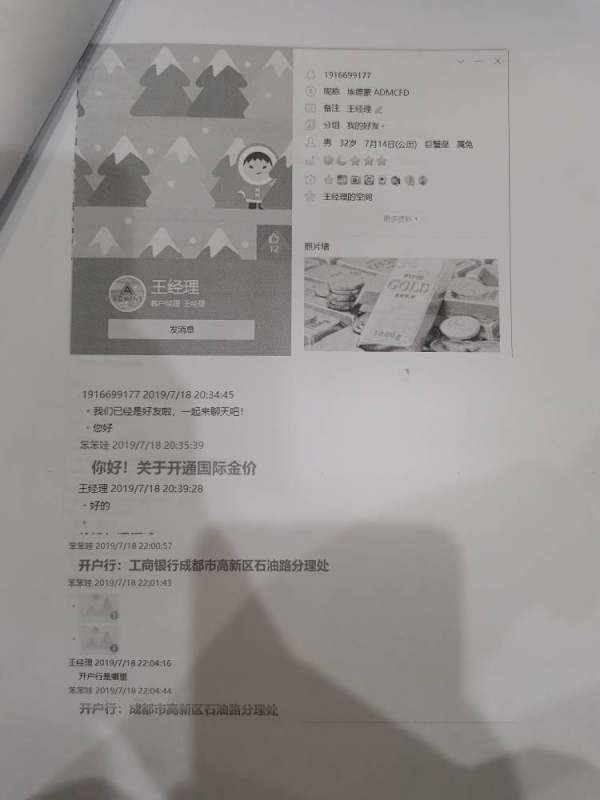

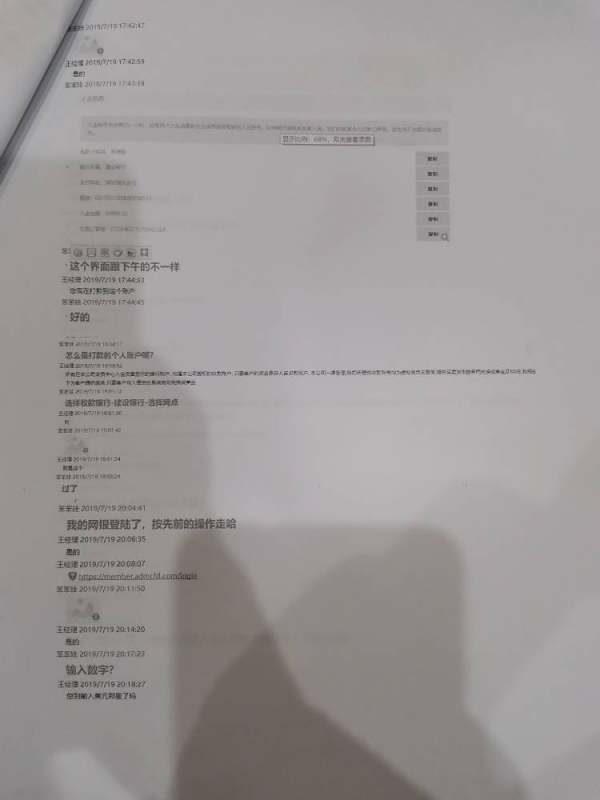

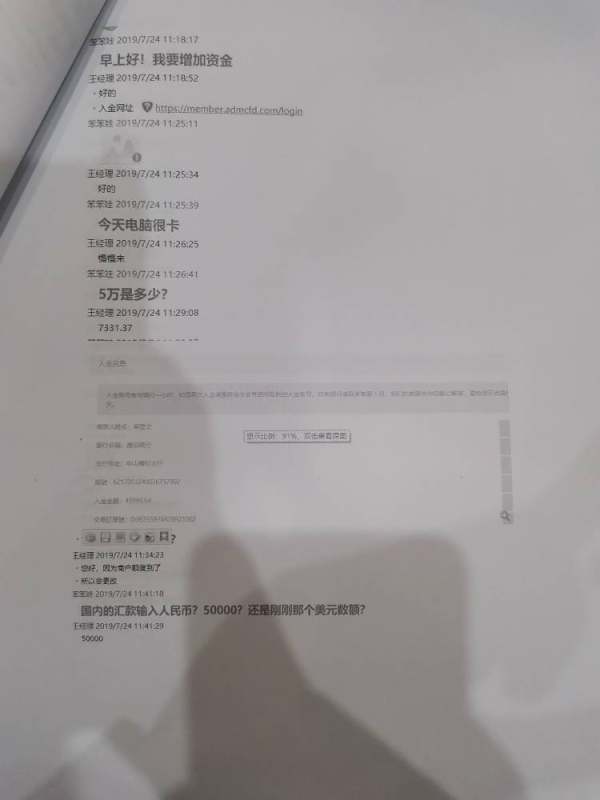

Admins 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Admins review examines a specialized broker-dealer that has emerged in the evolving financial services landscape. Based on available market information and user feedback, Admins represents a niche category of broker-dealers that focus on specific regulatory offerings, particularly Regulation CF and Regulation A+ services. However, our analysis reveals significant information gaps regarding traditional forex trading services, regulatory oversight, and comprehensive trading conditions.

The limited available data suggests mixed user experiences. Some feedback indicates dissatisfaction with certain aspects of the service. Without clear regulatory information, detailed trading conditions, or comprehensive user testimonials specifically related to forex trading services, we maintain a neutral stance in this Admins review. The broker appears to target institutional and specialized investment clients rather than retail forex traders. This may explain the limited information available for traditional FX market participants.

Important Notice

This Admins review is based on limited available information from market sources and user feedback. Readers should note that comprehensive regulatory information, detailed trading conditions, and specific forex-related services were not clearly documented in available materials. We recommend conducting independent due diligence before engaging with any broker-dealer services. The evaluation methodology focuses on available data while acknowledging significant information limitations that affect our ability to provide definitive assessments.

Rating Framework

Broker Overview

Admins operates as a specialized broker-dealer that has developed within the evolving regulatory framework of the past 10-15 years. According to market sources, these types of broker-dealers focus on serving as intermediaries for specific regulatory offerings, particularly Regulation CF offerings and acting as broker-dealer of record for Regulation A+ offerings. This specialized focus distinguishes Admins from traditional forex brokers that primarily serve retail currency trading markets.

