Stuart Winston 2025 Review: Everything You Need to Know

Summary

This comprehensive stuart winston review reveals significant concerns about the platform's legitimacy and safety for traders. Stuart Winston has received widespread negative attention across multiple review platforms. Users consistently report financial misconduct and fraudulent activities. The platform promotes itself as offering automated trading tools for financial markets, but user experiences paint a drastically different picture.

Key characteristics that emerge from user feedback include the availability of automated trading systems. These initially attract traders seeking algorithmic solutions. However, these features are overshadowed by the platform being flagged as a potential scam across various review websites. Trustpilot reviews specifically label Stuart Winston as "scammers." Multiple independent review platforms warn potential users to exercise extreme caution.

The platform appears to target traders with higher risk tolerance. Even experienced traders are advised to conduct thorough due diligence before considering any engagement. The lack of transparent regulatory information, combined with consistent negative user feedback, raises serious questions about the platform's operational integrity and financial practices.

Important Notice

This review is based on comprehensive analysis of user feedback and information gathered from multiple review websites and platforms. The evaluation draws from publicly available sources including Trustpilot reviews, independent broker review sites, and the platform's own promotional materials. Due to limited official regulatory disclosures, much of the assessment relies on user-reported experiences and third-party evaluations.

Readers should note that regulatory information for Stuart Winston remains unclear or unverified across available sources. The assessment methodology prioritizes user safety and transparency. It focuses on documented user experiences and warnings from established review platforms.

Rating Framework

Broker Overview

Stuart Winston operates as a financial trading platform that positions itself within the broader financial markets ecosystem. The platform's promotional materials emphasize their automated trading tools and claim to serve traders across various experience levels. However, specific details regarding the company's establishment date, founding team, and corporate background remain conspicuously absent from available public information.

The platform's business model centers around providing access to financial markets through their proprietary trading interface. Stuart Winston Broker presents itself as a comprehensive trading solution. However, detailed information about their operational structure, company registration, and business licensing is notably limited in publicly accessible sources.

The stuart winston review landscape reveals concerning gaps in transparency regarding fundamental company information. The platform operates without clear disclosure of regulatory oversight. This represents a significant red flag for potential users. The absence of verifiable company background information, combined with negative user feedback, suggests potential issues with operational legitimacy and regulatory compliance.

Regulatory Status: Available information does not specify any recognized financial regulatory oversight for Stuart Winston. The absence of clear regulatory authorization from established authorities like FCA, CySEC, or ASIC raises immediate concerns about platform legitimacy and user protection.

