ACEX 2025 Review: Everything You Need to Know

Executive Summary

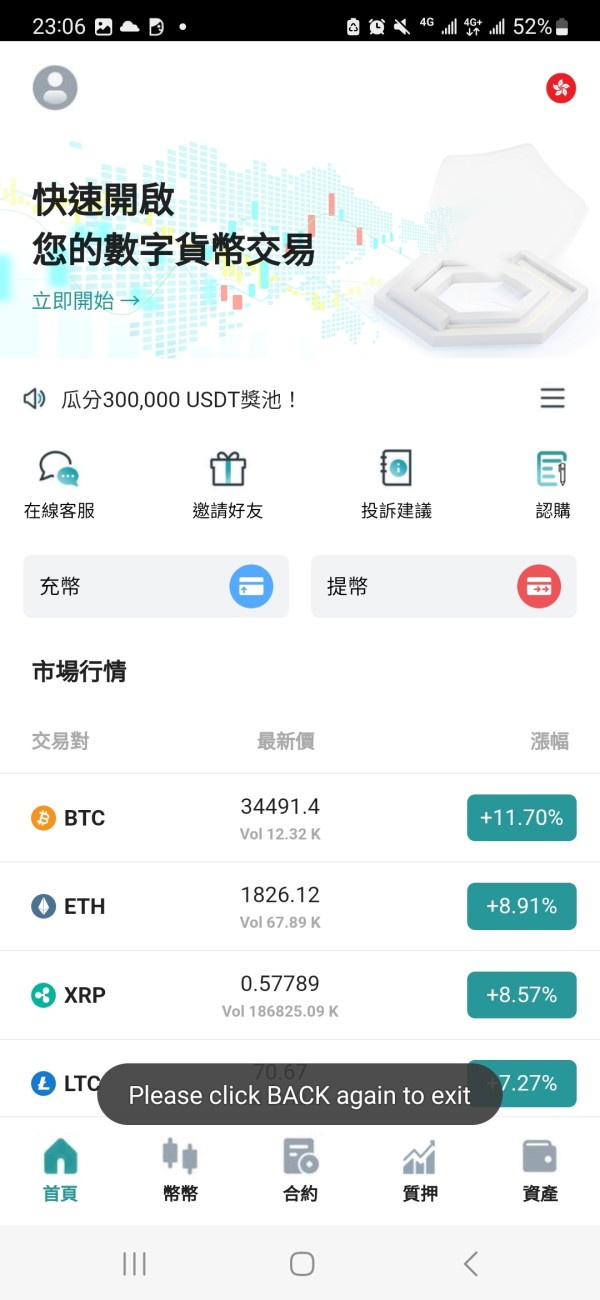

This comprehensive ACEX review reveals major concerns about this trading platform. Potential investors must carefully consider these issues before making any decisions. ACEX presents itself as a forex and cryptocurrency trading platform that offers multiple trading platforms including MetaTrader 4, WebTrader, and cTrader, along with access to various digital assets such as Bitcoin, Ethereum, and Ripple.

Our analysis uncovers troubling aspects that raise serious red flags. According to available information, ACEX operates without proper regulatory oversight, which significantly impacts transparency and reliability. The platform's trust score of 0 on acex.com presents an extremely concerning picture for potential investors.

User feedback indicates severe issues with payment processing. Investors report that they have not received payments as agreed upon their initial arrangements. While ACEX offers trading in multiple asset classes including forex, stocks, and cryptocurrency-related products through various platforms, the lack of regulatory protection and negative user experiences suggest this platform may not be suitable for most retail investors.

The platform appears to target investors interested in forex and cryptocurrency trading. However, the significant trust and reliability issues make it a high-risk choice that requires extreme caution.

Important Notice

Regional Entity Differences: ACEX does not provide specific regulatory information. This means users in different jurisdictions may face varying levels of legal protection. The absence of clear regulatory oversight means that investor protections may be limited or non-existent depending on your location.

Review Methodology: This evaluation is based on publicly available information and user feedback. Due to the limited transparency from ACEX, some data may be subject to update delays or may not reflect the most current platform conditions.

