Is ACEX safe?

Business

License

Is ACEX Safe or a Scam?

Introduction

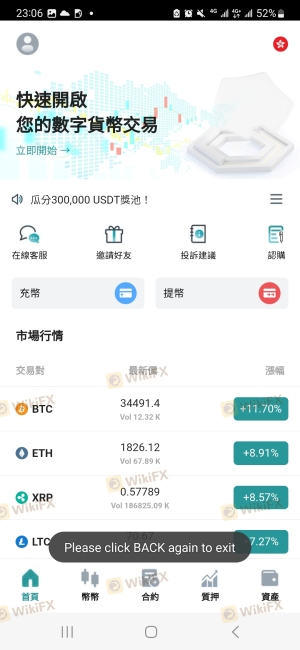

ACEX is a forex brokerage that has emerged in the competitive landscape of the foreign exchange market. Based in Seychelles, ACEX has positioned itself as a platform offering a variety of trading instruments, including cryptocurrencies like Bitcoin and Ethereum, alongside traditional forex pairs. However, as the trading environment becomes increasingly saturated, traders must exercise caution and conduct thorough evaluations of any broker before committing their funds. The importance of assessing a broker's legitimacy cannot be overstated, as the forex market is rife with unregulated entities that can jeopardize traders' investments. This article aims to provide a balanced assessment of ACEX by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety, ultimately answering the question: Is ACEX safe?

Regulation and Legitimacy

One of the first considerations for any trader is the regulatory status of their chosen broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' funds. Unfortunately, ACEX operates in an unregulated environment, which raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unverified |

The absence of regulation means that ACEX is not subject to oversight by any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of regulatory supervision can lead to higher risks for traders, including potential fraud and misuse of funds. Additionally, unregulated brokers often lack transparency, making it difficult for clients to seek recourse in the event of disputes or issues. Given these factors, it is crucial for traders to consider whether ACEX is safe for their trading activities.

Company Background Investigation

ACEX was established approximately 2 to 5 years ago, and its operational base is located in Seychelles. The company operates under the name T.E. Markets Ltd. However, limited information is available regarding its ownership structure and the backgrounds of its management team. A thorough investigation into the company's history reveals a lack of transparency, as there is little publicly available data about the individuals behind ACEX or their professional qualifications.

This lack of transparency raises red flags about the company's credibility. A brokerage with a solid reputation typically provides detailed information about its management team and their experience in the financial sector. Without this information, potential clients may question the reliability of ACEX. Furthermore, the company's relatively short history in the forex market may deter risk-averse traders from engaging with it. In light of these factors, one must ponder: Is ACEX safe for investment?

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is essential. ACEX provides a range of account types, including standard, gold, platinum, and VIP accounts, with a minimum deposit starting at $100. The maximum leverage offered is notably high at 1:400, which can amplify both potential profits and losses.

However, the fee structure raises some concerns. While the spreads start at a competitive rate of 0.5 pips, the absence of clear information regarding commission fees and overnight interest rates can make it challenging for traders to assess the overall cost of trading.

| Fee Type | ACEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding additional fees could be indicative of potential hidden costs that may arise during trading. This uncertainty further complicates the decision-making process for traders considering whether ACEX is safe for their trading endeavors.

Customer Fund Safety

The safety of customer funds is a critical aspect of any brokerage. ACEX's website does not provide comprehensive details regarding its fund protection measures, such as whether it utilizes segregated accounts or offers negative balance protection. These features are essential for safeguarding clients' investments and ensuring that traders do not incur losses exceeding their initial deposits.

Without clear information on these safety measures, traders may be left wondering about the security of their funds. Historical issues related to fund security, such as disputes or complaints from clients, can also signal potential risks associated with a broker. Unfortunately, the lack of documented incidents involving ACEX does not necessarily imply safety; rather, it highlights the need for traders to conduct their due diligence. Thus, the question remains: Is ACEX safe for traders looking to protect their investments?

Customer Experience and Complaints

Understanding customer experiences is vital in assessing a broker's reliability. While some traders have reported positive experiences with ACEX, numerous complaints have surfaced regarding withdrawal issues and limited customer support. These complaints often revolve around difficulties in accessing funds and a lack of timely responses from the support team.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited channels |

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and a loss of trust in the platform. Such experiences can deter potential clients and raise questions about the overall integrity of ACEX. As traders consider whether ACEX is safe, they must weigh these customer experiences against their own risk tolerance and expectations.

Platform and Execution

The trading platform offered by ACEX is another critical factor in evaluating its safety. ACEX provides access to popular trading platforms such as MetaTrader 4, WebTrader, and cTrader. However, the performance and stability of these platforms are vital for ensuring smooth trading experiences. Traders have reported varying levels of execution quality, with some experiencing slippage and order rejections.

The presence of any signs of platform manipulation can also contribute to concerns about the broker's reliability. If traders suspect that their orders are being manipulated or that the platform is not functioning as intended, it can significantly impact their trading outcomes and overall experience. Therefore, it is essential to consider whether ACEX is safe regarding its platform performance and execution reliability.

Risk Assessment

Engaging with ACEX presents several risks that traders should carefully evaluate. The lack of regulation, transparency issues, and customer complaints contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated environment |

| Fund Safety Risk | High | Lack of clear protections |

| Customer Support Risk | Medium | Limited response channels |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as using limited leverage and only investing amounts they can afford to lose. Additionally, seeking alternative brokers with robust regulatory oversight and transparent practices may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, while ACEX offers a range of trading instruments and competitive spreads, significant concerns regarding its regulatory status, transparency, and customer experiences raise red flags about its safety. The absence of regulation, coupled with complaints about withdrawal issues and limited customer support, suggests that traders should exercise caution when considering this broker.

For traders seeking a reliable and secure trading environment, it may be prudent to explore alternative options that are well-regulated and have established reputations in the industry. Ultimately, the question of whether ACEX is safe remains uncertain, and potential clients are advised to conduct thorough research and consider their risk tolerance before engaging with this broker.

Is ACEX a scam, or is it legit?

The latest exposure and evaluation content of ACEX brokers.

ACEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACEX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.