ABL Review 2

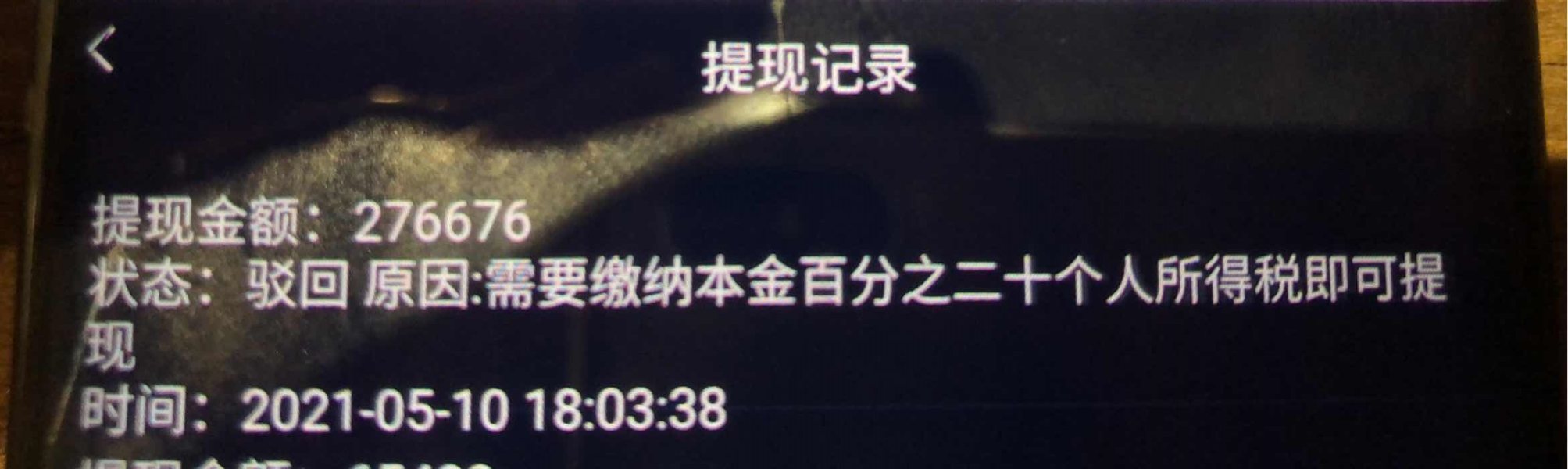

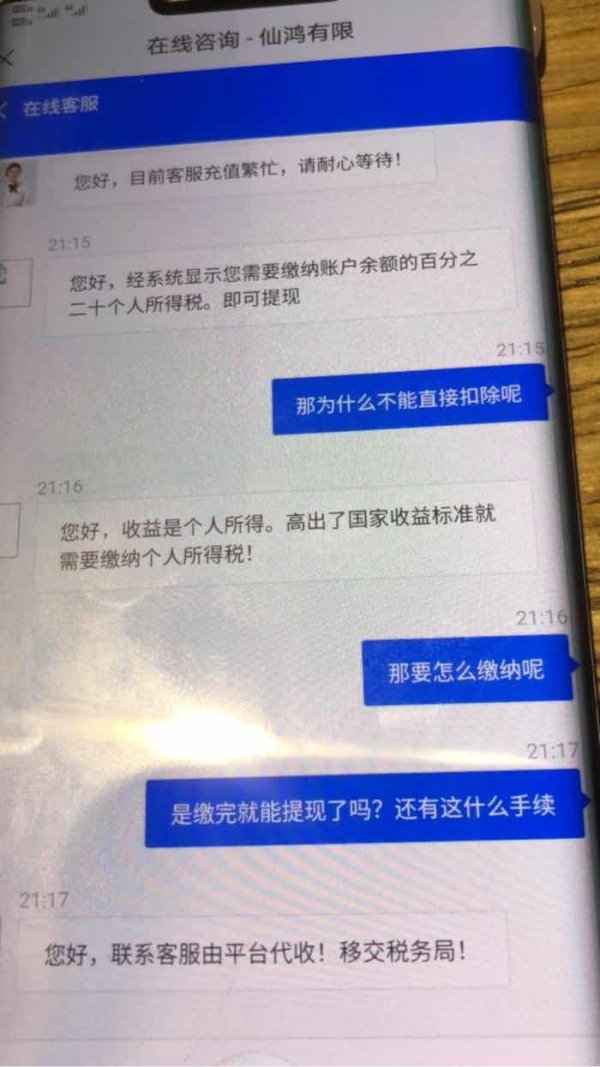

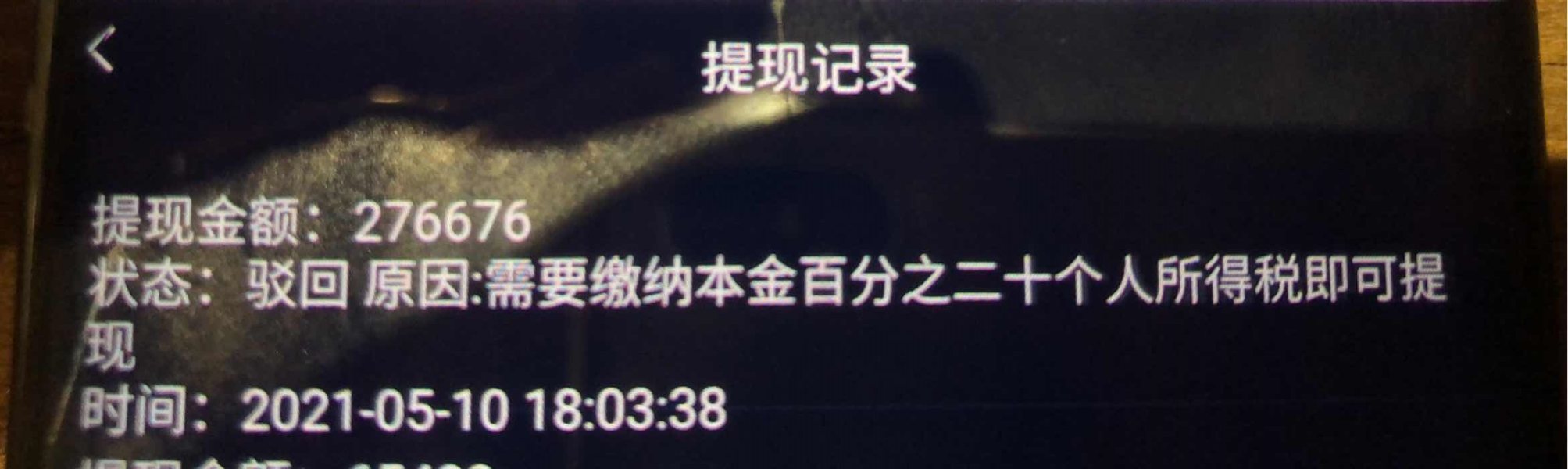

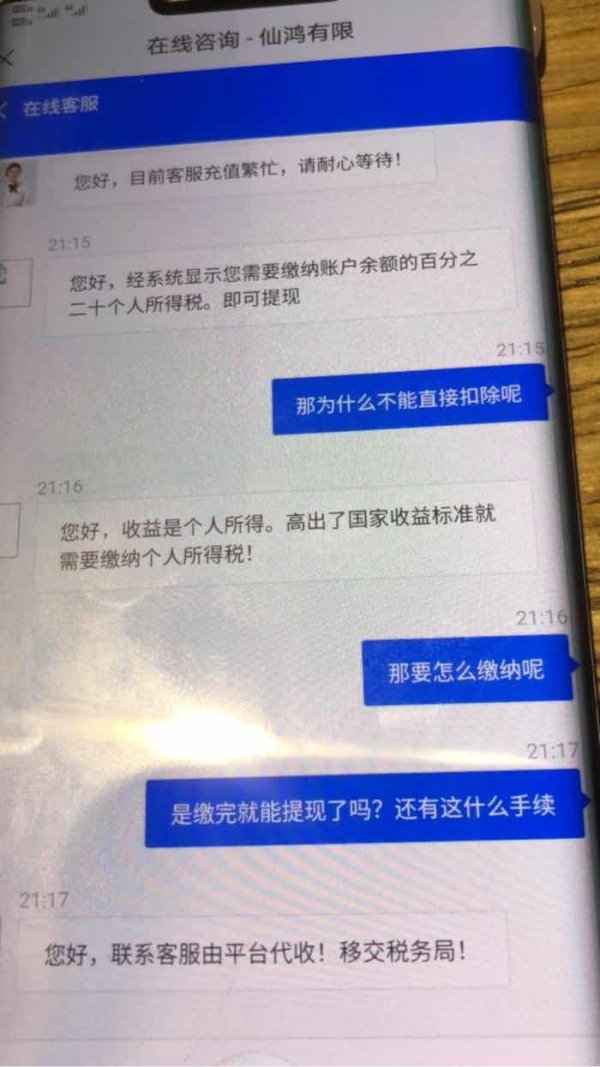

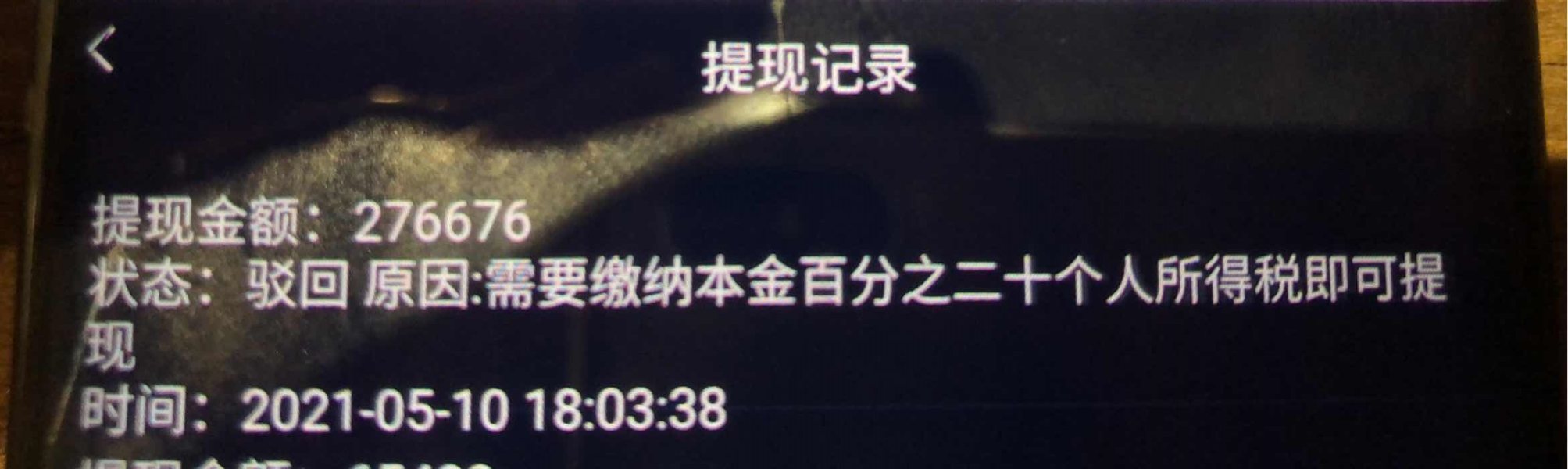

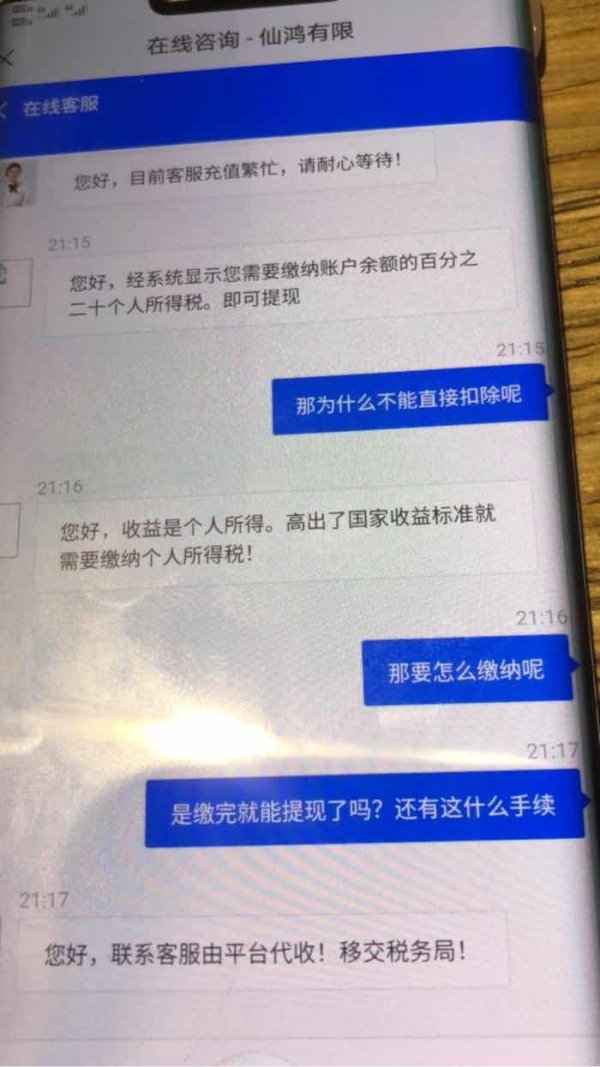

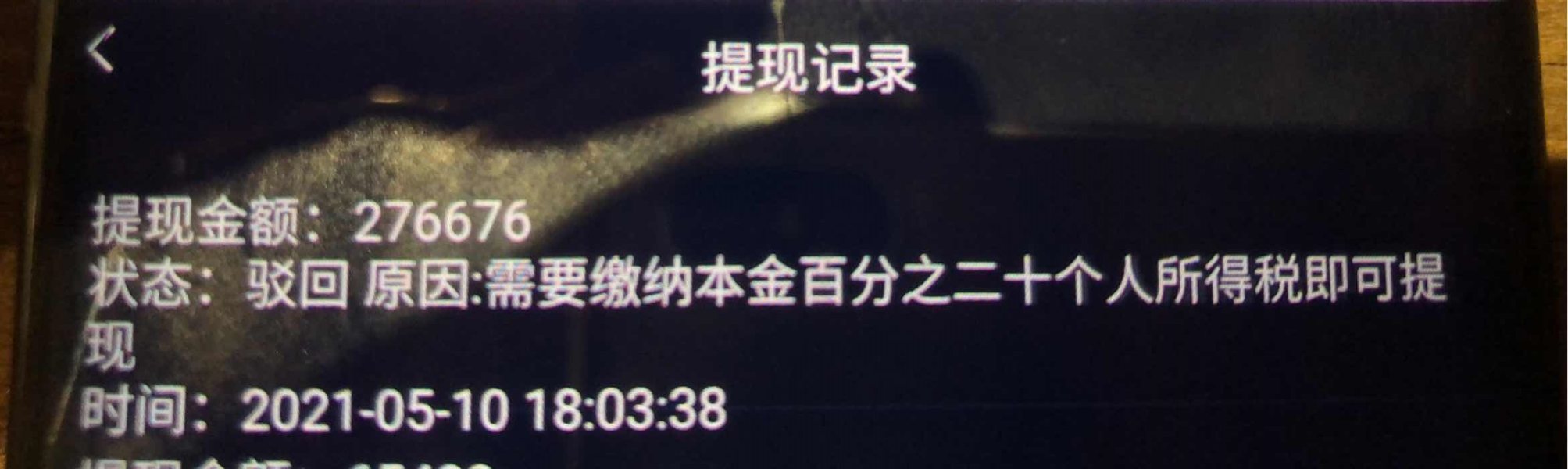

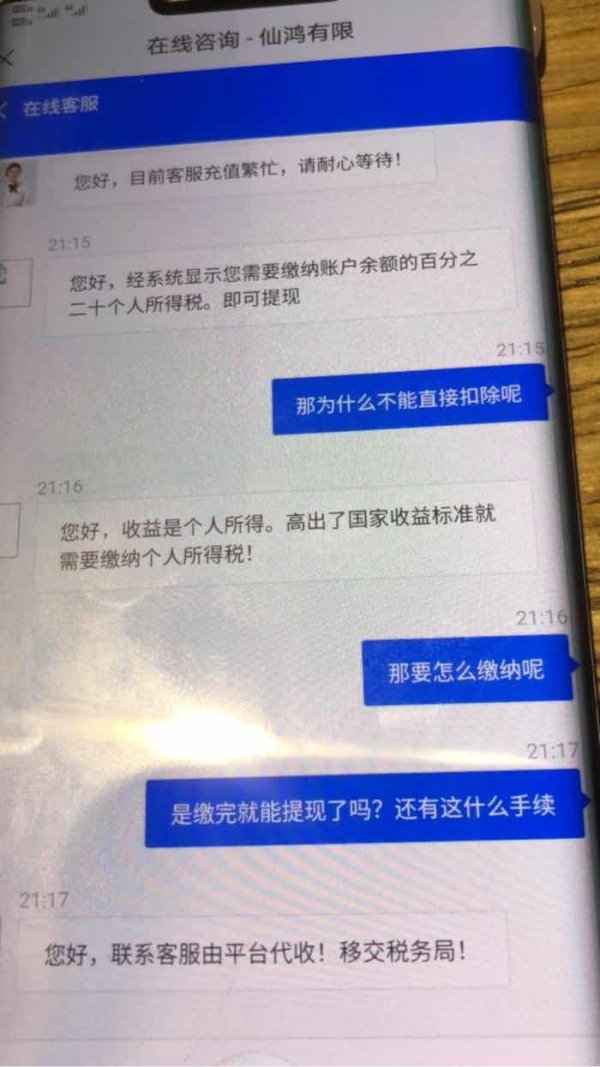

This platform froze all the money in my account and required me to pay 10% to unfreeze it. This is obviously a scam.