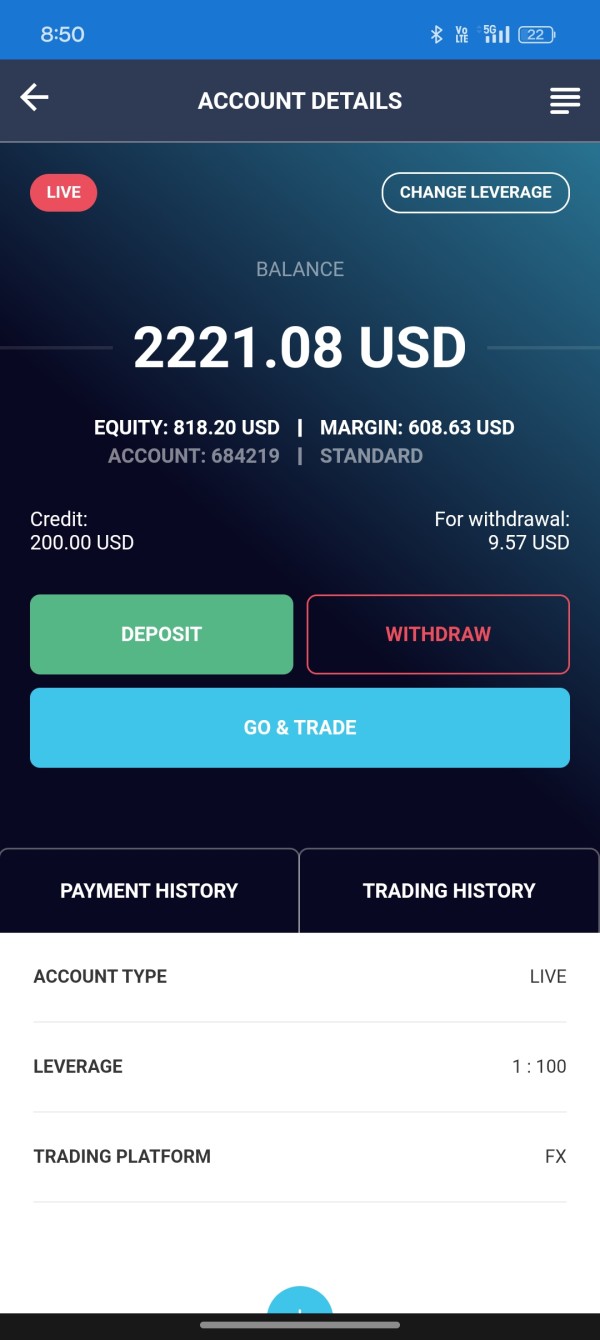

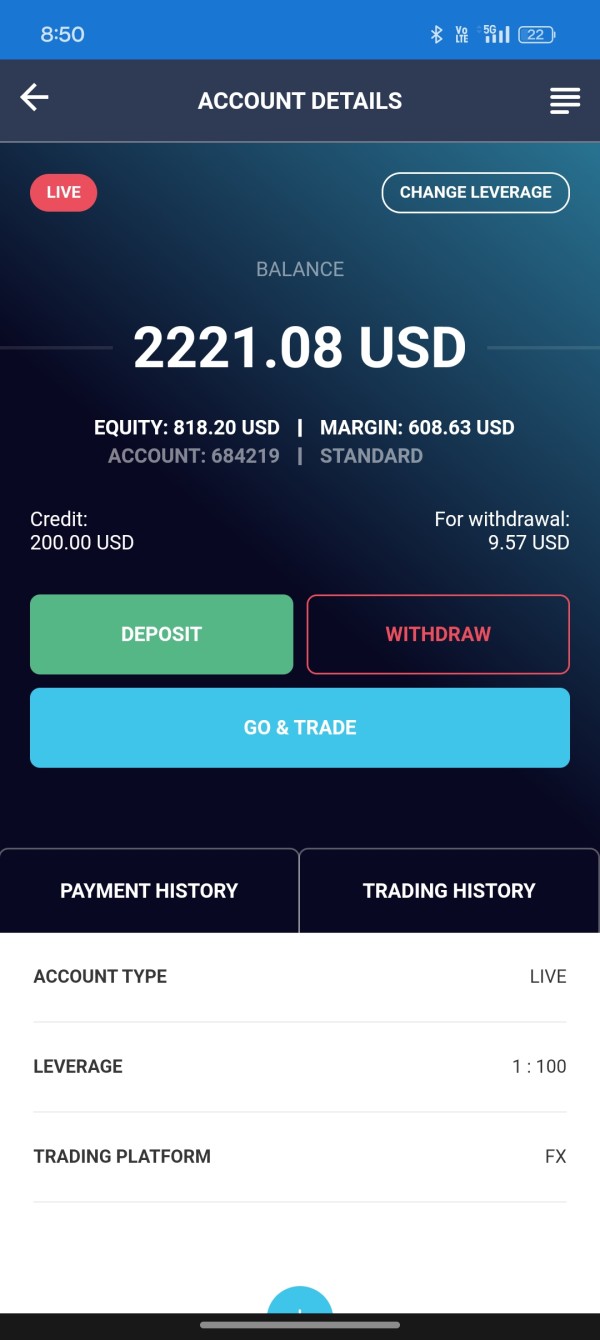

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and withdrawal procedures is not detailed in available sources. This itself represents a transparency concern for potential users.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in accessible platform information. This makes it difficult for potential users to understand entry requirements.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers are not clearly outlined in available materials. This may be intentional given regulatory restrictions in many jurisdictions.

