Goldenway Global 2025 Review: Everything You Need to Know

Executive Summary

This goldenway global review shows a neutral look at the broker. It points out big concerns about regulatory transparency and user satisfaction. Goldenway Global Investments Ltd operates as part of the Goldenway Group since 2009. The company offers forex trading services with notable features including leverage up to 1:500 and the popular MT4 trading platform. However, the lack of clear regulatory information and documented user complaints raise important questions. These issues make people wonder about the broker's reliability and trustworthiness.

The platform mainly targets traders seeking flexible trading conditions. It also appeals to those preferring the MT4 environment. While the broker provides two real account types and competitive leverage options, problems exist with transparency. The absence of detailed information about minimum deposits, commission structures, and comprehensive customer support details creates gaps. Potential clients should carefully consider these issues before committing to this trading platform.

Important Disclaimer

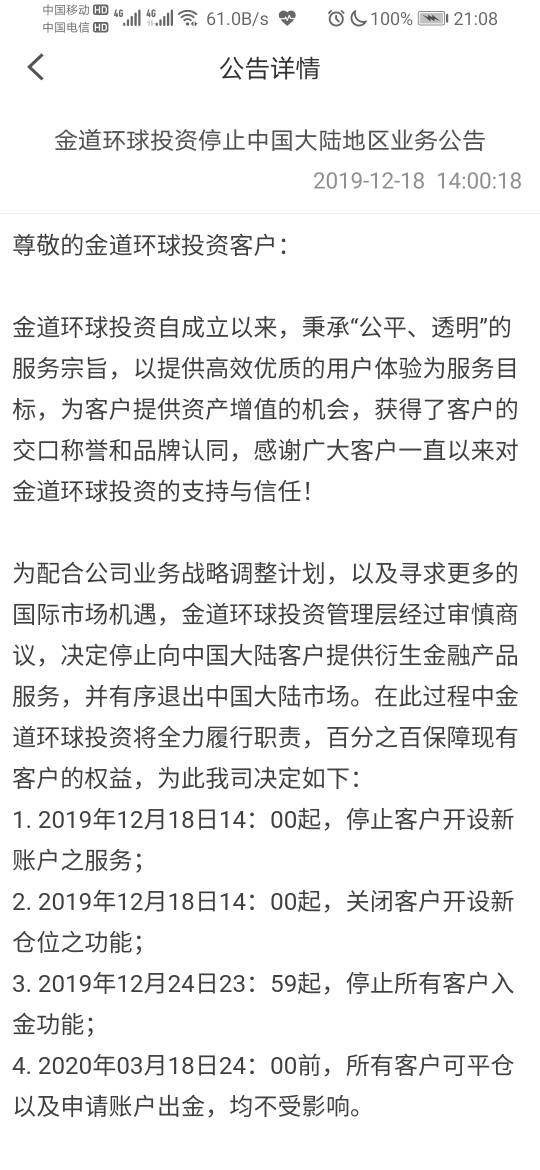

Regional Entity Differences: Goldenway Global Investments Ltd operates as a subsidiary of Goldenway Group. It has UK registration but headquarters located in Auckland, New Zealand. This cross-jurisdictional structure may create confusion regarding applicable regulations and dispute resolution procedures.

Review Methodology: This assessment uses publicly available information and user feedback. Due to limited transparency from the broker regarding key operational details, some information may be incomplete. Traders should verify information directly with the company before making trading decisions.

Overall Rating Framework

Broker Overview

Company Background and History

Goldenway Global Investments Ltd was established in 2009. It operates as part of the broader Goldenway Group structure. The company operates from its headquarters in Auckland, New Zealand, while maintaining UK registration through its subsidiary status. This dual-jurisdiction setup reflects the broker's attempt to serve international markets while maintaining operational flexibility. The company has focused mainly on online forex trading services. It positions itself as a platform for retail traders seeking access to foreign exchange markets with flexible leverage options.