Rating Framework

Broker Overview

ACEX operates as a trading platform specializing in forex, stocks, and cryptocurrency-related products. The platform attempts to position itself in the competitive online trading market by offering access to multiple asset classes and various trading platforms. However, the company's background information remains notably unclear, with limited transparency regarding its establishment date, corporate structure, or operational history.

The business model appears to focus on providing trading access to various financial instruments without the backing of recognized regulatory oversight. This approach raises significant concerns about the platform's legitimacy and the safety of client funds. The lack of proper licensing and regulatory compliance suggests that ACEX operates in a regulatory gray area that potentially exposes users to substantial risks.

The platform supports multiple trading environments including MetaTrader 4, WebTrader, and cTrader. This indicates an attempt to cater to different trading preferences. Available assets include traditional forex pairs, XTEM products, and popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple.

However, the absence of detailed information about the company's regulatory status, operational licenses, or compliance measures significantly undermines confidence in this ACEX review assessment.

Regulatory Status: Available information does not mention specific regulatory authorities overseeing ACEX operations. This represents a significant concern for potential users seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in available sources. This creates uncertainty about fund transfer processes.

Minimum Deposit Requirements: The platform has not disclosed specific minimum deposit amounts. This makes it difficult for potential users to plan their initial investment.

Bonus and Promotions: No information is available regarding promotional offers or bonus programs. The platform might provide these to new or existing clients, but details are unclear.

Tradeable Assets: The platform offers access to XTEM products, Bitcoin, Ethereum, Ripple, and other cryptocurrency-related instruments alongside traditional forex and stock trading opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available documentation. This hampers transparent cost comparison.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios are not mentioned in available information sources.

Platform Options: ACEX supports MetaTrader 4, WebTrader, and cTrader platforms. This provides users with multiple trading interface choices.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in available sources.

Customer Service Languages: Available customer support languages are not detailed in the provided information.

This ACEX review finds that the lack of detailed operational information significantly impacts the platform's transparency and user confidence.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for ACEX reveals significant information gaps. These gaps substantially impact the overall assessment. Available sources do not provide specific details about account types, their characteristics, or the range of options available to different trader categories.

This lack of transparency makes it extremely difficult for potential users to understand what to expect when opening an account with the platform. The absence of clear information about minimum deposit requirements creates uncertainty for traders trying to plan their initial investment. Without specific deposit thresholds, users cannot adequately prepare for the financial commitment required to begin trading.

Additionally, the account opening process details are not outlined. This leaves potential clients uninformed about verification requirements, documentation needs, or processing timeframes. Special account features that many traders seek, such as Islamic accounts for those requiring Sharia-compliant trading conditions, are not mentioned in available information.

This omission suggests either the absence of such specialized offerings or poor communication of available services. User feedback indicates serious concerns about payment processing, with investors reporting that they have not received payments according to their agreements. This represents a fundamental failure in account management and client service that directly impacts the practical utility of any account conditions the platform might offer.

The overall account conditions assessment in this ACEX review reflects the platform's poor transparency and concerning user experiences. This results in a low rating that potential investors should carefully consider.

ACEX demonstrates some strength in platform diversity by offering multiple trading environments. These include MetaTrader 4, WebTrader, and cTrader. This variety allows traders with different preferences and experience levels to access familiar interfaces, which represents a positive aspect of the platform's technical offerings.

MetaTrader 4 support provides access to one of the industry's most popular trading platforms. It is known for its comprehensive charting tools, technical indicators, and automated trading capabilities. The inclusion of WebTrader offers browser-based trading convenience, while cTrader support appeals to traders preferring advanced order management and market depth features.

However, the available information does not detail the quality of research and analysis resources that might support trading decisions. Professional traders often rely on market analysis, economic calendars, and research reports to inform their strategies, but ACEX's offerings in this area remain unclear. Educational resources, which are crucial for developing trader skills and understanding market dynamics, are not mentioned in available sources.

This absence suggests limited support for trader development. This could be particularly problematic for less experienced users. Automated trading support capabilities, while potentially available through MetaTrader 4, are not specifically detailed regarding any platform-specific enhancements or limitations that ACEX might implement.