The company's business model appears centered on regulatory compliance services and specialized investment offerings rather than conventional forex trading platforms. This positioning suggests that Admins targets institutional clients, investment firms, and companies seeking regulatory compliance assistance rather than individual forex traders. The specific founding date, company headquarters, and detailed corporate background information were not available in reviewed materials. This highlights the limited public information about the company's operational history.

Based on available information, Admins does not appear to offer traditional forex trading platforms or retail currency trading services that are typically associated with major FX brokers. The absence of detailed information about trading platforms, asset classes, and regulatory oversight in traditional forex markets indicates that this Admins review may be more relevant for institutional clients seeking specialized broker-dealer services rather than retail forex traders looking for currency trading opportunities.

Regulatory Jurisdiction: Specific regulatory oversight information was not clearly documented in available materials. The company operates within specialized broker-dealer regulatory frameworks.

Deposit and Withdrawal Methods: Information regarding funding methods and withdrawal processes was not detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in reviewed materials.

Bonuses and Promotions: No promotional offers or bonus structures were documented in available information.

Tradeable Assets: Asset classes and specific trading instruments were not comprehensively detailed in reviewed sources.

Cost Structure: Fee schedules, spreads, and commission structures were not specified in available documentation.

Leverage Ratios: Leverage options and margin requirements were not documented in reviewed materials.

Platform Options: Specific trading platforms and software offerings were not detailed in available sources.

Geographic Restrictions: Regional availability and restrictions were not clearly specified in reviewed documentation.

Customer Support Languages: Supported languages for customer service were not documented in available materials.