Trading Infrastructure and Services

The broker's main offering centers around the MetaTrader 4 platform. This provides traders with a familiar and widely-accepted trading environment. Goldenway Global specializes in forex trading products, though specific details about the range of currency pairs and additional asset classes remain unclear from available documentation. The company operates on a floating spread model. However, commission structures and detailed pricing information are not readily available. This goldenway global review notes that the lack of comprehensive product information may limit traders' ability to make fully informed decisions. Traders might struggle to assess account suitability without complete details.

Regulatory Status and Jurisdiction

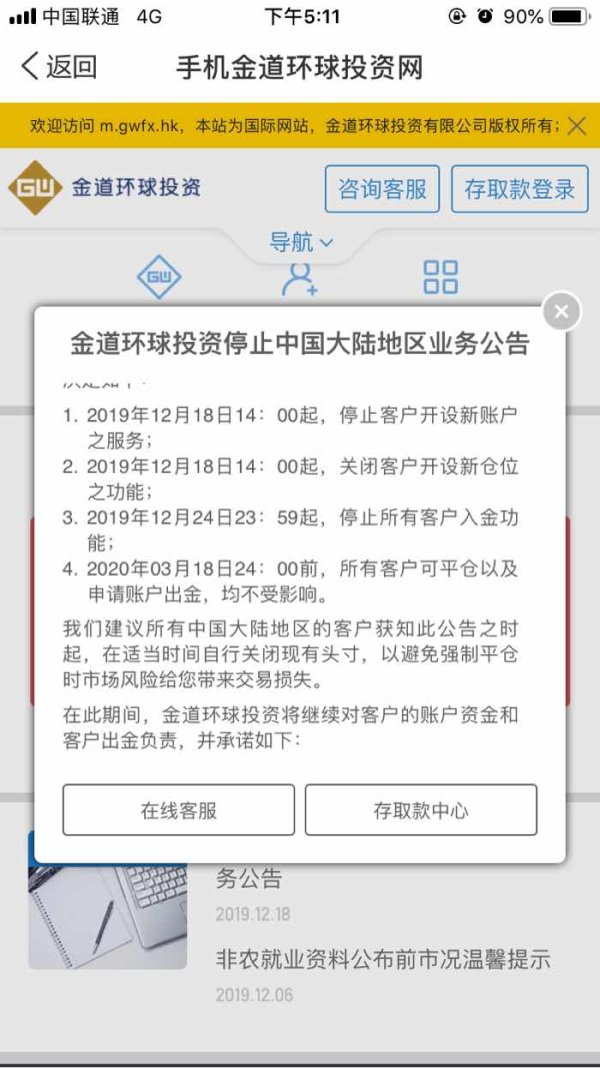

Goldenway Global Investments Ltd is registered in the United Kingdom. However, specific regulatory oversight details remain unclear. The absence of clearly stated regulatory authority supervision or license numbers raises significant concerns about compliance standards and client protection measures.

Account Funding and Withdrawal Methods

Available documentation does not provide specific information about supported deposit and withdrawal methods. Processing times and associated fees are also not detailed. This lack of transparency regarding financial transactions represents a significant gap in available information.

Minimum Deposit Requirements

Specific minimum deposit amounts for different account types are not detailed in available materials. This makes it difficult for potential clients to assess accessibility and account tier requirements.

Promotional Offers and Bonuses

Current promotional structures, welcome bonuses, or ongoing incentive programs are not documented. Information sources do not provide details about these offerings.

Available Trading Instruments

The platform mainly focuses on forex trading products. However, the specific range of currency pairs, exotic options, and any additional asset classes like commodities or indices remain unspecified in available documentation.

Cost Structure Analysis

The broker operates on a floating spread model. However, detailed commission schedules, overnight financing rates, and other trading costs are not clearly outlined in accessible materials. This goldenway global review emphasizes the importance of obtaining complete fee structures before account opening.

Leverage Options

Maximum leverage of 1:500 is available. This provides significant trading flexibility for experienced traders while requiring careful risk management considerations for retail clients.

Platform Technology

MetaTrader 4 serves as the primary trading platform. It offers standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions

Specific information about restricted jurisdictions or regional limitations is not detailed. Available materials do not provide these details.