Refuse withdrawal with various reasons. The turnover can not be reached.

ABL Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

This platform froze all the money in my account and required me to pay 10% to unfreeze it. This is obviously a scam.

Refuse withdrawal with various reasons. The turnover can not be reached.

ABL stands for Asset Based Lending, which is a special type of financing that has gotten attention in the business lending world. This abl review shows a mixed picture for people who might want to borrow money from them. ABL has a small presence in the asset-based lending market, and their TrustScore is only 2 out of 5 from 17 reviews on Trustpilot. This means they need to do much better at making customers happy.

The platform mainly helps small business owners, real estate investors, and commercial contractors who need different financing options. ABL is different from regular loans because it doesn't focus on how much money flows through your business. Instead, ABL looks at the value of things you own that can be used as collateral, like money owed to you, inventory, equipment, and commercial real estate. SLR Business Credit reports say that ABL loans are usually set up as revolving credit lines. This means companies can borrow money against their assets whenever they need to.

However, ABL doesn't share enough clear information about their specific terms, conditions, and who watches over their business. Employee reviews on Indeed say it's a fast-paced work environment, but there isn't much detailed information available to the public.

This review is based on information that anyone can find, user feedback, and market analysis. People who might want to borrow should know that asset-based lending terms can be very different depending on your situation and what assets you have. The information here shows general market observations and should not replace talking directly with ABL representatives.