This Admins review acknowledges that the limited availability of detailed operational information significantly impacts our ability to provide comprehensive assessments of traditional forex trading services.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for this Admins review faces significant challenges due to limited available information about account types, requirements, and structures. Traditional forex broker account categories such as standard, premium, or professional accounts were not documented in available materials. Without specific information about minimum deposit requirements, account tiers, or special account features, it becomes difficult to assess how Admins compares to industry standards.

The specialized nature of Admins as a broker-dealer focused on regulatory offerings suggests that account structures may differ significantly from conventional forex brokers. This specialization could mean that accounts are designed for institutional clients or companies seeking regulatory compliance services rather than individual forex traders. The absence of detailed account information in this Admins review indicates potential limitations for retail forex traders seeking traditional currency trading accounts.

Account opening procedures, verification requirements, and ongoing account maintenance conditions were not specified in reviewed materials. Additionally, information about Islamic accounts, demo accounts, or other specialized account types commonly offered by forex brokers was not available. This information gap significantly impacts the account conditions rating and suggests that potential clients should seek detailed account information directly from the company before making decisions.

The evaluation of trading tools and resources in this Admins review is constrained by the absence of detailed information about analytical tools, research resources, and educational materials. Traditional forex brokers typically offer comprehensive charting packages, technical analysis tools, economic calendars, and market research. However, specific information about such offerings from Admins was not documented in available sources.

Given the specialized broker-dealer focus on regulatory offerings, the tools and resources may be oriented toward compliance, regulatory documentation, and institutional services rather than retail forex trading tools. This specialized approach could explain the lack of information about traditional forex trading resources such as automated trading support, expert advisors, or retail-focused analytical tools.

Educational resources, webinars, market analysis, and trading guides that are standard offerings among forex brokers were not detailed in available materials. The absence of information about research teams, market commentary, or analytical support services further limits the tools and resources evaluation. This Admins review notes that the specialized nature of the business model may result in different resource priorities compared to traditional forex brokers.

Customer Service and Support Analysis (5/10)

Customer service evaluation in this Admins review is significantly limited by the absence of specific information about support channels, response times, and service quality. Traditional forex brokers typically provide 24/5 customer support through multiple channels including live chat, phone, and email. However, such details were not available for Admins in reviewed materials.

The specialized broker-dealer nature of the business suggests that customer service may be structured differently than typical forex brokers. It potentially focuses on institutional client support rather than retail trader assistance. This could involve dedicated account managers, specialized compliance support, and tailored service levels that differ from standard forex broker customer service models.

Multi-language support, which is common among international forex brokers, was not documented in available information. Additionally, customer service hours, regional support availability, and specific support for different service areas were not detailed. The limited information available for this Admins review prevents a comprehensive assessment of customer service quality and responsiveness.

Trading Experience Analysis (4/10)

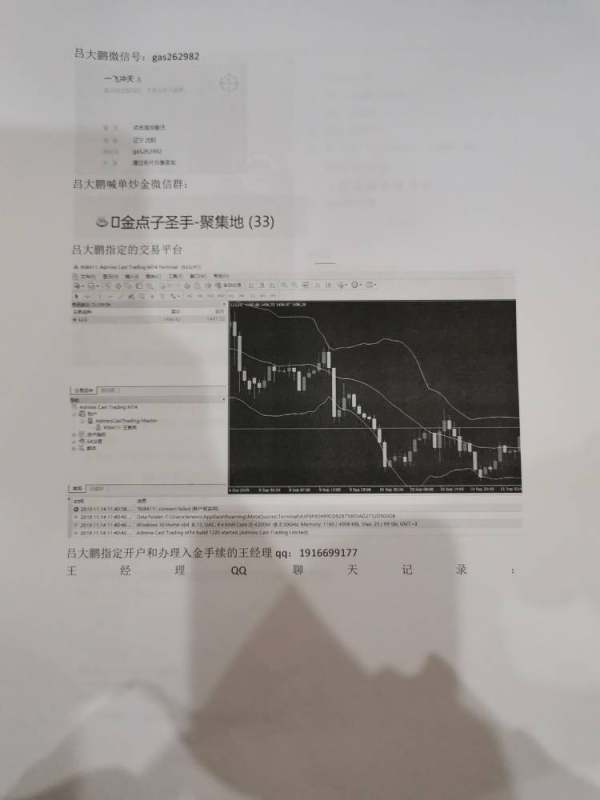

The trading experience evaluation faces substantial limitations in this Admins review due to insufficient information about trading platforms, execution quality, and overall trading environment. Traditional forex brokers provide detailed information about platform stability, order execution speeds, slippage rates, and trading conditions. However, such data was not available for Admins.