Customer Support Languages

Available customer service language options and support channels are not clearly specified. Accessible documentation lacks this information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

Goldenway Global offers two real account types. However, specific characteristics, benefits, and requirements for each tier remain unclear from available information. The lack of detailed minimum deposit requirements creates uncertainty for potential clients attempting to determine account accessibility. Without clear information about account opening procedures, verification requirements, or special features available to different account holders, traders face significant information gaps. These gaps make it difficult when evaluating suitability.

User feedback regarding account conditions remains limited. Some documented complaints affect overall perception of the broker's account management capabilities. Compared to industry standards where brokers typically provide comprehensive account specifications, minimum deposits, and clear tier benefits, Goldenway Global's lack of transparency represents a significant weakness. The absence of detailed commission structures and fee schedules further complicates account condition evaluation. This goldenway global review notes that potential clients should request complete account specifications directly from the broker. They should do this before making commitments.

The broker's tool offering appears limited to the MetaTrader 4 platform. Clear information about additional trading tools, market research resources, or educational materials is not available. While MT4 provides standard charting capabilities and technical analysis tools, the absence of proprietary research, market commentary, or educational resources limits the overall value proposition. This particularly affects traders seeking comprehensive support.

Available information does not indicate specialized tools for automated trading beyond standard MT4 Expert Advisor functionality. It also does not detail any unique analytical resources or market insights provided by the broker. The lack of educational materials, webinars, or trading guides represents a significant gap compared to full-service brokers who provide comprehensive learning resources. Without documented research capabilities or market analysis tools, traders must rely on third-party resources. They need these for market insights and trading education.

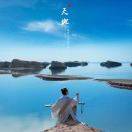

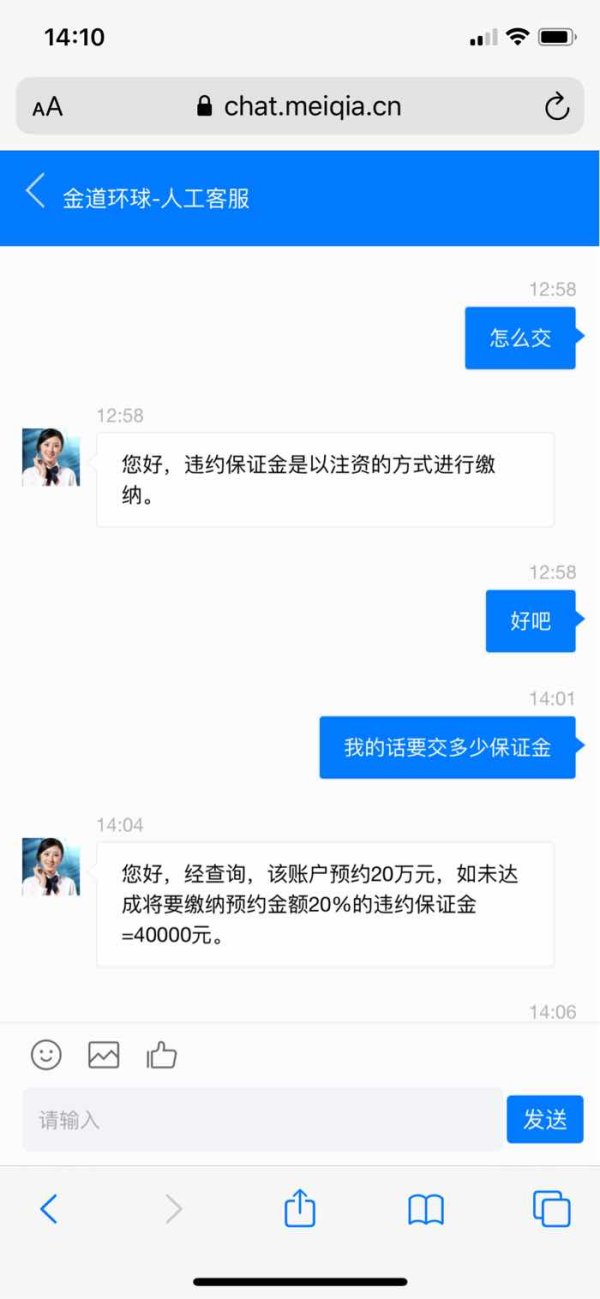

Customer Service and Support Analysis (Score: 4/10)

Customer service quality faces significant questions due to documented user complaints. The lack of clear information about support channels, availability, and response times also creates concerns. The absence of detailed customer service specifications creates uncertainty about assistance availability when needed. This includes available contact methods, support hours, and language options.