Our assessment uses user reviews from multiple websites, industry reports, and comparisons with other asset-based lenders. Since there isn't much regulatory information available to the public, readers should check licensing and compliance details on their own.

| Category | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 4/10 | Below Average |

| Customer Service and Support | 5/10 | Average |

| Trading Experience | 4/10 | Below Average |

| Trust and Security | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

ABL works in the asset-based lending sector and provides financing solutions that are very different from traditional business loans. ABL Funding sources say the company focuses on the value of collateral assets rather than borrower financial statements. This might make it easier for businesses to get money even if they wouldn't qualify for regular financing. When the company was started and its detailed corporate history are not clear in the public information available.

The business model focuses on secured lending where borrowers promise various assets as collateral. These assets can include money owed to you, inventory, equipment, real estate, and sometimes intellectual property or brand assets. The lending structure usually involves revolving credit lines, so businesses can get funds when they need them based on how their asset base changes.

Information about trading platforms, asset classes, and regulatory oversight is not detailed in available sources, but the company seems to work mainly in commercial lending. The lack of complete regulatory information in public sources raises questions about transparency and oversight that potential borrowers should look into more. This abl review emphasizes how important it is to do your homework since there are limited publicly available operational details.

Regulatory Jurisdiction: Specific regulatory information is not detailed in available public sources. This represents a big transparency gap for potential borrowers who want regulatory assurance.

Deposit and Withdrawal Methods: Information about funding mechanisms and withdrawal procedures is not completely detailed in available documentation.

Minimum Deposit Requirements: Specific minimum borrowing amounts or initial funding requirements are not clearly stated in accessible materials.

Bonus and Promotions: Current promotional offerings or incentive programs are not mentioned in available public information.

Tradeable Assets: While the focus is on asset-based lending rather than trading, the types of assets accepted as collateral include accounts receivable, inventory, equipment, and commercial real estate. This information comes from available sources.

Cost Structure: Detailed information about interest rates, fees, and cost structures is not available in public sources. You need to ask the company directly.

Leverage Ratios: Specific lending ratios and leverage terms are not detailed in available public documentation.

Platform Options: Information about digital platforms or application processes is not completely detailed in accessible sources.

Geographic Restrictions: Specific operational territories or geographic limitations are not clearly outlined in available materials.

Customer Service Languages: Available language support options are not specified in accessible public information.

This abl review highlights the need for more complete public disclosure of operational details.

The account conditions for ABL present a mixed picture because there isn't much publicly available information. The company offers asset-based lending solutions, but specific details about account types, minimum requirements, and application processes are not completely detailed in accessible sources. Industry standards reported by SLR Business Credit say that asset-based lending typically involves revolving credit structures. However, ABL's specific terms remain unclear.

The lack of clear information about account opening procedures, documentation requirements, and eligibility criteria is a big drawback for potential borrowers who want to evaluate their options. Traditional asset-based lenders typically require detailed asset appraisals and ongoing monitoring, but ABL's specific approach to these processes is not well-documented in public sources.

Potential borrowers face uncertainty when considering ABL as a financing option because there's no clear information about account minimums, fee structures, or special account features. This abl review emphasizes that the absence of detailed account condition information makes it difficult to provide a complete assessment. This contributes to the average rating in this category.

Information about specific tools and resources offered by ABL is very limited in available public sources. Traditional financial service providers typically offer complete digital platforms, analytical tools, and educational resources, but ABL's technological infrastructure and support tools are not well-documented.

The absence of detailed information about online platforms, mobile applications, or digital account management tools suggests either limited technological offerings or poor communication of available resources. Businesses seeking asset-based lending would expect access to real-time account information, asset valuation tools, and funding request systems.

Educational resources about asset-based lending, market insights, or business financing guidance are not prominently featured in available materials. This lack of educational support could be particularly challenging for first-time asset-based borrowers who need guidance through the process.

