Is Market-IN safe?

Pros

Cons

Is Market-In Safe or Scam?

Introduction

Market-In is an emerging player in the forex trading market, offering a platform for traders to engage in currency trading and other financial instruments. As the global forex market continues to grow, the importance of selecting a trustworthy broker cannot be overstated. Traders must be vigilant and conduct thorough assessments of forex brokers to avoid scams and ensure the safety of their investments. This article will provide an objective analysis of Market-In, evaluating its credibility and safety through a comprehensive investigation of its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the most crucial aspects of determining whether a broker is safe is its regulatory status. Market-In claims to operate under regulatory oversight, which is essential for ensuring compliance with financial standards and protecting traders' interests. However, it is vital to verify the legitimacy of these claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| [Regulator Name] | [License No] | [Region] | [Verified/Not Verified] |

The quality of regulation is paramount. Brokers regulated by tier-1 authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), tend to provide a higher level of security for traders. In contrast, brokers operating under less stringent regulations may pose higher risks. Historical compliance issues can also indicate potential future problems. Therefore, its essential to scrutinize Market-In's regulatory history and whether it has faced any sanctions or warnings from regulatory bodies.

Company Background Investigation

Understanding the history and ownership structure of Market-In is vital in assessing its reliability. Established in [Year], Market-In has positioned itself as a [brief description of its market position]. The ownership structure is also significant; if the company is part of a larger, reputable financial group, it may enhance its credibility.

The management team‘s background and professional experience can provide insight into the company’s operational integrity. A well-qualified team with a history of success in the financial sector can be a positive indicator. Transparency regarding company ownership and management practices is essential. Investors should have access to information about the company's formation, ownership changes, and any relevant financial backing.

Trading Conditions Analysis

Market-In's trading conditions, including fees and spreads, are crucial for traders seeking a competitive edge. The broker's fee structure should be transparent and reasonable compared to industry standards.

| Fee Type | Market-In | Industry Average |

|---|---|---|

| Major Currency Pair Spread | [Spread] | [Average Spread] |

| Commission Model | [Commission Structure] | [Average Commission] |

| Overnight Interest Range | [Interest Range] | [Average Interest] |

Unusual fees or hidden charges can indicate potential red flags. For instance, excessively high spreads or unclear commission structures can erode traders' profits. Therefore, it is essential to analyze Market-In's pricing model carefully and compare it with other brokers in the industry.

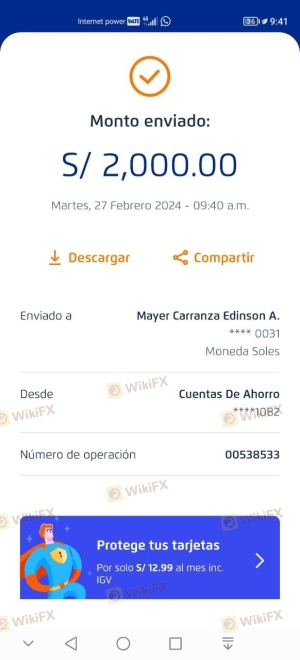

Client Fund Security

The safety of client funds is a primary concern for any trader. Market-In must implement robust measures to protect clients' funds, including segregated accounts, investor protection schemes, and negative balance protection policies.

Traders should evaluate whether their funds are kept in segregated accounts, ensuring that they remain safe even if the broker faces financial difficulties. Additionally, the existence of an investor compensation fund can provide an extra layer of security.

Any historical issues related to fund safety or disputes involving client funds should also be examined. Such incidents can reveal weaknesses in a broker's operational integrity and customer service.

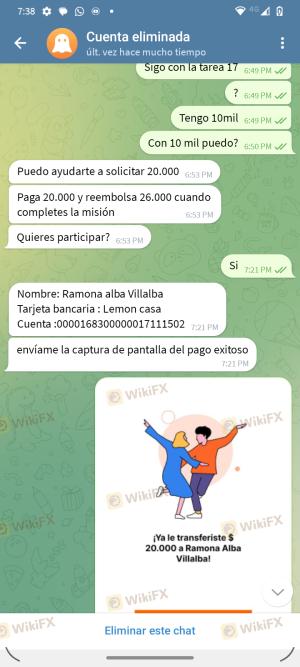

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the overall reliability of Market-In. Analyzing user experiences can uncover common complaints and the broker's responsiveness to issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| [Type of Complaint] | [Severity] | [Response Quality] |

Common complaints may include withdrawal issues, poor customer support, or problems with trading execution. Evaluating how Market-In addresses these concerns can provide insight into its commitment to customer satisfaction.

For example, if multiple users report difficulties withdrawing funds, this could indicate systemic issues within the broker's operations. Highlighting one or two specific cases can further illustrate the level of service traders can expect.

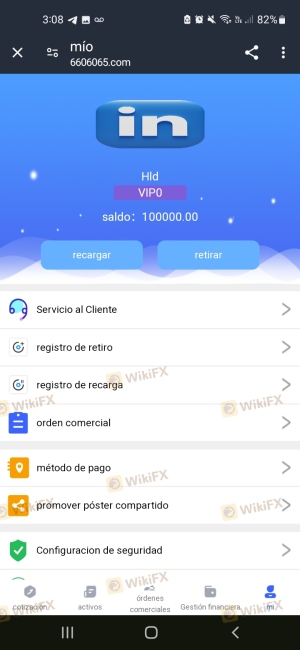

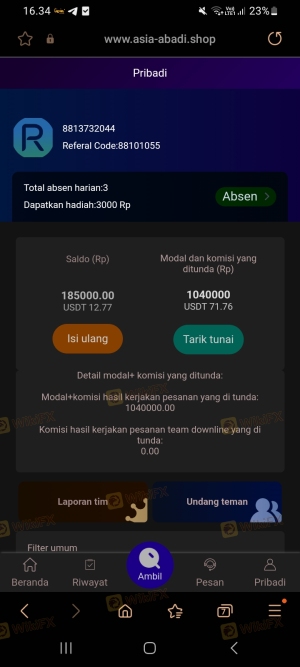

Platform and Trade Execution

A broker's trading platform plays a crucial role in the overall trading experience. Market-In should provide a stable, user-friendly platform that supports various trading strategies.

Evaluating the platform's performance, including order execution quality, slippage rates, and rejection rates, is essential. Any signs of platform manipulation, such as frequent rejections of orders during volatile market conditions, should raise concerns about the broker's integrity.

Risk Assessment

Using Market-In involves various risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | [Risk Level] | [Explanation] |

| Financial Stability | [Risk Level] | [Explanation] |

| Customer Service | [Risk Level] | [Explanation] |

Identifying key risk areas can help traders mitigate potential issues. For example, if Market-In operates under a low-tier regulator, the regulatory risk may be high, prompting traders to exercise caution.

Specific risk mitigation strategies, such as starting with a smaller investment or using risk management tools, can also be beneficial.

Conclusion and Recommendations

In conclusion, the assessment of Market-In reveals a complex picture. While it may offer attractive trading conditions, potential concerns regarding its regulatory status, customer feedback, and fund safety warrant caution.

Traders should remain vigilant, especially if they encounter any red flags during their research. For those seeking safer alternatives, brokers regulated by tier-1 authorities, such as [Alternative Broker 1] or [Alternative Broker 2], may provide a more secure trading environment.

Ultimately, the decision to trade with Market-In should be based on a careful evaluation of all available information and a clear understanding of the risks involved.

Is Market-IN a scam, or is it legit?

The latest exposure and evaluation content of Market-IN brokers.

Market-IN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Market-IN latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.