Eronto 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the ever-evolving landscape of online trading platforms, Eronto has emerged as a recent contender offering a diverse range of trading options, including CFDs, cryptocurrencies, and other asset classes. Tailored primarily for beginners, it boasts an easy-to-use interface and promotes social trading features that allow users to connect and exchange strategies with each other. However, the platform's appeal comes with significant risks. The absence of regulatory oversight raises concerns regarding its credibility, and user reviews point to alarming issues, particularly surrounding withdrawal processes and a lack of transparency in trading conditions. For inexperienced traders attracted by the platform's features, the trade-offs between accessibility and security remain critical considerations.

⚠️ Important Risk Advisory & Verification Steps

Risk Signals:

- Lack of Regulatory Oversight: Eronto operates without strong regulatory frameworks, making it risky for traders.

- Negative User Reviews: There are multiple complaints about the withdrawal process and overall security of funds.

- Recent Establishment: Founded in 2023, Eronto lacks a proven operational history.

Risk Statement

Investing with Eronto carries substantial risks due to its unregulated status, which could expose your funds to potential loss. It is vital to perform thorough verification and understand the operational legitimacy of any trading platform prior to engaging.

Self-Verification Guide

- Check Regulatory Resources: Visit authoritative sites like the NFA and FCA to verify the broker's licensing status.

- Review User Feedback: Analyze reviews from multiple platforms to compare user experiences and complaints.

- Monitor Withdrawal Processes: Test any small withdrawals to gauge the platform's reliability before committing larger amounts.

- Reach Out for Support: Contact Eronto‘s support team to assess responsiveness and professionalism.

- Research Company Details: Investigate the company’s registration and legal standing through official business registries.

Rating Framework

Broker Overview

Company Background and Positioning

Eronto emerged in the trading sector in 2023, citing its base in the Marshall Islands, a region known for its lenient financial regulations. Its operational model targets primarily new traders intrigued by accessible digital trading experiences. However, its basic service offerings and lack of regulation present potential red flags, making it crucial for prospective users to carefully evaluate their engagement.

Core Business Overview

Eronto differentiates itself by offering a broad variety of financial instruments:

- CFDs

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

- Other asset classes, though specific details such as the exact number of available assets are sparse.

The platform's design focuses on user engagement, allowing interaction among traders. However, the absence of robust educational resources and market analysis tools may hinder users who seek serious trading insights or wish to expand their trading knowledge.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

Analysis of Regulatory Information Conflicts

Eronto's lack of regulatory oversight is troubling. Operating outside established jurisdictions, it bestows no assurance of fund safety or operational reliability. Unregulated brokers often face minimal scrutiny leading to higher investment risks.

User Self-Verification Guide

- Use authoritative databases: Start at financial regulation websites like the NFA or FCA to verify the broker's registration status.

- Seek client reports: Utilize platforms for user reviews to uncover real experiences.

- Direct inquiries: Assess response quality by contacting customer service with questions.