Trading Assets: The platform indicates involvement in financial markets generally. Specific asset classes, instrument availability, and market coverage details are not comprehensively disclosed in reviewed materials.

Cost Structure: Information regarding spreads, commissions, overnight fees, and other trading costs is not transparently provided in accessible sources. This hampers proper cost analysis for potential users.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available platform information. This represents another transparency gap.

Platform Technology: Stuart Winston Broker operates as the primary trading interface. Technical specifications and platform capabilities require further investigation.

Geographic Restrictions: Specific information about regional availability and access limitations is not clearly outlined in reviewed materials.

Customer Support Languages: Available support languages and communication options are not specified in accessible platform information. This indicates potential limitations in international customer service.

This stuart winston review highlights significant information gaps that potential users should consider carefully before making any financial commitments.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions evaluation for Stuart Winston reveals critical deficiencies in transparency and user protection. Available information fails to provide clear details about account types, tier structures, or specific features available to different user categories. This lack of transparency immediately raises concerns about the platform's commitment to user clarity and regulatory compliance.

Minimum deposit requirements remain unspecified across reviewed materials. This makes it impossible for potential users to understand entry barriers or plan their investment approach effectively. The absence of clear account opening procedures and verification processes suggests potential issues with KYC compliance and anti-money laundering protocols.

Special account features, premium services, or institutional offerings are not documented in accessible sources. This information vacuum, combined with negative user feedback patterns, indicates that account conditions may not meet industry standards for transparency and user protection. The platform's failure to clearly communicate basic account information represents a significant red flag for potential users.

User feedback regarding account experiences is notably absent from positive testimonials. Negative reviews dominate available sources. This pattern suggests systematic issues with account management and user satisfaction that potential clients should carefully consider before engagement.

The stuart winston review consensus indicates that account conditions fail to meet basic industry standards for transparency, user protection, and regulatory compliance. This warrants the lowest possible rating in this category.

Stuart Winston's promotional materials highlight automated trading tools as a primary platform feature. This represents the most substantive offering identified in available information. These automated systems potentially provide algorithmic trading capabilities that could appeal to traders seeking systematic market approaches.

However, the quality, reliability, and effectiveness of these automated tools remain unverified through independent testing or user testimonials. The absence of detailed technical specifications, backtesting results, or performance metrics makes it difficult to assess the actual value proposition of these tools.

Research and analysis resources, educational materials, and market insights are not prominently featured in available platform information. This represents a significant limitation for traders who rely on comprehensive market analysis and educational support for their trading decisions.

The platform's failure to provide detailed information about tool functionality, customization options, or integration capabilities suggests potential limitations in the sophistication and utility of offered resources. Additionally, the lack of user testimonials specifically praising these tools raises questions about their practical effectiveness.

While the presence of automated trading tools prevents a completely negative assessment, the overall lack of comprehensive resources and verified tool quality limits the platform's appeal for serious traders seeking robust trading infrastructure.

Customer Service and Support Analysis (Score: 2/10)

Customer service evaluation for Stuart Winston reveals significant concerns based on available user feedback and platform information. The absence of clear customer support channels, response time commitments, or service level agreements indicates potential issues with user assistance and problem resolution.

Available user feedback consistently points to negative experiences. Specific customer service interactions are not detailed in accessible reviews. The lack of positive testimonials regarding support quality, problem resolution, or communication effectiveness suggests systematic issues with customer care operations.

Multilingual support availability remains unspecified. This could represent significant barriers for international users seeking assistance in their native languages. The absence of clear support hours, contact methods, or escalation procedures further compounds concerns about service accessibility and reliability.

Response time performance metrics, customer satisfaction scores, or service quality indicators are not available in reviewed materials. This makes it impossible to verify platform claims about support quality or user care standards.

The combination of negative user feedback patterns and lack of transparent support information suggests that customer service represents a significant weakness in Stuart Winston's operational structure. This contributes to overall user dissatisfaction and platform reliability concerns.