Despite the platform variety advantage, the lack of comprehensive information about additional tools and resources limits the overall assessment of this category.

Customer Service and Support Analysis

Customer service evaluation reveals concerning patterns that significantly impact the overall user experience with ACEX. Available information does not specify the customer service channels available to users. This creates uncertainty about how clients can seek assistance when needed.

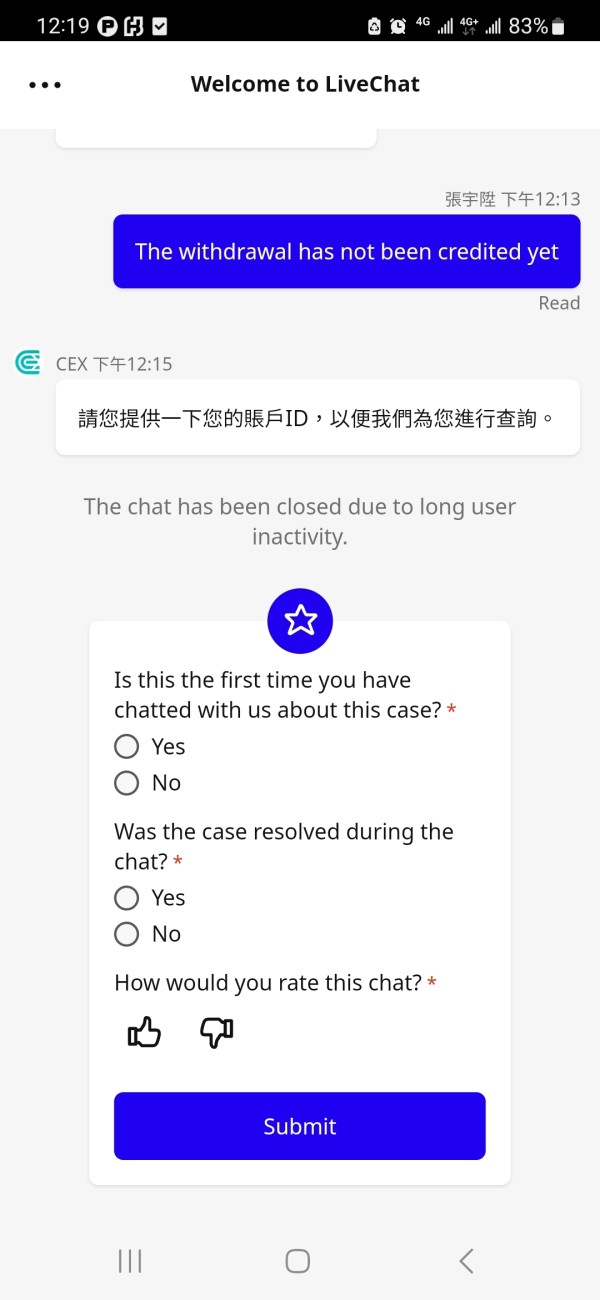

User feedback presents particularly troubling evidence of service quality issues. Reports indicate that investors have experienced problems receiving payments according to their agreements, which represents a fundamental failure in customer service and platform reliability. Such payment issues suggest either inadequate customer support systems or more serious operational problems that affect the platform's ability to fulfill its obligations to users.

The absence of information about response times makes it impossible to assess how quickly users might expect resolution to their inquiries or problems. Given the reported payment issues, it appears that response times may be inadequate for addressing serious user concerns effectively. Service quality indicators from user feedback suggest significant deficiencies in problem resolution and client communication.

When users report not receiving agreed-upon payments, it indicates either poor communication about payment processes or actual failures in service delivery. Information about multilingual support capabilities and customer service hours is not available, which further limits understanding of the support infrastructure. Professional trading platforms typically provide comprehensive customer service information, and the absence of such details raises additional concerns about the platform's commitment to client support.

Trading Experience Analysis

The trading experience assessment reveals a mixed picture with both positive technical aspects and concerning gaps in essential information. ACEX's support for multiple trading platforms including MetaTrader 4, WebTrader, and cTrader provides users with flexibility in choosing their preferred trading environment. This can enhance the overall trading experience for different user types.