Documented complaints suggest potential issues with service quality and problem resolution. However, specific details about common issues or resolution procedures are not readily available. The lack of clear escalation procedures or dispute resolution mechanisms further complicates the customer service landscape. Without information about multilingual support capabilities or regional service availability, international clients face additional uncertainty. They cannot be sure about support accessibility.

Trading Experience Analysis (Score: 6/10)

The MetaTrader 4 platform provides a solid foundation for trading experience. It offers familiar functionality and reliable performance that many traders expect. However, specific information about order execution quality, slippage rates, or requote frequency is not available in documented materials. The floating spread model provides market-based pricing, though without specific spread ranges or execution statistics, traders cannot fully assess trading cost expectations.

Platform stability and performance metrics are not documented. This makes it difficult to evaluate system reliability during high-volatility periods or peak trading hours. Mobile trading capabilities through MT4 mobile applications are likely available, though specific mobile platform features or optimizations are not detailed. The absence of user feedback regarding platform performance, execution quality, or trading environment satisfaction limits comprehensive assessment. This goldenway global review notes that traders should conduct thorough platform testing before committing significant trading capital.

Trust and Regulation Analysis (Score: 3/10)

The most significant concern regarding Goldenway Global centers on regulatory transparency and trust factors. The absence of clearly stated regulatory authority oversight, license numbers, or compliance certifications raises substantial questions about client protection and operational standards. Without documented regulatory supervision, traders face uncertainty about dispute resolution procedures, compensation schemes, or regulatory recourse options.

Fund safety measures, segregated account policies, and client money protection protocols are not detailed in available information. This creates significant trust concerns. The lack of published financial statements, audit reports, or operational transparency further compounds trust issues. Documented user complaints without clear resolution information suggest potential problems with client relationship management and dispute handling. Industry recognition, awards, or third-party endorsements are not evident. This limits external validation of the broker's reputation and service quality.

User Experience Analysis (Score: 5/10)

Overall user satisfaction remains unclear due to limited feedback availability. Mixed signals from documented complaints also contribute to this uncertainty. The registration and account verification process details are not specified, creating uncertainty about onboarding efficiency and requirements. Platform interface design and usability factors beyond standard MT4 functionality are not documented. This limits assessment of user-friendly features or customizations.

Fund management experience lacks detailed documentation that would help evaluate operational efficiency. This includes deposit and withdrawal convenience, processing times, and fee structures. Common user complaints appear to exist, though specific issues and resolution rates are not clearly documented. The broker appears suitable for traders seeking high leverage options and MT4 platform familiarity. However, limited user feedback makes comprehensive experience assessment challenging. Improvement opportunities include enhanced transparency, detailed service specifications, and clearer communication about operational procedures and client protections.

Conclusion

This comprehensive goldenway global review reveals a broker with mixed characteristics. These require careful consideration. While Goldenway Global offers attractive features such as high leverage up to 1:500 and the widely-accepted MT4 trading platform, significant concerns exist about regulatory transparency and limited operational information. These issues create substantial evaluation challenges.

The broker may suit experienced traders specifically seeking high leverage opportunities and MT4 platform familiarity. This particularly applies to those comfortable with limited regulatory oversight. However, the lack of clear regulatory supervision, documented complaints, and insufficient transparency regarding fees, account conditions, and customer service make it difficult to recommend for most retail traders.

Key advantages include competitive leverage options and established platform technology. Primary concerns center on regulatory transparency, limited customer service information, and insufficient operational details. Potential clients should conduct thorough due diligence and consider these factors carefully before account opening.