Regarding the legitimacy of VMGFX forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is VMGFX safe?

Business

License

Is VMGFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Clone FirmLicense Type:

Forex Trading License (EP)

Licensed Entity:

BETHLE ASTER GLOBAL INVESTMENT LIMITED

Effective Date:

2019-07-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 5, 8/F, Mega Cube, 8 Wang Kwong Road, Kowloon Bay, Kowloon, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is VMGFX Safe or Scam?

Introduction

VMGFX, a forex broker registered in the Marshall Islands, has positioned itself within the global forex market by offering various trading instruments, including forex, precious metals, and contracts for difference (CFDs). However, as the forex industry continues to grow, so does the number of unscrupulous brokers, making it imperative for traders to carefully evaluate the legitimacy of any broker before committing their funds. This article aims to investigate the safety and legitimacy of VMGFX by examining its regulatory status, company background, trading conditions, client feedback, and overall risk profile. Our assessment relies on a comprehensive review of available online resources, customer experiences, and regulatory databases to provide a well-rounded perspective on whether VMGFX is safe for traders.

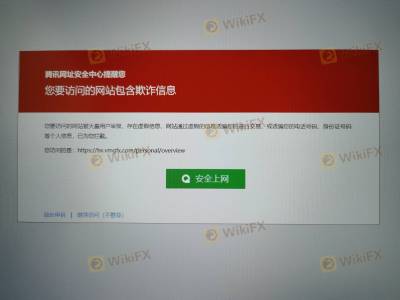

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. VMGFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC) with the license number 14663. However, it has been flagged as a clone firm, raising concerns about its regulatory compliance. Furthermore, the broker falsely claims to be regulated by the UK's Financial Conduct Authority (FCA), whose license for VMGFX was revoked. This raises significant red flags regarding the brokers adherence to regulatory standards.

Here is a summary of the core regulatory information for VMGFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 14663 | Vanuatu | Clone Firm |

| FCA | 442837 | United Kingdom | Revoked |

The lack of a credible regulatory framework poses a high risk for potential clients. Regulatory bodies like the FCA and ASIC enforce strict compliance measures to protect investors, while brokers operating under low-tier regulators like the VFSC often lack the same level of oversight. The historical compliance issues associated with VMGFX further complicate its legitimacy, as potential clients may find themselves exposed to fraud or mismanagement of funds.

Company Background Investigation

VMGFX was established with the intention of providing trading services to a global audience, yet its operational history remains murky. The broker claims to have been in business for 5 to 10 years, but the lack of transparency regarding its ownership structure and management team raises concerns about its credibility. A thorough background check reveals that information about the company's founders and executive team is scarce, which is often a warning sign in the forex industry.

Moreover, the broker's website lacks crucial details about its operational procedures, investor protections, and even contact information. This absence of transparency can lead to potential clients feeling uneasy about their decision to trade with VMGFX. Transparency and information disclosure are vital components of a trustworthy brokerage, as they help establish credibility and foster trust between the broker and its clients.

Trading Conditions Analysis

When evaluating whether VMGFX is safe, understanding its trading conditions is essential. The broker advertises competitive trading conditions, including spreads as low as 0.0 pips. However, the lack of clarity regarding commission fees and hidden costs raises concerns about the overall trading cost structure.

Heres a comparison of key trading costs:

| Cost Type | VMGFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | Not disclosed | $5 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The absence of detailed information about commission structures and overnight interest rates can lead to unexpected costs for traders. Additionally, the lack of educational resources or demo accounts further limits traders' ability to understand the trading environment before committing real capital. This lack of transparency raises questions about the broker's commitment to fair trading practices.

Client Funds Safety

The safety of client funds is paramount when assessing a broker's reliability. VMGFX claims to implement various safety measures, but the effectiveness of these measures is questionable given its low regulatory standing. The broker does not provide clear information about segregating client funds, investor protection mechanisms, or negative balance protection policies.

Historically, there have been numerous complaints from clients regarding withdrawal issues and account suspensions. Such incidents indicate a potential risk to client funds and highlight the importance of ensuring that a broker has robust security measures in place to protect traders' investments. Without clear evidence of fund security protocols, potential clients should approach VMGFX with caution.

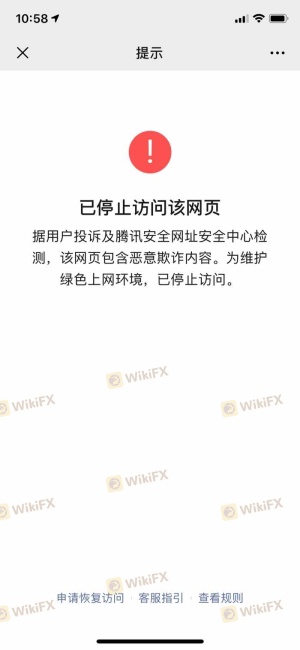

Client Experience and Complaints

Client feedback serves as a valuable tool for assessing a broker's reliability. Numerous reviews and testimonials about VMGFX highlight serious concerns regarding customer service and withdrawal processes. Many clients have reported being unable to withdraw their funds, with some claiming that their accounts were banned after multiple withdrawal requests.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Bans | High | Poor |

| Customer Support Quality | Medium | Poor |

For instance, one client reported that after depositing funds, they encountered difficulties when attempting to withdraw, eventually leading to their account being suspended without explanation. Such experiences raise significant concerns about the broker's operational integrity and commitment to customer satisfaction.

Platform and Trade Execution

Evaluating the trading platform and execution quality is essential for any broker assessment. VMGFX offers the widely used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading tools. However, user experiences suggest that the platform may suffer from execution issues, including slippage and order rejections.

The potential for platform manipulation is another concern, as clients have reported instances where trades were executed at unfavorable prices. Such practices can severely impact a trader's profitability and raise ethical questions about the broker's operational practices.

Risk Assessment

Using VMGFX presents several risks that potential clients should consider. The lack of regulatory oversight, combined with numerous client complaints, indicates a high-risk environment for traders. Below is a summary of the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated or poorly regulated broker. |

| Financial Risk | High | Reports of withdrawal issues and fraud. |

| Operational Risk | Medium | Concerns about platform reliability. |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a small deposit to test the broker's reliability before committing larger amounts.

Conclusion and Recommendations

In conclusion, the investigation into VMGFX raises significant concerns about its safety and legitimacy. The evidence suggests that VMGFX operates in a high-risk environment, characterized by a lack of regulatory oversight, poor client feedback, and questionable trading practices. Therefore, potential traders should exercise extreme caution when considering this broker.

For those seeking reliable alternatives, it is advisable to explore brokers regulated by top-tier authorities such as the FCA or ASIC, which offer more robust investor protections and transparent trading conditions. Overall, while VMGFX may present appealing trading opportunities, the risks associated with trading through this broker far outweigh the potential benefits.

Is VMGFX a scam, or is it legit?

The latest exposure and evaluation content of VMGFX brokers.

VMGFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VMGFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.