Trading Experience Analysis (Score: 3/10)

The trading experience evaluation for Stuart Winston faces significant limitations due to sparse user feedback and limited technical information about platform performance. Available materials do not provide specific details about platform stability, execution speeds, or order processing reliability.

User reviews consistently trend negative without specifically detailing trading experience elements such as slippage, requotes, or platform downtime. This absence of detailed trading feedback, combined with overall negative sentiment, suggests potential issues with core trading functionality and user satisfaction.

Platform functionality completeness cannot be adequately assessed due to limited technical specifications and feature descriptions in available sources. Mobile trading capabilities, advanced order types, and professional trading tools are not clearly documented or verified through user experiences.

The trading environment appears compromised by broader platform credibility issues. Negative user sentiment regarding financial conduct likely impacts overall trading confidence and experience quality. Technical performance metrics, execution quality data, and platform reliability statistics are notably absent from available information.

While the stuart winston review landscape doesn't provide specific trading horror stories, the overall negative platform sentiment and lack of positive trading testimonials suggest that the trading experience fails to meet professional standards expected by serious market participants.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents Stuart Winston's most critical weakness. Multiple independent sources flag the platform as potentially fraudulent. Trustpilot reviews explicitly label the platform as "scammers," while various review websites warn users about potential financial misconduct and fraudulent activities.

The absence of verifiable regulatory authorization from recognized financial authorities represents a fundamental trust deficit. Legitimate brokers typically maintain clear regulatory relationships with authorities like FCA, CySEC, ASIC, or other established financial regulators. Stuart Winston appears to lack this regulatory oversight.

Company transparency issues compound trust concerns. Limited verifiable information exists about corporate structure, management team, or operational history. The lack of clear business registration details, physical address verification, or corporate governance information raises serious questions about operational legitimacy.

Third-party evaluations consistently warn potential users about platform risks. Multiple review sites categorize Stuart Winston as a potential scam operation. This consensus among independent reviewers represents a significant red flag that potential users should not ignore.

The platform's industry reputation appears severely compromised. Negative warnings outweigh any positive endorsements or testimonials. This pattern of consistent negative evaluation across multiple independent sources strongly suggests fundamental issues with platform trustworthiness and operational integrity.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Stuart Winston appears consistently poor based on available feedback and review patterns. User testimonials trend heavily negative. Reports of financial misconduct and fraudulent behavior dominate the feedback landscape.

Interface design and platform usability cannot be adequately assessed due to limited user feedback focusing on these specific elements. However, the absence of positive reviews praising user interface or platform navigation suggests potential issues with user experience design and functionality.

Registration and verification processes are not detailed in available user feedback. The overall negative sentiment suggests potential issues with onboarding procedures and account setup experiences. The lack of positive testimonials about smooth account opening or verification processes represents a concerning pattern.

Financial operation experiences appear particularly problematic. Users report concerns about fund handling and withdrawal processes. These reports, combined with fraud allegations, suggest serious issues with the financial aspects of user experience.

The target user profile appears to be traders with higher risk tolerance. Even risk-accepting traders should exercise extreme caution given the consistent negative feedback patterns. User complaints focus primarily on financial conduct rather than technical platform issues. This indicates fundamental problems with business operations rather than merely technical limitations.

Conclusion

This comprehensive stuart winston review reveals a platform that fails to meet basic standards for safety, transparency, and user protection in the financial trading industry. Stuart Winston has been widely identified as a potential scam operation by multiple independent review sources. Trustpilot specifically labels it as fraudulent.

The platform may only be suitable for traders with extremely high risk tolerance who have conducted extensive independent research and due diligence. However, even risk-accepting traders should seriously consider the overwhelming negative feedback and fraud warnings before any engagement.

The main advantages of Stuart Winston remain unclear based on available information. Significant disadvantages include lack of regulatory oversight, consistent negative user feedback, fraud allegations, and poor transparency regarding company operations and financial practices. Potential users are strongly advised to consider regulated alternatives with established track records and positive user testimonials.