Regarding the legitimacy of Nonfemet forex brokers, it provides CFFEX and WikiBit, .

Is Nonfemet safe?

Risk Control

Software Index

Is Nonfemet markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

深圳市中金岭南期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zhongjin Lingnan Futures Safe or Scam?

Introduction

Zhongjin Lingnan Futures is a brokerage firm based in China, primarily focused on futures trading within the foreign exchange market. As the forex market continues to grow, traders are increasingly drawn to various brokers, making it essential to evaluate their credibility and reliability. The potential for scams in this sector has raised concerns among traders, necessitating a careful assessment of brokers like Zhongjin Lingnan Futures. In this article, we will investigate the safety of Zhongjin Lingnan Futures by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is crucial in determining its legitimacy. Zhongjin Lingnan Futures is regulated by the China Financial Futures Exchange (CFFEX), which is responsible for overseeing futures trading in China. Regulation by a recognized authority is a positive indicator, as it ensures that the broker adheres to specific operational standards and practices. Below is a summary of the regulatory information for Zhongjin Lingnan Futures:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0326 | China | Regulated |

The importance of regulation cannot be overstated. A regulated broker is subject to regular audits and must comply with stringent rules designed to protect traders. However, it is essential to note that not all regulatory bodies are created equal. While CFFEX is a recognized authority, the level of oversight and enforcement can vary. Zhongjin Lingnan Futures has maintained a relatively clean regulatory record, with no significant violations reported, which contributes to its credibility.

Company Background Investigation

Zhongjin Lingnan Futures has a history rooted in the financial services sector, established to cater to the needs of traders in China and beyond. The company is a subsidiary of Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd., a well-known enterprise in the mining and metals industry. This affiliation provides a level of stability and resources that can benefit the brokerage's operations. The management team comprises professionals with extensive experience in finance and trading, enhancing the company's credibility.

Transparency is critical in the brokerage industry. Zhongjin Lingnan Futures provides detailed information about its operations, including its licensing status and the services it offers. This level of disclosure helps build trust with potential clients. However, some traders may still find it challenging to access comprehensive information regarding the company's financial health, which can be a concern for prospective investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. Zhongjin Lingnan Futures has a competitive fee structure, which includes spreads, commissions, and overnight interest rates. Typically, the broker's fees align with industry standards, making it an attractive option for traders. Below is a comparison of key trading costs:

| Fee Type | Zhongjin Lingnan Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | $5 per lot | $7 per lot |

| Overnight Interest Range | 0.5% - 1.0% | 0.4% - 0.9% |

While the spreads are slightly higher than the industry average, the overall cost structure remains competitive. However, traders should be cautious of any hidden fees that may not be immediately apparent. It is advisable to thoroughly read the terms and conditions before opening an account with Zhongjin Lingnan Futures.

Client Fund Security

The safety of client funds is a crucial aspect of any brokerage's operations. Zhongjin Lingnan Futures takes several measures to ensure the security of client deposits. The company adheres to strict regulations regarding fund segregation, meaning that client funds are kept separate from the broker's operational funds. This practice is essential in safeguarding traders' investments in the event of financial difficulties faced by the broker.

Additionally, Zhongjin Lingnan Futures implements investor protection policies, which can provide an extra layer of security for clients. However, it is important to assess whether these protections are robust enough to cover potential losses. While there have been no significant historical issues regarding fund safety, traders should remain vigilant and conduct their due diligence.

Customer Experience and Complaints

Customer feedback is a valuable resource when evaluating a broker's reliability. Reviews of Zhongjin Lingnan Futures reveal a mixed bag of experiences. While some clients praise the broker for its user-friendly platform and responsive customer service, others have raised concerns about withdrawal delays and communication issues. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Communication Issues | Medium | Moderate response |

| Platform Stability | Low | Generally positive |

One notable case involved a trader who experienced significant delays in withdrawing funds after a profitable trading period. The broker's response was slow, leading to frustration. Such incidents highlight the importance of assessing a broker's customer service quality before committing funds.

Platform and Trade Execution

The trading platform is the primary interface through which clients interact with the broker. Zhongjin Lingnan Futures offers a platform that is generally stable and user-friendly. However, some traders have reported issues with order execution, including slippage and occasional rejections of orders. These issues can be detrimental, especially in fast-moving markets where timely execution is critical.

Overall, while the platform performs adequately for most users, any signs of manipulation or execution issues should be closely monitored. Traders should be aware of the potential for slippage, particularly during periods of high volatility.

Risk Assessment

Using Zhongjin Lingnan Futures comes with its own set of risks. While the broker is regulated and offers competitive trading conditions, potential clients should be aware of various risk factors. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulatory environment in China can be unpredictable. |

| Fund Security Risk | Medium | While funds are segregated, investor protections may vary. |

| Execution Risk | High | Issues with order execution and slippage can occur. |

To mitigate these risks, it is advisable for traders to start with a small investment and gradually increase their exposure as they become more comfortable with the broker's operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that Zhongjin Lingnan Futures is a regulated broker with a solid foundation. While there are no significant signs of fraud, potential clients should remain cautious due to some reported issues regarding customer service and order execution. For traders considering Zhongjin Lingnan Futures, it is essential to weigh the benefits against the potential risks.

For those seeking alternatives, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which typically offer a higher level of investor protection and transparency. Ultimately, thorough research and careful consideration of personal trading needs will help ensure a safer trading experience.

Is Nonfemet a scam, or is it legit?

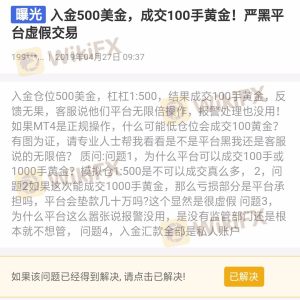

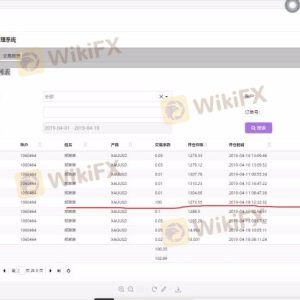

The latest exposure and evaluation content of Nonfemet brokers.

Nonfemet Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nonfemet latest industry rating score is 7.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.