Platform options, including desktop applications, web-based platforms, and mobile trading apps, were not specified in reviewed materials. The absence of information about platform features, customization options, and trading tools significantly impacts the trading experience assessment. Additionally, order types, execution models, and trading environment characteristics were not documented.

Mobile trading capabilities, which are essential for modern forex trading, were not detailed in available sources. The lack of information about platform reliability, system uptime, and technical performance metrics further limits the trading experience evaluation in this Admins review. The specialized focus on regulatory offerings may indicate that traditional forex trading platforms are not a primary service area.

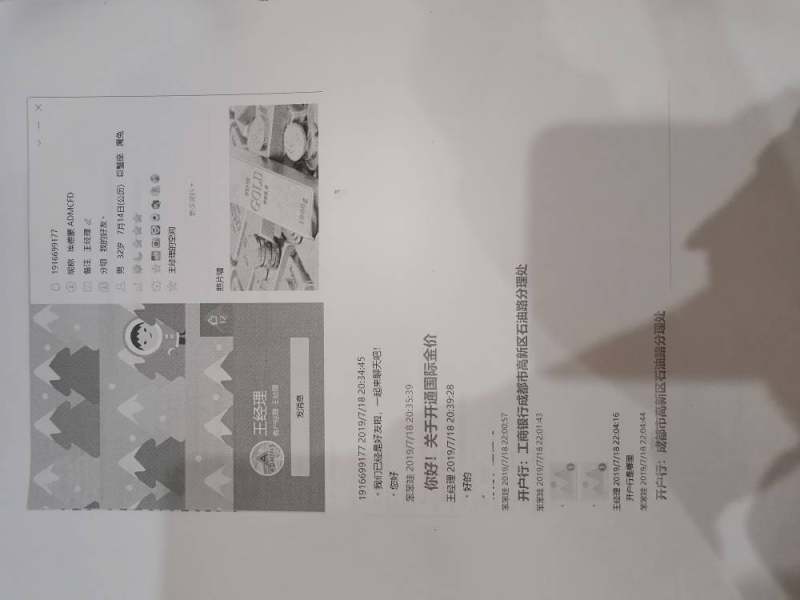

Trust and Reliability Analysis (3/10)

Trust and reliability assessment represents a significant challenge in this Admins review due to limited regulatory information and transparency data. Traditional forex brokers typically provide clear regulatory licensing information, segregated account details, and comprehensive compliance documentation. However, such information was not readily available for Admins.

The specialized broker-dealer classification suggests regulatory oversight exists. However, specific regulatory bodies, license numbers, and compliance frameworks were not detailed in available materials. This lack of regulatory transparency significantly impacts the trust and reliability evaluation, as regulatory oversight is fundamental to broker assessment.

Client fund protection measures, such as segregated accounts, insurance coverage, and compensation schemes, were not documented in reviewed sources. Additionally, company financial statements, audit information, and corporate governance details that contribute to reliability assessment were not available. This Admins review notes that the absence of comprehensive regulatory and financial transparency information affects the trust and reliability rating significantly.

