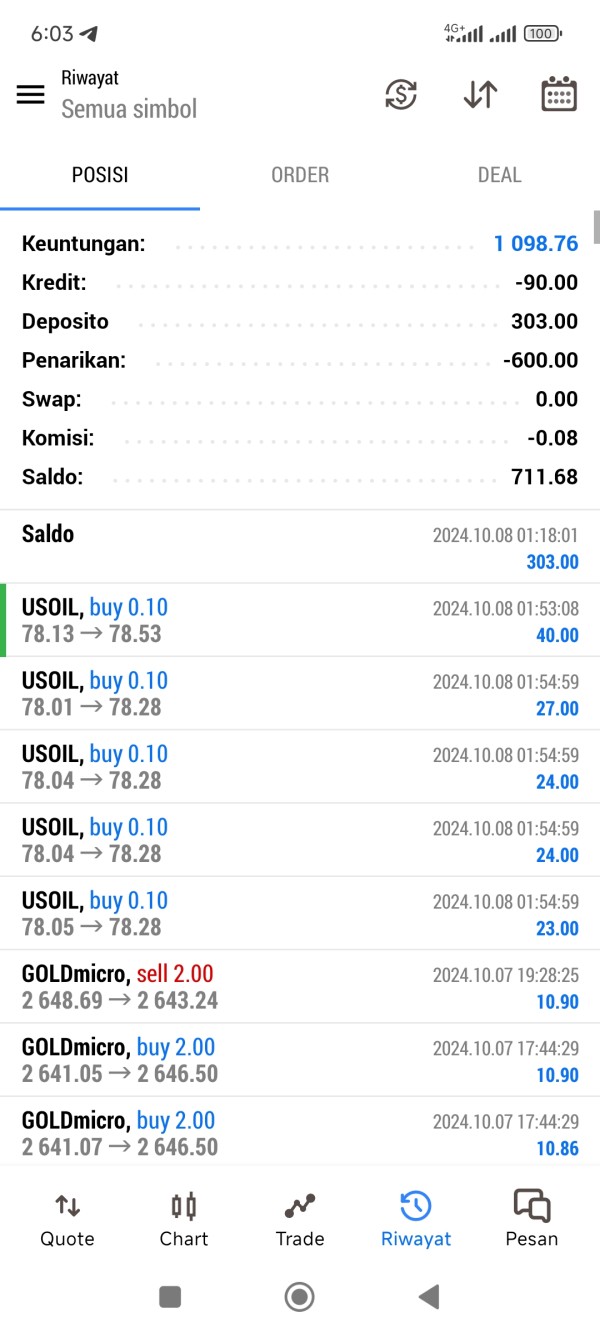

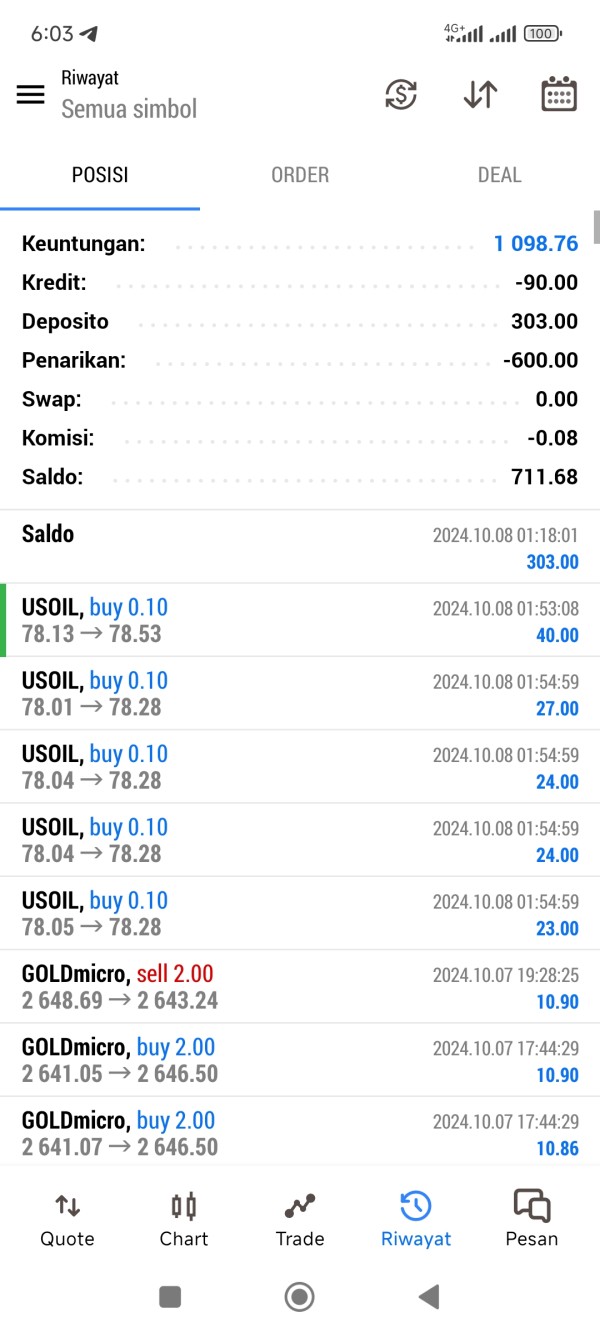

Fund Management Experience

Specific user experiences regarding deposit and withdrawal processes, processing times, and associated fees were not documented in available sources. Efficient fund management is crucial for trader satisfaction and operational confidence.

Common User Concerns

The limited available feedback suggests concerns primarily around service quality and execution performance. However, comprehensive user experience data was not extensively documented. This duhani capital review notes that more extensive user feedback would be valuable for prospective clients.

Conclusion

Overall Assessment

This comprehensive duhani capital review reveals a newly established offshore forex broker that offers high leverage trading opportunities and diverse asset access through the MetaTrader 5 platform. While the broker provides some attractive features for traders seeking amplified market exposure, significant concerns regarding regulatory oversight, transparency, and service quality impact its overall appeal.

Target User Recommendations

Duhani Capital may suit experienced traders with high risk tolerance who prioritize leverage availability over regulatory protection. However, the broker's offshore status and limited transparency make it unsuitable for conservative investors. It's also not suitable for those prioritizing capital protection and regulatory oversight.

Key Advantages and Limitations

Primary advantages include high leverage ratios up to 1:1000, diverse trading instruments across multiple asset classes, and access to the sophisticated MetaTrader 5 platform. However, significant disadvantages include weak offshore regulation, limited transparency regarding costs and policies, mixed user feedback on service quality, and concerns about legitimacy and fund safety. Potential clients must carefully consider these factors.