However, critical information about platform stability and execution speed is not available in the provided sources. These factors are fundamental to successful trading, as platform downtime or slow execution can significantly impact trading outcomes and user satisfaction. Order execution quality details are absent from available information, making it impossible to assess how effectively the platform processes trades or whether users might experience slippage or requotes during volatile market conditions.

This information gap is particularly concerning for active traders who require reliable execution. While the platform offers access to various asset classes including forex, cryptocurrencies, and other instruments, specific details about trading conditions such as spreads, execution models, or liquidity sources are not provided. This lack of transparency makes it difficult for traders to understand the actual trading environment they would encounter.

Mobile trading experience information is not available. This is increasingly important as many traders require mobile access for managing positions and monitoring markets while away from their computers. The overall trading environment assessment is hampered by insufficient information about crucial technical aspects that directly impact user experience and trading success.

This ACEX review finds that while platform variety provides some advantages, the lack of detailed trading condition information significantly limits confidence in the overall trading experience.

Trustworthiness Analysis

The trustworthiness evaluation reveals the most concerning aspects of ACEX's operations. It represents the primary area of concern for potential users. The platform operates without regulatory oversight from recognized financial authorities, which fundamentally compromises transparency and reliability standards that professional traders expect.

ACEX's trust score of 0 on acex.com represents an extremely serious red flag that potential users cannot ignore. This rating suggests significant concerns about the platform's credibility and operational integrity. Such a low trust score typically indicates either serious operational problems, user complaints, or other factors that severely undermine confidence.

Available information does not detail specific fund safety measures, such as segregated client accounts, deposit insurance, or other protections that regulated brokers typically provide. This absence of safety information is particularly concerning given the reported payment issues that users have experienced. Company transparency is notably poor, with limited information available about corporate structure, licensing, operational history, or management.

Professional trading platforms typically provide comprehensive company information to build user confidence. The absence of such transparency raises serious questions about legitimacy. Industry reputation appears to be significantly damaged by user complaints and the extremely low trust rating.

User feedback specifically mentions that investors have not received payments according to their agreements. This represents a fundamental breach of trust that directly impacts the platform's credibility. The handling of negative events and user complaints does not appear to be adequate, given the ongoing payment issues reported by users.

User Experience Analysis

User experience assessment reveals significant deficiencies that substantially impact overall satisfaction and platform usability. Overall user satisfaction appears to be poor based on available feedback, with users reporting serious issues that directly affect their ability to use the platform successfully.

The most serious user experience concern involves payment processing. Investors report not receiving payments according to their agreements. This fundamental failure creates a negative experience that undermines all other aspects of platform interaction.

Available information does not provide details about interface design and ease of use. This makes it difficult to assess how user-friendly the platform might be for daily trading activities. Professional trading platforms typically emphasize intuitive design and user experience, and the absence of such information suggests limited focus on user interface quality.

Registration and verification process details are not available. This creates uncertainty about how smooth the onboarding experience might be for new users. Complex or unclear registration processes can significantly impact initial user impressions and satisfaction.

Fund operation experiences, based on user feedback about payment issues, appear to be problematic. Users expect reliable and timely processing of deposits and withdrawals, and the reported problems in this area represent a major user experience failure. Common user complaints center around payment processing failures, which represents one of the most serious issues that can affect user experience with any trading platform.

The overall user experience assessment suggests that potential users should expect significant challenges and potential problems when attempting to use ACEX's services.

Conclusion

This comprehensive ACEX review reveals a trading platform that presents significant risks and concerns. Potential users must carefully consider these issues. Based on available information and user feedback, ACEX operates as an unregulated broker with notably low trustworthiness indicators and poor user experiences.

The platform is not recommended for risk-averse investors or those seeking regulated trading environments with proper investor protections. While ACEX offers some advantages in terms of platform variety and asset class diversity, these positive aspects are substantially outweighed by serious concerns about reliability, transparency, and user satisfaction.

The main advantages include access to multiple trading platforms and various asset classes including cryptocurrencies. However, the significant disadvantages include zero trust rating, lack of regulatory oversight, poor customer service quality, and serious user complaints about payment processing failures that represent fundamental operational problems.