Is VCTFX safe?

Pros

Cons

Is VCTFX Safe or a Scam?

Introduction

VCTFX is positioned as an online forex broker that claims to offer various trading services, including forex, cryptocurrencies, and commodities. As the online trading landscape continues to grow, traders must exercise caution when selecting a broker. This caution stems from the potential risks associated with unregulated or fraudulent trading platforms that can lead to significant financial losses. In this article, we will investigate the legitimacy of VCTFX, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk assessment. Our evaluation will be based on a comprehensive analysis of available information from multiple sources.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and the safety of traders' funds. VCTFX claims to operate under the auspices of the VCTFX Capital Holdings Ltd., allegedly based in the United States. However, a deeper investigation reveals a lack of registration with key regulatory bodies, such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). This absence raises significant concerns about the broker's compliance with legal and financial regulations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | USA | Not Registered |

| FCA | N/A | UK | Not Registered |

| ASIC | N/A | Australia | Not Registered |

The lack of regulatory oversight is a major red flag. Brokers that are not regulated can engage in questionable practices without accountability, leaving traders vulnerable to fraud. In the absence of a regulatory framework, traders have no legal recourse in case of disputes or issues, making it critical for potential clients to consider the absence of regulation when assessing whether VCTFX is safe.

Company Background Investigation

VCTFX's company history and ownership structure are essential components of its credibility. The broker presents itself as a legitimate entity; however, there is limited information available about its management team and operational history. A thorough examination reveals that VCTFX operates without transparency, as it does not disclose key details regarding its ownership or the professional backgrounds of its executives.

Moreover, the broker's physical address in Houston, Texas, appears to be unverifiable, raising questions about its legitimacy. A lack of transparency in company operations can indicate potential risks, as it becomes challenging for traders to assess the broker's reliability and accountability. The absence of a clear and verifiable operational history further complicates the evaluation of whether VCTFX is safe for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. VCTFX advertises competitive spreads and various account types, but the specifics of its fee structure remain ambiguous. Traders must be wary of hidden fees that can significantly impact their trading profitability.

| Fee Type | VCTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The comparison indicates that VCTFX's spreads may be higher than industry averages, which could erode potential profits. Additionally, the lack of clarity regarding commissions and overnight interest raises concerns about the broker's transparency. Such issues can lead traders to question whether VCTFX is safe to use, as unclear fee structures are often associated with less reputable brokers.

Client Fund Safety

The safety of client funds is paramount in determining the trustworthiness of a broker. VCTFX claims to employ safety measures for client funds, but the absence of valid regulation means that these claims cannot be independently verified. Regulated brokers typically offer segregated accounts to protect client funds, ensuring that even in the event of financial difficulties, clients' money remains secure.

In the case of VCTFX, there is no evidence to suggest that client funds are held in segregated accounts. This lack of protection means that traders' investments are at risk, especially if the broker engages in fraudulent activities or mismanagement. Historical reports of account freezes and withdrawal delays further exacerbate concerns regarding the safety of funds. Therefore, potential investors should carefully consider whether VCTFX is safe before depositing any money.

Customer Experience and Complaints

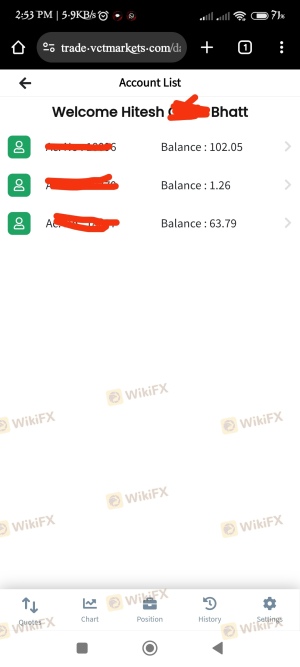

Analyzing customer feedback provides valuable insight into a broker's reliability. Reviews and testimonials about VCTFX reveal a pattern of negative experiences, particularly concerning withdrawal issues and poor customer support. Many users report difficulties in processing withdrawals, with requests often ignored or delayed indefinitely.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | High | Poor |

| Account Freezes | Medium | Poor |

Typical complaints include unresponsive customer support and unexplained account freezes, which indicate a lack of accountability. The company's response to these issues has been inadequate, leading to frustration among traders. Given the severity of these complaints, it is reasonable to question whether VCTFX is safe for trading.

Platform and Execution

The trading platform offered by VCTFX is another critical aspect to evaluate. Reports suggest that the platform's performance is subpar, with issues related to order execution, slippage, and potential manipulation. Traders have expressed concerns about the reliability of the platform, which raises alarms about the overall trading experience.

Furthermore, the quality of order execution is essential for traders looking to capitalize on market movements. Instances of slippage and rejected orders can lead to significant financial losses, making it crucial for traders to assess whether VCTFX is safe in this regard.

Risk Assessment

Using VCTFX presents several risks that traders must consider. The absence of regulation, unclear fee structures, and negative customer feedback contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from regulatory bodies |

| Financial Risk | High | Lack of fund protection mechanisms |

| Operational Risk | Medium | Issues with platform reliability |

To mitigate these risks, traders should conduct thorough research, avoid depositing significant funds, and consider using regulated alternatives with a proven track record. Understanding these risks is crucial for assessing whether VCTFX is safe for trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that VCTFX exhibits several characteristics associated with fraudulent or unreliable brokers. The absence of regulation, poor customer feedback, and a lack of transparency raise significant concerns about the safety of this platform. Therefore, potential investors should exercise extreme caution and consider alternative, regulated brokers that provide a safer trading environment.

For traders seeking reliable options, consider brokers that are well-regulated and have a positive reputation in the industry. These alternatives can help ensure a more secure trading experience, ultimately safeguarding your investments. In light of the findings, it is clear that VCTFX is not a safe choice for trading activities.

Is VCTFX a scam, or is it legit?

The latest exposure and evaluation content of VCTFX brokers.

VCTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VCTFX latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.