- Industry Reputation and Summary

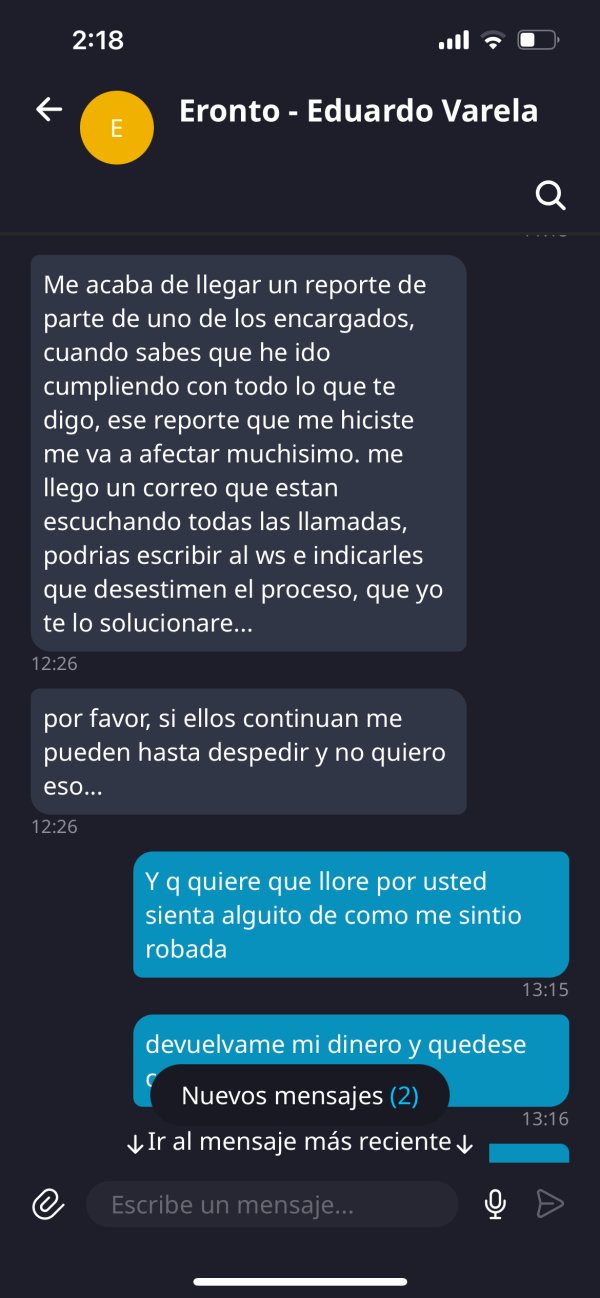

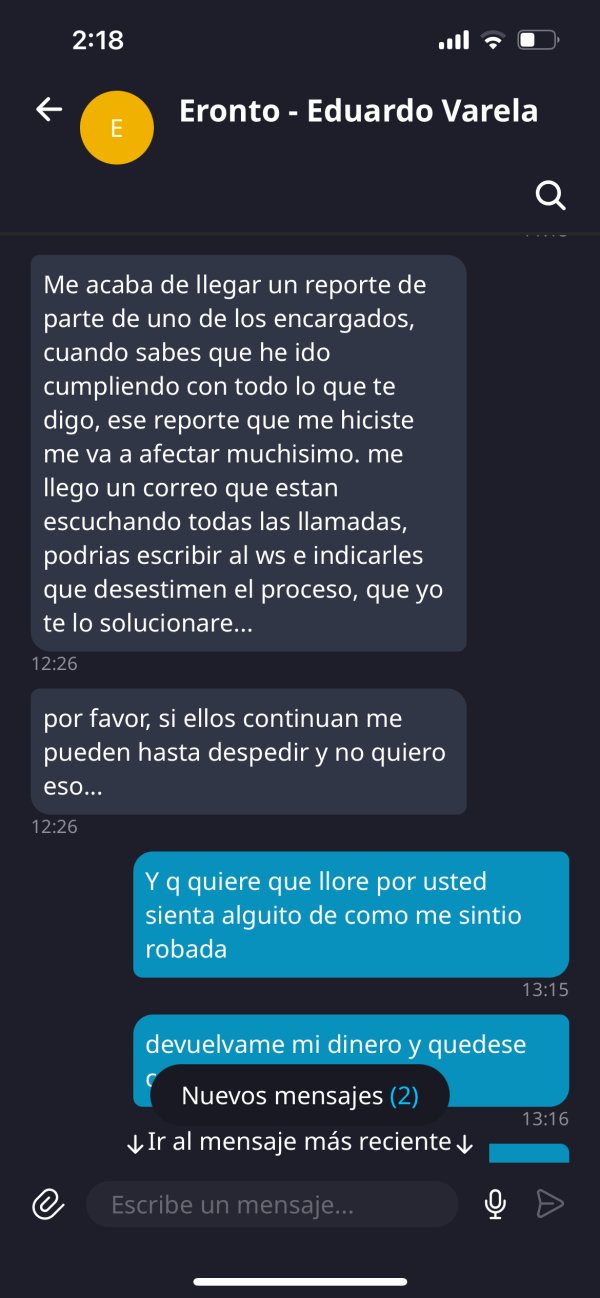

User feedback predominantly points to concerns about fund safety and problematic withdrawal processes. These sentiments underline the importance of self-verification to mitigate risks associated with unregulated platforms.

Trading Costs Analysis

The double-edged sword effect.

Advantages in Commissions

While Eronto offers a low-cost trading structure, the intricacies of the fee model may not become apparent until later trading stages. This attracts novice traders looking for simple commissions.

The "Traps" of Non-Trading Fees

Many users noted hidden costs, citing issues such as:

“I found they charged me a $30 withdrawal fee unexpectedly.”

Fees like these potentially negate the initial low-cost allure of the platform.

- Cost Structure Summary

Newcomers may find Eronto's pricing favorable for entry; however, as trading escalates, hidden fees could substantially detract from overall profit margins, particularly for more frequent traders.

Professional depth vs. beginner-friendliness.

Platform Diversity

Eronto utilizes a basic web-based trading platform which lacks advanced features like automated trading systems or mobile applications. This simplicity is appealing to new traders but could frustrate seasoned traders looking for depth.

Quality of Tools and Resources

Users reported a scarcity of robust analytical tools and educational resources to assist in decision-making. The platform primarily facilitates basic trading operations with minimal customization.

Platform Experience Summary

User opinions are mixed; while some admire its straightforward interface, others express dissatisfaction with its constraints. As one user stated,

“The lack of features makes it hard to trade efficiently.”

User Experience Analysis

Innovative interface versus functionality constraints.

User Interface Design

Despite offering a straightforward user experience, the platform's layout may frustrate traders needing quick access to comprehensive market analysis tools and educational content.

Support for Traders

Community engagement features exist, yet they often lack the depth found in platforms designed specifically for active trading. The assistance offered does not meet the expectations of seasoned traders accustomed to advanced support systems.

Feedback and Customer Print

Overall, users appreciate the intended ease of use, but an emerging trend shows current traders seeking richer analytical tools and more responsive customer supports.

Customer Support Analysis

Quality assistance in a digital age.

Response Times and Support Quality

Users have reported difficulty accessing timely support. Generally reliant on ticket systems and delayed responses, traders express frustration regarding resolution timelines.

Availability of Support Channels

Only a limited number of online support options permeate through user interactions, leading to longer wait times and customer dissatisfaction.

Comparison to Industry Standards

In comparison to competitors providing robust direct support, Eronto falls short, particularly when fast resolutions are crucial to active traders needing immediate assistance.

Account Conditions Analysis

Openness breeds trust, secrecy breeds suspicion.

Transparency of Account Types and Conditions

Little information surrounds the specific account types offered, leaving prospective users uncertain about operational conditions. This lack of clarity raises red flags about the broker's overall intention and sophistication.

Customer Feedback

Negative user experiences highlight concerns about hidden fees and unclear minimum deposit requirements, which may deter potential clients looking for clarity.

Conclusion on Conditions

The absence of well-defined account conditions creates a level of operational uncertainty, making careful scrutiny essential for those considering registration.

Final Thoughts

In summary, while Eronto offers functionalities and features that may appeal to novice traders, the substantial risks posed by its unregulated status and lack of transparency far outweigh the benefits. With numerous red flags in regulation, user experiences, and operational clarity, caution is paramount for anyone considering this platform. For traders serious about their investments, engaging with established brokers that provide regulatory assurance and transparency remains the safest path forward.