User Experience Analysis (4/10)

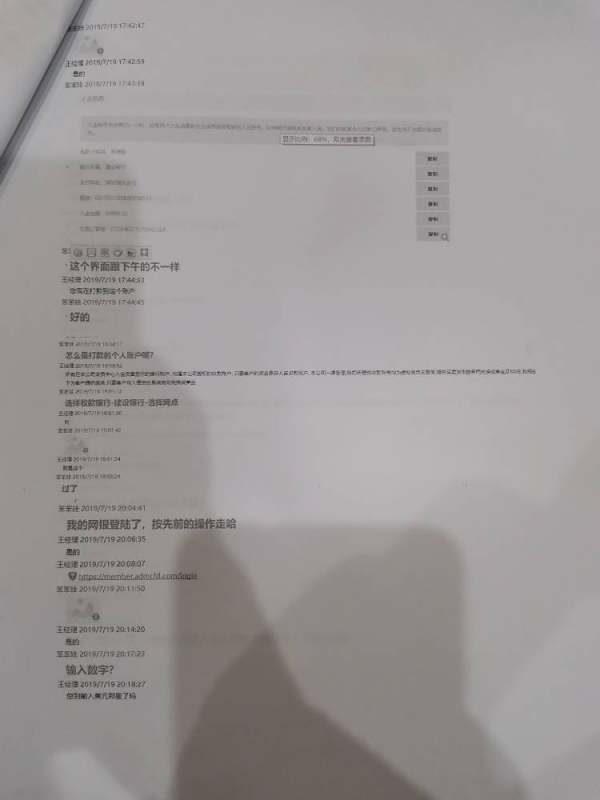

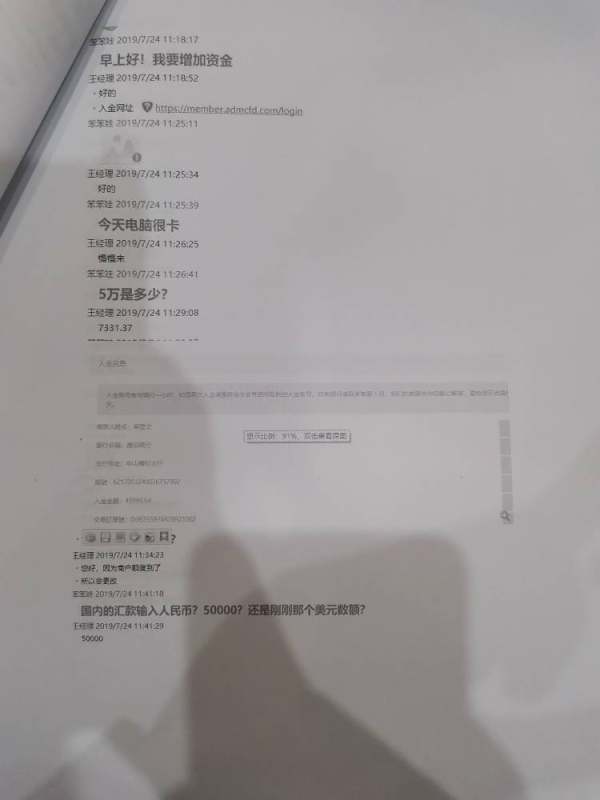

User experience evaluation in this Admins review is based on limited feedback suggesting mixed client satisfaction. Available user reviews indicated some dissatisfaction, with feedback describing certain aspects as "not funny" or unsatisfactory. However, the specific context and scope of these reviews were not clearly detailed in available materials.

The overall user interface design, platform usability, and client onboarding processes were not comprehensively documented in reviewed sources. Traditional forex brokers focus heavily on user experience optimization. However, specific information about Admins' approach to user experience design and client satisfaction was not available for evaluation.

Registration processes, account verification procedures, and ongoing user support experiences were not detailed in available materials. The specialized nature of the broker-dealer services may result in different user experience priorities compared to retail forex brokers. It potentially focuses on institutional client needs rather than retail trader user experience optimization.

Conclusion

This comprehensive Admins review reveals a specialized broker-dealer operating in regulatory compliance services rather than traditional forex trading markets. The significant information limitations regarding trading conditions, regulatory oversight, and comprehensive service offerings result in a neutral overall assessment. The available evidence suggests that Admins serves institutional and specialized investment clients rather than retail forex traders. This may explain the limited information available for traditional FX market evaluation.

Potential clients should conduct thorough independent research and seek detailed information directly from the company before making any decisions. The specialized nature of the services and limited publicly available information make this broker more suitable for institutional clients with specific regulatory compliance needs rather than retail forex traders seeking traditional currency trading services.