The limited transparency about available tools and resources contributes to a below-average rating in this category. Potential borrowers cannot properly assess the technological and educational support they would receive.

Customer service information for ABL is not completely detailed in available public sources. This makes it difficult to assess the quality and availability of support services. The TrustScore of 2 out of 5 from Trustpilot reviews suggests potential issues with customer satisfaction, though specific service-related complaints are not detailed in accessible information.

Response times, available communication channels, and service hours are not clearly specified in public materials. For asset-based lending, timing can be crucial for business operations, so the lack of clear information about support availability is a big concern.

Multilingual support options, specialized business lending expertise, and dedicated account management services are not mentioned in available sources. These services would typically be expected from a commercial lending provider serving diverse business clients.

The average rating reflects the uncertainty created by limited public information combined with modest user satisfaction indicators. This suggests that potential borrowers should directly investigate service quality before committing to ABL's services.

ABL operates in the lending rather than trading sector, but the user experience regarding platform functionality, application processes, and fund access represents the equivalent of "trading experience" for borrowers. Available information suggests limited technological sophistication in user-facing systems.

Platform stability, application processing speed, and digital interface quality are not detailed in accessible sources. For businesses requiring quick access to funding, the efficiency of ABL's systems would be crucial, but performance metrics are not publicly available.

The absence of information about mobile accessibility, online account management, or automated funding features suggests potential limitations in user experience. Modern asset-based lenders typically offer sophisticated digital platforms for asset monitoring and credit line management.

User feedback about the practical experience of working with ABL is limited in available sources. This makes it difficult to assess real-world usability and efficiency. This abl review notes that the below-average rating reflects uncertainty about operational efficiency and user interface quality.

Trust and security represent big concerns in this ABL assessment. The TrustScore of 2 out of 5 from Trustpilot reviews indicates substantial user dissatisfaction, though specific security-related issues are not detailed in available feedback.

Regulatory information is notably absent from accessible public sources. This raises questions about oversight and compliance frameworks. For asset-based lending, regulatory compliance is crucial for borrower protection, making this transparency gap particularly concerning.

Information about fund security measures, asset protection protocols, and data security practices is not completely available. Businesses providing assets as collateral need assurance about protection and handling procedures.

The company's transparency about corporate structure, leadership, and operational history is limited in public sources. This lack of transparency, combined with modest user satisfaction ratings, contributes to the poor rating in trust and security. Potential borrowers should conduct thorough research to verify regulatory compliance and security measures.

Overall user satisfaction appears modest based on available feedback. The TrustScore of 2 out of 5 suggests significant room for improvement. Employee reviews mentioning a fast-paced work environment may indicate operational challenges that could affect customer experience.

Interface design, application processes, and general usability are not detailed in accessible sources. This makes it difficult to assess the practical user experience. Modern borrowers typically expect streamlined digital processes, but ABL's capabilities in this area remain unclear.

Registration and verification procedures are not completely described in available materials. For business lending, complex documentation requirements are common, but ABL's specific processes and user-friendliness are not well-documented.

Common user concerns mentioned in available feedback are not specifically detailed, though the overall satisfaction ratings suggest various operational issues. The below-average rating reflects the combination of modest satisfaction indicators and limited transparency about user experience improvements.

This abl review reveals a lending provider with significant transparency challenges and modest user satisfaction ratings. ABL offers asset-based lending services that may suit small business owners, real estate investors, and commercial contractors, but the limited availability of detailed operational information creates uncertainty for potential borrowers.

The company's focus on asset-based rather than cash-flow lending provides an alternative financing approach. However, the lack of clear regulatory information, transparent terms, and complete service details represents substantial drawbacks. The TrustScore of 2 out of 5 suggests ongoing customer satisfaction challenges that potential borrowers should carefully consider.

Businesses considering ABL should conduct thorough research, verify regulatory compliance independently, and seek detailed terms and conditions directly from the company before proceeding with any lending arrangements.

FX Broker Capital Trading Markets Review